Forex swap manipulation can be a pitfall for forex traders. Here is an explanation on how it might happen and what you can do to avoid it.

A swap, also known as a forex swap or a rollover rate, is the interest received or paid for a trading position that is left open overnight. It can either be part of trading costs or extra income for forex traders. Considering its monetary value, many traders question whether brokers can manipulate forex swaps or not.

This article will discuss how swaps work and how forex swap manipulation might happen. At the end of the article, you will also find several tips to manage this risk.

How Do Forex Swaps Work?

Every currency on the forex market has a specific interest rate that is set by the central bank of the country it represents. Some currencies may have a higher interest rate than others. The difference between two currencies' interest rates in a forex pair will determine whether a trader is required to pay or receive a swap.

We usually call the difference between swaps, "carry". A positive carry occurs when a trader retains an open position in a certain currency that benefits from the positive swap payments. On the other hand, a negative carry occurs when a trader has to pay the difference in swap payments between two currencies in the forex pair they trade.

A trustworthy broker displays current swaps publicly because the rate may change every day. Traders have to see the latest data in order to plan their next trades. By calculating the latest swap rate, traders can avoid unnecessary swap charges or gain additional income.

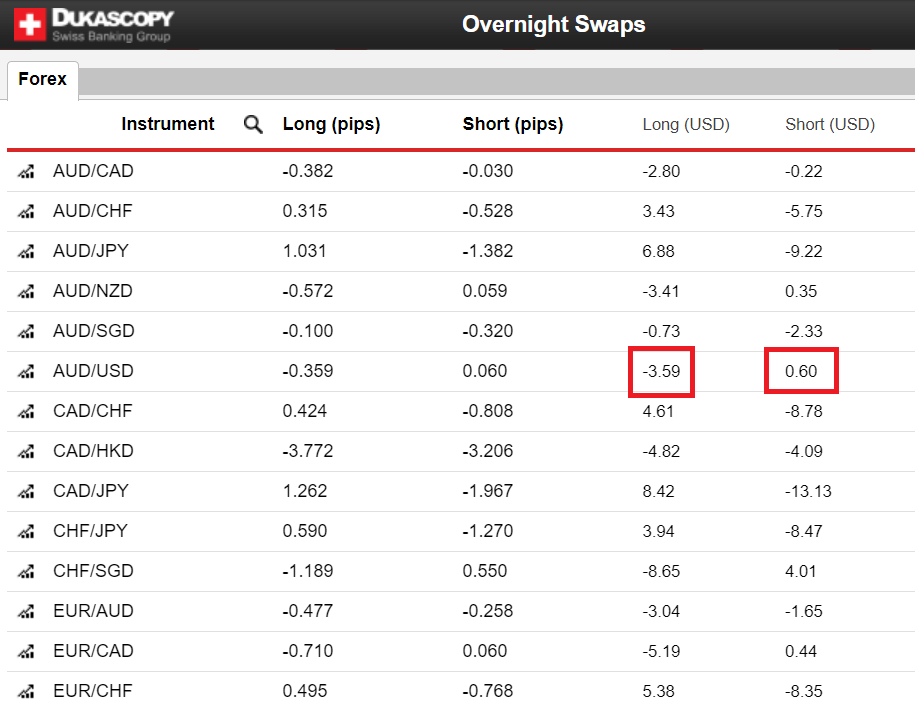

Here's an example of forex swap data released by Dukascopy, a popular and trustworthy Swiss-based forex broker:

Based on the data, a long position on AUD/USD has a negative carry of -3.59 USD. It means a trader who buys AUD/USD has to pay an additional charge of 3.59 USD per standard lot for each trade that is kept open overnight.

On the other hand, a short position on AUD/USD has a positive carry of 0.60. It means a trader who sells AUD/USD will receive an extra income of 0.60 USD per standard lot for each trade that is kept open overnight.

Who Benefits from Forex Swaps?

Both forex traders and brokers may benefit from positive carry. However, this mechanism, called "carry trade", greatly favors those who have ample funds and experience to target long-term returns.

Do note that small traders who have to use high leverage will not be able to obtain a substantial profit from carry trading. Let's look back at the data: A trader who sells AUD/USD will receive an extra income of 0.60 USD per standard lot for each trade that is kept open overnight.

Remember that to trade one standard lot without leverage, a trader has to deposit at least a million dollars. In this case, an extra income of 0.60 USD is nothing. Those who trade with leverage of 1:100 or more will only receive smaller benefits.

So, who benefits the most from regular forex swaps? The answers are large fund managers, banks, and brokers.

It might seem fair, but the benefits retail traders receive from swaps are actually insignificant compared to big institutions. On top of that, they can manipulate forex swaps to make them even more profitable.

How Forex Swap Manipulation Might Happen

There are at least three ways a forex broker might manipulate swaps. You should learn these in order to avoid unpredictable pitfalls while trading.

First, brokers may modify swaps in their favor by reducing positive carry and increasing negative carry.

Global central banks determine interest rates, which influence rollover interest rates. While some brokers use the interest rates set by central banks as primary references to determine swap rates, others reserve the ability to change them "in response to changes in the market".

As such, a trustworthy broker should display current swaps publicly on their website or at least make them available to their traders anytime in the client area. Otherwise, traders can't correctly calculate potential charges and/or income from swaps.

A slight difference between the central bank's rates and the broker's might be normal --after all, central bank's rates are mere references and swap rates are based on interbank rates. But you can raise hell if there is a large gap, or a positive carry turns into a negative.

Second, brokers may display and apply different swap rates.

Don't be excited when you find a forex broker website with updated swap rate data displayed publicly. First, try to trade with them. And then see whether they apply those rates to your trades... or not. If they don't, make screenshots with timestamps, and you can use them to sue your broker.

Third, brokers may promise you a swap-free account but then charge you hidden fees.

Muslim traders usually avoid swap-charged accounts because interest rates are haraam according to Sharia law. As such, forex brokers create swap-free accounts (a.k.a. Islamic accounts) to fulfill their needs. Non-Muslim traders can also access this type of account if their brokers allow it.

A swap-free account seems simpler and cheaper than a swap-charged account. However, certain dishonest brokers may use swap-free accounts to sneakily apply "substitute fees". As a result, traders may end up having to pay more expensive fees for swap-free accounts than for swap-charged accounts.

See Also:

Conclusion

There are trustworthy brokers who fairly show their swap rates and apply them correctly. Yet, there are also dishonest brokers who manipulate swap rates and charge higher fees than they should.

Forex swap manipulation is a rabbit hole. But you can avoid them with three simple steps:

- Make sure your broker shows their updated swap rates.

- Do some trial trades, and make sure your broker applies those rates properly.

- Pay close attention to potential hidden fees within the T&Cs and all the necessary documents you sign up for when joining your broker.

If you are already at the bottom of the rabbit hole (a.k.a., your broker manipulated their swaps so it became detrimental to you), the subsequent actions depend on whether your broker has proper licenses or not. You may be able to sue them if they are licensed by a prestigious regulatory body. Otherwise, just transfer your funds to more reliable brokers. It is one of the signs you should leave your broker after all.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance