The euro is under pressure since market participants expect the ECB to extend its QE program. Due to these expectations and the stable oil price around 50 USD, expect the euro to fall to 1.4490 and below.

Alpari: Market reviews

Short-term Trading Idea FX EUR/CAD – Bear Speculation: Development on 31st August Ideas

Trading opportunities for currency pair: the euro is under pressure since market participants expect the ECB to extend its QE program. Due to these expectations and the stable oil price around 50 USD, expect the euro to fall to 1.4490 and below. A close of the weekly candle above 1.4930 will stop any fall.

Background

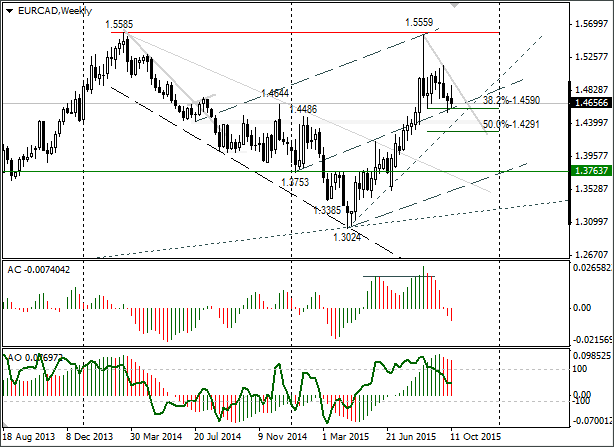

In August we could see a pinbar forming, on the weekly graph. I went for a fall of the euro to 1.4490 and then to 1.4220. Between 31st August and 19th October, the EUR/CAD has dropped 109 points. The pair has been stuck in a correctional phase for three weeks so not much has happened. The euro has lost 1.84% against the Canadian over the last three weeks (-275 points). The falling tendency is set to continue for the euro.

Current situation

On Thursday (15th October), the ECB’s Ewald Nowotny pushed the eurobulls into closing long positions. It’s highly likely that, before the ECB’s Thursday meeting, we’ll see euro sales increase across all pairs. A day earlier, on Wednesday, the Bank of Canada is set to convene.

The euro is under pressure, while the Canadian has support from the oil quotes. Brent costs more than 50 USD per barrel and doesn’t want to fall, even with news that OPEC extraction is up and so are reserves. Market participants are focused on the fall of oil rigs and oil extraction in the US.

According to the latest data from Baker Hughes, the total number of rigs in the US for the week ending 16th October was down by 8 to 787. This is a 1131 fall for the year. The number of oil rigs was down by 10 to 595. Gas rigs were up by 3 to 192.

What’s interesting at the moment?

The 1.4490 and 1.4220 targets are still on. The pair has now bounced from the 38.2% fibo-level from a growth from 1.3024-1.5559. For the fall to hasten, we need to see a strengthening below 1.4480. A close of the weekly candle above 1.4930 will cancel out the fall. As a long-term target, we can take 1.4000 for April 2016 (along the dotted line from the 1.3024 minimum).

Vladislav Antonov, Alpari Analyst

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance