Being one of the best social trading platforms in the industry, eToro offers various instruments from different markets to choose from. Find out how to optimize the diverse market for your profit.

Each day, there's a bunch of newbies who join the financial market to start their trading journeys. Thanks to the internet and technology advancement, access to learning materials and beginner-friendly brokers are even easier than before.

eToro is one of the highly popular brokerage companies that provide an excellent trading platform for most types of traders, including beginners, since 2007. The platform is known to have 3,000+ trading instruments that cover a diverse market that includes stocks, CFDs, cryptocurrencies, forex, indices, commodities, ETFs, and even NFTs.

As such, there are certain tips so you could gain benefits from eToro's diverse markets smartly through the copy trading service:

- Explore the markets section thoroughly.

- Diversify your portfolio wisely.

Let's dive into each tips in the section below.

Browsing through eToro's Markets Section

Just knowing how eToro's copy trading works is not enough. In fact, traders also need to learn how to take advantage of eToro's copy trading in its diverse market.

eToro prioritizes the social aspect of their services by creating what they call the Markets section. In this section, traders are able to monitor every market and assets that can be traded in the eToro's platform.

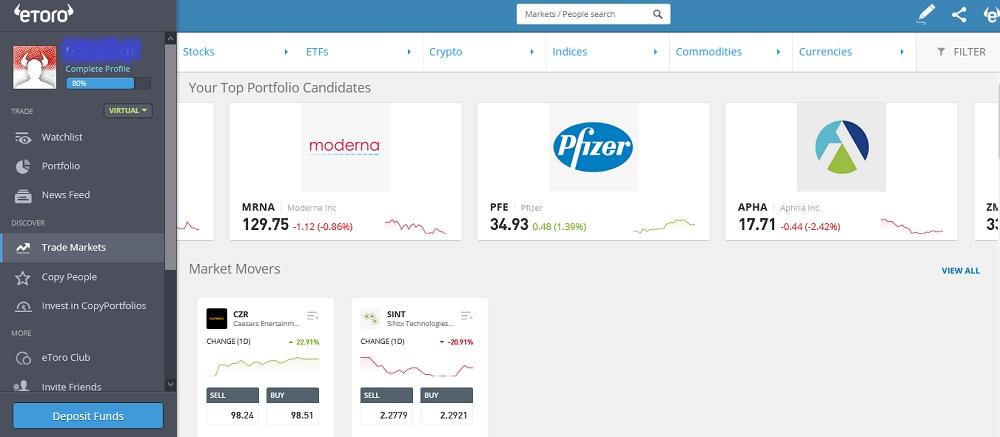

The Markets section would look like this on the platform:

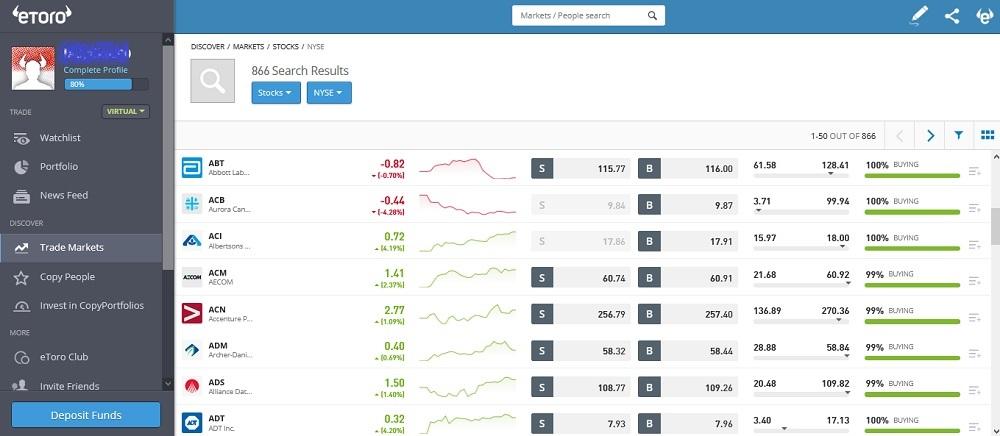

The market section is divided into the upper and central areas. The upper area shows you the menu that consists of the various asset classes (cryptocurrencies, ETFs, stocks, currencies, commodities, indices) and an advanced filter tool on the top right. If you click on each asset class, the instruments are displayed with further information, such as:

- Market: It shows the stocks' names along with their logo. For other asset classes, this column identifies the name of the trading instruments.

- Change: It shows the price change in percentage and pips, which relates to its reference price. By default, it displays the change from the previous day, but you can customize the time to last week or last month.

- Sentiment: It displays the percentage of investors who at that exact moment are having either Buy or Sell positions on that particular asset.

- Sell and Buy: The two best prices for buying and selling that particular asset. If you click on it, a pop-up to place an entry order will come up.

Take a look at the picture below:

In addition, there is a "+" symbol, which indicates that you can add that particular asset to your Watchlist, so you can receive constant updates directly from your profile without having to come back to the Market section every time.

Technically, the display for all four assets is exactly the same, but since eToro broker focuses more on stock CFDs, there are more options to choose and it can be a bit overwhelming. So in this case, it would be wise to use the advanced search feature.

Underneath the upper area, there's the central area where you can find various groups of instruments based on either common or more advanced categories, like Trending Markets or Market Movers. However, the actual CFDs are actually displayed randomly on eToro platform.

eToro established in early 2007, with a mission to make trading accessible to anyone, anywhere, and reduce dependency on traditional financial institutions. The company has head offices in the United Kingdom, Cyprus, USA, and Australia.

eToro (Europe) Ltd operates as a Financial Services Company authorized and regulated by the Cyprus Securities Exchange Commission (CySEC) under license no. #109/10. Meanwhile, eToro (UK) Ltd is authorized and regulated by the Financial Conduct Authority (FCA) under the license FRN 583263.

As for eToro AUS Capital Pty Ltd, the legal standing is acknowledged by the Australian Securities and Investments Commission (ASIC) to provide financial services under Australian Financial Services License 491139.

A broker that belongs to the 4-digit type, eToro offers both short-term options for day traders and long-term options for investors, such as their innovative Smart Portfolios, a fully managed thematic portfolio.

Since 2007, eToro has been at the forefront of the Fintech revolution. The most recent was launched in 2017, which is Smart Portfolios powered by Machine learning Al. Beyond developing Smart Portfolios, the company integrated Microsoft's machine learning technology into Momentum DD.

The new Smart Portfolios investment strategy uses artificial intelligence to find the steadiest traders who are most likely to generate a double-digit return and bundle traders into one fully-managed portfolio. eToro has hundreds of financial assets for trading across several categories including stocks, commodities, crypto assets, currencies, indices, and ETFs. Each asset class has characteristics and can be traded using a variety of investment strategies.

Some positions on eToro involve ownership of underlying assets, such as non-leveraged positions on stocks and cryptos. Employing CFDs will enable a variety of options, such as leveraged trades, short (sell) positions, fractional ownership, and more. For example, traders can invest as little as USD100 in gold, even if a single unit of gold cost USD1,000. Some of eToro's most popular CFD commodities include gold, oil, natural gas, silver, and platinum.

Currencies are traded on eToro only as CFDs. Also, CFDs enable Sell (short) positions and leveraged trade, even for assets that don't offer the option in traditional trading. Some of the popular currencies include EUR/USD, GBP/USD, AUD/USD, USD/JPY, and USD/CAD.

Furthermore, An Exchange-Traded Fund (ETF) is a financial instrument comprising several assets grouped to serve as one tradable fund. After opening an account in eToro, traders can invest as little as USD250 in an ETF that costs USD500. Some of the popular ETFs on eToro include SPY, VXXB, TLT, and HMMJ.

However, eToro also offers additional functions using CFD trading. All leveraged ETF positions in the UK are under FCA regulations. Meanwhile, all CFD positions executed by eToro Australia are under ASIC regulations.

The company has other advantages. In all financial assets that can be traded, eToro does not charge any deposit or trading frees other than spreads.

eToro charges a USD25 fee for withdrawals and the minimum withdrawal amount is USD50. Long (Buy), non-leveraged crypto, stock, and ETF positions are not executed as CFDs and do not incur any fees. eToro does charge overnight or weekend fees for CFDs positions, such as leveraged positions and short (sell) orders.

Fee updates always apply to open positions. Fees are subject to change at any given time and could change daily, without prior notice, depending on market conditions.

As a beginner, trader can use CopyTrading eToro. Different from the features of other brokers, traders can copy the strategies of professional traders without fee or profit-sharing. Therefore, 100% profit is fully owned by traders. For example, while trader A who is copied by trader B, produces a profit of 10% this month, then trader B also gets a profit of 10%.

The company is the world's leading social trading network. Since eToro operates in complete transparency, each trader has valuable information on their eToro profiles, so other traders that are interested to copy their trades can have assistance in creating their best portfolios.

Another feature that is unique to eToro is the personalized, social News Feed. Just like on any social media, traders can post their updates on feed, comment on other's posts, and gradually create a feed that is tailor-fitted to trader's trading and investing interests. On eToro social trading platform, traders will also get notifications when a trader writes a new post and many other important updates.

Into the Markets

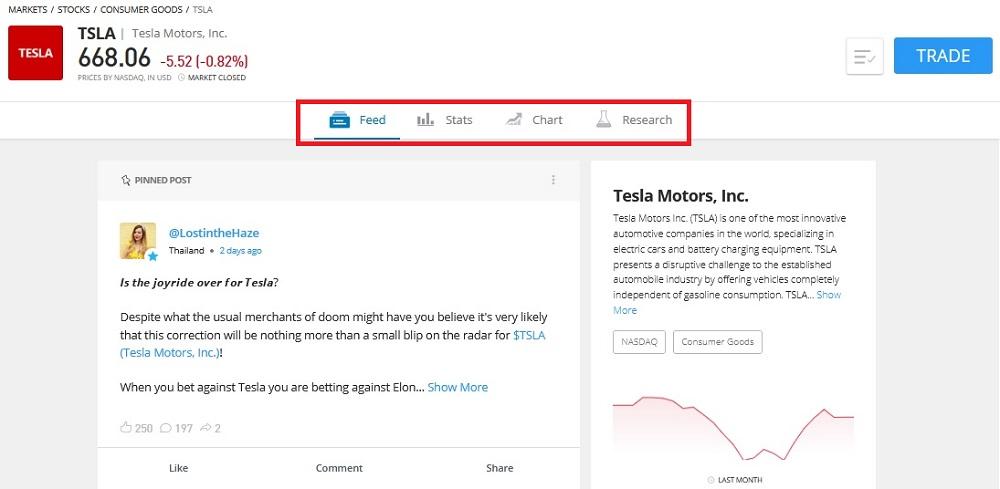

If you click on each market instrument, the platform will provide an interesting social tool that you can use because it consists of preliminary information on the nature of the instrument and allows traders to negotiate it. It also shows how other investors in the community are negotiating those instruments and who are the investors that are doing it.

On the top of the page, you can see several things:

- Name and Ticker.

- The current price of the instrument.

- Changes in terms of percentage and pips from the closing price of the previous day.

- The + button to add it to your Watchlist.

- The Trade button to execute a position.

Moving further below, there are four tabs that you can check out, which are Feed, Stats, Chart, and Research. The Feed basically shows you all of the recent talks and updates regarding the instrument.

You can check if it attracts interest from many investors or if it gets positive comments from other market players, which can help you measure the probability of investing in the instrument. Meanwhile, the Stat, Chart, and Research pages are dedicated to analytical purposes, both technically and fundamentally.

How to Diversify Your Portfolio

In copy trading, it is important to keep your portfolio balanced and diversified. It means that your portfolio should be strategically varied in order to minimize the risk and survive many different market conditions.

What you want to do is combine different types of investors, investment techniques, degrees of risks, and financial instruments, so your overall portfolio in eToro will not depend solely on a single investment.

It is worth noting that diversification doesn't depend on the "quantity" of the investments, but more on their nature and correlation with each other. You must consider the positive or negative correlation between two or more instruments, whether they move in the same direction or going against one another.

If the components are too interconnected positively, there's the risk that the entire portfolio is going in the same direction and could possibly bring loss all at the same time. This means that the risk is actually increasing, which is not good.

On the other hand, if the negative correlation is too strong, your portfolio's profitability can be affected because you can gain a similar amount of profit and loss simultaneously, so the profit will be tapered by the loss and vice versa.

Therefore, it is crucial to pay attention to the correlations so that the performance of each instrument is truly independent, hence diversified.

What You Should Do

The first step to diversify your portfolio in eToro would be to break down the overall risk of your portfolio by controlling its volatility and potential drawdowns.

Volatility refers to the speed of price movement. You can also measure the volatility of your overall portfolio from the sum of them. High volatility means faster profit, but it can also mean higher risk.

While it puts you in a position where you can get a lot of money in a short time, you can get a lot of loss instead if the market suddenly goes against you.

Meanwhile, drawdown refers to the loss of invested capital because of the negative performance of the financial instruments in your portfolio. A non-diversified and unbalanced portfolio would more likely get more drawdowns because of the investments' negative performance simultaneity.

As such, the next step is to look for the best investments that might give the best returns as well. You must first protect the investment by ensuring that the risk is manageable and it can survive during market turbulences.

After that, look for the best opportunities that can be included in the portfolio and try to maximize the profit as much as possible but keep the same level of risk.

While the theories of correlation between instruments and their advantages have been around for a few decades, the concept of the people-based portfolio –a portfolio where the assets are not based on instruments, but on people or traders– is still considered quite new. eToro is one of the trading platforms that focus more on people-based portfolio and social trading.

There are at least 3 aspects that you can use to diversify your portfolio in eToro:

1. Diversifying the Trading Style

While there are loads of investors to choose from, you can sort them out based on their operating style, the strategies and instruments that they use, and how they operate to diversify your portfolio.

But despite being different from each other, you should also make sure that each investor is compatible and useful to be included in your portfolio.

2. Diversifying the Markets

Another thing that you should pay attention to is the market. In this case, eToro broker offers a wider range of options compared to other trading platforms because you can pick investors who use completely different asset classes such as stocks and cryptocurrencies.

Moreover, you must identify the investors with reputable experience in certain asset classes and allocate them to your portfolio. So the goal is to copy different expert traders with different strategies and underlying so that could lead you to several winning positions at once.

Furthermore, eToro has a special sector that gathers a number of instruments and puts them into specific groups to form CopyPortfolios. By choosing portfolios, traders can invest directly in eToro's choices of market groups.

They classify the portfolios based on market sections, top traders' choices, and their partner's research.

3. Diversifying the Leverage

The term leverage here refers to the leverage used to replicate trading positions from the investors in your portfolio. The first thing to keep in mind is not overdoing the leverage because it can harm your portfolio. Set a specific limit and stay consistent with it.

Another thing is to distribute the leverage according to the operating characteristics of the investor's strategy by considering their strength, consistency, and risk.

Conclusion

Given the wide range of trading instruments that you can choose while trading in eToro, you must build a strategy that can bring the best returns and minimum risk. The goal is to keep a diversified and balanced portfolio to increase your chance of surviving any market condition.

It sure takes some time and practice to be able to identify a profitable investor with the right combination of instrument choices, so take your time and do your research thoroughly in eToro.

eToro stands out as an exceptional option for individuals seeking cost-effective stock, CFD, forex, and crypto trading through its impressive mobile app. With an active user community, eToro provides social features dedicated to supporting the needs of traders and investors across the globe.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance

15 Comments

Enzo

Apr 2 2023

Ag, ja, your article was about copy trading some of the products offered on eToro, right? I reckon you're spot on. Copy trading allows you to make small trades in other instruments. So, if you make a profit, you'll get more profit and prevent loss because you've invested your money in different assets.

Intriguing, I'd like to ask about eToro itself. Based on the title of your article, you mentioned maximizing eToro's diverse markets. How many assets are there really on eToro? From Forex to ETFs, how safe is eToro?

Hayde

Apr 2 2023

To answer your question about the assets offered by eToro, it is best to check their official website as the exact number of assets may vary depending on your country of residence and regulatory restrictions. eToro offers a wide range of assets including Forex, stocks, indices, commodities, ETFs, and cryptocurrencies. However, the availability of cryptocurrencies may differ depending on the country due to local rules and regulations. In terms of safety, eToro is generally considered safe and reliable as it is regulated by reputable authorities such as the Financial Conduct Authority (FCA) in the UK and the Cyprus Securities and Exchange Commission (CySEC) in Cyprus. Additionally, eToro implements various security measures such as two-factor authentication and encryption to protect users' funds and personal information

Enzo

Apr 2 2023

Hey, thanks a ton for your awesome answer about the assets on eToro. Your explanation was really helpful in understanding how different factors like where you live can affect the number of assets available on the platform. I'll definitely check out the official website to get the latest info on what's available.

Also, your insights on eToro's safety and reliability were really reassuring. It's lekker to know they're regulated by trustworthy authorities and have good security measures in place. Thanks again for taking the time to give such a thorough and informative response. You're a champ!

Johansen

Apr 2 2023

Hey, ah, I'm definitely a newbie here and I'm still learning about the different assets that can be traded. I know a bit about Forex, stocks, and even cryptocurrencies. I understand that we don't actually need to own the assets to trade them, but instead use a contract called a CFD. It's still a bit confusing to me, but I've tried it out on a demo account to get the hang of it.

What really piques my interest is this asset called ETF. I've never heard of it before, and my previous broker didn't offer it. So, can you explain to me what exactly an ETF is and if it's suitable for beginners like me to trade?

Haryanto

Apr 2 2023

Let me explain it. First you need to know what is ETF without CFD. ETF stands for "Exchange-Traded Fund," and it is a type of investment fund that trades on stock exchanges. ETFs are similar to mutual funds, but they are traded like stocks on an exchange. ETFs are designed to track the performance of a specific index, such as the S&P 500, and they offer investors a way to invest in a diversified portfolio of stocks or other assets.

In the context of CFD trading, an ETF (Exchange-Traded Fund) CFD represents a contract between the trader and the CFD provider, based on the price of an underlying ETF. And the rest, how the trade in that assets, you know about that, right. So, overall it can added your diverse assets to trade and also as you know, beginner can really trade with ETF.

Emil

May 3 2023

Hey there! I just wanted to ask something about diversifying my portfolio on eToro. It says that I need to diversify my trading style and leverage. As a new user, I understand that trading style refers to the method of trading, such as long-term positioning, swing trading, short-term scalping, or day trading.

The article suggests diversifying my trading style, but what if I'm a day trader? Can I also try scalping or should I focus on swing trading instead? In other words, is it necessary to diversify scalping with day trading?

Jason

May 4 2023

Hey there! So you're wondering if you should diversify your trading style on eToro, right? As a newbie, it can be tough to know where to start, but it sounds like you're on the right track. The idea is to mix things up a bit and not put all your eggs in one basket, ya know?

So, if you're a day trader, you're already used to making quick trades, but maybe you could try out scalping or swing trading too. Or, if you're not into scalping, swing trading could be a good option. The main thing is to try out different styles and see what works best for you.

But to answer your question, no, you don't have to diversify scalping with day trading. You can mix and match different styles however you want, as long as you're diversifying your overall portfolio. Just keep in mind that each style comes with its own set of risks and rewards, so be sure to do your research and be smart about it. Good luck!

Jamie

May 4 2023

Excuse me, I just want to tell you that mixing slower-paced trading styles, like swing trading, with faster-paced trading styles, like scalping and day trading, can help you balance out the risk in your portfolio.

Slower-paced trading styles generally involve holding positions for longer periods of time and taking advantage of larger market movements. This can help you capture bigger gains, but also involves holding on to positions for a longer period of time, which can be riskier.

On the other hand, faster-paced trading styles, like scalping and day trading, involve making quick trades and taking advantage of smaller market movements. While this can be a way to make gains quickly, it also involves higher risks, as the market can be unpredictable in the short-term.

By combining different trading styles, you can balance out the risks and rewards of each approach, potentially reducing overall risk while still having opportunities for quick gains

Barzagli

May 4 2023

I just have a question about leverage on eToro. The website says that we should diversify the leverage of our assets, but I've noticed that different brokers, including eToro, offer leverage for their assets at different rates. For instance, forex and metal may offer 1:500 leverage, while cryptocurrency may offer 1:20 and stocks CFD and indices may offer 1:100.

My question is, why do different assets have different leverage rates? I understand that some brokers offer the same leverage across all assets, but this seems to be rare.

Rui

May 5 2023

The reason why different assets on eToro and other trading platforms may have different leverage rates is due to the inherent differences in each asset class.

For example, forex and metal trading is generally considered to be more liquid and less volatile than trading cryptocurrency. As a result, brokers may offer higher leverage rates for these assets in order to encourage traders to participate in these markets.

On the other hand, trading cryptocurrency can be highly volatile and unpredictable, which means that brokers may offer lower leverage rates to help manage risk. Similarly, stocks and indices may have lower leverage rates due to the fact that they are less volatile than some other asset classes.

As for why some brokers offer the same leverage rates across all assets while others don't, this likely comes down to differences in their risk management policies and their overall business strategy. Some brokers may prefer to offer consistent leverage rates to simplify their offering and attract a wider range of traders, while others may prefer to adjust leverage rates based on the specific risks associated with each asset.

Jeshua

Jul 31 2023

You know what got me super intrigued? The fact that eToro offers a trading platform with a whopping 3,000+ instruments, including NFTs! That's right, Non-Fungible Tokens in the mix! Now, I'm itching to get in on the action and explore this whole NFT trading world.

But here's the thing - I'm not quite sure how to actually trade NFTs on eToro. I mean, it sounds fascinating, but I'd love to know the nitty-gritty details. How does one go about trading these unique digital assets on their platform? Can you spill the beans and enlighten me on the ins and outs of trading NFTs through eToro? I can't wait to dive in and discover this exciting realm! Thanks a bunch for helping me out!

Ryan

Aug 2 2023

In NFT trading, you can potentially profit in both bullish (rising) and bearish (falling) market conditions, unlike traditional assets like stocks, where profit usually comes from price appreciation. NFTs offer various ways to generate returns:

However, it's essential to remember that the NFT market can be highly speculative and volatile. While there are opportunities for profit, there are also risks involved. Do thorough research, understand the NFT's use case and demand, and only invest what you can afford to lose.

Read more: Top 10 Markeplaces to Buy NFTs

Martin

Jul 31 2023

After reading that article about eToro, I'm a bit puzzled. They seem to mention CFD and Forex separately, but to me, they sound kinda similar.

As far as I know, both CFD and Forex offer profit opportunities during bullish and bearish trends, and you can enter both buy (ask) and sell (bid) positions in both markets.

So, here's my question: On eToro's trading platform, is Forex considered a CFD (Contract for Difference) just like other trading instruments such as stocks, cryptocurrencies, indices, commodities, and NFTs? Or is there a difference between them? I'm eager to clarify this and understand if there's any distinction or if they're essentially two sides of the same trading coin. Thanks a bunch for helping me out with this!

Vito

Aug 1 2023

Hey there, I totally get your confusion after reading that article about eToro. I also have same problem too about Forex and CFD things. I mean, It seems like they mention CFD and Forex separately, but aren't they kinda similar?

You're right! Both CFD and Forex offer profit opportunities during bullish and bearish trends, and you can enter both buy (ask) and sell (bid) positions.

So, I'm wondering too - on eToro's trading platform, is Forex considered a CFD (Contract for Difference) alongside a diverse range of other trading instruments like stocks, cryptocurrencies, indices, commodities, and NFTs? I'd love to know if there's any distinction between them or if they're just two sides of the same trading coin. Thanks a bunch for clearing this up!

Read more: eToro Honest Review: the Pros and Cons

Ospina

Aug 2 2023

Let me break down that question for you, folks! On eToro's trading platform, Forex is indeed considered a type of CFD (Contract for Difference). CFD trading allows you to speculate on the price movements of various financial instruments without owning the underlying asset. This includes Forex pairs, stocks, cryptocurrencies, indices, commodities, and more.

The key feature of CFD trading is that it enables you to profit from both rising and falling markets. When trading Forex as a CFD, you can enter buy (ask) positions to profit from bullish movements and sell (bid) positions to profit from bearish movements.

So, essentially, Forex trading on eToro operates as a CFD, offering you the flexibility to trade various financial markets without the need to physically own the assets. This opens up a world of opportunities for traders, allowing them to access a diverse range of instruments and potentially profit in different market conditions.

Read more: How to Be a Successful Trader by eToro's Top Investor