List of Brokers with NFA Regulation

NFA stands for the National Futures Association. It is a self-regulatory organization (SRO) in the United States that operates under the regulatory oversight of the CFTC. Founded in 1982, The NFA's primary role is to regulate the activities of entities and individuals involved in the futures and derivatives markets, including brokers, futures traders, commodity pool operators, swap dealers, exchanges, commodity trading advisors, and retail foreign exchange dealers.

| Established | : | 1982 |

| Country | : | United States |

| Website | : | https://www.nfa.futures.org/ |

| Total Brokers | : | 8 |

Scroll for more details

If you are interested to try the brokers in the list above, make sure to use the forex demo account so you could experience trading firsthand with virtual money. You don't even have to deposit any funds since the demo account is 100% free. It is also available in most brokers.

What Does NFA-regulated Mean for Forex Traders?

NFA is a competent broker regulator, so NFA-regulated brokers have a good reputation in their class. They're also required to ensure consumer protection through segregated accounts and good transparency.

In terms of trading conditions, the maximum allowable leverage is 1:50, and hedging is not allowed due to FIFO regulations. Bonus promotions are also prohibited since the NFA considered such schemes as high-risk.

It's important to note that the registration process may not be as simple as other brokers. Before registering with an NFA-regulated broker, clients must fill out a series of questions in relation to their trading knowledge and experience, as well as sources of funds and other personal information.

How to Check an NFA-regulated Broker?

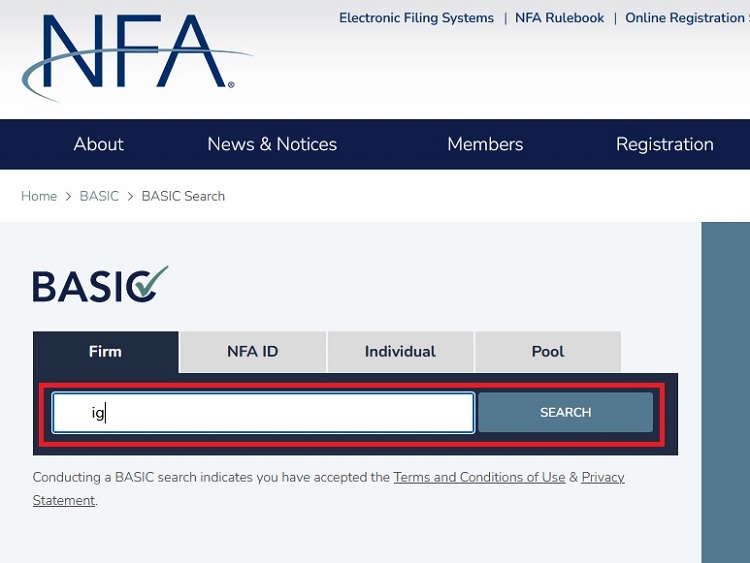

By accessing the BASIC (Background Affiliation Status Information Center), traders can find out the names of NFA-regulated brokers. You can follow the steps below:

- Visit NFA Basic Database.

- Write a broker's company name and click Search. You could also choose the NFA ID tab if you prefer to search the broker by its ID number.

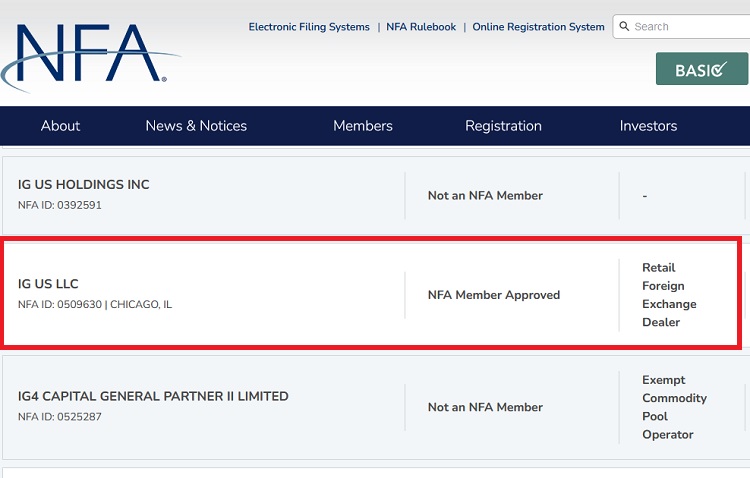

- If your broker is registered, you'll find the "NFA Member Approved" statement in the Membership Status column. To access more details about the broker, simply click on the broker's name.

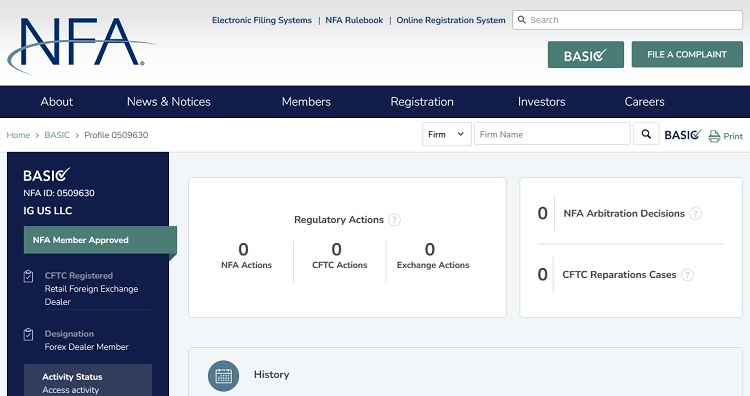

- You can monitor the broker's registration page for information regarding data, regulatory actions, decisions, and any reparation cases that may have been associated with the broker.

See Also:

The NFA registers and regulates various market participants, including commodity futures brokers, forex dealers, commodity trading advisors (CTAs), commodity pool operators (CPOs), and introducing brokers (IBs). It operates under the regulatory oversight of the CFTC and works closely with the CFTC to ensure consistent regulatory standards and enforcement across the derivatives markets.

The NFA monitors the trading activities of its registered members to detect and prevent market manipulation, fraud, and other violations of trading rules. It uses sophisticated surveillance tools and data analysis to identify unusual trading patterns.

In case of misbehaving from the broker part, NFA will dish out heavy penalties and sanctions. The agency is popular for its strict actions against broker scams as well as forex brokers that have a history of client manipulation.

How Is NFA Compared to Other Forex Regulations?

Here's a comparison between the NFA and a few other well-known forex regulatory bodies:

| Scopes | 🇺🇸 NFA (United States) | 🇬🇧 Financial Conduct Authority (FCA - United Kingdom) | 🇦🇺 Australian Securities and Investments Commission (ASIC - Australia) | 🇨🇾 Cyprus Securities and Exchange Commission (CySEC - Cyprus) |

| 💎Role and Function | Responsible for regulating various market participants in the US futures and derivatives markets, including forex trading. | The FCA is the regulatory authority for financial markets in the United Kingdom, including forex trading. | ASIC oversees financial markets in Australia, including forex trading. | Regulates financial markets in Cyprus, including forex trading, and is also relevant within the European Union due to Cyprus's EU membership. |

| 💼Regulatory Approach | Operates as a non-governmental entity but under the oversight of the CFTC. It sets rules and standards for its members, conducts audits, and enforces compliance. | The FCA is a governmental regulatory body that operates independently. It enforces strict rules and standards to ensure market integrity, investor protection, and fair competition. | ASIC is a government agency responsible for regulating financial markets. It focuses on market integrity, consumer protection, and maintaining fair and efficient markets. | CySEC enforces regulations to ensure market integrity, investor protection, and transparency in financial markets. |

| Investor Protection | The NFA places a strong emphasis on investor protection through rigorous compliance standards, transparency requirements, and enforcement actions against non-compliant members. | The FCA is known for its strong investor protection measures, including client fund segregation, compensation schemes, and strict disclosure requirements. | ASIC enforces measures to protect investors, including client fund segregation, professional indemnity insurance, and a compensation scheme. | CySEC enforces certain investor protection measures, such as capital requirements and dispute resolution mechanisms. |

| 📃Licensing and Registration | Forex brokers, commodity trading advisors (CTAs), and other entities need to register with the NFA to operate in the US markets. | Forex brokers and financial service providers must obtain authorization from the FCA to operate in the UK. | Forex brokers and financial service providers must obtain an Australian Financial Services (AFS) license from ASIC to operate in Australia. | Forex brokers operating in Cyprus or serving EU clients can be regulated by CySEC by obtaining a Cyprus Investment Firm (CIF) license. |

| 🔨Enforcement | The NFA has the authority to enforce its rules through disciplinary actions, fines, and suspensions. | The FCA has the power to take regulatory actions, impose fines, and revoke licenses to maintain compliance. | ASIC has the authority to take regulatory actions, impose fines, and enforce compliance. | CySEC has the authority to impose fines and sanctions, ensuring compliance with regulatory standards. |

Additional FAQ

What are some brokers regulated by NFA and CFTC?

Usually, US brokers are regulated by both CFTC and NFA. Some notable examples of NFA and CFTC brokers are:

- TD Ameritrade: Regulated by NFA (license number: 0313199) and a member of CTFC.

- IG Broker: A member of the CTFC and regulated by NFA (license number 0509630).

- OANDA: OANDA is regulated by NFA (license number 0325821) and is a member of the CFTC.

- AMP Global: Regulated by NFA (license number: 0412490) and a member of CTFC.

- Interactive Brokers: Regulated by NFA (license number 0258600) and a member of CTFC.

Continue Reading at The Two Major US Regulatory Agencies You Should Know

Why does NFA ban the use of e-payment as deposit method?

Remember that the ban applies to not only funding via credit cards but also other linked electronic payment methods that usually draw funds from the customer's credit card. This includes payment though PayPal and Skrill, among many others.

According to the NFA, this decision will limit potential scams and encourage traders only to use their funds. Depositing via traditional bank transfer methods and debit cards is still acceptable to fund an account if you're trading with a US broker. Also, US check payments and fund transfers conducted through an automated clearing house are still viable. Still, some brokers had anticipated a decline in new clients due to this regulation.

Continue Reading at The Problems with Forex Brokers that Accept Credit Cards

What are NFA's primary tasks and responsibilities?

Its primary tasks and responsibilities include:

- Registration and Membership: Specific entities and individuals engaged in derivatives trading must undergo registration with the CFTC.

- Rulemaking: Self-regulation entails identifying industry best practices and implementing them as mandatory standards.

- Enforcement and Registration Actions: NFA takes disciplinary actions against Members when appropriate.

- Member Education & Resources: NFA offers various educational opportunities to assist its members.

- Arbitration: NFA provides a cost-effective and streamlined arbitration program.

- Investor Protection: NFA provides various resources to aid investors in conducting due diligence before making investment decisions.

- Outreach Programs: NFA provides training, as requested, to regulators, exchanges, and self-regulatory organizations from across the globe.

- Market Regulation: NFA delivers regulatory services to designated contract markets (DCM) and swaps execution facilities (SEF).

Continue Reading at The Two Major US Regulatory Agencies You Should Know

How much does it cost to get broker license in US?

The US trade market is strictly regulated by several different authorities. With a registered capital of USD250,000 and the brokerage license costs that possibly reach USD1,000,000, getting everything approved and signed off can take up to 1.5 years in total.

Continue Reading at Top Countries to Apply for Brokerage Licenses

Forex Broker Articles

Broker Categories

Minimun Deposit

Payment

Country

Established

Instruments Traded

Features

Trading Platform