Shifting Stop Loss (SL) is what commonly called as trailing stop, and it is done mainly to protect the profit we have gained from our ongoing trades. It needs particular diligence to apply Trailing Stop manually.

Often, in trading chat rooms, forex traders ask something like: "Already 100 pips; is it good to close it now?"

I didn't know whether he did it to boast or genuinely seek pointers, but if he happened to ask me, I should advise him to close it.

If I have to answer seriously, I will say, "Look at the trend first, if it has weakened, then close it, but if it is still strong, shift your stop loss."

The Trailing Stop Concept

Shifting Stop Loss (SL) is what commonly called a trailing stop, and it is done mainly to protect the profit we have gained from our ongoing trades.

To do that, some friends usually shift SL upward every 10 pips. Some shift upward every time the price has walked half the target goal; if the Target Profit is 50 pips, he will shift the SL upward every 25 pips.

Some traders may also make use of Fibonacci levels as multilevel thresholds. And many others.

However we did it, the key point is to protect the position gained from returning to zero or even minus. Besides shifting SL, we can also shift Target Profit (TP).

It needs particular diligence to apply Trailing Stop manually, but we may have to do that if the trading platform we used lacks an automatic Trailing Stop facility.

We can always close our winning position and open another position in the same direction afterward, but it will mean that the spread cost and commission cost will add up. It will be really expensive, as spread in some brokers can reach up to a dozen pips.

But with a trailing stop, we can maintain the first position to reach the maximum profit before closing it. Thus, there will be no unnecessary cost of spread or commission.

How to Set Trailing Stop on MT4

The main obstacle in applying trailing stop is the lack of diligence on our part as traders. If our chosen trading platform does not facilitate trailing stop, then we have to do it personally, a tiring process that will not be able to be done if we have limited time to trade.

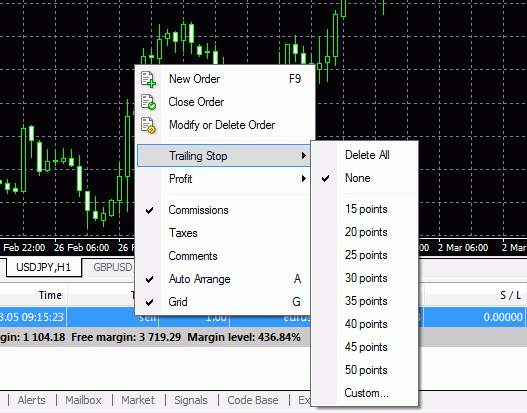

Luckily, there is a trading platform that can facilitate trailing stops automatically, most notably Metatrader 4 (MT4).

We can determine how many pips we want to trail in our position. However, the trailing stop in Metatrader 4 will only be activated after the first profit, so you will have to place a stop loss too.

Besides, the trailing stop will only be active if the platform (and your PC) is online; hence you cannot leave it alone. It is relatively easier, but trying it in a demo account before using trailing stop to trade for real will be better. By utilizing the trailing stop, we can get to the best exit point which is very important in making good trades with only minimum risk involved.

See also: Forex Brokers Providing Trailing Stops

Examples of Using The Trailing Stop

Trailing stops are divided into two types, namely manual and stop loss. Both have significant differences in how they work. To understand the difference, please see an example of using a manual and automatic trailing stop below.

Manual Trailing Stop

Here's an example of how you can implement a manual trailing stop in forex trading:

- Suppose you're trading the EUR/USD currency pair and bought it at 1.2000. You want to set a trailing stop at 50 pips, meaning if the price moves in your favor by 50 pips, your stop loss will move accordingly to lock in potential profits.

- Keep track of the EUR/USD price movement after you enter the trade. Let's say the price starts to rise and reaches 1.2050.

- Calculate the trailing stop distance in pips. In this case, it's 50 pips. Subtract this distance from the current price to determine your initial stop loss level. Your initial stop loss would be set at 1.2000 - 0.0050 = 1.1950.

- As the price rises to 1.2070, you will adjust your trailing stop to lock in profits. Calculate the new stop loss level by subtracting the trailing stop distance from the current price. In this case, your new stop loss would be 1.2070 - 0.0050 = 1.2020.

- Repeat the process as the price moves in your favor. Each time the price increases by 50 pips, adjust your stop loss to lock in additional profits.

Remember, in manual trailing stops, you must monitor the price and actively adjust your stop loss.

Automatic Trailing Stop

Here's an example of implementing an automatic trailing stop in forex trading using a platform that supports this feature.

- Let's say you open a long position on the EUR/USD currency pair at 1.2000.

- Determine the trailing stop distance you want to use. For this example, let's use 50 pips.

- In your trading platform, locate the option to set a trailing stop and enable it for your trade. Enter the trailing stop distance of 50 pips.

- As the price moves in your favor, the trailing stop automatically adjusts to lock in potential profits.

- If the price moves in your favor by 50 pips, the trailing stop will activate, moving your stop loss level 50 pips below the current price.

- If the price continues to move in your favor, the trailing stop will automatically adjust whenever the price increases by an additional 50 pips. This ensures that your stop loss level is always 50 pips below the highest price reached since the trade was opened.

- If the price reverses and moves against you, the trailing stop will stay in place and will only trigger a stop loss order if the price reaches the trailing stop level.

By using an automatic trailing stop, you don't have to adjust your stop loss level manually. The trading platform handles it based on the specified trailing stop distance. However, it's important to note that not all trading platforms offer automatic trailing stops, so checking if your chosen platform supports this feature is necessary.

Aside from trailing stop, another interesting tool related to stop loss that is very helpful to manage your trades is the guaranteed stop loss. Learn all about it in Is Guaranteed Stop Loss Better than Regular Stop Loss?

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance

1 Comment

Andrew G

Apr 25 2024

Could someone break down the distinction between SL Stop Loss and Shifting Stop Loss SL for me? The article explains that Shifting Stop Loss (SL), often referred to as a trailing stop, is primarily used to safeguard the profits earned from ongoing trades.

To implement this strategy, some traders opt to shift the SL upward by a fixed number of pips, such as every 10 pips. Alternatively, others adjust the SL upward when the price reaches halfway to the target profit goal; for instance, if the Target Profit is set at 50 pips, they would shift the SL upward every 25 pips.

Could you provide examples of each method and highlight the differences using the same example? Thanks!