Forex deposit failure have to be dealt with as soon as possible. After all, any delay in funding your account will set back your plan to make money.

Forex deposit failure is a common problem among new traders. There are various reasons, starting from innocuous cases such as mistype errors up to more complicated banking mistakes.

It's important to note that this article does not cover deposit failures resulting from human error, such as transferring funds to the wrong account or attempting to deposit an amount exceeding the available balance. Instead, it focuses on deposit failed where your money do not arrive within the estimated time in your trading account.

Read this article to learn why your forex deposit failed, how to resolve forex deposit issues, and what you should do to avoid falling into the same hole in the future.

What Happens When My Deposit Fails?

Forex brokers nowadays can process deposits instantly. Once you hit "send" on your preferred payment gateway, the funds will be sent to your trading account. When you look over your own trading account a minute later, you should see a message stating your account balance has increased by XXX amount.

You can wait at most 1-3 hours for your broker to handle your recent deposit. If your deposit is still unavailable even after 3 hours, you should reflect on whether something unusual occurred during the proceeding. Then, contact your broker with all the details.

Why Did My Deposit Fail?

There could be a variety of reasons why you experienced difficulties depositing money into your trading accounts, depending on your preferred payment method and the status of your account verification, among other factors. Even if you have provided valid information, a forex deposit failure may occur because of some troubles with your preferred payment method or your broker.

Here are several possible reasons why your deposit was unsuccessful:

1. General issues

- Unverified trading account.

- System error.

- Incorrect account details.

- Incorrect deposit amount.

- Expired session.

- The payment method you chose is not available in your region.

2. Debit/credit card issues

- Your card issuer refused to process the payment.

- Inaccurate card information.

- 3D authentication failed.

- The transactional limit or daily card limit has been reached.

- The name on the card is not the same as that of the trading account owner.

3. Wire transfer issues

- Your bank declines the transaction.

- Fraud prevention and/or other security measures.

- The name of the bank account owner is not the same as that of the trading account owner

4. Digital wallet issues:

- Invalid verification code.

- Insufficient funds.

5. Crypto payment issues

- Incorrect token: the token you sent is different from the token applied to the wallet opened for your trading account.

- Invalid recipient address: A crypto wallet address consists of a long string of letters and numbers that can easily trigger typos when entered manually.

- Network congestion: It is a situation in which there are more transactions than the blockchain network can handle, resulting in processing delays.

To avoid such occurrences, it is advisable to ensure that your trading account is verified before deciding to make a deposit. Also, don't forget to make sure that the name on your payment method matches the name on your trading account profile to facilitate and expedite the deposit process.

Whichever situation you find yourself in, make sure you contact your broker's support team as soon as possible. The sooner your broker identifies the problem, the sooner it can be resolved.

What Should I Do When My Deposit Failed?

Some forex deposit issues are easily detected through an error message or saved documents. Otherwise, your broker should be able to identify the problem for you.

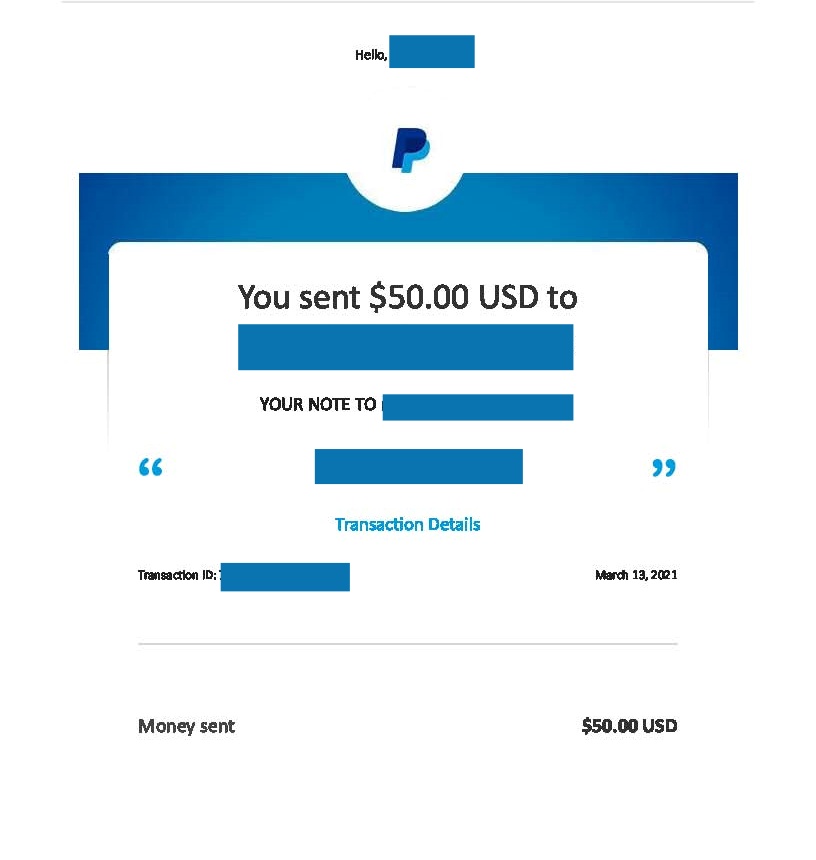

In any case, you should request assistance from your broker by enclosing the following details:

- Your trading account number.

- The transaction ID and/or proof of payment.

- The mode of payment you are using to deposit along with the corresponding data.

- The error message or any other atypical warnings you received (if any).

Debit/Credit Card Issues

When your deposit using a credit/debit card has not arrived within estimated time, there are several steps you can take to resolve the issue:

- Take a screenshot of the receipt showing that you've transferred the money to the broker.

- Check your debit/credit card balance to see if the money has been successfully transferred. You can see this information using a mobile banking app or asking your bank to print it. Contact your bank further to learn if your bank or broker caused the error.

- If your money has not decreased and your bank account shows no deposit history, then the error was caused by your bank. You need to contact your credit/debit card issuer to ask for the details.

- If your money has decreased from your debit/credit card balance, and your bank has confirmed that the transfer has been successful, then your money is stuck in your broker. You can follow the next step.

- Contact your broker and relay what your bank has said. The brokers usually will ask you to submit certain documentation. This could include a scanned copy of payment proof, your credit/debit card details, a screenshot of your account's transaction history, or an error that pops out when you deposit. The most important thing is that the broker needs to know when we transferred and your transaction's status.

- Once you have submitted the necessary documentation, you may need to wait for the broker to verify your account and payment method. Depending on the broker's internal procedures and workload, this process can take anywhere from a few hours to a few business days.

- If you haven't received any updates after submitting the required documentation, follow up with the broker's customer support team after a week.

Wire Transfer Issues

Here's what to do if your wire transfer deposit to a forex broker has not arrived within estimated time:

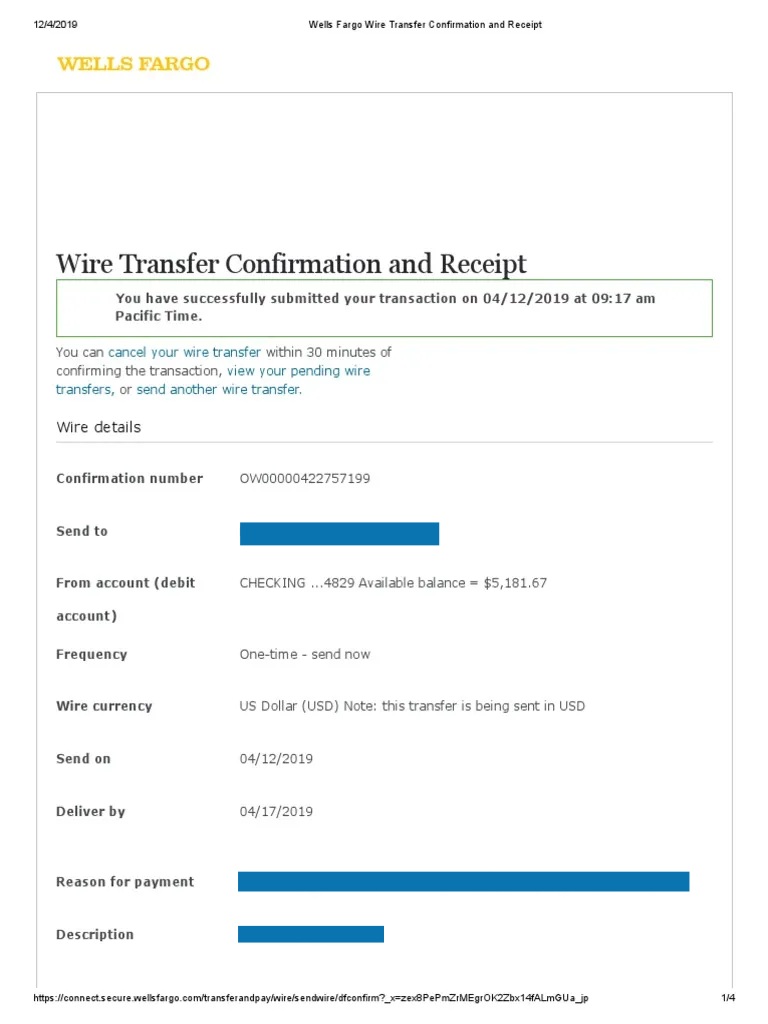

- If the transfer fails, reach out to your bank to understand why. Ask for the wire transfer receipt if it was labeled a successful transaction by your bank.

- Notify the forex broker about the failed transfer via live chat or e-mail and share any information your bank provided. This helps them investigate and find a solution.

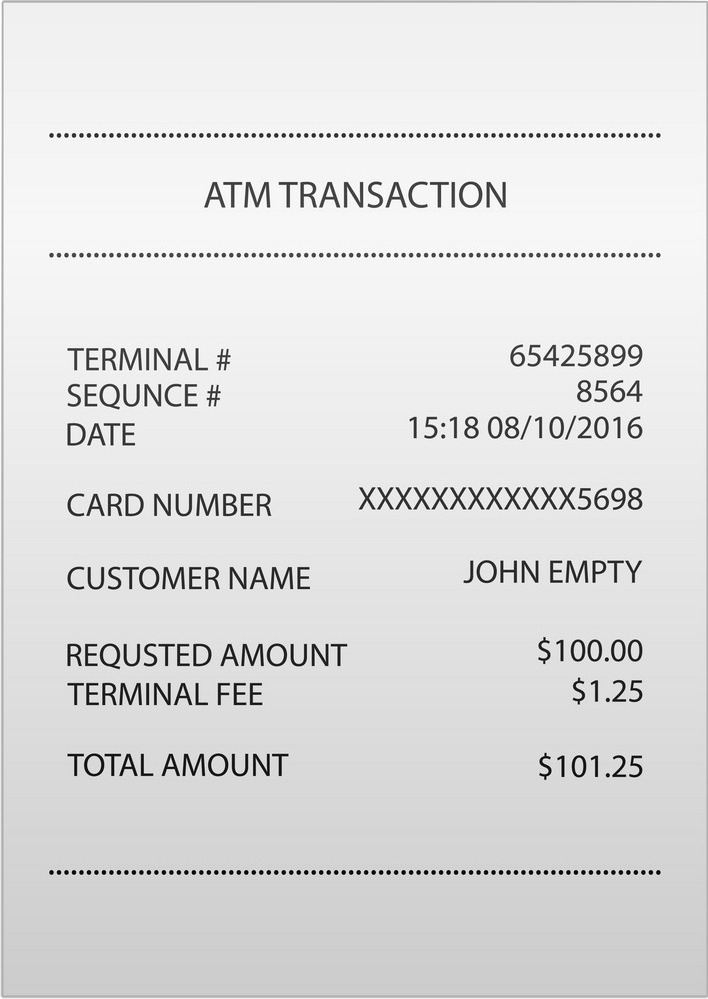

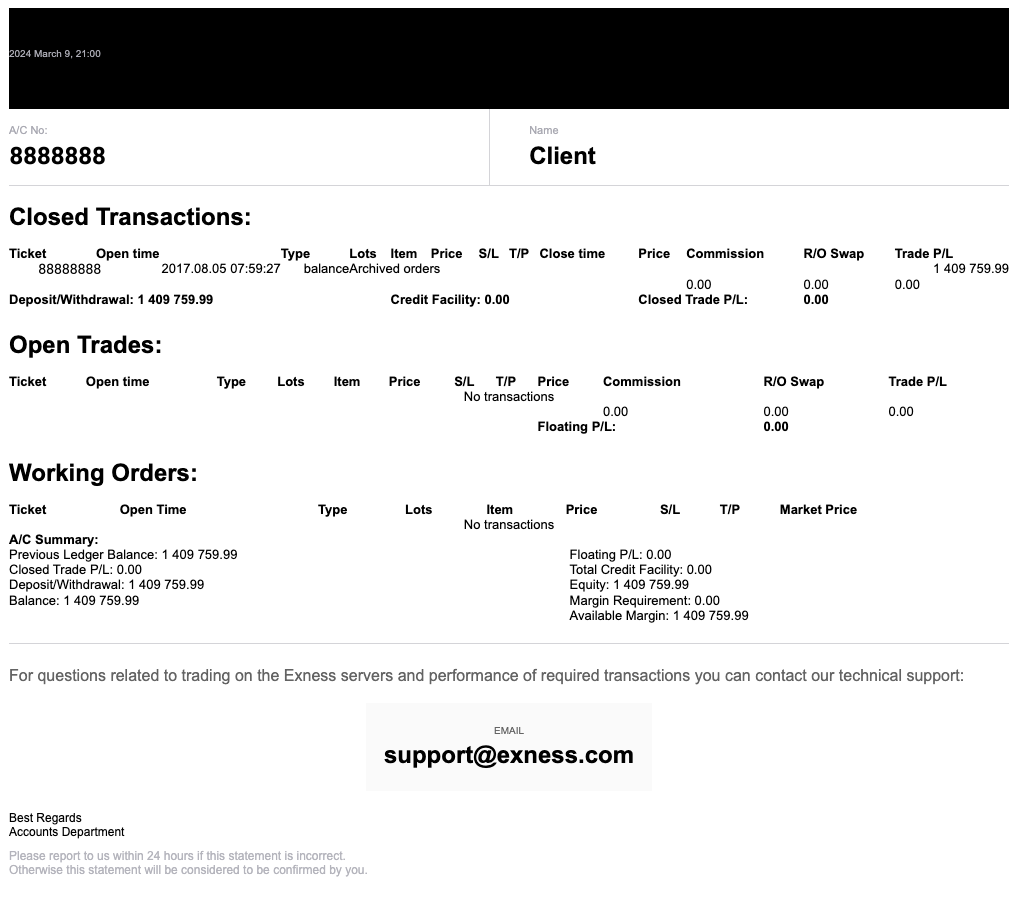

- You might need to submit documents like the wire transfer receipt, bank statements showing the transaction, and your ID. For example, in Vantage, if Vantage shows your funds deducted but the request is being processed, the money might not have reached their segregated account yet. Send them a receipt showing your name, funded amount, and bank details to [email protected]. Below is an example of a wire transfer receipt from Wells Fargo Bank.

- The duration for resolving a failed transfer can vary. After submitting the necessary documents, stay in touch with the broker's customer support team.

The wire transfer process usually takes 5 to 14 business days. However, if there is an error, the funds should be returned to the bank within 5 to 14 business days as well. So, the estimated time required for the funds to return to our account is approximately 1 month. Especially if there are data entry errors or rejections, the broker may take a long time to fix them.

Digital Wallet Issues

Depositing using a digital wallet is instant. Within a few minutes, your money should arrive in your trading account. But, there's the case where your money still has not arrived even after hours or days. Here's how to fix it:

- Verify your digital wallet has enough funds to cover any deposit or deposit fees.

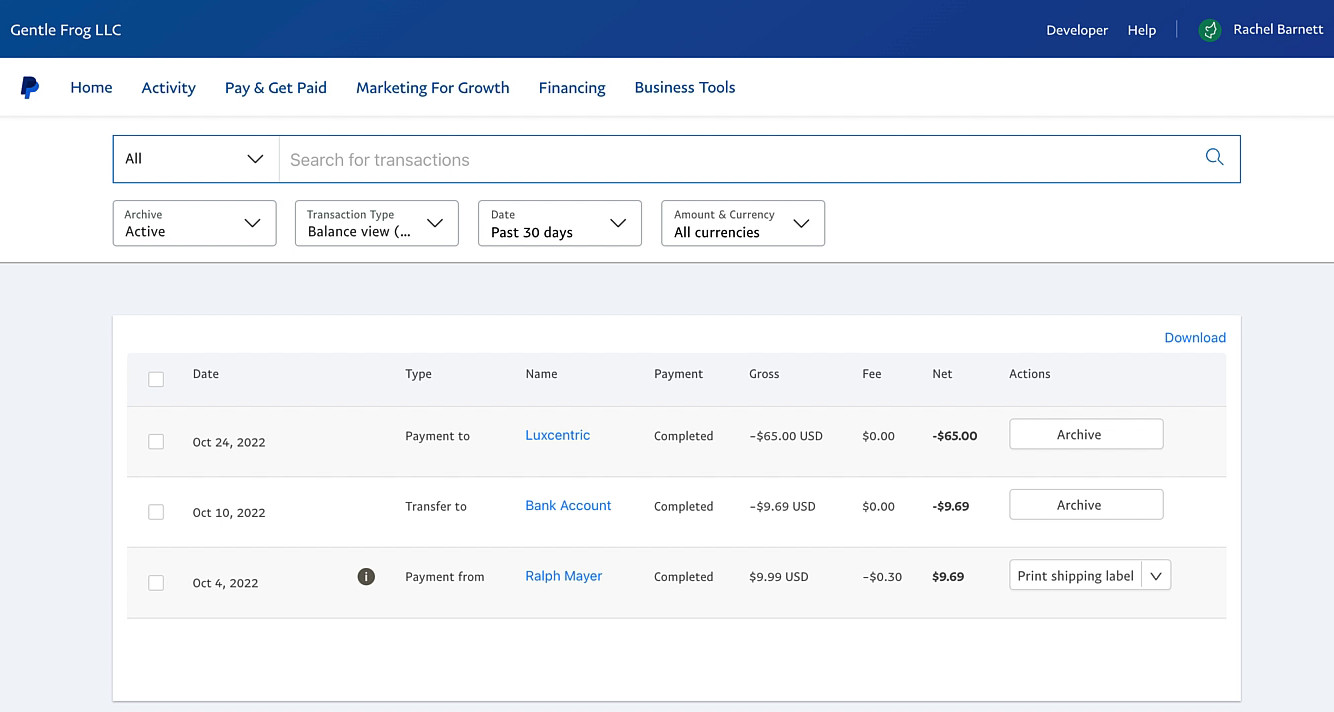

- Prepare screenshots of: your digital wallet transaction history, transaction IDs to prove that you've deposited, your digital wallet's balance before and after the transfer, any error messages you received, a page where you can see your digital wallet address and trading account number, and your trading account's payment history.

- You need to know where your money is, whether it's stuck in your digital wallet or broker. To know this, you need to follow the next step.

- Check your digital wallet's transaction history. If there's no recent transfer history, then the error was caused by your digital wallet. You need to contact your digital wallet issuer to fix this problem. To your digital wallet issuer, you need to submit proof of payment and your wallet's transaction history.

- If your money has been successfully transferred by digital wallet, then the money is stuck in your broker. Contact your broker and give them screenshots of your proof of payment, screenshots where you can see your digital wallet address and your broker account trading, your trading account payment history, and pop-up error messages, if any. In the case of Octa, you only need to upload a document (online banking screenshot, PDF file, or photo of a receipt) where all payment details are visible.

- Resolving the issue may take time, depending on the broker's procedures and the problem. After submitting documents, follow up with the broker's customer support for updates and further assistance if needed.

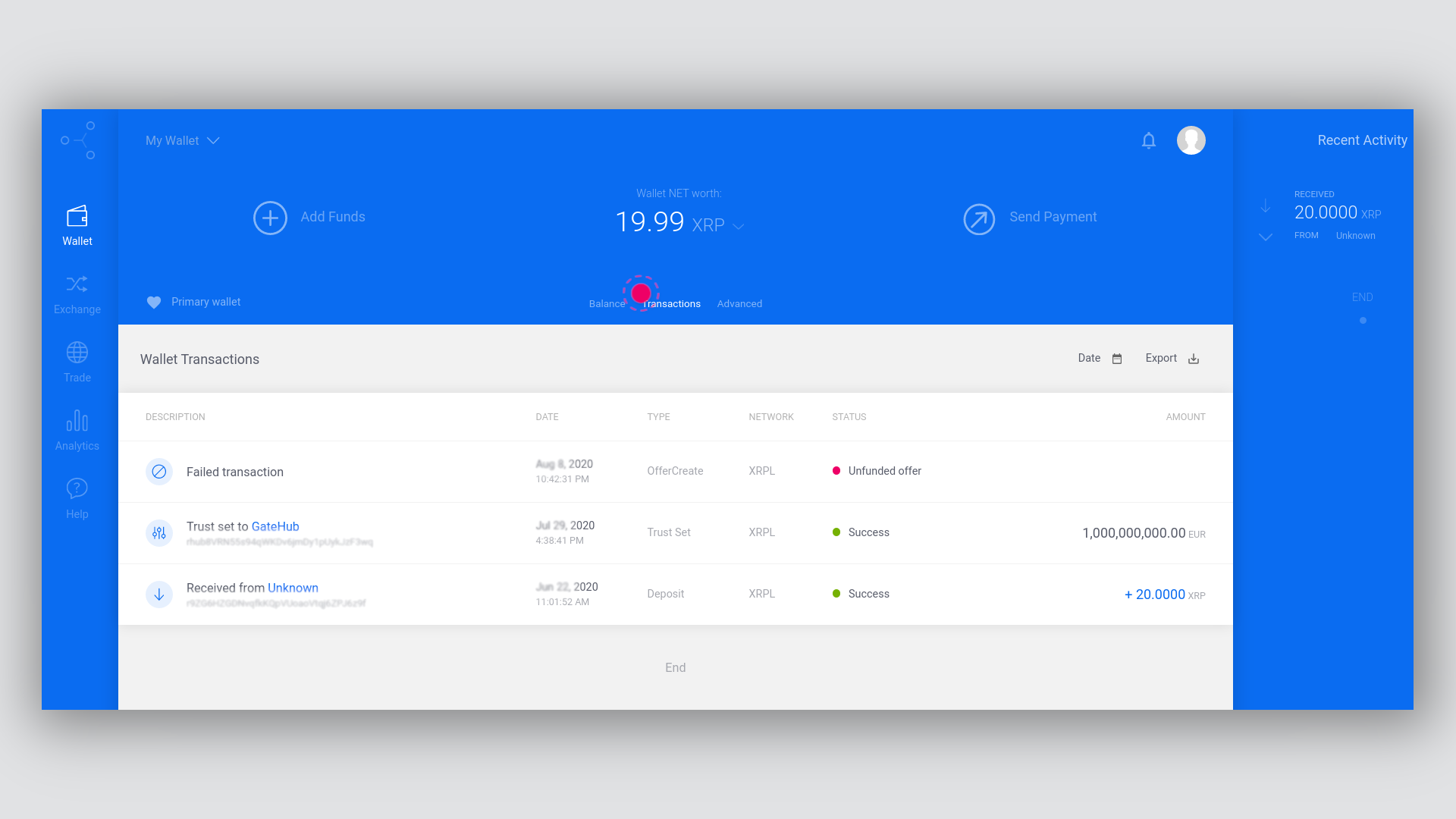

Crypto Payment Issues

I made a crypto deposit to a forex broker, but it failed to arrive in my account within the estimated time. Here's how to get it fixed:

- Check if the issue is network congestion (common with Bitcoin), wait for it to clear. Confirmations might take longer during peak times.

- Double-check your crypto wallet balance to ensure you have enough for the deposit amount.

- Check the transaction details, such as the recipient's wallet address and transfer amount. A single mistake can cause failure.

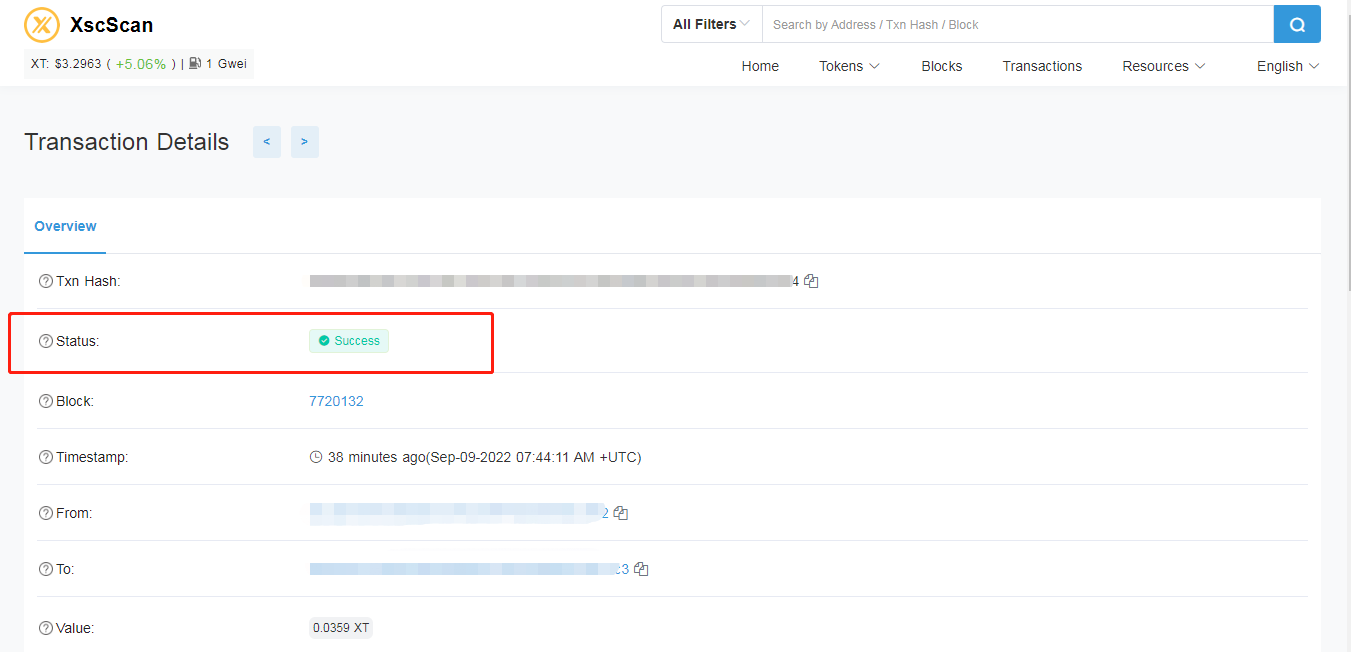

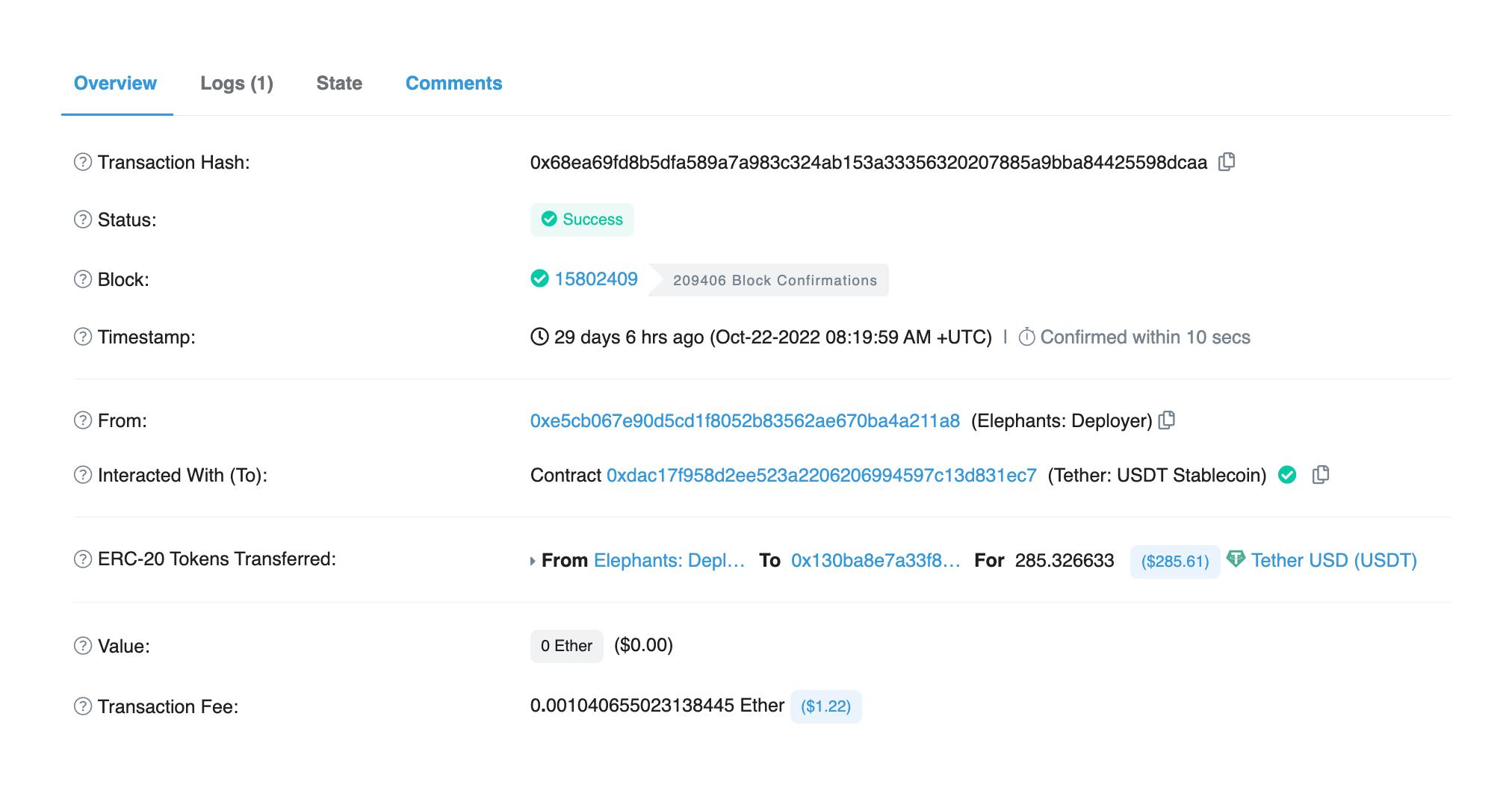

- Use a blockchain explorer (search by transaction ID or wallet address) to verify the transaction's status on the blockchain network. This reveals if it's broadcasted successfully or is still pending.

- Inform the forex broker about the failed deposit. They might have specific details or ways to help resolve the issue.

- The broker might request documents related to the failed deposit. This could include screenshots from your crypto wallet showing transaction details, transaction IDs, or Blockchain Explorer results displaying the transaction status.

For example, if you use FP Markets, you can send them a copy of the transaction receipt and hash number.

- After notifying the broker and submitting documents, allow them time to investigate and fix the issue. Resolution time varies depending on the broker's procedures and the problem's nature.

- If you haven't received updates after one week, follow up with the broker's customer support team for status updates and additional assistance.

Your broker should reply within 2x24 hours at the latest (working days). Afterward, if refunds are required, you might have to wait up to two weeks until you get your money back. It should be noted that refunds may be released by your broker or your payment provider, depending on at what stage the problem occurred. So, it is not always your broker's fault.

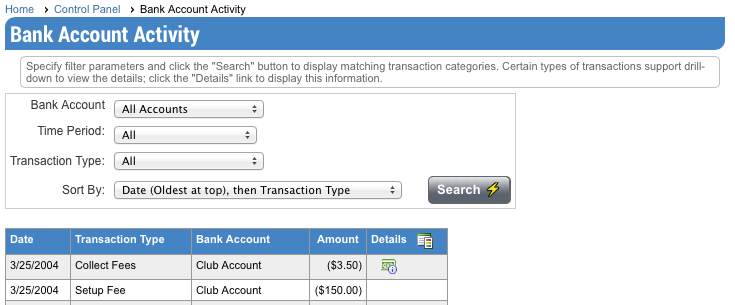

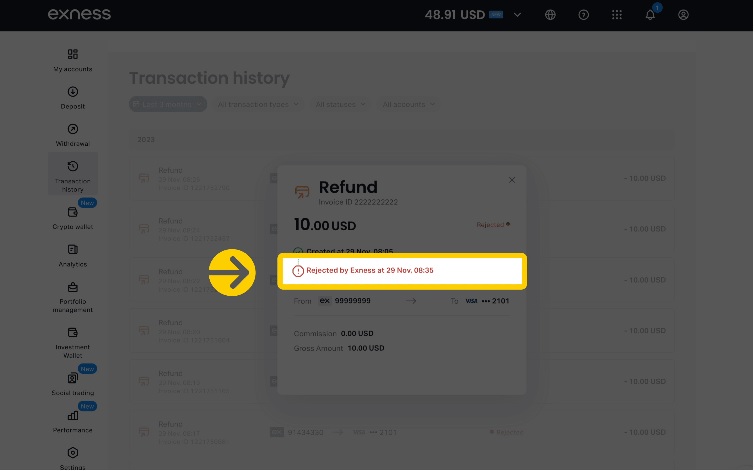

Sometimes, deposit failures occur due to rejection by the broker. You can find out about it on the transaction history page, where your deposit or transfer will be labeled "Rejected." To find out the reasons for this and how to handle it, you can contact the broker's customer support. For example, at Exness, when they reject a deposit, Exness will immediately label it as "Rejected" and automatically refund the funds, so clients don't need to worry about losing their money.

What Should I Do if the Broker and Payment Provider Offer No Solution?

If your broker does not respond at all until several working days after contact, you can escalate the case through third parties. For instance, financial regulatory bodies (the ones that provide licenses to your broker), your broker's social media pages, or online trader forums.

If the deposit issue stems from the payment provider's end, seeking assistance from their forums or community can often provide helpful insights and solutions, such as Paypal, Skrill, and Apple Pay.

Many payment providers maintain active online forums where users can discuss and troubleshoot common issues. By visiting these forums or communities, you may find valuable tips from other users who have encountered similar problems and successfully resolved them. Additionally, customer support channels provided by the payment provider can offer direct assistance in addressing deposit-related issues caused by their services.

If the deposit issue was caused by the broker, online forums such as Forex Factory and Forex Peace Army (FPA) are well-known hubs for troubleshooting various trading issues. You can find some tips from fellow traders and, sometimes, accelerate your broker's responses. Many brokers actually assign specific employees to scour those sites for unsavory comments and unresolved problems, then fast-track the settlement with related parties.

If you encounter any issues with your brokers, whether it's related to deposit problems or other concerns, feel free to visit our PROBLEM WITH BROKER forum page for assistance and support. Our forum provides a platform for traders to share their experiences, seek advice, and find solutions to various brokerage-related issues.

What Should I Do to Prevent Forex Deposit Failure?

People say prevention is better than cure. It is better to prevent forex deposit failure than deal with it after it has happened. At the end of the day, any delay in funding your account will set back your plan to make money.

Here are five steps to prevent forex deposit failure:

- Ensure that your trading account is completely verified, as there are restrictions on accounts that have not completed this critical procedure.

- Each trading account and each payment method has its own minimum and maximum deposit amounts; make sure you send the correct amount according to the guidelines.

- The payment methods associated with your trading account are contingent upon the nation of residency in which you have registered. Certain payment methods may not be available or supported in your country. In this situation, kindly attempt a different payment option that is accessible to you.

- Double-check any form you fill out for the deposit procedures, and save copies if possible.

- Fill out the forms as soon as possible while ensuring the accuracy of the information, because there may be timeouts and network disruptions if you carry out the process for too long.

Forex Deposit Failure Case Studies

You can find countless testimonies related to forex deposit failure in both offline gathering and online trader forums. The mistake might be with the trader themselves, the broker, or the payment provider. Either way, there are ways to resolve it.

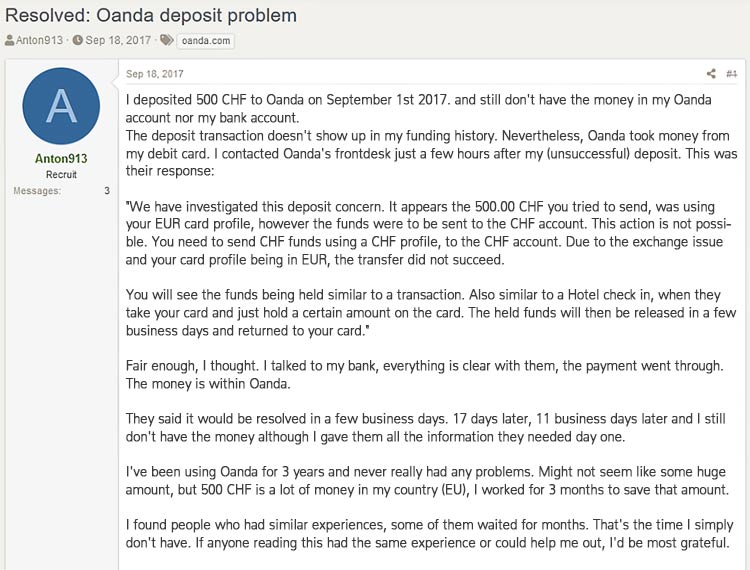

Case #1

An FPA member, nicknamed Anton913, failed to deposit CHF500 to OANDA in 2017. OANDA said the problem occurred due to a mismatched card profile, and the transfer did not succeed. The trader escalated the issue to FPA because the funds did not appear in his bank account. OANDA then suggested he contact his bank, and the funds later appeared in his bank account.

Traders looking for brokers with accurate precision, OANDA can be an option. That is because OANDA is a broker that provides quotes with 5-digit accuracy and active price movements that follow market developments. Order execution speed is also faster in this broker.

It provides benefits for novice traders, as they can trade with smaller volumes using the calculation system based on currency value, unlike other brokers adopting the lot system.

Founded in 1996, OANDA was built by Dr. Michael Stumm who is a lecturer in Computer Engineering at the University of Toronto, Canada, along with his colleague, Dr. Richard Olsen of The Olsen Ltd., which is one of the leading econometric research institutes. They have a head office in San Francisco, United States.

OANDA branch offices can be found everywhere. Some of these offices are located in the United Kingdom, Singapore, Japan, and Canada. With this number of offices spread, OANDA has increasingly attracted the attention of clients worldwide.

OANDA's company is registered under several well-known jurisdictions in financial trading. They are regulated by CFTC and NFA in the US, FCA in the UK, ASIC in Australia, and many others. Traders do not need to worry anymore about security when trading in OANDA. However, these advantages make trading rules at OANDA more stringent compared to other brokers.

For example, OANDA only allows maximum leverage of 1:20, because the rules in the US and Japan do not allow leverage above that. Besides, the registration procedure is more complex due to various additional requirements that are not submitted by other forex brokers. On top of that, hedging is not allowed in one trading account as the client must open an additional account to hedge.

Nevertheless, OANDA is known for being a leading broker with many advantages offered. OANDA faces increased market risk during periods of price volatility, such as economic and political news announcements. When market spreads increase or decrease, their pricing engine widens or narrows spreads accordingly. That way, traders can get the latest conditions from price movements in the market more quickly.

Prices move very fast in the market. Especially when news releases have a large impact on market volatility. This condition is often exploited by brokers to take advantage of clients with Requotes. However, traders do not need to worry about additional costs when trading with OANDA.

The company never withdraws Requotes so traders can get maximum profit. When traders are unavailable to monitor open positions, they can set take profit orders to lock in profits and Stop Loss orders to help protect against further losses.

As an experienced and well-known online forex broker, OANDA is committed to maintain an efficient trading environment that reduces latency and provid tools to help clients manage the degree of acceptable slippage.

With a fast & reliable trading platform by OANDA, clients' trades are executed in 0.012 seconds. This suits traders who choose brokers based on execution speed.

Because of this exceptional execution service, it is not surprising that OANDA won many awards, including the winner of the world's Best Retail FX Platform at the prestigious e-FX awards. The broker is also voted number 1 for Consistency of filling trades at quoted prices, Execution speed, and Reliability of platforms.

There is no minimum deposit or minimum balance required to open an OANDA account. Deposit and withdrawal can be done easily. OANDA provides a variety of payment method facilities, including Paypal, Wire Transfer, Credit Card, and Debit. Traders can adjust it to the region where they live.

OANDA provides more than 100 trading instruments, including 71 currency pairs, 16 indices, 8 commodities (Brent Crude Oil, Copper, Corn, Natural Gas, Soybeans, Sugar, etc.), 6 Bonds, and 23 Metals.

The fxTrade and MetaTrader platform are available at OANDA. These platforms can be used for Desktop and Mobile. Another plus is they have an OANDA Technical Analysis that exists in collaboration with a technical analysis provider called Autochartist.

With these platforms, clients can monitor price movements easier and automatically recognize patterns created on charts, as well as receive alerts when the awaited patterns appear. Access to this technology can be enjoyed free of charge.

In conclusion, OANDA is an ideal broker for traders in need of fast execution backed by many years of experience. The company is also a good alternative for those looking for a well-regulated broker with flexible trading and deposit conditions.

Case #2

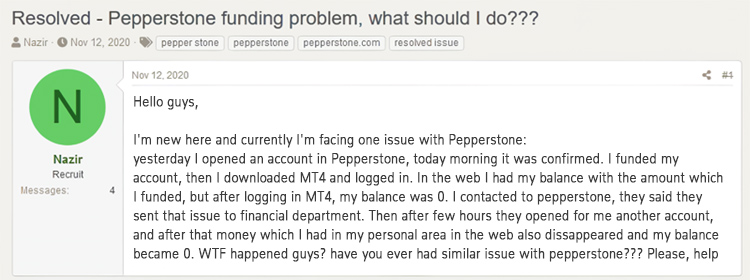

A new trader, nicknamed Nazir, experienced problems depositing $200 at Pepperstone. The deposit was confirmed, and he can see it in his client area, but it did not appear on his MetaTrader4 (MT4 balance was 0). Pepperstone responded by opening a new MT4 account for him with a maximum leverage of 1:30. The issue probably occurred because the trader resides in Europe. European authorities (ESMA) limit the maximum leverage for inexperienced traders' accounts up to 1:30, and so any account with inappropriate leverage is inaccessible.

Pepperstone was founded in 2010 by a team of experienced traders with a shared commitment to improve the world of online trading. Based in Melbourne, Australia, they grew to become one of the largest forex brokers in the world. If traders want to find a broker that provides low spreads, fast execution, and award-winning support, then the answer is Pepperstone.

Pepperstone has a strong legality guarantee because it has been licensed by the Australian regulator ASIC and FCA. Traders' funds can be deposited in segregated accounts at top Australian banks, one of which is the National Australia Bank (NAB). Therefore, the safety of funds is not a concern if a trader chooses to open an account in Pepperstone.

They succeeded in collaborating with 23 top banks to bring Bid to investors instantly via optical fiber. This allows all orders to be executed 100 percent automatically with low latency up to 0.05 milliseconds, without dealing desk intervention and requotes, as well as with super low trading costs.

Trusted by over 73,000 traders around the world, Pepperstone processes an average of USD12.55 billion of trading volumes every day. Because of that, they have many awards such as:

- The Best Global Forex ECN Broker 2019 and Best Forex Trading Support-Europe

- Best Australian Broker and Best Trading Platform 2018 by Compareforexbrokers.com

- Best Forex ECN Broker, Best Forex Trading Support, and Best Forex Trading Conditions by UK Forex Awards 2018

With the many rewards gained, Pepperstone hopes to attract more and more traders from all over the world. The rising performance of Pepperstone is not only due to the super-tight spreads and fast execution that it provides, but also because many traders are interested in trading with deposits in currencies other than US Dollars.

For this reason, Pepperstone is one of the most market-responsive brokers because it is willing to accept deposits in 10 currencies, which include AUD, USD, EUR, CAD, GBP, CHF, JPY, NZD, SGD, and HKD.

Trading in Pepperstone would allow traders to choose between 11 trading platforms: MT4 for desktop, MT4 Mac, MT4 iPhone, MT4 Android, MT4 iPad/Tablet, MT5, WebTrader, cTrader WebTrader, cTrader cAlgo, and cTrader Mobile. The choice of trading platforms may seem confusing to novice traders, but actually, it is very useful because it has fast execution.

When trading forex, traders can enjoy raw spreads from 0.0 pips on Razor accounts, over 61 currency pairs, and commission-free account funding on a wide range of deposit options. In addition to currency pairs, Pepperstone provides many types of trading instruments, including CFDs for indices and shares, commodities, and cryptocurrencies.

Instruments in commodity trading are pretty much diversified. Not only metal, gold, and silver, but traders can also trade with soft commodities such as cotton, sugar, coffee, cocoa, and orange juice. Pepperstone also provides trading on energy (oil and gas).

There are two types of accounts provided by Pepperstone, namely Razor accounts, and Standard accounts. If you area beginner, it is recommended to choose a Standard account with an average EUR/USD spread of 1.0-1.3 pips and free commission.

Those with particular trading styles such as scalpers and algorithmic traders may enjoy the lower cost setup traditionally seen in a Razor account, with a commission from AUD7 round turn of 100k traded. You can start trading with a minimum lot of 0.01 (micro) and 1:400 leverage.

As a Pepperstone client, a trader can fund and withdraw with alternative methods including Visa, Mastercard, POLi internet banking, bank transfer, BPay, PayPal, Neteller, Skrill, and Union Pay.

If you are new to trading or looking to practice your trading strategies in a risk-free environment, you can create Demo Account in Pepperstone. But if you are an experienced trader or prefer to learn by doing, Pepperstone provides a Live Account that allows you to trade with live executions and pricing.

Traders can also follow and copy strategies from popular traders using third-party services while learning how to improve their trading abilities. Pepperstone has partnered with a range of social trading platforms that traders can choose from, such as Myfxbook, ZuluTrade, Mirror Trader, MetaTrader signals, and Duplitrade.

#Case 3

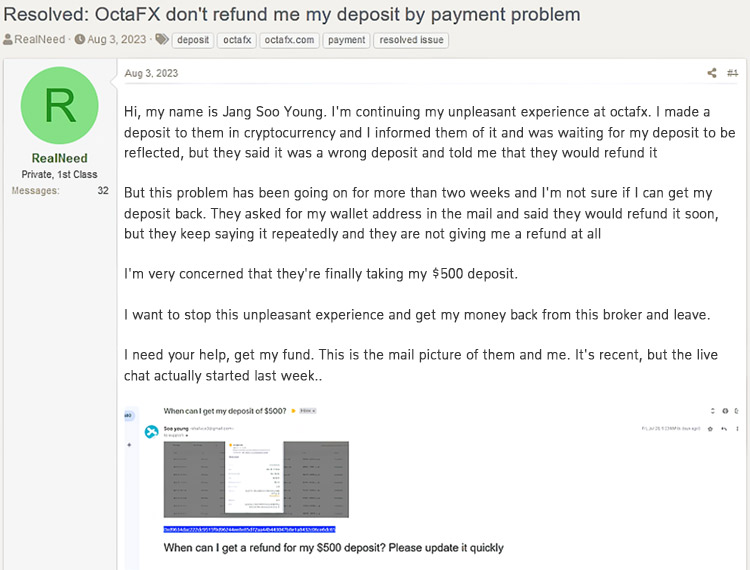

An FPA member, nicknamed RealNeed, failed to deposit $500 to OctaFX in 2023. OctaFX representative found the problem occurred because he deposited USDT in the Ethereum wallet (incorrect token). OctaFX later refunded the amount.

Octa is one of the most famous brokers in the world and has won many awards for its very comfortable trading atmosphere and proximity with customers. Octa was founded in 2011 with headquarters in Strovolou 47, Kyros Tower, Nicosia.

Prestigious awards that have been received by Octa include the Best ECN/STP 2019 and the 2019 Best Broker in Asia given by FX Daily Info. The Global Banking and Finance Review magazine also gave the Best Broker award in Asia in 2018 to this broker. More than that, there were also awards from European CEO Magazine (Best FX Broker 2018 and Best Trading Conditions).

For traders in most countries, Octa is under the authority of Octa Markets Incorporated and is registered in Saint Vincent and the Grenadines. This broker also provides various facilities, such as providing support services by live chat and WhatsApp in Indonesian. Not only that, deposits and withdrawals of funds can be done through various local banks. Octa does not charge commissions for every deposit and withdrawal of funds made by traders.

Octa offers different types of accounts that are carried out with market execution (STP/ ECN) and floating spreads from 0.2 pips. A variety of forex strategies, ranging from Scalping, Hedging, and the use of Expert Advisors are permitted in all accounts at Octa brokers.

There is also a fixed exchange rate offer when opening a Micro MT4 account. All deposits made in IDR will be calculated at the rate of USD1 = Rp10,000 and will be entered into the trader's account balance. Also, Swap-free accounts are available for Muslim traders who want to avoid overnight interest.

Trading in Octa is also suitable for novice traders. Because Octa offers low spreads, which are floating starting from 0.0 pips. The required initial deposit is also low, only USD25. The currencies used on the account are US Dollars and Euros.

Octa gives a bonus of 50% each time a trader makes a deposit. That way, the capital gained by the trader becomes bigger. Opportunities to open positions increased and deposit bonuses can be withdrawn on the terms and conditions.

If traders are still confused about calculating profits, the Octa platform provides a trading calculator for each account type. Traders only need to enter the currency pair being traded, the amount of leverage, the number of lots, and the type of currency used in the account.

Opportunities to get profits are also getting bigger with the Autochartist feature. Traders will get notifications quickly when there is a profit signal in trading. The accuracy of the trend prediction reaches 83%.

Traders do not need to worry about the safety of funds at this broker. Octa uses segregated accounts and protects personal data and online financial transactions with SSL technology. This is adjusted to the international accounting standards and regulations.

Another advantage offered by Octa is the Trade & Win program. Opening an account in Octa would open the opportunity to collect trading lots, which can be accumulated into a variety of attractive prizes. Traders only need to open a real account on MetaTrader4 or MetaTrader5 through Octa and simply exchange the prize lot in this promotion. Prizes that can be obtained by traders include T-shirts, Android Smartwatches, smartphones, and laptops.

Traders need not worry about missing out on promotions. Because Octa often bonuses and other promotions. This broker holds a trading contest every week on a demo account with real prize funds that can be used for trading.

One example of a prize contest is Octa Champion - MT4 Demo Contest. With a total prize of USD 1,000, there are places for 4 winners in each contest period.

So, you see, there is no need to worry. Legitimate forex brokers should respond promptly to any help request, including in cases of forex deposit failure and withdrawal issues.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance