XM copy trading service can bring in a lot of money for you as a strategy provider because you will receive payment in the form of commissions paid by those who copy your strategy.

Copy trading is currently gaining popularity among many traders. This is because this service can provide a decent additional income from trading. While making a profit, you also have the opportunity to earn by sharing your strategies with other traders.

Simply put, if the strategy you share turns out to be profitable, the individuals who replicate your strategy will "reward" you as a form of gratitude. Moreover, in XM Copy Trading, you can choose how much you want to be paid by them.

If you feel confident and believe your strategy is profitable, you can try registering in XM as a strategy provider, sometimes referred to as a "Master". This is someone whose strategy can be duplicated by many traders and gain money from the commission they paid.

Let's delve into all the aspects related to this in the article below.

Introduction to XM Copy Trading

XM is a renowned global broker with numerous licenses, including major ones such as FCA, ASIC, and CySEC. This broker has been in operation since 2009, providing satisfactory services throughout its operational period.

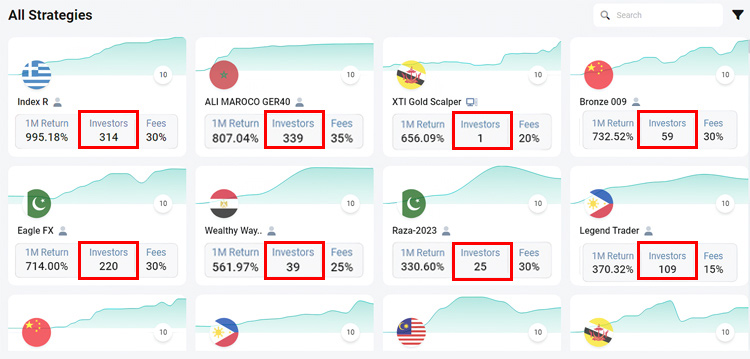

XM copy trading service under the umbrella of XM Global Limited is relatively new as it was just launched in 2023. Nevertheless, this service has attracted a lot of interest, with 200 people joining as strategy providers.

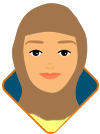

These 200 individuals come from various countries worldwide, with the majority hailing from China, Malaysia, Pakistan, and Thailand. You can view their profiles in the copy trading menu and click "Show All."

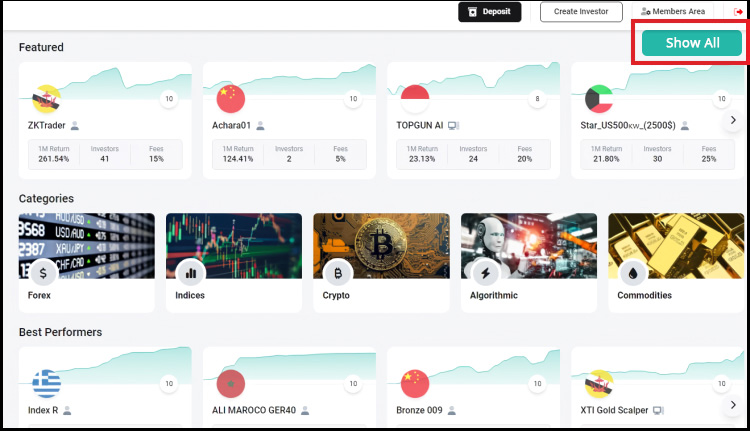

You can access XM's copy trading service through their website or the mobile app, which can be downloaded from the Play Store and the App Store. As of now, to obtain the XM mobile app on Android, you need to download the APK format.

Currently, there is no dedicated app for copy trading, but considering its popularity, it's highly likely that an app will be developed and made available for direct download from the Play Store.

XM Trading App Overview

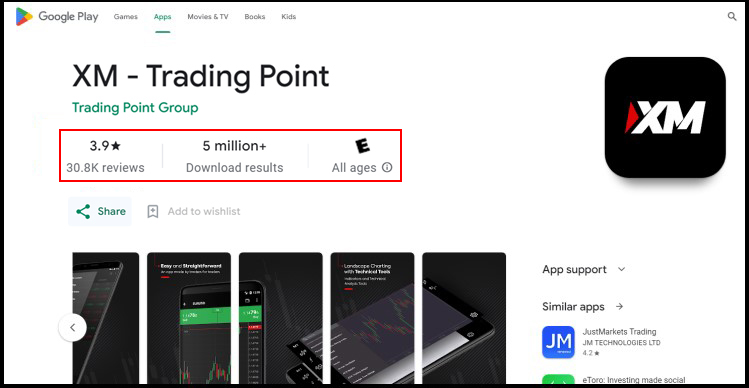

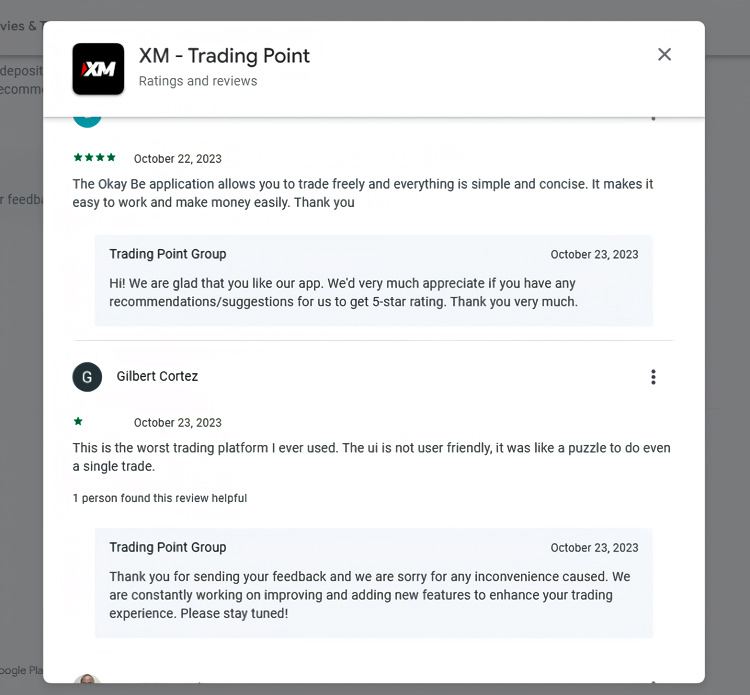

In terms of reviews, the XM mobile app is rated 3.9 out of 5, with comments from over 30,000 users. Review comments indicate that the XM app is generally well-received, with a balanced mix of positive and negative feedback.

In terms of reviews, the XM mobile app is rated 3.9 out of 5, with comments from over 30,000 users. Review comments indicate that the XM app is generally well-received, with a balanced mix of positive and negative feedback.

Most of the positive reviews praise the app for being fast, responsive, and user-friendly for deposits and trade execution. On the other hand, negative reviews mention occasional technical issues such as glitches, errors, or freezing.

The positive aspect is that XM's team actively responds to all reviews. When receiving positive feedback, they express gratitude, and when receiving negative feedback, they apologize and commit to improving the app in the future.

XM Group is a group of regulated brokers and it is owned by Trading Point Holdings Ltd. Entities under XM Group have significant experience as financial services providers worldwide.

Trading Point of Financial Instruments Ltd was established in 2009 with headquarters in Limassol, Cyprus, Trading Point of Financial Instruments Pty Ltd was established in 2015 with headquarters in Sydney, Australia, XM Global Limited was established in 2017 with headquarters in Belize and Trading Point MENA Limited was established in 2019 with headquarters in Dubai.

XM Group is regulated by the CySEC (Cyprus Securities and Exchange Commission) - Trading Point of Financial Instruments Ltd, FSC (Financial Services Commission) – XM Global Limited, the ASIC (Australian Securities and Investments Commission) - Trading Point of Financial Instruments Pty Ltd and DFSA (Dubai Financial Services Authority) - Trading Point MENA Limited.

XM is one of the more experienced brokers in the world of online forex trading today. Since its founding, the broker has experienced a lot of changes, including the addition of the Ultra-Low Account and EN Live Edu that is instructed by 16 global experts.

In terms of trading instruments, XM is a well-known diverse class assets provider, varying from Forex, Crypto, Stock CFDs, Turbo Stocks, Commodities, Equity Indices, Precious Metals, Energies, & Shares. XM prides itself to be the ideal broker in trading execution, offering a stat of 99.35% orders to be executed in less than 1 second. Trading in XM would be also provided with a strict no requotes policy, no virtual dealer plug-in, no rejection of orders, real-time market execution, and the choice for traders to place orders online or by phone.

Spreads on all majors can reach as low as 0.6 pips in Ultra-Low Account, while spreads on other accounts usually start from 1 pip.

To protect the client's fund in the event of extreme volatility, XM presents each account type with Negative Balance Protection. Minimum deposit of $5 applies to Standard, Micro, and also Ultra-Low Accounts. Traders who open accounts in XM are enabled a condition similar to a Cent Account environment in the Micro Account, in which the Contract Size for every lot is only 1,000 units. If it is applied with the smallest lot size in the MetaTrader platform which amounts to 0.01, it means that traders can go as small as 10 units per trade.

For the deposit, XM applies zero-fee deposits in most of its available payment methods. Traders can choose to fund or withdraw their accounts via wire transfer, credit card, as well as the most favorable e-payment choices like Skrill, Neteller, and FasaPay.

To give their clients the best experiment in trading, XM has given access to both MT4 and MT5 platforms, each is available for more than 6 display formats (PC, Mac, Multiterminal, WebTrader, iPad, iPhone, Android, and Android Tablet).

All in all, there is no doubt that XM has gone global with its deep commitment to providing services in more than 30 different languages across the world. Aside from easing traders' experience with mainstream trading platforms and high-quality trading execution, XM is open to various types of traders, from small capital traders to the more experienced ones with big deposits at the ready. Traders are even provided with a Cent Trading environment should they choose to register under Micro Account.

For their global approach, XM has ensured that traders from various countries could access their service easily. This results in the provision of different domains specified for traders in certain jurisdictions. For example, traders from Indonesia could access XM via this link.

How to Make a Strategy Provider/Master Account

To earn extra income from XM Copy Trading, you need to register yourself as a strategy provider. It's essential to understand that there are two roles here: the strategy provider or Master, and the Investor.

The strategy provider/master is the person who shares their strategy and will receive a commission from investors if their strategy is profitable. Meanwhile, an investor is the person who copies your strategy. Therefore, accounts for these two roles are distinct.

To create a strategy provider account, make sure you already have a real trading account with XM. If you don't have one yet, you can create it first. After that, you can follow the steps below.

- Log in to your real trading account using the registered email and password.

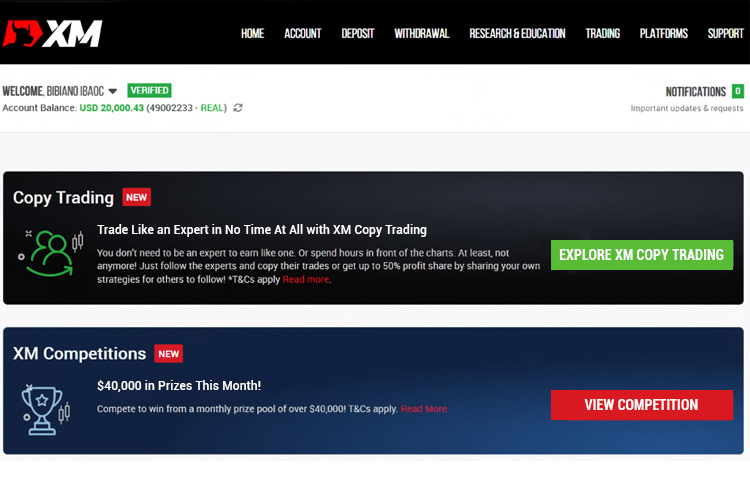

- Click the "Explore XM Copy Trading" button.

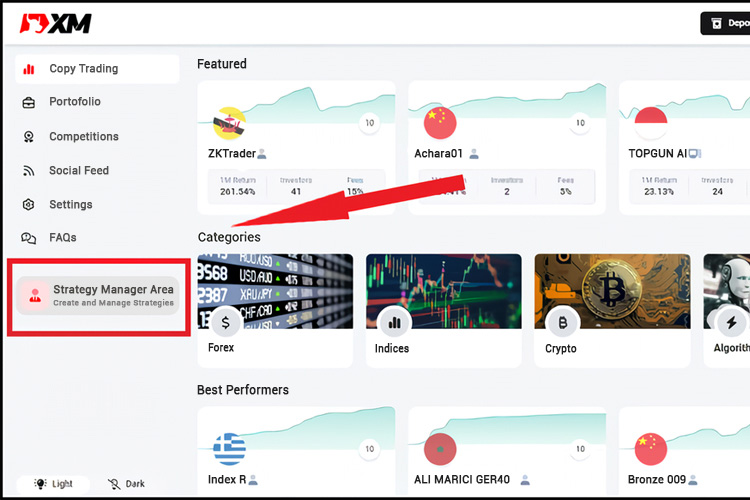

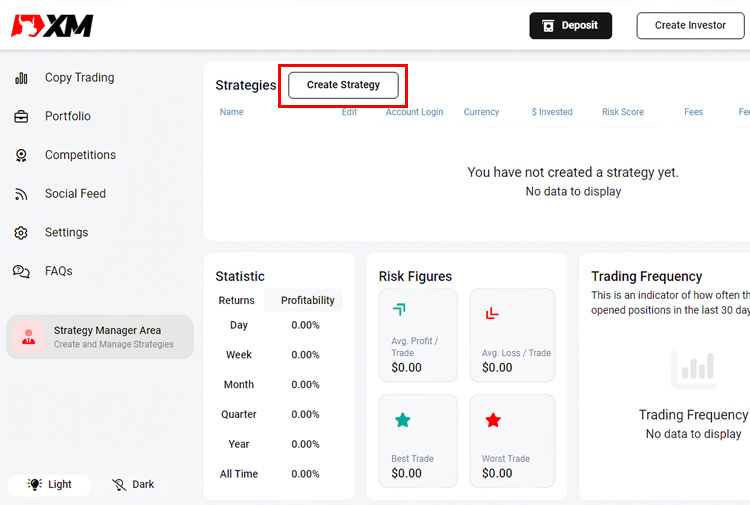

- You will be directed to a page that looks like this. Click on the "Strategy Manager Area" button.

- Click "Create Strategy."

- The registration process will take a little time, so please wait a moment until XM finishes processing your strategy provider account.

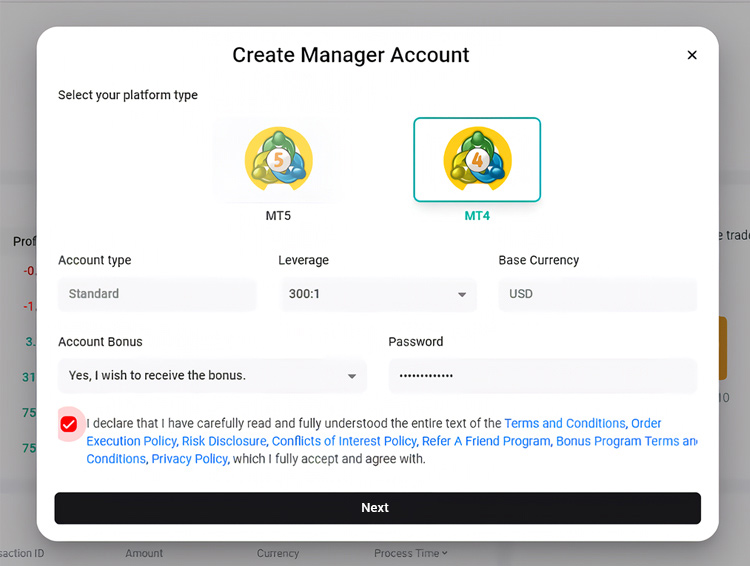

- Once it's done, you can start setting up your strategy provider account. Here, you can choose the platform you want to use, account type, leverage, and base currency. Don't forget to enter your password and indicate whether you want to receive a deposit bonus or not. Check the agreement box and then click "Next."

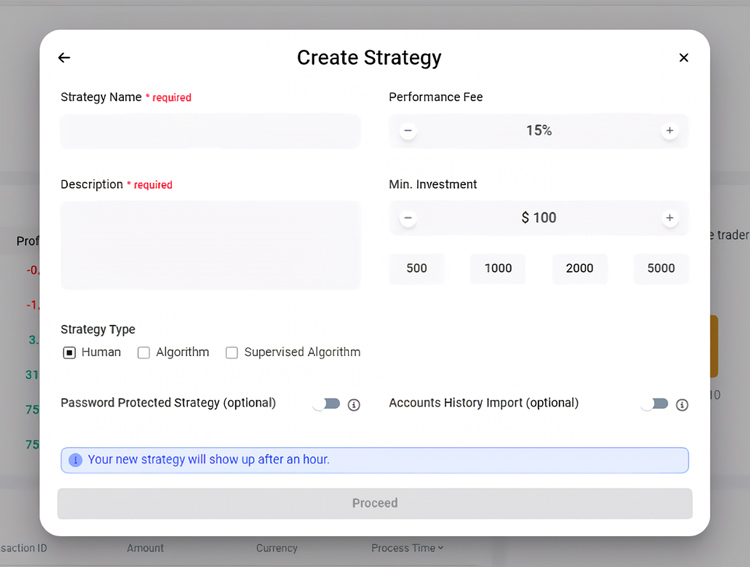

- Next, create your strategy. Enter the strategy name, description, performance fee, minimum investment, and strategy type. Once done, click "Proceed." It will take approximately 1 hour to process your request.

- Done. Your strategy will only be visible to investors if it has more than $50 of equity in it. Once you create the strategy, you will be able to see it on the main page.

- You can also see the number of investors as soon as it appears on the main page. The number of investors is fully visible because it will be displayed on the publicly available profile of the strategy provider.

See Also:

Features for Strategy Providers

In the XM copy trading platform, both on the website and the mobile app, there are tools that can assist you in optimizing strategy creation, reaching out to investors, and evaluating existing strategies. Some of these features include the following:

Strategy Manager Area

Here, you can find all the details related to your strategy provider account. You can view:

- A list of the strategies you've created, including the number of investors who have copied them and the fees you've earned.

- Statistics that encompass the percentage of your profitability performance on a daily, weekly, monthly, yearly, and all-time basis.

- Risk Figures include the average profit per trade, average loss per trade, best trade, and worst trade. All figures are calculated in dollars.

- Trading Frequency is an indicator that shows how often you've opened positions in the last 30 days.

- Asset Allocation, which contains the history of the assets you've traded.

- Manager Fees and Fee Details, which provide a history of the commissions you've earned as a strategy provider. The fee details even include subscription ID, transaction ID, amount, currency, and processing time.

Create Strategy

With this tool, you can optimize your trading strategy to be copied by investors. In this menu, you can configure the following:

- Strategy Name: This will appear in the list of strategy providers in the copy trading menu. You are free to name it as you like, and the more appealing it is, the better, as it can attract investors.

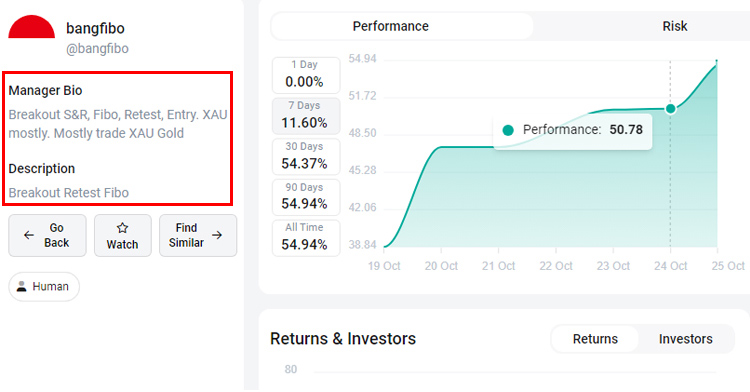

Some use aliases, some use their real names, some incorporate their trading strategy into the name (e.g., Bob the Scalper, Genius EA, etc.), and some use random names (e.g., Blackpink, Diamond, Turtle Guy, etc.). - Description: This is like your social media bio. You can fill it with anything you want. You can describe your strategy, similar to what bangfibo has done, or you can include your occupation like ZKTrader has done.

- Performance Fee: This is a tool to set the percentage of commission that investors must pay to you. You can adjust the percentage from 0% to 100%. The lowest provider fee currently is 10%, and the highest is 40%.

- Min Investment: This is the minimum balance an investor must have to copy your strategy. You can set it according to your profile.

- Strategy Type: There are three types to choose from Human, Algorithm, and Supervised algorithm. "Human" means you trade manually. "Algorithm" means you use an expert advisor. "Supervised algorithm" means you use a combination of EA and manual trading, or an EA controlled by a human.

Deposit

As the name suggests, this tool is useful for depositing funds into your trading account. The tool is already available on the copy trading page, so you don't need to go to the funding menu in the client area.

If you need to make a deposit, you can use this tool. After successfully accessing the funding page, you will be directed to choose payment options for your deposit, including wire transfer, mobile banking, credit/debit cards, and more.

You can also view the history of deposits, withdrawals, and internal transfers that you have made.

See Also:

Create Investor

This tool is useful for creating an investor account. One of the advantages of XM Copy Trading is that you can open both provider and investor accounts simultaneously. Having both active is allowed, so if you want to take on the role of an investor as well, you can utilize this tool.

Light and Dark Settings

This tool is essentially for changing the screen display, either light or dark. If you choose "light," your screen will predominantly be bright white. If you choose "dark," your screen will predominantly be dark. Just like on social media. You can change it at any time according to your preferences.

Competitions

Just so you know, XM organizes social trading competitions with prizes worth thousands of dollars. If you're confident enough, you can participate to test your own strategies.

There are several submenus you can find in this tool. There are real and demo submenus that show which accounts are used for the competition.

Then, there are submenus for competitions that are in progress, upcoming, and ended, which can show you the schedule of those competitions.

Social Feed

Social feed is a tool for strategy providers to share their thoughts, much like Facebook or X. You are free to write anything to be shared with others. You can also share interesting insights to attract investors.

Settings

This tool is useful for modifying account-related information. You can change your username and manager bio here. Additionally, you can also adjust your language preferences in the settings.

FAQs

Like FAQs in general, this tool serves as a guidebook as it presents a list of frequently asked questions by traders. If you need information, use this tool to obtain what you require.

How is the Strategy Providers' Commission Calculated?

As the primary goal, you must understand how the commission scheme works in XM's copy trading system. Once you've registered as a strategy provider, complete your profile, attract investors, and then trade until you make a profit. Once you've made a profit, investors will pay the commission that you have set.

As previously mentioned, as a provider, you have the freedom to set the commission percentage that investors must pay you. Of course, the size of this commission will impact the number of investors you attract. Why?

If you set the commission too high, investors may be reluctant to follow you because they would have to give up a larger portion of their profits. Especially if the profits from your strategy aren't substantial.

However, if the commission is too low, investors might be more interested because you're "cheap," but it could be detrimental to your own income as it won't amount to much.

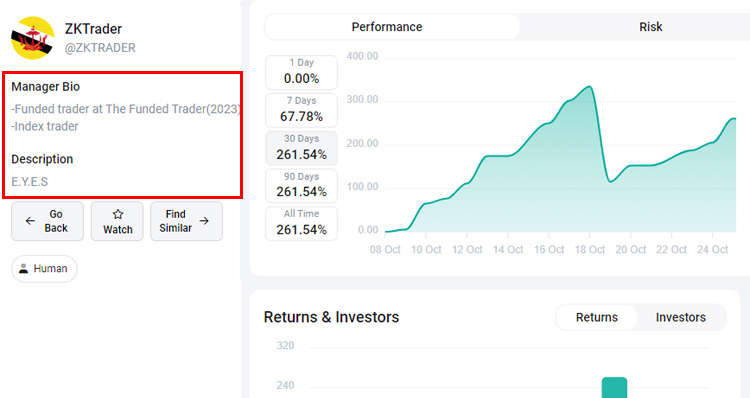

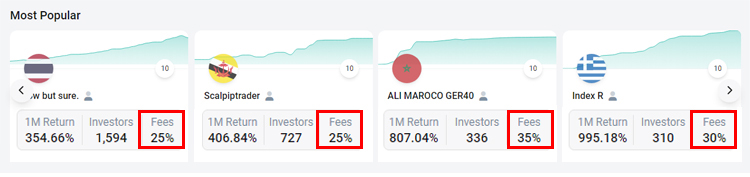

Based on the current list of strategy providers, the majority of providers set their commissions between 15-30%. The lowest is at 5%, and the highest is 50%. There is nothing higher than that because it would clearly make it difficult for them to attract investors.

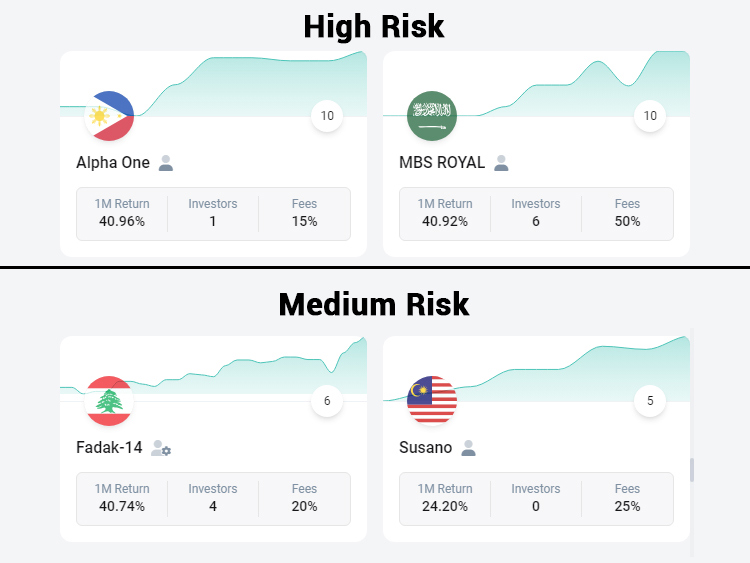

For example, among the "big four" in the most popular category, they set their commissions at around 25-35%.

So, how much money can you potentially earn from these percentages? It's quite simple; it depends on the amount of profit you manage to generate, which is then multiplied by the commission percentage. Here's an example calculation:

Let's say you also set your commission at 25%, just like the provider with the Slow but sure account, the number one guy above. You already have 10 investors following you. Then, your trades successfully generate a profit of $500. Now, let's add the calculation:

Commission paid = commission percentage x profit earned x number of investors.

Commission paid = 25% x $500 x 10 = $1,250

When you add the profit you earn from trading, it will amount to $1,250 + $500 = $1,750.

So, it's quite substantial, isn't it? A $500 profit can turn into $1,750 in an instant. This is how you make money by sharing your strategy in XM Copy Trading.

When is the Commission Paid?

The commission must be paid by the investors at the end of the trading session for that day. The commission will be credited to your strategy provider account at the end of the trading session for that day. So, it's a daily process.

You don't have to wait too long to get your "salary". Once you access your account, you also have the right to withdraw it.

How to Make Your Strategy Look Attractive to Investors

One important aspect of being a strategy provider is how to attract a lot of investors. Here are some tips you can apply:

- Complete your profile and make it as good as possible. The name is the first thing investors will see when browsing strategy providers to copy. Therefore, create a name that is good, clear, and attractive. It's best to keep the name short as well.

- Set a reasonable commission fee. After the name, investors will look at the commission fees you've set. If you set them too high, investors will automatically skip and won't be interested in exploring your strategy and profile further.

Moreover, you have to compete with other strategy providers. - Write about your background. In the description and bio, write something that can support your profile to make it convincing.

You can mention your experience, such as having 5 years of forex trading experience, winning trading competitions, or working in a funding company as a trader. Backgrounds like these will certainly make investors more confident in your credibility. - Improve your portfolio. Investors can easily see your portfolio. They can find out how you've performed so far, how many times you've won, how many times you've lost, your winning percentage, and so on.

This is a consideration for them. If your performance is good, investors will be confident in copying your strategy. - Develop the most reliable strategy by optimizing leverage and risk. Investors can also consider your strategy in terms of the level of leverage you use, whether it's manual or using a robot.

Avoid using risky strategies. The risk level is also publicly displayed. Investors will be reluctant to follow you if there's a displayed number 10 on your profile, indicating that the strategy you employ is highly risky.

- Furthermore, the dos and don'ts that you need to pay attention to as a strategy provider in XM Copy Trading will be listed as follows:

| ✔️Do's | ❌Don'ts |

|

|

Important Rules Regarding XM Copy Trading for Strategy Providers

When registering as a strategy provider on XM Copy Trading, there are several crucial aspects to be aware of. These pertain to the rules, restrictions, and regulations governing the service.

- You can create a maximum of 10 strategy provider accounts.

- There is no limit on the number of followers for strategies. Each strategy can be followed by an unlimited number of investors.

- You have the flexibility to set your commission rate as high as 50% of your followers' profits.

- There is no commission cap. The greater the number of investors who follow your strategy and the more successful the strategy becomes, the higher your potential earnings.

Bottom Line

XM Copy Trading is a great opportunity to earn additional income from trading. By becoming a strategy provider, you have the chance to earn more money through the commissions paid by investors who follow your strategy, in addition to the profits you generate from your own trading.

To do this, you can utilize various tools provided by XM to optimize your profile and attract a large number of investors. The more investors who copy your strategy, the more commissions you can earn.

This should also be accompanied by good trading performance. Improve your winning rate and use safe strategies to keep your risk level low. By doing so, you will become a successful strategy provider.

XM is a well-regulated forex brokerage that offers a wide range of trading instruments, including forex, CFDs, stocks, indices, commodities, and cryptocurrencies. XM also offers a variety of educational resources, including webinars, tutorials, and e-books. These resources can help traders learn about the forex market and how to trade.

Earn Infinite Loyalty Rewards

Earn Infinite Loyalty Rewards Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients