There are many reasons to open an account in FXOpen. If you are interested, read this guide and follow the steps accordingly.

No matter what instrument you are planning to invest in, you need a trading account to access financial markets. Trading accounts are available on brokerage firms and they are basically used to execute trades among other things. In this article, we're going to show you how to open a trading account in FXOpen, which is quite a well-known broker among global forex traders. If you're unfamiliar with the broker, let's do a quick introduction first.

Contents

Introduction to FXOpen

The FXOpen firm started off as an educational center offering training courses on technical analysis and financial markets. Only in 2005 did the company switch to a brokerage company to satisfy the growing need for a safe and transparent trading environment. FXOpen was among the first brokers that use ECN trading system via the MetaTrader 4 terminal.

Over the years, FXOpen has grown into one of the most well-respected brokers that specialize in forex and CFD trading. The FCA-regulated broker offers up to 70 tradable currency pairs with competitive spreads and low minimum deposits. Users can choose between a live and demo account, and trade with various different strategies. There are several trading platforms available, including MetaTrader 4 and 5 for Windows, iOS, and Android devices.

FXOpen started its operation as an online trading provider for retail clients since 2005. The company was founded by a group of traders with a mission to provide services that refer to the interests of traders. FXOpen claimed to be one of the firsts to offer ECN trading via MetaTrader 4 (MT4). With FXOpen's unique proprietary price aggregating technology, their clients can benefit from the industry's most competitive spreads (from 0 pips) and low trading commissions.

In 2006, FXOpen also became the first broker to offer a micro account and a swap-free account. After that, they continue to be the pioneers of several new and high-tech services, including the first Crypto account that can provide trading facilities on 24 Cryptocurrency pairs such as Bitcoin, Litecoin, and Ethereum.

Furthermore, the company provides One Click Trading and Level 2 MT4 plug-ins, enabling traders to place trades with just one click of the mouse. Traders do not need to worry about trading security at FXOpen. They have registered in Nevis, the UK FCA, and ASIC Australia.

A variety of trading accounts are provided such as STP, Micro, ECN, and free unlimited demo accounts. The minimum deposit for each account depends on the account type; USD1 in Micro Account, USD10 in STP and Crypto Accounts, and USD100 in ECN Accounts. As for leverage, FXOpen offers up to 1:3 (for Crypto Accounts), and up to 1:500 (for Micro, STP, and ECN Accounts).

Besides, traders can enhance their trading capabilities with Myfxbook and Zulutrade automated trading systems. Both of these services allow anyone to copy the transactions of experienced traders. Thus, traders can replicate the results of professional traders' strategies.

The FXOpen PAMM Service allows copying trades from a Master account to one or more than one Follower account and automates the distribution of profits and losses. The Master operates personal capital through a PAMM account, and his trading strategy is replicated to the Follower's capital. The owner of the Follower account can view and analyze the performance of the PAMM account with the help of advanced analytics. There are 3 PAMM accounts in FXOpen, namely STP, ECN, and Crypto PAMM.

On ECN accounts, traders will get direct price quotes from leading liquidity providers, including Dresdner, SG Paris, Standard Chartered, Barclays Capital, Bank of America, CRNX, JP Morgan, Morgan Stanley, Deutsche Bank AG, RBS, CITI, and UBS. This is one of the reasons why FXOpen's ECN account has become a trader favorite.

After seeing the various advantages offered by FXOpen, traders can easily register an account, simply by filling out the form in the registration menu on the FXOpen website. Traders will be asked to verify documents in advance if the trader will make a deposit or withdrawal of funds. Based on traders' experience and information since FXOpen was founded, there have not been any major complaints about payments (depositing or withdrawing funds) from clients.

Once registered with the FXOpen broker, traders also have the opportunity to get other benefits. One example is the FXOpen cashback program for the first 90 days from registration as a new client. The minimum cashback is USD5 and the maximum is USD1,000.

Furthermore, free VPS is available for ECN, STP, and Crypto account holders. Traders can use FXOpen VPS without any fees for 1 month if they can maintain equity of USD5,000 at the end of the month or trade with a trading volume of USD10,000,000 per month. The advantages of VPS on FXOpen are excellent accessibility, flexibility, and speed.

Trading on FXOpen is made easier because traders can add insight into trading by entering contests. FXOpen Broker offers weekly and monthly trading contests on demo accounts through the ForexCup.com site. Traders can join competitions that are free of charge to hone their skills. If a trader wants a bigger challenge, there is also a trading contest on a real account.

The company also offers Forex partnership programs to traders, Forex brokers, and website owners who publish information about fiat and crypto-currency trading. There are 3 types of partnership levels, including Forex IB (Forex Agent) that attracts new clients to FXOpen using a referral (affiliate) link, Forex Rebate, and individual partnership conditions.

In Conclusion, FXOpen is a well-rounded forex brokerage for traders with a desire to try various trading instruments, a trading environment in ECN account, low minimum deposits, the best cryptocurrency trading condition, as well as interesting trading features like PAMM and demo contests.

What to Prepare in FXOpen Registration

Opening a trading account in FXOpen is actually quite a straightforward process. You simply need to complete the registration form and verify your account. Both steps are equally important, but the latter needs a little extra preparation as there are document requirements that you'll need to submit. If your account is still unverified, you won't be able to deposit and use your account to trade.

At FXOpen, there are two types of documents that you'll need to provide:

Proof of Identity

To confirm your identity, you can choose to upload one of the following documents:

- Valid Passport

- National ID Card

- Driving License

- Residence Permit

Make sure that the document fulfills the criteria below:

- The photo must be clear and bright. The four corners of the document must be visible.

- If the document is double-sided, both sides must be provided.

- Ensure that there are no spots or highlights in the photo. Low-quality images are not accepted.

- The file must be in JPG or PDF format, no less than 500KB.

- The document must be valid for at least three months.

Proof of Residential Address

To confirm your address, you can choose from the following documents:

- Bank Statement

- Utility Bills

- Internet, Cable TV, or Landline Bills

- Tax Return

- Council Tax Bill

- Certificate of Residence issued by an authorized government body

- Valid ID Document with your residential address

Also, make sure that you adhere to the criteria below:

- FXOpen does not accept screenshots, mobile phone bills, medical bills, credit card statements, receipts for purchases, or insurance statements.

- PO Box address is not accepted, except for traders in the Arabian Peninsula Countries and Kenya.

- The document must be in Latin characters or have a notarized translation into English.

- The document must show your full name (as stated in the ID), address, and date of issue.

- The image must be clear and bright. All four corners must be visible.

- The document must be issued within the last 3 months and printed on the official form.

- The image must either be in JPG or PDF format, no less than 100KB and 300 DPI.

How to Register a Main Account in FXOpen

Before you can open a trading account, you need to register your Main account first. For the record, FXOpen allows each client to have 1 Main account and up to 10 trading accounts of each type. Here is the complete step-by-step to open a new Main account:

1. Visit the broker's official website and click "Open an Account Now".

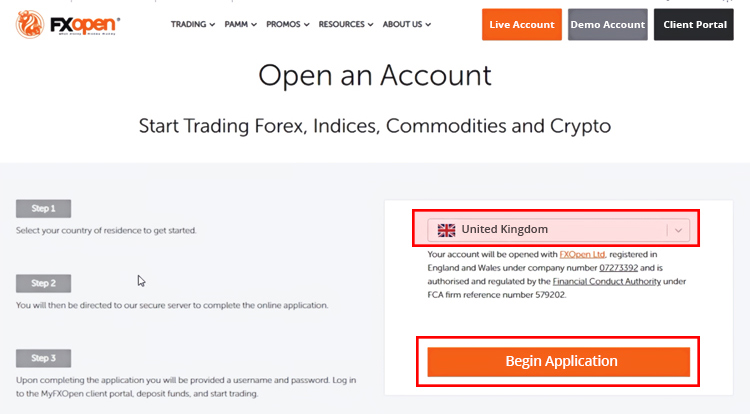

2. Choose your country of residence from the drop-down menu. Click "Begin Application" to proceed and you will be directed to a secure server where you can complete the registration form.

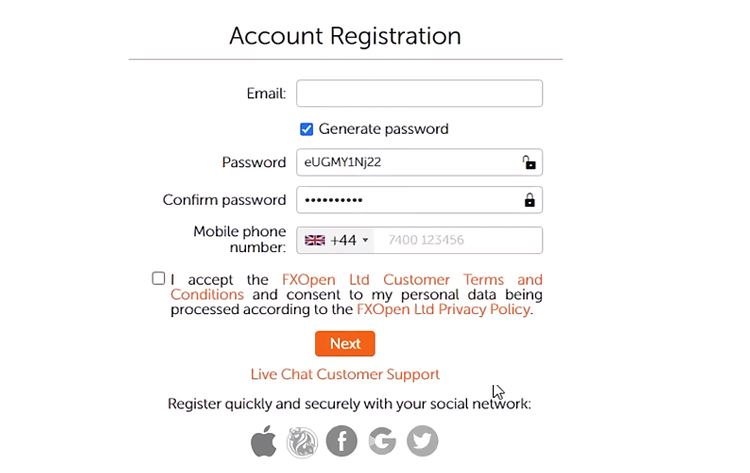

3. Enter your email address and phone number.

FXOpen's system will generate a unique password for you. Consider writing it down or storing it somewhere safe as the password is only shown once. Read and agree to the terms and conditions, then click "Next".

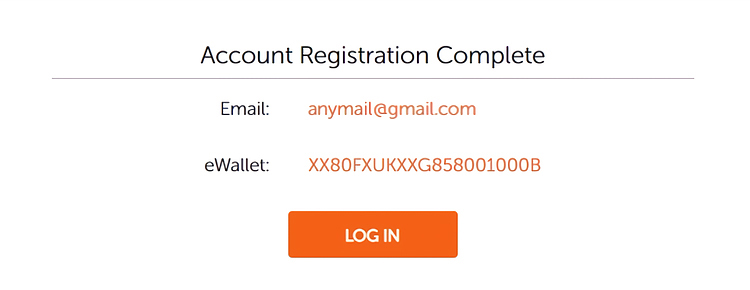

4. On the next page, you will be provided with your login credentials to your personal account. Click "Log in".

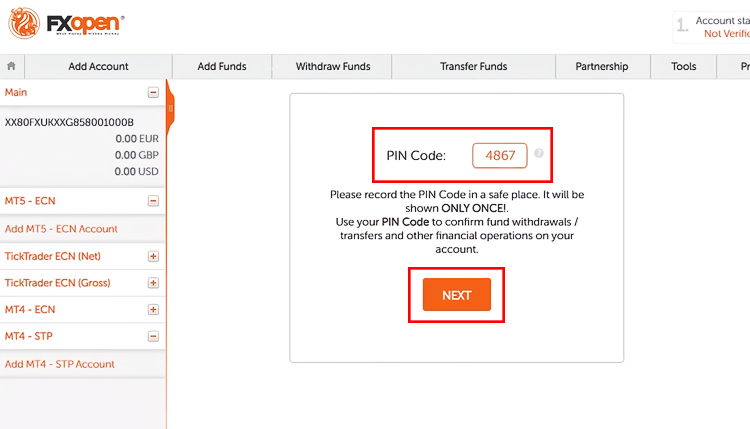

5. Once you're logged in, you'll see a unique PIN code. Please save the code as it will be shown only once. Click "Next" to start managing your Client Portal.

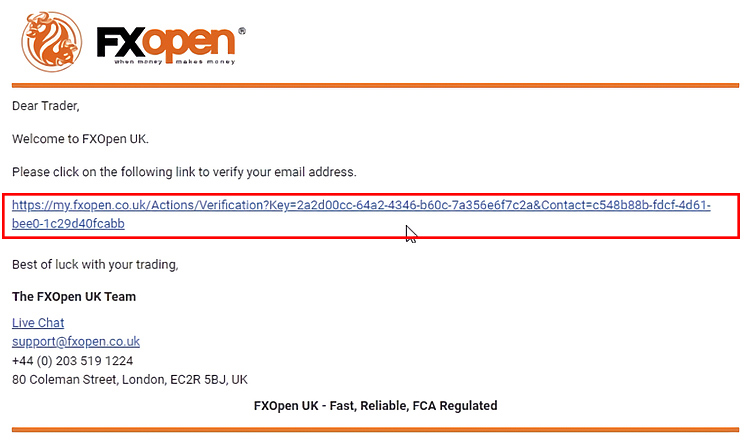

6. You will be asked to confirm your email. Simply go to your inbox, find the email from FXOpen, and follow the direction.

7. Congratulations! You have completed the registration process.

It is worth mentioning that you can use your social media accounts to register instead of email. Simply choose the social media logo and connect your social account to log in to the Client Portal. You will get an email notification stating that your social account has been successfully connected to your FXOpen account. You can add or remove your connected social accounts anytime in the Client Portal.

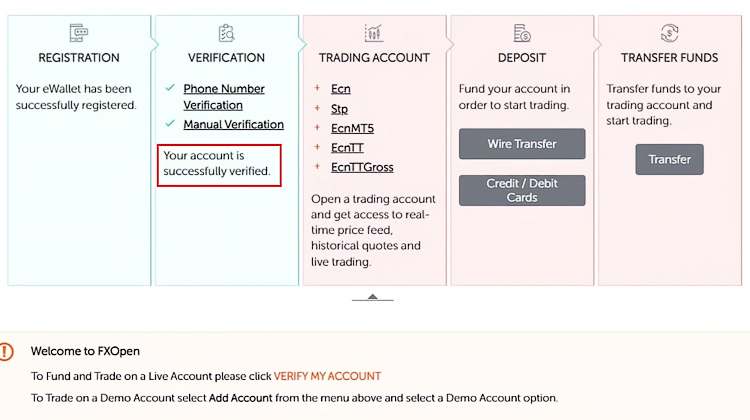

How to Verify Your FXOpen Account

In order to activate your account, you'll need to pass the verification procedure. If you are using a Personal account, you'll need to pass Grade 2 verification. You can check your account's verification status on the top right corner of the Client Portal. Here are the details of all of the grades:

- Grade 0: Unverified account.

- Grade 1: Phone verification completed via SMS or operator call

- Grade 2: Grade 1 + ID verification uploaded in the Client Portal and a selfie with the proof

- Grade 3: Grade 2 + vide verification

- Grade 4: Grade 3 + certified documents by mail or personal verification

Here is the complete step-by-step guide to verify your account in FXOpen:

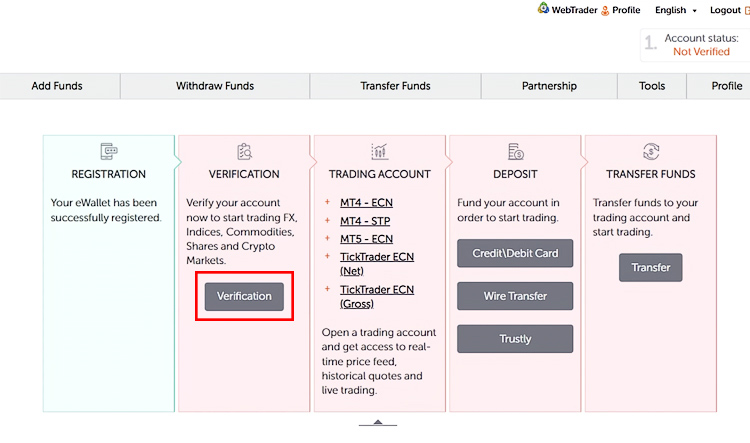

1. Click the "Verification" button in the Client Portal to begin the process.

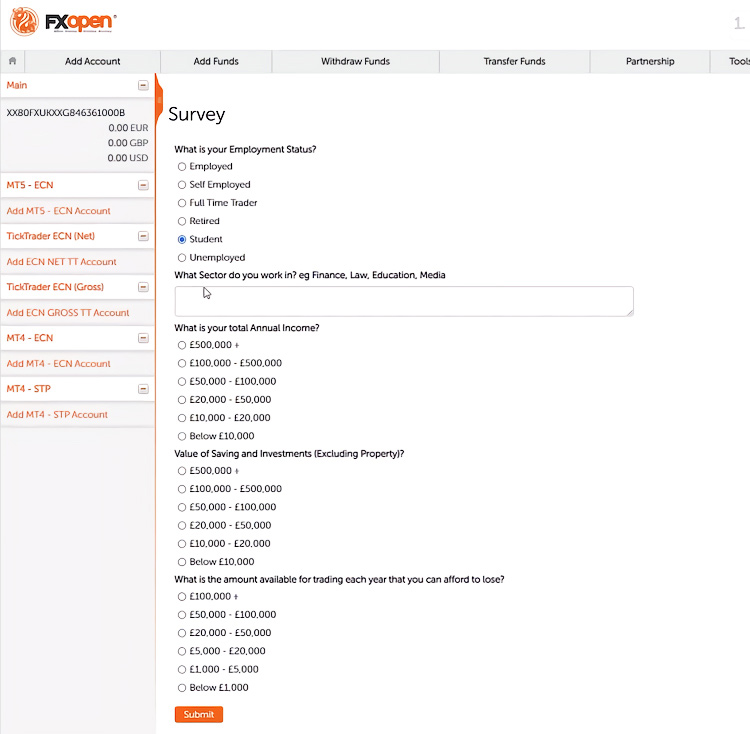

2. Answer a short questionnaire about your trading experience.

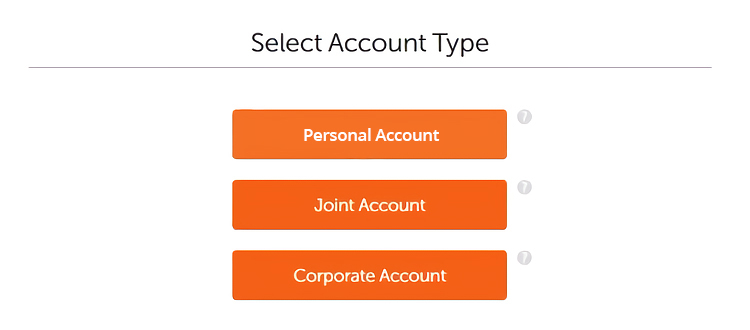

3. Choose your account type. Personal is for traders who trade individually, Joint is for parties who agree to manage the account simultaneously, while Corporate is specifically provided by FXOpen for institutional traders who represent their companies.

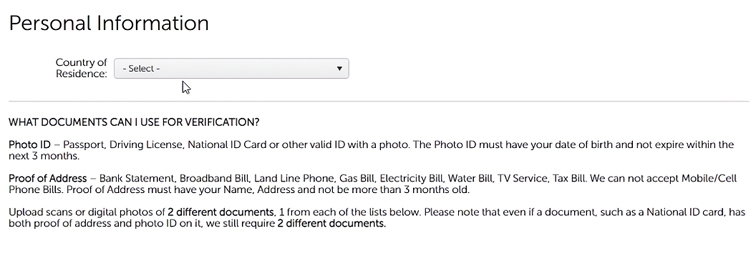

4. Select your country of residence.

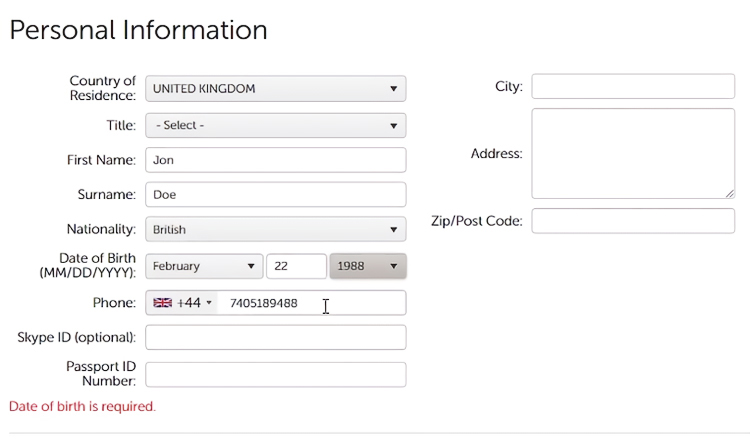

5. Enter your personal information, such as country of residence, your title, first and last name, nationality, date of birth, address, and so on.

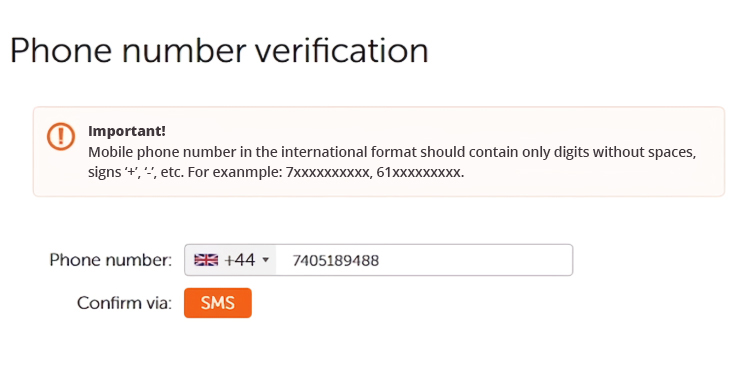

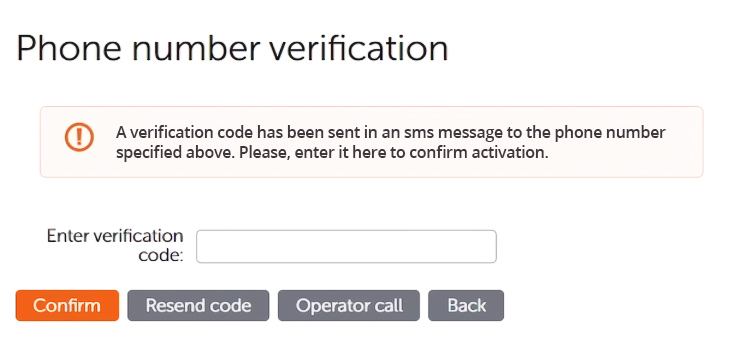

6. Under the Phone Number Verification, simply enter your phone number and choose "SMS".

7. FXOpen would send the verification code to your phone. If you have received it, simply enter the code and click "Confirm". If you haven't received the SMS, you can opt to verify via operator call.

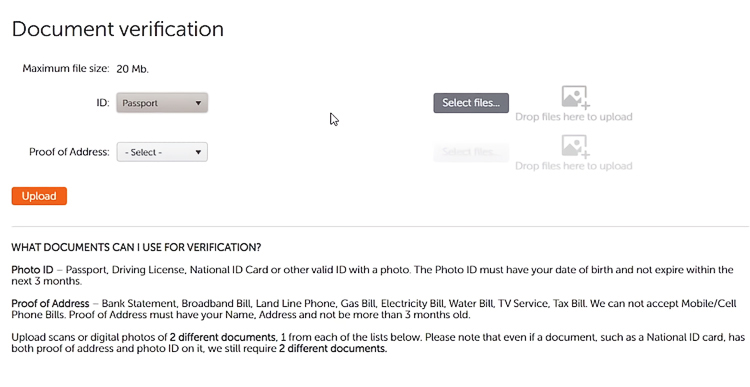

8. The next step is document verification. Simply choose the document types on the left side and upload the files on the right side of the screen. You can review and double-check the documents that you have attached. Once you're done, click "Verify".

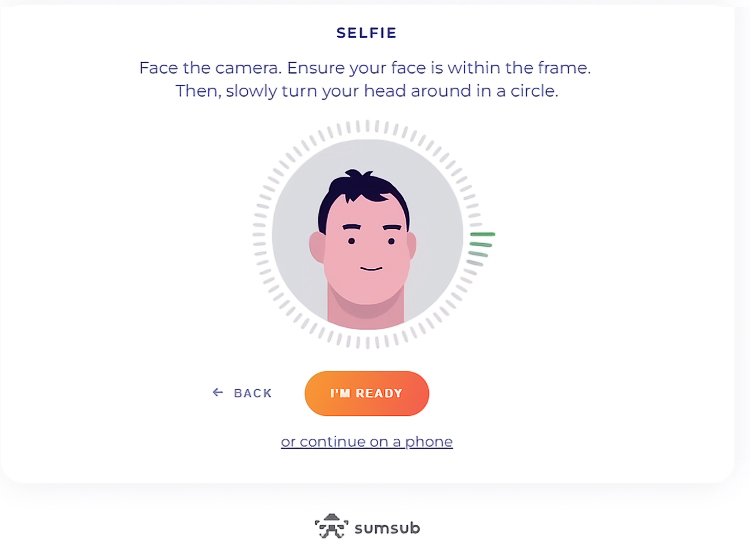

9. For the liveness check, simply follow the instruction on the screen and take a picture. You can either use the camera on your computer or mobile phone.

10. Wait for FXOpen to review your data. Your Main account status will change automatically once it's done. You will also receive email notification of the status.

The verification process typically only takes 48 hours to complete. However, the process might take longer if you have to resubmit your documents. If this is the case, check your email inbox to see why your documents were rejected.

How to Add an FXOpen Trading Account

Follow these steps to create a trading account at FXOpen:

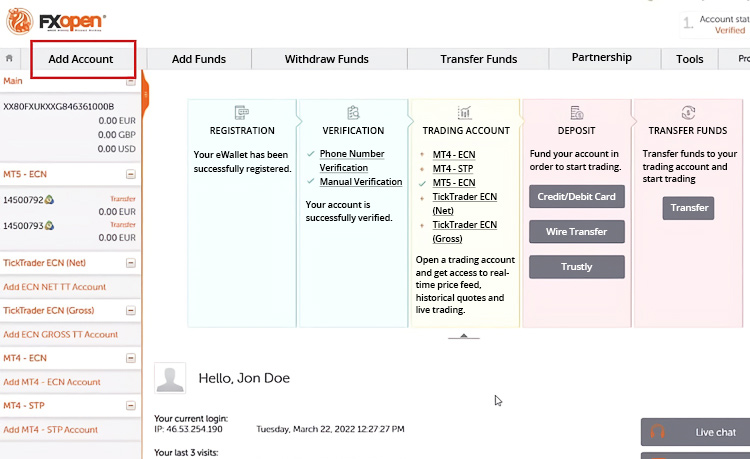

1. Log in to your Client Portal. Under the Trading Accounts panel, click "Add Account".

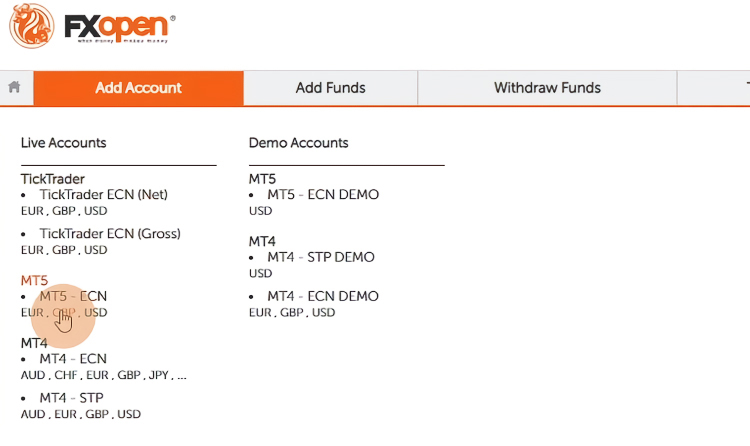

2. Select your preferred account type.

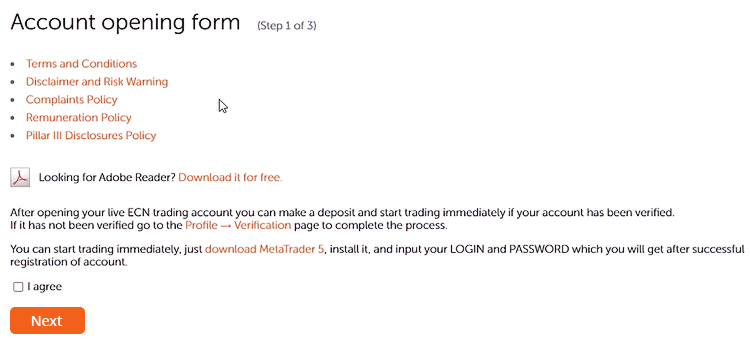

3. Read the terms and conditions. Tick the box if you agree and click "Next".

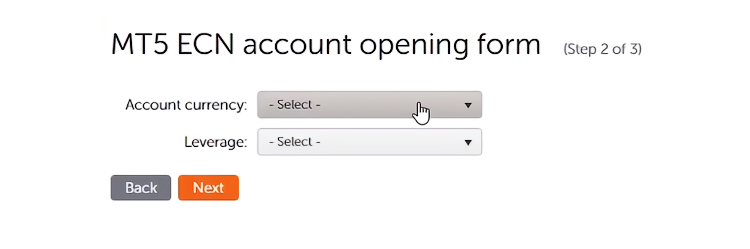

4. Choose your account base currency and leverage amount. Additionally, you can enter the agent's account number if you have one. Click "Next".

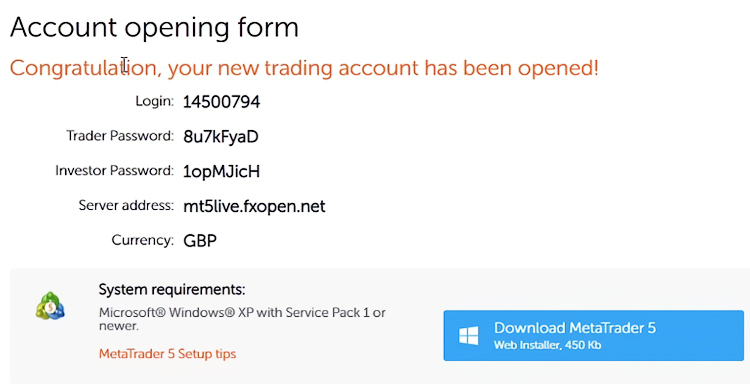

5. You will see your trading account details, including your email, password, and server address. This data will be sent to your email as well.

6. After that, simply install the trading platform and log in using your new account credentials.

Summary

There are many good reasons why it is a great idea to open an account in FXOpen. Based on the article above, we can see that the broker really takes the clients' safety seriously by conducting quite a strict verification process. Aside from documents, FXOpen also asks for a mandatory selfie or liveness check, which is quite a rare requirement among other brokers. The verification process is also divided into several grades and each client must reach a certain grade depending on their account type.

While it may sound like a lot, the whole process is still convenient though as everything is done online through the broker's user-friendly website. Under normal circumstances, your account will be ready in about 48 hours after the submission.

FXOpen is a forex brokerage that has been offering services since 2005. It is currently one of the most successful forex brokers in the world. Since the very start, FXOpen aims to make forex trading more professional, easy to access, and secure.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance

36 Comments

Marina

Dec 31 2022

What should I do if my documents got rejected?

Emiliano

Jan 25 2023

Marina: First, you need to know why your document was rejected. There are many possibilities that can cause your document to be rejected. Make sure to check again your documents and what type the documents that you upload, is it PDF, JPG, or other format. It is very important too, And after that you can checked for these :

Once you know your problem, you can re-upload your document and make sure it's readable, valid, and matched. But if you find that all documents are readable, valid and match, try uploading again, but if still not successful, try contacting customer service.

Suarez

Jan 5 2023

Is it easier to login using my social account?

Mason

Jan 25 2023

Suarez: Yes, it will be easier, but the note, open using social media is for demo accounts only. In my experience, if you log in with your social media account, you need to make sure the email address you used with social media account is active, and you absolutely must remember your email's password. Because the confirmation link will be sent into that email and need to confirm that to open a demo account with FXOpen.

Many people forget their email password and cannot open the confirmation email. This is very important as a verified demo account will allow you to start using the demo account and if you sign up for a live account you will also need this email to view your daily financial reports. Therefore, if you log into FXOpen using your social media accounts, please ensure that you have access to your email. Hope it helps!

Todd

Jan 8 2023

I have looked at the image above the article for the type of account that I can choose to trade on FXOpen. So I found out that there are several accounts that I can choose from STP account to ECN account. I don't know what kind of trading account is at FXOpen, I mean mini, micro or standard account at FXOpen is not available? Because many brokers that obviously will offer that accounts, anyway I don't know what STP and ECN mean and if it is a trading account What is the difference and advantage?

Yoga

Jan 8 2023

Todd: You can find the accounts that you want and read about the review of FXOpen at this website's broker review, click the link here. There are 9 kind of accounts in there but I think as international traders, I believe we can choose 4 kind of accounts, rest of them can be picked by Australia, UK, or EU traders. One of the accounts is Micro and the other one is crypto, and the rest is standard STP account and ECN Account. About STP, it is like the other standard account, basically STP is another type of brokers. There are two kind of brokers, Market maker and STP. The STP brokers connect their client's order to the liquidator that have access to the market. So, basically the trader can go live trade directly to the market through broker's services. It is just like usual standard account and actually the standard account itself. Meanwhil ECN is most advance trading system. At ECN you can see other trading, and can show you the highest demand and supply at the market. With that detailed, you can trade with negotiation too. But sadly ECN account need more deposit than standard account.

Graham

Jan 8 2023

Yoga: I have seen the review of the broker you told me about. There are 9 accounts we can choose right? But actually, after trying to register, it seems like it can automatically open an account based on your country of origin. So, when I chose UK, I will get STP, ECN, Crypto but not at micro. But my question is, is there any difference between other accounts such as STP, ECN, and crypto with a specified account that traders from the UK, Australia or EU area?

Yoga

Jan 8 2023

Graham: Yes, there is a difference but very little difference. If you are a UK and EU (European Union) trader, you must deposit a minimum of 300 USD with a minimum trading position of 0.01 lots. It's a standard STP and ECN account. Meanwhile, if you are an AU trader, your minimum deposit is $200, but you are not allowed to use scalping and Expert Advisor if you choose an ECN account. In an STP account, you can deposit 10$ minimum, and you can scalp and use an expert advisor. Meanwhile, the crypto account is only allowed for International Traders. And International traders' trading condition is more friendly than UK, EU, and AU Trading condition.

Todd

Jan 8 2023

Yoga: Why might FXOpen have such different conditions for EU, AU, and UK traders? I mean why this is so strict and mainly for EU and UK traders who need more money for deposit in order to trade with FXOpen. And at this time as I know international traders like us only send a deposit minimum of 1 dollar.

Yoga

Jan 8 2023

Todd: I believe due to the regulation at UK and EU are different with AU regulation. And also the regulation of these countries are different with other countries regulation such as for example, as I seen at the details of regulated country at FXOpen which is, China, India, Cyprus, Hong Kong, Japan and other countries. So, it is all about the regulation.

Todd Basie

Jan 14 2023

Which payment options are available on FXOpen?

Anthony

Jan 25 2023

Todd Basie: There are many option that you can choose, from banks transfer, credit/debit card, local bank transfer, also e-money such as AstroPay, exchange code, WebMoney, Perfect Money, QIWI Wallet, Yandex Money, FasaPay and AirTM.

The 3 best choices for depositing in FXOpen are:

But if you have the same bank as FXOpen or if FXOpen has your local bank, it is better to use that bank to guarantee fees and time.

Safrina Mezt

Jan 19 2023

How long does the verification process take?

Henry Duville

Feb 2 2023

Safrina Mezt:

The time it takes for FXopen to verify a new account can vary. Typically, the verification process can take anywhere from a few hours to several business days, depending on the volume of requests FXopen is receiving and the completeness of the information provided by the user.

Make sure that each document you submit is valid (issued by legal authorities), and your submitted photos (selfie/ID) have to be clear enough (not blurry or dirty) to make the verification and identification turn smooth.

It is recommended to check with FXopen's customer support for the latest information on their verification process and to ensure all required documentation is submitted accurately and promptly.

Wendy Harl

Jan 25 2023

Can I transfer funds between different accounts?

Michael Clark

Jan 25 2023

Wendy Harl: Yes, you can transfer your money to another account. According to the FXOpen FAQ at its website, you just need to go to your account, and then from the To list, the trading account you want to transfer funds to. If the account currency does not match, the funds will be converted at FXOpen's exchange rate. Enter your main account PIN. Click Verify, then click Submit. Hope it can answer your question!

Nathan

Jan 25 2023

It seems that all brokers around the world, don't care where they from or where they operate, they seem need to require our identity. I see all brokers no exception, always ask an ID card and other ID documents. The reason we have to do this is that not everyone wants to share their identity more easily.

What are brokers' exact purpose in wanting so many trader ID details? When it comes to security, can I trust a broker who doesn't share my identity and won't leak it? Sorry for asking too many questions as I am trying to search for a 'safe broker' to start learning forex. And I am very sensitive if someone ask my ID and where am I live.

Marvel

Mar 28 2023

Actually, I'm still new to the world of trading and yes, I rarely hear about brokers that provide trading instruments and platforms. You must be familiar with FBS and OctaFx which always appear in several advertisements on chrome and YouTube. As for the FXOpen broker, to be honest I have never heard of this broker.

And yes, I just found out in this article, and yes, what is discussed here is related to deposits and withdrawals. As already explained, this broker has only been established since 2003, but I cannot say for sure whether this broker is good and safe. I ask friends for an explanation, is the FXOpen broker safe for my trading and funds? Is my personal data also safe here? If anyone knows, could you please explain...

Taeyang

Mar 28 2023

Marvel: FXOpen Broker Company was founded in Cairo in 2003. It started trading services in 2005 and has since become one of the leading players in the forex industry. The company has provided a high level of service through optimal trading conditions, innovative technologies, and various financial services. FXOpen was the first broker to offer its clients a unique opportunity to trade via an electronic communications network (ECN) based on the MetaTrader 4 terminal. FXOpen is a member of the International Financial Commission and a member of the Federal Council Committee on Budget and Financial Markets.

I started trading at FXOpen about 5 years ago. We started trading currency pairs. I currently work with cryptocurrencies because this broker offers the most optimal conditions. Given the current situation, I think it's safer to deal with cryptocurrencies. Of course, there are no problems with scalping, but in the medium term it is quite normal.... By the way, FXOpen has an easy-to-use interface, perfect for beginners.

Diego

Mar 29 2023

Actually, I'm still new to the world of trading and yes, I rarely hear about brokers that provide trading instruments and platforms. You must be familiar with FBS and OctaFx which always appear in several advertisements on chrome and YouTube. As for the FXOpen broker, to be honest I have never heard of this broker.

And yes, I just found out in this article, and yes, what is being discussed here is regarding the trading services offered by this broker. As already explained, this broker has only been established since 2003, but I can't say for sure whether this broker is good and safe. I ask friends, is the FXOpen broker safe for my trading and funds? Is my personal data also safe here? If anyone knows, could you please explain...

Phil

Mar 30 2023

@Diego: So, you're new to trading and you've heard about brokers like FBS and OctaFx from those pesky ads that pop up everywhere. But FXOpen? Yeah, it's not as well-known as the others.

Now, you're wondering if FXOpen is a safe option for your trading and funds, right? Well, the first thing you should check is if they're regulated. Find out which financial authorities keep an eye on FXOpen and see if they have a good reputation.

When it comes to your hard-earned money, make sure the broker has policies in place to keep your funds separate from theirs. This way, even if something goes wrong, your money is protected.

And what about your personal data? Well, reputable brokers take data security seriously. They use fancy encryption technology to keep your info safe from any nosy hackers.

To really get a sense of how FXOpen performs, it's a good idea to read reviews and hear from other traders who have dealt with them. Their experiences can give you a better idea of whether FXOpen is reliable and safe.

If all the factors I mention above is qualified, you can say it is safe to trade with FXOpen

Hawke

Jun 9 2023

Hi! I just want to thank you for the article which gave me step-by-step instructions and a guide to open an account at FXOpen. That really helped, especially while uploading my documents to complete the process. Now, I'm really looking forward to the verification being done! It became very easy thanks to the article!

I have a question about the types of accounts that can be opened with FXOpen. I want to know if it is possible to open multiple accounts and if it is possible to specify different specifications for these accounts. If so, I'm wondering if I need to go through the KYC process again for each account. Can you tell us a little about this?

Thanks again for the informative article! This has been a great resource for me and any additional advice regarding the FXOpen account verification process would be greatly appreciated.

Barack

Jun 10 2023

Hi, glad to hear that this article helped you in guiding you through the process of opening an account with FXOpen! It's great that you feel easy-peasy. Now, to answer your question about multiple accounts, yes, you can open multiple accounts with FXOpen. The cool thing is, these accounts can indeed have different specifications, such as different base currencies, leverage levels, or even different types of STP, ECN, Micro, and Crypto accounts. In addition, there are many account base currencies that you can use your account denomination including USD, EUR, GBP, AUD, JPY, RUB, BTC, etc. make your payment process easier.

But here's the deal with the KYC process. When you open additional accounts with FXOpen, you usually don't need to go through the full KYC process again. After you complete KYC verification for your initial account, subsequent accounts usually go through a simplified verification process. This means you may only need to provide some basic information or documents to get those additional accounts up and running.

Mario

Jun 10 2023

As someone who doesn't have a passport, I'm curious to know what options are available for providing proof of identity when opening an account with FXOpen. If I can't provide a passport, are there alternative documents accepted by FXOpen, such as a national ID card or a driving license? It would be great to hear from FXOpen about their guidelines or requirements for individuals like me who don't possess a passport but still want to fulfill the proof of identity criteria. Having this information would greatly assist me in the account opening process and enable me to start trading with FXOpen smoothly.

Ogura

Jun 17 2023

@Mario: Not having a passport can be a bummer when it comes to opening an account with FXOpen. But don't fret, there might be some alternatives you can use to prove your identity.

So, if you don't have a passport, you can check if FXOpen accepts other documents like a national ID card or a driver's license. These are pretty common and usually do the trick when it comes to official identification. They've got your photo, personal deets, and can serve as valid proof.

To get all the nitty-gritty details, it's best to swing by FXOpen's website or hit up their customer support. They'll give you the lowdown on the alternative documents they accept and any extra steps you might need to take.

Knowing this info upfront will save you from any last-minute surprises and make the account opening process with FXOpen a breeze. So, grab your ID card or driver's license and get ready to dive into the exciting world of trading with FXOpen. Happy trading, my friend!

Baek Song

Jun 18 2023

Hey there! I have a question about converting a PNG file to PDF for the Proof of Identity requirement. So, here's the thing: I have this PNG document that I'd like to use, but it needs to be in PDF format, no less than 500KB. Do you have any suggestions on how I can go about converting it? Are there any user-friendly tools or online services that you would recommend for this task? Also, I noticed that the file size of my PNG document might be larger than the required 500KB. Is there an easy way to resize the document size without compromising the quality? I want to make sure the conversion is smooth and meets the specified criteria. Thanks in advance for your help!

Lucky Su

Jun 19 2023

@Baek Song: Hi there! To convert your PNG file to PDF, you can use online conversion services like Smallpdf or Zamzar. They provide user-friendly tools to upload your PNG file and convert it to PDF format. Alternatively, you can use a PDF printer software like Adobe Acrobat or CutePDF. Open your PNG file, the PDF printer, configure settings, and save the file as a PDF. If your PNG file size is larger than required, you can resize it using image editing software like Adobe Photoshop or online tools such as Pixlr or Photopea. Adjust the dimensions while maintaining aspect ratio, set a suitable resolution, and save the resized image. Remember to check the final file size to ensure it meets the specified limit.

Yosselyn

Sep 1 2023

I want to share my experience with all new traders in the world of trading, with my experience in FXOpen, I was a trader from 2011 until now, and I tried many companies to trade, but I found the best now is FXOpen, so I am they are now, they are an honest company, have many trust licenses in trading, and contact with them is very easy, and they have many options in trading and also many currency pairs, I did not encounter any problem with them till now, so if you are a new trader or even old trader, come and join us for free at FXOpen, you will see the difference with your own eyes,

My advice to every beginner trader First, choose an honest company you will trade with, like FXOpen After that, you can practice trading by opening a free account with no money and then you can start with real money by opening a real account Don't try greed or compensation. Just analyze the market well before trading and after that start trading with FXOpen and enjoy the many discounts offered by the company as well as fun prizes and competitions that continue throughout the year at FXOpen

Jamasetta

Sep 3 2023

I also want to add your opinion. I have been dealing with them for the last 5 years and gained significant experience trading their way and I see that from a reputable company that respects the customer and maintains that he owns it. One of

the most important feature of this company is trading options and diversity of accounts and contracts they have STP accounts and ECN accounts and they have many currency pairs that can be traded on the major currency pairs and secondary currency pairs can also be through them also trade digital currencies and they work all week i.e. you can trade cryptocurrency anywhere.

I have traded with more than 6 brokers, but in the end, I chose FXOpen because they provide the lowest ECN spreads and also very fast order flow. As a News trader, I need more liquidity from the market and they give me that. The most important thing for every trader is the speed of order execution and they are the best in terms of server response time. I can also use my Expert Advisors with them through the use of a VPS service. Withdrawals made via Bitcoin are very Fast and Automatic.

Vanacrono

Sep 18 2023

Wow, I am interested in trading on FXOpen now. I have some questions, if you want to trade, you just need to deposit $1, right? But if I only want to open a demo account, can I use this mobile app too? I have seen, this mobile app offers a lot of possibilities. For me, those who only learn Metatrader will not be confused as the view and design of this mobile app is very good and has a very simple view than Metatrader.

And really, I just want to try the app, but if I don't need to open a live account with FXOpen. Does anyone have an answer Thanks a lot!

Kalla Jane

Sep 19 2023

Yes, you can only open a demo account. Alternatively, the mobile app itself can be an app that allows you to set up your account include deposit and withdraw or act as your personal space. So, if you want to open a demo or live account, you don't need to visit their website and register. Just use the app or the FXOpen mobile app trader which you can download from the Google Play store or iOS store

Just follow the instructions and you should be able to use most of the features except for the tools you need to open a live market such as:

Autochartist.

Also, for the minimum deposit at FX Open, all account types require only $1. So it is very good for beginners and low capital traders.

For the details of the account type that you can choose, please read the review of FXOpen at here: FX Open Review

Lumiere

Sep 20 2023

1. if I deposit via the mobile app, how long will the process take and what data is needed?

Answer : The process between the mobile app and the website is 100% the same, but the mobile app makes it easier as you can upload documents more easily. The required documents are proof of identity, proof of address and bank account details. You can read more information here: How to Open An Account in FXOpen

2. Can the entire deposit and withdrawal process be carried out 100% via the mobile application?

Answer : yes! You can also open a new account there. FXOpen mobile app is a multifunctional app

3. What is the best deposit method if I'm more active on my cellphone than a PC?

I don't think the deposit method affects the trading location. If you simply want to transfer money over the phone, all the methods you can access over the phone are great. Read here to get the list of the methods : Guide to FXOpen Deposit and Withdrawal

Bernardo

Nov 26 2023

It looks like every broker out there, no matter where they're from or operate, is super into getting our IDs. Seriously, every single one is all about asking for ID cards and other personal docs. They say it's for security reasons, but let's be real—not everyone's cool with throwing their identity out there so easily.

I'm just wondering, why do brokers need so much of our ID stuff? Like, if they're all about security, can I really trust a broker who won't spill my identity beans? Sorry for the million questions, I'm just on the hunt for a "safe broker" to dip my toes into forex. I'm kinda touchy when it comes to giving out my ID and location, you know?

David

Nov 30 2023

Totally get your concern! Brokers asking for IDs is pretty standard in the trading game. It's mainly about security and making sure everyone's on the up and up. You know, keeping things legit. (It is known as Know Your Customer or KYC. Read more about KYC here : Is KYC Important in Forex Trading? )

Now, as for trusting a broker who's tight-lipped about your identity, it's a bit of a balancing act. On one hand, you want them to be serious about security, but on the other, you want to make sure they're not going overboard.

When you're looking for a broker, check out their reputation, reviews, and how they handle security measures. A good broker will have a solid track record and transparent practices. It's like finding the right balance between security and not feeling like your personal info is on display for the world.

So, ask those questions, do your research, and find a broker that vibes with your comfort level. Happy trading and stay safe out there!

Pedro

Feb 26 2024

As I'm exploring FXOpen's verification procedure, I've come across the step where they send a verification code to your phone. It seems pretty straightforward—if you receive the code, you enter it and click "Confirm." But what if you're waiting for the SMS and it doesn't show up? That's when you have the alternative to verify via an operator call. Now, this got me thinking: If I decide to go down the route of the operator call, what exactly does that entail? Are there any additional steps involved, or perhaps more importantly, could there potentially be fees associated with this option? I'm curious to understand the ins and outs of this process before making a decision.

Fuad

Mar 1 2024

So, if you're considering the operator call option for verification with FXOpen, you're probably wondering if there are any charges involved. It's completely understandable to have this concern and want to ensure you're aware of any possible fees associated with verifying your account through an operator call. Your best bet would be to reach out directly to FXOpen or consult their terms and conditions to get clarity on this matter. This way, you can make a well-informed decision about the verification process without encountering any unexpected fees. Additionally, if you prefer a free option, you can always opt for the SMS verification method, which is a more conventional and straightforward approach.