Did you know that the top 5 forex signal providers on eToro in terms of copiers only apply low to moderate risk trades? Here are their stories.

Copy trading has been gaining momentum since 2020 due to a growing demand. Many traders find themselves short on time for active trading or intensive learning, making copy trading services an appealing option to generate passive income.

eToro broker is recognized as one of the leading providers in copy trading and offers a wide range of signal providers, each with its unique levels of return and associated risks. Thanks to the eToro copy trading platform, selecting and filtering preferred signal providers is effortless.

✔️ Pros

- User-friendly and intuitive interface

- Allows you to copy the trades of successful traders on the platform

- A wide range of assets for trading, including stocks, ETFs, cryptocurrencies, and commodities

- Connect with other traders and share ideas through the platform's social features.

- No account management fees

❌ Cons

- Smaller selection of stocks and ETFs compared to other brokers.

- Trading fees, particularly for CFDs, can be higher than some competitors.

- Basic research tools compared to more advanced platforms.

- Customer service options may be limited.

- Past performance of copied traders is not a guarantee of future success

eToro established in early 2007, with a mission to make trading accessible to anyone, anywhere, and reduce dependency on traditional financial institutions. The company has head offices in the United Kingdom, Cyprus, USA, and Australia.

eToro (Europe) Ltd operates as a Financial Services Company authorized and regulated by the Cyprus Securities Exchange Commission (CySEC) under license no. #109/10. Meanwhile, eToro (UK) Ltd is authorized and regulated by the Financial Conduct Authority (FCA) under the license FRN 583263.

As for eToro AUS Capital Pty Ltd, the legal standing is acknowledged by the Australian Securities and Investments Commission (ASIC) to provide financial services under Australian Financial Services License 491139.

A broker that belongs to the 4-digit type, eToro offers both short-term options for day traders and long-term options for investors, such as their innovative Smart Portfolios, a fully managed thematic portfolio.

Since 2007, eToro has been at the forefront of the Fintech revolution. The most recent was launched in 2017, which is Smart Portfolios powered by Machine learning Al. Beyond developing Smart Portfolios, the company integrated Microsoft's machine learning technology into Momentum DD.

The new Smart Portfolios investment strategy uses artificial intelligence to find the steadiest traders who are most likely to generate a double-digit return and bundle traders into one fully-managed portfolio. eToro has hundreds of financial assets for trading across several categories including stocks, commodities, crypto assets, currencies, indices, and ETFs. Each asset class has characteristics and can be traded using a variety of investment strategies.

Some positions on eToro involve ownership of underlying assets, such as non-leveraged positions on stocks and cryptos. Employing CFDs will enable a variety of options, such as leveraged trades, short (sell) positions, fractional ownership, and more. For example, traders can invest as little as USD100 in gold, even if a single unit of gold cost USD1,000. Some of eToro's most popular CFD commodities include gold, oil, natural gas, silver, and platinum.

Currencies are traded on eToro only as CFDs. Also, CFDs enable Sell (short) positions and leveraged trade, even for assets that don't offer the option in traditional trading. Some of the popular currencies include EUR/USD, GBP/USD, AUD/USD, USD/JPY, and USD/CAD.

Furthermore, An Exchange-Traded Fund (ETF) is a financial instrument comprising several assets grouped to serve as one tradable fund. After opening an account in eToro, traders can invest as little as USD250 in an ETF that costs USD500. Some of the popular ETFs on eToro include SPY, VXXB, TLT, and HMMJ.

However, eToro also offers additional functions using CFD trading. All leveraged ETF positions in the UK are under FCA regulations. Meanwhile, all CFD positions executed by eToro Australia are under ASIC regulations.

The company has other advantages. In all financial assets that can be traded, eToro does not charge any deposit or trading frees other than spreads.

eToro charges a USD25 fee for withdrawals and the minimum withdrawal amount is USD50. Long (Buy), non-leveraged crypto, stock, and ETF positions are not executed as CFDs and do not incur any fees. eToro does charge overnight or weekend fees for CFDs positions, such as leveraged positions and short (sell) orders.

Fee updates always apply to open positions. Fees are subject to change at any given time and could change daily, without prior notice, depending on market conditions.

As a beginner, trader can use CopyTrading eToro. Different from the features of other brokers, traders can copy the strategies of professional traders without fee or profit-sharing. Therefore, 100% profit is fully owned by traders. For example, while trader A who is copied by trader B, produces a profit of 10% this month, then trader B also gets a profit of 10%.

The company is the world's leading social trading network. Since eToro operates in complete transparency, each trader has valuable information on their eToro profiles, so other traders that are interested to copy their trades can have assistance in creating their best portfolios.

Another feature that is unique to eToro is the personalized, social News Feed. Just like on any social media, traders can post their updates on feed, comment on other's posts, and gradually create a feed that is tailor-fitted to trader's trading and investing interests. On eToro social trading platform, traders will also get notifications when a trader writes a new post and many other important updates.

Within this article, we've compiled a list of the top 5 eToro forex signal providers boasting the highest number of followers:

- Celesh — Build the best portfolios for copiers and himself

- Analisisciclico — Directional POSITION TRADING based on the JM Hurst Cyclic theory and techniques.

- Jrotllant — Swing trading on commodities and currencies

- Hambear — Trade forex with simulation-based optimization, selecting the best parameters with zero emotion

- SwissWay — Proft in every market condition

Most Copied eToro Forex Signal Providers

When checking out forex signal providers on eToro, you'll want to look at how many people are copying their trades. That's because a high number of copiers reflect their reliability when it comes to giving profitable returns.

Investors may choose accounts that promise big returns, but they will be wary if said accounts only have small numbers of copiers. It indicates that not many investors trust their strategy to generate returns consistently in the long term.

Interestingly, top eToro signal providers with huge copiers tend to strike a good balance between making decent returns and keeping risks low. We've sifted through to include only those focused on forex trading. Here's the list:

| Rank | Investors | Username | Number of Copiers | Strategy | Risk Score |

| 1 | 🥇Celestino Brunetti | @Celesh | 4,867 | Intuitive and innovative approach to market analysis | 4 |

| 2 | 🥈Jose Angel Zabalegui Labarta | @Analisisciclico | 2,988 | JM Hurst cycle theory | 3 |

| 3 | 🥉Javier Rotlland Miras | @Jrotllant | 1,100 | Swing trading on commodities and currencies | 3 |

| 4 | Haobin Li | @Hambear | 828 | Simulation-based optimization selecting the best parameters | 5 |

| 5 | Marco Hildbrand | @Swissway | 623 | Reversal on oversold and overbought | 2 |

Disclaimer: The data provided were relevant as of March 25, 2023. It is possible for the numbers to change in the future.

Now that we've examined the list of eToro's top signal providers by the number of copiers, let's delve into their profiles.

1. Celesh

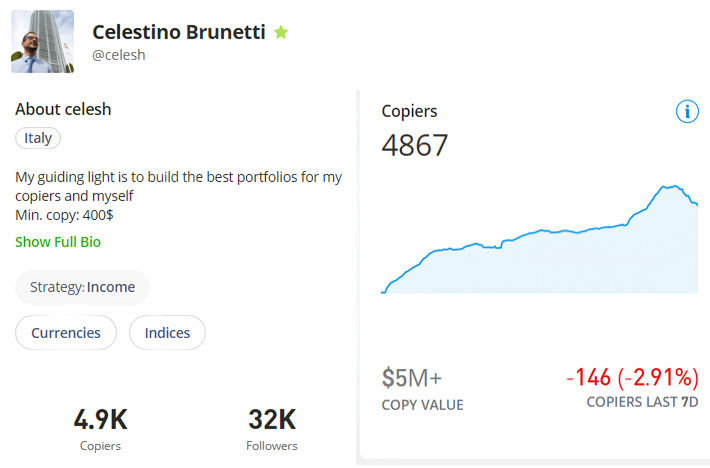

Taking the lead is an account known as Celesh, owned by an Italian individual named Celestino Brunetti.

Celesh has garnered a following of 4867 copiers, with a collective value surpassing 5 million dollars. Additionally, he boasts 32,000 followers.

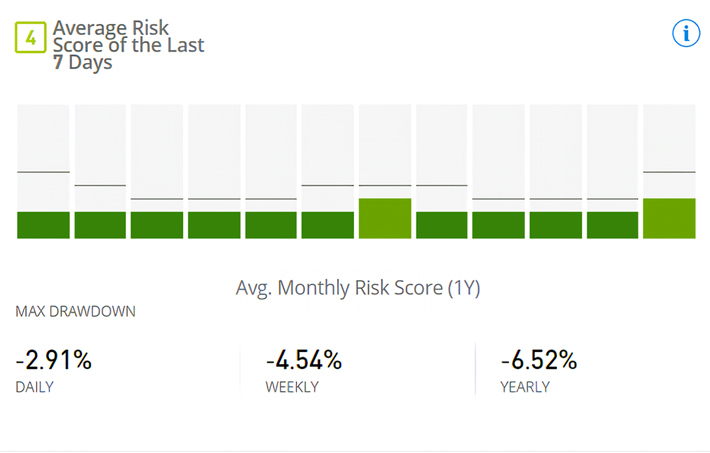

Celesh's appeal primarily stems from its low-risk profile and consistent annual profit margins. Since May 2020, he has yielded a return of 77.34%, equivalent to approximately 20% yearly profit.

Regarding risk, the risk score stands at 4, indicating it falls within the low-risk category. Celesh has closed profitable positions every year for the past three years on eToro, often reaching double-digit returns.

To copy his account, a minimum deposit of 400 USD is required.

Learn more about how Celesh trades

His trading strategy employs an intuitive and innovative approach to market analysis, resembling dollar-cost averaging (DCA) or double-down, with personalized improvisations using volume, direction, and diversification parameters.

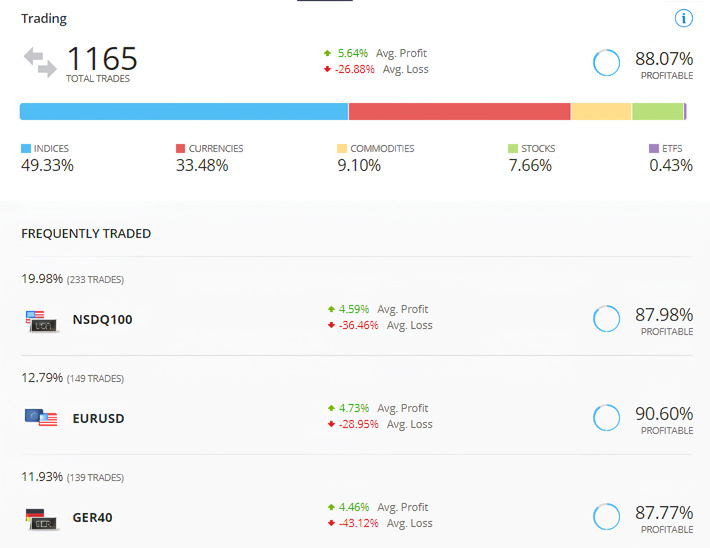

Regarding traded assets, Celesh concentrates on two main categories: stock indices and currencies, with the Nasdaq (NSDQ100), EUR/USD, and GER40 being the top profit contributors.

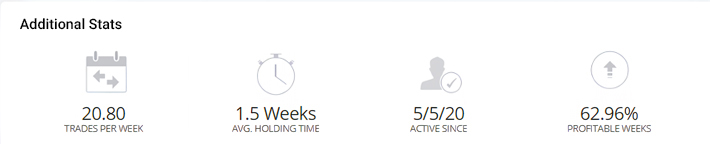

The account takes around 20 to 80 weekly positions, with an average floating time of 1.5 weeks. Since May 2020, he has closed profitable positions 62.96% of the total weeks up to the present.

2. Analisisciclico

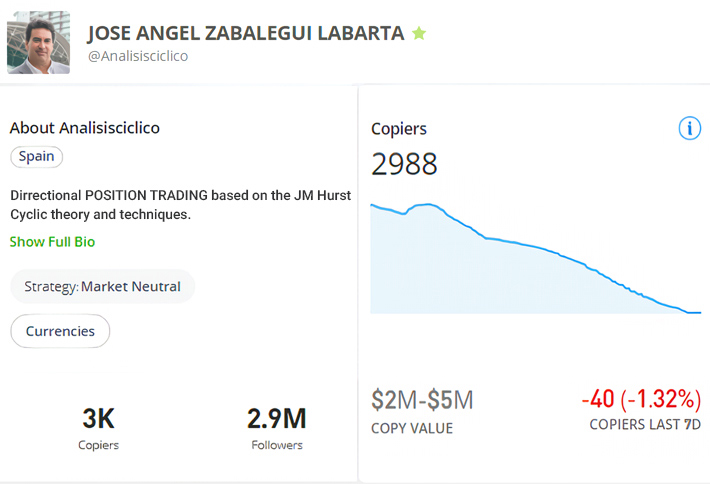

In the second spot, we find an account under the nickname AnalisisCiclico. It is owned by a Spanish individual named Jose Angel Zabalegui Labarta.

There are 2988 accounts following AnalisisCiclico, with a combined value ranging from 2 to 5 million dollars. Additionally, he boasts 2.9 million followers.

Examining the overall trading performance, his annual profits generated vary significantly. Since December 2017, AnalisisCiclico has yielded a return of 225.55%, approximately 37% annually.

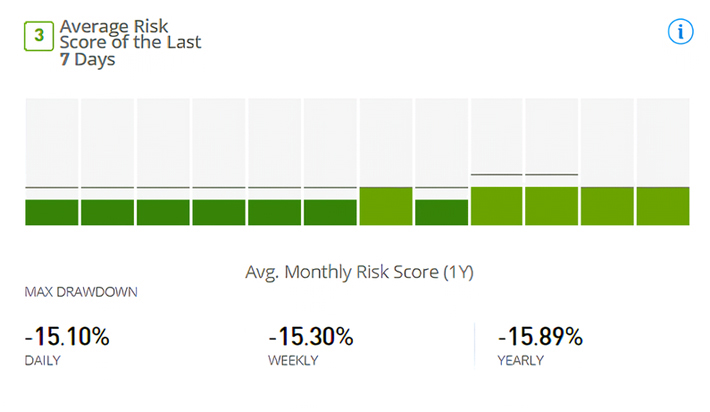

Despite the attractive returns on eToro, the risk level remains quite conservative, evidenced by a risk score of 3.

A minimum deposit of 200 USD is required to copy his account.

Go further to learn how Analisisciclico trades

The trading strategy revolves around the JM Hurst cycle theory, aiming to capitalize on market cycles regardless of the prevailing trend.

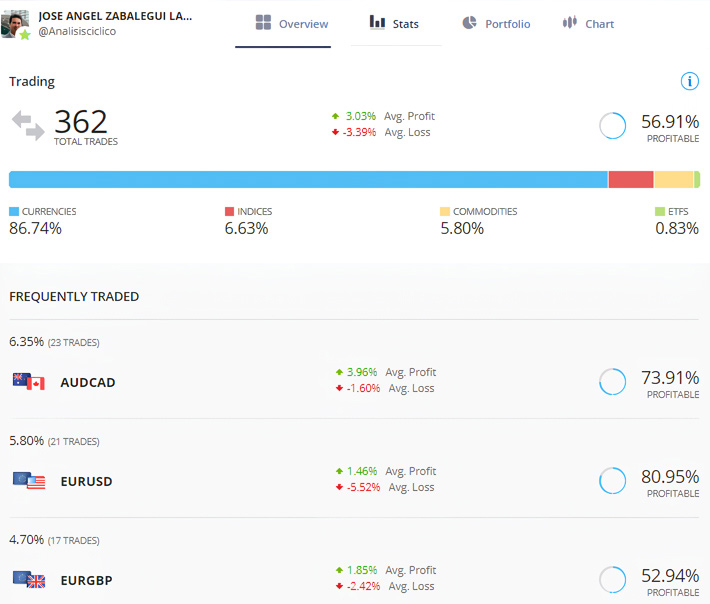

Regarding traded assets, his account focuses solely on currency pairs, with AUD/CAD, EUR/USD, and EUR/GBP being the most frequently traded.

