List of Brokers with IFSC (Belize) Regulation

The International Financial Services Commission or IFSC is the agency authorized by the government of Belize to regulate financial activities in the country. Founded in 1999, the IFSC is responsible for establishing and enforcing financial regulations and overseeing all market participants in Belize, including online forex brokers.

| Country | : | Belize |

| Website | : | https://www.belizefsc.org.bz |

| Total Brokers | : | 21 |

Scroll for more details

If you are interested to try the brokers in the list above, make sure to use the forex demo account so you could experience trading firsthand with virtual money. You don't even have to deposit any funds since the demo account is 100% free and is available in most brokers.

What Does IFSC-regulated Mean for Forex Traders?

Trading with an IFSC-regulated forex broker means lower trading costs as the agency applies zero tax structure to its members. Also, the IFSC expects its members to separate all client funds in segregated accounts to help protect traders and investors against brokers' misuse. This provides some kind of protection and security even though there are no compensation schemes in case of insolvencies.

Traders could enjoy higher leverage and bonus promotions since IFSC Belize doesn't limit a maximum cap to the feature nor bans its members to offer bonuses.

To anticipate brokers' fraudulent acts, the regulators require brokers to send audit reports and financial statements. Still, it hasn't been yet considered as comprehensive as those required by more trusted agencies like FCA, ASIC, or even CySEC.

What Are the Powers of IFSC Belize?

Although its general effectiveness as an offshore regulatory body is considered lenient, the IFSC Belize has the power to weed out broker scams and suspicious financial entities operating under false claims.

To ensure the effort, the agency can release notices, press releases, public warnings, and other information through its official platform to alert traders against companies that falsely claim to be regulated under the IFSC.

The IFSC may also provide mechanisms for resolving disputes between financial services providers and their clients, promoting a fair and efficient resolution process.

How to Check an IFSC-regulated Broker?

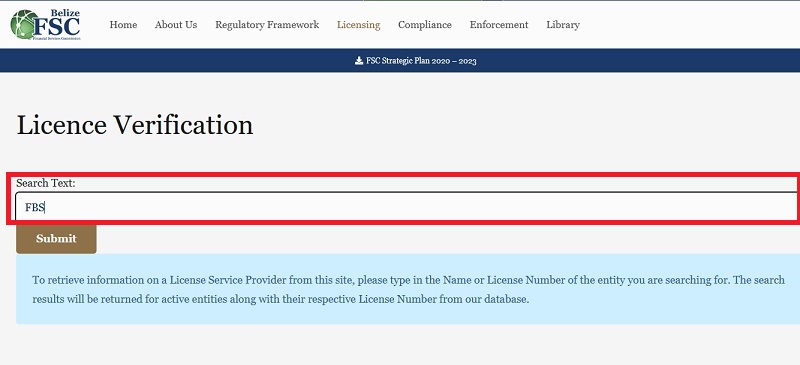

- Go to the official site of IFSC.

- Choose Licensing, then click on Licence Verification.

- Type your broker name or reference number in the search column, then click Submit.

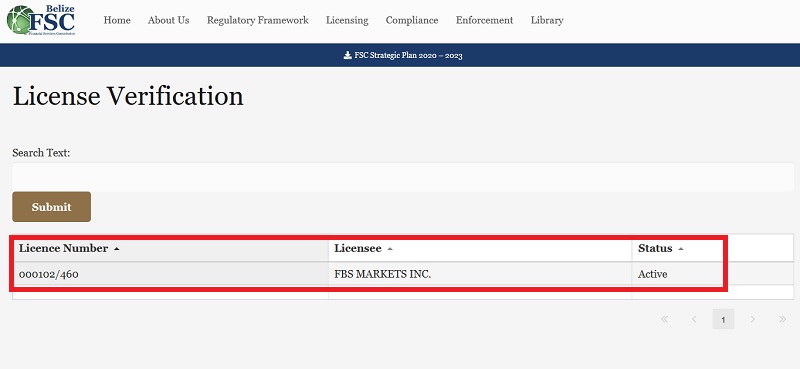

- If your broker is officially registered on IFSC, the data will appear as below:

How Is IFSC Belize Compared to Other Forex Regulators?

Different forex regulators around the world have varying levels of reputation, stringency, and recognition. Here's a general comparison of the IFSC Belize with other well-known forex regulators:

| Aspects | 🇧🇿 IFSC Belize (International Financial Services Commission of Belize) | 🇨🇾 Cyprus Securities and Exchange Commission (CySEC) | 🇬🇧 Financial Conduct Authority (FCA) - UK | 🇦🇺 Australian Securities and Investments Commission (ASIC) |

| Reputation | Relatively lenient, more accessible, and cost-effective option for brokers seeking to establish their operations. | Known for its presence in the European Union and has worked to improve its regulatory standards in recent years. It offers a balance between accessibility and investor protection. | Widely recognized for its stringent regulations and strong investor protection measures. It is considered one of the most respected regulatory bodies in the forex industry. | Known for its rigorous regulatory approach and strong commitment to maintaining the integrity of the financial markets. |

| 🔨Stringency | May not be as strict as regulators in more established financial centers. This can lead to concerns about investor protection and oversight. | Stricter regulations that align with EU directives like MiFID II. It places emphasis on investor protection, capital adequacy, and transparent operations. | Imposes strict requirements on brokers, focusing on consumer protection, capital adequacy, transparency, and ethical conduct. | Enforces strict rules on forex brokers operating in Australia, including requirements for financial stability, risk management, and client fund segregation. |

| 🔍Recognition | Might not be as widely recognized or respected in the global forex industry compared to regulators in more established jurisdictions. | Well-recognized within the EU and has a reputation for providing a framework that allows brokers to access the European market. | Carries significant credibility and recognition within the global financial community, making it attractive to brokers looking to establish a trustworthy reputation. | Recognized globally and can provide access to the Asia-Pacific region, making it appealing to brokers targeting that market. |

Keep in mind that the regulatory landscape can change over time, so it's important to conduct up-to-date research before making any decisions.

How Could a Broker Apply for an IFSC License?

- Gather all the necessary documents and information required for the application process. This may include details about the company's ownership structure, financial statements, business plan, compliance policies, and more.

- Set up a Belizean company if you haven't already. This company will be the legal entity through which you conduct your brokerage business.

- Select the appropriate license category that aligns with your intended business activities. You could choose between trading in securities, trading in financial and commodity-based derivatives, forex trading, and more.

- Complete the application form provided by the IFSC.

- Pay application fees and the $500,000 required capital. The fees can vary depending on the license type and services you intend to offer.

- The IFSC will conduct background checks on the company's directors, shareholders, and key personnel to ensure you meet the fit and proper criteria. This includes checks for any criminal history or financial improprieties.

- Provide a detailed business plan outlining your company's proposed operations, target markets, and financial projections. You'll also need to submit compliance policies and procedures that demonstrate how you will adhere to the IFSC's regulations and standards.

- Demonstrate your company's financial stability by submitting audited financial statements, capital adequacy plans, and any other required financial documentation.

- Make sure your company has a physical presence in Belize and employs local staff.

- The IFSC will review your application and supporting documents. The duration for license acquisition ranges from 5 to 6 months, and the IFSC might request additional information or clarifications during the review.

- Upon fulfilling all requirements and receiving approval, you will be issued the IFSC license, allowing you to legally operate as a financial services provider in Belize.

Once the application is approved, you will need to meet any remaining compliance requirements, which might include maintaining specific capital levels, implementing anti-money laundering (AML) procedures, and more.

Additional FAQ

What are the regulations for online forex trading in Nigeria?

When it comes to online trading regulation, the ambiguity of laws in Nigeria contrasts with other African countries that have already implemented regulations. For example, South Africa's Financial Sector Conduct Authority (FSCA) and Kenya's Capital Markets Authority (CMA) have already regulated online forex brokers in their countries. Furthermore, South Africa has even established rules for forex trading taxation.

Continue Reading at Is It Safe to Trade Forex in Nigeria?

What are some of the best offshore trading regulations?

Here are some of the best offshore trading regulations which attract forex traders worldwide:

- Tax Benefits: By offshore forex trading, a trader can be exempt from paying taxes in their country of residence.

- High Leverage: Offshore brokers are not being strictly controlled by their financial authorities. Due to this, they're able to offer riskier leverages up to even 1000:1 in order to attract more clients to invest with them.

- Assets Availability: Most countries have banned quite a few financial assets like cryptocurrency due to how volatile it is. Offshore forex trading is therefore extremely popular as traders don't have to worry about some assets not being available to them for trading.

Continue Reading at Your Simple Guide to Offshore Trading

How to check a broker's regulation?

Here are the steps on how to check if a forex broker is regulated:

- Check the broker's website.

- Visit the regulatory agency's website.

- Contact the regulatory agency.

Continue Reading at How to Avoid Forex Broker Scams

What is the regulatory status of forex trading in Nigeria?

Online trading in Nigeria is currently unregulated, while offline forex trading is well-regulated. This regulatory contrast is due to the differences like these two markets.

Continue Reading at Is It Safe to Trade Forex in Nigeria?

Broker Categories

Minimun Deposit

Payment

Country

Established

Instruments Traded

Features

Trading Platform