Forex Demo Account

What Is

Forex Demo Account?

Before committing your time and money to forex trading, you should be familiar with the ins and outs of the business. That's why forex brokers provide a demo account. A forex demo account is a practice account on a real trading platform funded by virtual money. This feature allows you to experience the real market without actually being exposed to the risk.

Why Do You Need Demo Account?

In demo account, you can:

- See how online trading really works.

- Trade without risk as there's no real money involved.

- Pratice how to make orders in the trading platform.

- Get the hang of the platform's tools and how to navigate them.

- Learn about the characteristics of market as well as the frequent changes in the market.

How to Start

Demo Account?

You can create a demo account in less than 10 minutes. Here are the steps to follow:

- Prepare you email address and phone number

This is because the broker would like to send verification codes to your email or phone.

- Go to a broker's official website

You can visit this broker as a start as it provides easy registration steps for beginners.

- Look for an account registration button

This is usually located at the top right of the page.

- Fill the registration form

Follow the instruction and write down your data as required on the registration form. After finishing this step, you would get login credentials that you need to save.

- Login and create a demo account

Enter the broker's Member Area with the credentials you have just acquired, then look for an option to create a demo account.

- Download the Platform

The broker would instruct you to download its trading platform. MetaTrader is usually the popular choice for demo trading.

Other Popular Brokers for Easy Demo Registration

How to install demo account for forex trading?

Installing a demo account is easy. That's because you can get it free from your Forex broker.

- Look for the "open demo account" button somewhere on your broker registration page. From there, brokers may offer more than one type of demo account, like; MetaTrader4 or 5 (MT4 or MT5), cTrader, etc. If you're pretty clueless, just pick MetaTrader4 because it's one of the most popular trading terminals.

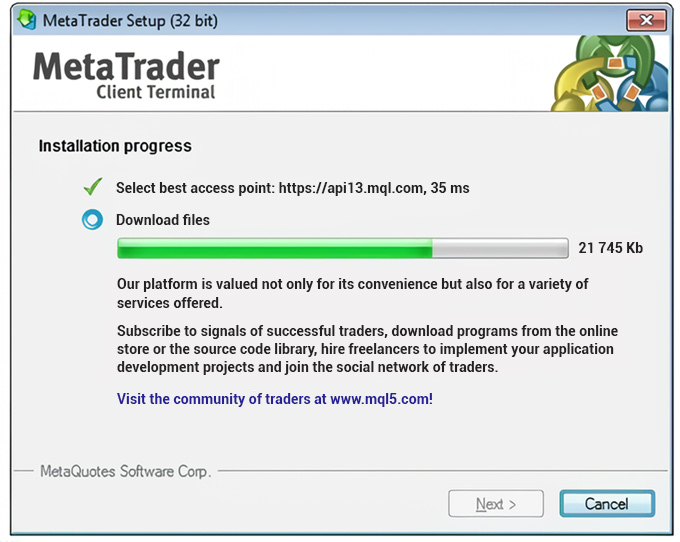

- Alternatively, you can download MT4 from the MetaQuote website. Once you start pressing the download button, the client file should stay on your computer folder. Step two, locate that mt4setup.exe file on your download folder.

- Fill the checkbox to confirm your installation agreements. After then, click next. Additionally, you can change the MT4 installation directory by clicking the Setting button.

- Wait until the installer finished downloading all the required files. When it's done, click the Finish button.

Voila, now you're done with the basic installation!

Continue Reading at Demo Account For Foreign Exchange Beginner: Simple How To's

Are there any downside of demo account?

The use of virtual money on demo accounts, while risk-free, also has its downsides. Here are the examples:

- Traders may not be able to learn risk management strategies because there is nothing to risk to begin with.

- Brokers tend to provide big amounts of virtual money that the demo traders exploit. This could shape up a habit of engaging in risky trading, which will be harmful in the long run.

- In the live market, sensible traders will most likely not risk the same amount of money they use in the demo account. Thus, demo accounts cannot fully replicate the pressure of trading with real money and the feeling of losing it altogether.

- Traders may not acquire money management skills essential to building a stable income.

Continue Reading at Forex Demo Account: The Good, the Bad, and the Brokers

How long should traders use demo account to check a broker's quality?

As a general guideline, using a demo account for at least a few weeks can give traders a reasonable idea of a broker's quality. However, it's essential to remember that a demo account may not fully replicate the experience of live trading, as there can be differences in order execution, slippage, and liquidity between the two environments.

Continue Reading at How Long Should You Trade on Demo Account?

How to use demo account to simulate forex trading?

The foreign exchange market basically works like other traditional markets. Simply put, to make a profit out of it, you have to offer something at a higher price than its original value. Well, that's easier said than done. To better illustrate it, we'll make a demonstration.

Take a look at the picture above. It's a chart depicting the Forex rate change in EUR/USD pair. As you can see, the forex rate went down from the end of September to November. During that time, you can make a profit by pressing the sell button to open a position. Let's say you open the position at 1.12500 by one full lot on 26th September. If you manage to hold your position from that day to 18th November 2016, you'll successfully close a deal that's worth about USD6,720!

But remember, simulation is the keyword. Whatever you're going to do here can't reflect 100% actual live account trading conditions. That's because there are some things that one can only experience in live trading sessions.

Continue Reading at Demo Account For Foreign Exchange Beginner: Simple How To's