What do you need to open an XM account? Here are details on what you should do and what to expect during the process.

If you want to become a serious trader that makes consistent profits, then you need the role of a broker. Through a broker, you can access the forex market as well as buy or sell currency pairs. For some traders, choosing the right forex broker may take a long time. You have to find the one that's not only legal but also matches your skills, trading style, and investment goals. In that case, brokers like XM can cater to almost all types of traders, whether you are a beginner, a professional, a scalper, or a day trader. This article would walk you through the registration process in XM.

Contents

Introduction to XM

Founded in 2009, XM broker is acknowledged as the next-generation broker in terms of online forex and commodity trading because it is friendly to not only beginners but also experienced traders. On top of that, traders can practice or test strategies on XM's demo platform which provides virtual currency of up to $100,000.

Today, the company has grown into a well-established international investment platform that always provides the best service for every client. It's likely that XM has managed to attract around 5 million clients in more than 190 countries, so it is unsurprising that the broker has become a favorite of many traders.

XM Group is a group of regulated brokers and it is owned by Trading Point Holdings Ltd. Entities under XM Group have significant experience as financial services providers worldwide.

Trading Point of Financial Instruments Ltd was established in 2009 with headquarters in Limassol, Cyprus, Trading Point of Financial Instruments Pty Ltd was established in 2015 with headquarters in Sydney, Australia, XM Global Limited was established in 2017 with headquarters in Belize and Trading Point MENA Limited was established in 2019 with headquarters in Dubai.

XM Group is regulated by the CySEC (Cyprus Securities and Exchange Commission) - Trading Point of Financial Instruments Ltd, FSC (Financial Services Commission) – XM Global Limited, the ASIC (Australian Securities and Investments Commission) - Trading Point of Financial Instruments Pty Ltd and DFSA (Dubai Financial Services Authority) - Trading Point MENA Limited.

XM is one of the more experienced brokers in the world of online forex trading today. Since its founding, the broker has experienced a lot of changes, including the addition of the Ultra-Low Account and EN Live Edu that is instructed by 16 global experts.

In terms of trading instruments, XM is a well-known diverse class assets provider, varying from Forex, Crypto, Stock CFDs, Turbo Stocks, Commodities, Equity Indices, Precious Metals, Energies, & Shares. XM prides itself to be the ideal broker in trading execution, offering a stat of 99.35% orders to be executed in less than 1 second. Trading in XM would be also provided with a strict no requotes policy, no virtual dealer plug-in, no rejection of orders, real-time market execution, and the choice for traders to place orders online or by phone.

Spreads on all majors can reach as low as 0.6 pips in Ultra-Low Account, while spreads on other accounts usually start from 1 pip.

To protect the client's fund in the event of extreme volatility, XM presents each account type with Negative Balance Protection. Minimum deposit of $5 applies to Standard, Micro, and also Ultra-Low Accounts. Traders who open accounts in XM are enabled a condition similar to a Cent Account environment in the Micro Account, in which the Contract Size for every lot is only 1,000 units. If it is applied with the smallest lot size in the MetaTrader platform which amounts to 0.01, it means that traders can go as small as 10 units per trade.

For the deposit, XM applies zero-fee deposits in most of its available payment methods. Traders can choose to fund or withdraw their accounts via wire transfer, credit card, as well as the most favorable e-payment choices like Skrill, Neteller, and FasaPay.

To give their clients the best experiment in trading, XM has given access to both MT4 and MT5 platforms, each is available for more than 6 display formats (PC, Mac, Multiterminal, WebTrader, iPad, iPhone, Android, and Android Tablet).

All in all, there is no doubt that XM has gone global with its deep commitment to providing services in more than 30 different languages across the world. Aside from easing traders' experience with mainstream trading platforms and high-quality trading execution, XM is open to various types of traders, from small capital traders to the more experienced ones with big deposits at the ready. Traders are even provided with a Cent Trading environment should they choose to register under Micro Account.

For their global approach, XM has ensured that traders from various countries could access their service easily. This results in the provision of different domains specified for traders in certain jurisdictions. For example, traders from Indonesia could access XM via this link.

What to Prepare Before Registering

With a minimum deposit of $5, signing up for an account at XM broker can be done by literally anyone, beginners or professionals. However, there are a number of things you need to pay attention to and prepare for before joining:

1. Documents

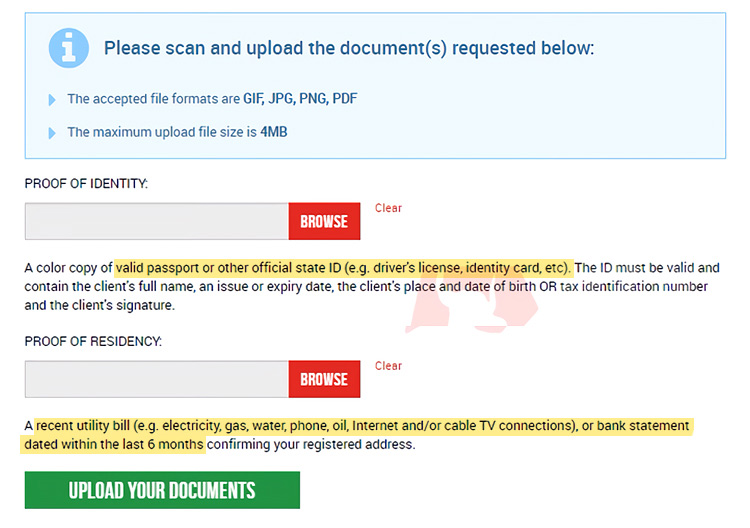

You need to submit some documents for account verification. As a regulated company, XM broker operates in accordance with a number of compliance-related issues and procedures imposed by its regulatory authorities. These procedures involve the collection of adequate documentation from clients with regard to KYC (Know Your Client). You have to prepare 2 essential documents which can be in GIF, JPG, PNG, or PDF format with a maximum file size of 4MB. These documents are:

- Proof of Identity

A color copy of a valid passport or other official state ID (e.g. driver's license, identity card, etc). The ID must be valid and contain. - Proof of Residency

A recent utility bill (e.g. electricity, water, telephone, oil, internet, or cable TV connections) or bank statement dated within the last 6 months confirming your registered address.

2. How to Fill out the Registration Form

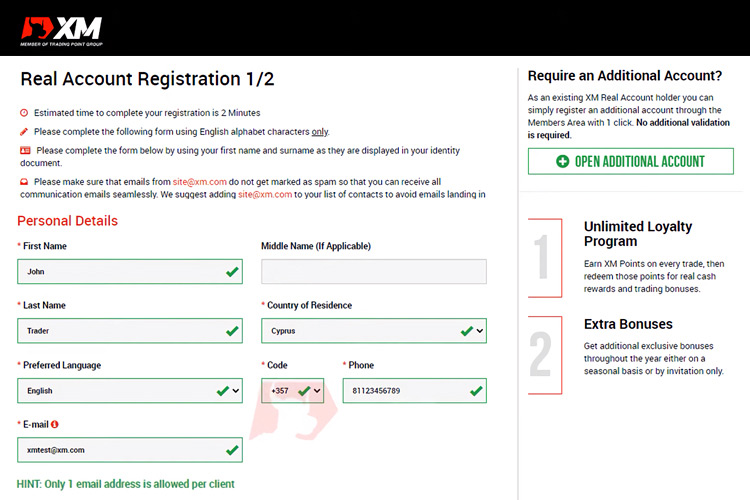

Since you will have to fill out long application forms, remember that only the English alphabet is accepted. Additionally, please complete the form using your first name and surname as they are displayed in your identity.

3. Account Types

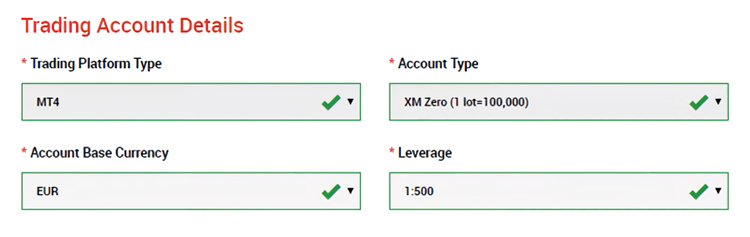

XM provides 5 types of accounts that you can choose according to your abilities and skills. The account types include:

- Standard (1 lot = 10,000)

- Micro (1 lot = 1,000)

- XM Ultra Low Standard ( 1 lot = 100,000)

- XM Ultra Lot Micro (1 lot = 1,000)

- Shares Account (Shares trading with $10,000 minimum deposit)

See Also:

4. E-mail Confirmation

Since you must receive an e-mail from XM to confirm your account, please make sure that e-mails from [email protected] do not get marked as spam. XM suggests adding [email protected] to your list of contacts to avoid emails landing in the spam folder.

Guide to Sign Up for XM Account

Before installing an MT4 trading platform, you need to open a live account with the following steps:

1. Head over to the XM official website and click "Open an Account" button.

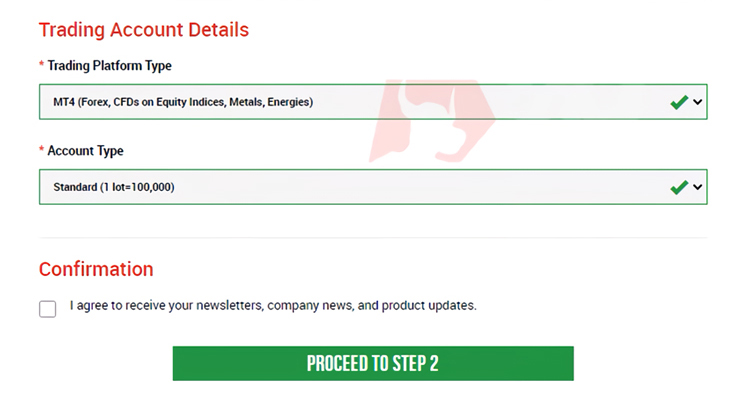

2. You will be directed to the Real Account Registration page where you need to fill out the form with your personal details, and trading account information. Afterward, click "Proceed to Step 2".

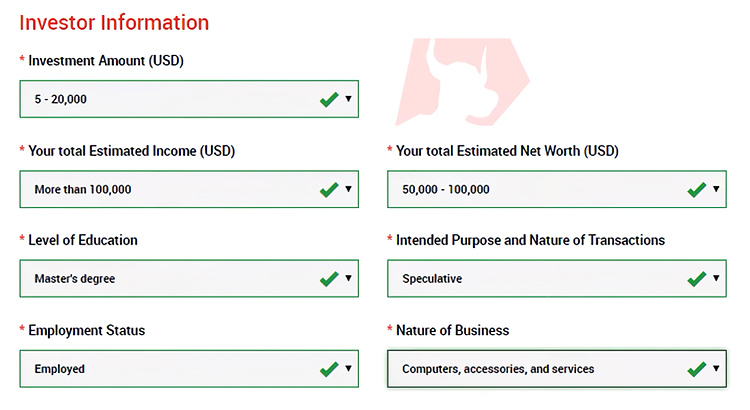

3. Besides trading account details, you must fill in investor information such as your investment amount, level of education, and so on.

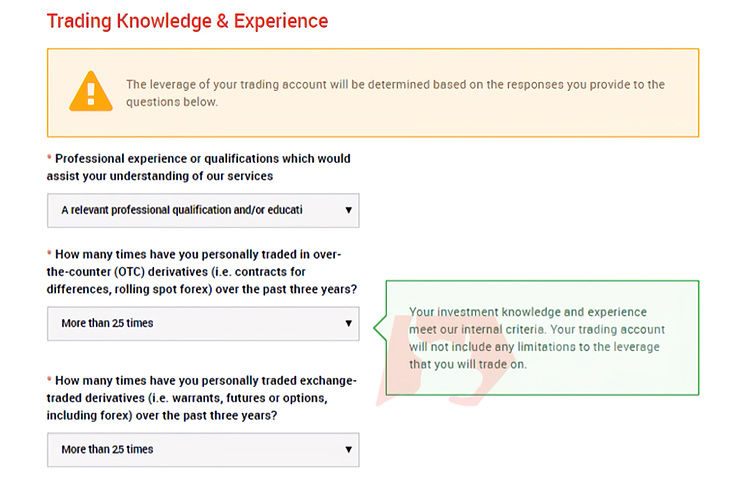

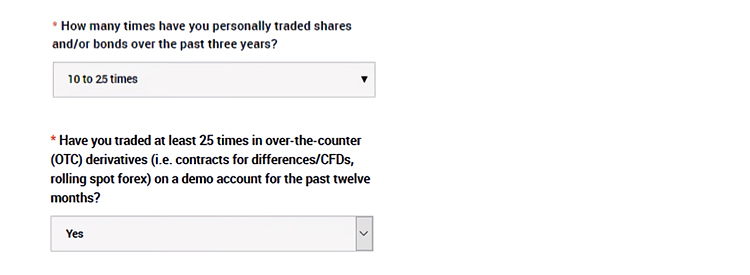

4. Next, complete the Trading Knowledge and Experience page honestly.

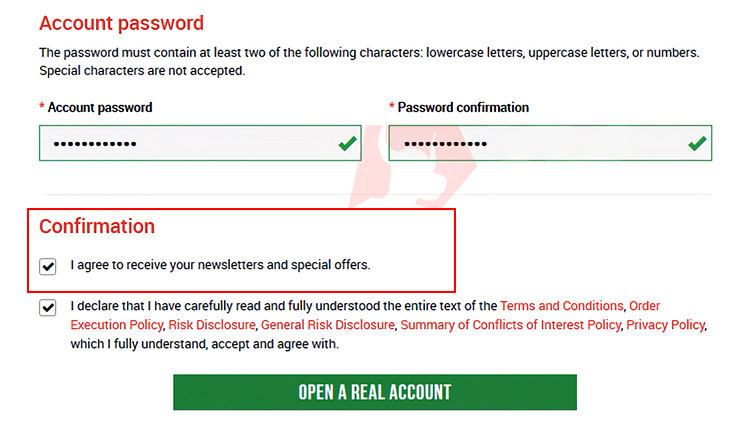

5. Once you're ready, you may enter the password of your choice. Check the box that you've read and fully understood the terms and conditions, then click "Open a Real Account" to finalize your account opening in XM broker.

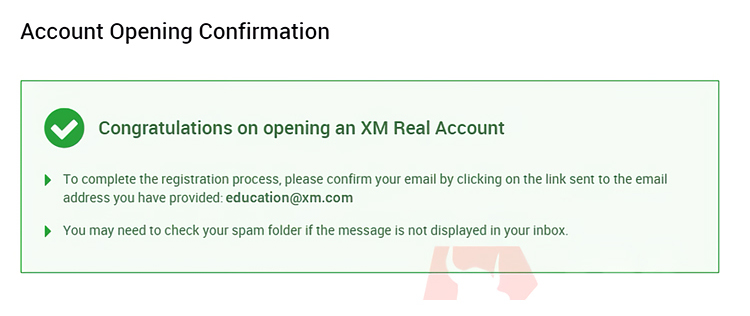

6. You have successfully opened an XM account. In this step, you need to confirm your e-mail address and install the MT4 trading platform.

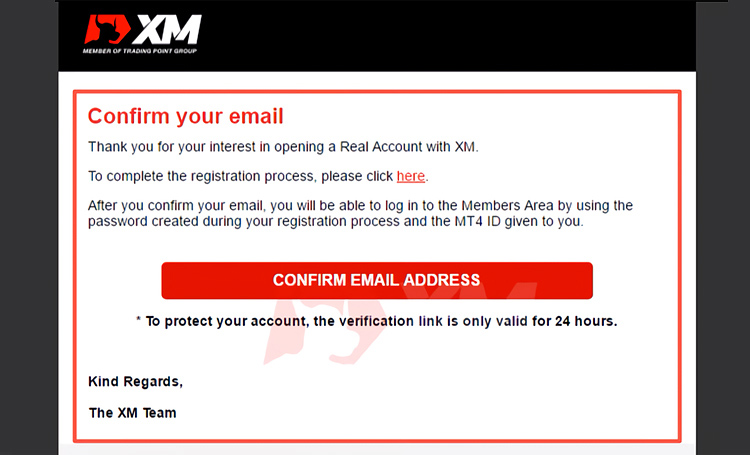

7. Go to your e-mail inbox and click the "Confirm email address" button. You would have to make sure to click the button within 24 hours after the email is sent to you so you can proceed to the next step.

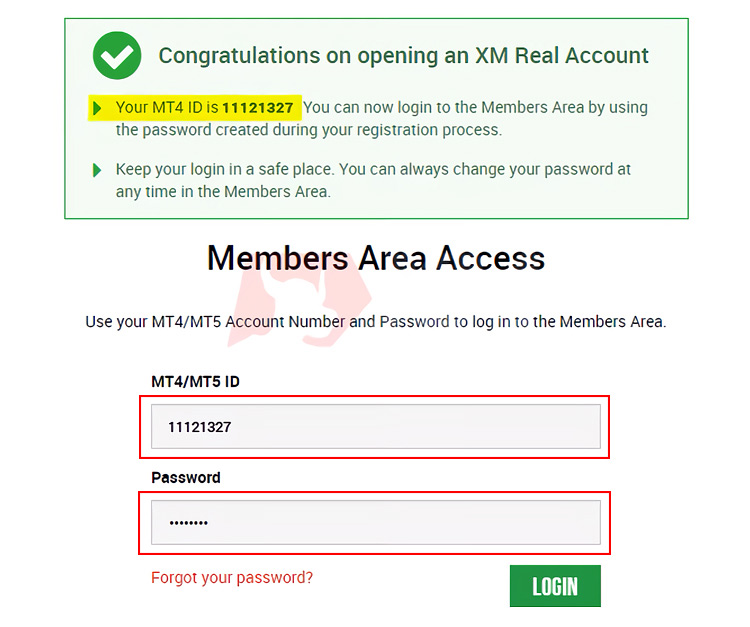

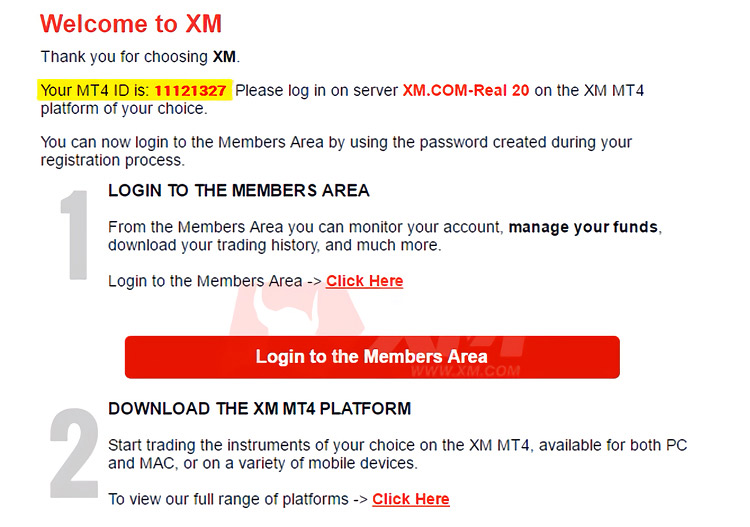

8. You will be directed to XM broker's Members Area. Here, you are provided with an MT4 ID unique number, which is required every time you access this page. Enter the password you've created before and click Login.

9. Shortly after, you will receive a second e-mail with your MT4 ID and server name. You may proceed to login into Members Area or download the XM MT4 platform.

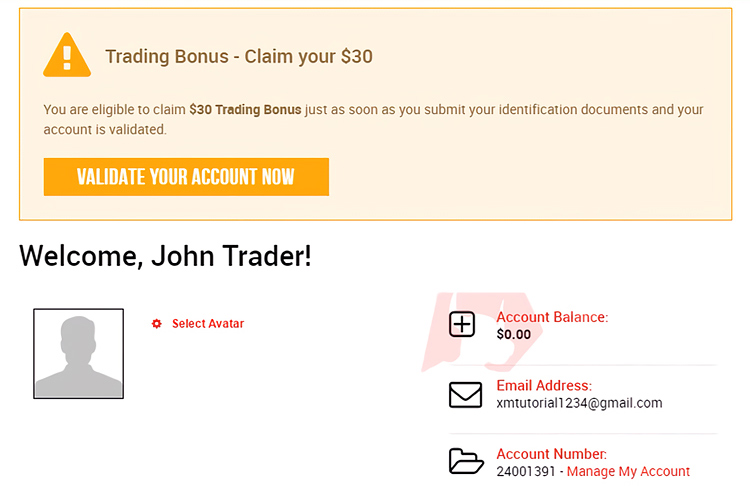

10. You've logged into XM Members Area but your trading account is still pending. To start the verification, click "Validate Your Account" button.

11. To be approved, you are required to upload necessary documents like Proof of Identity and Proof of Residency.

EndNote

After successfully opening an account in XM, you can enjoy a range of attractive features from the broker such as ultra-low spreads from 0.0 pips, low deposit requirements, high leverage, automated trading, and fast order execution in less than 1 second. Additionally, XM offers 1000+ trading instruments that cover more than 55 forex pairs, stocks in 600 companies, cryptocurrencies, major global indices such as the NASDAQ and DAX, and commodities like precious metals and energies.

You may find out if XM is the correct broker you're looking for by comparing its benefit and disadvantages. Read this article to understand more pros and cons of XM.

Earn Infinite Loyalty Rewards

Earn Infinite Loyalty Rewards Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients

16 Comments

Diego

Jan 26 2023

I like the trading style at Xm broker which provides many interesting features with very low trading costs in my opinion. Yes, as you know, at XM we can start trading with a spread of 0.0 pips. and, wow that's so crazy, so cheap. I don't imagine any broker offering mercy in trading.

why can I be cheap? spread is one of the costs that we have to consider in trading. everyone may have different targets, but when your funds are limited Xm can be a platform that provides a solution to all of these limitations.

and yeah after I read this article, registering at Xm is quite easy, compete with brokers who are equivalent to. So, I like it...

Charles

Jan 26 2023

Diego: I also agree with your opinion that XM is a broker solution for traders who want to trade at low cost. I am a user of the Xm application on your iPhone. I thought that at first it was difficult to register, but it's not like that. everything is easy with a fairly fast verification system. Morning service for new customers takes precedence at XM.

I registered, I verified the account, it only took less than 1 day. in my experience it is the fastest registration process in my opinion. not all brokers provide this speed. and what made me naam when registering an account, XM provided a complete guide with the right and simple choice of words in my opinion. This registration guide is a great service from XM.

Grace

Jan 26 2023

Charles: I agree if you say that the directions and registration process at XM are quite easy and the process is fast. but I don't agree if n = say that Xm is the account with the cheapest trading fees. I think Xm is a broker that offers low trading fees but is quite varied, so there are changes in spreads.

like this micro account on Xm, an entry-level XM Account, the minimum deposit starts from 5 USD on the Micro Account, and the average spread is 1.7 pips on EUR/USD, which is wider than other similar-sized market moving brokers. However, we find that the spread is close to 2.1 pips on EUR/USD.

To be more precise, traders will find spreads between 0.8 pips and 1.7 pips (EUR/USD), depending on the account.

Emilliano Enzo Martinez

Jan 30 2023

Charles: I disagree about the speed of account verification at the XM broker. I don't say that XM Broker slow at verifying, but I mean there is no broker that slows down their client verification process unless their new client provides blurry documents, invalid documents or even expired documents. I also have experience with my local broker, and it only takes 6 hours to verify as all my documents are cleared, also I verified all my documents before posting sign.

and after all, you talk about fast registration at XM, I think it is because you have a clear and valid document. Remember that the broker's customers are the broker's profits. So, they also want to verify quickly to make profits faster.

Michael

Jan 30 2023

Grace: Friend, can you explain more details about the spread offered by XM. When I look at your review and explanation, I care if the spread is variable or the spread is fixed? I mean if it is fixed the spread will be low because most of the fixed spreads start from 2 pips. And if the spreads are variable, it will be costly as many brokers have variable spreads starting from 0 pips!!

Meanwhile, what about roses? Is XM commission free? Thank you!

Albert

Jan 30 2023

Diego : I do understand spread after all. If you said about 0.0 spread, it means when I open position, I will get charged by 0.0 pip or $0.0, right? But what I need now is a low deposit and not much money to trade. I think we need to forget about spreads for a while, because if you start trading with a minimum deposit of $10,000 for example, everything you say about spreads, cheap fees, limited amounts is not helpful at all. any.

What is the best condition for a beginner trader and a trader with limited funds to start trading with XM?

Jonathan

Jan 26 2023

After reading this article, I know that XM is a platform that provides easy registration and there are guidelines that are quite easy to understand. after I read this article, I've tried to register my email account. Wow 5 minutes straight into the account.

I want to proceed to the verification step, but I still have doubts about it. In this article, it has been explained that verification can be processed by uploading some proof of your identity, such as proof of identity and proof of domicile. I don't understand how to upload, are there any conditions for the quality of uploaded documents? I don't understand, if there are friends who have traded at Xm, can you give me an explanation...

thank you

Backy J

Jan 26 2023

Jonathan: Hello @Jo, well what a coincidence, I'm a new trader at XM. I signed up about 2 months ago. as you all know that XM is a broker that offers trading with complete instruments and lots of choices and low spreads.

As far as I know, All XM accounts, except the stock accounts, have a minimum deposit of 5 USD, so they are accessible to beginners. No commission is charged for Forex trading on three out of five accounts, for relatively small spreads.

In order to verify your account, you will usually be asked to submit a copy of your ID or Passport with a signature page, as well as a copy of a recent utility bill or bank statement. Our documents are scanned as high-quality digital camera images. Once all your documents have been received, the account can be used for trading on the same day.

If you want to know more about the registration process, you can click Register XM

Bruce

Jan 30 2023

Backy J: Why do we need multiple ID documents to trade with XM? I mean, after reading your explanation of the XM trading conditions, which offers a wide ion of instruments and low spreads, I became interested. But after signing up for a live account, I was shocked that the broker even needed my real address and also the bill with my address to prove that I was using a real address.

I mean the broker takes my ID and phone number, which I understand because most of registration nowadays also needs an ID and phone number. But why need more than that? If my identity is revealed, who will be responsible in the end? My privacy is number 1 for me

Hansen

Jan 30 2023

Backy J: Do you have enough to trade with 5 dollars? and about the payment option, I had a case where the broker only offered a deposit of 1$. And I was interested, so I decided to open an account there. After verification, I try to deposit, there are many payment options. But what surprised me is that the entire payment option in the deposit offer starts from $4-$10! Ok, I still understand because there aren't many payment options that only accept $1. So I decided to deposit $4. But then the $4 I deposited actually was not enough to do the trade.

My question is, as a trader who trades XM, is it true that we only deposit $5 and that is enough to trade XM?

Michael

Feb 7 2023

Bruce: Dude, let me answer. Regulatory authorities around the world have enforced KYC (Know Your Customer) as a term that brokers must know before accepting traders. For what? because of UN sanctions. The United Nations will sanction all organizations and companies found to accept or conduct transactions with embargoed persons and receive sanctions in other countries, as well as those who are actually wanted by a person or criminal. The person I have described can bring money laundering potential to brokers. So I think without this rule all brokers, like it or not, would apply KYC step for their traders to avoid that thing.

There are also many factors why brokers need to know your identity. You can read here to know more about KYC : Why do broker need to know trader personal information

Jeremy Juan

Feb 7 2023

Jonathan: Dude, if you dont understand how to upload at PC, you can do it at XM Mobile App (you can read about the app : XM Mobile App). It is very simple since you only to click upload button and find the photo or document that you have been prepared.

The quality of documents, especially photos, need to be clear, no blurred and need to be vaild. Of course the term in document type such as PDF also same as well. And another that you needed to watch is your document size. Make sure to the maximum size is same with the allowed size.

Herald

Feb 7 2023

Hansen : "Do you have enough to trade with 5 dollars?"

Sorry, about your question, I guess you ask about is it enough to trade with $5, right?

In XM, with the leverage 1:500 and also minimum trading only 0.01 lot. Off course you can do the trade but with very limited times. And you need to ensure to open micro account because 1 lot micro has minimum risk. The pip's value in there only $1 and suprisingly you can trade with 0.01 lot micro! The 0.01 lot micro only have $0.01!

Another question about the payment option minimum transaction is not same with broker's minimum deposit, right?

I guess it is depending on payment option provider's term. I mean you can't do anything about it after all

Hansi

Mar 24 2023

I came across a review of XM on a broker review website and discovered that they offer both MetaTrader 4 and MetaTrader 5. When I went to open an account on their website, I noticed that I had the option to choose between the two trading platforms. I followed the article's steps and ed MetaTrader 4.

If later on, I change my mind and decide I want to use MetaTrader 5 instead, I'm wondering if I can simply switch the trading platform on my existing account or if I need to open a new account altogether? Hope for the explanation, thank you!

Antonio

Mar 29 2024

After revisiting the previous question, I encountered a review of XM on a brokerage review site and found out that they provide both MetaTrader 4 and MetaTrader 5. Upon attempting to create an account on their website, I noticed the availability of choosing between these two trading platforms. Following the instructions outlined in the review, I opted for MetaTrader 4.

In the event that I later change my preference and decide to switch to MetaTrader 5, I'm curious whether I can seamlessly transition to this platform within my existing account or if I'll be required to open a new account altogether. I'm seeking clarification on this matter. Thank you in advance for any explanation provided!

Pieter

Apr 4 2024

Hey there! If you decide to switch from MetaTrader 4 to MetaTrader 5 after initially choosing MetaTrader 4 for your XM account, you typically have the option to switch trading platforms within your existing account. This means you won't need to open a new account altogether. XM usually allows users to make such changes without the need for a new account setup. However, it's always a good idea to check with XM's customer support or review their platform policies to confirm the specific procedures for switching trading platforms within an existing account.