Are you curious about how beginners can make money with forex trading? Find out all the details with real scenarios and calculations here.

With the forex market boasting a daily transaction volume exceeding $6 trillion, it's no surprise it holds the title of the world's largest financial market. From this vast market, many individuals inquire about how to make money in forex market.

The solution lies in engaging in forex trading. However, despite its potential for substantial profits, forex trading also carries inherent risks.

But don't worry! This article is designed as an introductory guide, specifically tailored for beginners, to assist you in understanding how to profit from forex trading.

So, let's get started!

Contents

What Is Forex Trading?

At its core, forex trading involves buying and selling currency pairs to make money. Essentially, you're betting on the movement of currency prices.

For instance, if you purchase US dollars and the value of the US dollar increases, you make money in forex market from the difference in the price hike.

🔎Let's break it down a bit further

When you engage in forex trading, you're essentially buying one currency while simultaneously selling another. This is typically done in pairs, such as the EUR/USD (Euro/US Dollar) or GBP/JPY (British Pound/Japanese Yen).

Let's say you believe that the value of the Euro will increase relative to the US Dollar. In this case, you would buy Euros with US Dollars. If your prediction is correct and the value of the Euro indeed rises against the Dollar, you can then sell your Euros back for more Dollars than you originally spent, thus making a profit.

How to Make Money in Forex Market?

As mentioned previously, making money in forex trading involves investing money based on the direction of currency movements.

To simplify your understanding of how to get and calculate a forex profit, I'll provide clear examples on the chart for both sell and buy positions.

Buy Position

I enter a buy position of 1 lot on the currency pair EUR/USD at 1.08619. After entering the buy position, the price continues to rise, and at 1.08869, I close the buy position.

The formula for calculating profit in a buy position:

Profit (pips) = selling price - buying price

So, 1.08869 - 1.08619 = 25.0 pips

Now, let's find the profit value based on this difference. To determine the profit value, we multiply the difference in price by the volume (lot).

Profit = price difference x volume (lot)

In this case, on a standard account, 1 lot is worth $10 per pip.

If the transaction volume is 1 lot, the resulting profit is 5 pips x $10 = $250.

See Also:

Sell Position

Let's consider a scenario where we enter a sell position of 0.5 lots at 1.07893. Suddenly, the price sharply drops, and when it reaches 1.07065, we close the sell position.

The formula for calculating profit in a sell position remains unchanged:

Profit (pips) = selling price - buying price

Profit (pips) = 1.07893 - 1.07065 = 82.8 pips

Now, let's convert this into a dollar value by multiplying it with the volume (lot) used, where 1 lot equals $10.

Profit = price difference x volume (lot)

Profit = 82.8 x $5 = $414

You can also use Profit Calculator to get the numbers automatically.

What Is the Minimum Deposit to Start Forex Trading?

To start trading forex, you only need a little money; you can begin with just $10. Nowadays, many brokers offer micro accounts, allowing you to start with minimal funds to learn and profit in the forex market.

For instance, you open a micro account with a $10 deposit. Then, you execute a trade by opening a sell position on EUR/USD with a volume of 0.01 lots at 1.10000. After just 2 hours, the price drops to 1.09800, resulting in a profit difference of 20 pips.

Using 0.01 lot, the value per pip is $0.1. So, the profit from your trade is calculated as $0.1/pip x 20 pips = $2.

With a $2 profit, your balance is now $12.

Let's compare this with the same scenario but with a larger capital and volume, say $100 with 0.1 lot. You open a sell position of 0.1 lots (0.1 lot has $1/pips value) at 1.10000, and after 2 hours, the price reaches 1.09800, then you close the position.

With a price difference of 20 pips, the profit obtained is equal to $1/pip x 20 pips = $20. Now your balance is $120.

As you can see, the profit potential is significant. It can be realized quickly, depending on the volume you use when entering a position in the forex market.

Are You Interested in Forex Trading? If So, Follow These Steps...

1. Install MetaTrader

First, download the MetaTrader platform for forex trading.

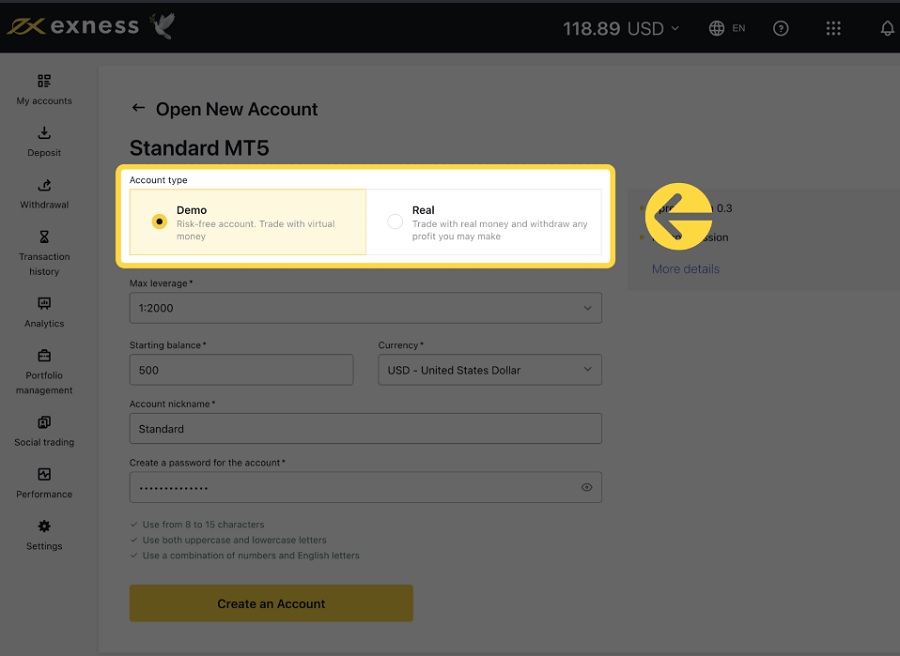

2. Create a Demo Account

Create a demo account to practice trading. You can follow the steps in this article.

Trading Simulations on Demo Account

To give you an idea of potential profits, I'll simulate trading on two accounts: one with $10 and another with $50.

Trading with $10

First, I enter a sell position on EUR/USD of 0.01 lots at 1.08609. Then, I enter another sell position on GBP/USD of 0.01 lots at 1.22635.

Next, I opened a sell position on AUD/USD with 0.01 lots at 0.65576, followed by a sell position of 0.01 lots on USD/JPY at 151.305. Finally, I entered a buy position of 0.01 lots on USD/CAD at 1.35691.

Two hours later, I closed all open positions one by one with the following results:

- Sell EUR/USD: $0.86 profit

- Sell GBP/USD: $1.94 profit

- Sell AUD/USD: $0.98 profit

- Buy USD/JPY: -$0.86 loss

- Buy USD/CAD: -$0.21 loss

💰 Total $2.71 profit

Out of 5 positions, 3 positions are profitable and 2 are at a loss.

This means the win ratio is (3/5) x 100% = 60%.

This simulation shows that within just a few hours with a win ratio of around 60%, the positions closed with a profit of $2.71.

A profit of $2.71 from a $10 capital means a profit of 27.1% in 2 hours.

Trading with $50

First, I take a sell position on GBP/USD with 0.02 lots at 1.26388. My second position is a sell on EUR/USD with 0.02 lots at 1.08494.

Next, in the third position, I sell AUD/USD with 0.02 lots at 0.65450, followed by a buy position on USD/CAD with 0.02 lots at 1.35676. Finally, I entered a sell position on NZD/USD with 0.02 lots at 0.60163.

Two hours later, I checked the charts and closed my positions one by one, resulting in the following results:

- Sell GBP/USD: 0.02 lots, $1.94 profit

- Sell EUR/USD: 0.02 lots, $3.68 profit

- Sell AUD/USD: 0.02 lots, $1.48 profit

- Sell USD/CAD: 0.02 lots, $0.49 profit

- Sell NZD/USD: 0.02 lots, $1.14 profit

💰Total profit: $8.73 or approximately 17.46% of the $50 capital.

All 5 positions are profitable, meaning the win ratio is 100%. From this simulation, you can see that in 2 hours with a capital of $50, you can make a significant profit.

If you repeat this activity every day, imagine how much profit you could make each month!

How to Increase Your Chance of Profit (Win Ratio)?

Boosting your profit percentage or forex win ratio in trading is one of the keys to long-term success. Here are a couple of straightforward strategies to help you achieve just that:

📈Align with the Trend |

One of the simplest yet most effective ways to increase your chances of success is by trading in the direction of the trend. Trends represent the general direction in which a currency pair is moving over time. By aligning your trades with the trend, you're essentially riding the momentum of the market. This not only enhances your chances of winning but also allows you to capture larger price movements. Remember, the trend is your friend! |

Trade at Significant Levels |

| It's crucial to enter trades at important levels in the market. These levels act as key areas where the price is likely to react or reverse. Two of the most significant levels are support and resistance. Support is a price level where buying interest tends to be strong enough to prevent the price from falling further, while resistance is a price level where selling interest is strong enough to prevent the price from rising further. By entering trades at these levels, you're positioning yourself to take advantage of potential price reversals or bounces. Additionally, identifying supply and demand zones can also provide valuable entry points for your trades. |

👛Apply Proper Money Management |

Ensure you don't risk more than 1% of your trading account on any single trade, strive for a risk/reward ratio of at least 1:2 in your trades, and avoid the temptation to stray from your risk limits. |

👨💻Stay Disciplined and Patient |

Maintain discipline and patience in your trading approach, avoiding emotional decision-making and overtrading. Stick to your trading plan and remain consistent in your trading strategy, even during periods of market volatility. |

🔍Monitor and Analyze Your Performance |

Regularly review and analyze your trading performance to identify strengths, weaknesses, and areas for improvement. Keep a trading journal to track your trades, record observations, and refine your strategies over time. |

ℹ️Stay Informed and Adapt |

| Stay updated on market news, economic events, and global developments that could impact the financial markets. Adapt your trading strategies accordingly to capitalize on opportunities and minimize risks. The financial markets are dynamic and ever-changing, so commit to continuous learning and improvement. Stay open to new ideas, strategies, and perspectives to evolve as a trader and adapt to changing market conditions. |

If you're keen on learning more about boosting your profits in forex trading, feel free to check out our educational section.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance