Pepperstone Review

💲 Min Deposit $0

⌛ Year Established 2010

💼 Regulation

💡 Min Position 0.01 lot

🌐 Website pepperstone.com

🌎 Country

![]()

![]()

![]()

![]()

![]()

![]()

![]()

⚖ Max Leverage 1:400

📖 Free education

👨💻 PAMM

📊 MAM

📁 Segregated accounts

🕋 Islamic accounts available

Compensation scheme

Negative balance protection

Low spread eur/usd

Copy trading

Webinar

Pros

- Pepperstone's research delivers superior quality and depth

- Regulated in two tier-1 jurisdictions

- No deposit, withdrawal, or inactivity fees

- Offering of MetaTrader and cTrader

- Fast execution and minimal spreads

Cons

- No cent account

- One-month-only demo account

- Lacks interactive courses, progress tracking, and educational quizzes for learners.

- Offers a limited choice of assets

Pepperstone is a well-established broker since 2010. Pepperstone has headquarters in Australia, Germany, Kenya, Cyprus, United Arab Emirates, United Kingdom and Bahamas. Pepperstone to provide their Forex/CFD trading services to global clients.

This broker has also been regulated by ASIC 414530, BaFin 151148, Capital Markets Authority of Kenya 128, CySEC 388/20, DFSA (Dubai) F004356, FCA 684312 and SCB SIA-F217.

Pepperstone's seven well-regulated subsidiaries will limit the potential for fraud and malpractice. Pepperstone clients may enjoy features such as negative balance protection while deposits remain segregated from corporate funds. Pepperstone members can utilize leveraged trading depends on subsidiaries:

- The Kenyan subsidiary offers negative balance protection plus maximum leverage of 1:400.

- Traders at the Bahamas unit get 1:200 without negative balance protection.

- Pepperstone Australia offers maximum leverage of 1:30, negative balance protection, but no compensation scheme for depositors.

- Pepperstone UK offers maximum leverage of 1:30, negative balance protection, and the best regulatory mandated compensation scheme of £85,000 per client.

- In CySEC, FSCA, and BAFIN licensed subsidiaries, Pepperstone offers maximum leverage of 1:30 for retail traders and 1:500 for professionals.

| Country of clients | Protection amount | Regulator | Legal entity |

|---|---|---|---|

| UK | £85,000 | FCA | Pepperstone Limited |

| Germany, Austria | €20,000 | BaFin | Pepperstone GmbH |

| Other European countries | €20,000 | CySec | Pepperstone EU Limited |

| Middle-Eastern countries | No protection | DFSA | Pepperstone Financial Services Limited |

| Australia | No protection | ASIC | Pepperstone Group Limited |

| African countries | No protection | CMA | Pepperstone Markets Kenya Limited |

| All other clients | No protection | SCB | Pepperstone Markets Limited |

Extensive Review

Pepperstone was founded in 2010 by a team of experienced traders with a shared commitment to improve the world of online trading. Based in Melbourne, Australia, they grew to become one of the largest forex brokers in the world. If traders want to find a broker that provides low spreads, fast execution, and award-winning support, then the answer is Pepperstone.

Pepperstone has a strong legality guarantee because it has been licensed by the Australian regulator ASIC and FCA. Traders' funds can be deposited in segregated accounts at top Australian banks, one of which is the National Australia Bank (NAB). Therefore, the safety of funds is not a concern if a trader chooses to open an account in Pepperstone.

They succeeded in collaborating with 23 top banks to bring Bid to investors instantly via optical fiber. This allows all orders to be executed 100 percent automatically with low latency up to 0.05 milliseconds, without dealing desk intervention and requotes, as well as with super low trading costs.

Trusted by over 73,000 traders around the world, Pepperstone processes an average of USD12.55 billion of trading volumes every day. Because of that, they have many awards such as:

- The Best Global Forex ECN Broker 2019 and Best Forex Trading Support-Europe

- Best Australian Broker and Best Trading Platform 2018 by Compareforexbrokers.com

- Best Forex ECN Broker, Best Forex Trading Support, and Best Forex Trading Conditions by UK Forex Awards 2018

With the many rewards gained, Pepperstone hopes to attract more and more traders from all over the world. The rising performance of Pepperstone is not only due to the super-tight spreads and fast execution that it provides, but also because many traders are interested in trading with deposits in currencies other than US Dollars.

For this reason, Pepperstone is one of the most market-responsive brokers because it is willing to accept deposits in 10 currencies, which include AUD, USD, EUR, CAD, GBP, CHF, JPY, NZD, SGD, and HKD.

Trading in Pepperstone would allow traders to choose between 11 trading platforms: MT4 for desktop, MT4 Mac, MT4 iPhone, MT4 Android, MT4 iPad/Tablet, MT5, WebTrader, cTrader WebTrader, cTrader cAlgo, and cTrader Mobile. The choice of trading platforms may seem confusing to novice traders, but actually, it is very useful because it has fast execution.

When trading forex, traders can enjoy raw spreads from 0.0 pips on Razor accounts, over 61 currency pairs, and commission-free account funding on a wide range of deposit options. In addition to currency pairs, Pepperstone provides many types of trading instruments, including CFDs for indices and shares, commodities, and cryptocurrencies.

Instruments in commodity trading are pretty much diversified. Not only metal, gold, and silver, but traders can also trade with soft commodities such as cotton, sugar, coffee, cocoa, and orange juice. Pepperstone also provides trading on energy (oil and gas).

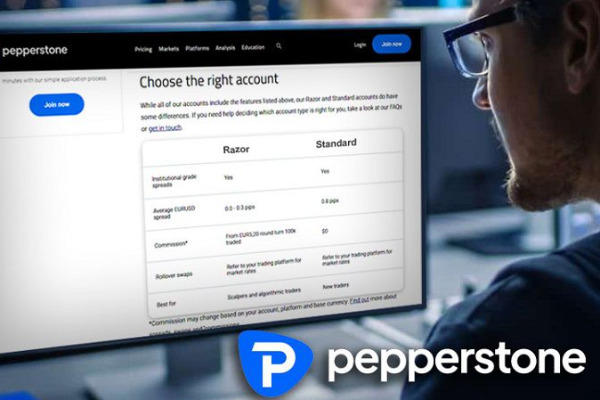

There are two types of accounts provided by Pepperstone, namely Razor accounts, and Standard accounts. If you area beginner, it is recommended to choose a Standard account with an average EUR/USD spread of 1.0-1.3 pips and free commission.

Those with particular trading styles such as scalpers and algorithmic traders may enjoy the lower cost setup traditionally seen in a Razor account, with a commission from AUD7 round turn of 100k traded. You can start trading with a minimum lot of 0.01 (micro) and 1:400 leverage.

As a Pepperstone client, a trader can fund and withdraw with alternative methods including Visa, Mastercard, POLi internet banking, bank transfer, BPay, PayPal, Neteller, Skrill, and Union Pay.

If you are new to trading or looking to practice your trading strategies in a risk-free environment, you can create Demo Account in Pepperstone. But if you are an experienced trader or prefer to learn by doing, Pepperstone provides a Live Account that allows you to trade with live executions and pricing.

Traders can also follow and copy strategies from popular traders using third-party services while learning how to improve their trading abilities. Pepperstone has partnered with a range of social trading platforms that traders can choose from, such as Myfxbook, ZuluTrade, Mirror Trader, MetaTrader signals, and Duplitrade.

Account Information

Apart from the forex demo account, this broker offers Standard and Razor. To successfully navigate your trading account, you also need to consider about leverage and minimum deposit. Talking about leverage in general, the maximum leverage offered by Pepperstone is up to 1: 400. Meanwhile, you can open an account with a starting capital of $0.

There are 2 account types that can be created during registration:

- Standard: Standard has minimum deposits of $200. The minimum lot size is 0.01. The account would be a good option for variable spreads that allow scalping, hedging, and Expert Advisors. It also supports trailing stop, pending orders, one-click trading, mobile trading, and automated trading. A swap rate will also apply to overnight positions.

- Razor: A minimum deposit amount of $200 and the minimum trading volume of 0.01 lot apply. Spreads are variable at Razor account and complemented by Expert Advisors, scalping, as well as hedging capabilities. Pending orders, trailing stop, one-click trading, mobile trading, and automated trading are available. Other charges include overnight swap fees.

If you want to look for a more simple explanation regarding this broker's account type(s), take a look at the following chart:

Min Deposit

$0

Max Leverage

1:400

Spread

Variable

Commission

$7

If you want to look for a more simple explanation regarding this broker's account type(s), take a look at the following chart:

💲 Min Deposit $0

💡 Min Position 0.01 lot

🔢 Spread Variable

📉 Scalping

🤖 Expert Advisors

💱 Hedging

🕛 Overnight interest rates (swaps)

⏱ Trailing stop

⏳ Pending orders

1️⃣ One-click trading

⚡ Automated trading

💸 Commission

Fees

Spreads are generally competitive, for example, the spread on EUR/USD during the London-New York session is 0 pips plus a commission of $7 with the Active Trader Program. This is the same as a spread of 0.7 pips. Their equity CFDs commission rates are also notably low with 0.07%, averaging at 0.10%. There are some other costs to be aware of. For example, an inactivity fee is charged to accounts that have been dormant for ten trading days. Also, swap rates are charged to clients that hold positions overnight.

| Assets | Fee level | Fee terms |

|---|---|---|

| EURUSD | Low | MT4/MT5 Razor account: $3.50 commission per lot per trade plus spread cost. 0.1 pips is the average spread cost during peak trading hours. |

| GBPUSD | Low | MT4/MT5 Razor account: $3.50 commission per lot per trade plus spread cost. 0.2 pips is the average spread cost during peak trading hours. |

| S&P 500 CFD | Low | The fees are built into the spread, 0.4 points is the average spread cost during peak trading hours. |

| Inactivity fee | Low | No inactivity fee |

Instruments Traded

Besides lots of currency pair, Pepperstone also offers some instruments you would like to trade on, such as Forex, Gold & silver, Crypto, Stocks, CFD, Indexes, Oil, Metals, Energies, Soft Commodities, Agriculture, Spread Betting (only for UK clients) and ETF for your best choice. Somehow, remember that different instrument has different trading conditions. In this case, you have to make sure that your strategy is well suited for the instrument you chose.

Pepperstone offers CFD trading in forex, commodities, stocks, and cryptocurrencies (depending on the region):

- 62 currency Pairs

- 18 cryptocurrency Pairs

- 3 cryptocurrency indices

- 23 commodities and metals

- 29 index CFDs

- 940+ equity CFDs

- 100+ ETFs

As for Standard account, Pepperstone specifically provides it with the following instruments and leverage. Note that these details apply under Pepperstone's SCB License:

Forex

1:400

Gold & silver

1:200

Crypto

Retail 1:10

Indexes

1:200

Metals

1:200

Energies

1:200

Soft Commodities

1:200

Agriculture

1:200

Spread Betting

1:200

💲 Min Deposit $0

💡 Min Position 0.01 lot

🔢 Spread Variable

📉 Scalping

🤖 Expert Advisors

💱 Hedging

🕛 Overnight interest rates (swaps)

⏱ Trailing stop

⏳ Pending orders

1️⃣ One-click trading

⚡ Automated trading

💸 Commission $7

Fees

Spreads are generally competitive, for example, the spread on EUR/USD during the London-New York session is 0 pips plus a commission of $7 with the Active Trader Program. This is the same as a spread of 0.7 pips. Their equity CFDs commission rates are also notably low with 0.07%, averaging at 0.10%. There are some other costs to be aware of. For example, an inactivity fee is charged to accounts that have been dormant for ten trading days. Also, swap rates are charged to clients that hold positions overnight.

| Assets | Fee level | Fee terms |

|---|---|---|

| EURUSD | Low | MT4/MT5 Razor account: $3.50 commission per lot per trade plus spread cost. 0.1 pips is the average spread cost during peak trading hours. |

| GBPUSD | Low | MT4/MT5 Razor account: $3.50 commission per lot per trade plus spread cost. 0.2 pips is the average spread cost during peak trading hours. |

| S&P 500 CFD | Low | The fees are built into the spread, 0.4 points is the average spread cost during peak trading hours. |

| Inactivity fee | Low | No inactivity fee |

Instruments Traded

Besides lots of currency pair, Pepperstone also offers some instruments you would like to trade on, such as Forex, Gold & silver, Crypto, Stocks, CFD, Indexes, Oil, Metals, Energies, Soft Commodities, Agriculture, Spread Betting (only for UK clients) and ETF for your best choice. Somehow, remember that different instrument has different trading conditions. In this case, you have to make sure that your strategy is well suited for the instrument you chose.

Pepperstone offers CFD trading in forex, commodities, stocks, and cryptocurrencies (depending on the region):

- 62 currency Pairs

- 18 cryptocurrency Pairs

- 3 cryptocurrency indices

- 23 commodities and metals

- 29 index CFDs

- 940+ equity CFDs

- 100+ ETFs

As for Razor account, Pepperstone specifically provides it with the following instruments and leverage. Note that these details apply under Pepperstone's SCB License:

Forex

1:400

Gold & silver

1:200

Crypto

Retail 1:10

Indexes

1:200

Metals

1:200

Energies

1:200

Soft Commodities

1:200

Agriculture

1:200

Spread Betting

1:200

Payment Methods

There's a decent range of payment options at Pepperstone, with only cryptocurrencies missing. All payment methods are free, except for bank wires outside Europe and Australia which charge $20. Note, there are third-party payment processor costs that clients need to pay.

| Regulator | Payment options |

|---|---|

| Australian Securities and Investments Commission (ASIC) | Credit/Debit card, Wire transfer, Neteller, Skrill, PayPal, Poli Transfer |

| Financial Conduct Authority (FCA) | Credit/Debit card, Wire transfer, PayPal |

| Dubai Financial Services Authority (DFSA) | Wire transfer |

| Securities Commission of The Bahamas | Wire transfer |

Deposit

| Bank transfer | ✔️ | ✔️ | ✔️ |

|---|---|---|---|

| Credit/debit card | ✔️ | ✔️ | ✔️ |

| Electronic wallets | ✔️ | ✔️ | ✔️ |

Withdrawal

| Bank transfer | ✔️ | ✔️ | ✔️ |

|---|---|---|---|

| Credit/debit card | ✔️ | ✔️ | ✔️ |

| Electronic wallets | ✔️ | ✔️ | ✔️ |

| Withdrawal fee | $0 | $0 | $0 |

Several payment methods are available:

Wire transfer : Wire Transfer is the most commonly used payment method. Nearly all brokers in the world provide this method on their service. The reason is wire transfer is basically traditional transfer between banks in the worldwide. So, this method is guaranteed for its safety. This really helps traders who avoid third-party payments or don't have credit cards.

Skrill : Mostly, all forex brokers provide Skrill as an online payment service option. Fast, easy, and safe transactions are the main reasons why traders using this method. Traders can use Skrill to fund their trading accounts with either payment cards, bank wire transfers, or directly from a Skrill e-wallet account.

PayPal : Online payment was not a thing back in the early 2000s, but PayPal has been in the market since 1999 and thus deserves to be regarded as one of the first e-payment services in the world. The US-based company is popular across many online platforms, including forex brokers.

Neteller : Like PayPal, Neteller is one of the most popular online payment services today. Due to this popularity, nearly all forex brokers accept Neteller as a payment method for their clients' fund deposit and withdrawal. Although the Neteller system is available almost all over the world, it remains particularly popular in Europe.

Pepperstone also provides payment with Credit/debit cards and UnionPay

Trading Platforms

Trading platform is a tool where you can buy or trade an instrument with only some clicks on your device, anytime and anywhere you want. In addition, price chart is also usually provided with some analytical tools to help you analyze the price movement, so you can increase your profitabiliy by placing well-planned trades.

Hereby, Pepperstone offers you MetaTrader 4, MetaTrader 5, cTrader, TradingView, Social trading and Web.

- MT4: Highlights of MT4 include 28 plug-ins Smart Trader suite, Autochartist, VPS hosting, support algorithmic trading, and copy trading functions. Pepperstone also provides social trading via third-party providers Myfxbook, MetaTrader Signals, and DupliTrade.

- MT5: MetaTrader 5 provides exceptional features to help you stay ahead of the markets as it is easier to use, easier to code using MQL5, provides advanced platform customization, offers 38 inbuilt indicators, Smart Trader Tools, Autochartist, and the ability to hed your position.

- cTrader: Created by Spotware with the mission to balance simple and complex functionality, cTrader is excellent for both new and advanced traders. Traders can place advanced order types and better understand the orders they're placing in more detail.

Let's compare the three platforms:

| cTrader | MetaTrader 4 | MetaTrader 5 | |

|---|---|---|---|

| Desktop platforms | Windows | Windows | Windows |

| Browser version | ✔️ | ✔️ | ✔️ |

| Android support | ✔️ | ✔️ | ✔️ |

| iOS support | ✔️ | ✔️ | ✔️ |

| 1200+ trading instruments available | ✔️ | ✔️ | ✔️ |

| Expert advisors/automated trading support | ✔️ | ✔️ | ✔️ |

| Strategy backtesting | ✔️ | ✔️ | ✔️ |

| Customisable charting and indicators | ✔️ | ✔️ | ✔️ |

| Adjustable session times | ✔️ | ❌ | ❌ |

| Depth of market functionality | ✔️ | ❌ | ✔️ |

| Advanced take-profit/stop-loss levels | ✔️ | ❌ | ❌ |

| Access to historical data | ❌ | ✔️ | ✔️ |

| Detachable charts for multiple monitors | ✔️ | ❌ | ❌ |

| Social/copy trading functionality | ✔️ | ✔️ | ✔️ |

| Cloud-hosted profiles, templates and passwords | ✔️ | ❌ | ❌ |

| Trade Share CFDs | ❌ | ❌ | ✔️ |

Unique Features

There are some useful trading services available, one of which is API trading. However, traders must accumulate $250 million in monthly trading volume or approximately 2,500 lots to enjoy this facility. If you have advanced trading solutions that require API trading, this amount might not be a problem for you.

Research and Education

Pepperstone has an extensive range of research material including high-quality written market commentary, trade ideas, and videos, presented with tradeable information and well-explained. Pepperstone offers a modest range of education resources for beginner traders with an in-depth collection of articles, supplemented by webinars and two trading courses.

| Beginner Course | ✔️ | ✔️ | ✔️ |

| Advanced Course | ✔️ | ✔️ | ❌ |

Bonuses and Promotions

Pepperstone does not offer any deposit bonuses at this time, even though there is an Active Trader Program to reward high-volume traders. Depending on the regulatory jurisdiction, you may find refer-a-friend promotions with referrals that must be fulfilled within 90 days.

Customer Support

Do you have any question or find any trouble related to Pepperstone? If you do, you should reach Pepperstone's support to get the information that you need. Here is the detail of the broker's customer support:

Pepperstone's support team operates 24/5, where the live chat function from the back office offers the most convenient contact method. Clients can also contact the customer support team via e-mail and a phone number.

Website Languages

Office Support

Email Support

Call Support

Chat Support

FAQ About Pepperstone

A good broker constitutes a good service for traders in terms of many criteria including trading instruments, deposits and withdrawals, as well as customer support. What is good for a certain trader does not necessarily mean the same thing to you. So the term "a good broker" can vary in meaning. You can decide for yourself if Pepperstone is a good broker for you or not by reviewing the criteria. In general, Pepperstone provides CFD trading service in Forex , Gold & silver , Crypto , Stocks , CFD , Indexes , Oil , Metals , Energies , Soft Commodities , Agriculture , Spread Betting (only for UK clients) and ETF . As for the payment methods, you can choose between Credit/debit cards, PayPal, UnionPay, Wire transfer, Neteller and Skrill. The customer support is available via Email, Live chat, Phone and Skype.

There is no starting capital required, but the broker recommends at least $200 to start.

Pepperstone is regulated by ASIC 414530, BaFin 151148, Capital Markets Authority of Kenya 128, CySEC 388/20, DFSA (Dubai) F004356, FCA 684312 and SCB SIA-F217. A regulated broker equals a more responsible trading environment. You can also expect a more guaranteed safety of funds as some of regulatory frameworks in the financial industry require a compensation scheme in case of unprecedented incidents that result in clients' financial losses.

Pepperstone is a brokerage company offering trading services for clients since 2010 with offices in Australia, Germany, Kenya, Cyprus, United Arab Emirates, United Kingdom and Bahamas.

Sep 18 2023

Sep 18 2023

Sep 17 2023

Sep 16 2023

Sep 11 2023

Sep 10 2023

1 Comment

Andrew newell

Sep 2 2023

Do not use this company. I opened an account 4 months ago and lost tens of thousands do to my own inexperience and foolishness, however that is not my main complaint. Yesterday they closed my account without warning and when I checked my email they had just sent me confirmation of this closure but did not give any reason. They just said we can do this because our Terms and conditions says we can. I have not broken their rules and my account is well above the minimum $200 threshold. The only reason I can think of is that I was starting to make a small profit of £600 scalping over the previous few days. It seems as if they are not happy making profit from spreads on each trade and will actually close you down if you start to make some money. Since I have lost over 50k since April, I figure they only have an issue when you manage to make some money. They are more that happy to take your losses.