Brokers with mobile apps are gaining more popularity nowadays as they provide simplicity and flexibility. Which brokers offer the best mobile apps?

The term mobile trading refers to the use of wireless technology in trading. Plenty of mobile trading apps allow traders to access trading platforms from their smartphones.

For your information, mobile trading apps in this article refer to apps that are developed by the brokers themselves. Some broker mobile apps only let traders access the trading platforms, but others allow full control of their accounts.

So, which broker with mobile apps is the best for trading on the go?

- eToro: Copy trading available.

- OctaFX: Deposit and withdraw through various methods in mobile apps.

- Exness: Offers utilities such as trading, analysis, and many more.

- AvaTrade: Allow traders to watch the market and process deposits.

- XM: Manage account on the go.

- FBS: Open positions and manage accounts.

- FP Markets: Easy technical analysis at traders' fingertips.

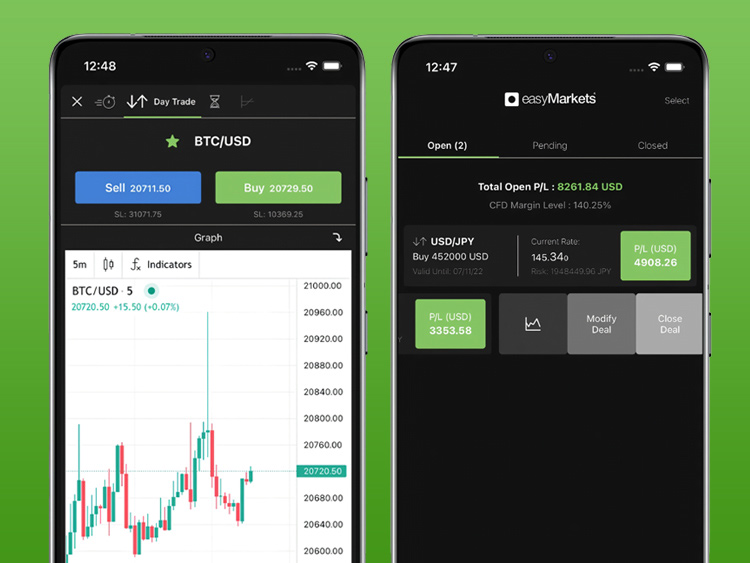

- EasyMarkets: Feature a free demo account

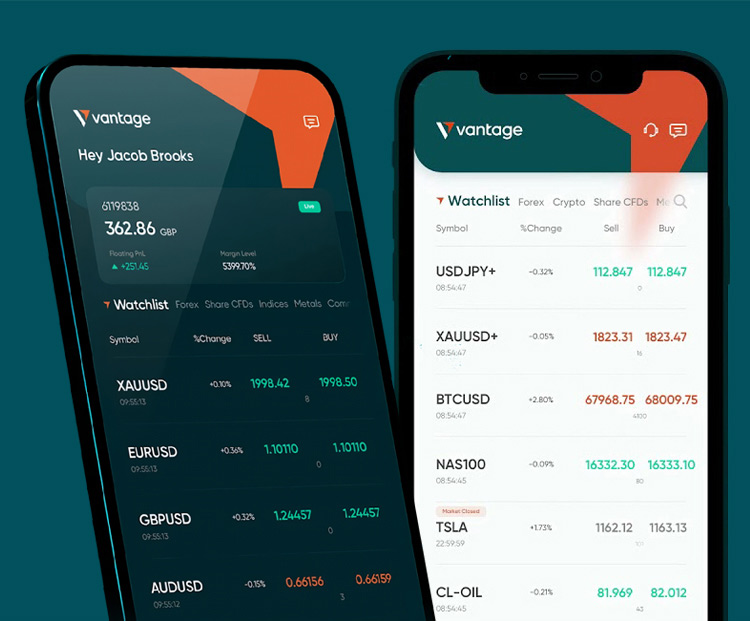

- Vantage FX: Technical indicators and analysis available.

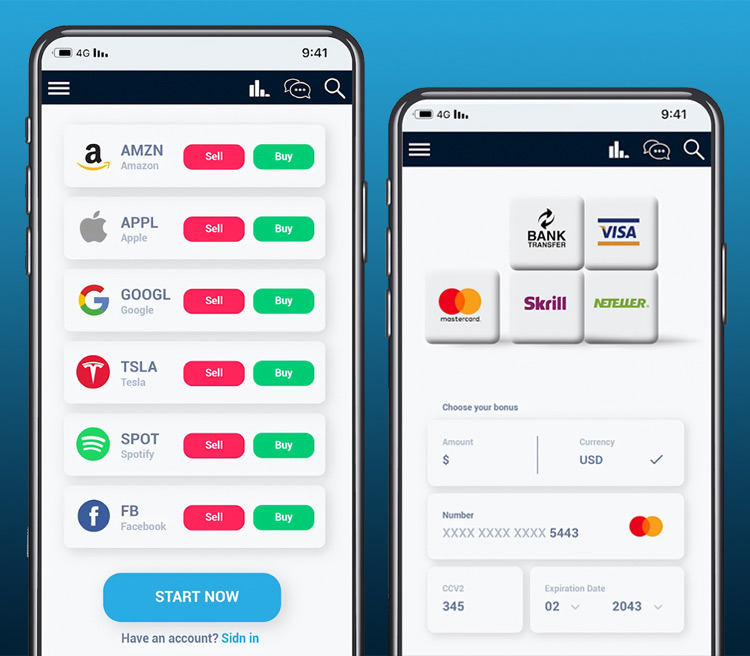

- Xtrade: Equipped with advanced technical analysis tools.

What else can traders get from the brokers above?

1. Exness

Exness is a broker founded by a group of professionals and was established in 2008. Since then, they have grown immensely and have 145,400 clients worldwide. Exness is widely known by CFDs traders and currently offers different kinds of instruments ranging from metals, commodities, forex, and many more.

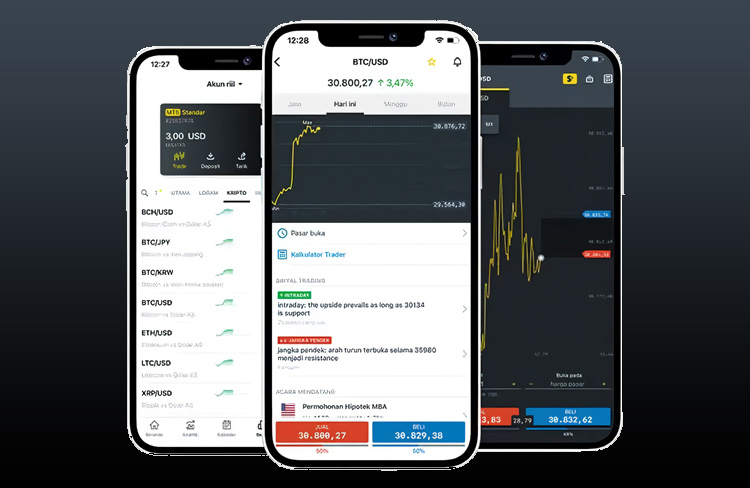

Exness is also one of the best brokers with mobile apps to support trading on the go for all kinds of traders. Their applications offer utilities such as trading, analysis, deposits, and withdrawals. Exness claims easy registrations, fast deposits, and 24/7 support to help their mobile traders. They also ensure clients receive the latest fundamental news from their built-in economic calendar.

The choice of broker is adjusted to the needs of each trader. If you are a trader who only needs a basic platform and trading features with the best attributes, then Exness can be your best choice.

Exness covers its lack of feature variations with other advantages like low spreads starting from only 0.1 pip. This is very suitable for traders who use scalping strategies (Scalper). Spreads on major pairs in certain account types can also be as low as 0.0 pip, depending on market conditions.

Not only that, but traders can also enjoy other advantages such as automatic fund withdrawals. Exness processes the majority of client withdrawals instantly, without manual checks; however, withdrawals may be subject tos depending on the payment provider or method of choice.

The safety of traders' funds is also guaranteed as Exness is one of the European-based STP/ECN brokers. Exness's ability to become an official partner of the Real Madrid soccer team for 3 years, starting July 2017, also provides evidence that the company has high solidity.

Deposits and withdrawals may be made 24 hours a day, 7 days a week. However, it is important to note that the company shall not be liable fors in processing deposits and withdrawals if suchs are caused by the payment system.

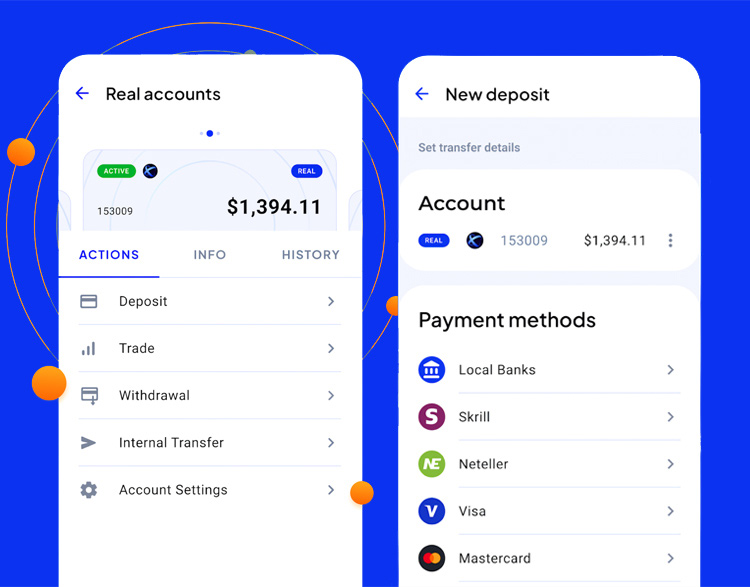

Traders do not need to worry about transaction fees when depositing and withdrawing. Exness doesn't charge any transaction fees to traders even though some charges may be incurred depending on the payment provider of choice. A variety of payment methods are provided for traders, including Wire Transfer, Bank Card, Neteller, Skrill, and many others.

The financial reports and metrics on the Exness website are audited quarterly by Deloitte, one of the four largest public accounting firms globally.

Moreover, Exness is one of the mote transparent brokers in the online trading industry. Traders can find out all information about this company on the website, such as trading volume, number of active clients, client deposits, company funds, and many more.

The platforms provided by Exness vary in MetaTrader 4, MetaTrader 5, Web, and Mobile platforms. This makes it easy for traders when trading on Exness, as they can also access Exness platforms anywhere and anytime.

Over the years, Exness has developed into a broker that attracts traders. Trader's trust is further enhanced by its compliance with financial regulations like the FCA and CySEC.

One measure of client confidence can be put on the trading volume. By December 2018, their clients' monthly trading volume reached USD348.4 billion and active traders around the world surpassed 50,342.

Through the program offered by Exness, traders also have the opportunity to earn extra income by becoming their partners. From the Introducing Broker (IB) program, partners can earn up to 33% spread commission from every new client that registers with them.

Additional income can also be obtained from Exness Partners. Traders can get a spread commission of up to 25% per transaction made by traders who register through an affiliate link.

When trading with Exness, clients can also make use of its free VPS hosting services. A VPS (Virtual Private Server) offers increased reliability and stability for traders as they can maintain their trades and expert advisors without interruption in the event of unexpected technical issues, such as internet or electricity downtime.

From the review above, it can be concluded that Exness is a favorite broker for traders because of low spreads and flexible account types. This condition is very suitable for traders with limited funds but is in need of more opportunities to get maximum profit. This broker is also well known for its maximum support on both new and existing partners.

2. FBS

FBS is an international brokerage that was founded in 2009. With more than 17,000,000 traders worldwide, it is safe to say that their experiences are more than enough. More than trading products, this broker offers educational materials for their clients, a lot of account types such as standard, micro, and cent.

It's no question that FBS has become one of the best brokers with mobile apps, as they take the mobile trading trend very seriously. Their apps not only allow traders to open positions but also manage accounts, as well as offer full statistics. This app also granted traders the ability to customize leverage, VPS security, bonuses, and etc.

Since 2009, the action of FBS Holding Inc. or known as FBS in the world of forex trading has been recognized by various international institutions. With clients reaching 14 million as of 2019, FBS has received the title of Most Transparent Forex Broker 2018, Best Investor Education 2017, Best Customer Service Broker Asia 2016, IB FX Program, and many others.

FBS is regulated by FSC Belize and CySEC Cyprus. This broker has been trusted by millions of traders and 370 thousand partners from various countries. Based on their data, FBS garners about 7,000 new traders and partner accounts every day. And, 80% of the clients stay in the FBS for a long time. No wonder the broker is growing rapidly due to the incredible growth in the number of clients.

Trading products offered by FBS range from forex, CFD, precious metal, and stock. For forex trading, CySEC-regulated FBS offers leverage up to 1:30 on Cent and Standard Accounts. Clients who want to try higher leverage than that can alternatively register an account under FBS Belize.

FBS spread begins from 0.5 pips for Pro account type and from 0.7 pips for Standard and Cent accounts. On a standard account, volume orders can be made from 0.01 to 500 lots. Therefore, this account is recommended for experienced traders.

Whereas on Cent Accounts, volume orders can be carried out with a maximum of 500 cent lots or the equivalent of 5 standard lots. Cent Accounts involve a different level of risk. FBS recommends Cent Accounts for beginner traders. All account types support the following trading instruments: 36 Forex pairs, 8 metals, 3 energies, 11 indices, 127 stocks, 5 crypto pairs.

Before plunging into the real forex market, traders can practice with FBS Demo Account which consists of two types, i.e Standard and Cent.

FBS uses the MetaTrader 4 and MetaTrader 5 platforms. They offer them on Windows and Mac as well as Android and iOS mobile. These platforms provide a trading experience at traders' fingertips, allowing traders to progress as a trader anywhere at any time.

MetaTrader platforms also have a variety of mainstay features, including the possibility to create, buy, and use expert advisors (EA) and scripts, One-click trading and embedded news, technical analysis tools, the possibility to copy deals from other traders, hedging positions, and VPS service support.

Another advantage provided by FBS is a deposit bonus of 100% for clients who fulfill certain requirements. The process of FSCing and withdrawing funds can be run easily and quickly. Based on clients' testimonies, each process usually takes no more than 3-4 hours, except on holidays.

Traders also have the opportunity to develop a side business when trading with FBS, namely as an Introducing Broker (IB) or Affiliate. The FBS partnership system provides partner commissions that are already in 3 level positions. Only by introducing new clients to FBS according to certain procedures, traders can earn extra income.

Traders will also get trading education experience at FBS. They have prepared a comprehensive forex course. The course consists of 4 levels: beginner, elementary, intermediate, and experienced. Traders can take courses that will turn them from newbies to professionals. All materials are well-structured. Besides, FBS provides various forex analyzes, webinars, forex news, and daily market analysis that can be accessed easily on their site.

Traders can access the FBS website with many language choices. Of course, this will increasingly provide comfort for traders. Available languages include English, Italian, French, Portuguese, Indonesian, Spanish, and others. Live chat support is also provided 24 hours 7 days a week.

In conclusion, FBS is a widely known broker among retail traders around the world. It continually grows to become a preferred broker because of flexible trading conditions that enable its clients to trade with various instruments, low deposit, and other trading advantages.

3. eToro

eToro is a multi-asset broker that was established in 2007 and now has served clients all over the world. This broker offers 0% commission and free insurance for their traders. For those who love social trading, eToro is the best broker. They have the largest community of traders and investors of over 20 million in over 140 countries.

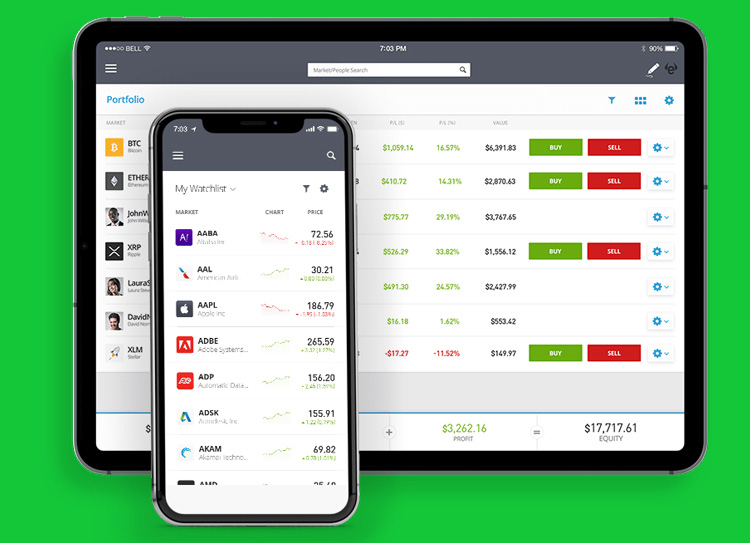

eToro is also one of the best brokers with mobile apps on Google Play. Their mobile apps include features such as trading, copy trading, and access to different instruments like forex, stocks, commodities, and cryptocurrencies. This broker makes sure clients can check their portfolio anytime.

eToro established in early 2007, with a mission to make trading accessible to anyone, anywhere, and reduce dependency on traditional financial institutions. The company has head offices in the United Kingdom, Cyprus, USA, and Australia.

eToro (Europe) Ltd operates as a Financial Services Company authorized and regulated by the Cyprus Securities Exchange Commission (CySEC) under license no. #109/10. Meanwhile, eToro (UK) Ltd is authorized and regulated by the Financial Conduct Authority (FCA) under the license FRN 583263.

As for eToro AUS Capital Pty Ltd, the legal standing is acknowledged by the Australian Securities and Investments Commission (ASIC) to provide financial services under Australian Financial Services License 491139.

A broker that belongs to the 4-digit type, eToro offers both short-term options for day traders and long-term options for investors, such as their innovative Smart Portfolios, a fully managed thematic portfolio.

Since 2007, eToro has been at the forefront of the Fintech revolution. The most recent was launched in 2017, which is Smart Portfolios powered by Machine learning Al. Beyond developing Smart Portfolios, the company integrated Microsoft's machine learning technology into Momentum DD.

The new Smart Portfolios investment strategy uses artificial intelligence to find the steadiest traders who are most likely to generate a double-digit return and bundle traders into one fully-managed portfolio. eToro has hundreds of financial assets for trading across several categories including stocks, commodities, crypto assets, currencies, indices, and ETFs. Each asset class has characteristics and can be traded using a variety of investment strategies.

Some positions on eToro involve ownership of underlying assets, such as non-leveraged positions on stocks and cryptos. Employing CFDs will enable a variety of options, such as leveraged trades, short (sell) positions, fractional ownership, and more. For example, traders can invest as little as USD100 in gold, even if a single unit of gold cost USD1,000. Some of eToro's most popular CFD commodities include gold, oil, natural gas, silver, and platinum.

Currencies are traded on eToro only as CFDs. Also, CFDs enable Sell (short) positions and leveraged trade, even for assets that don't offer the option in traditional trading. Some of the popular currencies include EUR/USD, GBP/USD, AUD/USD, USD/JPY, and USD/CAD.

Furthermore, An Exchange-Traded Fund (ETF) is a financial instrument comprising several assets grouped to serve as one tradable fund. After opening an account in eToro, traders can invest as little as USD250 in an ETF that costs USD500. Some of the popular ETFs on eToro include SPY, VXXB, TLT, and HMMJ.

However, eToro also offers additional functions using CFD trading. All leveraged ETF positions in the UK are under FCA regulations. Meanwhile, all CFD positions executed by eToro Australia are under ASIC regulations.

The company has other advantages. In all financial assets that can be traded, eToro does not charge any deposit or trading frees other than spreads.

eToro charges a USD25 fee for withdrawals and the minimum withdrawal amount is USD50. Long (Buy), non-leveraged crypto, stock, and ETF positions are not executed as CFDs and do not incur any fees. eToro does charge overnight or weekend fees for CFDs positions, such as leveraged positions and short (sell) orders.

Fee updates always apply to open positions. Fees are subject to change at any given time and could change daily, without prior notice, depending on market conditions.

As a beginner, trader can use CopyTrading eToro. Different from the features of other brokers, traders can copy the strategies of professional traders without fee or profit-sharing. Therefore, 100% profit is fully owned by traders. For example, while trader A who is copied by trader B, produces a profit of 10% this month, then trader B also gets a profit of 10%.

The company is the world's leading social trading network. Since eToro operates in complete transparency, each trader has valuable information on their eToro profiles, so other traders that are interested to copy their trades can have assistance in creating their best portfolios.

Another feature that is unique to eToro is the personalized, social News Feed. Just like on any social media, traders can post their updates on feed, comment on other's posts, and gradually create a feed that is tailor-fitted to trader's trading and investing interests. On eToro social trading platform, traders will also get notifications when a trader writes a new post and many other important updates.

4. OctaFX

Another broker with a good-performing mobile app is OctaFX, an STP broker based in St Vincent and Grenadines. As a well-known broker, OctaFX has proved to be an excellent choice for all kinds of traders. Their most popular features include tight spread, 50% deposit bonus, no commission fee, and many more.

OctaFX realizes that more and more traders are switching towards mobile trading, so they created a mobile app. This application allows traders to trade and manage their accounts from one app. They can also invest via virtual accounts and use many payment methods to deposit and withdraw funds. For those who want to try copy trading, OctaFX also introduces a special app dedicated to copy traders. This app lets traders choose who to copy from and track their investments.

5. AvaTrade

Established in 2006, the AvaTrade experience is not to be underestimated. This brokerage offers all kinds of instruments to trade, such as crypto, commodity, and of course, forex. Aside from presenting desktop trading platforms, they provide a mobile app to their mobile traders.

For a good reason, this broker even won the Global Forex Awards of 2020 for Best Forex Mobile Trading Platform/App-Global. There are more than enough features to enjoy with their mobile applications. For example, traders can trade with mobile apps, watch the market, and process deposits.

Avatrade can be called one of the most well-rounded brokers that support almost all trading styles. Not only allowing hedging, scalping, and expert advisor (EA), Avatrade also completes their service with One-cancels-the-other order (OCO) and AutoTrading in many variants of automated trading systems.

AvaTrade was founded in 2006, with the primary mission to empower people to trade with confidence. If traders are still confused about what is the best broker for supporting trader's trading, AvaTrade perchance option of traders, because it has been evaluated and honored for some of the industry's most remarkable financial and technological achievements that it provided to clients.

In 2019, the Dublin-based broker got achievement from Daytrading.com as The Best Forex Broker 2019. Besides, the company is honored as Best Forex Broker, Best Bitcoin CFD Trading Provider of the year, and Best Affiliation Programme in the European area.

Furthermore, for traders who have high mobility, AvaTrade provides many platforms that allow traders to trade using laptops and mobile phones. The availability of the free Autochartist tool in the platforms is the best support for both novice and experienced traders because it makes it easier for them to find trading opportunities without the need to glance at charts all day.

The Autochartist free signal is provided in Gold Account, Platinum Account, and AVA Select. By opening an account in AvaTrade, traders don't have to pay for getting a full Autochartist service. Autochartist itself is a market scanner tool that can detect trading signals from various technical perspectives.

Traders can access AvaTrade in many variants of platforms, such as AvaTradeGO, MetaTrader 4, MetaTrader 5, Automated Trading, Mac Trading, Web Trading, Mobile Trading, and AvaOptions.

In terms of regulation, AvaTrade is regarded as a superior broker because it has a lot of credible licenses. That way, even with deposits of up to ten thousand dollars, security can be guaranteed. Applying the Segregated Account system, AvaTrade is regulated by the Central Bank of Ireland (No.C53877), ASIC Australia (No.406684), JFSA Japan (No.1662), and South Africa (FSP 45984).

Can traders lose more than their deposit abruptly in the event of high volatility? AvaTrade explicitly answers no, as traders have negative balance protection.

With a minimum deposit of USD100, AvaTrade offers various leverage depending on the trading instruments; whether it is forex (starts from 30:1), indices (starts from 20:1), commodities (starts from 5:1), ETFs (starts from 5:1), or cryptocurrencies (starts from 2:1).

AvaTrade has committed to a set of values in relation to customers. Therefore, the company provides the best trading experience, offering multilingual customer service and the most sophisticated and user-friendly trading platform.

New traders can also learn forex trading in the Education tab on AvaTrade's official website. Traders will find a wide collection of articles, video tutorials, and more tools that will assist them every step of the way. It is an important requirement as the forex market might be a bit overwhelming and even scary at times, so traders need to make sure that they are fully prepared to begin trading in the real account.

There are many types of account types provided by AvaTrade. There is also an Islamic Trading Account, which is uniquely provided for Muslim Traders. Islamic account type is similar to a regular one with one key difference; it is not subject to any special fees or interests (swap-free), which sits well with the finance principles of Sharia Law.

If traders have felt confident for forex trading, traders can choose AvaTrade as an ideal choice. The minimum deposit and various platforms offered to make it a suitable destination for even beginners who would like to try forex trading for the first time.

6. XM

XM brokerage claims to have had over 5,000,000 clients since its founding in 2009. They cared for their clients by providing 24/5 support with over 30 languages in live support. XM offers different products, such as CFDs, stocks, indices, commodities, and forex. Right now, this brokerage also focuses on its mobile traders.

As a broker with a mobile app, XM provides different kinds of features for trading on the go. This application allows traders immediate access to their accounts straight from their smartphones. They can also manage accounts on the go, including deposit funds and withdrawals. XM mobile apps have a very simple user interface for easier use.

XM Group is a group of regulated brokers and it is owned by Trading Point Holdings Ltd. Entities under XM Group have significant experience as financial services providers worldwide.

Trading Point of Financial Instruments Ltd was established in 2009 with headquarters in Limassol, Cyprus, Trading Point of Financial Instruments Pty Ltd was established in 2015 with headquarters in Sydney, Australia, XM Global Limited was established in 2017 with headquarters in Belize and Trading Point MENA Limited was established in 2019 with headquarters in Dubai.

XM Group is regulated by the CySEC (Cyprus Securities and Exchange Commission) - Trading Point of Financial Instruments Ltd, FSC (Financial Services Commission) – XM Global Limited, the ASIC (Australian Securities and Investments Commission) - Trading Point of Financial Instruments Pty Ltd and DFSA (Dubai Financial Services Authority) - Trading Point MENA Limited.

XM is one of the more experienced brokers in the world of online forex trading today. Since its founding, the broker has experienced a lot of changes, including the addition of the Ultra-Low Account and EN Live Edu that is instructed by 16 global experts.

In terms of trading instruments, XM is a well-known diverse class assets provider, varying from Forex, Crypto, Stock CFDs, Turbo Stocks, Commodities, Equity Indices, Precious Metals, Energies, & Shares. XM prides itself to be the ideal broker in trading execution, offering a stat of 99.35% orders to be executed in less than 1 second. Trading in XM would be also provided with a strict no requotes policy, no virtual dealer plug-in, no rejection of orders, real-time market execution, and the choice for traders to place orders online or by phone.

Spreads on all majors can reach as low as 0.6 pips in Ultra-Low Account, while spreads on other accounts usually start from 1 pip.

To protect the client's fund in the event of extreme volatility, XM presents each account type with Negative Balance Protection. Minimum deposit of $5 applies to Standard, Micro, and also Ultra-Low Accounts. Traders who open accounts in XM are enabled a condition similar to a Cent Account environment in the Micro Account, in which the Contract Size for every lot is only 1,000 units. If it is applied with the smallest lot size in the MetaTrader platform which amounts to 0.01, it means that traders can go as small as 10 units per trade.

For the deposit, XM applies zero-fee deposits in most of its available payment methods. Traders can choose to fund or withdraw their accounts via wire transfer, credit card, as well as the most favorable e-payment choices like Skrill, Neteller, and FasaPay.

To give their clients the best experiment in trading, XM has given access to both MT4 and MT5 platforms, each is available for more than 6 display formats (PC, Mac, Multiterminal, WebTrader, iPad, iPhone, Android, and Android Tablet).

All in all, there is no doubt that XM has gone global with its deep commitment to providing services in more than 30 different languages across the world. Aside from easing traders' experience with mainstream trading platforms and high-quality trading execution, XM is open to various types of traders, from small capital traders to the more experienced ones with big deposits at the ready. Traders are even provided with a Cent Trading environment should they choose to register under Micro Account.

For their global approach, XM has ensured that traders from various countries could access their service easily. This results in the provision of different domains specified for traders in certain jurisdictions. For example, traders from Indonesia could access XM via this link.

7. FP Markets

This brokerage offer client the convenience of CFD trading across several instruments such as forex, shares, indices, and many more. FP Markets is a great choice for traders who like small spreads. This broker has been regulated by the Australian Securities and Investments Commission (ASIC) and has won more than 40+ awards in the field of execution technologies.

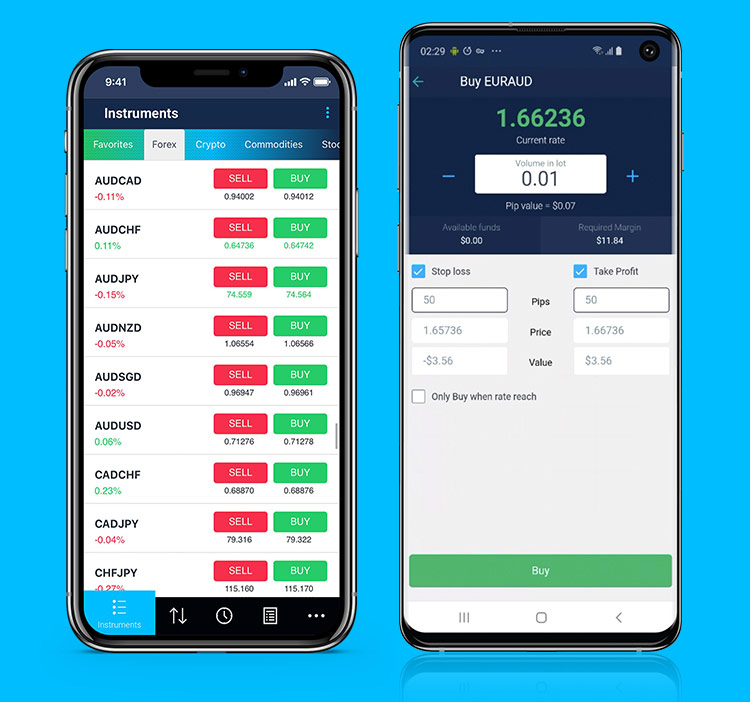

Is FP Markets a broker with mobile apps? Surely it is. Their app allows instant access to the market and provides the necessary tools for technical analysis at traders' fingertips. The simple and easy-to-use interface also makes their app suitable for all kinds of traders.

Keeping positions open overnight won't result in the overnight/rollover fee reducing your earnings, so you don't have to worry about it. FP Markets offers the most competitive swap rates in the industry by introducing Swaps Points in the form of a live swap rates list on the MT4 and MT5 platforms. Here are some examples:

- ACWI: -5.00 for long positions and -2.50 for short positions.

- ADAUSD: -20.00 for long positions and -20.00 for short positions.

- AGG: -5.00 for long positions and -2.50 for short positions.

8. easyMarkets

easyMarkets offers an easy, transparent, and accessible trading experience for their traders. This broker was founded back in 2001 and now has gained more success. Over the year, easyMarkets has expanded its CFD offerings to include global indices, energy, metals, and many more.

As one of the best brokers with mobile apps, easyMarkets allows mobile traders to access more than 200 instruments on their hands. This app features a free demo account for new traders to practice and learn without risking any money. easyMarkets also provides top trading tools and updates traders with their easy account monitoring.

Since 2001, easyMarkets have been writing their stories in financial markets. Simple, Honest, and Transparent, become three values that are carried on easyMarkets. The company has tried to make the process of trading as simple as possible.

They rebranded from easy-forex to easyMarkets in 2016. Over the years, easyMarkets expanded their CFD offerings to include global indices, options, metals, forex, commodities, and cryptocurrencies. The company is licensed by CySEC and ASIC.

Another privilege when trading in easyMarkets is its own platform. easyMarkets platform is simple and versatile. Based on reviews from traders, it's friendly to new clients and hosts a lot of features for experienced traders. Clients also receive free guaranteed stop loss, no slippage, fixed spreads, and no funding or withdrawal fees from easyMarkets.

There are three uniques features in the platform. Firstly, dealCancellation gives traders the ability to "undo" their trade. easyMarkets is the only broker that offers a way to close trade before it reaches 60 minutes duration only with a small fee.

Furthermore, traders can enjoy the Inside Viewer. This tool gives traders a deeper understanding of market sentiment by showing them percentage of buying and selling executed in the platform. The third unique feature is Freeze Rate. traders can pause a rate and place their trade at the "frozen" rate using this tool.

easyMarkets also includes financial calendar, market news, trading charts, and trading signals as the platform's perks. They also offer the technology on the mobile interface via iOS and Android devices. Traders can access markets anywhere and at any time.

MetaTrader 4 is also provided by easyMarkets. When using this popular trading platform, traders will get negative balance protection and fixed spreads. Besides that, Vanilla Options is available in this broker.

Because of those innovations, easyMarkets is an award-winning broker, receiving Forex Broker 2019 by The Forex Expo-Dubai, Most Innovative Broker 2018 by World Finance Markets Awards, Best APAC Region Broker 2018 by ADVFN International Financial Awards, Most Transparent Broker 2017 by Forex-Awards, Best Forex Service Provider 2017 by FXWord China, and many more over the years.

Moreover, easyMarkets offers three account types, such as VIP Accounts, Premium Accounts, and Standard Accounts. All of them can be accessed by the Web/App and MT4 platform. easyMarkets provide maximum leverage at 1:200 when using easyMarkets Web/App platform, and maximum leverage of 1:400 when using MT4.

Fixed spreads start from 1.0 pips in forex trading. Traders can become easyMarkets VIP clients with some benefits, such as trading via telephone, access to the tightest fixed spreads, personal analyst, and real-time market updates via SMS.

Traders do not need to pay additional fees whethere it is for commission, account fees, or deposit withdrawal. Account currencies are available in 18 options including EUR, CAD, CZK, JPY, NZD, USD, SGD, and many more. The company offers multiple ways to deposit and withdraw funds, some of them are credit/debit cards, bank transfers, and a ion of eWallets like Neteller, Skrill, and Fasapay.

For any questions or assistance, traders can contact the company directly at one of their local offices or at their headquarters in the Marshall Islands. Besides, traders can chat with their customer service by email, Facebook, WhatsApp, Viber, and Live Chat.

Based on the review above, easyMarkets provides easy-to-use platforms with some unique tools and it can be accessed by traders anytime and anywhere. Besides, traders do not need to pay extra fees for trading commission and deposit/withdrawal fees. Traders who register in easyMarkets can enjoy low spreads in EUR/USD pairs from 0.9 in the MT4 platform.

9. Vantage FX

Another broker with a mobile app to consider is Vantage FX. This broker was founded in 2009 by financial professionals. This brokerage claims to have over 50,000 active clients all over the world. With more than 300 CFD instruments, including forex and commodities, this broker is perfect for CFD traders.

Clients can trade CFDs from Vantage FX mobile app as well. Technical traders will love using this app because this broker allows many types of technical indicators in their mobile app. Market analysis is also provided to help traders create their best strategies and understand the current price situation. In addition, customer support is available 24/7 in multi-language.

10. Xtrade

Xtrade is not a new player in the market. They have been around for 10 years. This brokerage has been home to clients in more than 25 countries. They offer CFD trading, stocks, forex, commodities, and other instruments. Xtrade promises 24-hour support to make sure its clients are served well, and offers fascinating promotions in a welcome bonus package.

Being one of the best brokers with mobile apps, Xtrade makes sure its user experience is easy, fast, and intuitive. Trading with this broker means no commissions and secure payments as well. Traders can customize alerts and notifications according to their needs. Advanced technical analysis tools are provided to maximize the traders' experience.

Operating as an online CFDs broker since 2010, XTrade Europe Ltd. is a part of XTrade Group and provides trading in FX and CFDs as offersfx.eu. Previously known as xtrade.eu, this broker is regulated by the Cyprus Securities and Exchange Commission (CySEC) with license number 108/10.

Therefore, it is subject to the regulatory requirements of the Markets in Financial Instruments Directive (MiFID II). For non-European traders opening an account in XTrade, they will be managed by Xtrade International Ltd., a Belize-based entity that is licensed by the International Financial Services Commission in Belize.

As OffersFX, XTrade Europe Ltd. accentuates its rich options of trading assets for clients. From Forex to cryptocurrencies, OffersFX manages to offer them all. The broker also presents interesting alternatives like Shares, ETFs, and Bonds. This alone has opened opportunities to traders and investors from various markets.

Several attributes claimed as their distinctive advantages including strong financial resources, quick and efficient withdrawal process, cutting-edge platform technology, and worldwide customer support.

Following XTrade International's offering, XTrade Europe does not provide trading with the highly popular MetaTrader platform. This broker has its proprietary platform that enables traders to access the market via Web-Trader with a rich set of features and trading tools to ensure an optimized trading experience. Said platform is not only available on the desktop, but also in mobile app and tablets.

Trading conditions are not explained thoroughly, as the broker does not offer selectable account types. Forex trading in XTrade is presented with Fixed Spread from 2-5 pips with no commission.

There are no clear details of information on the maximum leverage and minimum deposit. However, XTrade Europe Ltd. mentions explicitly that there are premium charges for overnight trading positions.

There are no fees charged for deposit and withdrawal, and traders can choose between bank transfer, credit card, PayPal, Skrill, and Neteller as the payment method.

However, it is important to acknowledge that there is an inactivity fee of up to $50 per month if a trader somehow neglects their trading account in OffersFX for 3 months. Also, there is a dormant maintenance fee up to $100 per month for accounts that have been inactive for one year or more.

For all of the assets provided to traders, OffersFX does not exactly equip them with profound education materials. There are explanations dedicated to each trading instrument, but the broker has no further contents to educate traders about online trading in various markets.

To sum up, XTrade Europe Ltd. is a CySEC-regulated broker with many trading instruments to offer. It is a distinctive company in the way it offers Fixed Spread as the sole trading commissions to traders and does not comply with mass preference in the MetaTrader platform.

Unfortunately, XTrade Europe Ltd. is not too great on transparency and information sharing, as well as charges a quite big amount of fees for inactive accounts. Well, at least the broker states that it does not require deposit and withdrawal commissions.

Benefits of Mobile Trading

There are plenty of benefits of mobile trading, which is why this method gains even more popularity nowadays. For example, a broker with mobile apps usually provides traders with live market data as well as live-related news. That means, traders can review their portfolios anytime they want and take a brief idea about their assets' performance.

Most brokers with mobile apps also provide them as trading platforms as well. It allows traders to access their positions as well as placing market orders without having to turn on the computers. In fact, some premium apps present analytical tools and trading signals on mobile applications. To conclude, mobile apps provide quick and easy access to the market for busy traders.

Mobile Trading Limitations

That being said, mobile trading also has its drawbacks. For example, some apps have restricted access to some instruments and analytical tools. This means traders' choices will be limited if they trade from a mobile app. Another drawback is the small screen; this can be discomfort for traders who normally use a computer or laptop.

Connectivity issues can also be a problem for mobile trading, especially if the trader often visits remote locations without connectivity. Furthermore, a slow-speed smartphone can contribute to trouble during transactions. Not to mention it can cause your orders to be.

See Also:

After Thought

As the world leans towards digitalization, mobile trading is becoming increasingly popular. Most brokers realize their traders wish for a flexible trading experience to support their busy lives. More traders are looking for brokers with mobile apps for more flexible trading activities. But even though there are plenty of benefits for traders with mobile apps, there are also some limitations. For this reason, some traders should maintain their access to desktop trading platforms while using mobile apps for quick trading.

Mobile trading is very popular among crypto traders. Beside those brokers above, a popular trading provider such as IC Markets also offers IC Markets.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance

4 Comments

Osmane

Jan 18 2024

I find the mobile apps discussed in this article particularly intriguing. I share the concern highlighted about the challenges posed by the smaller screens of mobile trading apps, making it difficult to analyze candlestick graphics and employ analytical tools effectively. The limited screen size creates a hindrance for traders in utilizing these features.

However, what caught my attention is another point mentioned in the article, stating that mobile trading has its own downsides. Specifically, some apps impose restrictions on access to certain instruments and analytical tools. This implies that traders using mobile apps may encounter limitations in their choices. The question arises: why do some mobile trading apps restrict access to certain instruments and analytical tools?

Jeremy

Jan 20 2024

Hey there! Let me explain to you about the questions that you have been asked. So, the restricted access to certain instruments and analytical tools in some mobile trading apps can be attributed to several factors. One primary reason is the complexity and resource-intensive nature of certain financial instruments and tools. Mobile devices may have limitations in processing power, memory, and screen real estate, making it challenging to provide seamless access to all features.

Additionally, security concerns play a crucial role. Some advanced analytical tools and financial instruments may require robust security measures, and implementing them on mobile platforms might pose potential vulnerabilities. To maintain a balance between functionality and security, developers may choose to limit access to certain features on mobile apps.

Furthermore, user experience is a key consideration. Developers may prioritize the features that are deemed most essential for on-the-go trading, streamlining the mobile app interface to provide a more user-friendly experience. This decision-making process can lead to the exclusion of certain tools and instruments that may be perceived as less critical for mobile users.

Jeremy

Apr 24 2024

Hey, do you think the specifications of our mobile phones can impact our mobile trading experience? I read that using a slow-speed smartphone can lead to issues during transactions, potentially causing delays or even missed orders due to connectivity issues. But since trading apps are involved, I'm curious: can the specifications of our phones really make a difference, and what's the ideal phone specification for trading?

I mean, it makes sense that a faster phone with better processing power and a stable internet connection would provide a smoother trading experience. But I wonder if there's a specific standard specification that traders should aim for when choosing a phone for trading purposes. After all, we rely heavily on our phones for trading on the go, so having the right specs could make a significant difference in our trading performance. What do you think?

Afgan

Apr 26 2024

When it comes to choosing a smartphone for trading, you want one that can handle the demands of the task. Look for a device with at least 4GB of RAM to ensure smooth performance, especially if you're running multiple trading apps simultaneously. A fast processor, like those found in Qualcomm Snapdragon or Apple A-series chips, ensures quick order execution and chart loading times.

A stable internet connection is crucial for uninterrupted trading, so opt for a phone with reliable 4G LTE or 5G connectivity. A clear and spacious display is also essential for easy viewing of charts and order placement interfaces.

In summary, prioritize a smartphone with sufficient RAM, a fast processor, reliable network connectivity, and a high-quality display for optimal trading performance on the go. By choosing a device with these specifications, you can ensure a smooth and efficient trading experience, helping you stay on top of the markets wherever you are.