Islamic account is not only beneficial for Muslims but also for all traders who want to avoid the risk of an extra trading cost from swap rate.

Have you ever encountered the term "Swap-Free Account" while browsing forex brokers' specifications?

Even though it is often referred to as a trading account, swap-free differs from the standard or micro accounts that offer minimum lot-based trading. in forex trading, a swap (called rollover) is the interest charged for overnight trading positions. The amount is calculated from the difference in interest between two currencies of a traded pair. So if you trade EUR/USD, the swap rate is the difference between the current interest rates of the Eurozone and the US.

The problem is, Muslim traders can't pay or receive swaps due to religious beliefs. For this purpose, brokers created the Islamic account to accommodate free swap conditions for Muslim traders. They can be quite careful in choosing which traders can apply for an Islamic account, which makes this account have unique conditions.

Here are the most common rules that brokers use in their swap-free accounts:

- Only for Muslim traders: Traders might require to prove their religion upon applying.

- Maximum duration: The length at which the free swap can be applied on floating positions.

- Commission: Some brokers may charge an alternative commission to compensate for swap rates.

- Special account type: Due to the nature of this account, the free swap can come with different trading conditions.

That being said, let's dive into each condition to learn further about Islamic accounts in forex brokers.

1. Islamic Traders Only

Forex brokers specifically provide swap-free features for Muslims in this type of account. To ensure the trader's identity, brokers will add extra procedures and a unique verification process. Often, this might require traders to prove their own beliefs. This is because there are trader who tried to take advantage of Islamic accounts despite having different beliefs. Some brokers that provide this kind of swap-free account are JustForex, IC Markets, Exness, FXOptimax, HotForex, and XM.

2. The Maximum Duration of Position

Sometimes, a swap-free account does not always free from the risk of rollover. The swap-free account has an expiration date in some brokers, which varies from three to more than ten days in total. FXPrimus is one of the brokers that use this limitation. This broker will set a commission for trading positions open for over a week. FxPro is also known for this kind of policy.

3. The Commission

Free from swap doesn't guarantee that traders will be free from the overnight commission. In reality, some brokers charge fees as a swap rate replacement so they don't have to cover the negative rates. For example, Alpari broker, which charges a fixed fee in a swap-free account. It is not mentioned as the difference in interest rates but rather the type of pair and the number of trading lots.

On the other hand, Forex.com charges a $2.50 flat rate per Mini lot or $25 per standard lot for overnight positions. One thing they have in common is that the amount of commission charged is fixed and doesn't follow the dynamics of interest rates.

4. The Account Type

This policy is most commonly found among swap-free accounts provided by forex brokers. In this policy, swap-free is an extra feature in regular accounts and has become a particular trading account with its specifications.

If you register in a broker that provides a swap-free account as a particular type of account, then make sure you observe and pay attention to its terms and conditions and ensure that they do not contradict your trading conditions. Some brokers that use this policy for their Islamic accounts are Tickmill, GKFX Prime, and Grand Capital.

The Demand for Islamic Account

In general, here are some factors contributing to the demand for an Islamic account:

- Adherence to Islamic Principles: Swap-free trading allows Muslim traders to participate in the financial markets without compromising their religious beliefs. These accounts allow traders to trade by Sharia law, eliminating interest charges or earnings.

- Inclusivity and Diversity: Swap-free trading accounts promote inclusivity by providing equal opportunities for traders of different religious backgrounds. Brokers that offer swap-free accounts aim to cater to a diverse range of traders, respecting their cultural and religious requirements.

- Growing Awareness and Education: There has been increased awareness and education about Islamic finance and trading principles. This has led to more traders seeking swap-free accounts and understanding their associated features and requirements.

How Forex Brokers Provide Islamic Account

Every broker could have different terms when it comes to Islamic account. Here are some good examples.

Exness

Exness offers swap-free trading accounts that are exclusively designed for residents of Islamic countries who adhere to Sharia law. These accounts ensure that no swaps involving earning or paying interest are credited or withdrawn from the trading account.

It's important to note that swap-free status is automatically applied to trading accounts of clients in Islamic countries and some cases, non-Islamic countries as well.

However, there are no swap charges for instruments in the Cryptocurrencies and Stocks group.

The choice of broker is adjusted to the needs of each trader. If you are a trader who only needs a basic platform and trading features with the best attributes, then Exness can be your best choice.

Exness covers its lack of feature variations with other advantages like low spreads starting from only 0.1 pip. This is very suitable for traders who use scalping strategies (Scalper). Spreads on major pairs in certain account types can also be as low as 0.0 pip, depending on market conditions.

Not only that, but traders can also enjoy other advantages such as automatic fund withdrawals. Exness processes the majority of client withdrawals instantly, without manual checks; however, withdrawals may be subject tos depending on the payment provider or method of choice.

The safety of traders' funds is also guaranteed as Exness is one of the European-based STP/ECN brokers. Exness's ability to become an official partner of the Real Madrid soccer team for 3 years, starting July 2017, also provides evidence that the company has high solidity.

Deposits and withdrawals may be made 24 hours a day, 7 days a week. However, it is important to note that the company shall not be liable fors in processing deposits and withdrawals if suchs are caused by the payment system.

Traders do not need to worry about transaction fees when depositing and withdrawing. Exness doesn't charge any transaction fees to traders even though some charges may be incurred depending on the payment provider of choice. A variety of payment methods are provided for traders, including Wire Transfer, Bank Card, Neteller, Skrill, and many others.

The financial reports and metrics on the Exness website are audited quarterly by Deloitte, one of the four largest public accounting firms globally.

Moreover, Exness is one of the mote transparent brokers in the online trading industry. Traders can find out all information about this company on the website, such as trading volume, number of active clients, client deposits, company funds, and many more.

The platforms provided by Exness vary in MetaTrader 4, MetaTrader 5, Web, and Mobile platforms. This makes it easy for traders when trading on Exness, as they can also access Exness platforms anywhere and anytime.

Over the years, Exness has developed into a broker that attracts traders. Trader's trust is further enhanced by its compliance with financial regulations like the FCA and CySEC.

One measure of client confidence can be put on the trading volume. By December 2018, their clients' monthly trading volume reached USD348.4 billion and active traders around the world surpassed 50,342.

Through the program offered by Exness, traders also have the opportunity to earn extra income by becoming their partners. From the Introducing Broker (IB) program, partners can earn up to 33% spread commission from every new client that registers with them.

Additional income can also be obtained from Exness Partners. Traders can get a spread commission of up to 25% per transaction made by traders who register through an affiliate link.

When trading with Exness, clients can also make use of its free VPS hosting services. A VPS (Virtual Private Server) offers increased reliability and stability for traders as they can maintain their trades and expert advisors without interruption in the event of unexpected technical issues, such as internet or electricity downtime.

From the review above, it can be concluded that Exness is a favorite broker for traders because of low spreads and flexible account types. This condition is very suitable for traders with limited funds but is in need of more opportunities to get maximum profit. This broker is also well known for its maximum support on both new and existing partners.

IC Markets

IC Markets provides Islamic accounts, also known as swap-free accounts, to cater to clients who adhere to religious beliefs prohibiting earning or paying interest.

The swap-free condition is available for both Raw Spread and Standard account types on the MT4, MT5, and cTrader platforms. With these accounts, clients can trade over 90 instruments, enjoy the leverage of up to 1:500, benefit from low spreads as low as 0.0 pips, and avoid incurring additional costs in place of swaps.

IC Markets is an online forex broker operating under the company of International Capital Markets Pty Ltd. Traders under the Australian jurisdiction are provided with the trading service of IC Markets AU that is headquartered in Australia and licensed by the Australian Securities and Investments Commission (ASIC).

On the other hand, non-Australian traders who open an account in this broker are registered under IC Markets SEY that is based in Seychelles, and regulated under the Seychelles Financial Services Authority (SFSA). The dual operation is a result of the relatively new rules from ASIC that prohibit their regulated broker to offer trading services outside Australia.

Classified as an ECN broker, IC Markets provide clients with MetaTrader 4, MetaTrader 5, cTrader as platform trading options. This broker also follows market trends to include Cryptocurrencies as one of its products, enriching its already wide selection of trading assets that include Currencies, Indices, Metals, Energies, Softs, Stocks, as well as Bonds.

The minimum deposit in IC Markets is in the middle range compared to other ASIC-regulated brokers, as it reaches $200 for every client. Market analysis materials are also prepared regularly for trading insights on IC Markets's official website, proving their competence to serve their traders with important contents created by market experts that work specifically for them.

For payment methods, IC Markets allows funding and withdrawal via wire transfer, credit card, PayPal, Skrill, Neteller, FasaPay, UnionPay, as well as Bitcoin via BitPay. The more interesting aspect from this broker is its multi-base currencies that include USD, AUD, EUR, GBP, SGD, NZD, JPY, CHF, HKD, and CAD.

As the trading technology in IC Markets is highly equipped with co-located servers and extremely low latency (especially on cTrader), the broker is widely known for its capability in hosting traders with the special needs for high-frequency trading as well as scalping.

To sum up, IC Markets is a fitting destination for active traders looking for a well-regulated broker. IC Markets is also flexible in terms of base currency and payment methods, signaling their commitment to welcome traders beyond their home country. As of late 2019, IC Markets provided their website in 18 international languages including English, Korean, Indonesian, French, Spanish, Italian, Malay, German, and Chinese.

FP Markets

FP Markets offers the swap-free account option for both Raw and Standard accounts on the MT4 and MT5 trading platforms. The standard Islamic conditions for these accounts include a minimum opening balance of AUD 100 or equivalent, spreads starting from 1.0 pips, and access to 60+ FX pairs, metals, indices, and commodities. Unfortunately, doesn't provide swap-free for exotic pair trading.

Keeping positions open overnight won't result in the overnight/rollover fee reducing your earnings, so you don't have to worry about it. FP Markets offers the most competitive swap rates in the industry by introducing Swaps Points in the form of a live swap rates list on the MT4 and MT5 platforms. Here are some examples:

- ACWI: -5.00 for long positions and -2.50 for short positions.

- ADAUSD: -20.00 for long positions and -20.00 for short positions.

- AGG: -5.00 for long positions and -2.50 for short positions.

TriumphFX

TriumphFX provides two types of Islamic Accounts: Islamic Variable and Islamic Platinum. The Islamic Variable account requires a minimum deposit of 100 USD, offers floating spreads with a typical spread of 1.6 pips for EUR/USD, and no swap or commission charges. The maximum leverage for this account is 1:500.

On the other hand, the Islamic Platinum account has a minimum deposit of 2,000 USD, floating spreads with a tighter typical spread of 0.6 pips for EUR/USD, and no swap or commission charges. The maximum leverage for the Islamic Platinum account is 1:500 as well.

TriumphFX offers forex and CFD trading to retail and professional investors who have successfully opened live accounts with the broker. Regulated by FSA (Seychelles) SD080 and VFSC 17901, TriumphFX caters to traders from the EU to Cyprus, Great Britain, South Korea, Italy, Malaysia, Indonesia, Singapore, Australia, and Germany for trading forex and metals.

TriumphFX was founded in 2009 and has now opened offices in Malaysia, Hong Kong, Cyprus, and Australia. The company has a diverse client base, with opportunities for less experienced investors, as well as institutional traders.

MetaTrader 4 (MT4) is the main platform provided because. In addition to facilitating client navigation, the platform contains comprehensive educational material for beginners. Copy trading is also available, where users can copy other successful investors.

After you sign up, deposits can be made in the following currencies: USD, EUR, and GBP. Deposits and withdrawals through banks are usually completed within 2-5 days. TrimuphFX operates according to anti-money laundering guidelines, so document verification is required before a withdrawal can be approved.

The company offers a welcome bonus of 5% for the international division, however, this is not available to clients in the EU. TriumphFX offers one demo account and 4 different live accounts: Platinum, VIP, Premium, and Standard. The main difference between live accounts relates to the minimum deposit.

Clients can contact customer service via ticket, email, or telephone. The team will respond to any issues the client may have quickly and responsively.

Pepperstone

The Pepperstone Swap-free account is specifically tailored for traders who cannot receive or pay swaps. This account type ensures an interest-free trading experience while offering access to advanced trading technology and deep liquidity. With an average EUR/USD spread of 1.0 to 1.2 pips, traders can benefit from competitive pricing.

Pepperstone was founded in 2010 by a team of experienced traders with a shared commitment to improve the world of online trading. Based in Melbourne, Australia, they grew to become one of the largest forex brokers in the world. If traders want to find a broker that provides low spreads, fast execution, and award-winning support, then the answer is Pepperstone.

Pepperstone has a strong legality guarantee because it has been licensed by the Australian regulator ASIC and FCA. Traders' funds can be deposited in segregated accounts at top Australian banks, one of which is the National Australia Bank (NAB). Therefore, the safety of funds is not a concern if a trader chooses to open an account in Pepperstone.

They succeeded in collaborating with 23 top banks to bring Bid to investors instantly via optical fiber. This allows all orders to be executed 100 percent automatically with low latency up to 0.05 milliseconds, without dealing desk intervention and requotes, as well as with super low trading costs.

Trusted by over 73,000 traders around the world, Pepperstone processes an average of USD12.55 billion of trading volumes every day. Because of that, they have many awards such as:

- The Best Global Forex ECN Broker 2019 and Best Forex Trading Support-Europe

- Best Australian Broker and Best Trading Platform 2018 by Compareforexbrokers.com

- Best Forex ECN Broker, Best Forex Trading Support, and Best Forex Trading Conditions by UK Forex Awards 2018

With the many rewards gained, Pepperstone hopes to attract more and more traders from all over the world. The rising performance of Pepperstone is not only due to the super-tight spreads and fast execution that it provides, but also because many traders are interested in trading with deposits in currencies other than US Dollars.

For this reason, Pepperstone is one of the most market-responsive brokers because it is willing to accept deposits in 10 currencies, which include AUD, USD, EUR, CAD, GBP, CHF, JPY, NZD, SGD, and HKD.

Trading in Pepperstone would allow traders to choose between 11 trading platforms: MT4 for desktop, MT4 Mac, MT4 iPhone, MT4 Android, MT4 iPad/Tablet, MT5, WebTrader, cTrader WebTrader, cTrader cAlgo, and cTrader Mobile. The choice of trading platforms may seem confusing to novice traders, but actually, it is very useful because it has fast execution.

When trading forex, traders can enjoy raw spreads from 0.0 pips on Razor accounts, over 61 currency pairs, and commission-free account funding on a wide range of deposit options. In addition to currency pairs, Pepperstone provides many types of trading instruments, including CFDs for indices and shares, commodities, and cryptocurrencies.

Instruments in commodity trading are pretty much diversified. Not only metal, gold, and silver, but traders can also trade with soft commodities such as cotton, sugar, coffee, cocoa, and orange juice. Pepperstone also provides trading on energy (oil and gas).

There are two types of accounts provided by Pepperstone, namely Razor accounts, and Standard accounts. If you area beginner, it is recommended to choose a Standard account with an average EUR/USD spread of 1.0-1.3 pips and free commission.

Those with particular trading styles such as scalpers and algorithmic traders may enjoy the lower cost setup traditionally seen in a Razor account, with a commission from AUD7 round turn of 100k traded. You can start trading with a minimum lot of 0.01 (micro) and 1:400 leverage.

As a Pepperstone client, a trader can fund and withdraw with alternative methods including Visa, Mastercard, POLi internet banking, bank transfer, BPay, PayPal, Neteller, Skrill, and Union Pay.

If you are new to trading or looking to practice your trading strategies in a risk-free environment, you can create Demo Account in Pepperstone. But if you are an experienced trader or prefer to learn by doing, Pepperstone provides a Live Account that allows you to trade with live executions and pricing.

Traders can also follow and copy strategies from popular traders using third-party services while learning how to improve their trading abilities. Pepperstone has partnered with a range of social trading platforms that traders can choose from, such as Myfxbook, ZuluTrade, Mirror Trader, MetaTrader signals, and Duplitrade.

If you find yourself in a dilemma because your ideal forex broker turns out doesn't have a good swap-free policy, you can always minimize the trading cost from the other perspective: the spread. This list may provide you with the lowest major pairs' spreads you ever found in forex brokers.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance

7 Comments

Maya

Jan 19 2023

I understand that swap-free accounts do not charge a swap rate or rollover fee for each position opened overnight. However, considering the fees, why swap-free accounts are more burdensome than rollover fees. Does it appear to be Ok, in some cases you can make a profit on the price, but you will also be debited if the price is negative. For example, the commission is $2.5 for every 0.1 lot you open on forex.com. If you open 4 positions, you will be charged $10, right? Which has lower fees, Swap Free or Swap Rate?

Jorge

Jan 19 2023

Maya: In my opinion swap rate and swap free accounts are for swing traders and experienced traders.Because if you trade intraday trading which is scalping and one day trading you don't have to pay for swaps and Halal" or because it is allowed for Muslim traders.

But if you've talked about fees, the swap rate is actually the bigger fees. On Wednesday, swaps rate that broker charged will be three times as it takes two days for the broker to process the forex entry to be settled. So, if you have an entry trade during Wednesday and the entry is left overnight, you can only close on Friday.

Diego Mendez

Jan 19 2023

Dude, what are the other fees that may be incurred when trading Forex. Seems like a lot of fees are charged to the seller. I mean, the trader paid the spread, commission, sometimes deposit and withdrawal fees. And now need to pay the swap fee. Also don't forget taxes. Are there any fees I have to pay in forex trading? So many fees and need very good counting in that. Why forex need so many fees that broker charge to us?

Forex seems to be very profitable, but after seeing the variety of fees, I think you need to reconsider Forex trading.

Joshua Nathan

Jan 19 2023

Diego Mendez: Sir, if you want to trade Forex with real and real market, you need to prepare your money management. I think money management is the most basic thing of Forex. You need to calculate all possible fees, margin, number of trades you can trade, avoid overtrading, risk reward, log preparation, etc.

A lot of preparation is required before starting forex trading. After money management, you can also learn more about trading strategies, do some testing on a demo account and then you can trade real forex.

You can read these articles in order to get tips in Forex trading and know all fees that may be occured during Forex trading:

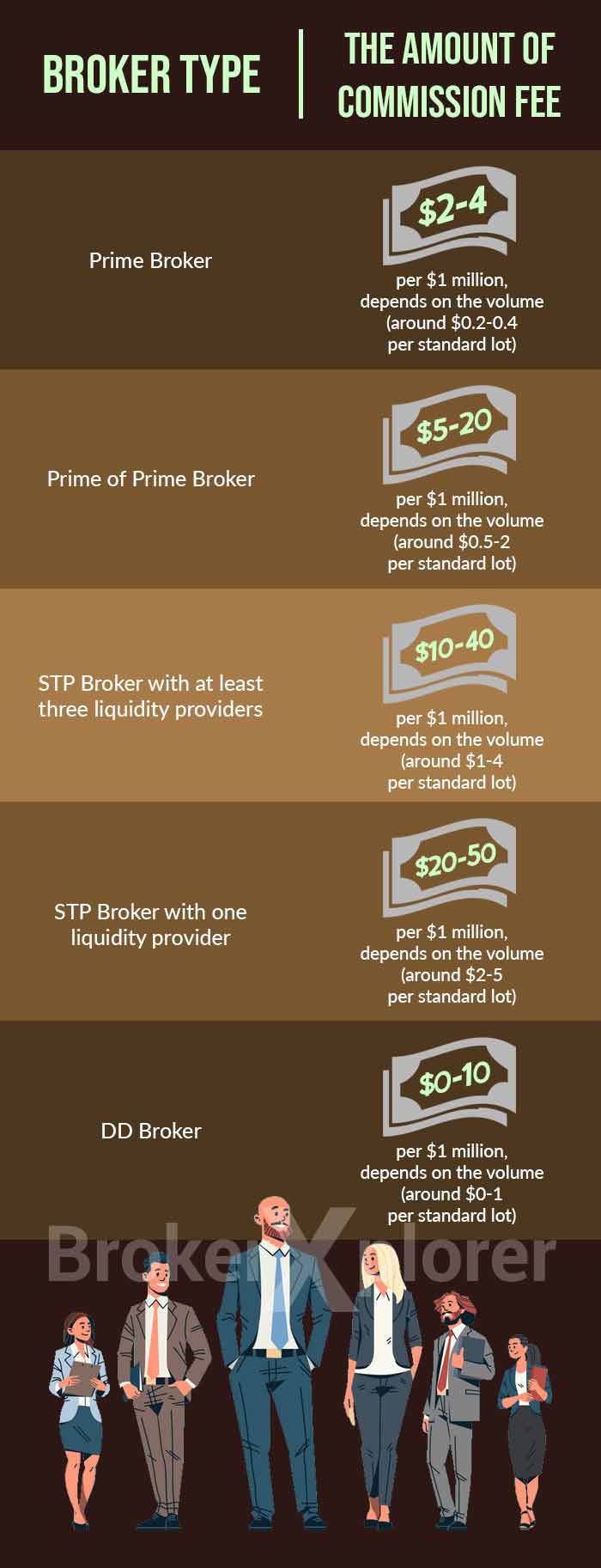

About your question : why there are so many fees in Forex? We need to know first that we cannot enter the Forex market if our money is only 1000$; 10,000 USD; even $100,000. Forex trading really requires huge amount of money which only hedge fund companies, central banks and large corporations can participate. But with the help of brokers we can participate because they offer many services include sending our order to the market and give us leverage. So, for feedback they charge every trade we open to get profit and money for their operation.

Diego Mendez

Jan 19 2023

Joshua Nathan: That's a lot explanation, yeah as you have said, money management is very important to forex trading. i will considered to enter the forex or not because I am not too great at money management. But thanks for the article that you give, I am little bit understand about forex money management.

Mona

Jan 27 2024

Hey, I had the impression that having an Islamic or Swap-free account meant being able to maintain positions for an extended period. However, it turns out that some brokers don't offer this feature. The article also mentions that a swap-free account doesn't necessarily eliminate the risk of rollover. Certain brokers impose an expiration date on swap-free accounts, ranging from three to more than ten days. FXPrimus is given as an example of such a broker.

So, my question is about why some brokers, despite seemingly providing swap-free accounts, impose time limits or expiration dates, making it seem like not all brokers can cover swap fees. Is the occurrence of swaps in Forex as common as spreads?

Choky

Jan 30 2024

Hey there, so why do some brokers act all chill about offering "swap-free" accounts but then throw in time limits or expiration dates? It's like they're saying, "Hey, it's fee-free, but only for a limited time." Well, turns out it's their way of handling risks and keeping their own boat steady in the market.

Take FXPrimus, for instance. They're one of those brokers putting an expiry date on the so-called swap-free vibe, lasting anywhere from a few days to a couple of weeks.

As for swaps, they're kind of like the behind-the-scenes thing in Forex. Not as noticeable as spreads, but they're pretty common. It's like paying a little extra for keeping your trades overnight. So, it depends on your game – but yeah, swaps are definitely a thing in the Forex world.