Lowest Swap Forex Brokers For Major Pairs

In forex trading, there are many types of fees that traders have to pay for brokers. Besides spread, traders should also pay for the swap. It is a commission, or an overnight interest charged by the broker to extend the position for the next trading day. A swap reflects the difference in interest rates between the two trading currencies.

If you prefer being a long-term trader, swap fees are important. Thus, you may need to choose forex brokers with the lowest swap. It will help you get more benefits, for it can reduce transaction costs for you. So, which forex pairs are you going to trade on? The list below gives you some forex brokers offering the lowest swap on Major Pairs.

Scroll for more details

What drives the demand for Islamic trading accounts?

Several factors contribute to the growing demand for Islamic trading accounts:

-

These accounts enable Muslim traders to participate in financial markets while adhering to Sharia law.

-

Swap-free accounts promote inclusivity by providing equal opportunities for traders from various religious backgrounds.

-

There is an increasing awareness and education surrounding Islamic finance and trading principles. As a result, more traders are seeking out swap-free accounts and gaining a better understanding of the features and requirements associated with these accounts.

Continue Reading at Introduction to Islamic Account in Forex Brokers

Why a swap free account is ideal for Muslim traders?

Due to Islamic law, Muslims are advised not to engage in a business or contract that includes charging and receiving interest. That's why many brokers specifically create swap-free accounts for Muslim traders. But in reality, Muslims are not the only traders that can benefit from swap-free accounts. Other traders would deliberately create Islamic accounts despite having different beliefs. The reason is that they don't want to be subjected to negative swaps.

Continue Reading at ASIC Brokers that Allow Swap Free

What are the limitations in a swap free account?

Although the main idea of a swap-free account is to help traders avoid rollover interest, keep in mind that some brokers may have time restrictions regarding your floating positions. For example, some brokers only allow a floating position for up to 3 days, while others allow you to open your positions for up to a week. This might be a deal-breaker for long-term traders.

Also, brokers offering swap-free accounts may charge a commission fee, in which some of them may assign you a fixed commission that isn't affected by the changes in interest rates. If this is the case, you need to ensure that this additional fee is affordable and doesn't influence your profitability.

Continue Reading at ASIC Brokers that Allow Swap Free

How does Credit Default Swap (CDS) work?

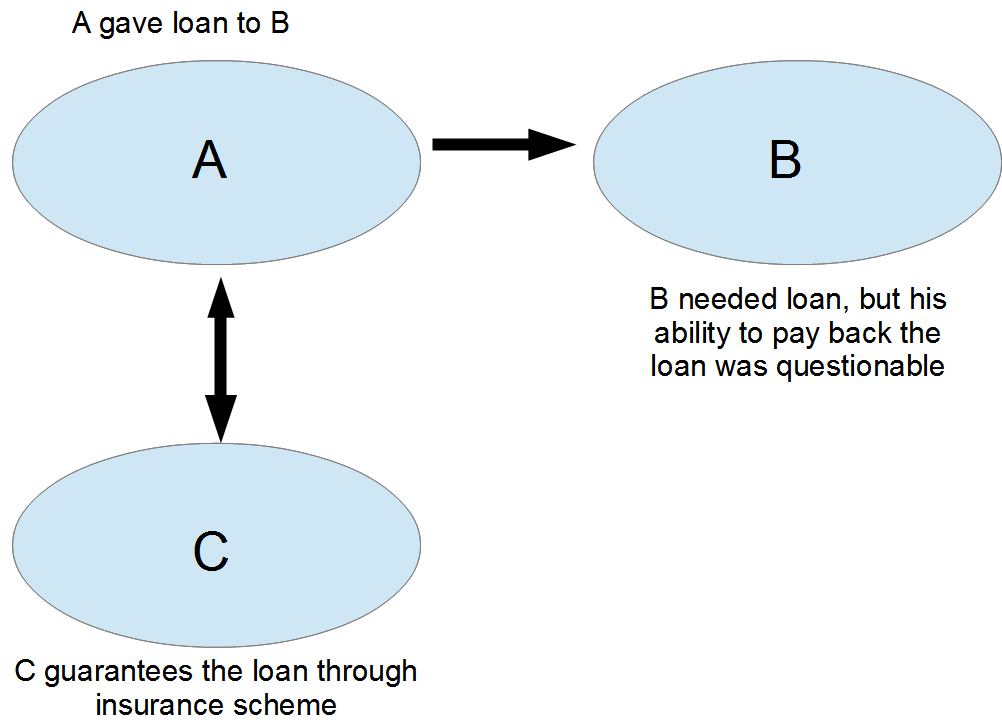

The definition of Credit Default Swap is the sale and purchase of agreement where the seller guarantees the buyers that the issued loan funds definitely will be paid.

Continue Reading at The Most Accurate Fundamental Analysis