Instant withdrawal allows traders to withdraw their money in less than 3 days or even in a matter of hours. The following brokers have been proven to give instant withdrawals.

Apart from the trader's skill and experience, the choice of broker may also determine the success of the trade. Among many factors that should be considered when choosing a forex broker, deposit and withdrawal are some of the most crucial ones.

Remember that in forex trading, you basically have to entrust your money to the broker. In this case, the deposit and withdrawal deal directly with the way you store and withdraw your funds. Therefore, you must make sure that the broker is safe and offers a wide variety of payment options with affordable fees.

Many traders often categorized withdrawal as one of the simplest indicators to detect a scam broker. Many scammers ended up taking their clients' money and blocking traders to withdraw.

That is why it would be wise to check if the broker has no withdrawal issues before opening a trading account there. Even better, a broker offering instant withdrawals would allow you to withdraw your funds relatively quickly.

In this article, we have summarized 5 brokers with instant withdrawals proven by real testimonies from traders. Including:

- FBS: Instant withdrawal process, only 15-20 minutes, maximum 72 hours.

- IC Markets: Free instant withdrawal service only took about 12-24 hours.

- Exness: Withdrawal process only take approximately 24 hours.

- Pepperstone: Only take 1-2 days for withdawal.

- XM: Withdrawal only takes a few hours to 2 business days.

- OANDA: Withdrawal usually takes at least 1 business day.

FBS

A client named Mike D once wrote his review regarding FBS' fast fund-refunds process. On August 21, he stated, "They are fast and reliable to get any of your withdrawal money."

Another review in the same month by VinK mentioned that the withdrawal process at FBS using Skrill and Neteller takes only 15-20 minutes, with no commission applied.

There was also a trader from Malaysia who expressed that they successfully withdrew funds from FBS using a local Malaysian bank, with a processing time of just 15 minutes and no issues.

From the available reviews, almost all of them indicate that FBS's withdrawal process is very fast and straightforward. As you may know, FBS is one of the top global brokers that has been operating since 2009 and has served millions of clients. FBS is licensed by several regulatory bodies such as ASIC, CySEC, FSCA, IFSC, and FCA. FBS is available in 190 countries worldwide.

FBS is well-known for offering favorable trading conditions. They offer a comprehensive range of financial assets, including forex, commodities, metals, energies, stocks, bonds, indices, and cryptocurrencies. The required minimum deposit to open a trading account with FBS is only $1. Furthermore, FBS frequently provides deposit bonuses and attractive promotions.

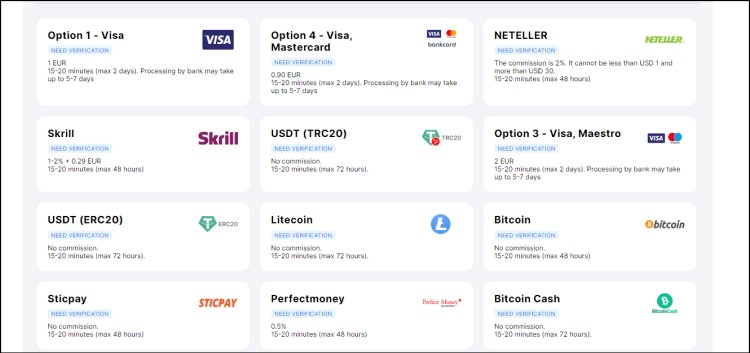

Many clients stay with FBS not only due to the appealing trading conditions but also because of the ease and swiftness of their withdrawal process. Clients have a variety of withdrawal methods to choose from, depending on what is available in their respective countries.

In general, FBS offers withdrawal options using local banks, Visa, MasterCard, Neteller, Skrill, FasaPay, Perfect Money, and Stic Pay. FBS also provides withdrawal options using cryptocurrencies like Bitcoin, Tether, Ethereum, Litecoin, and Bitcoin Cash.

All available options take around 15-20 minutes to process. In a short time, the requested funds will be credited. Some options ensure a maximum processing time of 48 hours or 2 business days, while others have a maximum of 72 hours or 3 days. Due to this speed, FBS has become a favorite among many traders worldwide.

Since 2009, the action of FBS Holding Inc. or known as FBS in the world of forex trading has been recognized by various international institutions. With clients reaching 14 million as of 2019, FBS has received the title of Most Transparent Forex Broker 2018, Best Investor Education 2017, Best Customer Service Broker Asia 2016, IB FX Program, and many others.

FBS is regulated by FSC Belize and CySEC Cyprus. This broker has been trusted by millions of traders and 370 thousand partners from various countries. Based on their data, FBS garners about 7,000 new traders and partner accounts every day. And, 80% of the clients stay in the FBS for a long time. No wonder the broker is growing rapidly due to the incredible growth in the number of clients.

Trading products offered by FBS range from forex, CFD, precious metal, and stock. For forex trading, CySEC-regulated FBS offers leverage up to 1:30 on Cent and Standard Accounts. Clients who want to try higher leverage than that can alternatively register an account under FBS Belize.

FBS spread begins from 0.5 pips for Pro account type and from 0.7 pips for Standard and Cent accounts. On a standard account, volume orders can be made from 0.01 to 500 lots. Therefore, this account is recommended for experienced traders.

Whereas on Cent Accounts, volume orders can be carried out with a maximum of 500 cent lots or the equivalent of 5 standard lots. Cent Accounts involve a different level of risk. FBS recommends Cent Accounts for beginner traders. All account types support the following trading instruments: 36 Forex pairs, 8 metals, 3 energies, 11 indices, 127 stocks, 5 crypto pairs.

Before plunging into the real forex market, traders can practice with FBS Demo Account which consists of two types, i.e Standard and Cent.

FBS uses the MetaTrader 4 and MetaTrader 5 platforms. They offer them on Windows and Mac as well as Android and iOS mobile. These platforms provide a trading experience at traders' fingertips, allowing traders to progress as a trader anywhere at any time.

MetaTrader platforms also have a variety of mainstay features, including the possibility to create, buy, and use expert advisors (EA) and scripts, One-click trading and embedded news, technical analysis tools, the possibility to copy deals from other traders, hedging positions, and VPS service support.

Another advantage provided by FBS is a deposit bonus of 100% for clients who fulfill certain requirements. The process of FSCing and withdrawing funds can be run easily and quickly. Based on clients' testimonies, each process usually takes no more than 3-4 hours, except on holidays.

Traders also have the opportunity to develop a side business when trading with FBS, namely as an Introducing Broker (IB) or Affiliate. The FBS partnership system provides partner commissions that are already in 3 level positions. Only by introducing new clients to FBS according to certain procedures, traders can earn extra income.

Traders will also get trading education experience at FBS. They have prepared a comprehensive forex course. The course consists of 4 levels: beginner, elementary, intermediate, and experienced. Traders can take courses that will turn them from newbies to professionals. All materials are well-structured. Besides, FBS provides various forex analyzes, webinars, forex news, and daily market analysis that can be accessed easily on their site.

Traders can access the FBS website with many language choices. Of course, this will increasingly provide comfort for traders. Available languages include English, Italian, French, Portuguese, Indonesian, Spanish, and others. Live chat support is also provided 24 hours 7 days a week.

In conclusion, FBS is a widely known broker among retail traders around the world. It continually grows to become a preferred broker because of flexible trading conditions that enable its clients to trade with various instruments, low deposit, and other trading advantages.

IC Markets

On 14 April 2015, Marx64 from Estonia wrote that he has been using IC Markets for a year and was satisfied with the service. Withdrawing funds with credit or debit cards only took about 12-24 hours, free of charge.

Another member called Space-trader from France also claimed that he has tried many brokers and IC Markets ended up being the best choice among all of them. He said that after the broker solved the DDoS issue in October 2015, IC Markets has been striving better than ever.

Shellsnail, a Singaporean trader and a High Impact Member of Forex Factory (top 1%) highly recommended IC Markets and stated that he never had any issues with withdrawal processes. He had withdrawn himself about 30 times or more, with more than $10,000 in profits. He said the process took about 3 business days.

For your information, IC Markets is an ECN broker that was founded in 2007. This ASIC-regulated broker is well-known to be suitable for scalping, day trading, and automated trading. The high reputation of IC Markets makes it often referred to as the best broker in Australia with many interesting and high-tech features.

For instance, this broker provides various types of platforms including MT4, MT5, and cTrader to support its raw spread offering so that clients can enjoy the best possible price in the market.

Regarding withdrawal, the broker offers a commission-free withdrawal with various payment options, such as bank wire, credit/debit card, PayPal, Skrill, Neteller, WebMoney, and Fasapay. Traders can choose several account currencies since IC Markets supports AUD, USD, JPY, EUR, NZD, SGD, GBP, CAD, HKD, and CHF. However, remember that each payment may have different ions of currencies.

IC Markets is an online forex broker operating under the company of International Capital Markets Pty Ltd. Traders under the Australian jurisdiction are provided with the trading service of IC Markets AU that is headquartered in Australia and licensed by the Australian Securities and Investments Commission (ASIC).

On the other hand, non-Australian traders who open an account in this broker are registered under IC Markets SEY that is based in Seychelles, and regulated under the Seychelles Financial Services Authority (SFSA). The dual operation is a result of the relatively new rules from ASIC that prohibit their regulated broker to offer trading services outside Australia.

Classified as an ECN broker, IC Markets provide clients with MetaTrader 4, MetaTrader 5, cTrader as platform trading options. This broker also follows market trends to include Cryptocurrencies as one of its products, enriching its already wide selection of trading assets that include Currencies, Indices, Metals, Energies, Softs, Stocks, as well as Bonds.

The minimum deposit in IC Markets is in the middle range compared to other ASIC-regulated brokers, as it reaches $200 for every client. Market analysis materials are also prepared regularly for trading insights on IC Markets's official website, proving their competence to serve their traders with important contents created by market experts that work specifically for them.

For payment methods, IC Markets allows funding and withdrawal via wire transfer, credit card, PayPal, Skrill, Neteller, FasaPay, UnionPay, as well as Bitcoin via BitPay. The more interesting aspect from this broker is its multi-base currencies that include USD, AUD, EUR, GBP, SGD, NZD, JPY, CHF, HKD, and CAD.

As the trading technology in IC Markets is highly equipped with co-located servers and extremely low latency (especially on cTrader), the broker is widely known for its capability in hosting traders with the special needs for high-frequency trading as well as scalping.

To sum up, IC Markets is a fitting destination for active traders looking for a well-regulated broker. IC Markets is also flexible in terms of base currency and payment methods, signaling their commitment to welcome traders beyond their home country. As of late 2019, IC Markets provided their website in 18 international languages including English, Korean, Indonesian, French, Spanish, Italian, Malay, German, and Chinese.

Exness

A trader with the username of Forexgain is a High Impact Member in Forex Factory (top 1%) from India. He wrote that no other broker can beat Exness in withdrawal in a thread titled "Best Withdrawal Brokers". He testified that all withdrawals are processed automatically and the process is really safe and fast.

Another member from Iran with the username of Smt361 added his comment by stating that Exness is still the best broker regarding its withdrawal feature, especially by e-currency. He added that he had withdrawn $300,000 from Exness without any problem. Other than Exness, he also recommended Roboforex for instant withdrawal.

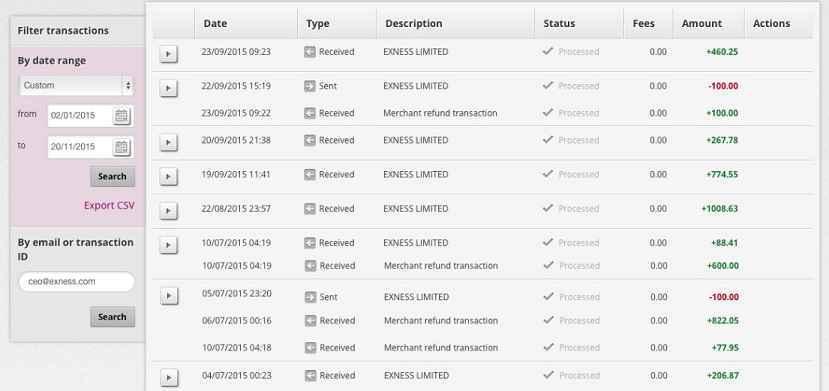

A similar statement also came from Rockthepips from Budapest, Hungary. He stated that Exness has the best withdrawal facility and included this screenshot:

Exness is a broker founded in 2008 and has become one of Europe's most popular forex brokers. The company is considered safe and reliable because it is under the regulation of CySEC (Cyprus) and FCA (UK). Exness is well-known to have an excellent withdrawal feature with many payment methods including wire transfer, credit card, WebMoney, SticPay, Skrill, Neteller, Perfect Money, and Bitcoin. Other than that, the broker also offers a quick withdrawal process in less than 5 minutes.

One of the main facilities provided by this broker is automatic withdrawal. The broker's website states that 98% of the withdrawals are automatic on most e-payments. Every withdrawal process will be checked first by the broker to ensure the authenticity of the order given.

Once it is authorized, the withdrawal request will be processed automatically and it will only take a few moments. Should the order is not subject to instant execution, the process will take approximately 24 hours.

Withdrawing funds in Exness is really simple. All you need to do is:

- Access your Personal Area.

- Click on the Withdrawal tab, choose a payment method.

- Fill in details like account number, payment method details, and the amount you wish to withdraw.

- After that, you need to confirm the transaction by entering the verification code sent to your device of choice (email or SMS).

However, keep in mind that the payment system you choose must be the same as the one used for deposits. Although there is no limitation, there may be minimum or maximum limits depending on your payment method.

The choice of broker is adjusted to the needs of each trader. If you are a trader who only needs a basic platform and trading features with the best attributes, then Exness can be your best choice.

Exness covers its lack of feature variations with other advantages like low spreads starting from only 0.1 pip. This is very suitable for traders who use scalping strategies (Scalper). Spreads on major pairs in certain account types can also be as low as 0.0 pip, depending on market conditions.

Not only that, but traders can also enjoy other advantages such as automatic fund withdrawals. Exness processes the majority of client withdrawals instantly, without manual checks; however, withdrawals may be subject tos depending on the payment provider or method of choice.

The safety of traders' funds is also guaranteed as Exness is one of the European-based STP/ECN brokers. Exness's ability to become an official partner of the Real Madrid soccer team for 3 years, starting July 2017, also provides evidence that the company has high solidity.

Deposits and withdrawals may be made 24 hours a day, 7 days a week. However, it is important to note that the company shall not be liable fors in processing deposits and withdrawals if suchs are caused by the payment system.

Traders do not need to worry about transaction fees when depositing and withdrawing. Exness doesn't charge any transaction fees to traders even though some charges may be incurred depending on the payment provider of choice. A variety of payment methods are provided for traders, including Wire Transfer, Bank Card, Neteller, Skrill, and many others.

The financial reports and metrics on the Exness website are audited quarterly by Deloitte, one of the four largest public accounting firms globally.

Moreover, Exness is one of the mote transparent brokers in the online trading industry. Traders can find out all information about this company on the website, such as trading volume, number of active clients, client deposits, company funds, and many more.

The platforms provided by Exness vary in MetaTrader 4, MetaTrader 5, Web, and Mobile platforms. This makes it easy for traders when trading on Exness, as they can also access Exness platforms anywhere and anytime.

Over the years, Exness has developed into a broker that attracts traders. Trader's trust is further enhanced by its compliance with financial regulations like the FCA and CySEC.

One measure of client confidence can be put on the trading volume. By December 2018, their clients' monthly trading volume reached USD348.4 billion and active traders around the world surpassed 50,342.

Through the program offered by Exness, traders also have the opportunity to earn extra income by becoming their partners. From the Introducing Broker (IB) program, partners can earn up to 33% spread commission from every new client that registers with them.

Additional income can also be obtained from Exness Partners. Traders can get a spread commission of up to 25% per transaction made by traders who register through an affiliate link.

When trading with Exness, clients can also make use of its free VPS hosting services. A VPS (Virtual Private Server) offers increased reliability and stability for traders as they can maintain their trades and expert advisors without interruption in the event of unexpected technical issues, such as internet or electricity downtime.

From the review above, it can be concluded that Exness is a favorite broker for traders because of low spreads and flexible account types. This condition is very suitable for traders with limited funds but is in need of more opportunities to get maximum profit. This broker is also well known for its maximum support on both new and existing partners.

Pepperstone

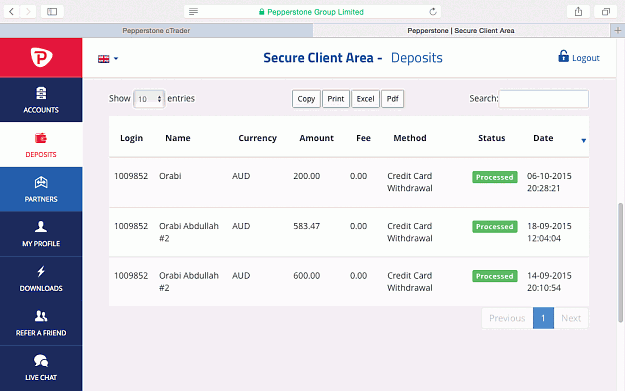

One of the popular Commercial Members in the Forex Factory, Orabi from Spain, stated that the withdrawal process in Pepperstone only takes about 1-2 days. He attached a screenshot of his Client Area view:

Similar to Orabi, a High Impact Member (top 1%) Dimi. A from Sidney is also satisfied with Pepperstone. Under the thread "Which brokers allowed you to withdraw profits without a problem?" she commented that Pepperstone is still the best in terms of withdrawal features. She also mentioned in her testimonials that she never had any issues with Pepperstone before, especially regarding deposits and withdrawals.

Pepperstone accepts withdrawals via Visa, MasterCard, POLi, bank transfer, BPay, PayPal, Neteller, Skrill, and Union Pay. In Pepperstone, you can withdraw your funds by heading into your secure client area. According to the broker's website, a minimum withdrawal amount for international bank wire transfers will be shown after completing the request in the client area.

Apart from that, it is important to note that you can only withdraw up to 90% of your free margin. In other words, the amount can change as the free margin of your account changes too.

But don't worry, this will be updated regularly and sometimes within a matter of seconds only. The broker will process all withdrawal requests on the same day if the broker receives them before 21:00 GMT. Otherwise, you have to wait for the following day for the processing.

Pepperstone was founded in 2010 by a team of experienced traders with a shared commitment to improve the world of online trading. Based in Melbourne, Australia, they grew to become one of the largest forex brokers in the world. If traders want to find a broker that provides low spreads, fast execution, and award-winning support, then the answer is Pepperstone.

Pepperstone has a strong legality guarantee because it has been licensed by the Australian regulator ASIC and FCA. Traders' funds can be deposited in segregated accounts at top Australian banks, one of which is the National Australia Bank (NAB). Therefore, the safety of funds is not a concern if a trader chooses to open an account in Pepperstone.

They succeeded in collaborating with 23 top banks to bring Bid to investors instantly via optical fiber. This allows all orders to be executed 100 percent automatically with low latency up to 0.05 milliseconds, without dealing desk intervention and requotes, as well as with super low trading costs.

Trusted by over 73,000 traders around the world, Pepperstone processes an average of USD12.55 billion of trading volumes every day. Because of that, they have many awards such as:

- The Best Global Forex ECN Broker 2019 and Best Forex Trading Support-Europe

- Best Australian Broker and Best Trading Platform 2018 by Compareforexbrokers.com

- Best Forex ECN Broker, Best Forex Trading Support, and Best Forex Trading Conditions by UK Forex Awards 2018

With the many rewards gained, Pepperstone hopes to attract more and more traders from all over the world. The rising performance of Pepperstone is not only due to the super-tight spreads and fast execution that it provides, but also because many traders are interested in trading with deposits in currencies other than US Dollars.

For this reason, Pepperstone is one of the most market-responsive brokers because it is willing to accept deposits in 10 currencies, which include AUD, USD, EUR, CAD, GBP, CHF, JPY, NZD, SGD, and HKD.

Trading in Pepperstone would allow traders to choose between 11 trading platforms: MT4 for desktop, MT4 Mac, MT4 iPhone, MT4 Android, MT4 iPad/Tablet, MT5, WebTrader, cTrader WebTrader, cTrader cAlgo, and cTrader Mobile. The choice of trading platforms may seem confusing to novice traders, but actually, it is very useful because it has fast execution.

When trading forex, traders can enjoy raw spreads from 0.0 pips on Razor accounts, over 61 currency pairs, and commission-free account funding on a wide range of deposit options. In addition to currency pairs, Pepperstone provides many types of trading instruments, including CFDs for indices and shares, commodities, and cryptocurrencies.

Instruments in commodity trading are pretty much diversified. Not only metal, gold, and silver, but traders can also trade with soft commodities such as cotton, sugar, coffee, cocoa, and orange juice. Pepperstone also provides trading on energy (oil and gas).

There are two types of accounts provided by Pepperstone, namely Razor accounts, and Standard accounts. If you area beginner, it is recommended to choose a Standard account with an average EUR/USD spread of 1.0-1.3 pips and free commission.

Those with particular trading styles such as scalpers and algorithmic traders may enjoy the lower cost setup traditionally seen in a Razor account, with a commission from AUD7 round turn of 100k traded. You can start trading with a minimum lot of 0.01 (micro) and 1:400 leverage.

As a Pepperstone client, a trader can fund and withdraw with alternative methods including Visa, Mastercard, POLi internet banking, bank transfer, BPay, PayPal, Neteller, Skrill, and Union Pay.

If you are new to trading or looking to practice your trading strategies in a risk-free environment, you can create Demo Account in Pepperstone. But if you are an experienced trader or prefer to learn by doing, Pepperstone provides a Live Account that allows you to trade with live executions and pricing.

Traders can also follow and copy strategies from popular traders using third-party services while learning how to improve their trading abilities. Pepperstone has partnered with a range of social trading platforms that traders can choose from, such as Myfxbook, ZuluTrade, Mirror Trader, MetaTrader signals, and Duplitrade.

XM

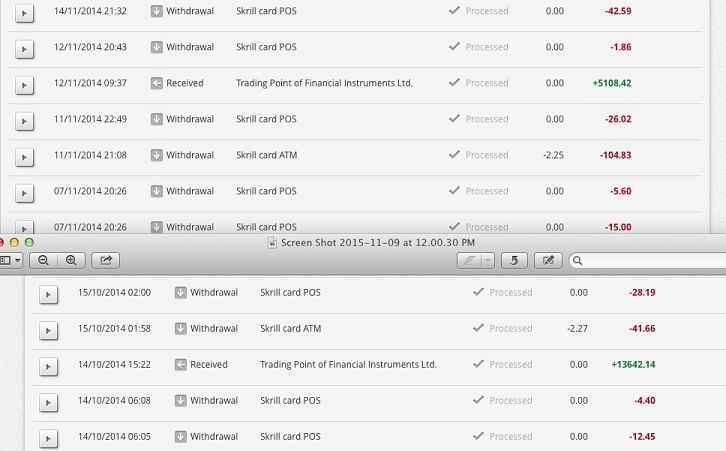

Not only did he leave comments for Exness, but Rockthepips also recommended XM and took a screenshot that shows the broker's fast withdrawal process (it only takes a few hours to 2 business days in 2014).

Another member with the username of Trader700 from the US also agreed that XM is a great broker in terms of withdrawal. He replied to a comment that accused XM of manipulation and scam.

He specifically wrote that he won a broker contest prize of $4,300 and had withdrawn all of it without encountering any issues. He thought people needed to stop blaming the broker when the stop loss was highly strict on volatile markets.

XM is a top broker that was established in 2009 and is regulated by several top-tier regulatory bodies including ASIC (Australia), CySEC (Cyprus), and IFSC (Belize). XM offers a wide variety of payment methods: Visa, Mastercard, Maestro, UnionPay, Skrill, Neteller, WebMoney, and bank wire.

The processing time is relatively quick as the broker will process your request within 24 hours. You will receive your money on the same day for payments made via e-wallet, while other payments such as bank wire and credit/debit card usually take 2-5 business days. The smallest amount that you can take or withdraw is $5 and there are no fees attached to it.

XM Group is a group of regulated brokers and it is owned by Trading Point Holdings Ltd. Entities under XM Group have significant experience as financial services providers worldwide.

Trading Point of Financial Instruments Ltd was established in 2009 with headquarters in Limassol, Cyprus, Trading Point of Financial Instruments Pty Ltd was established in 2015 with headquarters in Sydney, Australia, XM Global Limited was established in 2017 with headquarters in Belize and Trading Point MENA Limited was established in 2019 with headquarters in Dubai.

XM Group is regulated by the CySEC (Cyprus Securities and Exchange Commission) - Trading Point of Financial Instruments Ltd, FSC (Financial Services Commission) – XM Global Limited, the ASIC (Australian Securities and Investments Commission) - Trading Point of Financial Instruments Pty Ltd and DFSA (Dubai Financial Services Authority) - Trading Point MENA Limited.

XM is one of the more experienced brokers in the world of online forex trading today. Since its founding, the broker has experienced a lot of changes, including the addition of the Ultra-Low Account and EN Live Edu that is instructed by 16 global experts.

In terms of trading instruments, XM is a well-known diverse class assets provider, varying from Forex, Crypto, Stock CFDs, Turbo Stocks, Commodities, Equity Indices, Precious Metals, Energies, & Shares. XM prides itself to be the ideal broker in trading execution, offering a stat of 99.35% orders to be executed in less than 1 second. Trading in XM would be also provided with a strict no requotes policy, no virtual dealer plug-in, no rejection of orders, real-time market execution, and the choice for traders to place orders online or by phone.

Spreads on all majors can reach as low as 0.6 pips in Ultra-Low Account, while spreads on other accounts usually start from 1 pip.

To protect the client's fund in the event of extreme volatility, XM presents each account type with Negative Balance Protection. Minimum deposit of $5 applies to Standard, Micro, and also Ultra-Low Accounts. Traders who open accounts in XM are enabled a condition similar to a Cent Account environment in the Micro Account, in which the Contract Size for every lot is only 1,000 units. If it is applied with the smallest lot size in the MetaTrader platform which amounts to 0.01, it means that traders can go as small as 10 units per trade.

For the deposit, XM applies zero-fee deposits in most of its available payment methods. Traders can choose to fund or withdraw their accounts via wire transfer, credit card, as well as the most favorable e-payment choices like Skrill, Neteller, and FasaPay.

To give their clients the best experiment in trading, XM has given access to both MT4 and MT5 platforms, each is available for more than 6 display formats (PC, Mac, Multiterminal, WebTrader, iPad, iPhone, Android, and Android Tablet).

All in all, there is no doubt that XM has gone global with its deep commitment to providing services in more than 30 different languages across the world. Aside from easing traders' experience with mainstream trading platforms and high-quality trading execution, XM is open to various types of traders, from small capital traders to the more experienced ones with big deposits at the ready. Traders are even provided with a Cent Trading environment should they choose to register under Micro Account.

For their global approach, XM has ensured that traders from various countries could access their service easily. This results in the provision of different domains specified for traders in certain jurisdictions. For example, traders from Indonesia could access XM via this link.

OANDA

OANDA is one of the top regulated brokers that are based in the US. If we look at the comments on Forex Factory, we'll find a good number of traders recommending the broker, especially for its withdrawal feature. One of those traders is Lion from the US.

He wrote, "Withdrawing funds from OANDA via debit card usually takes at least 1 business day. One time, I even receive the money on a Saturday. I won't recommend any other method. Debit card is the best option."

OANDA is an American forex broker founded in 1996, giving it a relatively long track record. It is regulated by several trusted regulators including The US Commodity Trading Futures Commission.

OANDA offers an easy and quick withdrawal process with no fees except for bank transfers and PayPal. Also, it is worth mentioning that the withdrawal option and fees vary depending on your domicile.

Regarding withdrawal limits, no specified policy should be paid attention to. It is implied that there is no minimum or maximum limit, but there is a certain restriction when choosing the transfer method.

Clients can withdraw their original deposit funds via debit card or other payment methods, but the rest of the funds should be withdrawn via bank transfer.

Traders looking for brokers with accurate precision, OANDA can be an option. That is because OANDA is a broker that provides quotes with 5-digit accuracy and active price movements that follow market developments. Order execution speed is also faster in this broker.

It provides benefits for novice traders, as they can trade with smaller volumes using the calculation system based on currency value, unlike other brokers adopting the lot system.

Founded in 1996, OANDA was built by Dr. Michael Stumm who is a lecturer in Computer Engineering at the University of Toronto, Canada, along with his colleague, Dr. Richard Olsen of The Olsen Ltd., which is one of the leading econometric research institutes. They have a head office in San Francisco, United States.

OANDA branch offices can be found everywhere. Some of these offices are located in the United Kingdom, Singapore, Japan, and Canada. With this number of offices spread, OANDA has increasingly attracted the attention of clients worldwide.

OANDA's company is registered under several well-known jurisdictions in financial trading. They are regulated by CFTC and NFA in the US, FCA in the UK, ASIC in Australia, and many others. Traders do not need to worry anymore about security when trading in OANDA. However, these advantages make trading rules at OANDA more stringent compared to other brokers.

For example, OANDA only allows maximum leverage of 1:20, because the rules in the US and Japan do not allow leverage above that. Besides, the registration procedure is more complex due to various additional requirements that are not submitted by other forex brokers. On top of that, hedging is not allowed in one trading account as the client must open an additional account to hedge.

Nevertheless, OANDA is known for being a leading broker with many advantages offered. OANDA faces increased market risk during periods of price volatility, such as economic and political news announcements. When market spreads increase or decrease, their pricing engine widens or narrows spreads accordingly. That way, traders can get the latest conditions from price movements in the market more quickly.

Prices move very fast in the market. Especially when news releases have a large impact on market volatility. This condition is often exploited by brokers to take advantage of clients with Requotes. However, traders do not need to worry about additional costs when trading with OANDA.

The company never withdraws Requotes so traders can get maximum profit. When traders are unavailable to monitor open positions, they can set take profit orders to lock in profits and Stop Loss orders to help protect against further losses.

As an experienced and well-known online forex broker, OANDA is committed to maintain an efficient trading environment that reduces latency and provid tools to help clients manage the degree of acceptable slippage.

With a fast & reliable trading platform by OANDA, clients' trades are executed in 0.012 seconds. This suits traders who choose brokers based on execution speed.

Because of this exceptional execution service, it is not surprising that OANDA won many awards, including the winner of the world's Best Retail FX Platform at the prestigious e-FX awards. The broker is also voted number 1 for Consistency of filling trades at quoted prices, Execution speed, and Reliability of platforms.

There is no minimum deposit or minimum balance required to open an OANDA account. Deposit and withdrawal can be done easily. OANDA provides a variety of payment method facilities, including Paypal, Wire Transfer, Credit Card, and Debit. Traders can adjust it to the region where they live.

OANDA provides more than 100 trading instruments, including 71 currency pairs, 16 indices, 8 commodities (Brent Crude Oil, Copper, Corn, Natural Gas, Soybeans, Sugar, etc.), 6 Bonds, and 23 Metals.

The fxTrade and MetaTrader platform are available at OANDA. These platforms can be used for Desktop and Mobile. Another plus is they have an OANDA Technical Analysis that exists in collaboration with a technical analysis provider called Autochartist.

With these platforms, clients can monitor price movements easier and automatically recognize patterns created on charts, as well as receive alerts when the awaited patterns appear. Access to this technology can be enjoyed free of charge.

In conclusion, OANDA is an ideal broker for traders in need of fast execution backed by many years of experience. The company is also a good alternative for those looking for a well-regulated broker with flexible trading and deposit conditions.

Conclusion

Choosing a broker with instant withdrawal is important yet often underestimated. Being able to withdraw your funds quickly and safely is something you can't always get from any broker. If we look at the brokers mentioned above, we can see that all of them are regulated and have more than enough experience to be highly reputed among traders.

In the end, you would want to pick a broker that suits you the most, whether it concerns your capital, trading condition, payment method, etc. It would also be helpful to check the reviews from other traders so you can see if the broker really acts according to what they claim or not. Trying out the demo account might also be useful as you can use their platform and try their service before depositing any funds.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance

11 Comments

Queen Jr

Oct 29 2021

No matter how many good features on a forex broker. The most important thing is the broker should be consistently good service on their withdrawals process. I used to trade with Oanda that will process your withdrawal in 1 business day if raised through skrill, Neteller, or debit/credit cards. That's awesome.

Amier

Feb 7 2022

Queen Jr: That's right, Oanda is the best overall. I have traded on this broker for years and no problem at all.

Amintha

Apr 21 2022

Queen Jr: If you only rely on a fast deposit or withdrawal process, good customer service, without looking at other important aspects such as order execution, trading facilities, it seems that it is still lacking. Order process and CS should not be the main benchmark in choosing a broker. There are other aspects that are better

Adriano Lopez

Nov 25 2021

Deposits and withdrawals are always sensitive. If a broker is not serious about this, then there is a loud NO from my side. I had my account on Exness that was brilliantly running, but it was time for me to change the broker because of some system-related issues. Their withdrawal process was amazing, never got any late withdrawals.

Wilhelmina

Apr 13 2022

Adriano Lopez: What kind of issue do you mean? Currently I also using EXNESS. Reading your comments makes me anxious. Are they cheating?

Maria Clearwater

Apr 18 2022

Wilhelmina: They don't cheat. It's just that as an EXNESS user lately there have been a lot of system maintenance which sometimes disturb the deposit or withdrawal process. The process doesn't take long, it's just that if you are used to a smooth process and then suddenly encounter problems several times, it is clear that traders will start to feel doubtful.

Mark Davis

Apr 11 2022

The audacity to put OANDA on this list!!??? Instant withdrawal and OANDA shouldn't on the same sentence.

Alexander Perry

Apr 12 2022

Mark Davis:LOL that's what I tought too. Please author, define instant withdrawal. If it takes 2-4 hours to receive the money, it's not instant.

Rachel Swinton

Jan 24 2023

In an absolute state of shock to be honest, invested in two Forex companies and both brokers really took everything I had, worst of all they kept making me invest more my life's savings. It was by pure co incidence i got in contact with GH they helped me get all of my funds back. For others who have been in similar situations do reach out to Geminihacks -.- com they would help you get it all back.

Fernan

Apr 7 2024

It's emphasized that selecting a broker offering instant withdrawal is crucial but often overlooked. Having the ability to withdraw funds rapidly and securely isn't always guaranteed with every broker. Reviewing the mentioned brokers reveals they are all regulated and possess ample experience, making them highly esteemed among traders.

As for my question about highly reputable and safe regulations, could anyone elaborate on which specific regulatory bodies or standards I am referring to?

Sammy

Apr 9 2024

Hey there, as for your question about highly reputable and safe regulations, I'd say it's crucial to look for brokers regulated by recognized authorities such as the Financial Conduct Authority (FCA) in the UK, the Australian Securities and Investments Commission (ASIC) in Australia, or the Commodity Futures Trading Commission (CFTC) in the United States. These regulatory bodies set strict standards and oversight to ensure brokers operate with integrity and safeguard traders' funds.

some articles about those regulator, you can read :