List of Brokers with CFTC Regulation

The CFTC (Commodity Futures Trading Commission) is an independent government agency responsible for oversight of futures and options market regulations in the US. Founded in 1975, they are one of the oldest and most established regulatory agencies in the world that aim to protect consumers who trade in financial products like forex and commodities.

| Established | : | 1975 |

| Country | : | United States |

| Website | : | https://www.cftc.gov |

| Total Brokers | : | 8 |

Scroll for more details

If you are interested to try the brokers in the list above, make sure to use the forex demo account so you could experience trading firsthand with virtual money. You don't even have to deposit any funds since the demo account is 100% free. It is also available in most brokers.

What Does CFTC-regulated Mean for Forex Traders?

Due to CFTC's strict rules, trading in a CFTC-regulated broker would mean limited leverage (50:1 for major currency pairs and 20:1 for non-major currency pairs), no hedging from the same currency pair since the US regulator imposes the FIFO rule, and no bonus programs are allowed to be provided.

The reason for such prohibition is that CFTC considers leverage, hedging, and bonus programs as highly risky. Based on their previous cases, those three have the most potential in misleading new clients who don't know better.

The upside of trading with such strict regulation is that clients could expect the highest level of assurance in data security and funds safety. In case of suspicious broker acts, clients could always report to CFTC and be followed up with a settlement.

How to Check a CFTC-regulated Broker?

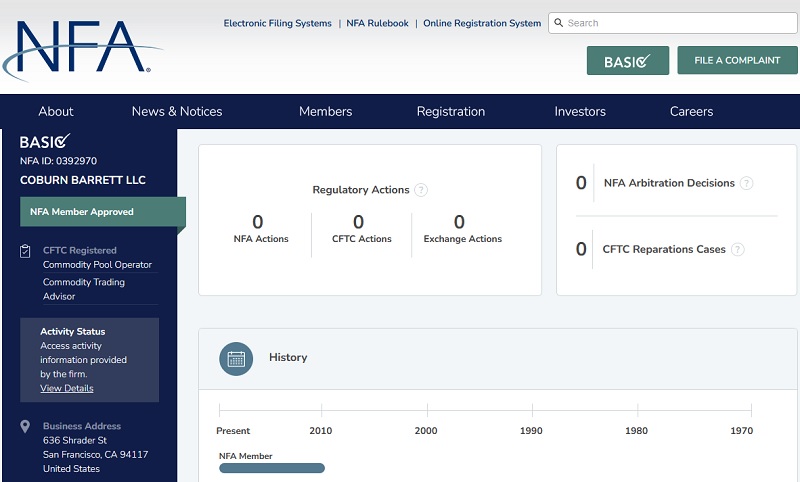

Since CFTC designates NFA to oversee forex brokerages, they have been directing clients to the NFA Basic Database to check their official members. Here's the simple guide:

- Go to the NFA Basic Database.

- Type the brokerage name in the available column, then click Search.

- If your broker has been registered, there should be the "NFA Member Approved" statement in the Membership Status column. You could click on the broker's name to check further information about the broker.

- On the broker's registration page, you could track the data, regulatory actions, decisions, as well as reparation cases (if there are any) that fell upon the broker.

Interestingly, CFTC also provides the RED List which consists of illegal brokers soliciting and/or accepting funds from US customers and offering a product within their jurisdiction. You can check them on this page and see more details on each entity.

The form of punishments imposed on violators of the CFTC regulations is divided into several levels, ranging from fines, freezing of activities, to permanent termination. Over the years, CFTC has frozen numerous fraud companies and expelled problematic brokers. Some of the cases that happened in recent years were:

- Sues on Binance for deliberate violations of their trading and derivatives regulations. The case has been brought to the US court and has yet to be settled as of August 2023.

- $45 million penalty on HSBC for manipulative and deceptive trading. The most highlighted of this violation is the use of WhatsApp Messenger for discussing deals

- $300,000 fine on GAIN Capital for ambiguous trades presented by Foremost, the brokerage's independent introducing broker.

- Civil Lawsuit against FXCM in consequence of the broker's under-capitalized state and failure to report their capital shortfall in a timely manner. This eventually led to FXCM's exit from the US market.

How Is CFTC Compared to Other Forex Regulators?

Comparing the Commodity Futures Trading Commission (CFTC) with other forex regulatory bodies involves considering factors such as the regulatory approach, investor protection measures, and the overall regulatory environment. Here's a comparison of the CFTC with a few other well-known forex regulatory bodies:

| Scopes | 🇺🇸 CFTC (United States) | 🇬🇧 Financial Conduct Authority (FCA - United Kingdom) | 🇦🇺 Australian Securities and Investments Commission (ASIC - Australia) | 🇨🇾 Cyprus Securities and Exchange Commission (CySEC - Cyprus) |

| 💼Regulatory Approach | Regulates forex trading as part of its oversight of derivatives markets, focuses on ensuring market integrity, preventing fraud, and maintaining transparency. | Focuses on consumer protection, market integrity, and competition in financial markets, including forex. | Oversees financial markets, including forex trading, with a focus on market fairness, investor protection, and consumer confidence. | Regulates forex trading as part of its oversight of financial markets, with a focus on market integrity and investor protection. |

| Investor Protection | Places a strong emphasis on protecting retail traders by setting leverage limits to mitigate risk and enforcing strict anti-fraud measures. | Enforces robust investor protection measures, including client fund segregation, compensation schemes, and stringent reporting standards. | Enforces strict rules to protect investors, including client money segregation, professional indemnity insurance, and a compensation scheme. | Enforces certain investor protection measures, including capital adequacy requirements, client fund segregation, and dispute resolution mechanisms. |

| 🔨Enforcement | Has the authority to take legal action against individuals or firms that violate trading rules, engage in fraudulent activities, or manipulate markets. | Has the authority to impose fines, revoke licenses, and take legal action against firms that breach regulations. | Has the authority to take legal action against firms that violate its regulations, and imposes fines and sanctions for non-compliance. | Has the authority to impose fines, suspend licenses, and take legal action against firms that breach its regulations. |

| 🔍Transparency | Reporting, record-keeping, and financial disclosure requirements. | Detailed reporting requirements and disclosure obligations for forex brokers. | Disclosure requirements and financial reporting standards for forex brokers. | Reporting requirements and disclosure obligations for forex brokers. |

| 📃Licensing and Registration | Forex dealers and RFEDs must be registered with the CFTC and become members of the National Futures Association (NFA). | Forex brokers must be authorized and regulated by the FCA to provide services to clients in the UK. | Forex brokers must hold an Australian Financial Services (AFS) license from ASIC to operate in Australia. | Forex brokers seeking to operate within the European Union can become licensed and regulated by CySEC due to Cyprus's EU membership. |

What Are the Most Popular CFTC Brokers?

| ⌛ Established | 1996 |

| 💲 Min Deposit | $0 |

| ⚖ Max Leverage | 1:20 |

| ⭐ Rating |

OANDA provides traders with exceptional trading platforms that are both high-quality and user-friendly. The broker offers powerful research tools, including various technical indicators and an impressive API offering. Opening an account with OANDA is a seamless and efficient process, ensuring a user-friendly experience.

However, it is essential to note that the company has a limited product portfolio, focusing primarily on forex and CFD trading. Additionally, as OANDA is not listed on a stock exchange and lacks a banking background, some may consider this a potential drawback regarding safety qualifications. Furthermore, customer support is available 24/5, which means it is not accessible around the clock.

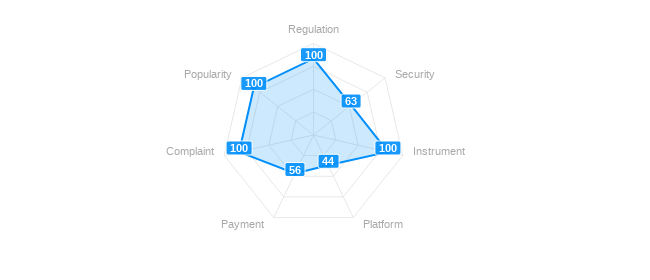

This is how the broker performs on 7 important aspects in trading:

✔️ Pros

- More than 70 currency pairs

- Available worldwide

- No commission per lot

- Great learning content

- No minimum deposit

❌ Cons

- Limited customer support hours

- Lack of direct social copy trading features

- Only USD as the base currency

| ⌛ Established | 2010 |

| 💲 Min Deposit | $200 |

| ⚖ Max Leverage | 1:500 |

| ⭐ Rating |

IG provides a well-designed and user-friendly web trading platform that offers customization options. The website offers a range of educational tools to support traders. Funding and withdrawals are convenient, with multiple options available.

However, it's worth noting that IG's trading fees for stock CFDs are relatively high. The product portfolio is also limited in some countries, primarily offering CFD and options trading. Customer support could be improved to meet customer expectations.

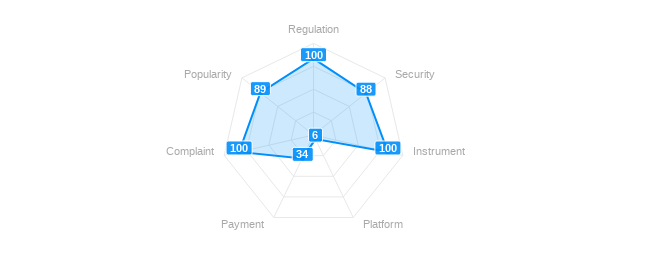

This is how the broker performs on 7 important aspects in trading:

| ⌛ Established | 1999 |

| 💲 Min Deposit | $250 |

| ⚖ Max Leverage | 1:200 |

| ⭐ Rating |

FOREX.com, a subsidiary of GAIN Capital Holdings, has been a prominent global online broker since its establishment in 2001. It caters to retail traders interested in FX and CFD markets. FOREX.com provides a wide range of trading options globally. Alongside forex trading, which is its namesake, it offers CFDs, spread betting, futures, and more across multiple asset classes.

However, the availability of these instruments may vary depending on the region. In addition to forex, traders can access commodities, indices, individual stocks, bonds, ETFs, gold and silver, cryptocurrencies, and futures, catering to diverse trading preferences.

This is how the broker performs on 7 important aspects in trading:

| ⌛ Established | 1977 |

| 💲 Min Deposit | $10000 |

| ⚖ Max Leverage | 1:100 |

| ⭐Rating |

Interactive Brokers (IBKR) is a top choice for active traders, offering low per-share pricing, advanced trading tools, and a wide range of tradable securities, including foreign stocks. With its new IBKR Lite option, clients can enjoy commission-free trades of stocks and ETFs.

IBKR leads the market with its comprehensive investment platform, allowing trading in stocks, options, futures, forex, cryptocurrencies, bonds, and funds across 150 markets from a single account. It's favored by professionals for its institutional-grade desktop trading platform and competitive trade executions, while everyday investors benefit from user-friendly mobile apps.

This is how the broker performs on 7 important aspects in trading:

Additional FAQ

Does CFTC support segregated account?

Yes. CFTC requires account segregation for its members to ensure the separation between clients' and the brokers' operational funds.

Continue Reading at Forex Compensation Schemes Explained

What are the responsibilities of the CFTC?

In the United States, the Commodities and Futures Trading Commission (CFTC) is responsible to ensure the regulation of forex trading and brokerage business.

The CFTC achieves this goal with powers granted by law, such as enforcement by using steep fines, heavy financial penalties, and even outright banishment from the US market.

Continue Reading at Comparing US and Offshore Forex Brokers

Does the CFTC only regulate forex brokers?

In America, each legal company must register themselves at the CFTC. However, not all companies registered there are forex brokers; it could be a business company, publishing company, and so on.

Continue Reading at Forex Regulation Insights: Defining Your Broker's Status

Its goals are:

- to foster competitive and efficient markets

- to safeguard investors against manipulation, fraudulent activities, and abusive trade practices.

Continue Reading at 6 Best Forex Broker Regulators in the World

Forex Broker Articles

Broker Categories

Minimun Deposit

Payment

Country

Established

Instruments Traded

Features

Trading Platform