Choosing between price action or indicator is not a matter of which one is better but a quest of traders' understanding of the market. For beginners, it's probably safer to use indicator trading.

There are two major methods employed for technical analysis and both methods have been sources of debates and discussions over the years among traders. The two methods are price action trading and indicator trading. This article will be discussing both methods while also offering insights on how to choose between the two.

Contents

What is Price Action Trading?

Price action trading is a form of technical analysis that involves chart analysis based on price movements and this determines the trading decisions of traders. Some of the tools employed by price action traders include support and resistance levels, chart patterns (e.g. heads and shoulders, wedges, etc.), trendlines, and candlestick patterns (e.g. engulfing, spinning top, etc.).

Pros of Price action trading

- Price action trading enables traders to draw conclusions that are unique to them from the analysis they carry out. Thus, they have more control over their trading decisions since these are based on their interpretation of the price action which will most likely differ from one trader to another.

- Since it encourages subjective interpretation which means no right or wrong, this allows price trading action to be compatible with just about any type of trading strategy.

Cons of Price action trading

- The analysis of price action can be time-consuming since it is difficult to automate.

- Due to its subjective interpretation, novice traders might find it difficult to optimize price action trading since they are yet to fully understand how the market works.

What is Indicator Trading?

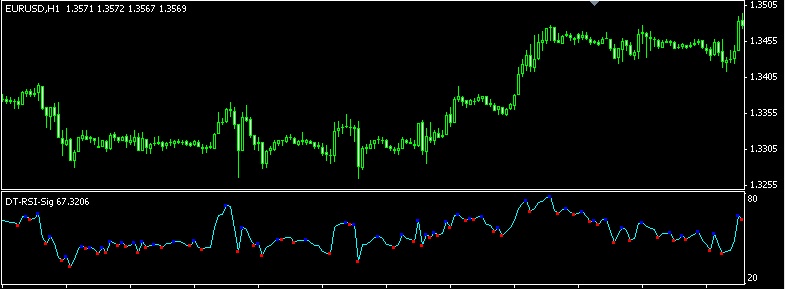

Trading with indicator is a form of technical analysis that employs indicators for the analysis of a financial instrument and then uses that to generate trade signals.

Pros of Indicator trading

- The signals of indicators tend to be clear as their interpretations are usually the same for most traders. This is because they tend to use common pre-defined parameters to represent definite things.

- Indicators are rarely subjected to human errors since they are purely based on programming and calculation.

- Novice traders can easily learn and use this method of technical trading because all they need is to apply the indicator to their trading platforms and it will generate trade signals automatically.

Cons of Indicator trading

- It requires rigorous testing before using so that traders can be sure the indicator will generate reliable signals.

- Indicators can sometimes be leading or lagging and this may be a problem for novice traders. This will likely lead to them making a lot of errors when trading if they do not know whether their indicator is leading or lagging.

Differences between Price Action and Indicator Trading

- Indicator trading can be learned faster by novice traders and it is easier to use though this does not necessarily automatically translate into more profits. On the other hand, price action trading is a bit more difficult for novice traders to pick up due to the manual effort involved.

- Indicators are automatically drawn on the chart while traders have to draw price action patterns.

- Since the signals generated via indicator trading are automatic, they tend to be objective and are not subject to how a trader interprets them. However, the signals generated via price action trading are entirely subjected to a trader's interpretation.

So, Which One is Better?

At the end of the day, it all comes down to a trader's preference because as you can see from above, both have strong pros as well as cons and it is up to traders to decide the most suitable one for them. Truth is that each method can only be as optimal as the trader using it.

If you are still fixated on the method that is better and more guaranteed to produce profitable results, you might be focusing on the wrong thing. This is because you can easily combine both methods which will allow you to use the strengths of one approach to complement the weaknesses of the other one.

You can employ the objectiveness of indicators to make your decision based on the analysis of price action. For instance, you can wait for your indicator to generate a buy signal and then use price action to determine how you will enter your trades using the signal generated by the indicator.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance