Brokers Providing Oil Trading

Energy commodities are considered to be very important parts of any industrialized economy. As a result, the prices of these commodities also tend to follow economic growth in the world. One of those kinds is oil, energy commodity which commonly used for heating, transportation, cooking, and so on. The market for oil is by far the biggest.

This page will give you a list of Forex Brokers that offer oil as its trading instrument.

Scroll for more details

Additional FAQ

What is OPEC and how they influence oil price?

Some of the World's major crude oil producers banded together in 1960 within OPEC (Organization of the Petroleum Exporting Countries). It is an intergovernmental oil cartel comprising Algeria, Angola, Ecuador, Iran, Iraq, Kuwait, Libya, Nigeria, Qatar, Saudi Arabia, the United Arab Emirates, and Venezuela. Later, the organization transformed into OPEC+ to include Russia.

Their decisions, be it a political one (such as an embargo), or in relation to oil production itself (production quotas and prices), have a definite influence on Crude Oil. War in and around these countries which was seen as endangering oil production, will drive up oil prices.

Continue Reading at Understanding the Effect of Commodity and Stock in Forex

What is the effect of Russia-Ukraine war in the market?

The Russia-Ukraine war had several effects, including a significant spike in crude oil prices and supply uncertainties in various locations. In early March, crude oil prices reached a 13-year high, hitting $125 per barrel.

Continue Reading at What Can We Learn from Market Trends in 2022?

How did shale fracking contribute to US oil imports?

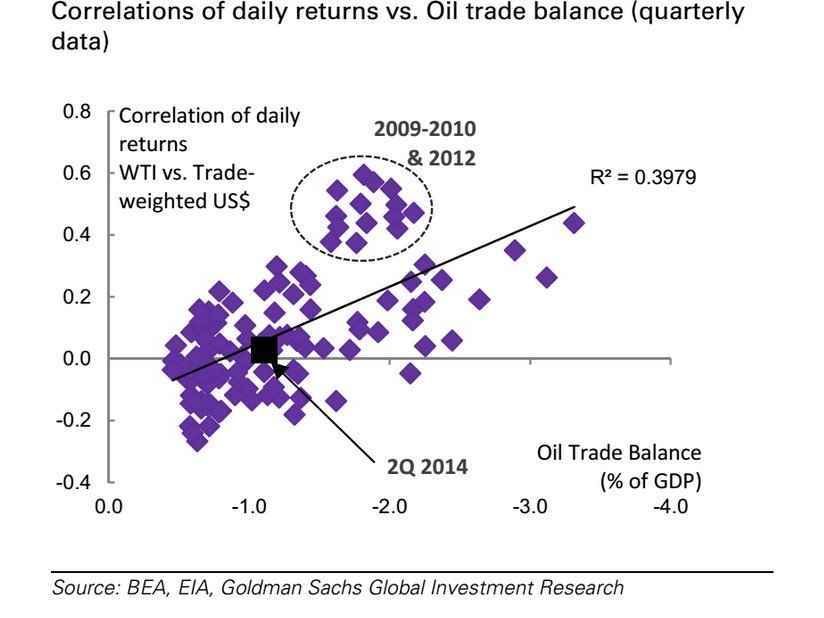

The US imported approximately 12 million barrels a day of oil in 2008; but the figure has skydived, and today US oil imports is less than 5 million barrels a day due to the US shale technology. Around 2.6 millions of it is imported from Canada and Mexico. That means, US oil imports has fallen more than 60% since 2008, and this significantly decreased the commodities correlation with the US Dollar.

Along with the post-crisis financial market normalization, (the drop in oil imports) has dramatically reduced the correlation between oil and the USD, to around 0% (i.e. uncorrelated) today from historical highs near 60% in 2008/2009.

Continue Reading at How World Oil Prices Affect Forex, Before And After US Shale Fracking

How does the global economy impact oil prices?

During economic upturns with increased industrial production, the demand for oil rises, causing prices to increase. Conversely, during global recessions when industrial activity decreases, oil demand declines, leading to price decreases.

Continue Reading at Why Are WTI and Brent Prices Different?

Broker Categories

Minimun Deposit

Payment

License

Country

Established

Features

Trading Platform