Is your broker honest? Check out these forex broker cheats, how to tips identify and recover from them. After all, trading with a fair and reliable forex broker is crucial to ensure your success.

Trading with a good broker is one of the main keys to ensure the success of your trading. Imagine if you had a well-planned trading strategy and controlled psychology, but your broker cheated you in the back. All your efforts and hard work will certainly be wasted.

The main trading facilities such as platform, price quotes, and order execution tools are all provided by the broker. If the broker intends to manipulate their clients' trades, no matter how good their trading strategies or how calm their mental states, their capital will always be in danger. Not because of the risk of loss from the market's perspective, but because the broker plays its part to steal their clients' money discreetly.

6 Common Forex Broker Cheats

Normally, forex brokers profit either from commission fees or spreads from their clients' transactions. Still, some brokers use fraudulent ways to try and get bigger profits. It sounds terrible, but it's a real issue in the forex brokerage business. Of the many ways those forex brokers can trick you, here are 6 of the most common forex broker cheats:

1. Stop Loss Hunting

Brokers who frequently do this are also known as "stop loss hunters". With the help of a particular type of software, the broker monitors clients' trades and manipulates the spreads. This trick is not limited to the use of certain software. Sometimes, brokers also employ special experts to carry out their fraudulent acts. This trick is to make sure that the clients' trading positions are quickly hit by stop loss when the market price moves against their orders.

For example, a short EUR/USD position at 1.2180 is placed with a stop loss at 1.2280. When the price moves up to 1.2275, the difference between the current market price with the stop loss is only 5 pips away. Say the initial spread costs 2 pips, there are only 3 pips left before the order hits the stop loss. In a situation like this, a stop loss hunter will widen the spread from 2 pips to 5 pips, so that the short position is closed with a stop loss.

Forex broker cheat like this is difficult to identify because most traders will think that they are the ones who miscalculate the price movement.

2. Mark-up Spreads

Well, this one has to do with ECN/STP brokers. Although they claim to be able to transfer orders directly to liquidity providers, not all brokers of this category apply the provider's original spreads. As a matter of fact, some of them want to earn a bigger income and end up marking up the spread.

An unreliable ECN/STP broker will add some extra pips to the raw spread from the liquidity provider. For example, the EUR/USD spread can be increased from 0.5 pips to 1.5 pips and no clients will know that the spread has been marked up.

How do you find out if your broker likes to mark up the spread? Believe it or not, you can ask the broker directly. Some ECN/STP brokers openly state that they mark up spreads because they feel they have the right to do so. You can also check the authenticity of spreads from an ECN/STP broker that (perhaps) covers up its spread mark-up by directly comparing the broker's spread with the actual market spread.

The normal spread in the market is usually very low. Even for crosses such as GBP/JPY, the spreads offered by liquidity providers can only be up to 3 pips.

See also: Forex Brokers with the Lowest Spread for Cross Pairs

3. Slippage

Here is an example of a case that retail traders often talk about. Slippage is the execution of an order at the price that was not ordered. This condition can occur when the market is very active due to a surge in volatility. However, this naturally only applies to ECN/STP brokers, given the system that allows them to connect the clients' orders directly to the liquidity providers.

The process does run automatically, but obviously, it takes time because of latency (the time interval in which data is transferred from the client to the liquidity provider server). When the market is very active, price volatility will increase rapidly, so it's no wonder that orders can be executed at a different level from the price you ordered previously. In this case, slippage is reasonable.

But it can be modified into a forex broker cheat, especially if the slippage frequently occurs when the price movement is stable. This way, slippage can be one of the ways for scheming brokers to take advantage of clients' losses.

For example, a buy position of EUR/USD is ordered at 1.3120. But after clicking the buy button, the order is executed at the level of 1.3135. If the price then goes up to 1.3140, the profit will be only 5 pips instead of 20 pips. But if the price goes down, for example to 1.3110, then your loss can accumulate to 35 pips, when the loss from the initial price will only be limited to 10 pips. Take a note that we haven't included the spread fee yet.

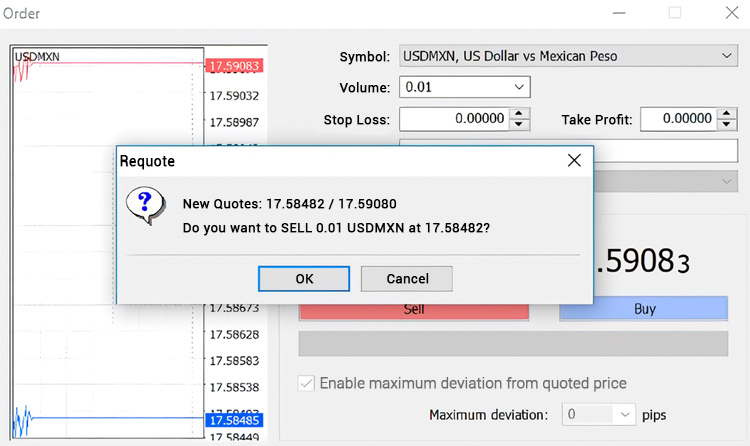

4. Requote

Requote is a in trade execution, wherein the broker will offer you a new (less profitable) quote so that you can continue the entry. This forex broker cheat usually aims to prevent traders from reaping profits from a position that goes well with the current price trend.

For example, when prices are falling sharply, you decide to step in with a sell entry. This winning scenario will be prevented bying the order's execution. In replacement, the broker will offer a different price (requote) in which your sell order can be executed, only after the price has dropped to a lower level (when the bearish momentum is about to run out). You will find it difficult to get the maximum profit if the broker frequently requotes you.

5. Swap Manipulation

A swap is a commission you have to pay when you have an overnight position. The fee is calculated from the difference between the interest rates of a currency pair. In general, the swap can vary between brokers. But first, you can review the comparison between the broker's swap rates and the actual differences between the central bank's benchmark rates. If the comparison is not too drastic, then it can be concluded that your broker doesn't manipulate the swap rates. However, if it is too extreme, this could be a sign that your broker is taking too much profit from overnight positions.

Long-term traders who usually leave their positions open for days are obviously the most affected, especially if the applied swap rates are not in favor of their orders.

6. High Leverage

Initially, leverage was considered to be a powerful feature, able to support a trader to take a trade size larger than his capital strength. But this facility can also leave an account vulnerable to margin calls when overused. When a market maker offers a leverage of up to thousands and even reaches 1:2000, instead of helping you, it may plunge your trading account to a very quick loss.

The broker type that is most likely to apply high leverage options is the market-maker one. ECN/STP brokers are typically not allowed to provide the facility. How so? Liquidity providers are not allowed to handle the risk of using too much leverage, thus leaving ECN/ STP brokers out of this type of forex broker cheat.

Is Your Broker Really Cheating?

After knowing the 6 forex broker cheats above, it doesn't mean you can immediately accuse a forex broker of a scam when you experience losses either from frequent stop loss executions or slippage. Many traders immediately "feel cheated" by their brokers after reading a bit of information about the broker's fraudulent tricks without really getting the real lessons. Therefore, it's a good idea to pay attention to the following ideas:

1. Requote is the Deal Breaker

Requotes can be identified as the only cause of loss by a fraud broker, especially if this happens to your positions most of the time. There are really no other words to defend this trick, so you may seek alternatives to open an account with another broker should your current broker gives you a lot of requotes.

2. Stop Loss Hunting or Just a Common Mistake?

"My broker cheated because the stop loss was hit even though it wasn't the time yet."

Firstly, you need to check what causes your stop loss to be hit faster. Could it be that you are trading when the volatility increases and the stop loss is placed too close to the entry level? Another possibility is that you don't have good trading psychology, which in turn causes you to frequently move your stop loss in the event of extreme price fluctuations.

On the other side, if your positions are often subject to stop losses due to spreads that suddenly increase, then this could be a warning signal. To confirm this, you can run 2 of the same positions on the forex demo account and live account simultaneously. Open buy positions with the same stop loss levels on the demo and live accounts.

When the price drops and approaches the stop loss, pay attention to whether the position on the live account has been hit by the stop loss first or not. If the buy position on the live account has been hit by a stop loss but the position on the demo account is still running, then it confirms that your broker is a stop loss hunter. But if not, you could be the one who miscalculates the stop loss and the market condition.

3. A Study of Slippage

"My broker is cheating because the slippages happen too often"

For this one, first, pay attention to the type of your broker. If it is an ECN/STP, then this kind of situation is ideal, and the slippage is not always a disadvantage. In reality, inaccurate order executions from slippages can be profitable at times. For example, when you buy EUR/USD at 1.3250, the position can be executed at a lower price at 1.3240. It is still considered a slippage since the execution price is not at the ordered level. This is what you call a positive slippage.

In market makers, slippages are generally resulting in clients' losses (negative slippages). Don't believe their notion that the slippage is caused by increased volatility, because this type of broker can control their own pricing.

The important key here is, slippage in ECN/STP brokers can vary between positive or negative slippage, while slippage in market markers is mostly negative. If you open a buy position, then the slippage is always at a higher level, while for a sell, slippage always occurs at a lower level.

How to Protect Yourself from Forex Broker Cheats

You can avoid them by choosing a broker more carefully. Here are things you can pay attention to avoid the mischief acts of a fraud broker:

1. Broker's License Does Not Guarantee Everything

Many people think that a regulated broker is always good and will never perform forex broker cheats. In reality, it is not actually true. Oftentimes, the license is only used by brokers to attract clients registering with the broker. In fact, behind the common assumption about prestigious regulators, there are phenomena as follows:

- There are always fraudulent acts that can be committed without being detected by regulatory agencies.

- Brokers can bribe regulators to hide their fraudulent acts.

- Some important figures who hold positions in regulatory agencies are the owners of brokerage companies.

Therefore, don't consider license and regulation as the only important factors when choosing a broker. You should understand the next points to further avoid forex broker cheats.

2. Testimonials and Reviews

Testimonials from traders can be a good indicator, as they offer some clients firsthand experiences with brokers. You can browse various testimonials and broker reviews, especially regarding the 6 forex broker cheats above as well as the quality of the payment process. However, you need to be able to distinguish which ones are real complaints and which ones are just emotional complaints.

Sometimes, irrational traders or beginners who don't really understand anything give bad testimonials just to smear their brokers' reputations. Also, there is always a possibility of fake reviews and testimonials from competing brokers (if negative) or the broker itself (if positive).

3. Recognize the Difference Between a Market Maker and an ECN/STP Broker

The market maker acts as a dealer and seeks profit against the trades of his clients. They profit when you lose, and lose when you earn. On the other hand, an ECN/STP broker act as an intermediary and will not open positions against their clients because they do not get anything when their traders lose. The more clients grow their accounts, the more profitable the ECN/STP broker will be.

From a glimpse of the differences above, it is clear that forex broker cheats are ideally more practiced by market makers. If you are already trading at an ECN/STP broker and are still experiencing these problems, it could be that the ECN/STP status is just a cover. In other words, the broker is just a market maker who hides behind its ECN/STP claim to attract clients.

Meanwhile, the ECN/STP broker was also not immune to cheating. Marking up the spread is one example to get them more money discreetly. Market makers on the other hand will never mark up the spread because they control how much the spread costs to be fixed. To increase the spread, they can do it directly without having to mark up the actual market spread.

Apart from the methods above, only swap manipulation can apply to both types of brokers. Although both have the potential to be fraudulent, however, trading at an ECN/STP broker is much better and safer than a market maker broker. At least, this type of broker does not compete against your trading position so there are fewer cheats that can be practiced against you.

4. Terms and Conditions

Have a good understanding of the broker's documents relating to the terms and conditions as well as the bonus programs. Brokers generally provide this file and can be accessed before you open an account with them.

5. Don't Be Quick to Trust

After examining a broker, don't immediately register an account with a large deposit. Test the trading service with a demo account or live account with a minimum deposit.

If you already trade in a problematic broker, the solution is not only limited to withdrawing all funds and immediately closing the trading account. Before deciding to reach the point of no return, consider these two things:

- When you are sure that the broker has cheated you, learn what caused your trading losses. Apply the tips we discussed earlier. After that, check the trading terms and conditions. If there are details in the document that "justify" the broker's fraudulent actions and they have escaped your attention, then the broker is not to blame. You must be prepared to face the risk of your own negligence. After that, withdraw all of your funds and close your trading account with this broker.

- If you have confirmed that the broker's fraudulent act cannot be "justified" by their terms and conditions, send a complaint to the broker's customer service. You can be assertive, but don't be rude. Describe your problem and include the proofs. Also, state the actions you will take if there is no significant response from the broker. These threats may include the publication of broker's fraud on broker review websites, reporting to the regulatory agency (if the broker is regulated), or marking the broker on certain websites that warn against broker scams.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance

19 Comments

Macejkovic

Nov 4 2021

Well said brother. forex Brokers are not a scam. It's just the same as every other business in the world.

Sometimes, there are a lot of dishonest Forex Brokers that need to be aware of. To do that, make sure you trade on the right brokers that have a license from the bonafide regulator.

Winata Kusuma

Jan 15 2023

Macejkovic: At some cases, the brokers do fake the regulations. So they mention on their website where they have regulated. As a professional and experienced trader, you can tell the difference between fraudulent brokers and those who aren't. But for a newbie like me just starting out in Forex, it's hard to tell if a broker is a scam or not. Even in this article it is said that a broker license does not guarantee everything! Broker fraud or not based on what we know. No need to try to deposit in them, right?

Sandy

Jan 15 2023

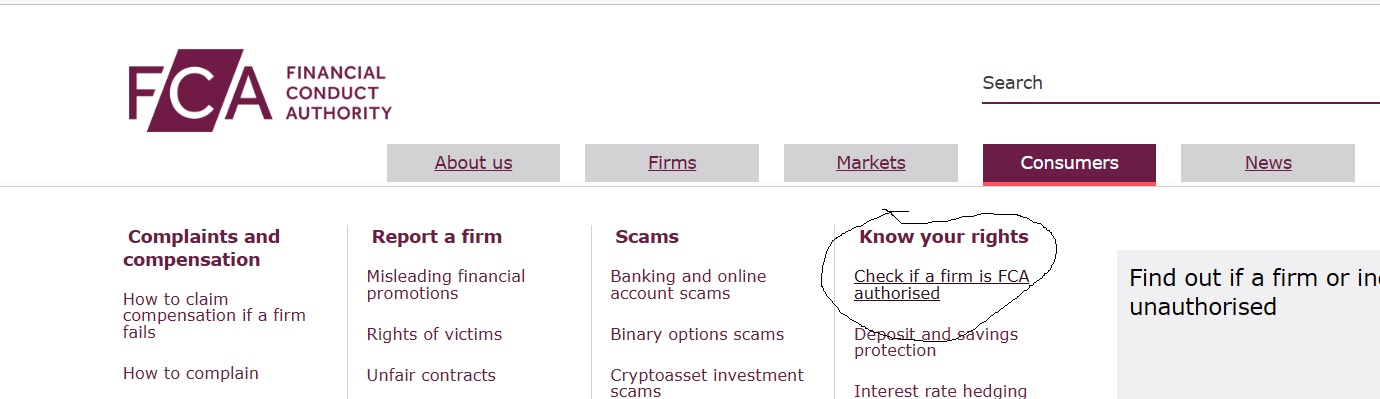

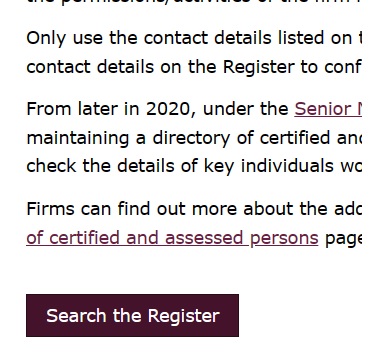

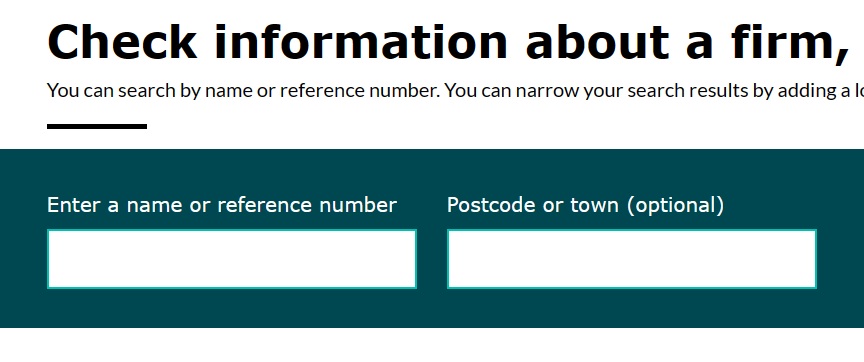

Winata Kusuma: Let me answer dude, the best way to check the regulation is by checking the regulator's website. For example, if the brokers said about being regulated by FCA (UK body regulator), you can directly check their website. Here is some steps. open the FCA website, which is you can search by googling, after enter the website: search for customers and click on the submenu : check is the firms is authorised Next, after entered the submenu, find the register search register and click on it

Next, after entered the submenu, find the register search register and click on it  After that, you will get into the register FCA website and you can enter the number regulation that your brokers wrote at its website. If not found, the broker is scam broker!

After that, you will get into the register FCA website and you can enter the number regulation that your brokers wrote at its website. If not found, the broker is scam broker!  this is my method, and it is 100% accurate to see your broker are scam or not. As the article said about the manipulation that may brokers do is true after all but if they are registered, they will not manipulate because they can being punished

this is my method, and it is 100% accurate to see your broker are scam or not. As the article said about the manipulation that may brokers do is true after all but if they are registered, they will not manipulate because they can being punished

Frank Paulo

Nov 22 2021

Very good article

Sarada

Dec 3 2021

A few quick ways to notice a forex broker scam:

1. How well is there customer support when dealing with issues.

2. if the broker is offering insane leverage like 1:3000

3. if the major forex pairs quotes are off by 10 to 20 pips from regulated major pairs.

4. (experienced traders only) stress testing the broker by depositing and flipping accounts then withdrawing profits quickly to see how fast they approve it.

these are all red flags if you encounter any of these issues. I would recommend is going to a forum that literally rates 1000s of brokers and can tell you from other past experiences/reviews of other traders whether they are legit or not.

Jaqualine

Jul 1 2022

Sarada:hey can you please share a link to this forum please

Sullie

Jan 15 2023

Sarada: I disagree with one of your statement. The leverage for example, some brokers may offer high leverage like 1:3000 but you can choose to use it or not because most of brokers may offer lower deposit too. But I do agree about the manipulation of major pair's quote and the deposit and withdrawing issues. By the way, this website also has article that said about the red-flagged brokers too. You can read at this link : red flagged broker.

Kyle

Dec 13 2021

I am a former forex trader. Now, I have been quit trading after I got bad experience dealing with a forex broker in the past.

MiMi

Apr 12 2022

Kyle: Failed to trade not only because the broker is cheating you know. In fact, many traders do not understand trading, so that if there is a slight loss, they immediately blame the broker. Even though he himself did not understand. Sorry for broker English. I use Google Translation.

Kaya Maguire

Nov 27 2022

I think it doesn't matter if someone quits forex because a lot of people have failed in forex not only because of lack of understanding of forex but also because of environment and emotions in trading. In fact only few forex trader that enter the Forbes. Even top 3 in Forbes sometimes come from Technology Industry, Retail Industry and E-commerce industry like : Tesla, Amazon, and Apple. If the broker is cheating, it can hurt traders and cause them to give up. Also, if they have tried forex trading many times and still lose, it is possible (sorry to say) that they are not very good and not talented at forex trading. I also believe in luck that has to happen in forex, even a little, as well as knowledge of forex, technical and fundamental; Price action; and so on, and hard work and discipline will lead to success in forex

Mariana Fishers

Apr 11 2022

What is an example of a market maker broker?

Tommy

Jan 15 2023

Mariana Fisher: A market maker broker is a broker that can hold orders or hold against orders. So, when you trade with an MM broker, you are essentially trading against a broker or other trader who has the opposite order on your broker's behalf. In this condition, brokers are called market makers because they create their own liquidity pools. The best example of a market maker broker is eToro, although it is a hybrid broker with some markets using STP and ECN brokers, but some markets currently in use the market maker method. You can read the review at: eToro Review And remember that not all market maker brokers are bad. In some cases, they also offer fast execution and low fees. And one, MM brokers do not offer scalping. From this point on, you may find that your broker is most likely an MM broker.

Janette

Apr 13 2022

Testimonials cannot be used as a benchmark to determine whether a broker is good or not. In practice, many brokers pay people to give fake reviews. The review could be a review that is too good for a broker or a review that vilifies other brokers.

Matilda

Jan 15 2023

Janette: I have some tips to see if the review of brokers is an honest review or not. first of all, all brokers will have very average scores. If the score is based on five stars, 1 star is the worst and 5 is the best, you can see the if all reviews give 5 and 4 stars, and get 4.9 scores. You must be careful because this maybe fake review. But if you found a review that has 4.4 or 4.5 it still can be considered. And for me, if I found a review that has only 3 stars or 3.5 stars, I can ensure that will have some honest reviews in there. I can say it because first of all, our money is deposited in brokers. Imagine if we get a little bit of trouble in trading even losing at trading, sometimes the trader will give a bad score. So, it is not perfect or too well graded in the review broker's grade. it's my experience, you can believe it or not. Thank you

Haruto 陽翔

Apr 18 2022

The three main enemies of trading in my opinion are: slippage, stop-loss hunting, and spread modification. These problems sometimes stress me out.

Jared

Dec 16 2022

Haruto 陽翔: Slippage is common in the forex market and cannot be classified as broker fault. But I do agree that stop-loss hunting and spread modification can be main enemy at trading. Especially, stop loss hunting and spread changes can be a serious problem as they can be done at any time and under the broker's control. Yes, it can be a serious loss and as a trader you may not know about it as it works quietly. I think you should test your broker first. A lot of people say you can buy ratings, so I don't rely on ratings so I have to be extra careful when choosing a broker.

Renato Manahan

Dec 1 2022

The points raised are apply to traders with no trading strategy and only use "Technical Analysis" of the shapes and angles of trading chsrts ususually, they use Candlestick charts that tell you only ehatvyou already know. A teadet with a strategy already tskes into account all these minor amounts of spreads, swaps, commissions and rates of slippages. Assuming the aggregate of all of these total say 20 pips, then a trader eith a strategy will only place a trade that will cover them plys his expected trading profit.

Oh Seyun

Jan 22 2024

As per the article, it suggests acquiring a thorough comprehension of the broker's documentation, specifically focusing on terms and conditions and bonus programs. Brokers typically furnish these details, and they are accessible prior to initiating an account with them.

I'm interested in knowing what specific examples or terms one should pay attention to for a comprehensive understanding. In other words, what kind of language or instances in the terms and conditions ensure that the broker is transparent and not engaging in deceptive practices? Knowing the regulations is good, but what are the practical aspects to look out for?

Jeremy

Jan 25 2024

Here are examples of terms and conditions that you might find in a broker's documentation based on my experience (note : it might be general term and condition that broker offered:

These examples illustrate the types of information you might find in a broker's terms and conditions. It's important to carefully read and understand these terms to ensure a clear understanding of the broker's policies and practices.