S&P 500 and NASDAQ trading mixed while Dow rise on Monday as big tech companies like Alphabet, Amazon, Apple, Facebook, and more scheduled to announce their first-quarter earnings this week.

On Friday, the American indices rose significantly. The S&P 500 and NASDAQ 100 finished the last session of the week above their R1 resistance levels, and the Dow Jones Industrial Average ended the day slightly below it. Today, the DJIA index is rising and the other two are showing mixed sentiment. From the data front, durable goods orders in March will be published. Anyway, let's start the analysis, S&P 500 first:

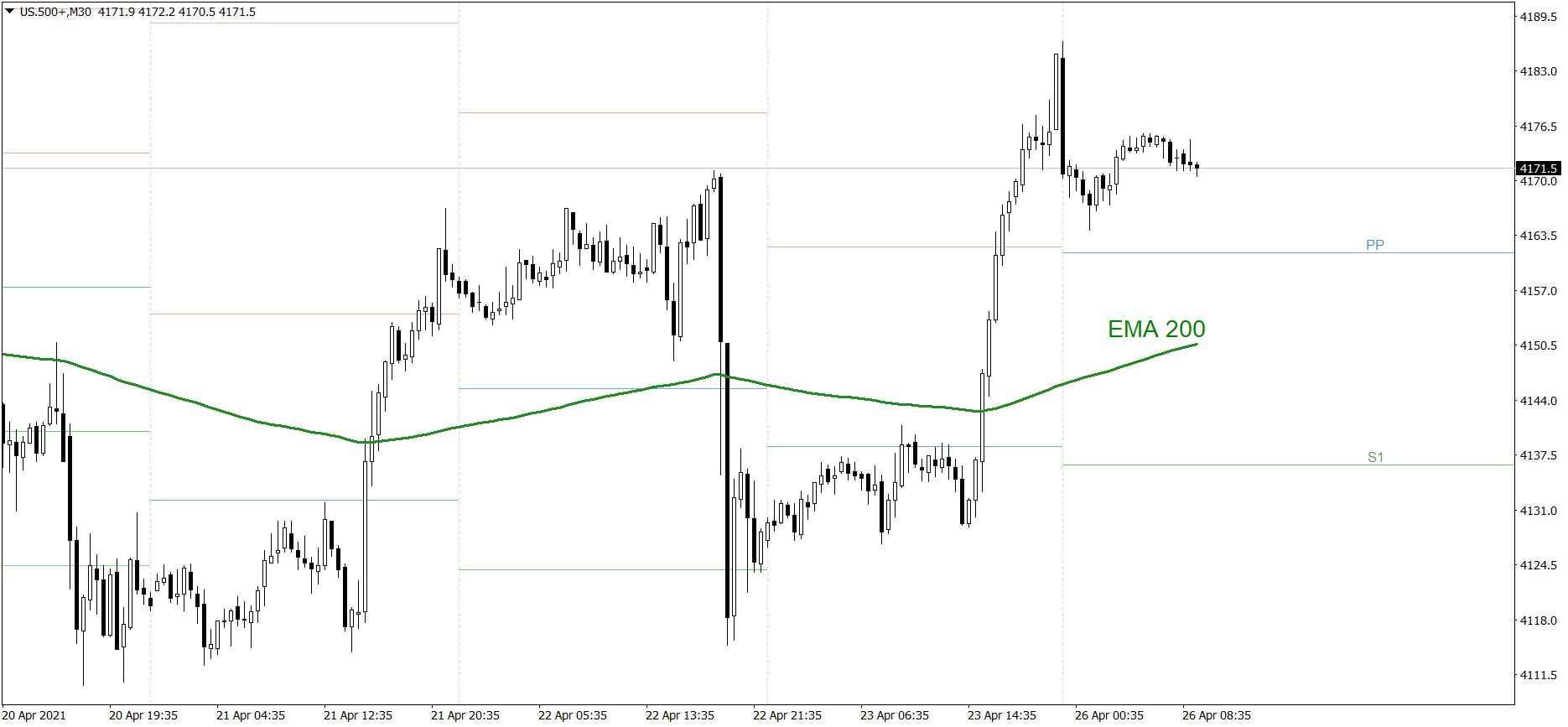

S&P 500

The S&P 500 rose strongly on Friday. The price went up above the R1 resistance level and even set the new all-time high. Today, it is showing mixed sentiment, though. If the buyers show their strength once again, the price might even reach 4,200. But if the bears take control over the market, the price could drop below the Pivot Point.

NASDAQ 100

NASDAQ 100 also rose strongly on Friday. The price finished the last session of the week significantly above the R1 resistance level. Today, it is showing mixed sentiment, though. If the buyers show their strength once again, the price might return above 14,000. But if the bears take control over the market, the price could drop below the Pivot Point and test the EMA 200.

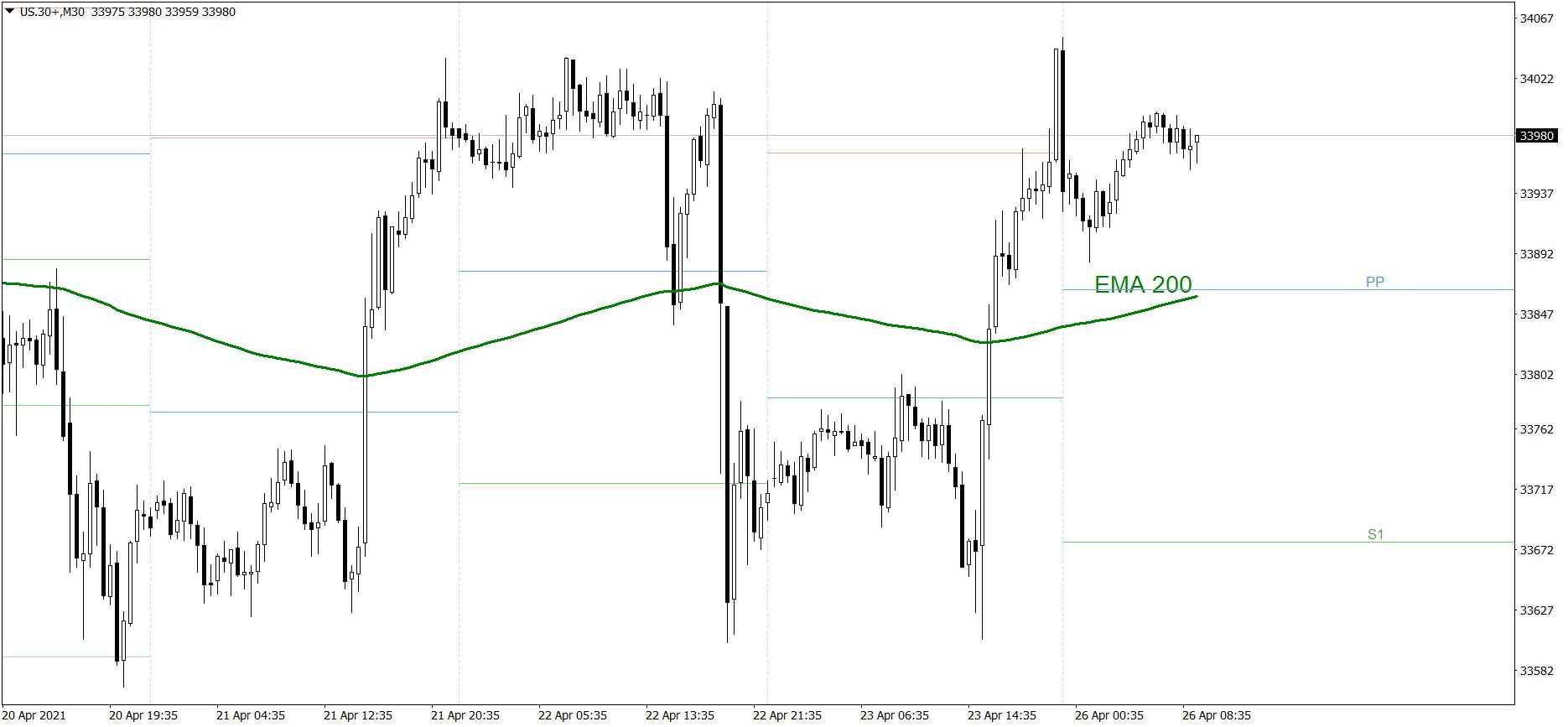

Dow Jones Industrial Average

The DJIA index went up significantly on Friday as well. The price finished the week slightly below the R1 resistance level. Today, it is rising even more. Right now the price is getting close to 34,000. If the buyers continue generating firm demand, the price should successfully attack that level and maybe bounce even more. But if the bears counterattack, the price could drop to the Pivot Point.

EXCO offers the ability to trade financial markets on leverage through multiply asset trading platforms. Be that pricing, execution, or promotions, they emphasize that what they advertise is what they give to clients, regardless of the size of their investment.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance