List of Brokers with BAPPEBTI Regulation

Badan Pengawas Perdagangan Berjangka Komoditi (BAPPEBTI) is an institution owned by the Ministry of Trade that was established to assist in overseeing and drafting regulations related to commodity trading, futures, and foreign exchange markets in Indonesia. Founded in 1997, the agency is known for restricting foreign brokerages to take clients from Indonesia. Here's a list of BAPPEBTI-regulated forex brokers.

| Established | : | 1997 |

| Country | : | Indonesia |

| Website | : | https://bappebti.go.id |

| Total Brokers | : | 16 |

Scroll for more details

If you are interested in trying the brokers in the list above, make sure to use the forex demo account so you could experience trading firsthand with virtual money. You don't even have to deposit any funds since the demo account is 100% free. It is also available in most brokers.

BAPPEBTI stands for "Badan Pengawas Perdagangan Berjangka Komoditi," which translates to the "Commodity Futures Trading Regulatory Agency" in English. BAPPEBTI is an Indonesian regulatory agency that oversees and regulates the trading of commodity futures and derivatives in the country.

BAPPEBTI operates under the Ministry of Trade of the Republic of Indonesia and is responsible for supervising and ensuring the proper functioning of commodity futures exchanges, commodity brokers, and other entities involved in commodity futures trading activities. Its main objectives include maintaining market integrity, protecting investors, and promoting fair and transparent trading practices in the Indonesian futures and derivatives markets.

The agency sets rules and regulations that govern the operation of commodity futures exchanges and the conduct of market participants, including brokers and traders. BAPPEBTI also enforces compliance with anti-money laundering (AML) and anti-terrorism financing measures to prevent the misuse of the commodities markets for illicit activities.

What Does BAPPEBTI-regulated Mean for Forex Traders?

Considering the Indonesian demographic that primarily consists of Muslims, forex brokers under BAPPEBTI are stipulated to enforce trading conditions in accordance with the Sharia Law. That means no interest or riba to be earned or paid, no excessive risk (gharar), and no speculation or gambling.

Due to the fee policy applied to its members, BAPPEBTI-regulated brokers charge spreads in addition to trading commissions. The amount of leverage is also limited to 1:100 to protect clients against market risks.

International forex brokers are banned from offering services in Indonesia since 2013. Traders within the country are advised not to open accounts with overseas brokers since they won't be trading under the protection of BAPPEBTI's regulation.

What Are the Powers of BAPPEBTI?

BAPPBETI has the power to investigate suspicious brokers operating in Indonesia. The agency has the authority to suspend, impose sanctions, and liquidate any members who have been proven guilty of violating BAPPEBTI's guidelines.

As an official financial regulator, BAPPEBTI can give recommendations to other official institutions like the Indonesian Department of Communication to block scam brokers as well as unlicensed financial companies in Indonesia.

How to Check a BAPPEBTI-Regulated Forex Broker?

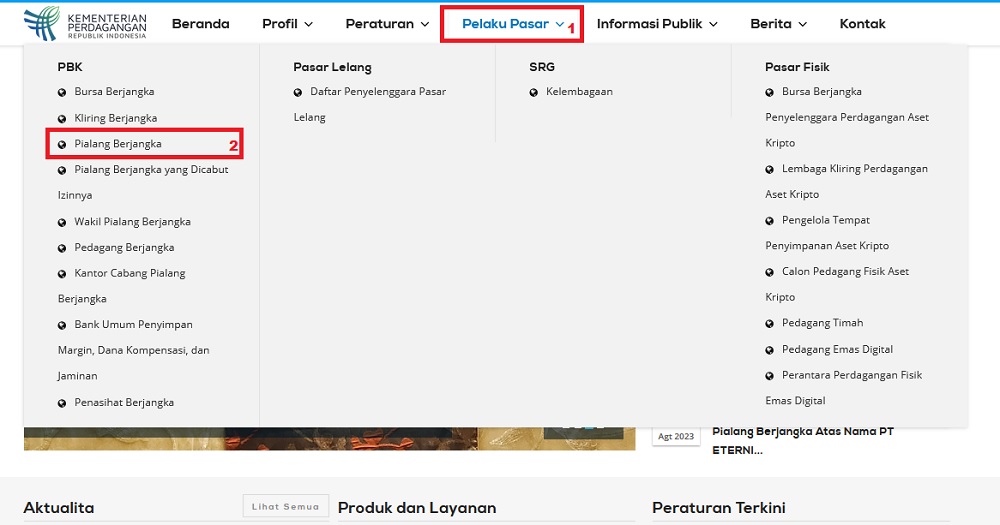

- Go to the official page of BAPPEBTI.

- Open "Pelaku Pasar" on the upper menu, then click on "Pialang Berjangka".

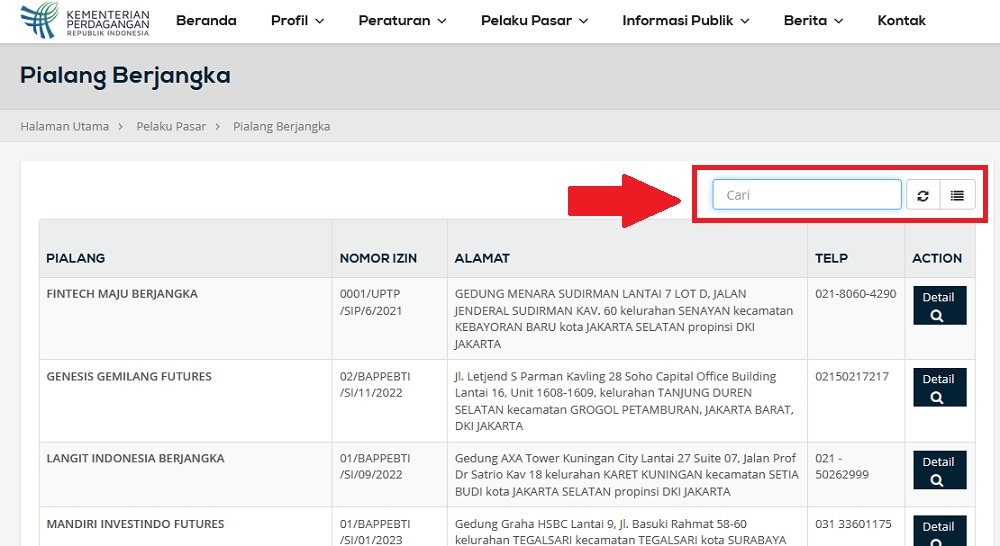

- Immediately, there would be a complete list of registered brokers under their regulation. To simplify your search, type a broker's name on the search column as indicated below.

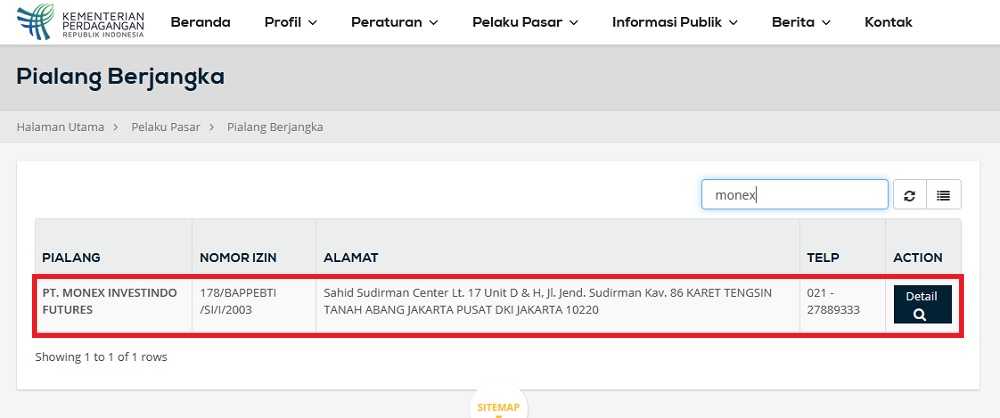

- If your broker is an official member, the identity will be automatically displayed like this.

How Is BAPPEBTI Compared to Other Forex Regulators?

BAPPEBTI primarily regulates commodity futures and derivatives trading in Indonesia, rather than specifically regulating the forex market. It's important to note that different regulatory bodies have varying scopes and focus areas.

Here's a comparison between BAPPEBTI and other well-known forex regulators:

| Aspects | 🇮🇩 BAPPEBTI (Indonesia) | 🇨🇾 Cyprus Securities and Exchange Commission (CySEC - Cyprus) | 🇬🇧 Financial Conduct Authority (FCA - UK) | 🇺🇸 Commodity Futures Trading Commission (CFTC - US) | 🇦🇺 Australian Securities and Investments Commission (ASIC - Australia) |

| 🔍Focus | Regulates commodity futures and derivatives trading in Indonesia. | Regulates financial markets and investment firms in Cyprus, including forex and CFD trading. | Regulates financial markets and firms in the UK, including forex trading. | Regulates commodity futures and options markets in the United States, including forex trading. | Regulates financial markets and firms in Australia, including forex trading. |

| Scope | Oversees the trading of commodities such as agricultural products, energy, metals, and other futures contracts. | Oversees a wide range of financial activities, including forex trading, investment services, and other financial instruments. | Oversees various financial activities, including forex and CFD trading, investment management, and more. | Oversees derivatives markets, including forex, commodities, and swaps. | Oversees various financial activities, including forex trading, securities, and investments. |

| 🔨Authority | Operates under the Ministry of Trade of the Republic of Indonesia. | An independent regulatory agency with authority to license, supervise, and impose regulations on financial services providers. | An independent regulatory body with the power to create rules, supervise financial firms, and enforce regulations. | An independent agency with the authority to regulate and enforce rules for derivatives trading. | An independent government agency responsible for regulating and enforcing rules for financial services providers. |

| Oversight | Ensures fair and transparent trading practices, market integrity, and investor protection in the commodity futures market. | Aims to ensure investor protection, market integrity, and adherence to European Union (EU) regulations. | Focuses on consumer protection, market integrity, and promoting competition in financial markets. | Aims to prevent fraud, manipulation, and abusive practices in derivatives markets while ensuring market integrity and investor protection. | Focuses on market integrity, investor protection, and maintaining a fair and transparent financial market environment. |

Additional FAQ

How did Russian forex regulation become very strict?

The first official effort to regulate the industry began in 2004 through the establishment of Federal Financial Markets Service (FFMS/FSFR). After the agency's disbandment in 2013, the Central Bank of Russia took over supervising Russian forex brokers.

In 2015, the Central Bank of Russia launched far stricter law enforcement. Forex brokers were given a January 2016 deadline to obtain licenses from CBR, or abstain from carrying out their services in the region. Since then, CBR only granted licenses to a handful of brokers.

Continue Reading at Best Forex Brokers in Russia

How's the forex regulation in Kenya?

The Capital Markets Authority (CMA) is the financial regulatory body in Kenya. Although the CMA was established in 1989, it was not until 2016 that the government granted the CMA the power to monitor forex trading. Before this, the market was full of scams committed by unregulated brokers. Today, thanks to the Financial Act of 2016, forex trading is more secure and transparent in Kenya.

Continue Reading at Is Forex Trading Legal in Africa?

How is the forex regulation in South Africa?

African countries are forex-friendly, but naturally, there are minor restrictions from the government. Forex brokers must hold a license before running their business in any of these countries. The status of forex trading in these countries is still unclear; it is not yet legalized but not against the law.

The South African Financial Sector Conduct Authority (FSCA), previously known as Financial Services Board (FSB), is one of the most well-known forex regulatory bodies.

Continue Reading at Is Forex Trading Legal in Africa?

What is the role of CNMV in regulating brokerage in Spain?

The CNMV is responsible for supervising and regulating the financial markets in Spain. It collaborates closely with the European Securities and Markets Authority (ESMA) and applies unified laws for trading in leveraged markets for retail investors, as Spain is a member of the European Union.

Continue Reading at 3 Interesting Facts of Forex Trading in Spain

Broker Categories

Minimun Deposit

Payment

Country

Established

Instruments Traded

Features

Trading Platform