List of Brokers with FCA Regulation

The FCA (Financial Conduct Authority) is one of the most prestigious financial regulatory bodies that exists independently from the United Kingdom Government. FCA helps regulate more than 56,000 financial services companies. Founded in 2013 to replace FSA, their responsibilities include overseeing financial markets in the UK, as well as promoting fair competition in financial services for the benefit of consumers.

| Established | : | 2013 |

| Country | : | United Kingdom |

| Website | : | https://www.fca.org.uk |

| Total Brokers | : | 95 |

Scroll for more details

If you are interested to try the brokers in the list above, make sure to use the forex demo account so you could experience trading firsthand with virtual money. You don't even have to deposit any funds since the demo account is 100% free and is available in most brokers.

FCA stands for the Financial Conduct Authority, which is a regulatory body in the United Kingdom. The FCA is responsible for regulating financial markets and firms to ensure that they operate in a way that is fair, transparent, and in the best interests of consumers.

The process of regulating financial companies is performed in conjunction with the Bank of England and the Prudential Regulatory Authority (PRA). The split of financial industry regulation into different entities helps to streamline the entire process of regulation and ensure integrity and transparency of the UK's financial markets.

As such, FCA-regulated brokers are known to have clear regulations, reputations, and infrastructure. This does not come as a surprise as the UK is one of the countries with the most advanced financial activities in the world.

What Does FCA-regulated Mean for Forex Traders?

Being regulated by FCA (Financial Conduct Authority) means operating under the standards of the United Kingdom's financial regulator. Due to its strict rules, traders in FCA-regulated brokers would have to deal with limited leverage (up to 30:1) and stop out level at 50%. It means all trading positions would be automatically closed when the trader's funds fall to 50% of the margin needed to maintain open positions on their CFD account.

More importantly, FCA doesn't allow brokers to offer monetary and non-monetary inducements to encourage trading, so promotions and bonus offerings are prohibited.

Nonetheless, traders would be guaranteed safety and protection as FCA is one of the few regulators that are proven to compensate some of the traders' funds following brokers' insolvency cases. That is made possible by the FSCS (Financial Services Compensation Scheme) which can provide funds of up to 85,000 pounds of the deposit amount per customer per broker.

See Also:

The FCA is overseen directly by the Bank of England and works with the UK Financial Ombudsman to resolve disputes. Although FCA does not personally get involved in any conflict between brokers and traders, the regulatory agency will investigate any instances of fraud or consumer abuse.

The FCA will revoke a company's licenses and issue hefty fines to if it is found guilty, to the extent of permanently banning the broker from operating in the UK.

To help them conduct their tasks, the FCA has an excellent online resource to track a vast amount of information on regulated brokers, new scams, financial malpractices, and other relevant data. It has been made clear that the agency has been granted immense powers by the UK Government to keep financial businesses in line with the rules and framework.

How to Check an FCA-regulated Broker?

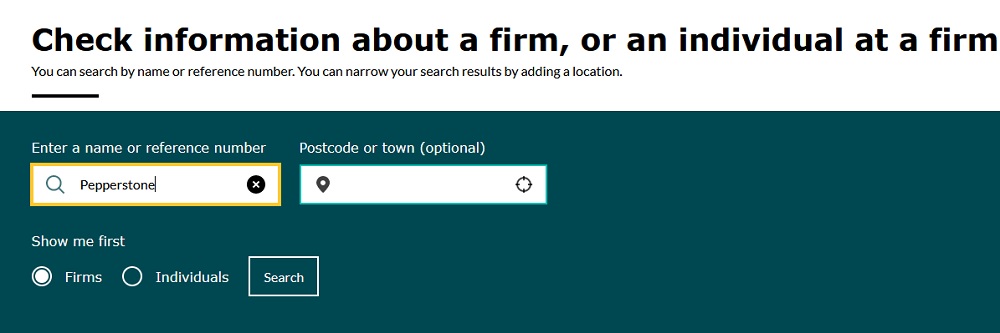

- Go to the official website of FCA Registry.

- Scroll down the page until you find the "Search" section.

- Type out the name of a broker or their FCA number in the left column.

- You can skip the Postcode column, but you have to check the type of entity that you search for, whether it is a firm or an individual.

- Finally, click Search.

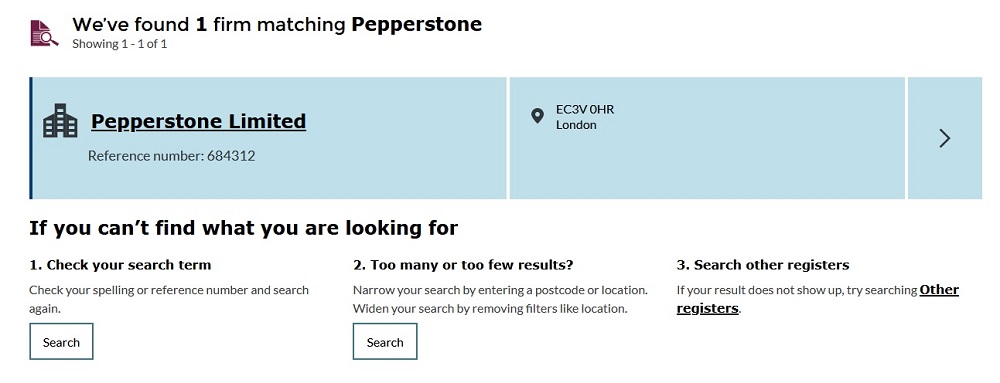

- If your search matches a regulated broker in FCA, the result would look like this:

- You could click on the name of the company to explore more information about the broker.

How Could a Broker Apply for an FCA License?

Here's a general outline of the process:

- Determine your business activities as a forex broker or trading company, as the FCA regulates a wide range of financial activities.

- Create a detailed business plan, risk assessments, and compliance procedures.

- Complete online application in the FCA system. You will need to fill out the relevant application forms, providing detailed information about your business, structure, activities, management, financials, and compliance procedures.

- The FCA will assess your application against their "threshold conditions," which are a set of requirements to ensure your firm's fitness, competence, and financial soundness.

- Provide supporting documents such as financial statements, business plans, organizational structure, and details of key personnel.

- Demonstrate that you have appropriate systems and controls in place to ensure compliance with FCA regulations. This might include anti-money laundering procedures, data protection measures, and risk management frameworks.

- The FCA will review your application and may request additional information or clarification during this process. They might also conduct interviews or meetings to better understand your business.

- The FCA will communicate their decision regarding your application. If successful, you'll be granted an FCA license, and you'll need to pay the relevant authorization fees.

The FCA commonly categorizes applications into three groups: simple, moderately intricate, and intricate. The complexity of the application determines the corresponding application fee. It may range from £1,500 to £5,000.

The duration for preparing the FCA application documents can span several weeks, depending on how fast you can gather the required information. After submitting the application, it generally takes around 2-4 weeks to be assigned an FCA case officer. The review process by the FCA might extend from 3 to 6 months, although they retain a maximum of 12 months to assess and determine the firm's authorization.

What to Do After Acquiring an FCA License

After receiving your FCA license, you'll be subject to ongoing regulatory oversight and compliance requirements. This includes regular reporting, audits, and updates to the FCA about changes in your business.

In general, all FCA-regulated forex brokers are expected to uphold these regulatory standards to prevent them from committing any financial fraud:

- Keep the client funds in segregated accounts away from the company accounts. Traders' money should not be used for any purposes.

- Maintain at least £1 million in operating capital. It could increase according to the number of traders and the trading capital.

- Ensure all withdrawals are processed instantaneously and meet all financial obligations without fail.

- Submit yearly audit reports and periodic financial statements to verify that all the facts provided to the FCA are accurately represented.

- Protect the clients under the FSCS (Financial Services Compensation Scheme) by providing a guarantee of compensation from £50,000.

In addition, as regulations and procedures can change, it's essential to stay informed about any updates or changes in the regulatory landscape that might affect your business.

Additional FAQ

How does FCA pay regulatory visit?

To encourage compliance with the rules, the FCA will also pay regulatory visits, which can be divided into these types:

- Virtual visit: a conference call that can last up to 2 hours with a 6-week notice prior to the call.

- Surgery: an invitation from the FCA for a Treating Customers Fairly (TFC) meeting in a suitable venue.

- Actual Visit: a visit by the FCA team, either announced or announced.

Continue Reading at What are the Top UK Financial Regulators?

What is FCA main reponsibility?

The FCA's main responsibility is to regulate the conduct of financial services in the UK. In a broader scope, the FCA's responsibilities include:

- Regulating standards of conduct in retail and wholesale markets.

- Supervising trading infrastructures that support those markets.

- Supervising prudential regulation on firms that are not regulated by the PRA.

- Regulating securities markets

Continue Reading at What are the Top UK Financial Regulators?

What are the type of firms that FCA supervise?

The types of firms that must be authorized by the FCA include:

- Banks

- Building societies

- Credit unions

- Claim management companies

- Consumer credit firms

- Financial advisers

- General insurers and insurance intermediaries

- Electronic money and payment institutions

- Investment managers

- Mortgage lenders and intermediaries

- Life insurers and pension providers

- Mutual societies

- Sole advisers

- Wealth managers

Continue Reading at What are the Top UK Financial Regulators?

The FCA has the objective of ensuring that financial markets work well in accordance with the regulation. By doing so, the FCA strives for:

- Protecting customers.

- Enhancing the integrity of the UK financial system.

- Promoting fair competition in the interests of customers.

Continue Reading at What are the Top UK Financial Regulators?

Related Articles

- UK FCA vs ASIC, Which Forex Regulator is More Reliable?

- FSA Vs FCA: Exposing the Differences and the History

- All About Forex Trading in the UK

- Comparing CySEC Vs FCA Regulation

- FX Regulation: Unveiling The Dark Sides of the Restrictions

- Top 10 Forex Brokers in the United Kingdom

- 6 Best Forex Broker Regulators in the World

Broker Categories

Minimun Deposit

Payment

Country

Established

Instruments Traded

Features

Trading Platform