Trading in a mobile app provides convenience for many traders nowadays. If you're from the UK, these trading apps can be good recommendations based on their popularity.

In the fast-moving world of finance, having the right tools can make a big difference. Trading apps are like powerful helpers in your pocket, letting you trade financial instruments more easily everywhere you go.

But with so many choices, it can be hard to pick the best one. In this article, we'll list the most popular UK trading apps, making it simpler for British traders to find one they like.

- eToro — Well-established platform pioneering in copy trading

- AvaTrade — Most user-friendly for beginners

- Vantage — Integrated technical analytics within the app

- FxPro — Swift execution and global reach

- OANDA — Reliable transaction speed

- Plus500 — Commission-free accounts and tight spreads

- Trading212 — Easy-to-use chart powered by TradingView

Now that we've gone through the lineup of the UK's most popular trading apps, let's take a closer look at who they are.

DISCLAIMER: All data provided in this article are updated as of April 1, 2024.

Breaking Down Most Popular Trading Apps for UK Traders

To fit the criteria of being a popular trading app in the UK, we've researched platforms that are brought by FCA-licensed brokerage companies. To determine their popularity, the number of downloads and ratings are used as the main criteria as they both represent users' choices and satisfactions. As such, these brokers's apps are already sorted by their FCA status, number of downloads, and user ratings.

|

|

|  |  |  |  |  |

| Visit Vantage | Visit FxPro | Visit OANDA | Visit Plus500 | Visit Trading 212 |

eToro

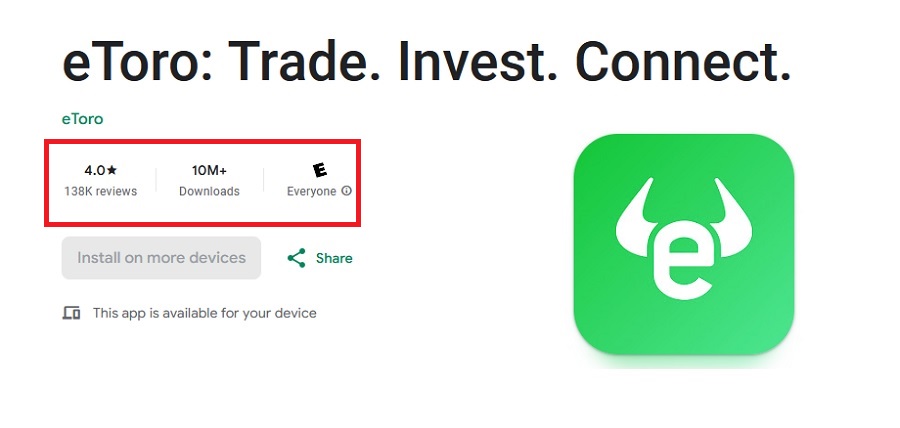

The eToro trading app provides an investment platform across various asset classes at low costs, offering zero commissions on stock investments. Renowned for its pioneering social trading, eToro is popular in the UK with 8 million active traders worldwide. On the Play Store, the app has garnered over 10 million downloads with a rating of 4.0/5 from 138k reviews.

Established in 2007 and headquartered in Tel Aviv, Israel, eToro serves more than 4 million clients globally in forex and CFD trading. Its use of advanced technology is pivotal in this multi-asset brokerage, leading to a valuation of $800 million in 2018.

eToro's office in the UK is located on the 24th floor, One Canada Square, Canary Wharf, London E14 5AB, UK. The broker is registered and supervised by the FCA with reference number 583263. Apart from being an FCA-regulated broker, eToro is also regulated in other countries by CySEC, ASIC, FINRA, and FSA.

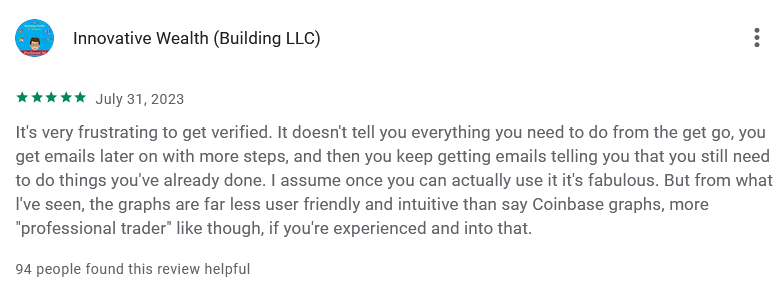

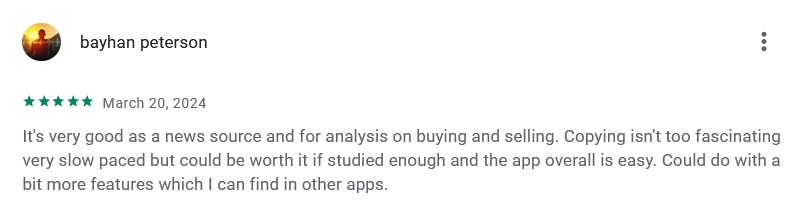

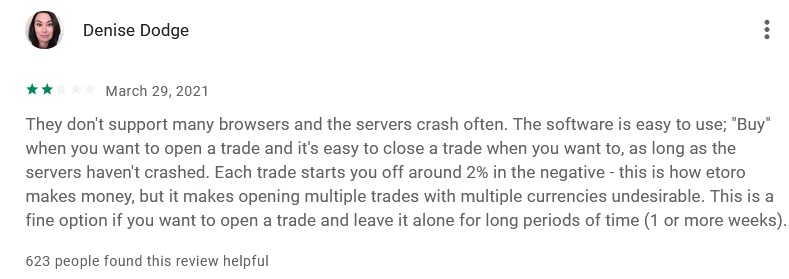

What They Say About eToro App

Learn More About eToro Broker

✔️ Pros | ❌ Cons |

|

|

eToro established in early 2007, with a mission to make trading accessible to anyone, anywhere, and reduce dependency on traditional financial institutions. The company has head offices in the United Kingdom, Cyprus, USA, and Australia.

eToro (Europe) Ltd operates as a Financial Services Company authorized and regulated by the Cyprus Securities Exchange Commission (CySEC) under license no. #109/10. Meanwhile, eToro (UK) Ltd is authorized and regulated by the Financial Conduct Authority (FCA) under the license FRN 583263.

As for eToro AUS Capital Pty Ltd, the legal standing is acknowledged by the Australian Securities and Investments Commission (ASIC) to provide financial services under Australian Financial Services License 491139.

A broker that belongs to the 4-digit type, eToro offers both short-term options for day traders and long-term options for investors, such as their innovative Smart Portfolios, a fully managed thematic portfolio.

Since 2007, eToro has been at the forefront of the Fintech revolution. The most recent was launched in 2017, which is Smart Portfolios powered by Machine learning Al. Beyond developing Smart Portfolios, the company integrated Microsoft's machine learning technology into Momentum DD.

The new Smart Portfolios investment strategy uses artificial intelligence to find the steadiest traders who are most likely to generate a double-digit return and bundle traders into one fully-managed portfolio. eToro has hundreds of financial assets for trading across several categories including stocks, commodities, crypto assets, currencies, indices, and ETFs. Each asset class has characteristics and can be traded using a variety of investment strategies.

Some positions on eToro involve ownership of underlying assets, such as non-leveraged positions on stocks and cryptos. Employing CFDs will enable a variety of options, such as leveraged trades, short (sell) positions, fractional ownership, and more. For example, traders can invest as little as USD100 in gold, even if a single unit of gold cost USD1,000. Some of eToro's most popular CFD commodities include gold, oil, natural gas, silver, and platinum.

Currencies are traded on eToro only as CFDs. Also, CFDs enable Sell (short) positions and leveraged trade, even for assets that don't offer the option in traditional trading. Some of the popular currencies include EUR/USD, GBP/USD, AUD/USD, USD/JPY, and USD/CAD.

Furthermore, An Exchange-Traded Fund (ETF) is a financial instrument comprising several assets grouped to serve as one tradable fund. After opening an account in eToro, traders can invest as little as USD250 in an ETF that costs USD500. Some of the popular ETFs on eToro include SPY, VXXB, TLT, and HMMJ.

However, eToro also offers additional functions using CFD trading. All leveraged ETF positions in the UK are under FCA regulations. Meanwhile, all CFD positions executed by eToro Australia are under ASIC regulations.

The company has other advantages. In all financial assets that can be traded, eToro does not charge any deposit or trading frees other than spreads.

eToro charges a USD25 fee for withdrawals and the minimum withdrawal amount is USD50. Long (Buy), non-leveraged crypto, stock, and ETF positions are not executed as CFDs and do not incur any fees. eToro does charge overnight or weekend fees for CFDs positions, such as leveraged positions and short (sell) orders.

Fee updates always apply to open positions. Fees are subject to change at any given time and could change daily, without prior notice, depending on market conditions.

As a beginner, trader can use CopyTrading eToro. Different from the features of other brokers, traders can copy the strategies of professional traders without fee or profit-sharing. Therefore, 100% profit is fully owned by traders. For example, while trader A who is copied by trader B, produces a profit of 10% this month, then trader B also gets a profit of 10%.

The company is the world's leading social trading network. Since eToro operates in complete transparency, each trader has valuable information on their eToro profiles, so other traders that are interested to copy their trades can have assistance in creating their best portfolios.

Another feature that is unique to eToro is the personalized, social News Feed. Just like on any social media, traders can post their updates on feed, comment on other's posts, and gradually create a feed that is tailor-fitted to trader's trading and investing interests. On eToro social trading platform, traders will also get notifications when a trader writes a new post and many other important updates.

AvaTrade

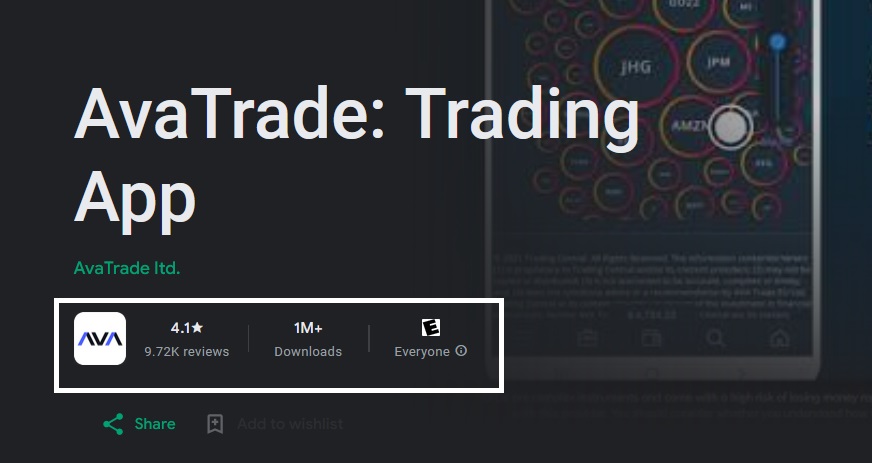

The AvaTrade app provides a comprehensive MetaTrader trading suite (MT4+ MT5), demo accounts, live signals for major Forex currency pairs, trading alerts, and advanced charts. AvaTrade's app is widely favored in the UK due to its user-friendly interface tailored for beginners and trading conditions featuring very tight spreads. The service has earned a satisfactory rating of 4.1/5 on the Play Store with over one million downloads.

Established in 2006 and headquartered in Ireland, AvaTrade serves more than 4 million clients globally in forex and CFD trading. With offices in various countries like Japan, Australia, and South Africa, it operates under regulation from authorities such as the FFAJ, ASIC, and FSCA.

In the UK, AvaTrade is overseen by the FCA with reference number 504072. The company is situated at Dockline, IFSC, Dublin, Dublin 1, Ireland.

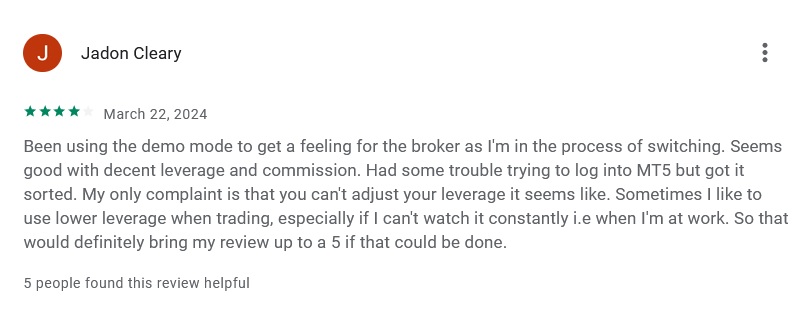

What They Say About AvaTrade App

Learn More About AvaTrade Broker

✔️ Pros | ❌ Cons |

|

|

Avatrade can be called one of the most well-rounded brokers that support almost all trading styles. Not only allowing hedging, scalping, and expert advisor (EA), Avatrade also completes their service with One-cancels-the-other order (OCO) and AutoTrading in many variants of automated trading systems.

AvaTrade was founded in 2006, with the primary mission to empower people to trade with confidence. If traders are still confused about what is the best broker for supporting trader's trading, AvaTrade perchance option of traders, because it has been evaluated and honored for some of the industry's most remarkable financial and technological achievements that it provided to clients.

In 2019, the Dublin-based broker got achievement from Daytrading.com as The Best Forex Broker 2019. Besides, the company is honored as Best Forex Broker, Best Bitcoin CFD Trading Provider of the year, and Best Affiliation Programme in the European area.

Furthermore, for traders who have high mobility, AvaTrade provides many platforms that allow traders to trade using laptops and mobile phones. The availability of the free Autochartist tool in the platforms is the best support for both novice and experienced traders because it makes it easier for them to find trading opportunities without the need to glance at charts all day.

