Vantage is a popular broker suitable for both beginners and professionals. Here's how to open a new live trading account in Vantage.

The first step of becoming a true trader is to sign up with a broker and open a live trading account. While it may sound complicated at first, opening a live account today has never been easier as the registration process in most brokers is now fully online. Digital signatures, scanned documents, and electronic funding options mean that you can easily apply and get approved in just a matter of minutes. Once the account is ready, you can make a deposit and use the money to start trading.

There are many good, investor-friendly brokers out there. You can choose based on your needs, preference, and trading style. It's always a great idea to do early research before registering in a broker. Since you clicked on this article, there is a good chance that you've been eyeing Vantage Markets already and are planning to open a live account there. In that case, we'll provide everything you need to know about it in this article.

Introduction to Vantage

Vantage is a popular Australian-based broker that has been around since 2009. The broker offers various tradable instruments, including forex pairs, commodities, indices, share CFDs, and cryptocurrency CFDs. Although it was initially designed for Australian-based traders, the broker has now grown into a global platform that accepts clients from 172 countries worldwide. Vantage has also been authorized by multiple regulators, from ASIC of Australia to the VFSC of Vanuatu.

In a nutshell, Vantage has great services for almost any type of trader. The non-trading fees are relatively low as there are no deposit, withdrawal, or inactivity fees. The trading platforms are highly intuitive and the customer service is excellent. For beginners, Vantage offers plenty of educational materials in the form of a demo account, trading platform tutorials, educational videos, and live webinars. Apart from that, Vantage offers a good amount of trading tools and market analysis suitable for more experienced traders. You can find many useful tools such as the economic calendar, market buzz, analyst views, and many more.

Vantage Markets was founded in 2009 in Australia. It is the brand name of the Vantage International Group which is regulated by the Cayman Islands Monetary Authority (CIMA). Before it is known as Vantage Markets as today, they used to be MXT Global in 2009 and Vantage Markets Pty LTD in 2015. The Vantage Group also operates other companies such as Vantage Global Prime, which is regulated by the Australian Securities and Investments Commission (ASIC) and the Financial Conduct Authority (FCA).

According to the broker's website, Vantage Markets adds further protection to clients by segregating client funds and holding their funds with Australia's National Australia Bank (NAB). NAB is one of the 4 largest financial institutions in Australia as well as the Top 20 safest banks in the world. Thus, clients don't need to worry about saving their funds at Vantage Markets.

With Vantage Markets, traders will experience super-fast trade execution, as well as interbank grade and RAW ECN spreads. When combined, these elements offer clients a true institutional trading experience, across a wide range of trading instruments. They also offer services designed for both beginners and professionals with access to Forex ECN trading, as well as CFD trading on Indices, Commodities, and U.S & Hong Kong Shares. Those instruments are available to trade on MetaTrader 4, MetaTrader 5, MetaTrader WebTrader, CHARTS by TradingView, Mobile Apps, either for Mac, PC, iOS, or Android. There are also social trading platforms such as MyFXbook and Zulutrade.

By registering in Vantage Markets, traders will have access to an impressive range of educational materials and research tools including MT4 SmartTrader Tools, a wide variety of promotional trading offers and rebate programs, as well as access to accounts with up to 500:1 leverage. However, the leverage for ASIC and FCA clients is 30:1, and normally no promotion for AU and UK clients because of the compliance policy.

Vantage Markets provides research in the form of technical and fundamental analysis on its blog from in-house staff as well as guest writers. There is also an economic calendar powered by MQL5 from MetaQuotes. For clients who deposit at least $1,000, Vantage Markets offers a suite of plugins for MT4 branded as MT4 SmartTrader Tools, developed by FX Blue LLP.

As an authorized representative of Vantage Global Prime, the broker caters to retail traders under the Vantage Markets brand and offers access to the following instruments:

- 44 currency pairs, which are the most liquid global forex market currencies.

- 16 most liquid Indices from across the globe, including the S&P 500, DAX, FTSE, DJ30, and more.

- 16 commodities, either soft commodities or precious metals.

- 5 indices futures such as DJ30ft, DAX4ft, and NAS100ft.

- 600+ US, UK, and HK shares from large companies, such as Apple, Google, Coca-Cola, and big corporations listed on the Hong Kong Stock Exchange.

Clients can open accounts in Vantage Markets and deposit funds in 8 base currencies: USD, GBP, CAD, AUD, EUR, SGD, NZD, HKD, and JPY. They also provide clients with convenient deposit and withdrawal methods through local and international bank transfers, credit/debit cards, and e-payment.

Overall, Vantage Markets is valued to be proper for retail traders with small deposits who like the max leverage thresholds. In terms of pricing, the broker's commission-based Raw ECN account is the clear choice for cost-sensitive traders as it features a lower all-in cost compared to its Standard account offering.

Vantage Live Account Opening Requirements

Opening a live account in Vantage is quite an easy process. You simply need to fill out the registration form and provide the required documents. Remember that as a fully regulated broker, Vantage must comply with the regulation that requires all clients to provide certain documentation regarding their identity alongside the account opening application itself. In other words, full account verification is needed to activate your Vantage account.

Basically, you will be asked to upload a scanned copy of multiple documents. You can use your smartphone, digital camera, or scanner to get the requested copy. Make sure that all documents you provide are legit and issued by your local government.

Proof of Identity

In order to verify your identity in Vantage Markets, you'll need to provide one of the following documents:

For Australian Applicants

- Valid Passport

- Valid Driver's License

- Notarized Proof of Age Card

For International Applicants

- Valid Passport

- Notarized Driver's License

- Notarized National Identity Card

- Notarized Proof of Age Card

All notarized documents must be certified by a public notary, accountant, solicitor, lawyer, commissioner of oaths, justice of the peace, or other authorized professionals. Every page of the document must be stamped with the notary stamp, which shows the business name and address of the notary. The notary should also sign and date all copies, then print and sign their full name.

For international applicants, any Photo ID other than passports must be notarized. Make sure that the Photo ID shows your name, plus either your date of birth or full residential address. The notarized document must also contain a statement similar to "I certify that this copy is a true copy of the original document".

2. Proof of Address

In order to verify your address, you'll need to provide one of the following documents:

- Bank Statement

- Utility Bill (Gas, Electricity, Water, Phone)

- Tax Document issued by the Government

- Certificate of Citizenship

The scanned copy must be multicolor and clearly show your name, issue date, and your residential address. Keep in mind that PO Box address is not accepted. If you can't provide any of the requested documents, you may submit a secondary Photo ID that contains your address information such as a copy of your passport, driver's license, or national ID; whichever has not been used already for the Proof of Identity.

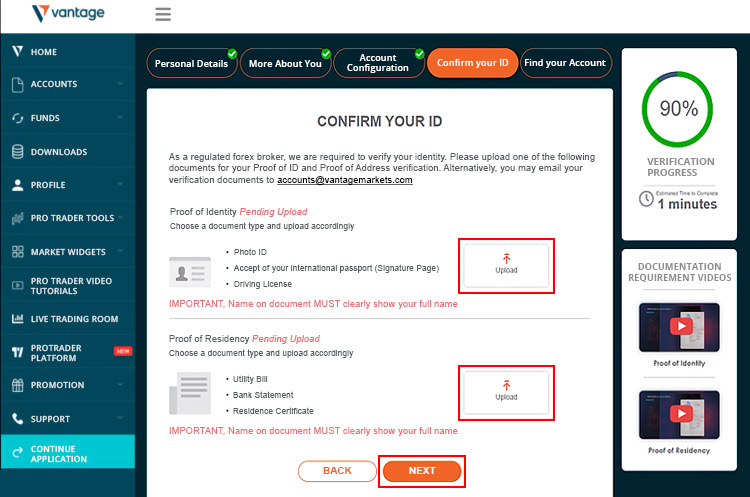

You can directly upload the documents via your Client Portal or send them via email to [email protected]. Document verification can take several minutes to one business day. If you haven't received any confirmation from the broker regarding the status of your application in a few days, you can contact customer service or send an email to [email protected].

Steps to Open an Account in Vantage

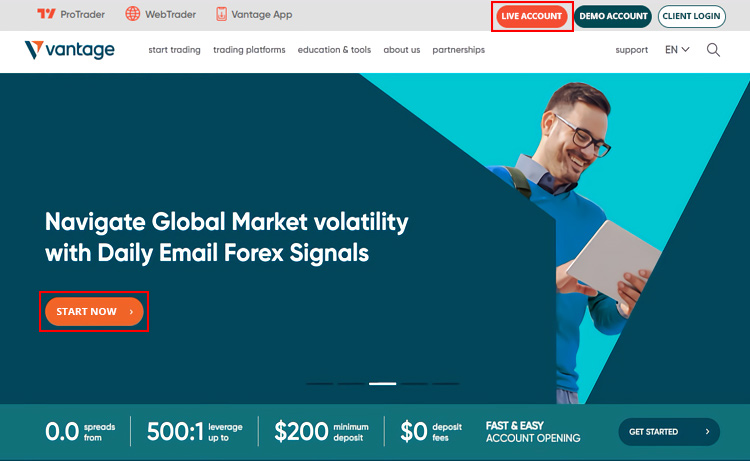

1. Visit the broker's official website and click "Start Now" or "Live Account" at the top right side.

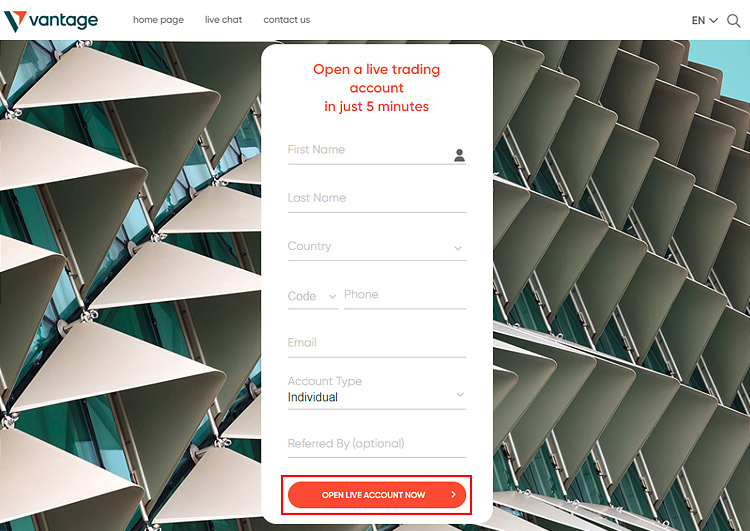

2. Enter your first name, last name, country of residence, phone number, and email address. Then, choose your account type (individual or company) and click "Open Live Account".

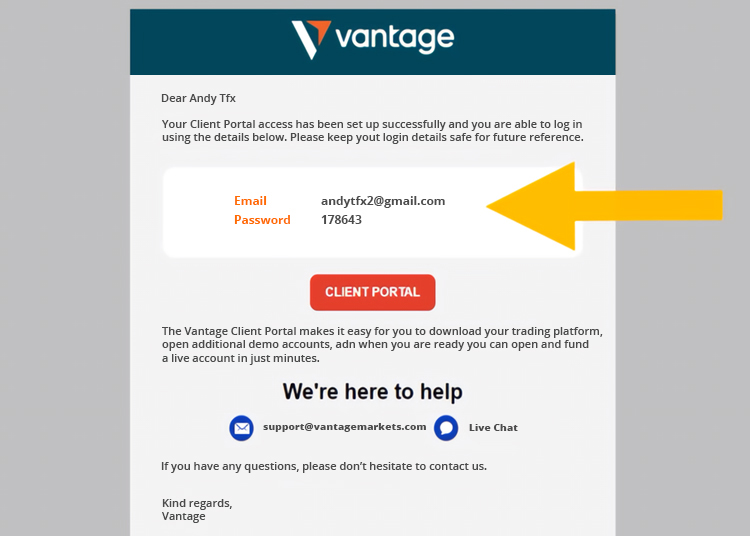

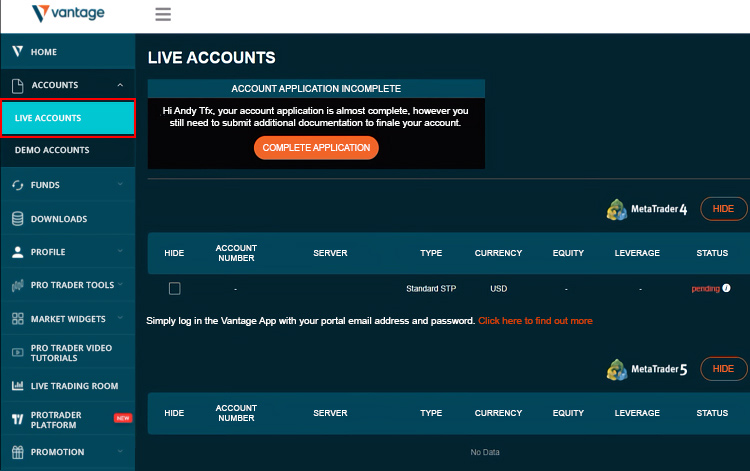

3. You can now access the Client Portal and complete the application. If you are somehow logged out, simply go to your email inbox and find the email that contains your account credentials. Re-login to Vantage Markets using your account ID and password.

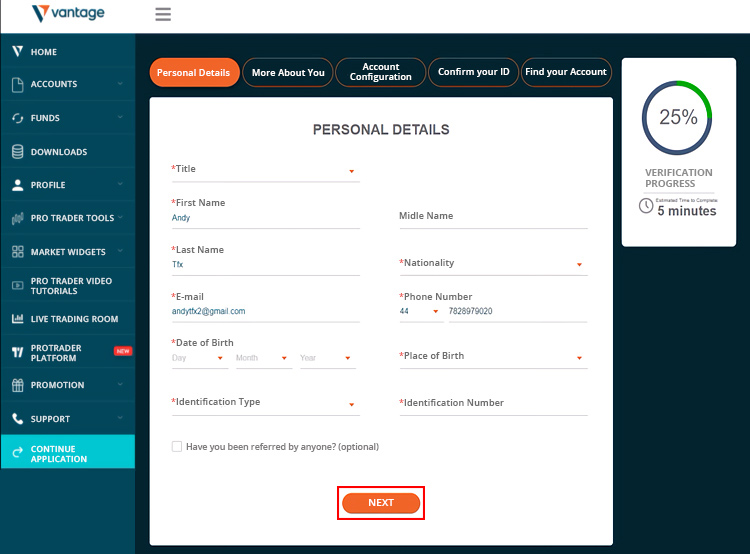

4. Fill in your personal information details. This includes your title, nationality, date and place of birth, identification type, and identification number. You can also enter a referral code if you have one. Click "Next" to proceed to the next step.

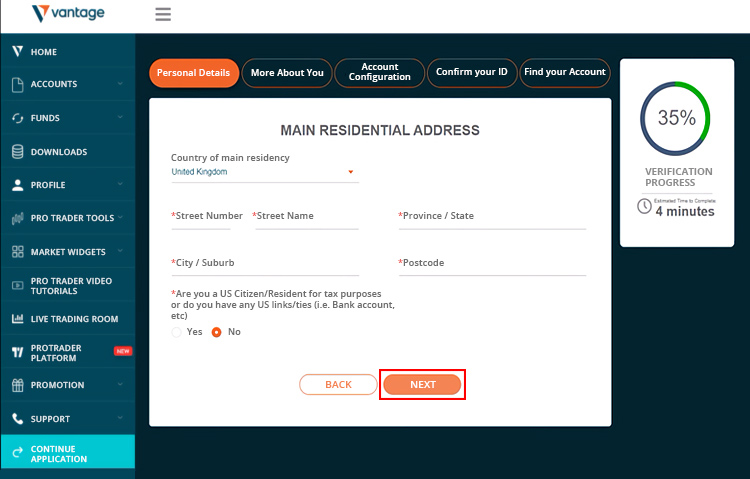

5. Enter your full address and answer the question regarding your US citizenship status.

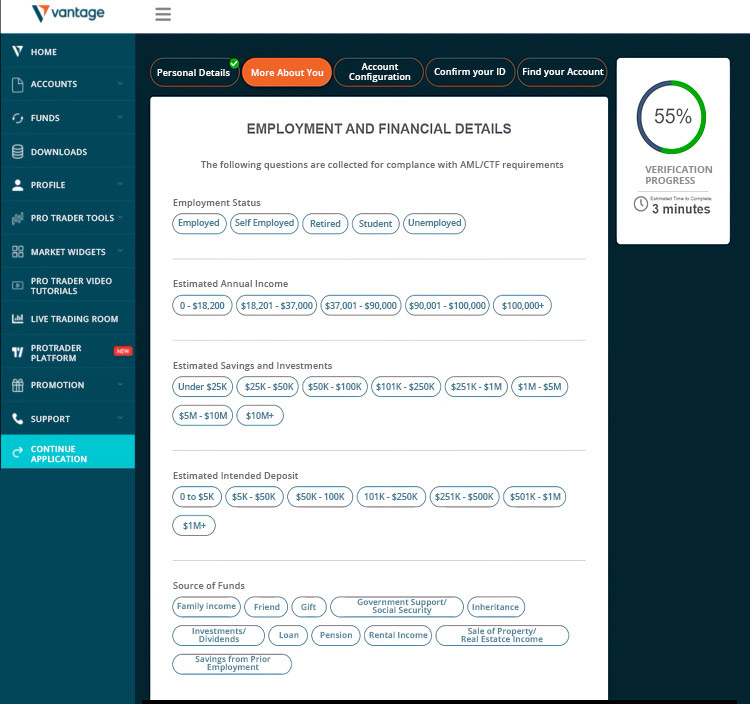

6. Answer some questions regarding your employment status, financial situation, and trading experience. Make sure to answer truthfully and click "Next".

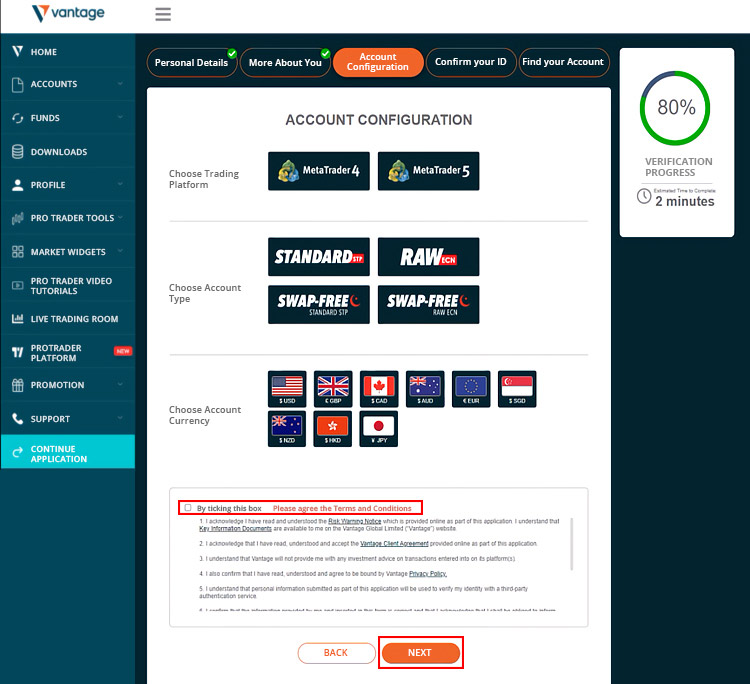

7. Specify your account details, including what trading platform you want to use, your preferred account type, and the base currency that you will be funding your account with. You can browse through the account types first to decide the best one for you. Also, note that Vantage allows you to open multiple accounts, so you can make new accounts with different specifications later.

Read and accept the terms and conditions, then click "Next".

8. Once you complete the application form, you will be asked to upload your verification documents which are divided into two categories: Proof of Identity and Proof of Address. Click "Upload" on the right side of each category and find the files you want to upload. Make sure that the documents are correct and valid, then click "Next". Your Vantage account will be verified within hours.

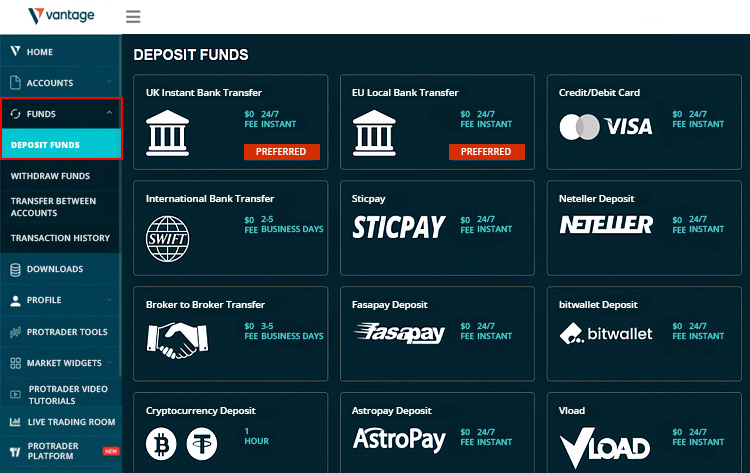

9. You're almost there! Now you just have to wait for the account verification. While your documents are being reviewed, you can see the funding methods available on the platform. Click "Funds" from the menu on the left side of the page and click "Deposit Funds". Choose the funding method of your choice.

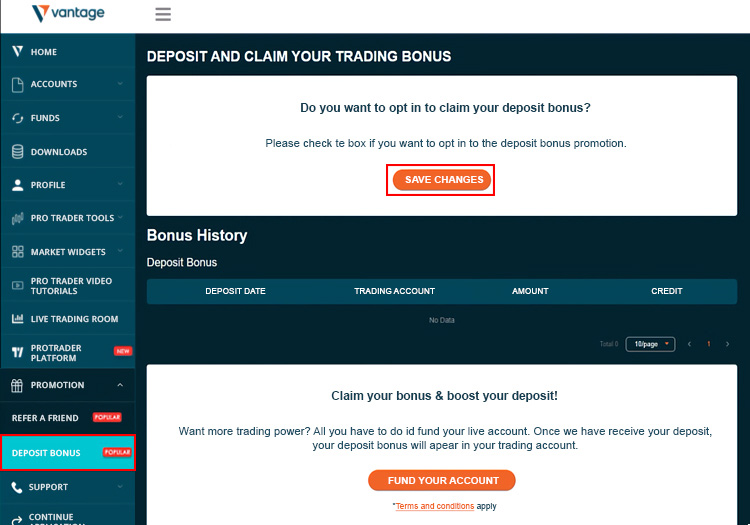

10. Opt in for the deposit bonus by clicking the "Promotion" button from the menu, then click "Deposit Bonus". Tick the box to get the bonus and click "Save Changes".

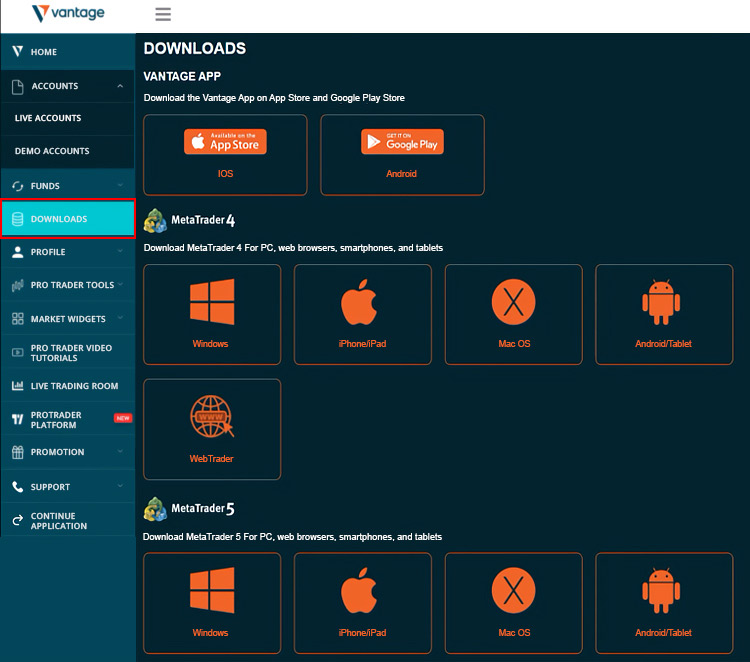

11. You can also spend time to prepare the trading platform that you want to use in Vantage Markets. Click "Downloads" from the left-side menu.

12. Choose your favorite trading platform and install it on your device.

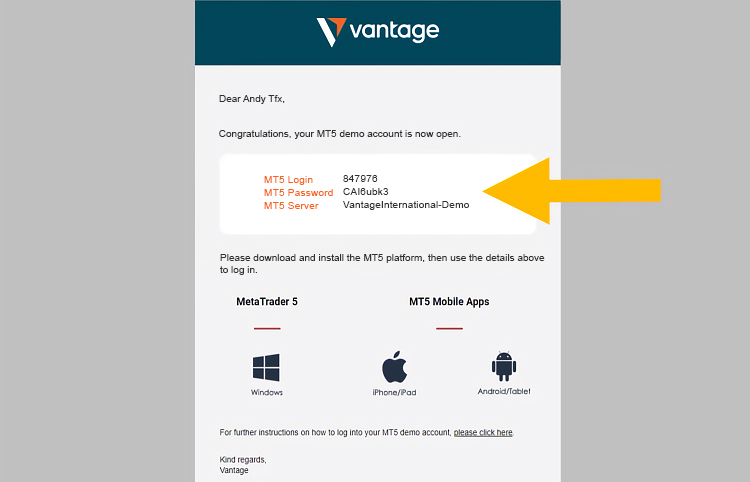

13. Once your documents are approved, you'll receive an email containing your account number and password.

14. Congratulations, your account is ready! You can now log in with your account credentials and start your trading journey by depositing some funds.

See Also:

Conclusion

All in all, Vantage is a great broker that offers many excellent services. While there are several areas that can still be improved, Vantage is still highly recommended for both beginners and expert traders. As explained in this article, we can see that opening an account in Vantage is very easy and relatively quick. Everything is done online, so you can easily register from your PC or your mobile phone. If you are ready to sign up for Vantage today, simply submit an application through their website and enjoy the benefits of trading.

Vantage is a multi-asset broker with over 10 years of experience. Headquartered in Sydney, the award-winning broker operates in 172 countries with more than 1,000 employees in over 30 global offices. Some of their winning points include transparency and stong regulation, lightning fast trading execution, and raw ECN spread from 0.0.

Receive Daily Forex Signals from Trading Central

Receive Daily Forex Signals from Trading Central Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus

25 Comments

Charles

Dec 22 2022

Why can't I upload my documents on the website?

Jim Kae Took

Jan 14 2023

Dakota

Dec 25 2022

How much should I deposit for my first transaction?

Donovan Serragakis

Jan 14 2023

Willow

Dec 27 2022

Why is my account invalid?

Thiery

Feb 15 2023

Willow: Invalid in what terms? If you mean invalid because failed to getting sign, you need to check all the documents that you uploaded. Watch some number, is it any number lefted? Or because your documents date is expired. I mean most of traders that failed to open an account in Broker because of the expired date. And brokers will refuse to give you live account, and will be making your account invalid.

But, if you mean invalid by other than opening an account, it is better to find its customer service

Carylon

Jan 3 2023

What are the account types offered by Vantage?

Bernard

Jan 14 2023

Kalynda

Jan 10 2023

Does Vantage accept clients from the Middle East?

Suwandy

Feb 15 2023

Kalynda: Yes, Vantage accepts all merchants worldwide including Middle East country, But Vantage doesn't accept US trader and traders those who from embargoed countries. However, we need to watch about the swap- free account.

Since the majority of traders in the Middle East are Muslim, they should trade with brokers that have swap-free accounts when making swings and position trades. Because these two trading method required to be opened for overnight. So, it will be getting swap that can taint Muslim trader. But Thankfully, Vantage offers swap-free accounts. This is a big factor and shows that Vantage really embraces Middle Eastern customers.

Gemma

Feb 15 2023

Little bit out of the topic. I need to find the brokers that allow me to use its own trading platform since I am busy man and dont have time to bring and open laptop to trade. So, in order to getting touch with Forex, every day I traing but with Metatrader 4 mobile version. I think the MT4 mobile is far from perfect.

So, I decided to try the mobile trading that broker's original app. And I found the article that talk about opening account in Vantage. To open in there seems lttle bit difficult but yet you can sign up without any cinfusing

Back to the question, is Vantage has its own mobile trading ? Which is better to use, Mt4 mobile or broker mobile app?

Xavi

Feb 15 2023

If you want to trade on your smartphone, I think you are better off using your broker's mobile trading app. The limited graphics and trading tools make the mobile app more compact and easier to trade, making it very useful for trading. But if you're a technical trader who wants to see more indicator tools, MT4 is better for PC than mobile trading.

You can read a review about the Vantage app here. Vantage APP Review

in my opinion, if you want trade at smartphone, it is better to use mobile trading app from brokers beacuse it really helping you to trade since the graphic and trading tools in there are limited, making mobile app become more compact size and simple trading. But if you are technical trader that want to see more indicator tools. It is better to use MT4 PC version rather than mobile trading.

You can read the review about Vantage app here,Vantage APP review

Shanur Rahaman

Mar 26 2023

What are the key steps involved in opening an account with Vantage, and what are some of the different account types that are available to traders? Additionally, how do these account types differ in terms of minimum deposits, leverage, spreads, and other important factors, and how can traders determine which account type is best suited to their needs? Finally, what are some of the key features and tools offered by Vantage that can help traders to maximize their potential profits and minimize their risk in the market?

Andy

Jun 1 2023

@Shanur Rahaman: Hey there! I think most of your question can be answered by read the article again! But I will help you with the key features and tools offered by Vantage!

Based on my experience with Vantage, they offer several key features and tools that can help traders maximize profits and minimize risk in the market. Here are some notable ones:

Advanced Trading Platforms: Vantage provides access to reliable platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5) that offer a range of trading tools and advanced charting capabilities.

Competitive Spreads: Vantage strives to offer competitive spreads, allowing traders to enter and exit trades at favorable prices.

Risk Management Tools: Vantage provides tools such as stop-loss orders, take-profit orders, and trailing stops to help traders effectively manage risk.

Educational Resources: They offer educational resources like webinars and market analysis to support traders in improving their skills and decision-making.

Account Types and Leverage: Vantage offers various account types and flexible leverage options to suit traders' preferences.

Responsive Customer Support: Vantage has a responsive customer support team that can assist traders with inquiries or issues.

Hope it can help you!

Aiman Hossain

Mar 26 2023

For traders who are new to Vantage and want to open an account, what are some of the most important factors to consider when choosing an account type and filling out the necessary paperwork? How can traders ensure that they are providing accurate and up-to-date information, and what are some of the common mistakes or oversights that can causes or problems during the account opening process? Additionally, what are some of the resources and support tools that are available to Vantage traders, and how can traders make use of these tools to improve their trading strategies and results over time?

Erwin

Mar 29 2023

@Aiman Hossain: When you're new to Vantage and want to open an account, there are a few things you should keep in mind. Here's my take:

So, that's my take on opening an account with Vantage. Remember, it's not just about getting started, it's about continuing to learn and grow as a trader. Keep exploring, stay informed, and enjoy the journey!

That's it from me. If you want to get more about account forex in general, you can read this article for more information : Account Types You can find in Forex Brokers

Nikita

Apr 18 2023

Vantage complements the MetaTrader suite of platforms offerings with support for multiple social trading platforms, content powered by Trading Central, and a proprietary mobile app. However, Vantage follows industry leaders in key areas such as research and education.

Opening an account on Vantage is a very rewarding experience because the process is very fast (less than 5 minutes) and completely digital. The broker offers a variety of deposit and withdrawal options and most of them are free of charge. Customer service could be better, especially the relevance of the email responses. Lastly, Vantage provides investor protection in the UK only.

But I'm quite curious about what payment options are available at FXOpen? sorry, guys, even though it's a little off topic, this can also be one of my considerations in choosing the right trading broker. Apart from that, guys, I also want to ask about the commissions and fees offered by this broker? I just want to make sure trading fees on Vantage are low and not too big a drain on my wallet. You know, guys, I only have a little experience with trading, and I want low fees to avoid lots of losses when trading.

Angeline

Apr 19 2023

STP/ECN broker Vantage FX offers two accounts with tighter spreads and lower transaction fees with a minimum deposit. A standard commission-free account requires a minimum deposit of £200, but spreads start from 1.2 pips on EUR/USD. Trading conditions are greatly improved with a minimum deposit of £500 on a Raw ECN account with 0 pip spreads and very low fees. These transaction fees are among the lowest in the industry.

CFDs available on Vantage FX include Forex, Indices, Energies, Metals, Stocks, and Cryptocurrencies, but the limited number of assets per class is frustrating for experienced traders. Vantage transaction fees depend on which account you open and which Vantage entity owns your account. Vantage offers three account options: the standard spread-only STP account and the commission-based RAW ECN and PRO ECN accounts. Overall, Vantage's prices align with industry averages but still fall short of price leaders Saxo Bank, IG, and CMC Markets.

Comparison of Standard vs. Standard: Vantage lists a typical spread of 1.22 pips on EUR/USD (August 2021) for spreads on Standard accounts only. For his Raw account, the average spread is 0.15 pips and the additional commission is $3 per side ($6 per spin), for a total of 0.75 pips for the same period.

PRO accounts: Vantage PRO accounts are reasonably priced, with fees as low as $2 per side (or $4 per spin). The requirements for opening a PRO ECN account with Vantage vary by the regulatory authority. Australian companies must qualify for the Wholesale Customer Classification. To open an account with a Vantage entity in the Cayman Islands, you must deposit a minimum of US$10,000 into your account. For those who can meet various account needs, the PRO ECN account is Vantage's most affordable option, rivaling similar accounts offered by FP Markets and Tickmill.

Active Traders: Vantage's Active Traders Program offers discounts from $2 to $8 per standard lot, depending on your balance and monthly volume. The lowest level starts at $10,000 and the highest level requires a minimum equity of $300,000. However, it is only available for standard accounts with the highest spreads among all available account options.

Gavriil

Apr 20 2023

Vantage differentiates itself from other MetaTrader brokers by offering competitive pricing on commission-based Raw ECN accounts and by supporting additional platform integrations such as Zulutrade and DupliTrade. It also offers its own Vantage app, which – despite the added distraction of in-app advertising – shows real promise as a trading platform.

Vantage FX offers a variety of payment methods, while deposits are free, some withdrawal methods are chargeable. In addition, the processing time is average for the industry. As a properly regulated broker, Vantage FX ensures that all Anti-Money Laundering rules and regulations are complied with.

Vantage FX offers a variety of deposit and withdrawal methods, including bank transfers, local bank transfers, credit and debit cards, Skrill transfers, Neteller, BPay, Poli, and Unionpay. However, these are not all available for UK clients.

Sets for all payment methods are free, although clients have to bear fees charged by their various banking institutions. All withdrawal requests are processed from Monday to Friday, 09.00 – 19.00 (AEST), within one business day. Clients can withdraw funds online by simply logging into the secure Vantage FX client portal and ing the withdrawal tab from the menu. Overall, Vantage FX offers a decent range of financing and withdrawal methods, which are generally free, with average processing times.

Larry

Apr 24 2023

I'm still new to the trading world, and yes, I rarely hear about brokers that provide trading instruments and platforms. You must be familiar with FBS and OctaFx which always appear in several advertisements on Chrome and YouTube. As for the Vantage Markets broker, I have honestly never heard of this broker.

And yes, I just found out in this article, and yes, what is being discussed here is related to how to open a trading account at this broker. As already explained, this broker has only been established since 2009, but I can't say for sure whether this broker is good and safe. I asked friends, is the Vantage Markets broker safe for my trading and funds? Is my personal data also safe here? If anyone knows, could you please explain...

Gavriil

Apr 25 2023

Vantage FX will appeal to traders who value low trading costs and use indicators to make trading decisions. Be aware that Vantage FX's financial instruments are somewhat limited compared to other similar brokers. Vantage FX is a safe broker to trade with. It retains regulation from several high-level authorities, including ASIC Australia and the UK FCA. It is also registered in the Cayman Islands and Vanuatu.

Founded in 2009 and headquartered in Sydney, Australia, Vantage FX is authorized and regulated by the Australian Securities and Investments Commission (ASIC), Financial Conduct Authority (FCA), Cayman Islands Monetary Authority (CIMA), and Vanuatu Financial Service Commission (VFSC). In addition, any deposits are covered by the Investors Compensation Fund or the Financial Services Compensation Scheme in the UK. See the following list of Vantage FX registered companies:

UK traders will trade with the UK subsidiary of Vantage FX, which is licensed and regulated by the Financial Conduct Authority (FCA).

Siegfried

Apr 26 2023

Considered one of the world's best regulators, the FCA imposes strict restrictions on CFD trading to better protect traders. As a result, Vantage FX UK clients will have a leverage limit of 30:1 for Forex trading and will be provided with negative balance protection, meaning that traders can never lose more money than they have in their trading account. In addition, FCA regulations ensure that Vantage FX segregates its operating funds from client accounts, but also prevent Vantage FX from offering promotions or bonuses.

While the added protection offered by FCA regulations is welcome, some UK traders may find the low leverage levels and lack of bonuses at Vantage FX limiting. The only way around these restrictions is to trade with a broker that doesn't have FCA regulation, which of course means less protection.

Overall, due to its history of responsible conduct, ASIC and FCA regulations, and the fact that Vantage FX is regularly audited, we consider Vantage FX to be a safe broker to trade with UK traders. VANTAGE FX offers three account types: Standard STP, Raw ECN, and ECN PRO, with the latter being the most popular options. The Standard STP Account is ideal for beginner traders, while the RAW ECN Account is ideal for more experienced traders. The PRO ECN account is ideal for professional traders or money managers who trade high volumes.

Adam

Jun 1 2023

Opening an account with Vantage seems to be a hassle-free process, as mentioned in the article. They offer convenient online registration from either a PC or a mobile phone. That got me thinking: What exactly are the steps involved in signing up with Vantage? Do they require any specific documents to be uploaded during the application? And here's an interesting scenario: What if someone's original documents are lost and they only have copies available? Would Vantage accept the copied documents for the application? It would be great to know how Vantage handles such situations and if they have any specific guidelines or procedures in place for submitting copied documents.

Morgan

Mar 29 2024

It's mentioned that Vantage enables the opening of multiple accounts, offering the flexibility to create new accounts with varied specifications afterward. However, the initial step requires registration and verification of personal data. The primary query is straightforward: if multiple accounts are opened, will each require KYC verification again?

Furthermore, in the event of rule violations, will all accounts be subject to closure, or will only the offending account be affected?

Lita

Mar 31 2024

Hey there! If you open multiple accounts on Vantage, you may need to undergo KYC verification again for each new account. This is typically a standard procedure to ensure compliance with regulatory requirements and to maintain the security and integrity of the platform.

About your second question, in the event of a rule violation, the consequences may vary. It's possible that all accounts associated with the user could be closed, depending on the severity of the violation and the platform's policies. However, it's also possible that only the specific account involved in the violation would be affected, while the other accounts remain operational. The specific actions taken would likely depend on the circumstances of the violation and the platform's terms of service. I think it is not good idea to break the law since our accounts can be closed at once.