In the realm of conservative trading, traders usually choose investments that are secure and less prone to volatility, often with a focus on the long-term.

Conservative trading is an approach that prioritizes capital management and risk minimization. It's a smart path for stable, long-term investments.

Conservative trading is the opposite of aggressive trading. The concept behind aggressive trading involves assuming more risk and, as a result, being willing to accept bigger losses.

Traders with a higher risk tolerance aim to expand their portfolios by taking ten steps forward and accepting five steps backward. This approach differs from conservative trading, which prioritizes a slower, one-step-at-a-time approach.

Conservative Trading Involves More Waiting

Typically, conservative traders do not rush to enter positions. They tend to wait for confirmation signals before entry. Conservative entries are safer, with fewer losses but some missed opportunities. They require more patience.

In simple terms, you engage in forex trading to make a profit, right? The easiest way that comes to mind would be to take as many profitable positions as possible and accumulate the income you earn. However, the concept of conservative trading is quite the opposite.

Quite Similar with Buy and Hold Strategy

Conservative trading is often associated with a "buy and hold" strategy, where traders buy quality assets and hold them for extended periods, often years or even decades.

The fundamental idea behind this strategy is to capitalize on the historical upward trend of the financial markets. Instead of actively trading and trying to time market fluctuations, buy-and-hold traders believe in the power of compounding and the potential for their investments to appreciate over time.

Although conservative trading may generate relatively moderate returns when compared to aggressive trading strategies, it is favored by individuals who place higher importance on safeguarding their capital and maintaining a reduced level of risk in their investment endeavors.

Conservative Trading Needs More Confirmation

Conservative trading focuses more on taking truly safe positions. Conservative traders, those who follow this style, don't immediately enter a trade when there's a specific price movement. They tend to think one or two steps ahead, carefully weighing the comparison between the profit potential and the risks they face.

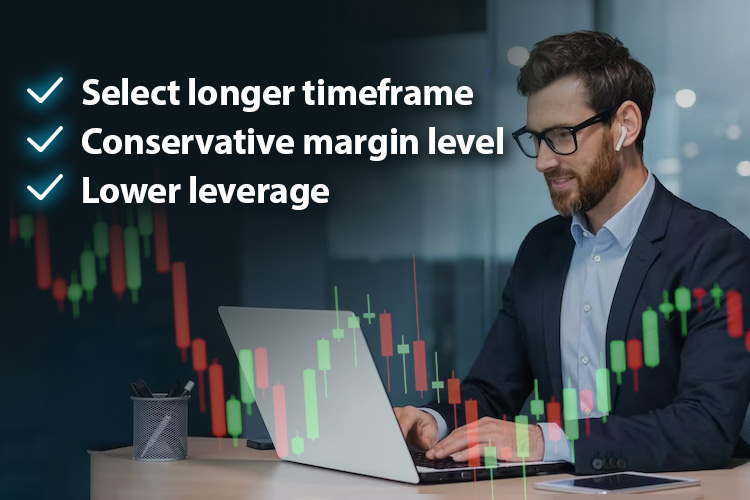

Aggressive entries occur at the initial signs of a reversal or other crucial movements, while conservative entries prefer to wait for more substantial structural shifts within the trend and multiple confirmations either from the market or technical signals.

For a clearer understanding, examine the chart below. This was taken from Jeafxtrading on their explanation of conservative vs aggressive entries.

Case Study: Meet Bob, the Conservative Trader

Still can't quite envision how it works in practice? In that case, let's take a closer look at the following case study, featuring Bob, who applies his risk management, time constraints, and financial goals, providing steady and lower-stress returns over time.

Bob is a conservative trader who prefers a long-term, low-risk approach to trading. He has a full-time job and doesn't want to be glued to his trading screen all day. He has chosen position trading to align with his financial goals and lifestyle.

- Bob only focuses on major currency pairs. He chose USD/JPY because he believes the pair is more stable and less prone to extreme fluctuations.

- He uses a weekly time frame.

- He uses conservative margin levels, never risking more than 1-2% of his trading capital on a single trade.

- He keeps a close eye on economic indicators, central bank policies, and geopolitical events that could affect the currency pairs he's trading.

Trade Example

Suppose Bob observes that the USD is strengthening due to positive economic data and the Federal Reserve's hawkish stance. He decided to take a long position on USD/JPY.

He practices conservative trading, which means he doesn't enter trades randomly. He takes a position at the level of 120.00. His current capital is $10,000. When should he set his stop loss and take profit levels?

The Outcome

- Risk Amount

= 2% of $10,000 = 0.02 x $10,000 = $200

- Risk per Trade

Assuming the ideal Stop Loss is at 119.50

= Entry Price - Stop Loss Risk per Trade

= 120.00 - 119.50 = 0.50 (or 50 pips)

- Position Size (in units)

Let's assume he's trading one standard lot (100,000 units) of USD/JPY, where one pip is worth 10 JPY.

Risk Amount / (Risk per Trade x Pip Value)

= $200 : (50 pips x 10 JPY/pip)

= $200 : 500 JPY Position Size = 0.4 standard lots (40,000 units)

- Take Profit

= Entry Price + (2 x Risk per Trade) = 120.00 + (2 x 0.50) = 121.00

So, for Bob's trade on USD/JPY, he could set his stop loss at 119.50 with a take profit at 121.00 to risk only 2% of his $10,000 capital. This way, if the trade goes against him, he won't lose more than $200.

4 Key Aspects of Conservative Trading

- Longer Time Frame Selection

The conservative trading approach involves selecting longer time frames, such as daily or weekly. This is done to steer clear of short-term market fluctuations that can be unfavorable. - Emotional Control

In the often volatile and unpredictable financial markets, the ability to manage emotions like fear and greed is of utmost importance. Conservative traders practice patience and composure, ensuring they don't make impulsive decisions based on short-term market fluctuations. - Conservative Margin Level

Traders should adhere to the principle of not jeopardizing more than 1-2% of their account balance in a single trade to avert substantial losses. Also, you should always maintain a sufficient margin level in your accounts. A conservative margin level typically hovers at around 200%, implying that traders should possess at least twice as much equity as margin in their accounts. This safeguards against potential losses and helps in averting margin calls. - Avoid High Leverage

In conservative trading, traders opt for lower leverage ratios to minimize the risk of substantial losses. High leverage can lead to rapid and significant capital erosion, which goes against the conservative trader's primary objective of capital preservation.

Pros and Cons of Conservative Trading

| Pros✔️ | Cons❌ |

|

|

Final Thoughts

In conclusion, conservative trading is a long-term approach to navigating the forex markets. It prioritizes the protection of capital and the minimization of risks, making it well-suited for those who value steady and reliable growth over potentially high returns.

Thus, this approach will be suitable for patient, risk-averse traders seeking peace. On the other hand, for traders who are enthusiastic, adrenaline-driven, and easily bored, conservative trading won't align with their style.

Therefore, conservative trading is fit for long-term strategies like position trading or trend trading strategy. Additionally, the carry trade strategy, which seeks differentials in currency pair prices for substantial income and long-term investments, pairs well with it.

Conservative trading won't be a good fit for scalping enthusiasts aiming to capture even the smallest profit opportunities. Day traders and swing traders will also likely find this approach less compatible.

The opposite of conservative trading is aggressive trading, which is commonly associated with scalping strategy. How does it work? Explore further in The Secrets of Successful Scalping Strategy.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance