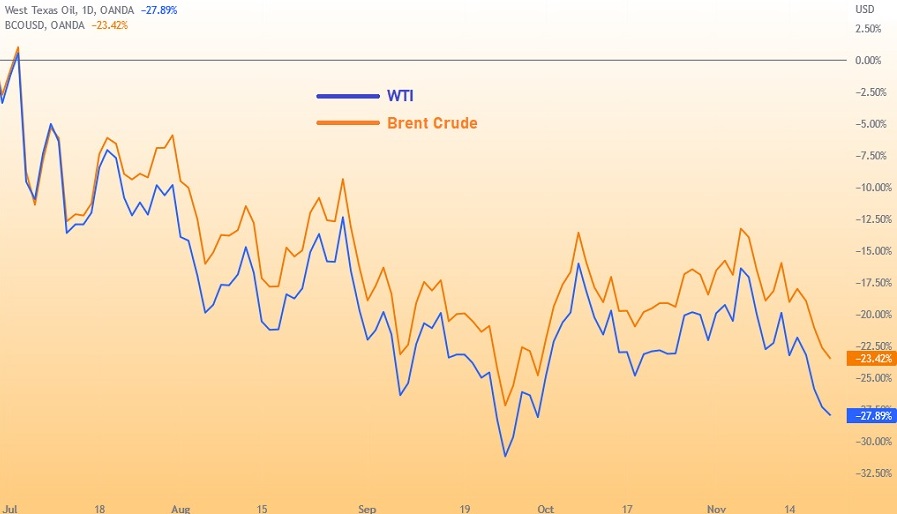

WTI and Brent are two of the most commonly traded types of crude oil in the world. What are the differences and do they affect your analysis?

Oil is one of the most actively traded commodities in the world due to its unique role within the global economic and political systems. Apart from being a fundamental source of energy, oil is also present in almost any sector of our everyday lives, ranging from transportation to agriculture. However, while oil is in great demand, the global supply is limited. This makes the price of oil highly volatile and heavily influenced by market sentiment.

Before you start trading, it's important to know that there are several different grades of crude oil. The two most commonly traded grades are Brent crude and West Texas Intermediate (WTI). Both options are so popular among traders that the prices are made as the main references when it comes to oil trading. That's why Brent and WTI are usually offered as trading instruments by major brokers. Let's find out the main differences between the two and see how it affects your analysis.

Contents

What is West Texas Intermediate (WTI)?

WTI is the benchmark crude for North America. The oil is extracted from oil fields in the United States, primarily in Texas, Louisiana, and North Dakota, and then transported via pipeline to Cushing, Oklahoma for delivery. Cushing is located at the intersection of pipelines and storage facilities, providing easy access to deliver oil to refiners and suppliers.

WTI crude oil futures contracts are traded on the New York Mercantile Exchange (NYMEX), which is a division of the Chicago Mercantile Group (CME). Compared to Brent, WTI oil is considered "sweeter" and "lighter", which makes it incredibly useful to produce petrol.

What is Brent Crude?

Meanwhile, Brent is the benchmark for European, African, and Middle Eastern crude oil. It refers to the blend of four crude oils, namely Brent, Forties, Osberg, and Ekofisk. Together, they are known as BFOE quotations. The pricing system for Brent determines the value of about two-thirds of the world's internationally traded crude oil production and it is based on the North Sea of Northwest Europe. The oil was first extracted from the Brent oilfield in the 1970s and the price has been used as a benchmark since 1971.

See Also:

The Brent Crude oil markers are Brent Blend, London Brent, and Brent Petroleum. It is traded on the Intercontinental Exchange (ICE). Brent Crude is usually classified as sweet light crude oil due to its relatively low density and sweet taste which comes from its low sulfur content. However, it still has higher sulfur than WTI, so while WTI is mostly used as petrol fuel, Brent Crude is commonly used for diesel fuel.

Factors that Affect Oil Prices

As mentioned before, oil is one of the most important commodities in the world. This is why oil prices can move quite drastically during certain times or conditions. There are at least three major things that influence the prices of oil in general:

- Global Economy. The state of the global economy heavily influences the prices of oil. When the economy is booming and factories are producing goods at full capacity, it's quite clear that the demand for oil must be high, so we can expect that the price will rise. On the other hand, a global recession means less demand for oil, so we can expect the price to move downward for a while. The easiest example happened not long ago during the COVID-19 pandemic when the global phenomenon reduced global industrial production which resulted in a drop in demand for oil and the decline of oil prices as well.

- Supply. The scarcity of oil can also directly impact the price of the commodity. If OPEC decides to limit or increase production, the market will definitely be affected. They might intentionally reduce the supply to push the prices up or produce more to get the opposite effect.

- Political Uncertainty. Oil is produced in various regions around the world and the political conditions of these areas can certainly affect the price. For example, we saw a massive price soar during the first Gulf War that occurred in the 1990s due to the low oil production in Middle Eastern countries like Iraq and Kuwait. After the war ended, the price steadily declined to a certain level.

What Makes WTI and Brent Prices Different

In the past, WTI traded at higher prices than Brent. However, WTI's price has slowed down due to the rise in production from the Shale Revolution in the early 2000s, along with more imports to the US from Canada. Today, WTI remains the benchmark for oil prices in the US, while the rest of the world is referenced from Brent's price. This makes Brent the global benchmark for oil prices.

The difference between WTI and Brent prices is known as WTI vs Brent Spread. The spread amount will always change from time to time depending on several factors, such as:

Content and Composition

WTI and Brent have different sulfur content and API gravity, both of which can directly affect the oil prices on the market and cause the price differential called Quality Spread. The sulfur content is used to determine how sweet or sour the oil is. Sweeter crudes contain less sulfur, which makes them easier to refine into products and certainly more attractive to refiners. Meanwhile, API gravity is used to measure the oil's density relative to water. The higher the number, the less dense the oil is.

To put it into perspective, WTI has a sulfur content of 0.24% and an API gravity of about 39.6, while Brent has a sulfur content of 0.37% and an API gravity of about 38.06. Both WTI and Brent are considered sweet and light crudes, but Brent is considered slightly heavier than WTI.

Geopolitical Influences

WTI and Brent are located in different parts of the world, which then results in the Location Spread. Geopolitical situations such as volatile political systems in oil-producing countries can give a huge impact on oil prices. In this case, Brent traders must pay attention to geopolitical tensions in the Middle East as it is one of the biggest oil producers in the world. Similarly, WTI oil traders should be on watch for the supply and demand factor in the United States.

Disruptions to either WTI or Brent crude oils can cause the WTI-Brent spread to change or widen. It is also worth noting that during the time of crisis, Brent oil prices are considered more sensitive to geopolitical changes because of the high political uncertainty in its producing countries. On the other side, WTI is usually less affected because it's based on landlocked areas in the US.

Trading Crude Oil on HF Markets

Crude oil trading provides a great opportunity to make a profit from the constant fluctuations in crude prices. It is particularly suitable for short-term traders who are able to take advantage of highly volatile markets. HF Markets is one of the brokers that offer derivatives trading on spot energies, such as Brent and crude oil. If done correctly, crude oil trading in HF Markets enables you to expand your investment portfolio and maximize your returns.

Compared to other brokers, HF Markets offers access to trade derivatives on energies with many benefits, such as low margin requirements, leverage of up to 1:66 for UK Brent oil, fast execution, and low spreads starting from 0.7 pips. You can also manage your risks by using the trading execution desk which allows you to manage your open positions on the phone if necessary. Just keep in mind that oil trading is not free of risks.

HF Markets is an award-winning forex and commodities broker. Established since 2010, the company provides trading services and facilities to both retail and institutional clients. For more than 9 years in business, HF Markets has around 1,500,000 live accounts opened and 200 employees globally.

Based on its services, HF Markets can be regarded as middle-class category. Clients do not need to prepare a big deposit for joining to trade with this broker. Also, there are various account types, trading software, and tools to facilitate individuals and institutional customers to trade forex and CFD online.

HF Markets is a registered brand name of HF Markets (Europe). Based on the location, the company is regulated by various financial regulators. Here are the details:

- HF Markets (SV) Ltd, registered in St. Vincent & the Grenadine as an International Business Company with the registration number 22747 IBC 2015.

- HF Markets (Europe), authorized and regulated by the Cyprus Securities and Exchange Commission (CySEC) with Licence Number 183/12.

- HF Markets SA (PTY), is authorized and regulated as a Financial Service Provider (FSP) by the Financial Sector Conduct Authority (FSCA) in South Africa, under license number 46632.

- HF Markets (Seychelles), incorporated under the laws of the Republic of Seychelles with registration number 8419176-1, regulated by the Seychelles Financial Services Authority (FSA) under Securities Dealer Licence number SD015.

- HF Markets (DIFC) Ltd, authorized and regulated by the Dubai Financial Services Authority (DFSA) under license number F004885.

- HF Markets (UK) Ltd, authorized and regulated by the Financial Conduct Authority (FCA) under firm reference number 801701.

If traders have more experienced, knowledgeable, and sophisticated trading environment, they can join to become Professional Clients, who can manage and assess their own risks. For that reason, these kinds of clients are granted access to more favorable rates but afforded lesser regulatory protections than retail clients.

Trading with HF Markets can enable traders to access a variety of trading instruments like CFDs on Forex, Cryptocurrencies, spot metals (gold, silver, and others), energies (oil and gas), commodities (such as coffee, copper, and sugar), indices, bonds, and popular shares such as Google, Apple, and Facebook.

HF Markets offers some of the tightest spreads in the market, starting from 0 pips in Zero Account. This broker quote major foreign exchange currency pairs to five decimal places. Therefore, traders have the opportunity to get more accurate pricing and the best possible spreads.

HF Markets receives numerous highly prestigious titles, including the huge honor of being ed to join the ranks of the World Finance Top 100 Global Companies. Others are Best Client Funds Security Global by Global Brands Magazine, Best Global Forex Copy Trading Platform by Global Forex Awards 2019, Fastest Growing Forex Broker Mena 2019 by International Business Magazine, and many more.

After opening an account in HF Markets, traders will obtain various forex trading platforms to accommodate all of their trading demands. Whether traders like to trade on desktop or prefer to trade on-the-go, they can use MetaTrader 4 on desktop (terminal, multi-terminal, and web terminal) and phone (iPhone, iPad, and Android).

Clients' funds are held in segregated accounts. Only major banks are used by Markets because they believe that successful traders have to give their full attention to their trading rather than worrying about the safety of their funds.

Traders do not need to worry about transaction fees when depositing and withdrawing. Transaction fees are not charged, and diversity of payment methods enable them to choose between Wire Transfer, Bank Card, and online payments (Neteller, iDeal, Sofort Banking, and Skrill). HF Markets ensures that traders make fast transactions 24/5 during the standard hours.

Traders can earn extra income by joining the affiliate program offered by Markets. Clients who join this program will get some advantages, such as 60% of Net Spreads based on the volume traded by sub-clients, up to $15 per a lot of net revenue, and many more. More information about HF Markets can be obtained on their official website which is supported in 27 languages.

From the review above, it can be concluded that HF Markets is one of the award-winning forex and commodities brokers. There are various account types traders can choose in HF Markets, and the broker itself becomes a favorite among traders for its low spreads. This condition is very suitable for traders with limited funds and a desire to get more opportunities to gain maximum profit.

While high volatility may create more opportunities to make money, it also exposes you to higher trading risks. Thus, it is very crucial to learn how to trade commodities first and keep tabs on anything that happens in the oil market as well as the economic and political conditions in oil-producing countries.

HF Markets is a global Forex and Commodities broker that facilitates both retail and institutional clients. Previously known as HotForex in the brokerage industry, HFM has positioned itself as the forex broker of choice for traders worldwide through their various account types and trading tools. Furthermore, HF Markets allow scalpers and traders use Expert Advisors unrestricted.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance