List of Brokers with ASIC Regulation

ASIC (Australian Securities and Investments Commission) is the regulatory authority in Australia that oversees financial markets, including forex brokers. Found in 1998, the regulatory body requires their members to adhere to certain standards and regulations to ensure the protection of investors and maintain the integrity of the financial system in Australia.

| Established | : | 1998 |

| Country | : | Australia |

| Website | : | https://asic.gov.au |

| Total Brokers | : | 51 |

Scroll for more details

If you are interested to try the brokers in the list above, make sure to use the forex demo account so you could experience trading firsthand with virtual money. You don't even have to deposit any funds since the demo account is 100% free and is available in most brokers.

The Australian Securities and Investments Commission (ASIC) serves as the regulatory body overseeing financial market behavior in Australia. It plays a crucial role in fostering a financial system that is characterized by equity, transparency, and effectiveness, benefiting all participants.

ASIC exercises its regulatory authority over various entities, including Australian companies, financial markets, financial services institutions (such as banks, life and general insurance companies, mutual funds, and forex brokers), as well as professionals engaged in investment, superannuation, insurance, deposit-taking, and credit activities. Furthermore, ASIC holds the responsibility for granting authorizations for operations within the sectors under its regulatory oversight.

See Also:

What Does ASIC-regulated Mean for Forex Traders?

Due to ASIC's strict rules, trading in an ASIC-regulated broker would mean bonus prohibition, leverage limited to 30:1, and the absence of retail binary options. It should also be noted that as of 2019, ASIC has issued a regulation that brokers under its regulation can only accept domestic clients. In this case, the compensation funds would only apply to traders within Australia.

On a positive note, ASIC-regulated forex brokers allow hedging strategies without First-In-First-Out regulations. Most of them offer trading on ECN accounts with the application of the FIX API.

How to Check an ASIC-regulated Broker?

- Go to ASIC Connect.

- Look for the search bar on the top-right side of the page.

- On the "Within" column, select "Organisation and Business Names".

- On the "For" column, type a broker or its company name. You can also choose to type its ASIC number.

- Click "Go".

- If your broker is indeed regulated under ASIC, you would see a list of company names registered by your broker. Make sure that the license status is still "Registered" and not "Cancelled".

What are the Most Popular ASIC Brokers?

Founded in 2007 in Sydney, Australia, IC Markets provides access to financial markets worldwide and operates within the legal framework of different jurisdictions. The group has offices in various regions, allowing them to cater to traders from diverse locations while complying with local regulations. Reputable authorities license these companies within the IC Markets group:

- International Capital Markets Pty Ltd is licensed by the Australian Securities and Investments Commission (ASIC)

- Raw Trading Ltd. holds a license from the Seychelles Financial Services Authority (SFSA)

- IC Markets (EU) Ltd is licensed by the Cyprus Securities and Exchange Commission (CySEC).

In addition, IC Markets is a member of the Financial Commission, an independent organization that handles disputes and provides an insurance fund with coverage of up to EUR 20,000 per trader.

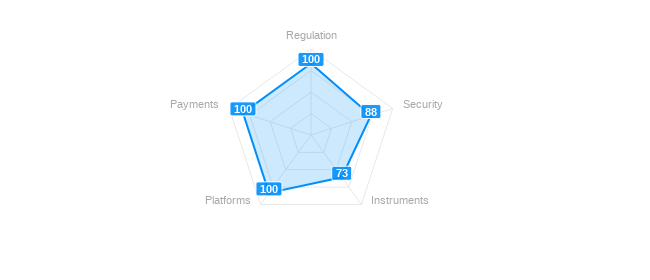

This is how the broker performs on 5 important aspects in trading:

✔️ IC Markets Pros

- The availability of credit/debit card options

- No deposit fees

- Multiple account base currencies

- Regulated in both tier-1 and tier-2 jurisdictions

- Low average spreads across all types of accounts

- Access to third-party research and trading tools

❌ IC Markets Cons

- Some restrictions may apply to withdrawals

- IC Markets does not have a proprietary trading app

- High minimum deposit is required to open an account

- Limited market analysis

- The availability of in-depth market analysis may be more limited

With its headquarters in New York, OANDA has established itself as a comprehensive provider of currency-related services. Their offerings range from currency conversion and FX data services for businesses to a global online brokerage service catering to individual traders in the retail FX and CFD markets.

OANDA offers two main account types, standard and Advanced Trader, and provides a diverse product catalog, including CFD and spread betting options across various asset classes.

It is important to note that the availability of these offerings may vary depending on the region being served. In addition to foreign exchange trading, OANDA facilitates trading opportunities in indices, metals, commodities, and bonds, enabling clients to participate in various financial markets.

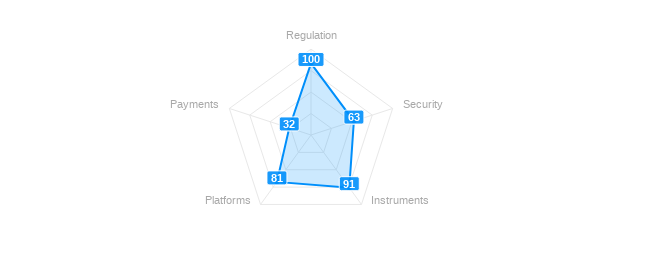

This is how the broker performs on 5 important aspects in trading:

✔️ OANDA Pros

- More than 70 currency pairs available

- Available worldwide

- No commission per lot

- Great learning content

- No minimum deposit

❌ OANDA Cons

- Limited customer support hours

- Lack of direct social copy trading features

- Only USD as the base currency

XM broker is a renowned global broker offering forex and CFD trading, with regulation from respected authorities such as ASIC in Australia, CySEC in Cyprus, and IFSC in Belize. One of XM's key strengths lies in its low stock CFD and withdrawal fees, which provide cost-effective trading opportunities for clients. The account opening process is designed to be user-friendly and efficient.

Additionally, XM offers a range of educational tools, including webinars and a demo account, to support traders in their learning journey. It's important to note that XM's product portfolio primarily focuses on CFDs and forex trading, limiting the variety of available instruments.

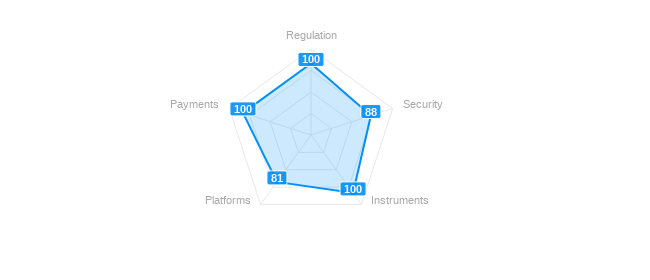

This is how the broker performs on 5 important aspects in trading:

✔️ XM Pros

- Low withdrawal fees

- Great educational tools

- Minimum deposit start from USD5

- Unlimited demo account

- Low spread, low commissions

❌ XM Cons

- Investor protection not available for EU clients

- Inactivity fees charged

- Limited product selection

Admirals is a well-established global broker specializing in forex and CFD trading. It operates under the regulation of reputable authorities, including the FCA and ASIC, ensuring high trust and security for clients. One of Admirals' notable advantages is its low fees for forex CFD trading, allowing traders to minimize costs and maximize potential returns.

The broker offers convenient and swift deposit and withdrawal processes with various options, including credit/debit cards and electronic wallets. Account opening is quick and user-friendly, streamlining the onboarding experience. While Admirals primarily focuses on CFDs, it does provide access to real stocks and ETFs for selected clients.

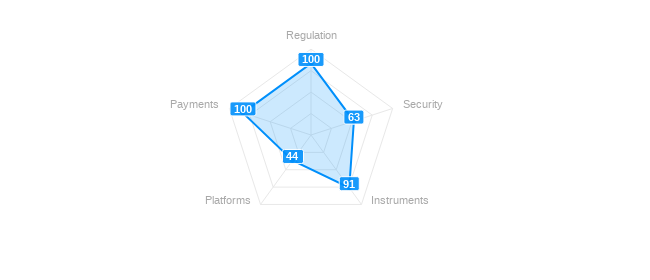

This is how the broker performs on 5 important aspects in trading:

✔️ Admirals Pros

- Easy withdrawal

- Good support team

- Keeps client funds separate

- Simple educational resources for new traders

- Low CFD fees

❌ Admirals Cons

- Inactivity fee

- Limited maximum contract size

- Limited customer service hours

FBS broker is a globally recognized firm with a presence in 190 countries. With over a decade of experience, the company has received approximately 40 international awards, highlighting its commitment to excellence. FBS is regulated by CySEC under license number 331/17, ensuring adherence to strict financial standards.

The broker offers flexible trading conditions for Forex, catering to the diverse needs of its clients. In addition to a wide range of currency pairs, FBS provides trading opportunities in indices, futures contracts, exotic currencies, and metals. Notably, FBS enjoys significant popularity in Asian countries such as India, Malaysia, as well as the trading market in Indonesia, reflecting its strong presence and reputation in the region.

This is how the broker performs on 5 important aspects in trading:

✔️ FBS Pros

- Low stock and stock index CFD fees

- No inactivity fee

- Easy and fast account opening

- Excellent customer support & education

❌ FBS Cons

- Slim product portfolio

- Few account base currencies

- No investor protection for non-EU clien

How Could a Broker Apply for an ASIC License?

Securing a financial license in Australia entails a complex process. On average, the entire procedure for obtaining a financial license in Australia spans a duration of 3-4 months.

The initial step necessitates the registration of a resident company, specifically a private company (designated as "Pty Ltd"). This company structure can be wholly established by individuals who are non-residents of Australia.

Documents prepared to file an application with ASIC are:

- The ASIC form FS01 that mandates the comprehensive details about the applicant, the business, the intended financial services and products, and the capacity to adhere to AFS (Australian Financial Services) license prerequisites. This entails having responsible directors, ample resources, and robust systems and processes.

- A comprehensive business description to encompass a detailed overview of the business, outlining income sources, prospective customer types, and the organizational methodologies and strategies in place.

- Documentary evidence or confirmation for each responsible manager (director).

The regulator then will examine the documents for:

- The qualifications and experience of the company's responsible managers (directors) in the relevant field.

- The presence of adequate funds to support the business's operations

- The office, having a legal address suffices, and a physical office is not obligatory.

- Mandatory reporting, including the necessity to have a bank account for this purpose.

- The bank account, which must be established with one of the banks in Australia.

- The possibility of performing services as a representative of the licensee.

Additional FAQ

What does it mean to be an ASIC-licensed forex broker?

Here's what it means to be an ASIC-licensed forex broker currently:

- All ASIC-licensed forex brokers are required to hold at least AUD1 million in operating capital.

- Like FCA, ASIC will monitor the company continuously to ensure segregation of client funds, periodical report and audit, efficient management including AML and KYC procedures, and proper risk disclosure for clients.

- ASIC Forex brokers are not allowed to have any conflict of interest with their customers. This is the reason why Australian Forex brokers usually offer direct market access through ECN or STP facilities.

- ASIC allows leverage for forex and CFD trading up to 30:1.

Continue Reading at UK FCA vs ASIC, Which Forex Regulator is More Reliable?

ASIC is responsible for:

- promoting a fair, transparent and efficient financial system for all

- regulates the conduct of Australian companies, financial markets, financial services organizations and professionals who deal in and advise on investments, superannuation, insurance, deposit-taking, and credit

- responsible for authorizations to operate in industries it regulates

Continue Reading at 6 Best Forex Broker Regulators in the World

What are the regulations for online forex trading in Nigeria?

When it comes to online trading regulation, the ambiguity of laws in Nigeria contrasts with other African countries that have already implemented regulations. For example, South Africa's Financial Sector Conduct Authority (FSCA) and Kenya's Capital Markets Authority (CMA) have already regulated online forex brokers in their countries. Furthermore, South Africa has even established rules for forex trading taxation.

Continue Reading at Is It Safe to Trade Forex in Nigeria?

What are the forex regulaors in UAE?

Official regulators in the UAE are as follows:

- The Dubai Financial Services Authority (DFSA)

- The Abu Dhabi Global Market (ADGM)

- The Securities Commission Authority (SCA)

- Central Bank of the United Arab Emirates (CBUAE)

It is important to understand that the UAE is divided into two financial areas, namely the Mainland and Free Zones. Brokers who operate in the Mainland are regulated by the SCA or CBUAE. Meanwhile, DFSA and ADGM regulate brokers in the Free Zones, which are designated to encourage foreign investments and allow foreign-owned companies to be located.

Continue Reading at Best Forex Brokers in United Arab Emirates (UAE)

Forex Broker Articles

- UK FCA vs ASIC, Which Forex Regulator is More Reliable?

- FSA Vs FCA: Exposing the Differences and the History

- FX Regulation: Unveiling The Dark Sides of the Restrictions

- Best Forex Brokers for Professional Traders

- Best Forex Brokers in Australia

- 6 Best Forex Broker Regulators in the World

- How to Choose the Best Forex Broker

Broker Categories

Minimun Deposit

Payment

Country

Established

Instruments Traded

Features

Trading Platform