List of Brokers with CySEC Regulation

Founded in 2001, CySEC (Cyprus Securities and Exchange Commission) is a public corporation from Cyprus. Once Cyprus becomes a member of the EU, all registered brokers and licensed companies are granted access to the European market. While CySEC generally adheres to EU standards in trading regulations, brokers and traders can expect more flexible requirements from this institution.

| Established | : | 2001 |

| Country | : | Cyprus |

| Website | : | https://www.cysec.gov.cy/en-GB/home/ |

| Total Brokers | : | 89 |

Scroll for more details

If you are interested to try the brokers in the list above, make sure to use the forex demo account so you could experience trading firsthand with virtual money. You don't even have to deposit any funds since the demo account is 100% free. It is also available in most brokers.

CySEC stands for the Cyprus Securities and Exchange Commission. It is the regulatory authority responsible for overseeing the financial markets and financial services firms in Cyprus. CySEC's primary objective is to ensure the integrity, transparency, and stability of the financial markets in Cyprus and to protect investors.

With the acceptance of Cyprus to the European Union in 2004, CySEC automatically became a subsidiary of MiFID, a European regulatory organization. This enables CySEC-regulated brokerages to carry out their business activities in the European region.

As a financial regulator, CySEC's responsibilities include:

- Supervising and controlling the operation of the Cyprus Stock Exchange and the transactions carried out in the Stock Exchange, its listed companies, brokers, and brokerage firms.

- Supervising and controlling Licensed Investment Services Companies, Collective Investment funds, investment consultants, and mutual fund management companies.

- Granting operation licenses to investment firms, including investment consultants, brokerage firms, and brokers.

- Imposing administrative sanctions and disciplinary penalties to brokers, brokerage firms, and investment consultants as well as any other legal or natural person who falls under the provisions of the Stock Market legislation.

What Does CySEC-regulated Mean for Forex Traders?

There are CySEC-regulated forex broker brokers who offer their services throughout the world. Trading with a CySEC-regulated broker means affordable minimum deposits and a simple registration process.

For traders who want to start with limited funds and looking for brokers that require simple registration but are still regulated by Europe, CySEC brokers are approved as a reference.

However, despite requiring Separate Accounts and regular financial reporting, CySEC-regulated forex brokers lack enforcement for rules violation. Brokers generally only need to pay a fine to remain regulated. While compensation schemes are managed under the ICF (Investor Compensation Fund), refunds are not directly handled by CySEC. If there is a loss or broker bankruptcy, traders are advised to contact the broker independently.

Apart from that, it is worth noting that CySEC has been improving some policies and adapting to ESMA rules to prevent high-leverage misuses and bonus frauds. As such, trading in a CySEC-regulated broker nowadays also means ensured negative balance protection, limited maximum leverage (up to only 1:30 ), and no welcome bonus offerings.

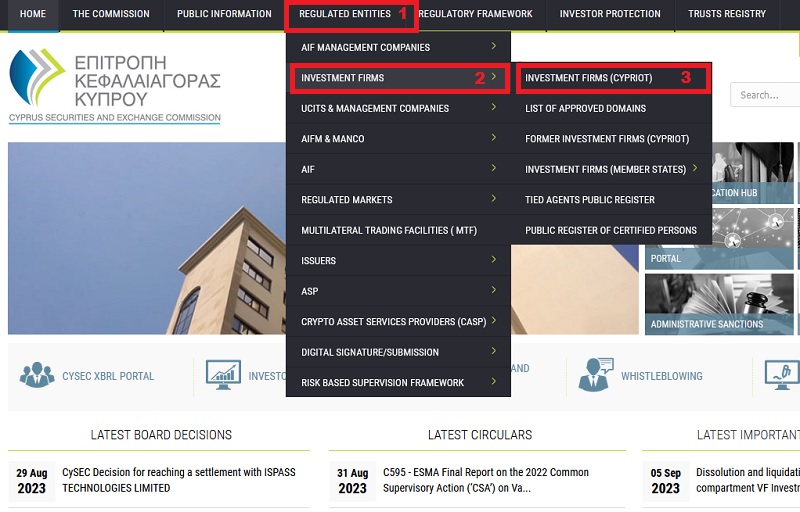

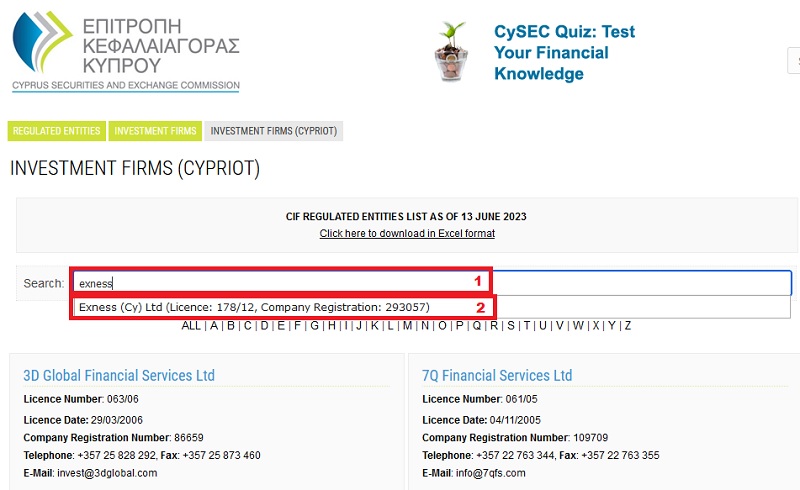

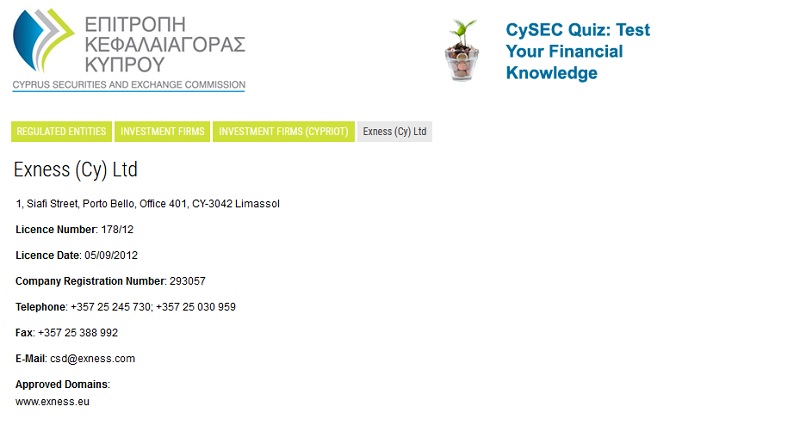

How to Check a CySEC-regulated Broker?

- Go to the official main page of CySEC.

- On the upper menu, choose "Regulated Entities" then "Investment Firms".

- Write the name of your broker on the Search column. If your broker is a CySEC member, the result should appear immediately below.

- You can click on the broker result to see more information on their CySEC registration.

How Is CySEC Compared to Other Forex Regulators?

When comparing CySEC (Cyprus Securities and Exchange Commission) to other regulatory authorities overseeing the financial industry and forex brokers, several aspects come into play. Here's a comparison of CySEC with some key aspects in mind compared to other regulators:

| Aspects | CySEC | Other Forex Regulators |

| 💼 Regulatory Standards | Over the years, CySEC has worked to enhance its regulatory standards. It aligns with EU directives and has implemented measures to increase transparency and investor protection. | CySEC's regulatory standards are generally seen as less stringent compared to regulators like the FCA (Financial Conduct Authority) in the UK or ASIC (Australian Securities and Investments Commission) in Australia. |

| 📃 Licensing Process | The process of obtaining a CySEC license can be complex and time-consuming, with rigorous scrutiny of applicants' financial stability, business plans, and compliance measures. | Some regulators, such as the FCA and ASIC, are as thorough and strict as (if not more than) CySEC in terms of licensing processes, often requiring higher capital requirements and a deeper level of scrutiny. |

| 🔰 Investor Protection | CySEC provides a certain level of investor protection by enforcing rules related to client fund segregation and compensation schemes. | Regulators like the FCA and ASIC offer more robust investor protection, including compensation schemes that can reimburse investors if a regulated firm becomes insolvent. |

| 👮 Enforcement and Penalties | CySEC has imposed fines and penalties on forex brokers and financial institutions for regulatory violations. But the enforcement actions are still improving and not quite yet established. | Regulators like the FCA and CFTC have a reputation for stricter enforcement and more significant penalties for regulatory violations. |

| 🌎 Global Reputation | CySEC has made efforts to improve its reputation and align with international standards, but it still faces criticism for perceived leniency in the past. | Regulators like the FCA and ASIC are often regarded more favorably in terms of their global reputation for stringent regulation. |

In summary, CySEC has taken steps to enhance its regulatory framework and improve its oversight of forex brokers and financial services providers. However, it may still be perceived as having lower regulatory standards compared to some other major regulators globally.

See Also:

What Are CySEC Requirements for Forex Brokers?

As a whole, CySEC-regulated brokers must conform to the following rules:

- Maintaining at least €750,000 in operating capital.

- Keeping regular financial statements and submit them to the CySEC for review on a periodic basis.

- Keeping traders' capital in well-known and tier-1 banks in Europe in segregated accounts

- Adhering to all new rules and regulations enforced by the CySEC and the MiFID from time to time.

- Protecting their traders from broker insolvency or bankruptcy by providing protection under the ICF (Investor Compensation Fund), which compensates clients up to €20,000.

Additional FAQ

What is the responsibilities of CySEC?

CySEC (Cyprus Securities and Exchange Commission) is an independent public supervisory authority responsible for the following:

- overseeing the investment services market, transferable securities transactions, and the collective investment and asset management sector

- regulates firms that provide administrative services

- market surveillance and investigations

Continue Reading at 6 Best Forex Broker Regulators in the World

What is the structure of CySEC?

CySEC is run by a board of five people, along with two full-time staff members, a chairman, and a vice chairman. On the highest part of that, the Central Bank of Cyprus is represented by a board member who does not have a vote. The government is also attached to CySEC, in which the Minister of Finance makes suggestions to the Ministerial Council about who should be on the boards of directors.

Continue Reading at A Guide to Cyprus Securities and Exchange Commission (CySEC)

What are the obligations of CySEC?

The following are the obligations that fall under the Securities and Exchange Commission of Cyprus:

- Control and direction of all business dealings and other activities carried out in Cyprus.

- The Stock Exchange, in addition to all the businesses and brokerages listed there.

- Control and management of licensed investment firms, funds, and other financial institutions

- Consult firms and businesses specializing in financial management.

- Grant licenses to brokerages dealing in foreign exchange, financial consultants, and investment enterprises.

- Impose fines and other punishments on businesses that, under its legislation, are supposed to be in violation of the rules, terms, and conditions.

- Help with submitting the authorizing applications for the acquisition of venture administration, including obtaining authorization to act as forex brokers.

- Manage the company's internal audits.

- Educate employees on all relevant administrative issues through training.

Continue Reading at A Guide to Cyprus Securities and Exchange Commission (CySEC)

What kind of power does CySEC have?

CySEC is widely recognized to have a weak ability to keep an eye on things and give out light punishments. Forex brokerage firms that CySEC usually regulates only have to pay the penalty to stay regulated. CySEC does not handle refunds, so when there's a loss or the broker goes out of business, traders would have to reach the broker on their own.

Continue Reading at A Guide to Cyprus Securities and Exchange Commission (CySEC)

Forex Broker Articles

Other Articles

Broker Categories

Minimun Deposit

Payment

Country

Established

Instruments Traded

Features

Trading Platform