The Autochartist free signal is provided in Gold Account, Platinum Account, and AVA Select. By opening an account in AvaTrade, traders don't have to pay for getting a full Autochartist service. Autochartist itself is a market scanner tool that can detect trading signals from various technical perspectives.

Traders can access AvaTrade in many variants of platforms, such as AvaTradeGO, MetaTrader 4, MetaTrader 5, Automated Trading, Mac Trading, Web Trading, Mobile Trading, and AvaOptions.

In terms of regulation, AvaTrade is regarded as a superior broker because it has a lot of credible licenses. That way, even with deposits of up to ten thousand dollars, security can be guaranteed. Applying the Segregated Account system, AvaTrade is regulated by the Central Bank of Ireland (No.C53877), ASIC Australia (No.406684), JFSA Japan (No.1662), and South Africa (FSP 45984).

Can traders lose more than their deposit abruptly in the event of high volatility? AvaTrade explicitly answers no, as traders have negative balance protection.

With a minimum deposit of USD100, AvaTrade offers various leverage depending on the trading instruments; whether it is forex (starts from 30:1), indices (starts from 20:1), commodities (starts from 5:1), ETFs (starts from 5:1), or cryptocurrencies (starts from 2:1).

AvaTrade has committed to a set of values in relation to customers. Therefore, the company provides the best trading experience, offering multilingual customer service and the most sophisticated and user-friendly trading platform.

New traders can also learn forex trading in the Education tab on AvaTrade's official website. Traders will find a wide collection of articles, video tutorials, and more tools that will assist them every step of the way. It is an important requirement as the forex market might be a bit overwhelming and even scary at times, so traders need to make sure that they are fully prepared to begin trading in the real account.

There are many types of account types provided by AvaTrade. There is also an Islamic Trading Account, which is uniquely provided for Muslim Traders. Islamic account type is similar to a regular one with one key difference; it is not subject to any special fees or interests (swap-free), which sits well with the finance principles of Sharia Law.

If traders have felt confident for forex trading, traders can choose AvaTrade as an ideal choice. The minimum deposit and various platforms offered to make it a suitable destination for even beginners who would like to try forex trading for the first time.

Vantage

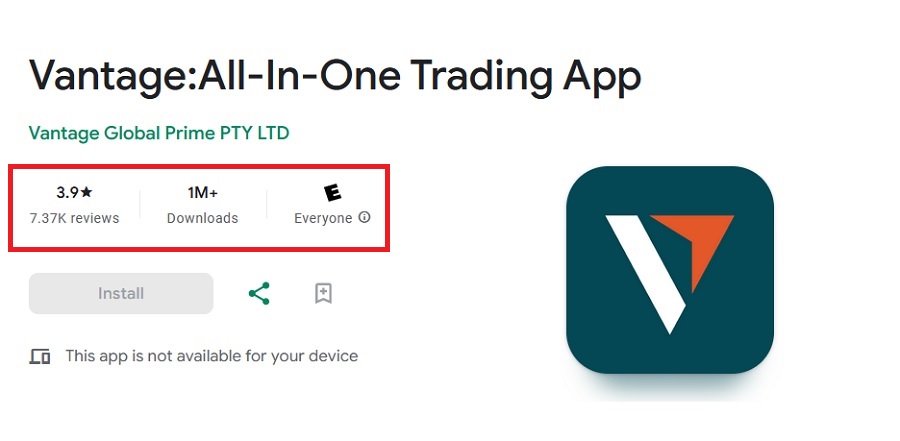

The Vantage trading app offers features like access to over 1000 CFDs, a virtual demo account with $100,000, and advanced technical analysis customization within the app. Known for its swift execution quality, the app has gained popularity. On the Play Store, it has garnered more than one million downloads and holds a rating of 3.9/5 from over 7k reviews.

Established in 2009, Vantage Markets is a well-regarded broker with headquarters in Australia, Vanuatu, the Cayman Islands, and the UK, serving more than 4 million clients in forex and CFD trading. Vantage brings over ten years of market experience and employs over 1,000 staff across 30 global offices, with its primary office situated in Sydney.

In the UK, Vantage is registered with the FCA under the name Vantage Global Prime LP with reference number 590299. The company's address is at 7 Bell Yard, London, WC2A 2JR.

