Forex Brokers that Provide Copy Trading

Copy trading is a form of investment strategy that allows individuals to replicate the trades of another, typically more experienced, trader. It essentially involves mirroring the positions (buying and selling of assets) opened and managed by a chosen "signal provider" or "leader" in the copy trading platform.

Copy trading can be provided by independent platforms, forex brokers, or forex brokers that are integrated with said platforms. For a more efficient process, copy trading from forex brokers are much more recommended. Here is the list:

Scroll for more details

Copy trading can be a suitable option for beginners or individuals seeking an alternative approach to entering the market. However, it's crucial to remember that it comes with inherent risks and requires careful consideration and responsible trading practices. The following explanation will give you clearer insights into copy trading.

- Choose a platform: Several online trading platforms offer copy trading features.

- Select a trader to copy: You can browse through profiles of traders on the platform, considering their performance history, trading style, risk tolerance, and fees.

- Allocate funds: Choose how much capital you want to allocate to copying the chosen trader's trades.

- Automatic execution: The platform automatically replicates the trader's positions in your account, proportionally based on your allocated funds.

What are the Benefits of Copy Trading?

- Copy trading allows beginners and individuals with limited knowledge to participate in the market by following established strategies.

- By copying successful traders, there's a chance to achieve similar returns.

- Observing experienced traders can help you learn valuable trading skills and market behavior.

- Copying established strategies can help avoid impulsive decisions based on emotions.

Things to Consider Before Copy Trading

- Past performance of copied traders doesn't guarantee future success.

- Do your research: It's crucial to research and understand the risks involved before selecting a trader to copy.

- Develop your own skills: While copy trading can be a starting point, relying solely on it is not advisable. It's essential to develop your own trading skills and knowledge to make informed decisions in the long run.

See Also:

Additional FAQ

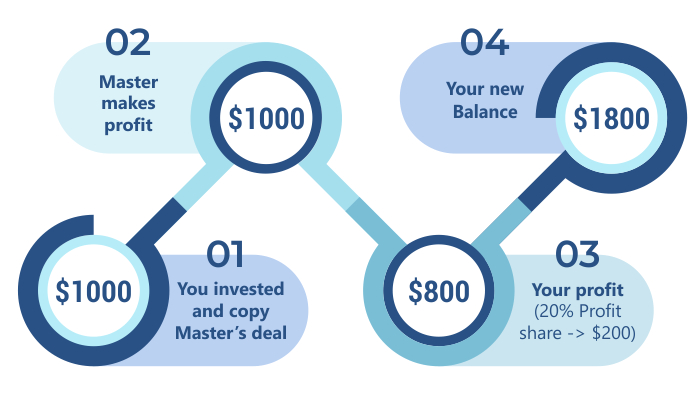

Forex copy allows followers to replicate trading results from a master using a scheme like this:

- You register as a follower.

- You replicate the master's trades.

- The master makes a profit, let's say $1000.

- You also receive $1,000.

- You pay profit sharing/daily commission to the master.

- The total profit you receive is $1,000 minus the amount of profit sharing/daily commission.

Continue Reading at Forex Copy: The Easy Way to Make Money in SuperForex

How to keep your portfolio balanced and diversified in copy trading?

What you want to do is combine different types of investors, investment techniques, degrees of risks, and financial instruments, so your overall portfolio in eToro will not depend solely on a single investment.

It is worth noting that diversification doesn't depend on the "quantity" of the investments, but more on their nature and correlation with each other.

Continue Reading at Smart Tips on Maximizing eToro's Diverse Markets

What are the criteria of best traders to copy?

There are at least 5 qualities that the trader you copy must have, such as:

- Can really show their trading knowledge and experience on their profile feed.

- Can maintain low weekly and daily drawdowns.

- Don't have incredibly high returns.

- Don't have a 100% win rate.

- Open and communicative.

Continue Reading at Understanding eToro Copy Trading Platform

What are the aspects to see if copy trading worth to try?

To measure its worth, there are 6 aspects to consider, including:

- Market reach.

- Users growth

- Legitimation

- Profitability

- Available platforms

- Risk management

Continue Reading at Is Copy Trading Really Worth It? Let's Expose the Facts

Broker Categories

Minimun Deposit

Payment

License

Country

Established

Instruments Traded

Features