Forex Brokers Providing Trailing Stop

A trailing stop is a type of stop-loss order that combines elements of both risk management and trade management. Trailing stops are also known as profit protecting stops, because it helps traders to lock profits on trades while also capping the amount that will be lost if the trade does not work out. Trailing stops can be manually implemented by the trader, or set up to work automatically with most brokers/software. A list below will show you some forex brokers that offer trailing stop in their platforms.

Scroll for more details

What is the simple setup of trailing stop?

If you want to enter the position in the long term and don't know where to come out, it is recommended to use 25% trailing stop as minimum protection. 25% trailing stop is quite big and makes it possible for you to catch the trend movement. The most important thing is to get out of position before a big reversal. When you're out from a bad position faster, it will minimize your trauma.

Continue Reading at How to Maximize Your Trading Performance

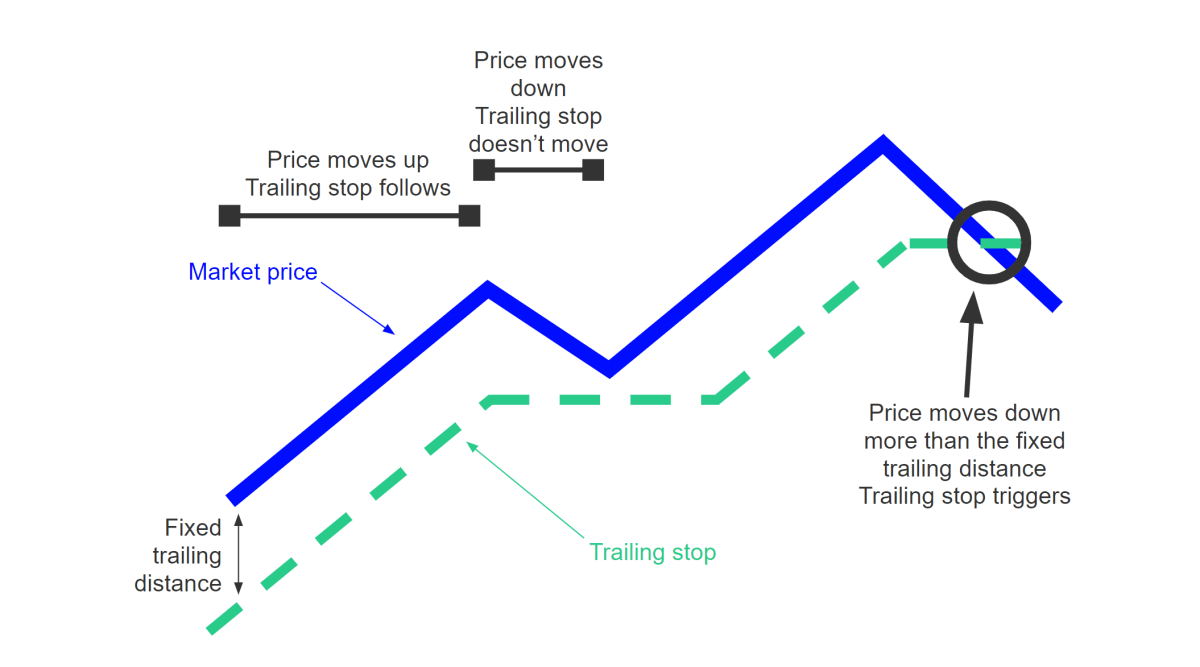

If the price reverses and moves against you at some point, the trailing stop can protect the profits you've earned before. Here's how trailing stop loss basically works:

Continue Reading at Stop Loss Strategies to Protect Your Trades

How to exit the market with trailing stop?

The trailing stop is highly effective for managing profitable trades, providing traders with real-time position protection as the market moves. The stop loss level moves with the market when using a trailing stop.

For instance, let's consider a scenario where a trader buys GBP/USD with an initial stop of 50 points and a trailing stop of 50 points. As the price of GBP/USD increases, the trailing stop will "trail" or move higher accordingly. If the GBP/USD reached a high of 0.7712, the trailing stop would be adjusted to 0.7662. If the price fell below this level, the trade would automatically be closed, safeguarding the profits attained.

Continue Reading at How to Find Entry and Exit Points in Trading

What is the scenarios of using trailing stop?

while running position AUD/USD on 1.0400, we predict that the movement will rise, then we open BUY position with 60 points T/P above it (1.0460), put S/L 10 points below it, and put trailing stop by 45 points. Afterward, there will be two scenarios:

Scenario 1: When the price keeps rising, the price will reach level 1.6464 + 45 = 1.6511. S/L will move, and when the price decreases after reaching the 45 points , the system will close that position, so you will get 45 points of profits.

Scenario 2: If the prices moves down (contrary with our position) the position will be closed with a 10-point loss + spreads.

Continue Reading at How to Maximize Your Trading Performance

Broker Categories

Minimun Deposit

Payment

License

Country

Established

Instruments Traded

Features