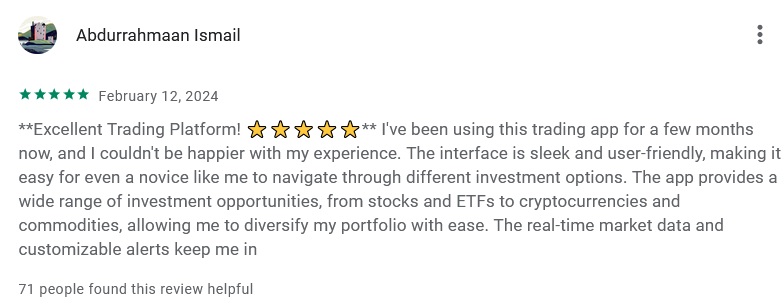

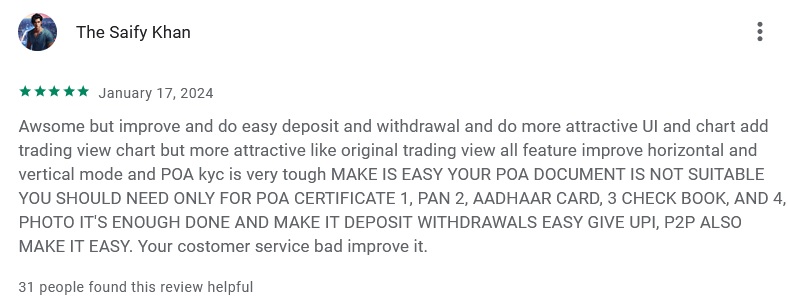

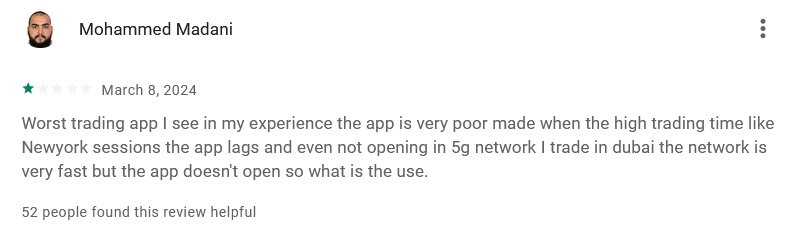

What They Say About Vantage App

Learn More About Vantage Broker

✔️ Pros | ❌ Cons |

|

|

FxPro

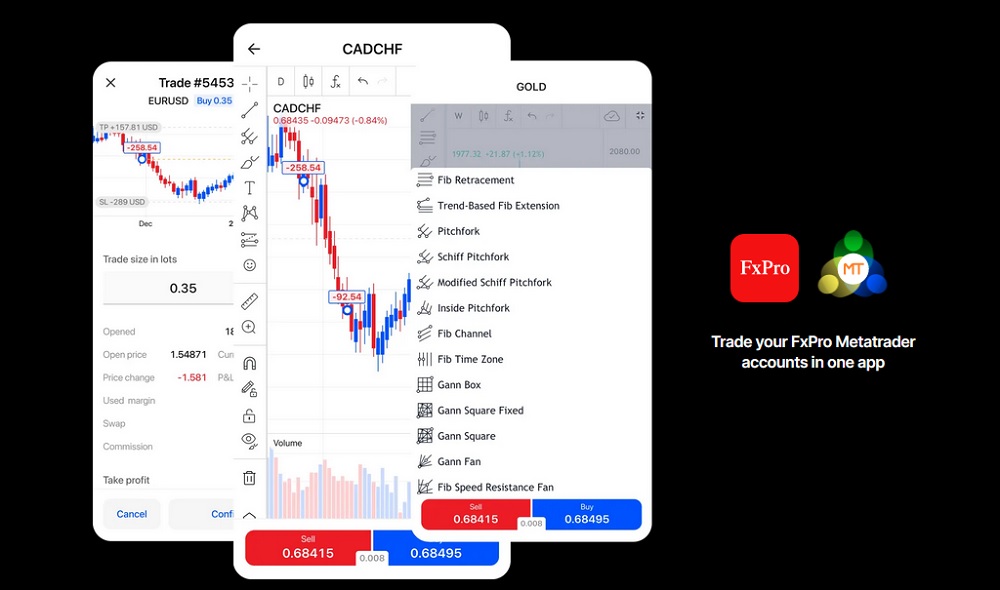

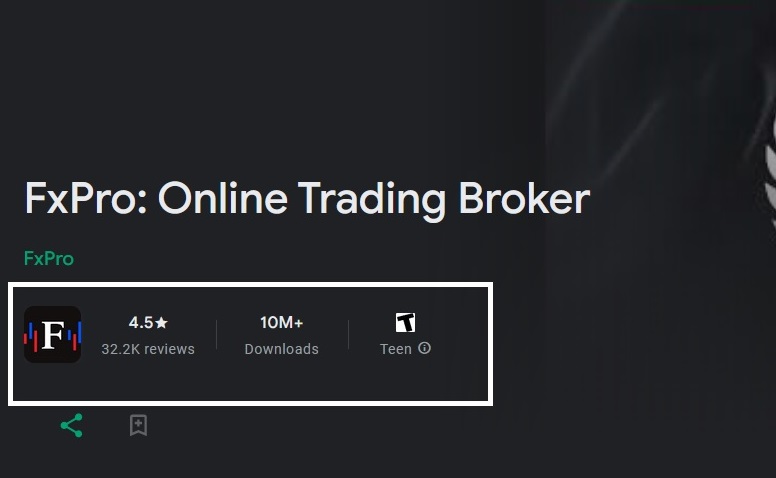

The FxPro trading app offers a range of features such as access to diverse assets with zero commissions, high-quality chart tools and indicators supported by TradingView, and customizable 24/5 customer support. This app is well-liked in the UK for its swift execution and user-friendly interface. On the Play Store, it has been downloaded over 10 million times with a rating of 4.5/5 from more than 32k reviews.

Established in 2006, FxPro has extended its presence to over 170 countries, catering to both retail and institutional clients. Based in London, UK, FxPro is licensed and overseen by the FCA with reference number 509956, operating under FXPRO UK Limited. Its UK office is situated at 13-14 Basinghall Street, City of London, EC2V 5BQ.

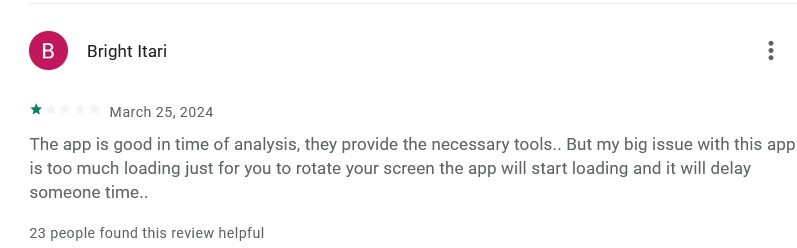

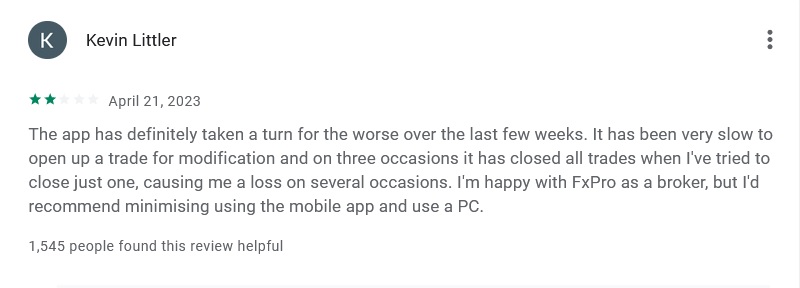

What They Say About FxPro App

Learn More About FxPro Broker

✔️ Pros | ❌ Cons |

|

|

Ever since its establishment in 2006, FxPro has successfully expanded to serve retail and institutional clients in more than 170 countries. Their head office is in London, UK.

FxPro UK Limited is authorized and regulated by the FCA since 2010. Meanwhile, other subsidiaries such as FxPro Financial Services Limited is authorized and regulated by CySEC since 2007 and the FSCA since 2015. Because of that, traders do not need to worry again about their funds safety. As a strong proponent of transparency, it established the highest standards of safety for clients' funds, as the company chooses to keep the funds in major international banks, fully segregated from the company's funds.

They always try to provide transparent and ethical practices across the global trading industry. In 2018, 74.65% of market orders were executed at the requested price while 12.8% of the client's orders were executed with positive slippage. Also, only 1.4% of all instant orders received a requote with 0.72% of them receiving better price when executed.

The total number of trades in FxPro has increased from year to year. In 2018, the number of trades achieves 53.6 million. Based on trust from their clients, FxPro received awards as Most Trusted Forex Brand UK 2017 by Global Brands Magazine. Besides, they became the first broker to sponsor an F1 team in 2008. There are around 60 UK and International Awards which had been achieved by FxPro.

They are committed to create a dynamic environment that equips traders with all the necessary tools for their trading experience. Opening an account in FxPro grants access to more than 250 CFDs on 6 asset types, including forex, shares, spot indices, futures, spot metals, and spot energies. They want to provide their clients with access to top-tier liquidity and advanced trade execution with no dealing desk intervention. The average execution time is less than 11.06 millisecond with up to 7,000 orders executed per second. Those advantages enable traders to benefit from tight spreads and competitive pricing.

Furthermore, FxPro is recognized as an innovative broker. The company allows its clients to enjoy a wide range of trading platforms, such as MetaTrader 4, MetaTrader 5, cTrader, and FxPro Edge. Web-based versions and mobile applications are also available so that traders can access financial markets at any time and anywhere.

Traders can choose platforms according to their needs. Fans of MT4 is provided with instant execution and easy-to-use trading platform. In this account, leverage is up to 1:500 and spreads start from 1.6 pips without commissions.

If traders want to get experience with more modern technology, traders should choose FxPro MT5 Accounts. In this account, spreads start from 1.5 and leverage is up to 1:500 without commissions.

Another type of accounts is FxPro cTrader. It is suitable for traders who give priority to the speed of execution with the most restrictive spreads compared to other account types'. FxPro cTrader is a powerful trading platform offering the best available bid and ask prices, with orders filled in just milliseconds. The platform also provides Market Depth and trading analysis tools. In this account, spreads start only from 0.3 pips. But, traders have to pay commissions $45 per $1 million traded (upon opening and closing a position) in forex and metals.

The key difference between MetaTrader 4, MetaTrader 5, and cTrader lies in the range of the CFD products that are available. The MT4 platform gives traders a chance to open positions on all of the 6 asset classes, whereas the MT5 doesn't support shares, and cTrader doesn't support shares and futures.

Besides 3 types of platforms above, trading in FxPro also enables access to FxPro Edge. This platform offers clients a new way to trade the markets in the form of spreads betting.

Each broker has pros and cons, and FxPro is not an exception. Aside from the advantages as explained before, FxPro has a high minimum deposit. Also, there are not many types of payment and withdrawal methods available at FxPro. Some types of methods even require traders to pay fees. However, it is still important to note that clients can trade forex, shares, indices, metals, and energies, with limited risk account at no additional cost in Fxpro

Regardless of the advantages and disadvantages, FxPro can be traders' choice as one of the best brokers with sophisticated technology. The company is suitable for traders prepared to trade with funds starting from $500.

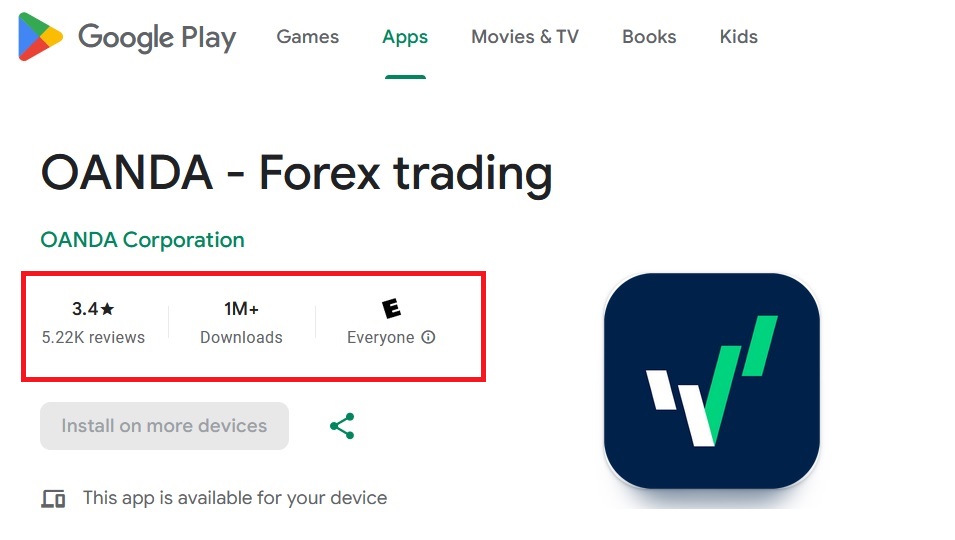

OANDA

OANDA's trading app offers a range of features including advanced charting, fast execution, and a variety of assets such as forex, indices, metals, and commodities. The app is popular for its user-friendly interface and reliable transaction speed. On the Play Store, the app has been downloaded over a million times and holds a rating of 3.4/5 from 5k+ reviews.

Established in 1996, OANDA is a well-known broker with offices in different countries like the US, UK, and Japan. They serve over 4 million clients in forex and CFD trading. In the UK, OANDA is registered with the FCA as Oanda Europe Limited with reference number 542574. Their office address is Dashwood House, 69 Old Broad Street, London, EC2M 1QS.

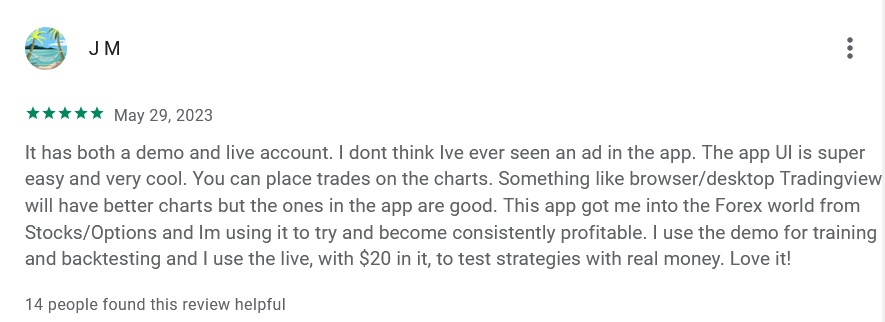

What They Say About OANDA App

Learn More About OANDA Broker

✔️ Pros | ❌ Cons |

|

|

Traders looking for brokers with accurate precision, OANDA can be an option. That is because OANDA is a broker that provides quotes with 5-digit accuracy and active price movements that follow market developments. Order execution speed is also faster in this broker.

It provides benefits for novice traders, as they can trade with smaller volumes using the calculation system based on currency value, unlike other brokers adopting the lot system.

Founded in 1996, OANDA was built by Dr. Michael Stumm who is a lecturer in Computer Engineering at the University of Toronto, Canada, along with his colleague, Dr. Richard Olsen of The Olsen Ltd., which is one of the leading econometric research institutes. They have a head office in San Francisco, United States.

OANDA branch offices can be found everywhere. Some of these offices are located in the United Kingdom, Singapore, Japan, and Canada. With this number of offices spread, OANDA has increasingly attracted the attention of clients worldwide.

OANDA's company is registered under several well-known jurisdictions in financial trading. They are regulated by CFTC and NFA in the US, FCA in the UK, ASIC in Australia, and many others. Traders do not need to worry anymore about security when trading in OANDA. However, these advantages make trading rules at OANDA more stringent compared to other brokers.

For example, OANDA only allows maximum leverage of 1:20, because the rules in the US and Japan do not allow leverage above that. Besides, the registration procedure is more complex due to various additional requirements that are not submitted by other forex brokers. On top of that, hedging is not allowed in one trading account as the client must open an additional account to hedge.

Nevertheless, OANDA is known for being a leading broker with many advantages offered. OANDA faces increased market risk during periods of price volatility, such as economic and political news announcements. When market spreads increase or decrease, their pricing engine widens or narrows spreads accordingly. That way, traders can get the latest conditions from price movements in the market more quickly.

Prices move very fast in the market. Especially when news releases have a large impact on market volatility. This condition is often exploited by brokers to take advantage of clients with Requotes. However, traders do not need to worry about additional costs when trading with OANDA.

The company never withdraws Requotes so traders can get maximum profit. When traders are unavailable to monitor open positions, they can set take profit orders to lock in profits and Stop Loss orders to help protect against further losses.

As an experienced and well-known online forex broker, OANDA is committed to maintain an efficient trading environment that reduces latency and provid tools to help clients manage the degree of acceptable slippage.

With a fast & reliable trading platform by OANDA, clients' trades are executed in 0.012 seconds. This suits traders who choose brokers based on execution speed.

Because of this exceptional execution service, it is not surprising that OANDA won many awards, including the winner of the world's Best Retail FX Platform at the prestigious e-FX awards. The broker is also voted number 1 for Consistency of filling trades at quoted prices, Execution speed, and Reliability of platforms.

There is no minimum deposit or minimum balance required to open an OANDA account. Deposit and withdrawal can be done easily. OANDA provides a variety of payment method facilities, including Paypal, Wire Transfer, Credit Card, and Debit. Traders can adjust it to the region where they live.

OANDA provides more than 100 trading instruments, including 71 currency pairs, 16 indices, 8 commodities (Brent Crude Oil, Copper, Corn, Natural Gas, Soybeans, Sugar, etc.), 6 Bonds, and 23 Metals.

The fxTrade and MetaTrader platform are available at OANDA. These platforms can be used for Desktop and Mobile. Another plus is they have an OANDA Technical Analysis that exists in collaboration with a technical analysis provider called Autochartist.

With these platforms, clients can monitor price movements easier and automatically recognize patterns created on charts, as well as receive alerts when the awaited patterns appear. Access to this technology can be enjoyed free of charge.

In conclusion, OANDA is an ideal broker for traders in need of fast execution backed by many years of experience. The company is also a good alternative for those looking for a well-regulated broker with flexible trading and deposit conditions.

Plus500

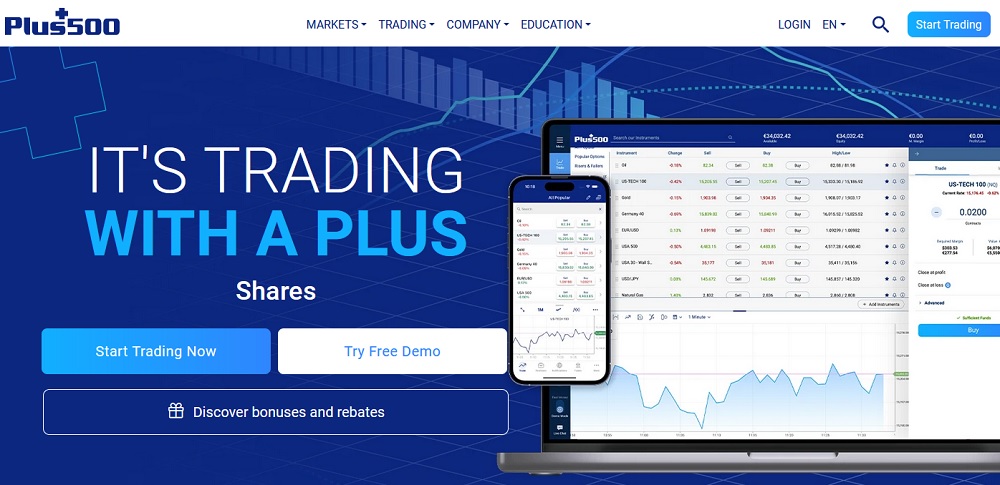

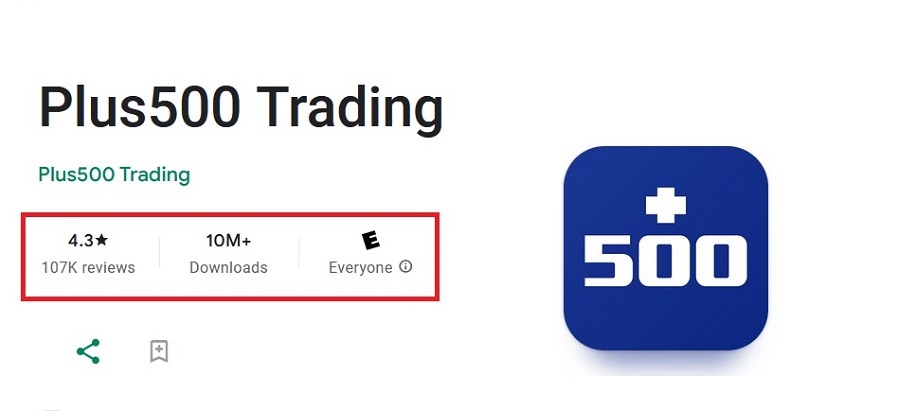

The Plus500 trading app offers excellent features like unlimited demo accounts for practice and powerful, reliable trading tools. It's a popular choice in the UK due to its user-friendly interface and low trading costs with commission-free accounts and tight spreads. The app has been downloaded over 10 million times on the Play Store and has a rating of 4.3/5 from 107K reviews.

Established in 2008, Plus500 now has offices in major cities worldwide, including Cyprus, Australia, Israel, South Africa, Singapore, Estonia, and the United Arab Emirates. By 2021, the broker had amassed over 20 million customers.

Plus500 is a leading broker based in London and listed on the London Stock Exchange. It's the biggest CFD broker in the UK today under an FCA license number 509909. Its office is situated at 8 Angel Chord Avenue, London EC2R 7HJ.

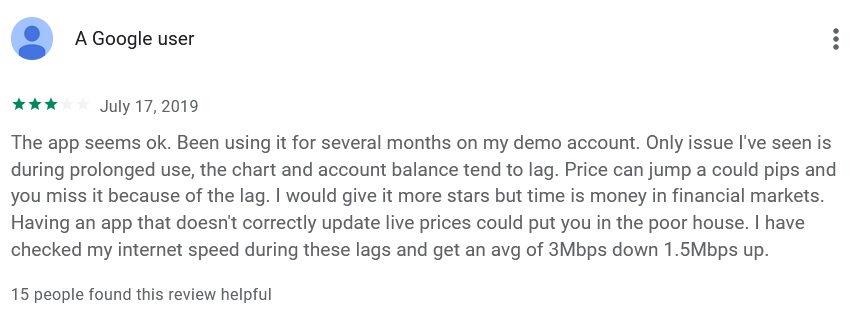

What They Say About Plus500 App

Learn More About Plus500 Broker

✔️ Pros | ❌ Cons |

|

|

Plus500 is a UK-based company with its main offices located in the city of London. The company is authorized and regulated by FCA. For traders who are looking for a broker with top-tier regulators, Plus500 can be the right choice.

Plus500 offers 2,000 instruments to over a million clients. List of instruments available for trading with their CFD service include forex currency pairs, indices, cryptocurrencies, commodities, shares, and ETFs. Traders can choose instruments suitable for their needs.

Regardless, beginners should be extremely cautious while choosing their assets, as it can get daunting, confusing, and inherently risky.

When traders open an account, Plus500 will hold traders' funds on a segregated basis, following FCA's client money rules. Traders do not need to worry about Plus500 using their funds for hedging, as it is strictly prohibited to use clients' funds for this purpose.

Other advantages when trading in Plus500 are tight spreads and no commissions. The company only offers a single type of account, but traders can update the account from Retail to Professional by following some standards.

To apply Professional Accounts, traders have to fulfill at least 2 of the following 3 criteria eligible, such as sufficient trading activity in the last 12 months, financial instrument portfolio of over 500,000 Euro, and relevant experience in the financial services sector.

Plus500 is well-regarded for its services through the market spread, leverage up to of 1:30 for Retail Accounts, and leverage up to of 1:300 for Professional Accounts. Plus500 tries to give a sensible choice of leverage, which not only controls the risk but also helps novice traders to exercise more control over their trading emotions.

Founded in 2008, Plus500 provides almost the same features to both Retail and Professional account, including clients' money protection, negative balance protection, best execution for orders, clear and transparent information, as well as financial services compensation scheme. Still, Professional account is more advanced as it has access to FOS.

Based on the statistics, 76.4% of Retail account owners in Plus500 lose money when trading CFDs. Because of that, Plus500 always warns traders to consider their understanding of how CFDs work and their affordability to take high risk of losing money, before starting a trade in Live Account.

Even so, Plus500 has gained the trust of traders throughout the world. They have around 39 million positions opened, 304,000 active customers, and billions of volume trading processed by their system.

Plus500 always tries to give the best services to their clients. One of the ways to reach their goals is by making clients feel confident in their trading activity. They have a simple and easy-to-use trading platform, with an especially well-designed mobile platform. Traders can access the Plus500 platform via web-trader, iPhone/iPad, and Mobile App.

In their platform, traders will get advanced tools such as stop limit, guaranteed stop, free email and push notifications on market events, and alerts on price movements. All of these tools can help traders to navigate the market with better understanding.

As for payment methods, Plus500 provides various choices like Visa or MasterCard, electronic wallets (PayPal and Skrill), and bank transfer (direct bank to bank funds transfer).

For any concerns, troubles, or trading issues, traders can contact Plus500's customer service that is available 24 hours a day and 7 days a week. The official website of Plus500 can be accessed in 24 languages.

Overall, Plus500 has some advantages and disadvantages. As it has a license from an elite regulator, traders can feel safe when trading in Plus500. It also provides a 24/7 support team to help traders. But, offering leverages up to 1:300 is not suitable for high-risk traders, such as scalpers, who indulge in high-frequency trading that holds positions in the market for a brief period and typically use high leverage.

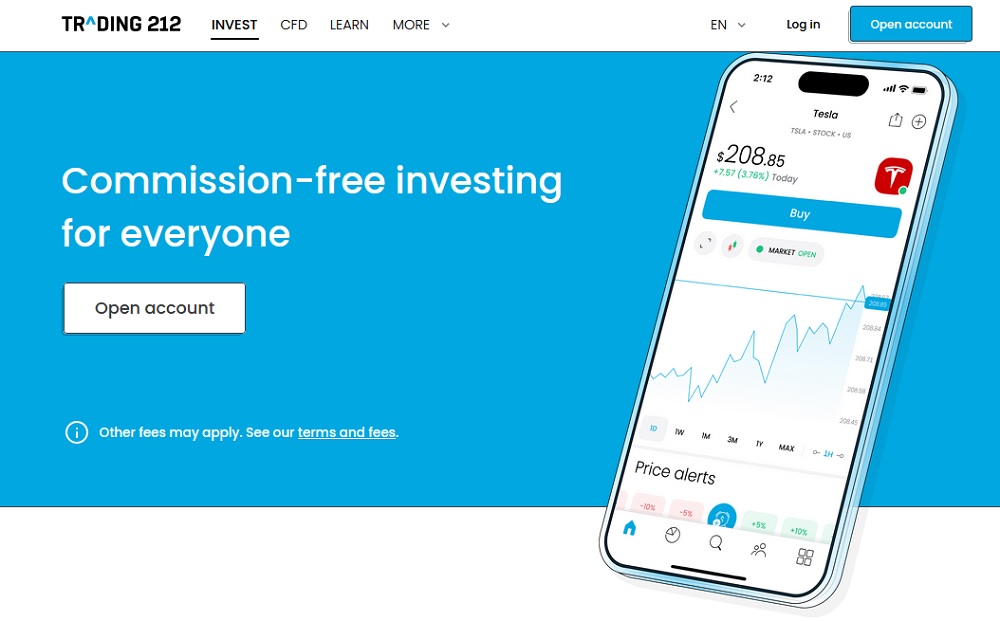

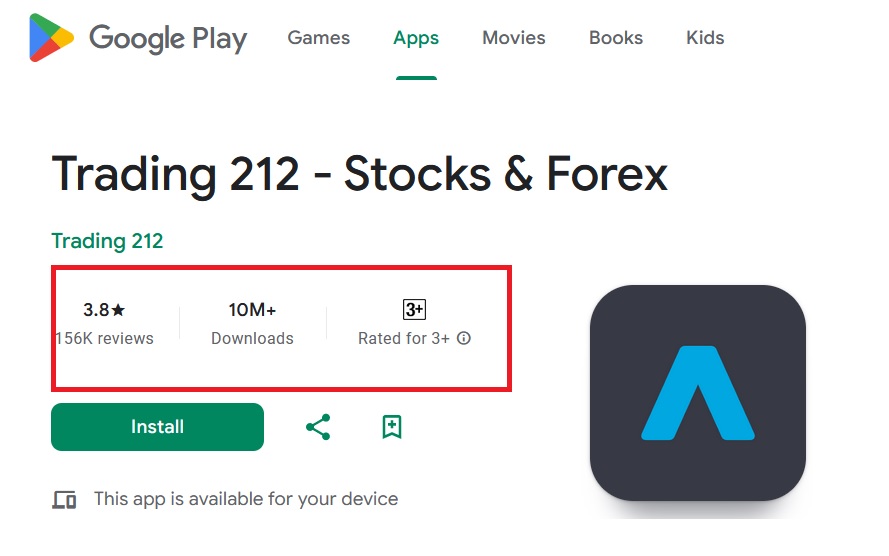

Trading 212

The Trading 212 app offers a wide range of features including over 9000 CFDs, very tight spreads even during news releases, and an easy-to-use chart display for technical analysis, powered by TradingView. On the Play Store, the app has surpassed 10 million downloads with an impressive rating of 3.8/5 from 156K reviews.

Trading 212 is a UK-based broker established in 2006. It is officially licensed by the FCA with reference number 609146, operating under the name of Trading 212 UK Limited. You can find their office at Aldermari House, 10-15 Queen Street, London, EC4N 1TX.

Apart from the UK, Trading 212 has branch offices in various countries like Bulgaria, Cyprus, the European area, and France. Interestingly, this broker offers a rewarding feature called interest on margin. As such, clients can get returns on uninvested cash in their accounts. Trading 212 set the return at 5.2% on GBP cash where clients will get daily payment and unlimited withdrawal.

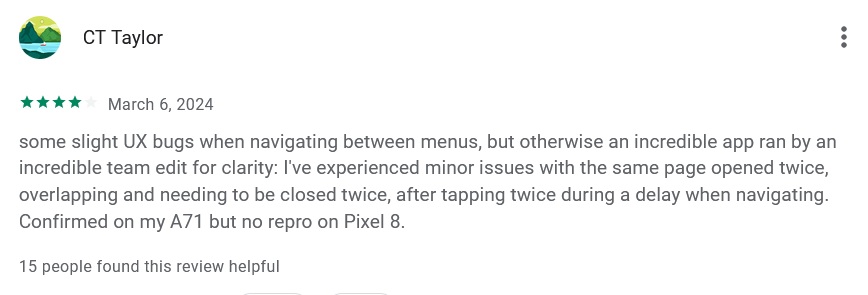

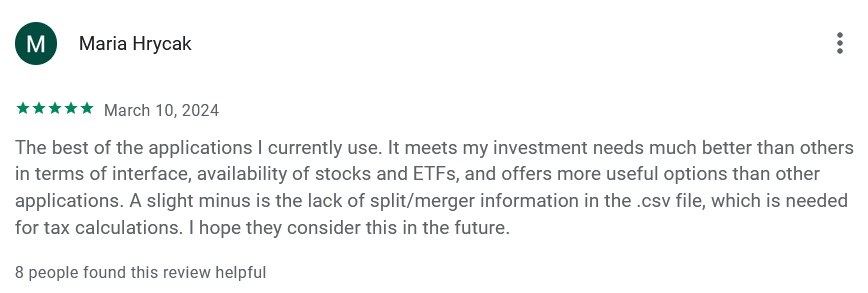

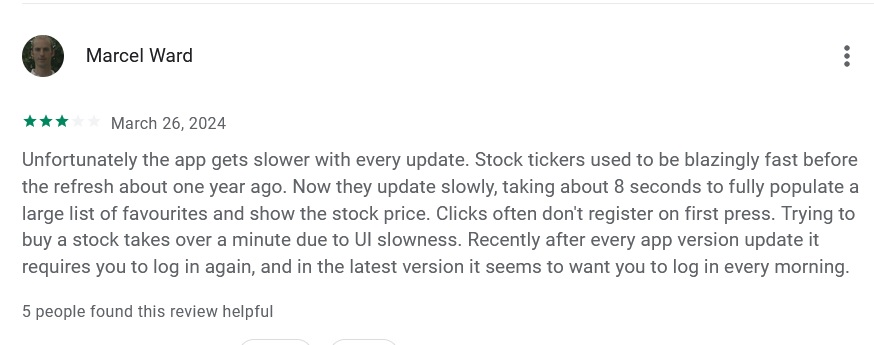

What They Say About Trading 212 App

Learn More About Trading 212 Broker

✔️ Pros | ❌ Cons |

|

|

FAQs on Forex Trading App

What is a forex trading app?

A forex trading app is a software application designed specifically for trading currencies in the forex market. These apps are typically available for mobile devices, such as smartphones and tablets, and provide traders with access to the forex market from anywhere with an internet connection.

Forex trading apps offer a range of features and functionalities that allow traders to execute trades, analyze markets, and manage their portfolios on the go.

Some common features of forex trading apps include:

- Trading platform where traders can place buy and sell orders for currency pairs.

- Real-Time Quotes and charts for currency pairs for traders to monitor price movements and identify trading opportunities.

- Account management to deposit and withdraw funds, view account balances, and track transaction history.

- News and analysis to help traders stay informed about market developments and make informed trading decisions.

- Alerts and notifications that notify traders about price movements, trading signals, and important market events.

- Demo accounts with virtual funds that enable traders to practice trading strategies and familiarize themselves with the platform before trading with real money.

- Customer support features such as live chat, email support, or phone support to assist traders with any questions or issues they may encounter while using the app.

How to choose the best trading app?

Choosing the best forex trading app requires careful consideration of several factors to ensure it meets your trading needs and preferences. Here's a guide on how to select the most suitable forex trading app:

- Ensure the app is regulated by reputable financial authorities to protect your funds and personal information. Look for apps regulated by authorities such as the FCA (Financial Conduct Authority) in the UK, ASIC (Australian Securities and Investments Commission), or CySEC (Cyprus Securities and Exchange Commission).

- Evaluate the trading features offered by the app, such as order types, charting tools, technical indicators, and analysis resources. Choose an app that provides the necessary tools and functionalities to execute your trading strategies effectively.

- Opt for an app with an intuitive and user-friendly interface. The app should be easy to navigate, with clear menus, charts, and trading tools, ensuring a seamless trading experience.

- Consider the compatibility of the app with your device and operating system. Ensure the app is available for your preferred device, whether it's iOS or Android, and that it offers a responsive and stable performance.

- Check the app's execution speed and reliability. Look for apps that offer fast and efficient order execution, with minimal latency and slippage, especially during periods of high market volatility.

- Evaluate the quality of customer support provided by the app. Ensure there are responsive support channels available, such as email, live chat, or phone support, to assist you in case of any issues or inquiries.

- Look for apps that offer a demo account feature, allowing you to practice trading strategies and familiarize yourself with the platform risk-free using virtual funds.

- Consider the costs and fees associated with using the app, including spreads, commissions, and any additional charges. Choose an app with transparent pricing and competitive fees that align with your trading budget.

- Check if the app provides educational resources, such as articles, tutorials, webinars, or market analysis, to help you improve your trading skills and knowledge.

- Read reviews and testimonials from other users to gauge the app's reputation and reliability. Look for apps with positive feedback and a strong reputation in the forex trading community.

What are the drawbacks of using trading apps?

- With mobile trading, the screen size can be quite inconvenient for users. This can limit the data presented on screen and traders might miss certain details.

- Some brokers restrict some of their instruments on trading apps, so traders may have more limited opportunities when accessing the market.

Smaller memory of mobile devices may affect the performance of some trading features. This can lead to technical issues and can cause disruptions or while placing an order.

What are the most used trading apps in the UK?

Based on the research discussed in this article, there are four FCA-regulated trading apps that have exceeded 10 million downloads:

Choosing forex brokers in the UK does not only concern the trading apps but also the spread conditions. Learn about it further in UK Forex Brokers with the Lowest Spreads.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance