US indices continue to surge ahead of the FOMC interest rate decision. If buyers' support remains strong, prices will penetrate Pivots.

Yesterday the American indices managed to rise. Today all three of them are showing mixed sentiment. From the data front, all eyes will be focused on the U.S. Federal Open Market Committee's interest rate decision and the press conference. Anyway, let's move on to the analysis, S&P 500 first:

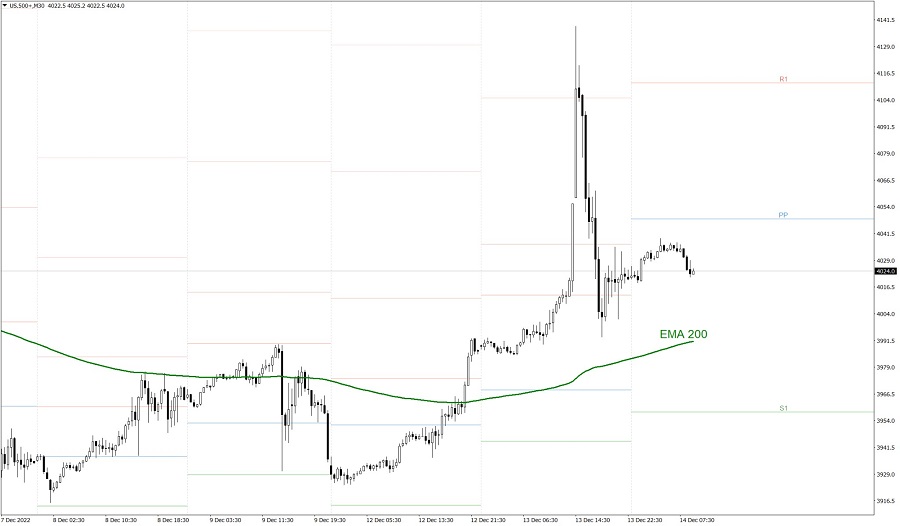

S&P 500

The S&P 500 rose significantly yesterday. The price finished the session above the R1 resistance level, at 4,020. Today it is showing mixed sentiment. If the buyers show their strength once again, the price might go up above Pivot Point and reach 4,050. But if the bears take control over the market, the price could even drop below 4,000 and reach the EMA 200.

NASDAQ 100

NASDAQ 100 was the strongest one yesterday. The price finished the session a little below the R2 resistance level, at 11,830. Today it is showing mixed sentiment. If the buyers show their strength once again, the price might go up above Pivot Point and reach 11,950. But if the bears take control over the market, the price could even reach 11,750.

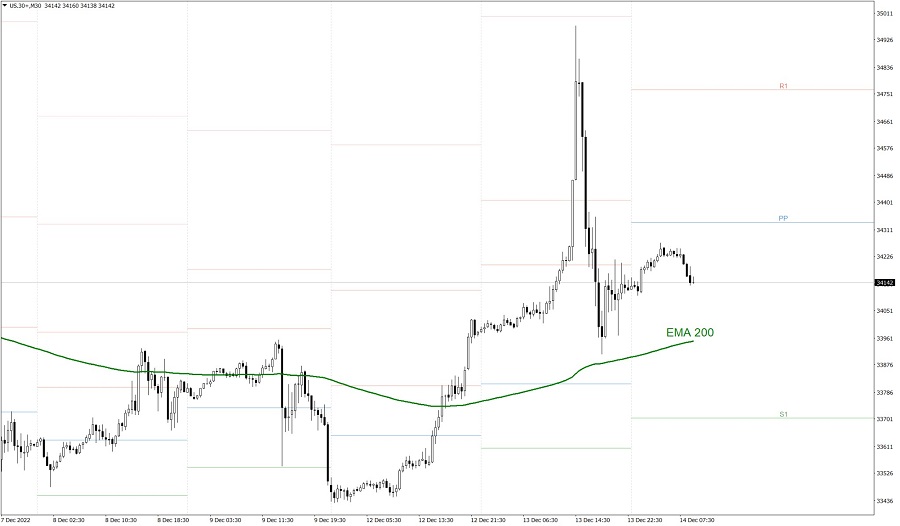

Dow Jones Industrial Average

The DJIA index managed to rise yesterday as well. The price finished the session slightly above 34,100. Today it is showing mixed sentiment. If the buyers show their strength once again, the price might go up above Pivot Point and reach 34,400. But if the bears take control over the market, the price could even drop below 34,000 and reach the EMA 200.

EXCO offers the ability to trade financial markets on leverage through multiple asset trading platforms. Be that pricing, execution, or promotions, they emphasize that what they advertise is what they give to clients, regardless of the size of their investment.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance