Trending market, ignorance to rumours, and avoiding temptations are amongst the steps that you need to perform if you want your trading performance maximized.

Trading is not about win or lose, but how much (amount of money) we win and how much we lose. This time, we are going to discuss four things we should do to deal with troubled trading where losses may happen. With these principles, I wish you will be able to handle your losses and turn it into profits. And if you've been able to turn losses into profits, then try to take bigger profits and sustain it for a long, long time.

These are the four things you should note to maximize your trading performance, they are:

1. Invest in the trending market

Before you enter any market, make sure you know what's going on and relevant in the market. Is it going up or down? Never hold contrary positions; don't hold 'buy' position unless you are sure the market is going up, and don't hold 'sell' unless the market is going down. The way to get lots of profit is by determining the main trend and follow it. If your trading isn't going to same direction with the market, then turn around and follow the market.

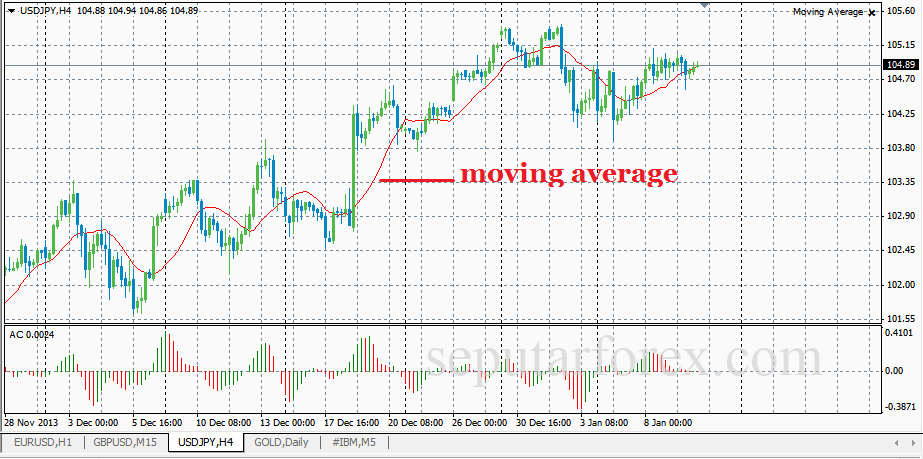

There are many ways to determine market trend. One example is by using 10-day Moving Average. For instance, if you trade USD/JPY, then add up the closing price of the last 10 days trading, and divide it with 10. When you move a day forward, then you dropped the oldest data, and add up the earliest, and so on.

When you are on bearish market and the main trend is going down, wait for a while until you are sure that the movement is indeed going to go down, then you can take 'sell' position.

In my opinion, it is safer to sell on bearish forex market when the market is going down 200 points from peak price, rather than got only 40 points. The reason is, price below 200 is already passed through the whole supports and there's no hope to break to the top. However, don't let your position goes downward to the bottom.

The same thing applies (in reverse) on bullish position. Always keep up with the market, don't even fight it.

2. Don't be wishy-washy

It's not easy to trade forex. You must have a strong will. After you identify the market trend, don't change your mind until indicators signals changes. On every big movement, there will always be corrections. Some rumours will come out and lead to a strong correction. But usually, it is followed by reversal movement back to the main trend direction. If you listen to the rumours, you may be tempted to liquidate your position prematurely.

3. Avoid temptation and don't listen to anyone but the market

One way to do this is by never make decisions without having a particular reason. It is a bad habit to open position based on expectation only (even though many people did it anyway). For example, there was an investor who relies on his broker. They bought USD/JPY at 79. His broker said that the price will go on till 80. He held on to the position even after the price is already entering 79.95 and downtrend is already established. Even after the price goes lower, and lower, he is still waiting for the price to get to 80. This means that he trades based on expectation, not market facts. This is what amateurs do, not professionals.

4. Having Exit Strategy

Do not enter position without knowing where to come out. Most people enter a certain position because they are thinking to hold the position in a long term. The good old investment world taught us to take and hold position until we gain profit as the best strategy. However, it could lead us to disaster if the market trend is contrary with our position. To maximize your trading performance, you have to put railings on your trading. What's called railings is 'Exit Strategy'; you must know when to come out from your open position, and execute it without when the time comes.

Exit strategy could be done by using Stop Loss, Limit Order, and Trailing Stop. I hope this could help you to put railings in your trading position, so we can limit the risks as far as we want by using Stop loss (S/L). We can also limit our profits with Taking Profit (T/P) facility. Why should we limit our profits? The reason to limit the profit here is because forex trading is very volatile; the profits we gain from our position could instantly changed into losses when the trend reversal occurs

The purpose of 'railings' in the shape of Stop Loss and Limit Order is to prevent unpredictable events that may influence our positions. Stop Loss is limit of loss we are willing to bear, while Limit Order (Taking Profit, T/P) is profit target limit we plan to attain. For example, you've opened buy position of AUD/USD on 1.0400. Then, your ideal Stop Loss is 1.0350 (if we assume you are just willing to bear 50 points of losses ) and your ideal Take Profit is 1.0450 - 1.0480 (if we assume you want to get 50 - 80 points of profits).

Aside of Stop Loss and Limit Order, there is one more facility we could use to put 'railings' on our positions. Trailing Stop is a facility to shift limit of losses. It is a combination between Stop Loss and Limit Order. For example, while running position AUD/USD on level 1.0400, we predict that the movement will rise (up-trend), then we open BUY position with 60 points T/P above it (1.0460), put S/L 10 points below it, and put trailing stop by 45 points. Afterward, there will be two scenario:

Scenario 1: When the price keeps rising, the price will reach level 1.6464 + 45 = 1.6511. S/L will move on, and when the price decreases after level 45 is reached , the system will close that position, so you will get 45 points of profits

Scenario 2: If the prices moves down (contrary with our position) the position will be closed as loss 10 points + spreads.

If you want to enter the position in a long term now and don't know where to come out, it is recommended to use 25% trailing stop as minimum protection. 25% trailing stop is quite big and make it possible for you to catch the trend movement. The most important thing is to get out of position before big reversal makes you bankrupt.

One point you should note is not to change stop loss often. From 100 times of changing stop loss, 99 times are wrong. It is better to change profit taking, but it will be better to stop loss sooner. When you're out from bad position faster, it will minimize your trauma; not only your funds could be maintained, but your assessment too will be much better.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance