List of Brokers with FSC Regulation

The Financial Services Commission in Mauritius is one of forex brokers' regulatory agencies from an offshore jurisdiction. Established in 2001, it was mandated under the Mauritius Financial services act of 2007. There are several forex brokers licensed under FSC Mauritius and they accept clients from many countries as the agency does not limit their brokers' operations area.

| Established | : | 2001 |

| Country | : | Mauritius |

| Website | : | https://www.fscmauritius.org/en |

| Total Brokers | : | 29 |

Scroll for more details

If you are interested to try the brokers in the list above, make sure to use the forex demo account so you could experience trading firsthand with virtual money. You don't even have to deposit any funds since the demo account is 100% free and is available in most brokers.

FSC Mauritius is an offshore regulatory agency that is responsible for overseeing and regulating non-banking financial services on the island of Mauritius. The main purpose of FSC is to keep a steady balance between regulatory measures and business development in all of its aspects. FSC makes sure that all activities of its members are above board and that the code of conduct is observed in their business dealings in terms of fairness, efficiency, and transparency.

The institution is attractive to a lot of forex brokers as the license is much cheaper compared to onshore European forex licenses. Still, FSC Mauritius is known to be quite stringent and puts stress on the importance of conducting brokerage operations in a transparent manner. There are cases when it has issued several warnings to FSC-licensed brokers, proving its reliability despite its status as an offshore regulatory agency.

What Does FSC-regulated Mean for Forex Traders?

Trading in an FSC-regulated broker would mean higher leverage that benefits traders with small deposits. Since the license acquisition is not costly, brokers operating under FSC Mauritius generally offer low trading costs in spreads, commissions minimum deposits, and transaction fees. The regulatory agency does not explicitly prohibit its brokers to attract clients with promotions, so traders could easily find bonus programs when trading with an FSC-regulated broker.

However, it is also important to note that an FSC license does not ensure segregated accounts, so the safety of the client's funds is not highly guaranteed. Clients are recommended to do their due diligence when dealing with a forex broker that is only regulated by FSC Mauritius.

How to Check an FSC-regulated Broker?

- Go to the official website of FSC Mauritius.

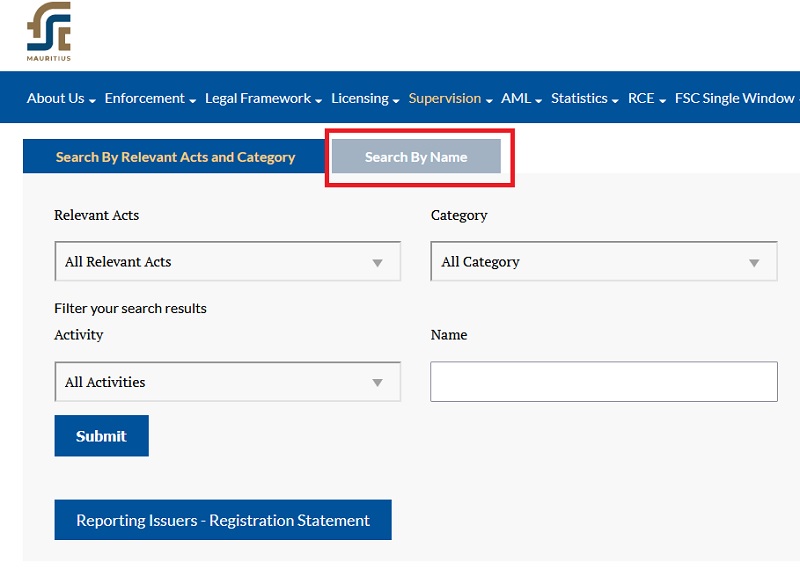

- Click on Supervision, and choose Register of Licensees.

- To simplify your search, skip this form and choose the Search By Name tab.

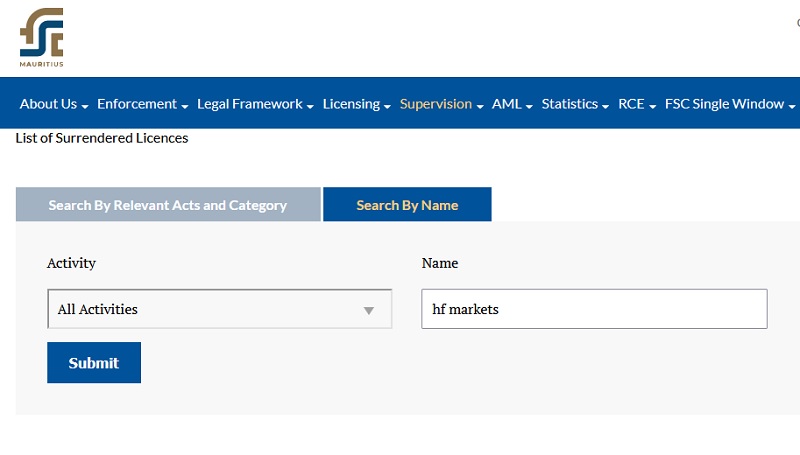

- Next, type the company name of your broker and click Submit.

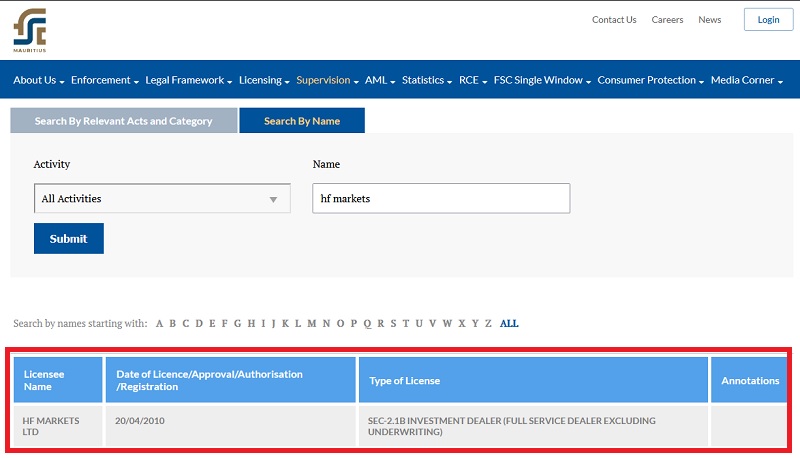

- If your broker is rightfully registered in FSC Mauritius, there should be a detail like this below the search section.

How Is FSC Mauritius Compared to Other Forex Regulators?

The Financial Services Commission (FSC) of Mauritius is one of many regulatory bodies around the world that oversee and regulate forex (foreign exchange) and financial services activities. Each regulatory authority operates within its own jurisdiction, and the effectiveness of regulation can vary based on several factors. Here's a general comparison between FSC Mauritius and other forex regulators:

| Comparison Aspects | FSC Mauritius | Other Forex Regulators |

| 💼 Regulatory Framework and Stringency | The FSC of Mauritius has established a standard regulatory framework to oversee various financial activities, including forex trading. It sets guidelines, standards, and requirements to ensure the stability and integrity of the financial system in Mauritius. | Regulatory bodies in countries such as the United States (CFTC, NFA), the United Kingdom (FCA), Australia (ASIC), and the European Union (ESMA) are known for having more stringent regulations and strict enforcement mechanisms in place for forex brokers. These regulators often require brokers to meet higher capitalization requirements, maintain segregated client funds, and adhere to strict reporting and transparency standards. |

| 🔰 Investor Protection | The FSC works to protect investors and ensure fair practices in the financial sector. It implements measures to ensure that brokers adhere to anti-money laundering (AML) and know your customer (KYC) regulations. | Regulators in well-established financial centers place a strong emphasis on investor protection. They often offer compensation schemes that reimburse traders in case a regulated broker becomes insolvent. |

| 📃 Licensing and Approval Process | The licensing process for forex brokers in Mauritius involves meeting certain criteria, submitting documentation, and undergoing due diligence checks. The FSC evaluates the fitness and propriety of key individuals and the broker's compliance procedures. | Regulatory authorities in countries like the UK, the US, and Australia have comprehensive licensing processes that include strict financial and operational requirements, background checks on company directors, and ongoing oversight of licensed brokers. |

| 🌎 Global Recognition | While the FSC regulates financial services in Mauritius and attracts international business, it may not be as widely recognized on the global stage as some other regulators. | Regulators in established financial centers often have a higher level of global recognition and credibility. Brokers regulated by these authorities can attract clients from various parts of the world. |

| 👮 Enforcement and Transparency | The FSC enforces regulations to maintain the stability of the local financial market and ensure fair practices. Enforcement mechanisms may differ based on the type of violation. | Regulators in major financial centers are known for strong enforcement actions against non-compliant brokers. They have the authority to impose fines, revoke licenses, and take legal action when necessary. |

How Could a Broker Apply for an FSC License?

In general, here are the steps to apply for an FSC Mauritius license:

- Identify the specific type of license you need from the FSC. If you're a forex broker, you could choose Investment.

- Gather all the necessary documents and information required for the application. This may include:

- Business plan detailing your proposed financial activities.

- Information about the company's shareholders, directors, and management.

- Financial statements, including audited accounts.

- Compliance policies and procedures.

- Anti-Money Laundering (AML) and Know Your Customer (KYC) procedures.

- Proof of sufficient capital and financial resources.

- Any other documents specific to the type of license you're applying for.

- Prepare the application form provided by the FSC and submit it along with all the required documents. The application form can usually be downloaded from the FSC's official website.

- The FSC will review your application and conduct a thorough evaluation of your proposed business, compliance with regulations, financial stability, and other relevant factors.

- The FSC will then conduct due diligence checks on the company's shareholders, directors, and other relevant individuals. This is to ensure that the individuals involved meet the required fit and proper criteria.

- During the review process, the FSC may request additional information or clarifications about your application. It's important to respond promptly and provide accurate information.

- If your application meets all the requirements and passes the evaluation process, you will receive approval from the FSC. Once approved, you will be issued the relevant license to operate your financial services activities in Mauritius.

After obtaining the license, you will need to adhere to the regulatory requirements set by the FSC. This includes regular reporting, compliance with regulations, and maintaining adequate records.

Additional FAQ

What are the regulations for online forex trading in Nigeria?

When it comes to online trading regulation, the ambiguity of laws in Nigeria contrasts with other African countries that have already implemented regulations. For example, South Africa's Financial Sector Conduct Authority (FSCA) and Kenya's Capital Markets Authority (CMA) have already regulated online forex brokers in their countries. Furthermore, South Africa has even established rules for forex trading taxation.

Continue Reading at Is It Safe to Trade Forex in Nigeria?

What are reliable forex broker regulations?

Some of the top regulatory agencies in the world include:

- The Financial Conduct Authority (FCA) and the Prudential Regulation Authority (PRA) in the United Kingdom

- The Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA) in the United States

- The Swiss Financial Market Supervisory Authority (FINMA) in Switzerland

- The Australian Securities and Investments Commission (ASIC) in Australia

- The Financial Services Agency of Japan (JFSA) in Japan

- The Cyprus Securities and Exchange Commission (CySEC) in Cyprus

If the broker you use is regulated by one of the regulatory agencies above, you can be confident that it is safe. The reason is that these regulatory agencies have strict requirements that brokers must meet to be licensed.

Only the most reputable and trustworthy brokers can obtain a license.

Continue Reading at How to Avoid Forex Broker Scams

How did Russian forex regulation become very strict?

The first official effort to regulate the industry began in 2004 through the establishment of Federal Financial Markets Service (FFMS/FSFR). After the agency's disbandment in 2013, the Central Bank of Russia took over supervising Russian forex brokers.

In 2015, the Central Bank of Russia launched far stricter law enforcement. Forex brokers were given a January 2016 deadline to obtain licenses from CBR, or abstain from carrying out their services in the region. Since then, CBR only granted licenses to a handful of brokers.

Continue Reading at Best Forex Brokers in Russia

What is the regulatory status of forex trading in Nigeria?

Online trading in Nigeria is currently unregulated, while offline forex trading is well-regulated. This regulatory contrast is due to the differences like these two markets.

Continue Reading at Is It Safe to Trade Forex in Nigeria?

Forex Broker Articles

Other Articles

Broker Categories

Minimun Deposit

Payment

Country

Established

Instruments Traded

Features

Trading Platform