Forex trading scams are frequently occurring in Indonesia. You can avoid them by understanding Indonesian forex trading environment, then take the following steps.

Forex trading scams are rampant in Indonesia. A huge population and low financial literacy turned the biggest Southeast Asian country into a sweet spot for scammers.

Nevertheless, there are many ways to avoid trading scams in Indonesia as long as we can learn from other people's experiences. Here are some of the most necessary steps to take:

- Avoid financial advice from so-called influencers

- Beware of fixed returns

- Conduct thorough research before investing

- Only choose regulated brokers

Before we dive into each tips, it would be better to understand the basics of forex trading in Indonesia and study some of the most notable scams first.

Forex Trading in Indonesia

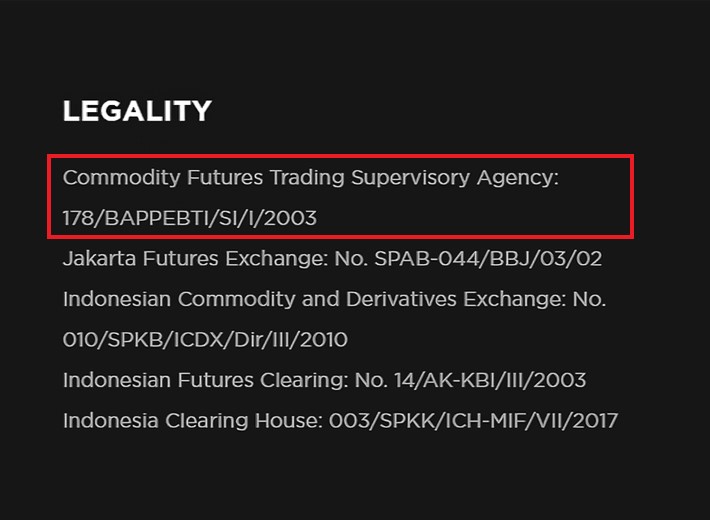

Indonesia allows forex and CFD trading as long as it is done legally through the appropriate channels and in accordance with all relevant laws. The main regulatory body overseeing forex and CFD trading in Indonesia is BAPPEBTI (Badan Pengawas Perdagangan Berjangka Komoditi; lit. Commodity Futures Trading Regulatory Agency).

BAPPEBTI is an office specifically created to supervise the futures market under the Indonesian Ministry of Trade. They established all the working rules to regulate the market, as well as supervising market participants. As such, forex and CFD brokerage companies should first register themselves to gain a relevant permit from BAPPEBTI.

Read more to learn about forex brokers' situations in Indonesia

It should be noted that all BAPPEBTI-licensed forex brokers are Indonesian companies. Some of their most notable characteristics are:

- They should have headquarters in Indonesia

- They should be members of the Jakarta Futures Exchange and PT Kliring Berjangka Indonesia

- They should store their clients's funds in segregated accounts at Indonesian banks, and so on.

Almost all Indonesian forex brokers share similar characteristics. They are either self-proclaimed STP brokers or Market Makers. They can't offer zero spread and zero commission for clients. Also, they typically facilitate online trading via Metatrader4 or Metatrader5.

Admittedly, the Indonesian futures market lags behind similar markets in advanced countries, which limits the growth of domestic forex brokers. Many Indonesian traders prefer to engage with foreign forex brokers (or "illegals," as BAPPEBTI called them) because they can offer a better trading environment.

Indonesian brokers have started to adopt various innovative ideas from their internationally- renowned counterparts in recent years. Such as providing swap-free options, higher maximum leverages, and easier online registration. The effort has attracted large numbers of funds back to Indonesia, but many people still prefer foreign brokers anyway.

Famous Trading Scams in Indonesia

Due to most Indonesian traders' preference for using international brokers, most scam cases involved foreign companies who irresponsibly promote their schemes in the country. They take advantage of beginners' lack of knowledge in recognizing trading scams and take away their money. Here are some of the biggest trading scams in Indonesia.

Sunton Capital (2021)

Sunton Capital offered forex trading with fixed profits of as much as 20% via Telegram, Instagram, and their official website. But the self-proclaimed UK companies were actually a mere ponzi game.

Later on, they manipulated their charts to trigger mass margin calls. Following the event, they disappeared along with clients' funds.

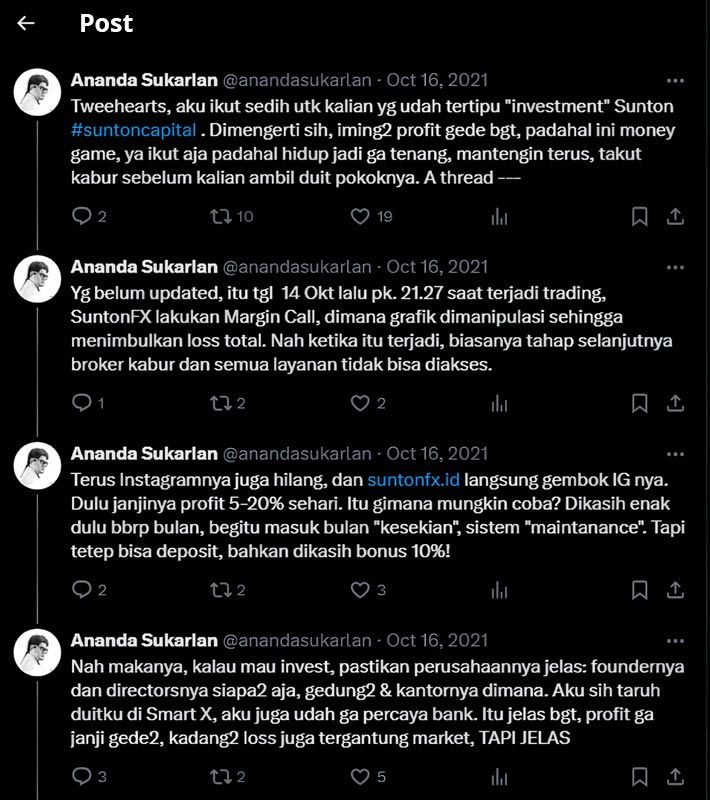

The case rose to prominence following the viral Twitter post of a famous local musician, Ananda Sukarlan. There are no clear records of losses and victims as the case involves an unknown illegal entity that could not be brought to court.

Translation:

A thread — Tweehearts, I feel sorry for those of you who have been deceived by the "investment" Sunton #suntoncapital. I understand, the promise of huge profits is tempting, but this is actually a money game. You join in, but your life becomes restless, always worrying and fearing they will disappear before you can withdraw your money.

For those who haven't been updated, on October 14th at 21:27 during trading, SuntonFX issued a Margin Call, where the graph was manipulated resulting in total losses. Usually, when this happens, the next step is for the broker to disappear and all services become inaccessible.

Then their Instagram disappeared, and they locked their IG. They used to promise 5-20% profit per day. How is that even possible? They lured you in for a few months, then when it's been "a while," suddenly it's "maintenance." But you can still deposit money, and they even give you a 10% bonus!

So, if you want to invest, make sure the company is clear: who are the founders and directors, where are their buildings and offices located. Personally, I put my money in Smart X, I no longer trust banks. It's clear, the profit is not guaranteed, sometimes there are losses depending on the market, BUT IT'S CLEAR.

CNN Indonesia reported that one of Sunton's clients lost USD2000, while CNBC Indonesia suggested total losses might amount to "billions" of rupiahs.

NET89 (2021)

A newly-emerged company called PT Simbiotik Multitalenta Indonesia (SMI) created a multi-level marketing scheme (NET89) to sell an e-book about forex trading with Smart X Bot as a bonus.

But in mid-2023, CNBC Indonesia reported there were approximately 300 thousand victims with total losses of up to IDR2 trillion due to their schemes.

How the scam worked and went down

There was only one type of e-book and one type for the bot, but buyers could choose between two packages with different "capacity" and "profit sharing". The Basic package cost IDR1.5 million, while the Pro package cost IDR7.5 million.

After buying the e-book, members have to register with one of the three SMI-appointed forex brokers and deposit at least USD500 to start trading. The choices were MaxGlobal, ZenTrade, and GlobalPremier — all of them are unlicensed entities in the whole world.

Following the registration, the bot will be activated in the account (note that members did not receive any EAs (Expert Advisors) or other types of trading bot software in the process).

NET89 gained fame overnight as an easy investment scheme involving an e-book, robot trading, and multi-level marketing. They pretended to be a legitimate business by rejecting the notion of fixed profits but actually reported 1% daily profits to the members.

Translation:

Artificial Intelligence Created for One Purpose Only

TO GIVE YOU PROFITSMARTX The Best Auto Trading

-Target profit of 1% per day

-Anti margin call

-Real trading

-Self-managed funds

-Easy profit withdrawals

-Consistent profit

-Daily results

The scam went smoothly at first. People got attracted by easy profits and extra income gained by recruiting new members. Furthermore, the company (SMI) was actually registered legally as a trading company and recruited famous Indonesian personalities to promote their products on social media.

The scam went bust within two years following the inevitable withdrawal failures. BAPPEBTI later labeled them as an illegal entity and shut down their business. Furthermore, Indonesian National Police declared the company's top officials as fugitives.

How to Avoid Trading Scams in Indonesia

The aforementioned forex trading scams feature several notable characteristics, such as fixed profits, no-fuss investments, and illegal entity. Most Indonesians were not prepared to learn complicated financial market mechanisms but they wanted the profits — no wonder so many fell victim to the "too good to be true" offers.

You can avoid such disaster with the following tips:

🔍Watch out for free financial advice on social media |

An increasing number of self-described social media influencers and financial gurus giving tips on how to be as rich as they appear to be. But it's never a good idea to base your financial decisions on the recommendations of social media celebrities with unproven financial experiences.

Generally, scammers will flaunt their wealth and the ease of making money. However, the real experienced traders on social media will continuously warn about the risks involved in trading.

One of the most widely discussed figures in the Indonesian online sphere is Indra Kesuma, also known as Crazy Rich Indra Kenz. He gained prominence as an influencer promoting the Binomo binary options app.

With a background in engineering, Indra Kenz touted Binomo as a legitimate platform. Through his social media presence, he frequently flaunted photos of his glamorous personal life, owning many luxurious sports cars, traveling abroad, and going on luxurious dates with his girlfriend.

However, Indra Kenz is not the only affiliate; several other influencers also endorsed Binomo, although only a handful faced legal repercussions. Indra Kenz himself is currently serving a 10-year prison sentence and facing a hefty fine of IDR5 billion.

Fakar Suhartami Pratama, also known as Fakarich, who is Indra Kenz's financial guru, was also detained after being caught receiving a flow of money amounting to IDR1.9 billion from Indra Kenz and posting a photo of himself bathing in money.

Beware of fixed returns |

Be cautious of investment opportunities promising exceptionally high fixed returns with minimal risk. If it sounds too good to be true, it probably is. Trading requires careful consideration, particularly when lacking substantial knowledge.

As the saying goes, "high risk, high return," trading inherently carries significant risks, implying that there are no shortcuts to easy money in trading. This vulnerability becomes an opportunity for scammers to ensnare unsuspecting individuals.

The NET89 case is a prime example. 1% daily fixed return is clearly too unrealistic when it comes to forex trading. In the end, it was all bluffs.

📝Do your homework |

Do extensive research on the forex broker before making an investment. Check for reviews, see what regulations they are subject to, and make sure they are well-known in the business.

For example, here are the steps to check a legitimate Indonesian broker:

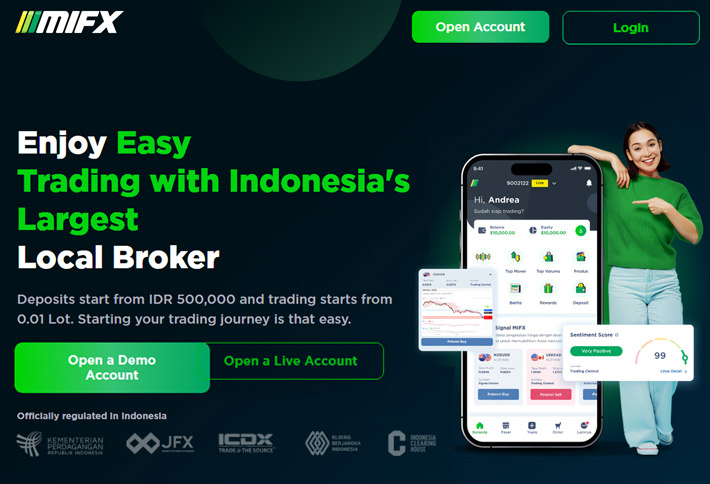

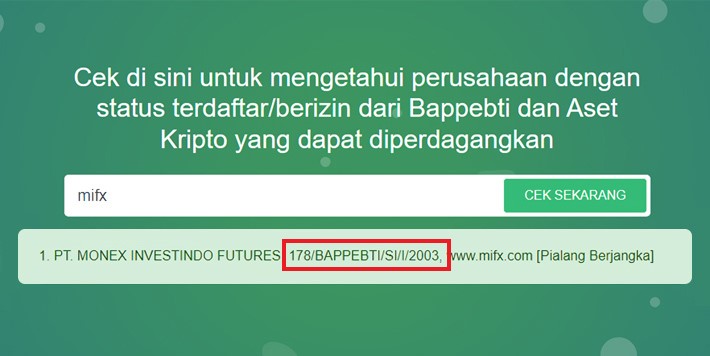

- Go to the official website of the broker. For this example, we will use MIFX broker.

-

Check the legality. You can visit the broker's legal information or the bottom of the website's homepage.

-

Verify the information on the regulator's website, which is BAPPEBTI.

- To make sure they're well-known in the business, you can check their social media accounts, recommendations from broker reviewer websites, and traders' testimonials.

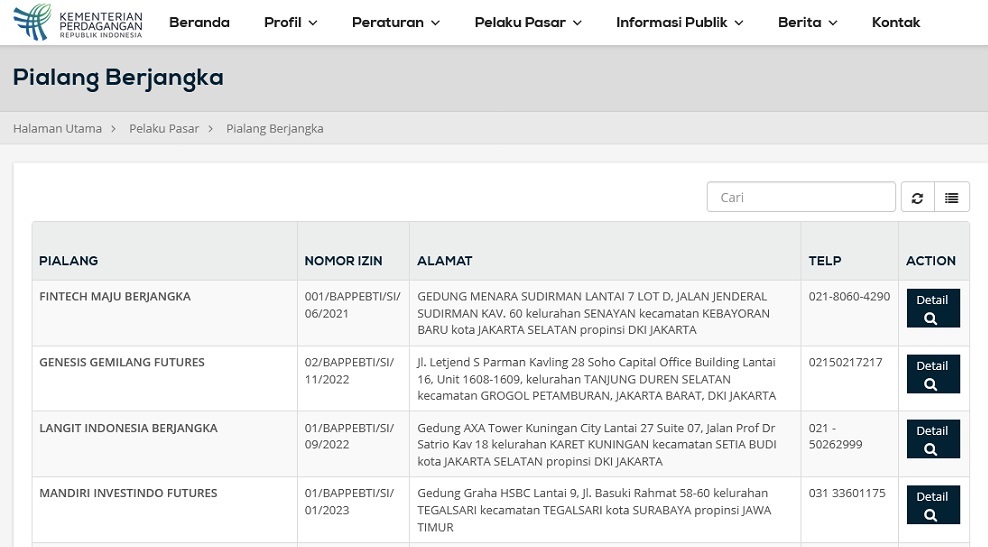

💼Choose the legitimate ones |

The most effective countermeasure against falling for a scam is to select a broker who is subject to stringent regulation. Always turn down unsolicited offers that promise enormous or guaranteed riches; trustworthy brokers don't operate this way. Sign up with brokers who are overseen by a reputable financial regulatory body.

For Indonesian brokers, the list of regulated companies that legally operate with their licenses is available on this page.

Finally, it is important to remind yourself that forex trading should be viewed as a business, not a game.

Just like any other business, becoming profitable takes time, hard work, and skills. Rather than sending your money to an unknown entity that promises easy riches, you should learn the trade step-by-step to generate a comfortable income on a long-term basis.

Also, you should carefully choose forex brokers in Indonesia to trade with.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance