Tickmill is a multi-asset broker that offer various tools with cutting-edge technology. Here's how to sign up and create a Tickmill trading account.

Every trader needs to sign up with a broker to start trading. Essentially, a broker acts as an intermediary between traders and the markets where financial instruments are bought and sold. However, many brokers nowadays offer a much wider range of services and some even claim to be "financial advisors" for their clients. So, aside from executing orders, brokers may provide investors with strategy recommendations, research and market analysis tools, and so on.

If you are searching for an innovative broker that offers various tools and cutting-edge technology, Tickmill is a great solution. Over the years, the award-winning broker has captured the attention of thousands of active traders worldwide. This article will show you how to open a Tickmill account in easy steps.

Contents

Introduction to Tickmill

First introduced to traders in 2014, Tickmill is known as a multi-asset broker that mainly focuses on forex and CFD trading. It is regulated by several financial entities, including FCA of the UK, CySEC of the Cyprus, Labuan FSA of Malaysia, and FSA of Seychelles. At the time of writing, the company operates in more than 200 countries and has over 550,000 registered clients around the globe.

Tickmill is an award-winning global ECN broker, authorized and regulated by the Financial Conduct Authority (FCA) in the UK, CySEC in Cyprus, and the FSA of Seychelles. Founded in 2014, it offers its retail and institutional clients various trading services with a prime focus on forex, stock, commodities, CFDs, and metals.

For traders who prioritize the value of spreads in broker selection, Tickmill provides excellent services with low spreads, starting from 0.0 pips.

The London-based company has a mission to provide clients with the best possible trading environment, so clients can focus on trading and become successful traders. One way to reach its mission is to offer a fast-execution of 0.15s. With this facility, it's no wonder that Tickmill gets the 2019 Best Forex Execution Broker award by the CFI.co Awards. Also, Tickmill received the achievement as Best CFD Broker Asia 2019 by International Business Magazine, the Best Forex Broker Asia, and the Most Transparent Broker 2019 by Forex Awards.

After registering in Tickmill, traders can choose the most ideal asset among 60 currency pairs that they can trade. If traders aren't sure yet to open a real account, Tickmill recommends learning to trade through a demo account.

There are also educational features such as Webinars, Seminars, Ebooks, and Video Tutorials. All of these facilities can be used by traders to increase knowledge about trading and the financial market as a whole. If traders already have enough knowledge, they have a greater opportunity for earning profit consistently.

For traders registered in real accounts, they can choose between provides three types of accounts, including Pro Account, Classic Account, and VIP Account. Traders can open positions with a minimum order of 0.01 Lots. This applies to all types of accounts.

The company provides recommendations for traders who are still confused when choosing an account. For example, for novice traders, Tickmill encourages clients to choose a Classic Account. It offers optimal conditions with fast order execution while enabling traders to use virtually any trading strategy. Additionally, the account is trade commission-free so traders only pay the bid/ask spread. Other than the 3 main accounts above, Tickmill also provides an Islamic account (swap-free).

The downside is, trading with Tickmill will only enable traders to use MetaTrader 4 as their offered trading platform. Although not much if compared to other brokers, the Tickmill platform provides a user-friendly and highly customizable interface, accompanied by sophisticated order management tools to help traders control positions quickly and efficiently.

The convenience of trading on Tickmill is enhanced by the existence of One-Click EA integrated on MT4. Traders will get Stop Loss and Take Profit calculations automatically. On top of that, Tickmill provides a VPS hosting for automated traders that can't be bothered with technical problems such as troublesome internet connection.

They offer several third-party research solutions, including Autochartist, which is a popular pattern-recognition software that uses automated technical analysis to make forecasts and generate trading signals. Autochartist is available both in Tickmill's web portal and as a platform plugin for MetaTrader 4.

As a Tickmill client, a trader can deposit and withdraw with a variety of payment methods, including Visa, Mastercard, bank transfer, and Skrill. Tickmill accepts deposits and withdrawals in 4 currencies, which include USD, EUR, GBP, and PLN.

Overall, Tickmill is a competitive broker in spreads and provides a safe trading environment with its regulated entities in three different jurisdictions. Although their trading platform is not outstanding, the analytical tools they present to equip traders' needs are considered by retail broker standards.

Built by a group of professionals with decades of trading experience, Tickmill is clearly passionate about providing the best trading environment for both retail and institutional clients, allowing them to reach their full potential. Tickmill offers access to 180+ tradable assets, including currency pairs, stock indices, energies, precious metals, bonds, stocks, and cryptocurrencies. The spreads can go as low as 0 pips and the commissions are some of the lowest on the market.

Furthermore, Tickmill aims to cater to all types of traders' needs. This translates to providing multiple account types to choose from and supporting various trading strategies such as EAs, hedging, and scalping. The trading platforms are powered by innovative technology and advanced tools to improve clients' trades. On top of that, clients get a dedicated team of customer service that can be easily reached via email, web form, phone, or live chat.

Before you can trade with Tickmill, you'll need to create an account first. This can be done by signing up on the broker's website. The process is actually very easy and relatively quick. However, there are some things that you should prepare beforehand, particularly for the account verification step.

Documents to Prepare

As a fully regulated broker, Tickmill must comply with certain rules imposed by the authorities. Part of it is to conduct the KYC procedure and require clients to verify their accounts. In this case, the broker will ask you to upload several types of documents depending on what type of client you are.

For Retail Clients

Proof of Identity (POI)

This document is used to verify your identity, so make sure that it contains your full name and photo. You can choose to upload one of the following options:

- National ID

- Driving License

- Passport

Proof of Address (POA)

In order to verify your address, the document must contain your full name and address (PO Box is not allowed). Here are the available options:

- Utility Bills

- Bank Statement

- Other Financial Documents

The documents can be scanned or taken by your cellphone camera. Just make sure to include all four edges of the document and that the writing can be read clearly. The format can be PNG, JPEG, JPG, or PDF. The documents must also be valid (not expired) and issued by the official government in your area.

For Institutional Clients

If you register as a corporate client, you must submit the following documents:

- Articles of association, identification document, and proof of both individual and corporate address.

- Certificate of incorporation or company registration card (containing the address, legal representatives, and registration data).

Please note that Tickmill may ask for additional documents depending on your country. This includes articles of association, memorandum of understanding, certificate of good standing, certificate of incumbency/register of members, or the last full year's audited accounts.

Guide to Sign Up for a Tickmill Account

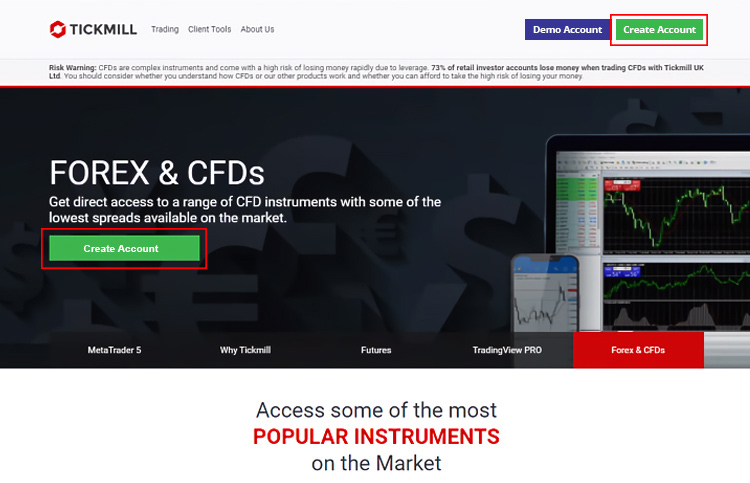

1. Go to Tickmill's official website and click the "Create Account" button.

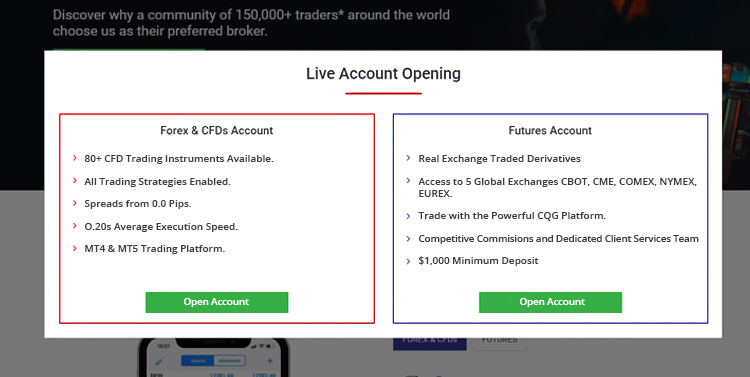

2. Choose to open either a live Forex and CFD Account or a Futures Account depending on your needs.

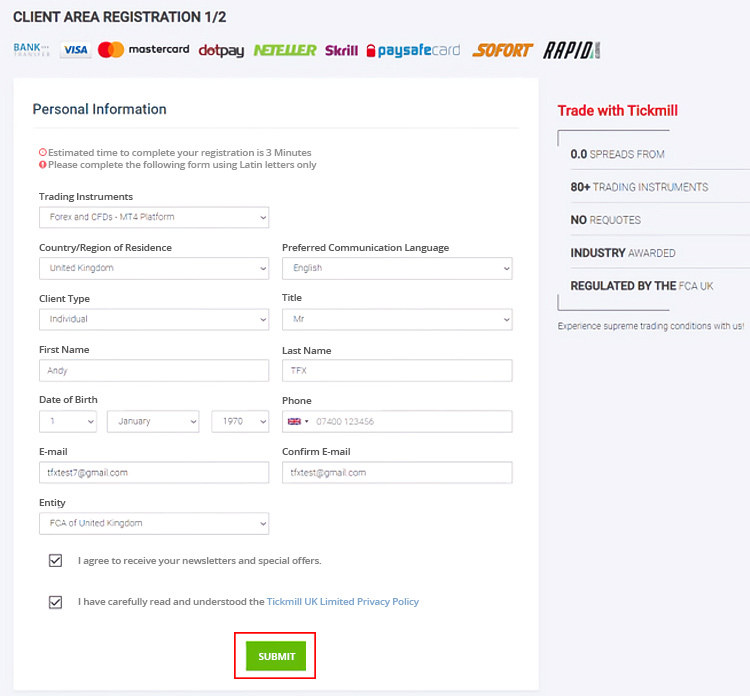

3. Fill up the Client Area Registration form, which is divided into two parts.

In the first part, you'll need to enter your preferred trading instrument, country of residence, preferred language, client type, title, first and last name, date of birth, phone number, and email address. Choose the entity that you'd like to trade with Tickmill and accept the terms and conditions. Once you're done, click "Submit".

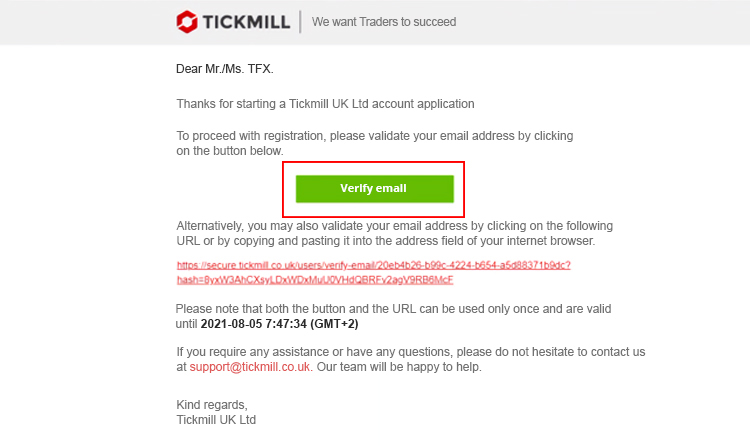

4. To proceed to the next step, you'll need to verify your email. Open your email inbox and find the message containing a validation link, then click "Verify Email".

Keep in mind that the link will be active for 48 hours only. Check the spam folder if you couldn't find it in your inbox.

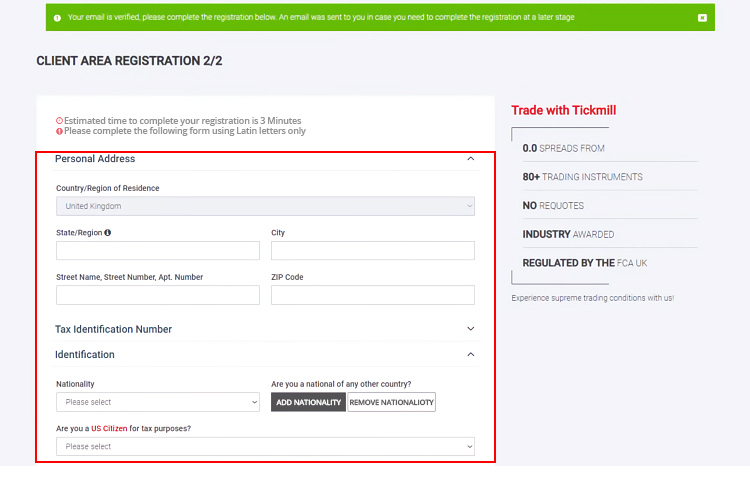

5. Once you have verified your email, you can proceed to the second part of the Client Area Registration Form in Tickmill. Start by entering your personal address and tax identification number.

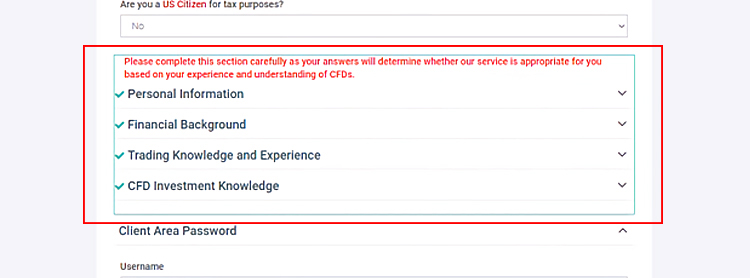

6. The next part is a section that aims to measure your experience and understanding of trading. There are several categories that must be completed, namely Personal Information, Financial Background, Trading Knowledge and Experience, and CFD Investment Knowledge.

This information would help Tickmill determine whether you are an appropriate client to use their service. To begin, simply click the drop-down button and answer the questions based on your condition.

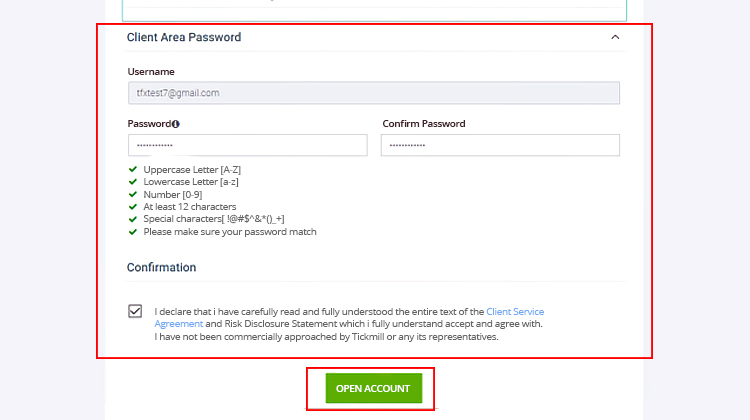

7. Create a strong password for your Client Area and agree to the terms and conditions. Click "Open Account" to finish the registration process.

8. Log in to your Client Area using the email address and password that you've created.

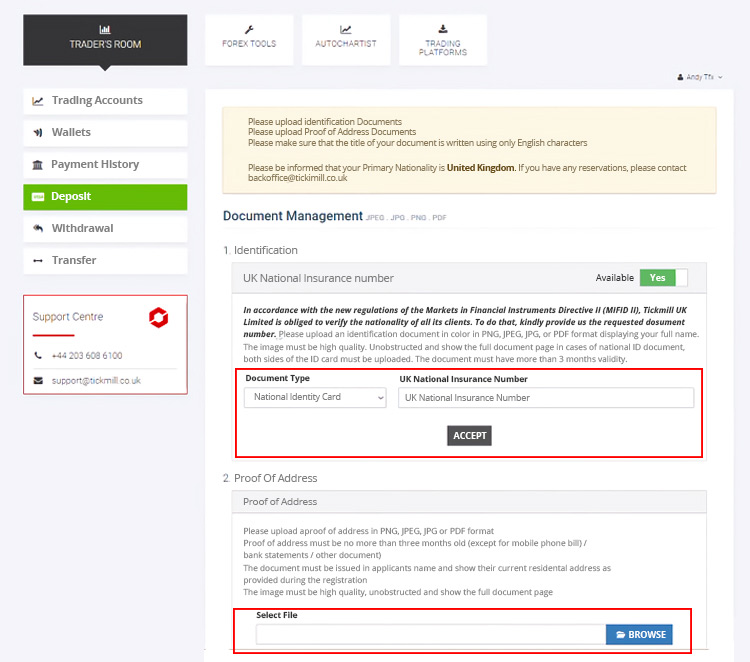

9. Once you're logged in, the first thing that you should do is start the verification process and submit your identification documents to Tickmill.

Keep in mind that you won't be able to make deposits if your account is still unverified. To upload the documents, simply click "Browse" to find the files you need and submit them.

10. Tickmill typically needs a couple of hours up to one business day to process your documents. Once it's done, you'll be able to get full access to your account and make your first deposit to start trading.

The Bottom Line

Tickmill is a good choice of broker for various types of traders. Beginners can enjoy the platform's accessibility and educational materials, while most advanced users would appreciate the ability to use any trading strategy ranging from scalping to algorithmic trading.

As explained in this article, opening an account at Tickmill is quite easy, even for newbies. Everything can be done online, so the process is relatively quick. The registration form only takes about 10-15 minutes to complete, while the verification process typically takes around one business day. Once you pass all that and created your account, you can immediately use it for trading on real markets.

Tickmill is the brand name of Tickmill Ltd. which offers trading services with premium products and innovative technology. Superior trading conditions, ultra-fast execution, safety of client funds, and dedicated support are at the forefront of their offering.

20% Discount on Forex VPS

20% Discount on Forex VPS Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise

29 Comments

Kamuzu

Dec 28 2022

What account type is best for beginners?

Jeremiah

Jan 20 2023

Kamuzu: Speaking of the best accounts for beginners in general, I think the cent account will be the best as it has very low losses and you can only win in cents. Therefore, $1 trades just as well as $100. However, please note that the cent account brings very very little profit. When you think you're ready for Forex, jump to the next level Micro account to get the experience of loss and profit more in order to prepare your physiology in trading.

However, if we are talking about the best type of account for Tickmill beginners, I recommend opening a Classic account with a $100 deposit and leverage of 1:500. However, I recommend that you first create a demo account before opening a Classic account.

Ludoslaw

Dec 31 2022

I've tried signing up but I haven't received the confirmation email. What should I do?

Tabitha

Feb 5 2023

Ludoslaw: I can say that for the account registration process, this broker is quite fast, easy, and instant, of course, yes it competes with other brokers. However, because I haven't tried trading at Tickmill, I'm not too sure whether this account is good for retail clients or not.

Even though I haven't traded with this Tickmill broker, I have tried other brokers, and yeah I don't think it's much different. So, I'll be sure to answer your questions regarding email verification. There are a few things that usually cause you not to receive email verification from Tickmill. If you didn't get a verification email, try the following:

So, if you still can't find an email verification message from Tickmill, there could be an error when you enter your email address or the Tickmill account is undergoing the same repair or update, which slows down this process. So, I suggest that if it doesn't work, try registering your account again at Tickmill with the same or a different email than before...

good luck guys...

Tabitha

Feb 5 2023

Ludoslaw: I can say that for the account registration process, this broker is quite fast, easy, and instant, of course, yes it competes with other brokers. However, because I haven't tried trading at Tickmill, I'm not too sure whether this account is good for retail clients or not.

Even though I haven't traded with this Tickmill broker, I have tried other brokers, and yeah I don't think it's much different. So, I'll be sure to answer your questions regarding email verification. There are a few things that usually cause you not to receive email verification from Tickmill. If you didn't get a verification email, try the following:

So, if you still can't find an email verification message from Tickmill, there could be an error when you enter your email address or the Tickmill account is undergoing the same repair or update, which slows down this process. So, I suggest that if it doesn't work, try registering your account again at Tickmill with the same or a different email than before...

good luck guys...

Lucchese

Jan 1 2023

Can I make more than 1 trading account at Tickmill?

Katya Hernandova

Jan 24 2023

Lucchese:Yes, you can make multiple trading accounts with Tickmill. However, you should check with Tickmill to see if there are any restrictions or limitations on the number of accounts you can open. Additionally, it's important to note that it's against the regulations in some countries to open multiple account under the same name or same personal details.

This is how you can open more than 1 trading account at Tickmill:

To open multiple trading accounts with Tickmill, you will need to complete the following steps:

Go to the Tickmill website and click on the "Open Account" button.

Fill out the registration form with your personal details, such as your name, address, and contact information.

Choose the type of account you want to open, such as a standard or VIP account.

Submit the form and wait for confirmation from Tickmill.

Once you have received confirmation from Tickmill, you can log in to your account and start trading.

Repeat the process for each additional account you wish to open.

It's important to note that each account will have its own account number and login credentials, which you will need to use to access and manage each account. Also, each account may require its own verification process, dependent on the regulations of the country you reside.

Nataniele

Jan 11 2023

Is there an option to close or deactivate my account?

Katya Hernandova

Jan 24 2023

Nataniele:

To close or deactivate your account with Tickmill, you will need to follow these steps:

Log in to your Tickmill trading account.

Go to the "My Accounts" section and the account you want to close or deactivate.

Click on the "Close Account" button or "Deactivate account" button and follow the instructions provided.

In some cases, you may be prompted to provide additional information or submit a request to close the account.

Wait for confirmation from Tickmill that your account has been closed or deactivated.

It's important to note that some brokerages may require you to withdraw any remaining funds from your account before closing it. You may also need to provide additional documentation or information to verify your identity before closing your account. It is recommended to check the broker's terms and conditions and the local regulations of your country to make sure you are following the correct process.

Radoslav

Jan 17 2023

Can I open a demo account?

Claravia Sidney

Jan 24 2023

Radoslav:

To open a demo account with Tickmill, you can follow these steps:

Go to the Tickmill website and click on the "Open Account" button.

Fill out the registration form with your personal details, such as your name, address, and contact information.

Select "Demo account" as the account type.

Submit the form and wait for confirmation from Tickmill.

Once you have received confirmation from Tickmill, you can log in to your demo account and start trading using virtual money.

It's important to note that demo accounts are intended for practice and learning purposes and may not reflect the same conditions as live trading accounts. Also, some brokerages may have different procedures and requirements for opening demo accounts. It's recommended to check the broker's website for more information or contact their support team for clarification.

Calista

Feb 5 2023

actually, I know several brokers including Ticmill which I just met. there are a number of things that I can conclude about the opening at a broker. I don't think it's the same at tickmill in several brokers such as Pepperstone, Exness, and AvaTrade. The requirements for opening an account and non-account steps are the same, namely only requiring an email and proceeding to the verification stage to complete identity documents such as national ID and others.

However, at Tickmill, I see that there are several differences, namely the grouping in the verification section. so for those who register for trading for individuals (retail clients), there are their own steps as well as for those who register as institutional clients.

However, in my opinion, all of this is still reasonable and normal, in fact, it is almost the same as other brokers. Most of the difference is only in the registration section as a company. because I registered as an individual I didn't have a problem anyway...

Well, so far I don't know the advantages of this broker compared to other brokers. what made me have to choose this broker as a trading provider compared to other brokers? what makes this broker stand out from the rest? if anyone knows can help explain.

Hellena

Feb 5 2023

Calista: Tickmill is a trading name of Tickmill Ltd, a member of the Tickmill Group, which is regulated by the Seychelles Financial Services Authority (FSA).

Tickmill provides you with one of the lowest spreads (starting from 0.0 pips) and a super-fast execution speed of 0.15 seconds on average. Skrill, Neteller, FasaPay, UnionPay, and credit card deposits are processed instantly while withdrawals are processed within 1 business day. We pride ourselves that we have no trading restrictions and no requotes. We also allow scalping, hedging, arbitrage, EAs and algorithms.

There is one other reason that makes me like trading with Tickmill, namely the trading execution model of this broker. Tickmill's execution model is designed to provide clients with a fast and secure trading experience. Therefore, Tickmill's hybrid execution model involves both market-making and direct processing (STP). Such a model guarantees an average execution time of 0.20 seconds of trades without requotes, and some of the best spreads on the market.

Keylen

Feb 5 2023

Hellena: I agree with your explanation that Tickmill is a trusted broker with MT4 and MT5 support and two trading accounts with the lowest fees in the industry, Tickmill provides the perfect trading environment for both serious beginners and more experienced traders.

This broker has been established since 2014, which means that this broker has developed for approximately 8 years to provide easy trading features and instruments with fast market execution. The reason this broker separates retail clients from institutional clients is so that traders get a good and privileged trading environment to reach the full potential of its customers in trading.

Apart from speed in market execution, this Broker also allows almost all trading strategies including EAs, hedging and scalping. Market education and analysis is also excellent and experienced traders will appreciate the wide variety of currency pairs on offer.

Tickmill offers a number of excellent trading tools, including Autochartist, Myfxbook, PelicanTrading, VPS services, advanced trading tools and one-click trading plugins. Autochartist is free for all registered users, while other third party tools such as myfxbook, Pelican Trading and VPS hosting incur additional fees from traders.

Reynarl

Feb 5 2023

Yes, even though the Tickmill broker registration and verification process are almost the same as the registration process for other brokers. I still like this account because this broker differentiates the account verification process between retail clients like me and institution clients, and that's good for me and interesting to both of them.

the process of opening the account is also fast, in my opinion, it only takes about 10 minutes to complete, and after sending all the required documents, the account will be ready to use in a few hours. in essence, Overall, the Tickmill account opening process is quick and efficient, and accounts are generally ready to go within hours.

But there are a few things that make me confused, namely, if you want to register me in the client area, are there any special requirements? please if anyone knows can help answer yes guys...

Diego

Feb 5 2023

Reynarl: Actually, the documents that must be prepared by individual traders for account verification at Tickmill have been explained in this strike article. To register for an individual Client Area, you must submit your Proof of Address (POA) and Proof of Identity (POI) documents,

whereas to register for the Enterprise Client Area, you must submit: Articles of association, identification documents, and proof of address of individuals and corporations. Certificate of incorporation card or company registration (must show address, legal representative, and registration data).

We may ask for additional documents depending on the country, recipient, etc (offshore :). For example Certificate of incorporation, articles of association, memorandum of understanding, certificate of good performance, certificate of office / Member Register, and last year's audited account.

Indeed, if we look at it, the account verification process for institutional clients is quite complicated and there are lots of documents that must be prepared, but that's reasonable and normal considering that my registrant is a corporate client.

Immanuel

Feb 5 2023

Yeah, to be honest, I'm still not too interested in the previous Tickmill broker because as far as I know, this broker is not as complete as XM in providing trading instruments. So, in my opinion, it's just not comfortable, what's more, the cryptocurrency offered is still limited in my opinion. Tickmill offers only eight cryptocurrencies for trading, including Bitcoin, Ethereum and Litecoin. This offer is also quite limited compared to what is available at other brokers.

Despite the wide ion of Forex pairs, Tickmill has a disappointing range of CFDs. But I'm glad that the process of opening an account at this broker is quite easy and instant and it only takes a few hours to process the account verification.

Oh yeah, don't forget that this account separates account verification between individual clients and institutions, so I feel comfortable and maybe institutional clients and brokers also feel comfortable if there is a separation of verification like this.

But I still don't know, is this broker safe for forex trading? Are my accounts and funds safe when deposited into this account? because to be honest, security is something that is very crucial in my opinion.

Gara

Feb 5 2023

Immanuel: okay, I will help answer your question, but before that, I will explain what regulators have been obtained by this Tickmill broker. I was impressed to find that Tickmill holds licenses from a number of regulators around the world: such as the UK's FCA which is an international broker.

Apart from the FSA, there are several other regulators such as the Financial Sector Conduct Authority (FSCA), the Seychelles Financial Services Authority (FSA), the Cyprus Securities and Exchange Commission (CySEC), the Labuan Financial Services Authority (OJK Labuan).

From that description, you can conclude that Tickmill retains regulation from a number of high-level authorities, but there are still some countries joining through the Seychelles-based Tickmill entity, which offers less protection.

John Wesley

Mar 24 2023

Hey man, I gotta say I was really digging Tickmill as a trading platform. I mean, they've got some killer features that had me super tempted, especially when it came to their leverage, which is actually higher than what's allowed in my own country, the US.

So after reading this article, I decided to give their demo account a whirl. I trained with it for a few months and finally felt ready to open up a live account. I followed all the steps outlined in the article, but when I tried to open up the live account, it was declined. I was bummed and ended up contacting Tickmill's customer support.

They explained to me that they don't accept US traders. I was a little confused since they allowed me to open up a demo account in the first place, but wouldn't let me open up a live account. Do you know why that is? What's the deal with Tickmill not accepting US traders?

Robert

Jul 1 2023

@John Wesley: Hey, man! It's a bummer that you had that experience with Tickmill. So, here's the deal with Tickmill not accepting US traders. The thing is, Tickmill is a global brokerage firm, but they have certain regulatory restrictions and policies in place. One of those restrictions is that they don't accept clients from the United States.

Now, you may be wondering why they let you open a demo account in the first place. Well, demo accounts are often available to traders worldwide, regardless of their location. It's a way for traders to get a feel for the platform and test out their strategies without risking real money. But when it comes to opening a live account, Tickmill needs to comply with the regulations set by the authorities in the countries they operate in, and unfortunately, that means they can't accept traders from the US

Yugo

Jul 5 2023

As a trader hailing from Malaysia, I've come across Tickmill, a well-known multi-asset broker specializing in forex and CFD trading. What caught my attention is that Tickmill is regulated by various financial entities, including the Labuan FSA of Malaysia, alongside the FCA of the UK, CySEC of Cyprus, and FSA of Seychelles. With a presence in over 200 countries and an impressive client base of more than 550,000 registered traders worldwide, Tickmill seems to have established itself as a reputable player in the industry.

Now, here's my query: Considering Tickmill's regulation by the Labuan FSA in Malaysia, I'm curious to know whether as a Malaysian trader, I can expect additional legal protection and safeguards when trading with them. Does Tickmill's regulatory status with the Labuan FSA offer any specific benefits or advantages for traders like myself? It would be great to gain some insights into the extent of protection and the significance of this regulatory aspect for traders operating from Malaysia.

Ostard

Sep 10 2023

What's the minimum age someone needs to be in order to open a Tickmill Account? I'm asking because I've been hearing about this account designed specifically for professional traders, and I'm curious if there are any age restrictions. It's fascinating to learn that the account offers tight spreads and some of the lowest commissions in the world.

Can you tell me more about how these features compare to what other brokers offer for professional accounts? I'm particularly interested in understanding how these benefits, like floating spreads and high leverage, can potentially improve a trader's experience and profitability.

Oh, and speaking of commissions, I noticed that there's no commission on certain types of trades. Could you clarify which instruments are exempt from commissions and how that can impact a trader's overall trading costs

Kalla Jane

Sep 11 2023

To open Tickmill Account, person go need to dey above 18 years old usually. Dis age requirement dey to follow wetin law and regulation talk about financial services and trading accounts. E make sure say people wey dey open Tickmill Pro Account don reach the legal age of majority for their own places.

By putting age restriction, brokers like Tickmill dey follow regulatory guidelines and dem dey put their clients' protection first. Dem dey try make sure say people wey dey do professional trading get the maturity, understanding, and legal power to make informed financial decisions.

Liam Melker

Sep 24 2023

How does Tickmill compare to other brokerage firms in terms of the advanced trading tools and features it offers, and what are the unique advantages and benefits of choosing Tickmill as a platform for advanced trading? Also, could you discuss the potential drawbacks or limitations associated with using Tickmill for advanced trading, and provide tips and advice for traders looking to optimize their experience on the platform?

Sorry in advance guys, I have a question for a song, but it's a bit out of the topic of this article. I am very curious, If I'm a non-Muslim, Can I open a Free-swap Account? I want to trade with an Islamic account.

Jeffrey Brown

Sep 26 2023

When it comes to features and advanced trading tools, Tickmill stands out from the crowd, folks! They offer an array of cutting-edge tools and technologies that give traders an edge in the marketplace. One of its standout features is its advanced graphing capabilities.

Tickmill also provides advanced order types, such as limit orders, stop orders and trailing stops. This order type gives you more control over your trades and allows you to implement more sophisticated trading strategies.

Now, let's talk about the unique advantages of choosing Tickmill for advanced trading. First, they offer competitive spreads, which means you can maximize your profit potential. They also have fast execution speed, ensuring that your trades are executed quickly and accurately. Tickmill operates as an ECN broker, meaning you have access to deep liquidity and can enjoy tight spreads during volatile market conditions. Read (5 Ways You Can Step Up to Advanced Trading with Tickmill)

In terms of drawbacks or limitations, it is important to note that Tickmill's advanced features may require a certain level of experience and knowledge. To optimize your experience on the Tickmill platform, my advice is to start with a demo account. This allows you to familiarize yourself with advanced features and practice your strategy without risking real money.

Furthermore, Tickmill has offered Islamic accounts on its platform. But yes, swap-free accounts are usually only available to Muslim traders, as the purpose of these accounts is to comply with Islamic finance principles which prohibit charging or paying interest. Swap values ​​are basically the cost of holding a position overnight.

Even though non-Muslim traders cannot open swap-free accounts, they can still benefit from swap rates. If a trader buys a currency with a higher interest rate than the currency they are selling, they will earn a positive swap rate. Conversely, if a trader sells a currency with a higher interest rate than the currency he bought, he will pay a negative swap rate.

Lili

Nov 22 2023

Greetings! I'm at the beginning of my trading journey, and I've recently discovered Tickmill, a platform that offers a seamless and user-friendly sign-up experience. Their step-by-step guidance for document upload has made the onboarding process quite straightforward. As a novice, I've opted to kick off my trading endeavors with a demo account, a recommended approach for beginners.

The demo account allows me to practice without risking real funds, but it does raise some questions. I'm curious to know if the price charts in the demo account accurately reflect the dynamics of a real Tickmill trading account. Any insights or experiences on this front would be greatly appreciated!

Enzy

Nov 25 2023

Sonny

Mar 29 2024

As detailed in the article, setting up an account with Tickmill is straightforward, even for beginners. The entire process can be completed online, making it relatively fast. Filling out the registration form usually only requires 10-15 minutes, and the verification procedure typically takes approximately one business day.

Now, the question arises: What type of verification process requires a whole day to confirm my identity? After all, I'm not involved in any criminal activities.

Indah

Apr 3 2024

Hey there! Let me explain to you! So, the verification process that Tickmill implements usually involves confirming your identity and ensuring compliance with regulatory requirements. While it may seem surprising that this process takes a day, it's important to understand that brokers like Tickmill are obligated to adhere to strict regulations to prevent fraud, money laundering, and other illicit activities.

The verification process often includes validating personal information provided during registration, such as your name, address, and identification documents. Additionally, brokers may need to conduct background checks and verify your financial information to ensure the security and integrity of their platform.

Even though you're not involved in any criminal activities, regulatory standards require brokers to thoroughly vet all clients to maintain the safety and trustworthiness of their services. Therefore, the one-day verification period is likely a necessary precaution to fulfill these obligations and safeguard the interests of all parties involved. (you can read more about this verification in this article : Is KYC Important in Forex Trading?)