Various reactions emerged after Jerome Powell speech. US markets indices showing upwards and downwards movement.

Yesterday's speech by Fed Chairman Jerome Powell caused some increased volatility in equity markets, both upwards and downwards, which was interesting. In consequence, all three American indices managed to set their new highs. What's more, two of them went even higher during the Asian trading session last night. So, what can we expect next? Let's see below.

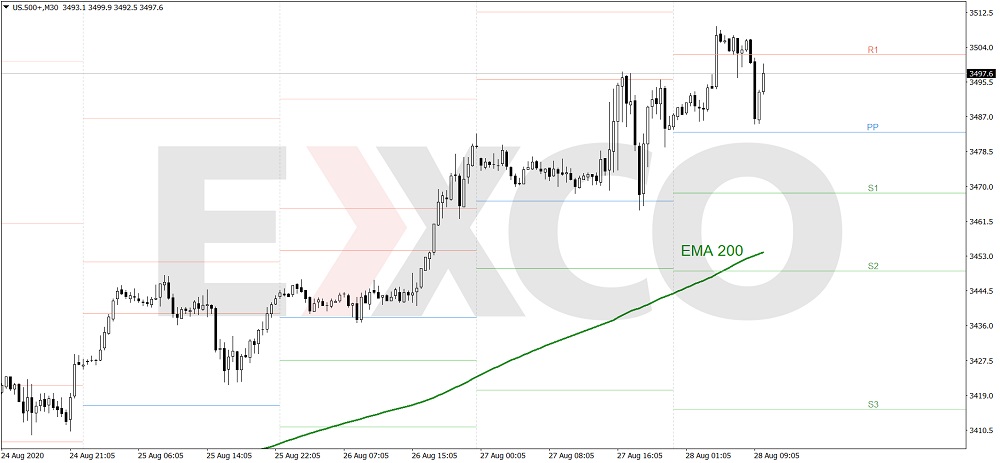

S&P 500

During the Asian trading session, the S&P 500 finally crossed the 3500 psychological barriers. However, it didn't manage to hold above the R1 resistance level this morning. Now it seems that the price is going to attack it one more time. Only falling below the Pivot Point could raise concerns about the bullish bias today.

NASDAQ 100

NASDAQ 100 seems to be relatively weaker than the S&P 500 today. After setting the new all-time high, it fell lower than the others yesterday afternoon, and in consequence, the price didn't manage to go higher during the Asian trading session. Now, the bulls are trying to defend the Pivot Point. If they do it successfully, we can expect the test of the R1 resistance level, which is also where the price peaked yesterday. However, if they fail, the price might go down to the S1 support level, which is also the place where yesterday's low was, or even test the EMA 200.

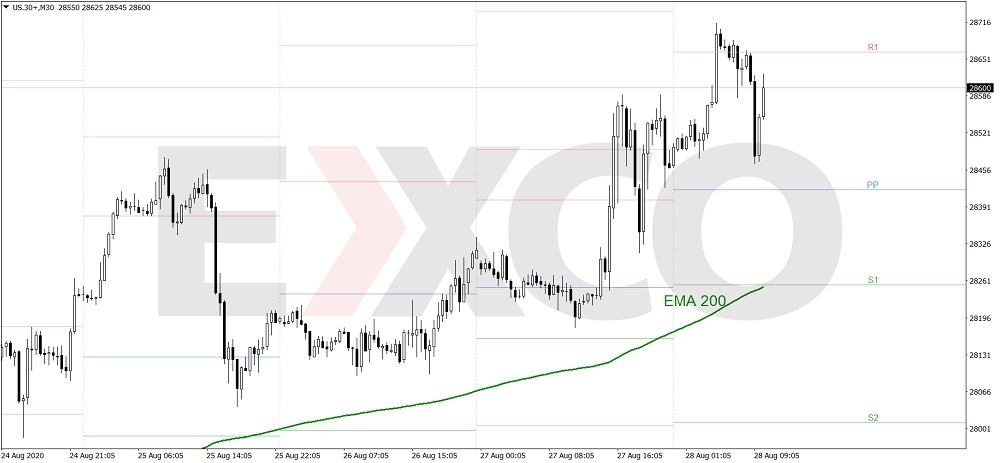

Dow Jones Industrial Average

The DJIA index acts similarly to the S&P 500 today. After going very high during the Asian trading session, it didn't manage to hold above the R1 resistance level this morning. Now it seems that the price is attempting to beat it once more. In this case also, only falling below the Pivot Point would flip the daily chart bearish today, but for now, the bullish bias seems to be pretty safe.

EXCO is a broker for traders to to trade financial markets on leverage through multiply asset trading platforms. Be that pricing, execution or promotions, they emphasize that what they advertise is what they give to clients, regardless of the size of their investment.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance