List of Brokers with BaFin Regulation

BaFin (Bundesanstalt für Finanzdienstleistungsaufsicht) is the German financial regulator that was established on May 1, 2002. It is an independent institution under the supervision of the Federal Ministry of Finance. BaFin supervises thousands of banks, hundreds of insurance undertakings, and 800 financial services companies including forex brokerages in Germany.

| Established | : | 2002 |

| Country | : | Germany |

| Website | : | https://www.bafin.de |

| Total Brokers | : | 25 |

Scroll for more details

If you are interested to try the brokers in the list above, make sure to use the forex demo account so you could experience trading firsthand with virtual money. You don't even have to deposit any funds since the demo account is 100% free and is available in most brokers.

What Does BaFin-regulated Mean for Forex Traders?

BaFin regulations aim to ensure the safety of client funds and the integrity of the financial markets. They designed their guidelines in accordance with the MiFID directives

As such, trading on a BaFin-regulated broker means having segregated accounts and negative balance protection. These measures are considered mild compared to FCA and CySEC as the German institution doesn't put on the limit for maximum leverage. European traders in need of trading with leverage higher than 30:1 may find what they're looking for in a Bafin-regulated broker.

Additionally, BaFin doesn't explicitly prohibit any bonus offers as a means to promote brokerage services. But that doesn't mean you can expect loose safety measures from the regulator. As a matter of fact, BaFin oversees the obligatory compensation and guarantee scheme plan, designed to safeguard customers' deposits. This mechanism outlines a compensation ceiling of up to €100,000, ensuring that every client is eligible to receive this protection.

The downside is, taxation is high in Germany so it is unlikely that small companies can keep up with the requirement. This leads to the situation where only prominent brokerages apply for BaFin licenses, and they usually don't have the best trading condition for beginners or small-cap traders.

BaFin can investigate every case of reported misconduct and penalize companies according to their involvement in the scam. They also allow consumers to initiate complaints and other reports concerning alleged violations of any regulated firm.

In case of disputes, BaFin encourages companies and clients to reach an out-of-the-court settlement. Should the problems need arbitration, they can either be referred to the Financial Ombudsman or the court.

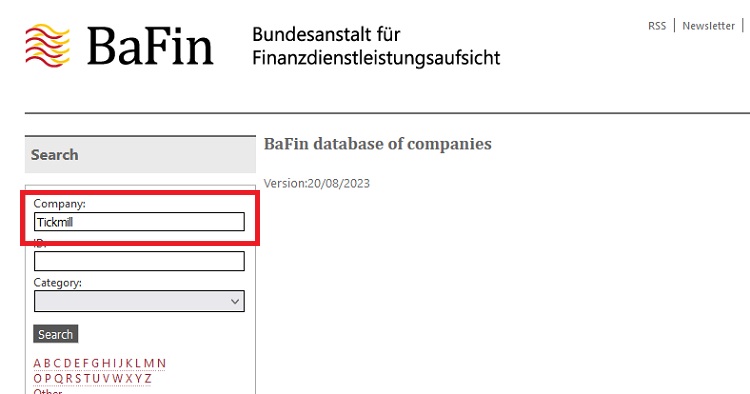

How to Check a BaFin-regulated Broker?

- Go to the search portal of BaFin companies.

- Type the broker's name in the Company column of the Search section.

- Click Search.

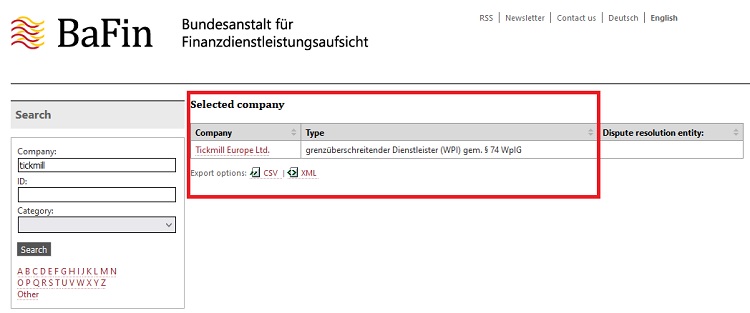

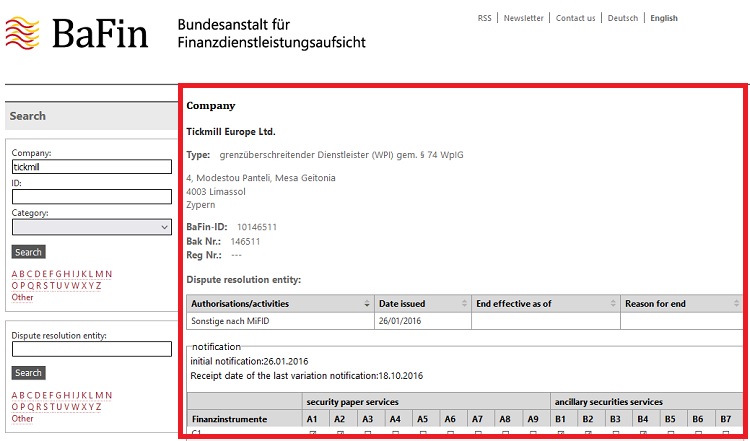

- If your broker is a registered member, the name will appear in the main section.

- You can click on the broker's name to get more info about its company registration with BaFin.

How Is BaFin Compared to Other Forex Regulators?

Here's a general comparison of BaFin with some other well-known forex regulators:

| Aspects | 🇩🇪 BaFin (Germany - Bundesanstalt für Finanzdienstleistungsaufsicht) | 🇨🇾 Cyprus Securities and Exchange Commission (CySEC) | 🇬🇧 Financial Conduct Authority (FCA) - UK | 🇦🇺 Australian Securities and Investments Commission (ASIC) |

| Reputation | BaFin is regarded as a strict and thorough regulator known for maintaining high standards of investor protection and market integrity. | More accessible to brokers due to its relatively streamlined application process. However, it has worked to enhance its regulatory standards over the years. | The FCA is highly regarded for its stringent regulations and commitment to investor protection. It's considered one of the most respected financial regulators globally. | ASIC is known for its thorough supervision of financial services and markets, promoting fairness, transparency, and accountability. |

| 🔨 Stringency | Rigorous requirements on forex brokers operating within its jurisdiction, focusing on client fund protection, transparency, and compliance with EU regulations. | CySEC has introduced stricter regulations in line with MiFID II. It emphasizes investor protection, transparent operations, and adherence to anti-money laundering (AML) policies. | Enforces robust rules, including stringent AML measures, capital requirements, and transparent pricing practices. It also imposes restrictions on leverage for retail traders. | Enforces strict standards on forex brokers, focusing on risk management, client fund segregation, and transparent trading practices. |

| 🔍Recognition | Respected within the European Union and are subject to MiFID II regulations, which enhances their credibility. | Widely recognized within the EU and allow brokers to offer services across the European Economic Area (EEA). | An FCA license carries substantial credibility and recognition within the global financial community, making it attractive to brokers seeking a reputable presence. | ASIC-regulated brokers have credibility in the Asia-Pacific region and beyond, making it a sought-after jurisdiction for brokers targeting that market. |

Keep in mind that the regulatory landscape can change over time, so it's important to conduct up-to-date research before making any decisions.

What are the Key BaFin Policies for Forex Brokers?

- BaFIN-regulated brokers need to have at least two financial experts functioning as managers for the head of operations with no negative records or issues in relation to their roles in the company.

- Forex brokers under the regulation of BaFin are required to hold an operating capital from €750,000 to €5 million and beyond. The capital should be proportional to the amount of trading capital held on behalf of their clients.

- Audit reports and financial statements should be submitted periodically to BaFin. They will be scrutinized by the agency to filter any discrepancies or modifications.

- BaFin-regulated brokers need to ensure that they have the financial capacity to anticipate market fluctuations and an efficient insolvency procedure to prevent traders from losing their capital in case of inability to overcome market volatility.

- All brokers should only act as an intermediary between traders and the market. Indulgence in any scams or malpractices that may endanger investors' security of their funds is strictly prohibited.

Additional FAQ

How is the forex regulation in South Africa?

African countries are forex-friendly, but naturally, there are minor restrictions from the government. Forex brokers must hold a license before running their business in any of these countries. The status of forex trading in these countries is still unclear; it is not yet legalized but not against the law.

The South African Financial Sector Conduct Authority (FSCA), previously known as Financial Services Board (FSB), is one of the most well-known forex regulatory bodies.

Continue Reading at Is Forex Trading Legal in Africa?

What are the regulations for offline forex trading in Nigeria?

The foreign exchange transaction activity in the offline market is supported by law. Some of these include the Central Bank of Nigeria Act of 1958, the Foreign Exchange (Monitoring and Miscellaneous Provisions) Act of 1995, the Exchange Control Act of 1962, the Banks and Other Financial Institutions Act of 2007, and the Investments and Securities Act of 2007.

Continue Reading at Is It Safe to Trade Forex in Nigeria?

What are reliable forex broker regulations?

Some of the top regulatory agencies in the world include:

- The Financial Conduct Authority (FCA) and the Prudential Regulation Authority (PRA) in the United Kingdom

- The Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA) in the United States

- The Swiss Financial Market Supervisory Authority (FINMA) in Switzerland

- The Australian Securities and Investments Commission (ASIC) in Australia

- The Financial Services Agency of Japan (JFSA) in Japan

- The Cyprus Securities and Exchange Commission (CySEC) in Cyprus

If the broker you use is regulated by one of the regulatory agencies above, you can be confident that it is safe. The reason is that these regulatory agencies have strict requirements that brokers must meet to be licensed.

Only the most reputable and trustworthy brokers can obtain a license.

Continue Reading at How to Avoid Forex Broker Scams

What should we do if the broker's regulation is still "in process"?

Some brokers might claim that they are in the process of applying for a license or a license extension. But in reality, not all brokers are true to their words. Some of them don't actually apply for any license and only use those words to steal the clients' funds. Even if the license is indeed "in the process", the broker's still unregulated during that time.

Continue Reading at Forex Regulation Insights: Defining Your Broker's Status

Broker Categories

Minimun Deposit

Payment

Country

Established

Instruments Traded

Features

Trading Platform