If you are looking for the best trading apps, FxPro trading platform can be your choice. Read this article to learn more about the FxPro trading app.

In today's fast-paced financial markets, having access to real-time information and the ability to trade on the go is essential for success. FxPro, a global leader in CFD trading, understands traders' changing needs and has created the FxPro Trading App to provide a variety of benefits to your trading experience:

- Access to real-time information and the ability to trade on the go

- Seamless and powerful trading experience on your mobile device

- Wide variety of tradable instruments, including forex, stocks, metals, indices, energy, and futures

- Efficient account management with improved digital onboarding and accessible account management features

- High levels of security measures, including personal data encryption and two-factor authentication

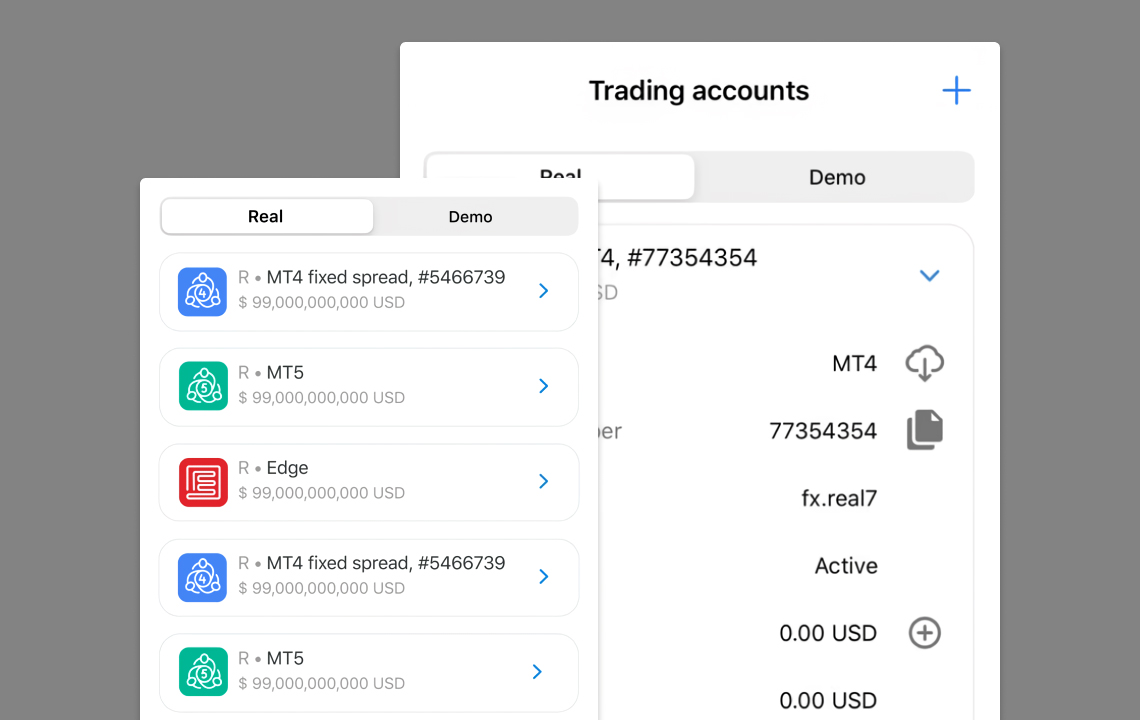

- Ability to manage multiple FxPro MetaTrader accounts in one app

- Safe and straightforward fund management system with no fees for deposits and instant transfers between trading accounts

- Competitive spreads and commission fees

But before exploring more deeply into what benefits the app offers, let's get to know about the app first!

FxPro Trading App at a Glance

The FxPro trading mobile app is made to improve your trading experience with its easy-to-use interface and many features. No matter how much you know about trading or how new you are, this app gives you the tools and features to navigate the financial markets confidently and easily.

The FxPro App for mobile provides an all-in-one solution for managing your accounts, funds and trading from a single integrated platform. It is compatible with iOS and Android devices and has a quick sign-up process.

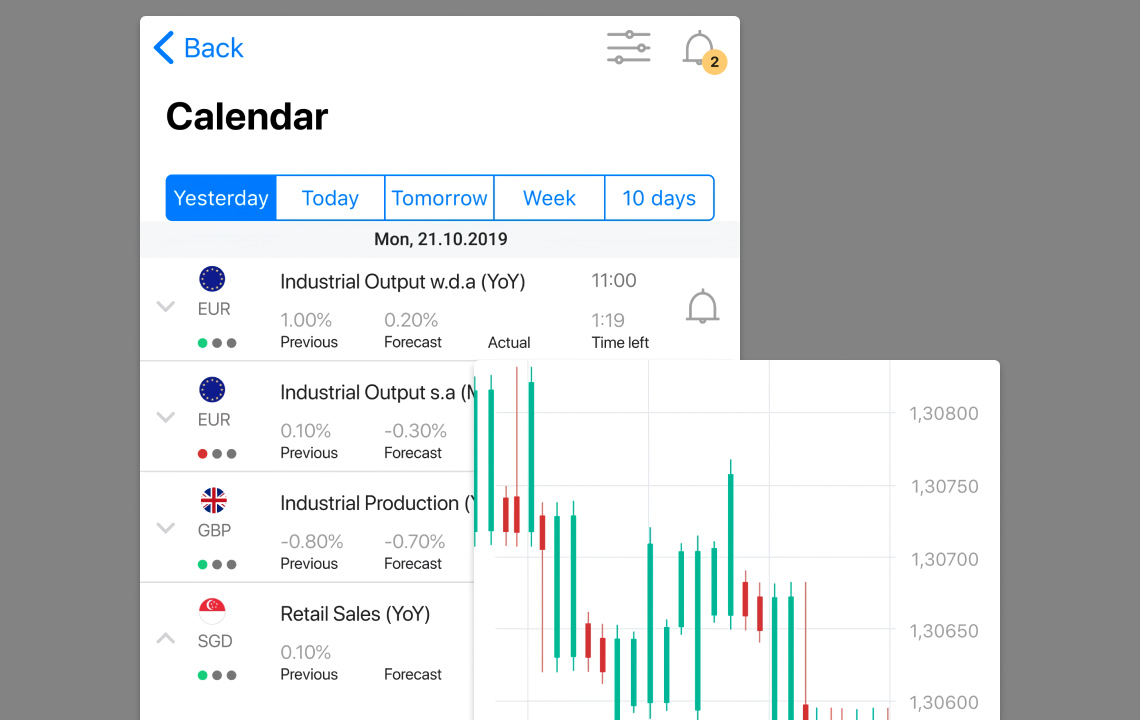

Once you're in, you'll have access to a trading platform that is all in one and makes trading easy. You can use the app to access the integrated trading platform, interact with the economic calendar, open and manage accounts, deposit, transfer, withdraw funds, etc. Furthermore, the app sends push notifications about market volatility, keeping you current on potential trading opportunities.

The FxPro App for mobile has gained significant popularity with over 500,000+ downloads, showcasing its broad user base. It has received positive user feedback, evidenced by its 4.6 ratings on Google Playstore. This high number of downloads and positive ratings highlight the app's reliability, user satisfaction, and trustworthiness among traders in the market.

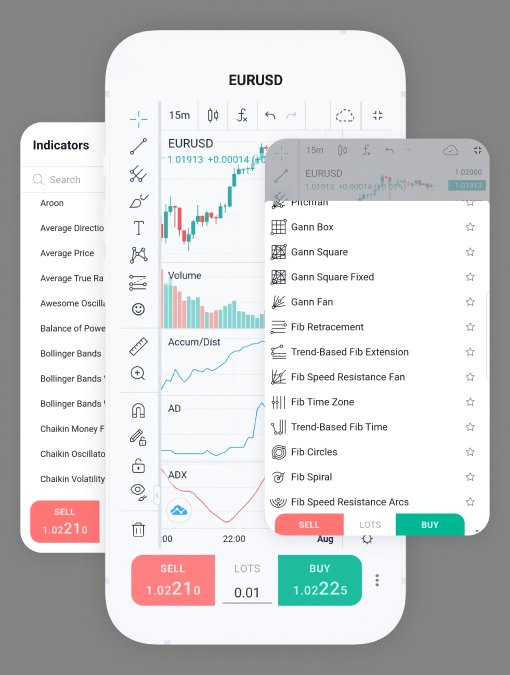

Advanced Charting with TradingView

To provide advanced fullscreen charting capabilities, the FxPro Trading App integrates with TradingView, a well-known charting platform. You can analyze the market like a pro with hundreds of technical indicators and tools. The immersive charting experience enables detailed analysis, allowing you to make sound trading decisions.

Trade Thousands of CFD Instruments

The FxPro Trading App provides various tradable instruments, including forex, stocks, metals, indices, energy, and futures. You can execute orders and analyze markets on the go using the award-winning mobile platform. You can diversify your trading portfolio and seize opportunities across multiple markets with access to multiple asset classes.

Efficient Account Management

The FxPro Trading App makes it simple to manage your trading accounts. Benefit from improved digital onboarding, allowing a more efficient registration process. Conveniently create new trading accounts, change passwords, update contact information, and manage bank details. If you have questions or need help, the app gives you direct access to FxPro's award-winning support team.

Increased Security Measures

Your security is a top priority at FxPro. The FxPro Trading App uses the highest levels of personal data encryption to protect your information. Two-factor authentication, passcode protection, and fingerprint authentication add additional layers of security to your account and financial transactions. Trade with confidence, knowing that your funds and personal information are secure.

See Also:

Trade Multiple FxPro MetaTrader Accounts in One App

The FxPro Trading App allows you to manage all of your FxPro accounts in one place, whether you trade on . Switch between account types and demo/live accounts easily, giving you the flexibility and convenience to adapt to changing market conditions.

Seamless Fund Management

The FxPro Trading App comes with a safe and straightforward fund management system. Deposit funds to your FxPro Wallet with no fees, allowing instant transfers between trading accounts. Enjoy the convenience of submitting withdrawals without. The app accepts various convenient payment methods, ensuring an easy and efficient fund management experience.

See Also:

FxPro Commissions & Spreads

When evaluating the costs associated with trading, it is crucial to consider spreads and commission fees. In cTrader, FxPro quotes commission fees of $45 per $1,000,000 traded. Even with these commission fees, the spreads offered by FxPro appear to be relatively low.

The spreads on MetaTrader 5 and MetaTrader 4 are variable, with a value of 1.39 for market execution and 1.56 for quick execution, respectively. FxPro's spreads vary across different instruments. Here are some examples of changes in major pairs: a reduction of 0.3 pips for EUR/USD, 0.5 pips for USD/JPY, 1.2 pips for NZD/USD, 0.4 pips for EUR/JPY, and 0.7 pips for GBP/USD.

Stay Updated with Economic Events

The FxPro Trading App's integrated Economic Calendar keeps you updated on the latest economic events. Set up event alerts to receive notifications and stay on top of market data releases. Furthermore, the app sends push notifications when market volatility rises, providing valuable insights into real-time market movements.

Funding Methods

The FxPro app offers a range of convenient payment methods to enable users to add funds to their accounts seamlessly. Clients have various options available to them. It includes Bank Wire Transfers, Credit and Debit Cards, PayPal, Neteller, Skrill, and other payment methods that may be specific to their place of residence. This diverse selection ensures flexibility and accessibility for users worldwide.

Ever since its establishment in 2006, FxPro has successfully expanded to serve retail and institutional clients in more than 170 countries. Their head office is in London, UK.

FxPro UK Limited is authorized and regulated by the FCA since 2010. Meanwhile, other subsidiaries such as FxPro Financial Services Limited is authorized and regulated by CySEC since 2007 and the FSCA since 2015. Because of that, traders do not need to worry again about their funds safety. As a strong proponent of transparency, it established the highest standards of safety for clients' funds, as the company chooses to keep the funds in major international banks, fully segregated from the company's funds.

They always try to provide transparent and ethical practices across the global trading industry. In 2018, 74.65% of market orders were executed at the requested price while 12.8% of the client's orders were executed with positive slippage. Also, only 1.4% of all instant orders received a requote with 0.72% of them receiving better price when executed.

The total number of trades in FxPro has increased from year to year. In 2018, the number of trades achieves 53.6 million. Based on trust from their clients, FxPro received awards as Most Trusted Forex Brand UK 2017 by Global Brands Magazine. Besides, they became the first broker to sponsor an F1 team in 2008. There are around 60 UK and International Awards which had been achieved by FxPro.

They are committed to create a dynamic environment that equips traders with all the necessary tools for their trading experience. Opening an account in FxPro grants access to more than 250 CFDs on 6 asset types, including forex, shares, spot indices, futures, spot metals, and spot energies. They want to provide their clients with access to top-tier liquidity and advanced trade execution with no dealing desk intervention. The average execution time is less than 11.06 millisecond with up to 7,000 orders executed per second. Those advantages enable traders to benefit from tight spreads and competitive pricing.

Furthermore, FxPro is recognized as an innovative broker. The company allows its clients to enjoy a wide range of trading platforms, such as MetaTrader 4, MetaTrader 5, cTrader, and FxPro Edge. Web-based versions and mobile applications are also available so that traders can access financial markets at any time and anywhere.

Traders can choose platforms according to their needs. Fans of MT4 is provided with instant execution and easy-to-use trading platform. In this account, leverage is up to 1:500 and spreads start from 1.6 pips without commissions.

If traders want to get experience with more modern technology, traders should choose FxPro MT5 Accounts. In this account, spreads start from 1.5 and leverage is up to 1:500 without commissions.

Another type of accounts is FxPro cTrader. It is suitable for traders who give priority to the speed of execution with the most restrictive spreads compared to other account types'. FxPro cTrader is a powerful trading platform offering the best available bid and ask prices, with orders filled in just milliseconds. The platform also provides Market Depth and trading analysis tools. In this account, spreads start only from 0.3 pips. But, traders have to pay commissions $45 per $1 million traded (upon opening and closing a position) in forex and metals.

The key difference between MetaTrader 4, MetaTrader 5, and cTrader lies in the range of the CFD products that are available. The MT4 platform gives traders a chance to open positions on all of the 6 asset classes, whereas the MT5 doesn't support shares, and cTrader doesn't support shares and futures.

Besides 3 types of platforms above, trading in FxPro also enables access to FxPro Edge. This platform offers clients a new way to trade the markets in the form of spreads betting.

Each broker has pros and cons, and FxPro is not an exception. Aside from the advantages as explained before, FxPro has a high minimum deposit. Also, there are not many types of payment and withdrawal methods available at FxPro. Some types of methods even require traders to pay fees. However, it is still important to note that clients can trade forex, shares, indices, metals, and energies, with limited risk account at no additional cost in Fxpro

Regardless of the advantages and disadvantages, FxPro can be traders' choice as one of the best brokers with sophisticated technology. The company is suitable for traders prepared to trade with funds starting from $500.

Conclusion

The FxPro Trading App provides numerous benefits to traders of all levels. TradingView's advanced charting capabilities enable traders to analyze the market like professionals, using various technical indicators and tools. The app enables seamless trading across multiple FxPro MetaTrader accounts, giving you flexibility and convenience.

Traders can diversify their portfolios and seize opportunities across multiple markets by accessing thousands of CFD instruments such as forex, stocks, metals, indices, energy, and futures. The app is user-friendly and secure due to efficient account management features, enhanced security measures, and seamless fund management options.

Furthermore, FxPro provides competitive spreads and commission fees, ensuring low-cost trading. Including an economic calendar and push notifications keeps traders updated on the most recent market events and volatility.

FxPro's mobile app and desktop platform also cater to different trading preferences, allowing traders to access the solution that best suits their needs. Traders can stay connected, informed, and in control of their trading activities with the FxPro Trading App, increasing their chances of success in the fast-paced financial markets.

Besides FxPro, many other brokers have integrated TradingView to make trading easier for their clients. Who are they? Find out in the article Which is the Best TradingView Broker?

Trading Central Signals

Trading Central Signals Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest

5 Comments

Bima

Jul 21 2023

Please, help me! The information mentioned different terms like spreads and commission fees, but I'm not entirely familiar with what they mean in the context of trading. Specifically, I'd like to know more about how spreads and commission fees impact my overall trading expenses. For instance, what does it mean when they say FxPro quotes commission fees of $45 per $1,000,000 traded on cTrader? How does that affect my trades and profits?

Moreover, the spreads seem to play a significant role in trading costs as well. The provided examples show changes in spreads for various major currency pairs, but I'm a bit confused about how they differ between market execution and quick execution on MetaTrader 5 and MetaTrader 4. Additionally, I'd appreciate some clarity on what it means when FxPro's spreads are "variable" and how it affects my trades.

If you could break down this information into simpler terms and explain the impact of spreads and commission fees on my overall trading expenses, it would be incredibly helpful. I want to make well-informed decisions when it comes to my trades, and your assistance in simplifying this information will undoubtedly make it easier for me to understand and manage my trading costs effectively. Thank you so much for your help!

Memphis

Jul 21 2023

Let me xplain to you, my beginner friend! Spreads and commission fees are two factors that can affect your overall trading expenses. The spread is the difference between the buying (bid) and selling (ask) prices of a trading instrument. It's like a small fee that you pay to the broker when you open a trade. FxPro offers competitive spreads, and they vary depending on the currency pair you're trading. For example, they reduced the spread by 0.3 pips for EUR/USD, 0.5 pips for USD/JPY, and so on. This means that the cost of trading those pairs is slightly lower.

On the other hand, commission fees are additional charges that FxPro quotes at $45 per $1,000,000 traded on their cTrader platform. This fee is separate from the spread and applies for each trade you make. It's essential to factor in both the spread and commission fees when calculating your total trading costs.

So, to sum it up, the spread is a small fee built into the buying and selling prices, while the commission fee is an additional charge for each trade. By keeping an eye on both the spreads and commission fees, you can better manage your trading expenses and make informed decisions about your trades.

(read : How Does Spread Affect Profit in Forex?)

Bima

Jul 22 2023

Hey, thank you so much for breaking down the trading costs on FxPro in such a super simple way! Your explanation totally made things clear for me, and I gotta say, you're awesome at making complex stuff sound easy-peasy! I really appreciate your help, man. Now I feel like I can handle my trading expenses like a pro and make some smart moves and understand about the spread and commission works! Seriously, thank you a bunch for taking the time to guide me through this. You rock! Have an amazing day!

Vito

Jul 21 2023

Really curious about calender economic in there! Why is the economic calendar so important in the FxPro mobile trading app? I mean, they mentioned it's an all-in-one platform with easy navigation and features for trading, managing accounts, and more. But what's the deal with the economic calendar, and why should I care about it? Can you explain how it helps me in my trading journey, especially if I'm not that experienced? Also, how does it keep me updated on market volatility, and what kind of trading opportunities can I expect to find through those push notifications? I'm curious to know how this economic calendar feature can improve my overall trading experience on the FxPro app. Thanks for shedding some light on it!

Herry

Jul 23 2023

Let me answer it! The economic calendar in the FxPro mobile app is super important for us traders! It's like a treasure map that tells us about upcoming events and data releases that can shake up the markets. Even if you're new to trading, this thing is a game-changer!

Here's the deal: the economic calendar helps us stay informed about big events, like when the central banks make announcements or when important reports come out. Knowing these dates lets us prepare and adjust our trading strategies accordingly.

And guess what? The app's got our back! It sends us push notifications about market stuff, so we're always in the loop, even when we're on the move. It's like having a personal assistant that keeps us updated on juicy market opportunities!

So, bottom line, this economic calendar thingy is a must-have. It helps us make smart decisions and feel more confident in our trades. Go ahead and use it to level up your trading game on the FxPro app! Happy trading, my friend!