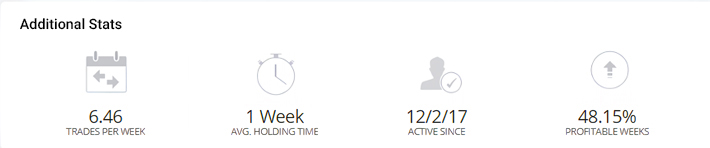

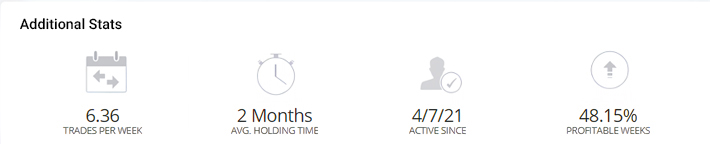

With an average holding period of around one week, the trading approach leans towards swing trading, with an average of 6.46 weekly transactions.

Since 2017, his account has seen profitable weeks comprising 48.15% of the total weeks up to the present, indicating a balanced mix of profitable and losing periods.

3. Jrotllant

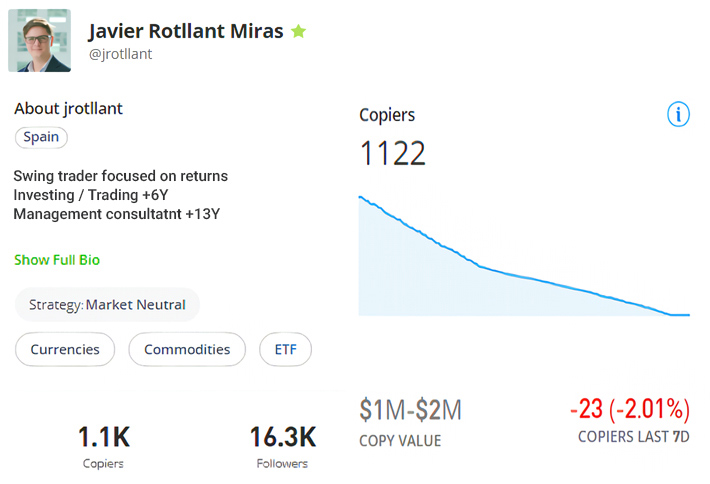

Moving forward, let's take a closer look at an account that goes by the name Jrotllant. The individual behind this account is Javier Rotlland Miras, who is from Spain.

With a following of 1122 copiers and 16,300 followers, he's quite the popular choice.

Now, regarding how his account performs, it's doing well. Since April 2021, he has managed to rack up approximately 45.57% in returns, around 15.19% annually.

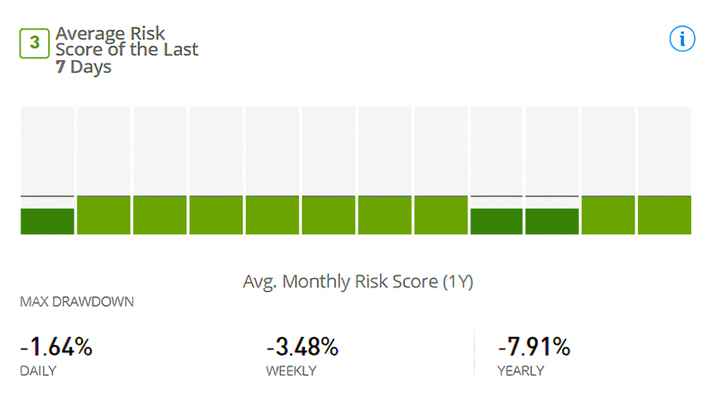

One thing worth noting is that he tends to keep risk levels relatively low on eToro. His account got a risk score of 3, indicating a cautious approach. So, while generating decent returns, he's also playing safe.

If you're thinking about following in Jrotllant's footsteps, you'll need to deposit a minimum of 200 USD.

How Jrotllant manages his trades

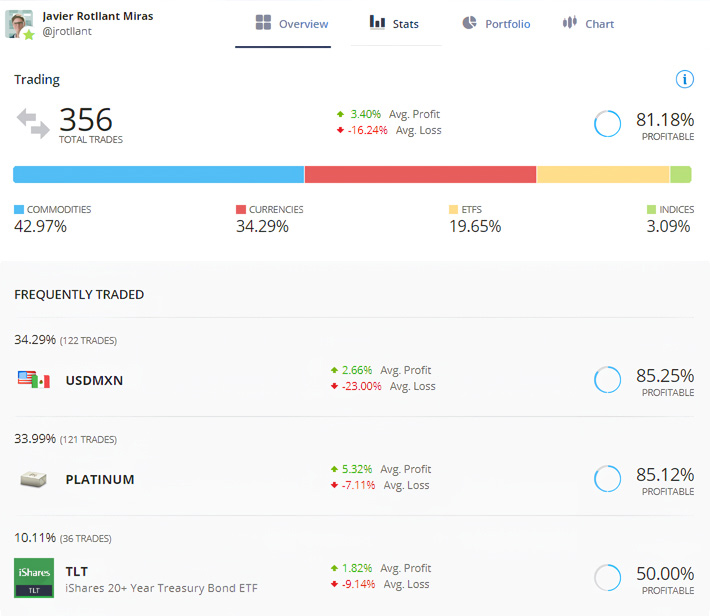

His trading style leans towards swing trading, which involves taking advantage of short- to medium-term market movements. This strategy suits many traders because it doesn't require constant monitoring.

As for what's being traded, it's pretty diverse. You've got everything from currency commodities to ETFs and indices in the mix. And what are the top three assets that get the most action? That would be USD/MXN, platinum, and treasury bonds.

On average, positions are held for about 2 months, and the account makes about 6-7 weekly trades. And get this: since 2021, Jrotllant has been closing out each week with a profit, averaging a 48.15% profit rate.

See Also:

4. Hambear

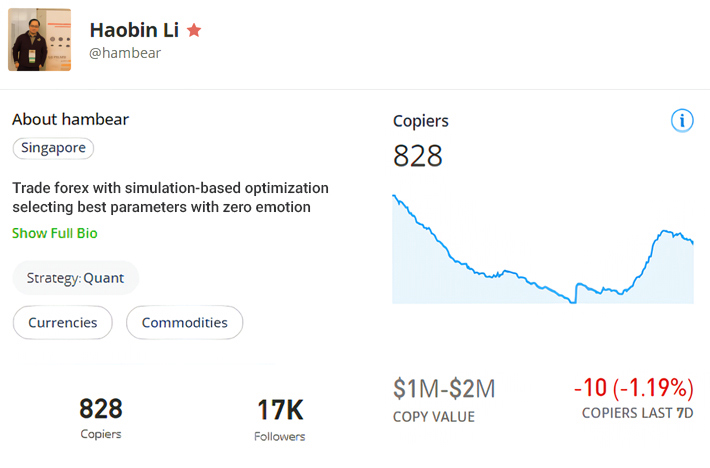

At number four, we have an account under the nickname Hambear. Its owner, Haobin Li, originates from Singapore.

His account has garnered 828 copiers, with a value ranging from approximately 1 to 2 million dollars, and boasts a solid following of 17,000 followers.

Offering an appealing return with minimal risk, he has delivered a total return of 65.11% since February 2021, averaging around 21.7% annually. These numbers are particularly enticing, especially considering the account's previous achievement of over 30% profits in 2022.

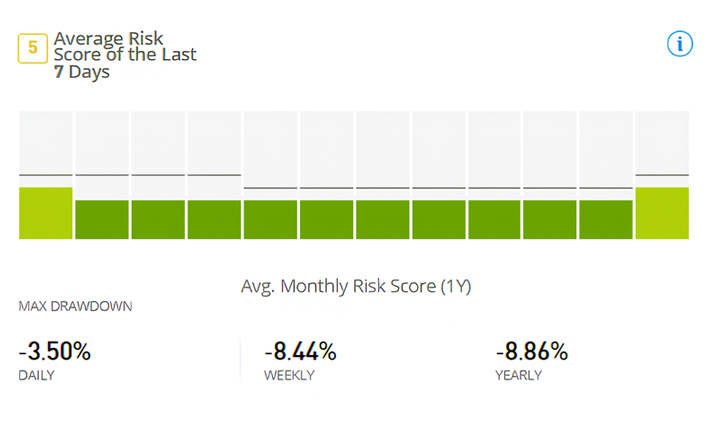

The risk level remains quite conservative, as evidenced by a risk score of 5.

A minimum deposit of 200 USD is required to mirror his account.

Dive into Hambear's trading strategy

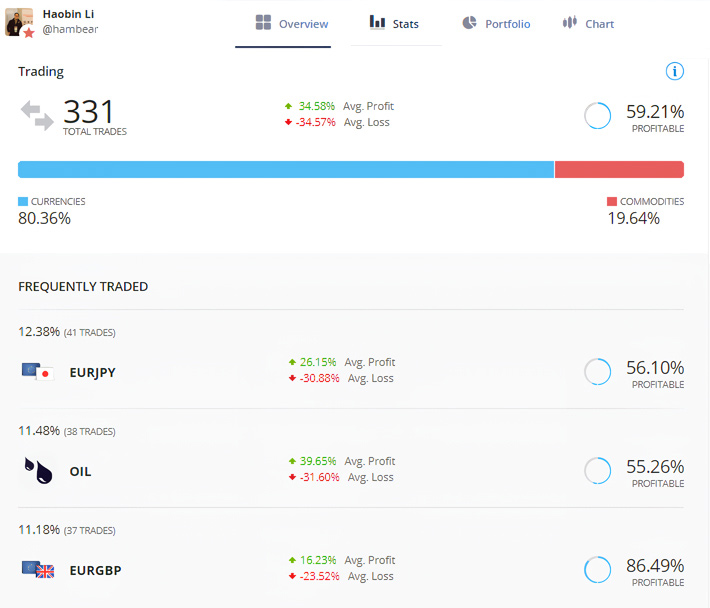

Utilizing a fully automated trading strategy with a quantitative approach on eToro, he focuses exclusively on trading currencies and commodities, with top assets including EUR/JPY, oil, and EUR/GBP.

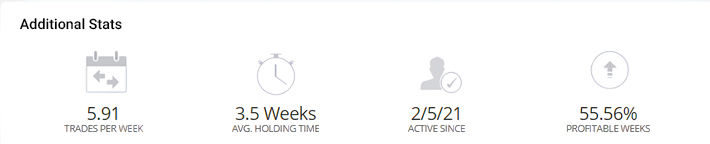

With an average holding period of 3.5 weeks, his strategy leans towards swing trading, completing about 5.91 weekly transactions. Since 2021, Hambear has closed profitably in 55.56% of weeks, showcasing its consistency in performance.

5. SwissWay

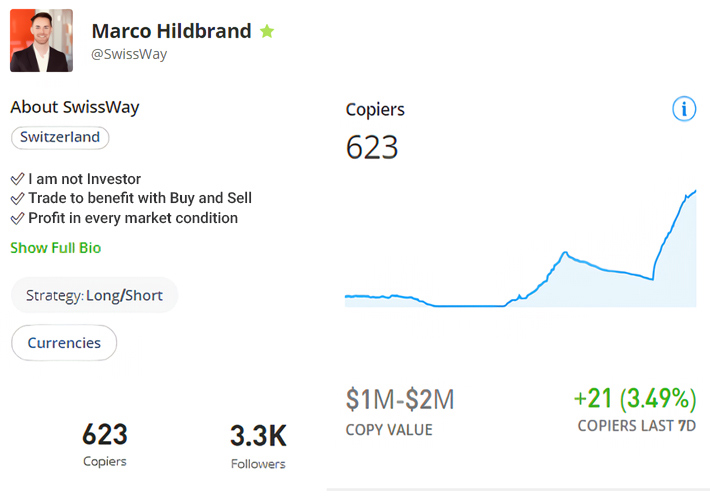

In the final slot, we have an account by Swissway, owned by Marco Hildbrand from Switzerland.

Swissway has garnered about 623 copiers, with a combined value of 1 to 2 million US dollars. Additionally, he boasts a follower count exceeding 3300.

Despite being relatively young at around 2 years old, his account is catching attention for its consistent profitability, with each year closing with profits exceeding 20%. From February 2022 till the present, Swissway has amassed a total return of 57.76%, averaging approximately 28.88% annually.

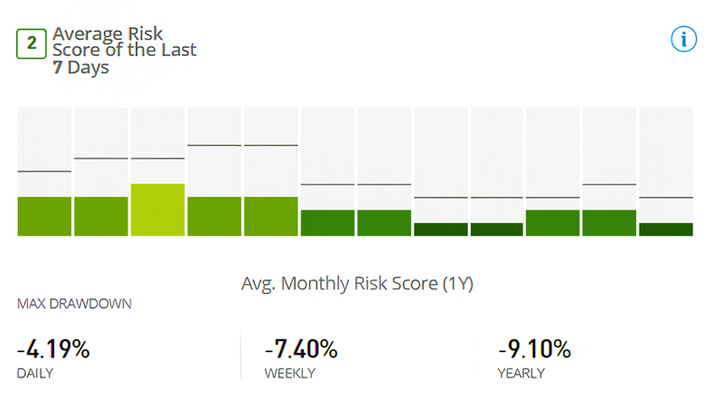

Moreover, it maintains a remarkably low risk level, indicated by an average risk score of 2.

To replicate Swissway's trades, a minimum deposit of 200 USD is required.

Explore SwissWay's trading strategy

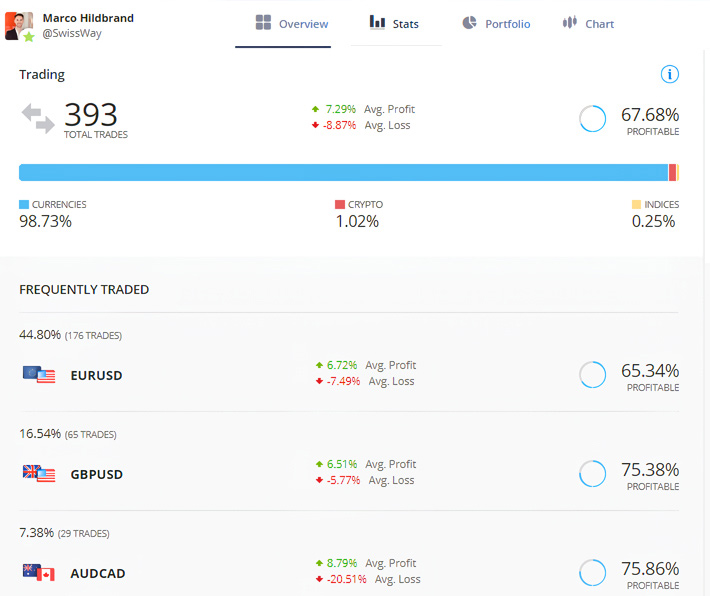

In terms of trading strategy, Swissway focuses on identifying oversold and overbought market conditions, seizing opportunities for reversals. He concentrates solely on currency pairs on eToro, with top choices being EURUSD, GBPUSD, and AUDCAD.

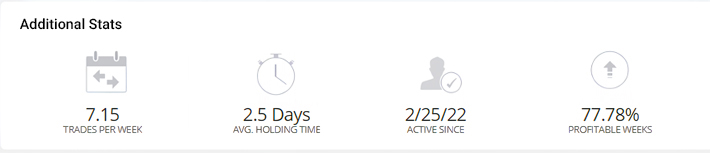

Swissway adopts a swing trading approach, holding positions for about 2.5 days on average, and executes an average of 7.15 trades per week. Since February 2022, it has boasted a profit rate of 77.78% per week out of the total weeks up to now.

Final Words

That's a roundup of the 5 forex signal providers on the eToro platform boasting the highest number of copiers.

It's clear that they share a notable commonality: they all exhibit remarkably low levels of risk. This minimal risk is apparent through risk scores ranging merely from 2 to 4, with 1 signifying the lowest risk and 10 representing the highest.

This underscores the awareness among most eToro traders and eToro top investors that prioritizing risk parameters outweighs the potential returns.

Furthermore, they can seamlessly blend low-risk profiles with promising returns. That explains why they're copied by many traders.

This compilation can serve as a handy guide for those aiming to earn extra income through trading without the hassle of active participation. This approach allows your funds to grow with calculated risk.

If you're considering following any of the mentioned providers but remain uncertain, it's wise to utilize a virtual account in eToro. This enables you to track their performance over several months until you feel confident enough to invest your actual funds.

eToro stands out as an exceptional option for individuals seeking cost-effective stock, CFD, forex, and crypto trading through its impressive mobile app. With an active user community, eToro provides social features dedicated to supporting the needs of traders and investors across the globe.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance