Due to low export prices for commodities and the expected worsening foreign debt situation, over the next two years the NZRB will need to force its currency rate down. In connection with this, it's likely we'll see a growth from the AUD/NZD to 1.13 by the end of August.

Alpari: Technical Analysis

Short-term Trading Idea FX AUD/NZD - Bull Speculation: Hammer Formed

Trading opportunities for currency pair: The New Zealand central bank is readying itself to drop its base rate. Due to this, it’s likely we’ll see a growth from the AUD/NZD to 1.13 by the end of August.

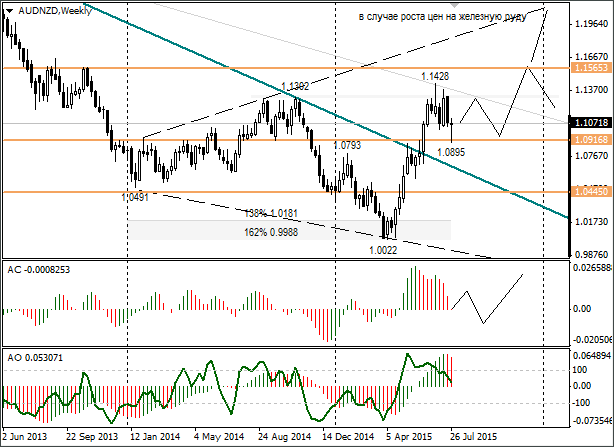

Before my holiday I did a review on the AUD/NZD. In it I assessed the likelihood of a fall in the AUD/USD on a pinbar to the 1.0835-1.0916 zone. Last week the 1.0895 target was reached. The idea came to fruition.

On Wednesday 29th June, the AUD/NZD broke from 1.0895. The jump happened after the RBNZ’s governor gave a speech. In his speech, Graeme Wheeler announced that a drop in the base rate is needed for stimulation of economic growth and inflation.

Due to low export prices for commodities and the expected worsening foreign debt situation, over the next two years the NZRB will need to force its currency rate down. In connection with this, I’ve set a fall for the NZD against the AUD.

The Aussie isn’t doing any better. It’s suffering because of low iron ore prices and weak Chinese stats. Last week’s candle closed with a hammer. The break was clean from the support. There’s reason to believe that the price will return to 1.13. If the price of iron ore starts to recover, growth in the AUD/NZD will hasten. The line forecasts which I’ve drawn show how the Aussie could strengthen against the New Zealander. For the moment, this idea sees me looking at a growth to 1.13.

Vladislav Antonov, Alpari

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance