eToro is one of the best brokers currently offering a variety of trading instruments. To start trading at this broker, you need to have an account. Follow this guide to open a live and demo account on eToro.

eToro was established in early 2007, with a mission to make trading accessible to anyone, anywhere, and reduce dependency on traditional financial institutions. The company has head offices in the United Kingdom, Cyprus, the USA, and Australia. eToro is also known for its social copy trading features and wide range of cryptocurrency offerings.

Highly regulated by CySEC, FCA, ASIC, FINRA, and FSRA, eToro has consistently pushed the boundaries of financial technology since its inception. In 2017, they revolutionized investing with CopyPortfolios, powered by machine learning. Furthermore, their integration of Microsoft's AI technology into Momentum DD showcases their commitment to harnessing cutting-edge advancements for the benefit of their users.

To start trading at eToro, clients need to open an account at this broker. This article will cover in full the steps to open an account at eToro.

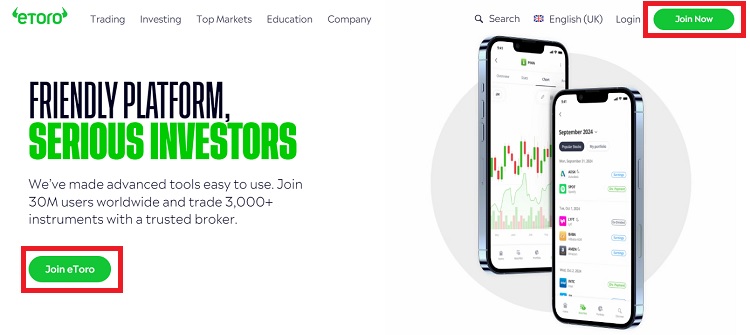

How to Open a Live Account in eToro

Opening an account at eToro is quite easy and simple and can be completed in just a few steps. Here is a complete guide on how to open an account at eToro.

- Head to the official eToro website and click "Join Now" in the right corner.

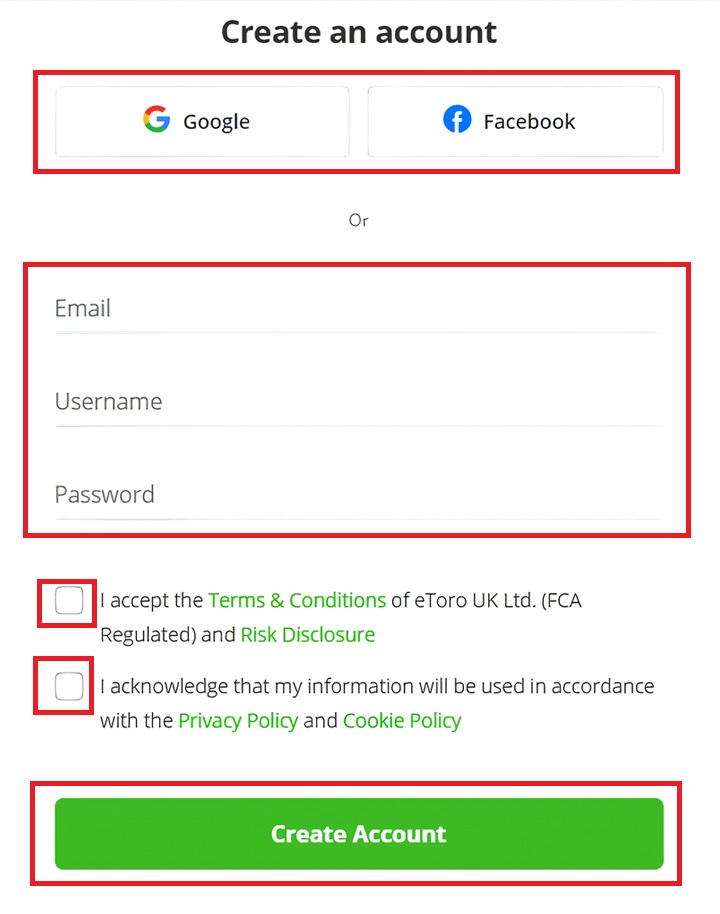

- Fill out the registration form. You can also sign up with your Facebook or Gmail account. But, at this time, the writer will show you how to sign up with an email account.

- Review eToro's Terms & Conditions and privacy policy. Make sure you're comfortable with them before agreeing.

- Click "Create Account" to submit your information to eToro.

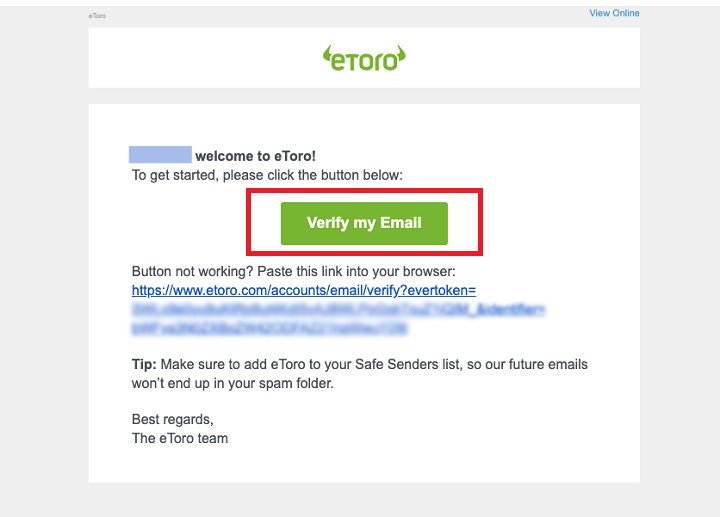

- After applying to open an account, you are required to verify the email used when registering. Open your email and look for a message from eToro. Please click "Verify my Email".

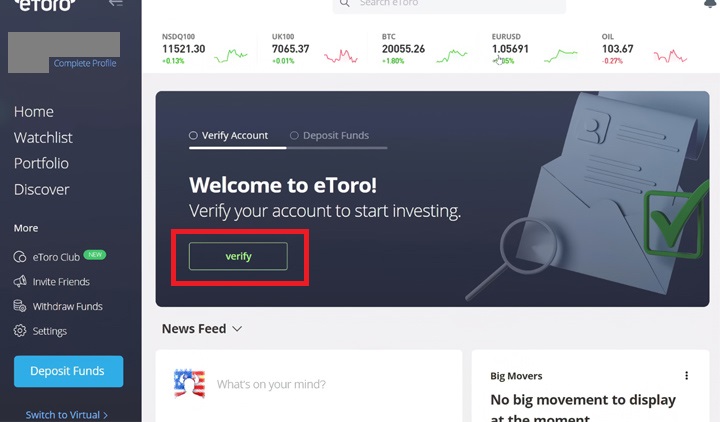

- Then you will be redirected to the Client Area account page.

- The next step is completing the Know Your Customer (KYC) process. This helps eToro prevent money laundering and terrorism financing. It's simple: just provide proof of identity (passport, etc.) and residence (utility bill, etc.). To perform KYC, please click the "Verify" button in your client area.

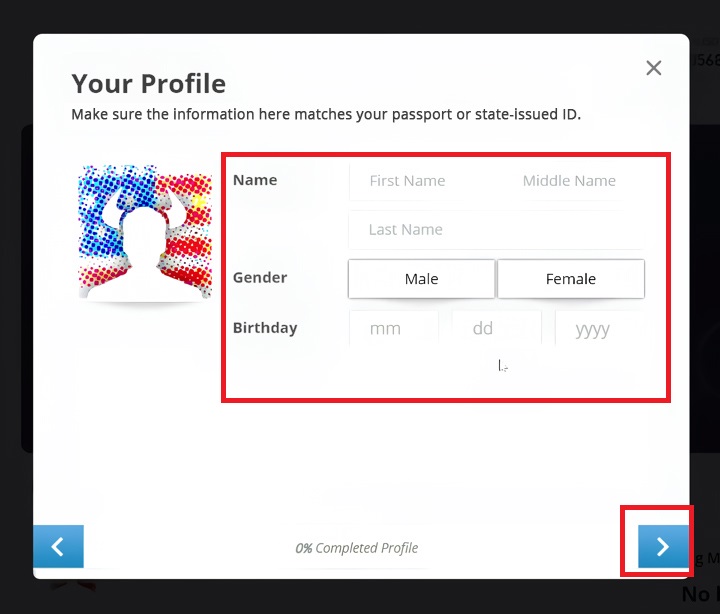

- After that, you will be asked to fill in your full name, date of birth, etc. The select button ">" on the right bottom.

- Next, you will be asked to upload your data which states your full name and residence address. You can choose to use an ID Card or Passport.

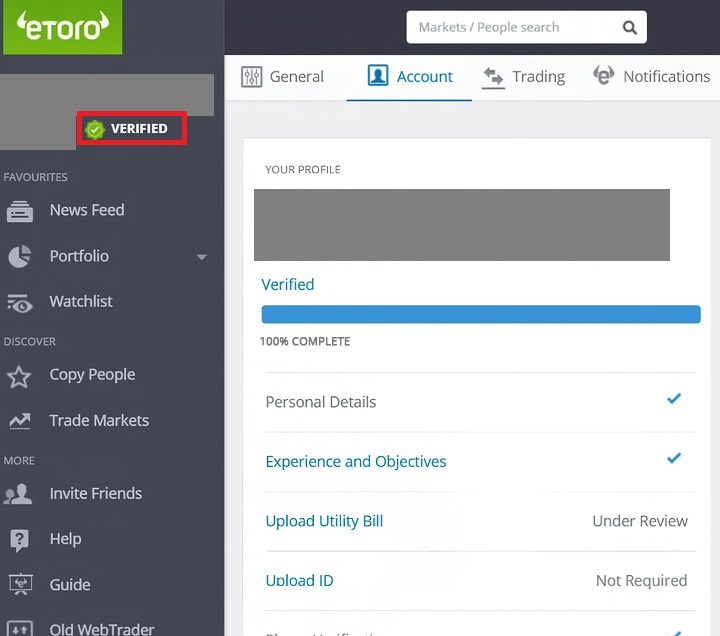

- And finally, your eToro account has been successfully verified. Typically, the verification process takes a maximum of 2-3 working days.

- If a checkmark appears under the account name, it indicates the account is fully verified.

How to Open a Demo Account

If you are still unsure about a Live Account, you can open a demo account first. For steps to open a demo account, please follow the following guide below.

- Please log in to eToro's Client Area.

- In the bottom left corner, click "Switch to Virtual" in the bottom menu.

- Then, a pop-up will appear like this. Please click "Switch to Virtual Portfolio" to be redirected to the home page of your demo account.

- To start trading, please select the "Discover" menu, you will be shown a large selection of assets, starting from Cryptocurrencies, stocks, ETFs, indices, commodities, and currencies. In this example, the author will try to choose a Bitcoin instrument. To start, please select Bitcoin.

- Next, select the "Trade" menu.

- Then, please select the "+" or "-" sign to increase and decrease the nominal amount of money to buy BTC assets. If it is correct, please click "Open Trade", and your position order will be successfully executed.

- To view the position order history, please go to the "Portfolio" menu.

eToro established in early 2007, with a mission to make trading accessible to anyone, anywhere, and reduce dependency on traditional financial institutions. The company has head offices in the United Kingdom, Cyprus, USA, and Australia.

eToro (Europe) Ltd operates as a Financial Services Company authorized and regulated by the Cyprus Securities Exchange Commission (CySEC) under license no. #109/10. Meanwhile, eToro (UK) Ltd is authorized and regulated by the Financial Conduct Authority (FCA) under the license FRN 583263.

As for eToro AUS Capital Pty Ltd, the legal standing is acknowledged by the Australian Securities and Investments Commission (ASIC) to provide financial services under Australian Financial Services License 491139.

A broker that belongs to the 4-digit type, eToro offers both short-term options for day traders and long-term options for investors, such as their innovative Smart Portfolios, a fully managed thematic portfolio.

Since 2007, eToro has been at the forefront of the Fintech revolution. The most recent was launched in 2017, which is Smart Portfolios powered by Machine learning Al. Beyond developing Smart Portfolios, the company integrated Microsoft's machine learning technology into Momentum DD.

The new Smart Portfolios investment strategy uses artificial intelligence to find the steadiest traders who are most likely to generate a double-digit return and bundle traders into one fully-managed portfolio. eToro has hundreds of financial assets for trading across several categories including stocks, commodities, crypto assets, currencies, indices, and ETFs. Each asset class has characteristics and can be traded using a variety of investment strategies.

Some positions on eToro involve ownership of underlying assets, such as non-leveraged positions on stocks and cryptos. Employing CFDs will enable a variety of options, such as leveraged trades, short (sell) positions, fractional ownership, and more. For example, traders can invest as little as USD100 in gold, even if a single unit of gold cost USD1,000. Some of eToro's most popular CFD commodities include gold, oil, natural gas, silver, and platinum.

Currencies are traded on eToro only as CFDs. Also, CFDs enable Sell (short) positions and leveraged trade, even for assets that don't offer the option in traditional trading. Some of the popular currencies include EUR/USD, GBP/USD, AUD/USD, USD/JPY, and USD/CAD.

Furthermore, An Exchange-Traded Fund (ETF) is a financial instrument comprising several assets grouped to serve as one tradable fund. After opening an account in eToro, traders can invest as little as USD250 in an ETF that costs USD500. Some of the popular ETFs on eToro include SPY, VXXB, TLT, and HMMJ.

However, eToro also offers additional functions using CFD trading. All leveraged ETF positions in the UK are under FCA regulations. Meanwhile, all CFD positions executed by eToro Australia are under ASIC regulations.

The company has other advantages. In all financial assets that can be traded, eToro does not charge any deposit or trading frees other than spreads.

eToro charges a USD25 fee for withdrawals and the minimum withdrawal amount is USD50. Long (Buy), non-leveraged crypto, stock, and ETF positions are not executed as CFDs and do not incur any fees. eToro does charge overnight or weekend fees for CFDs positions, such as leveraged positions and short (sell) orders.

Fee updates always apply to open positions. Fees are subject to change at any given time and could change daily, without prior notice, depending on market conditions.

As a beginner, trader can use CopyTrading eToro. Different from the features of other brokers, traders can copy the strategies of professional traders without fee or profit-sharing. Therefore, 100% profit is fully owned by traders. For example, while trader A who is copied by trader B, produces a profit of 10% this month, then trader B also gets a profit of 10%.

The company is the world's leading social trading network. Since eToro operates in complete transparency, each trader has valuable information on their eToro profiles, so other traders that are interested to copy their trades can have assistance in creating their best portfolios.

Another feature that is unique to eToro is the personalized, social News Feed. Just like on any social media, traders can post their updates on feed, comment on other's posts, and gradually create a feed that is tailor-fitted to trader's trading and investing interests. On eToro social trading platform, traders will also get notifications when a trader writes a new post and many other important updates.

eToro Account Types

In short, eToro offers four account types:

- Personal (retail) account: It is eToro's default account type. It's perfect for most folks, offering access to all assets, copying experts, and smart investment tools. Although leverage is limited, account holders enjoy the highest level of consumer protection.

- Professional account: Up your game with the Professional account and unlock higher leverage for experienced traders (qualifications required).

- Corporate account: It is designed for business purposes and used by legal entities, this account type is suitable for trading with business-owned capital.

- Islamic account: This type of account complies with Islamic law and does not charge any interest or fees. So, this account is very suitable for Muslim traders. However, this account type is available to users in certain countries only.

eToro stands out as an exceptional option for individuals seeking cost-effective stock, CFD, forex, and crypto trading through its impressive mobile app. With an active user community, eToro provides social features dedicated to supporting the needs of traders and investors across the globe.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance