XM copy trading for investors is a service that allows you to make a profit equal to the profit of the person whose strategy you duplicate.

The popularity of copy trading from XM has successfully attracted the interest of many traders. The reason is that with this service, traders can easily make a profit by duplicating the strategies of experienced traders.

That's it. There's nothing more for you to do. If they make a profit, you'll make a profit too. The profit you gain will be the same as what the experienced trader earns.

Are you new to this XM copy trading service and interested in using it to gain more significant profits? If so, then you should read this article until the end and get yourself ready to become a successful investor through XM copy trading.

A Brief Introduction to XM Copy Trading

XM is a global forex broker with years of experience. It has been in operation since 2009 and has obtained numerous licenses from major global regulatory bodies, including ASIC, CySEC, and FCA.

Under the umbrella of XM Global Limited, XM copy trading was officially launched earlier this year. Since its initial release, this service has gained significant popularity among many traders.

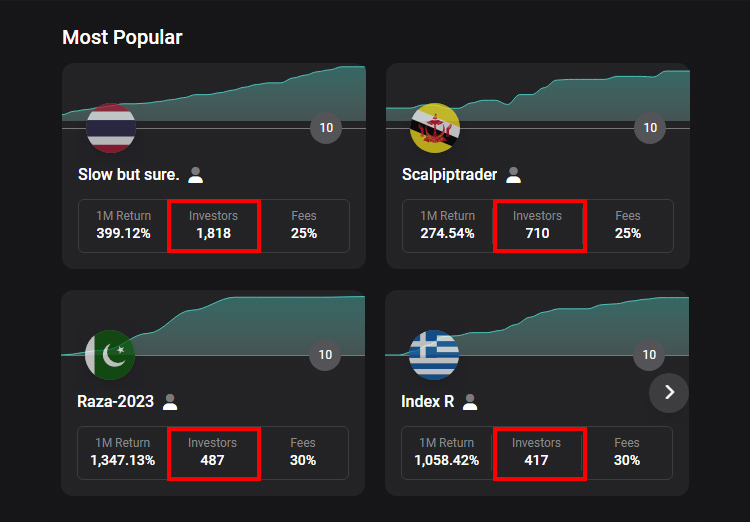

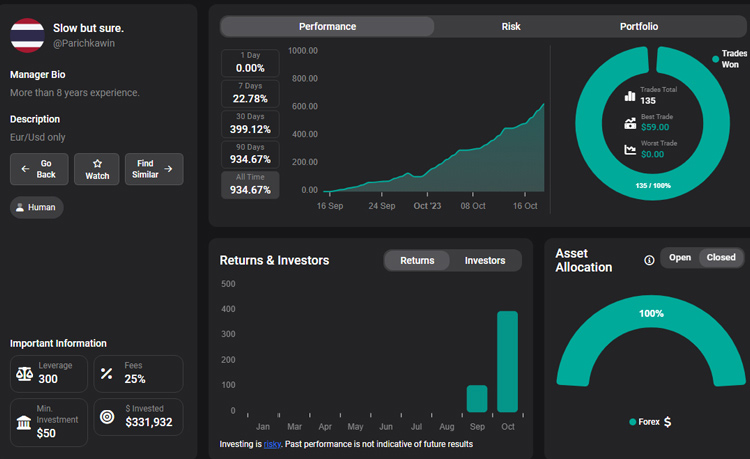

As of the time this article is written, there are approximately 200 strategy providers who have joined since XM copy trading was first launched. Each of them has a varied number of investors that cannot be counted anymore due to the sheer volume.

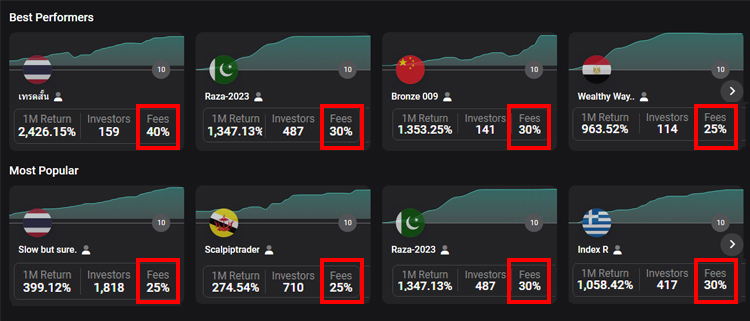

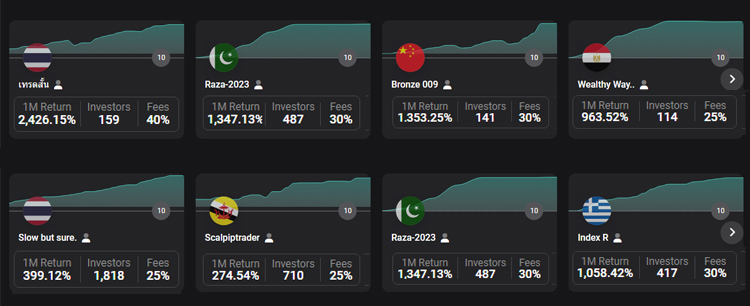

It's evident that thousands of investors have joined and followed their most reliable providers. For example, as you can see in the profiles of the most popular strategy providers, the number of investors has exceeded 1,000.

This is still one provider, while there are many other providers. Quite remarkable, isn't it?

Besides it allows you to duplicate the reliable strategies of other traders, XM copy trading also allows you to freely choose whose strategy you want to follow.

Furthermore, XM copy trading is very transparent because you can view complete details about the people whose strategies you intend to follow through the strategy providers' profiles.

XM Copy Trading App Overview

Alright, let's move on to the next topic, which is XM's copy trading application. Does XM have a dedicated application for copy trading? Unfortunately, not yet.

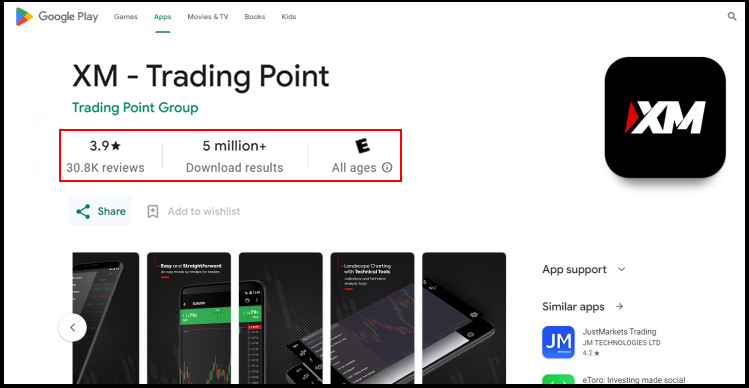

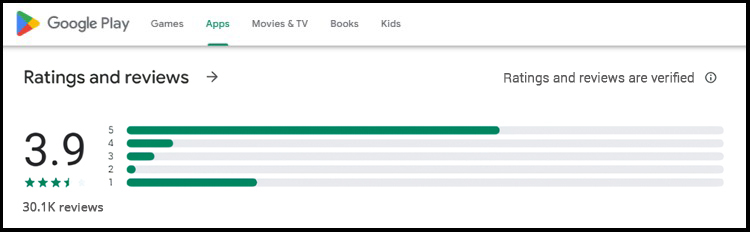

For now, you can access the copy trading service through the XM website or the mobile app, which can be downloaded for free from the Play Store or App Store. If you check on the Play Store, the XM mobile app is rated at 3.9 out of 5 by over 30,000 users.

Specifically for Android users, the XM trading app can only be downloaded in APK format by scanning the barcode on their website. However, don't worry; with XM's current popularity, it's not out of the question for them to create a dedicated copy trading app in the future.

No matter where you access XM's copy trading service from, you'll need to log in and navigate to their copy trading menu to see the features. You'll also need to register again to access the copy trading service.

XM Group is a group of regulated brokers and it is owned by Trading Point Holdings Ltd. Entities under XM Group have significant experience as financial services providers worldwide.

Trading Point of Financial Instruments Ltd was established in 2009 with headquarters in Limassol, Cyprus, Trading Point of Financial Instruments Pty Ltd was established in 2015 with headquarters in Sydney, Australia, XM Global Limited was established in 2017 with headquarters in Belize and Trading Point MENA Limited was established in 2019 with headquarters in Dubai.

XM Group is regulated by the CySEC (Cyprus Securities and Exchange Commission) - Trading Point of Financial Instruments Ltd, FSC (Financial Services Commission) – XM Global Limited, the ASIC (Australian Securities and Investments Commission) - Trading Point of Financial Instruments Pty Ltd and DFSA (Dubai Financial Services Authority) - Trading Point MENA Limited.

XM is one of the more experienced brokers in the world of online forex trading today. Since its founding, the broker has experienced a lot of changes, including the addition of the Ultra-Low Account and EN Live Edu that is instructed by 16 global experts.

In terms of trading instruments, XM is a well-known diverse class assets provider, varying from Forex, Crypto, Stock CFDs, Turbo Stocks, Commodities, Equity Indices, Precious Metals, Energies, & Shares. XM prides itself to be the ideal broker in trading execution, offering a stat of 99.35% orders to be executed in less than 1 second. Trading in XM would be also provided with a strict no requotes policy, no virtual dealer plug-in, no rejection of orders, real-time market execution, and the choice for traders to place orders online or by phone.

Spreads on all majors can reach as low as 0.6 pips in Ultra-Low Account, while spreads on other accounts usually start from 1 pip.

To protect the client's fund in the event of extreme volatility, XM presents each account type with Negative Balance Protection. Minimum deposit of $5 applies to Standard, Micro, and also Ultra-Low Accounts. Traders who open accounts in XM are enabled a condition similar to a Cent Account environment in the Micro Account, in which the Contract Size for every lot is only 1,000 units. If it is applied with the smallest lot size in the MetaTrader platform which amounts to 0.01, it means that traders can go as small as 10 units per trade.

For the deposit, XM applies zero-fee deposits in most of its available payment methods. Traders can choose to fund or withdraw their accounts via wire transfer, credit card, as well as the most favorable e-payment choices like Skrill, Neteller, and FasaPay.

To give their clients the best experiment in trading, XM has given access to both MT4 and MT5 platforms, each is available for more than 6 display formats (PC, Mac, Multiterminal, WebTrader, iPad, iPhone, Android, and Android Tablet).

All in all, there is no doubt that XM has gone global with its deep commitment to providing services in more than 30 different languages across the world. Aside from easing traders' experience with mainstream trading platforms and high-quality trading execution, XM is open to various types of traders, from small capital traders to the more experienced ones with big deposits at the ready. Traders are even provided with a Cent Trading environment should they choose to register under Micro Account.

For their global approach, XM has ensured that traders from various countries could access their service easily. This results in the provision of different domains specified for traders in certain jurisdictions. For example, traders from Indonesia could access XM via this link.

Setting Up XM Copy Trading Account for Investors

Before we start, it's essential to understand that there are two roles in XM's copy trading service.

First, there's the role of the strategy provider, which is an experienced trader who shares their strategies to be copied by other traders. Sometimes, this role is also referred to as a strategy manager or simply "Master."

Secondly, there's the role of an investor, which is someone who copies the strategies of the master. When a trade by the strategy provider results in a profit, the investor who follows it can also earn a similar profit. In return, investors must pay the strategy provider a commission fee.

Now, from these two roles, there are also different types of copy trading accounts. To become an investor, you need to register as an investor by following these steps:

- Make sure you already have a live XM trading account, and it's verified. If not, you can create one first.

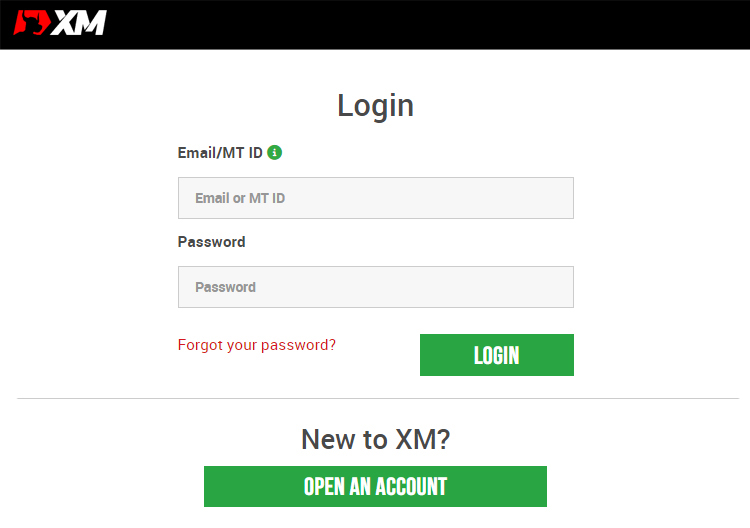

- Log in to Member Area using your registered email and password.

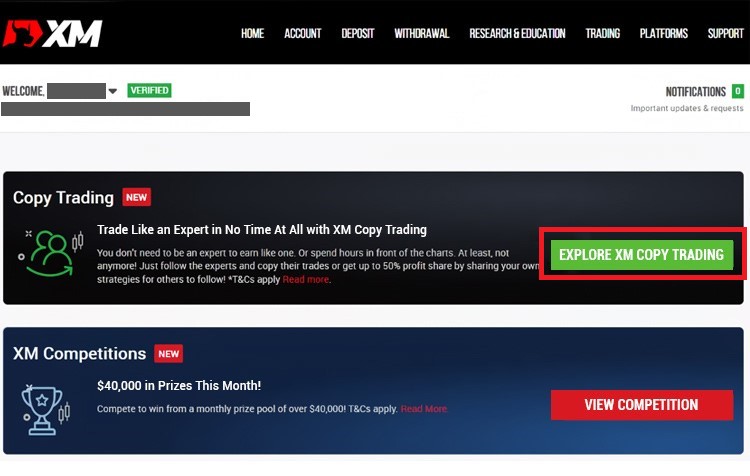

- On the main Members' Area page, click on the "Explore XM Copy Trading" banner like this.

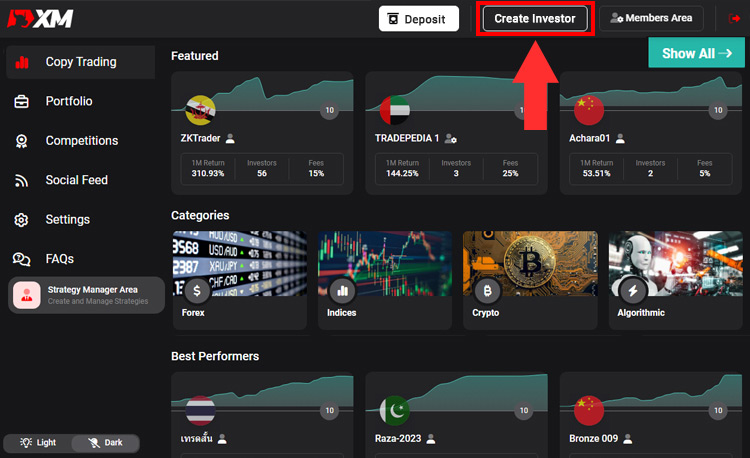

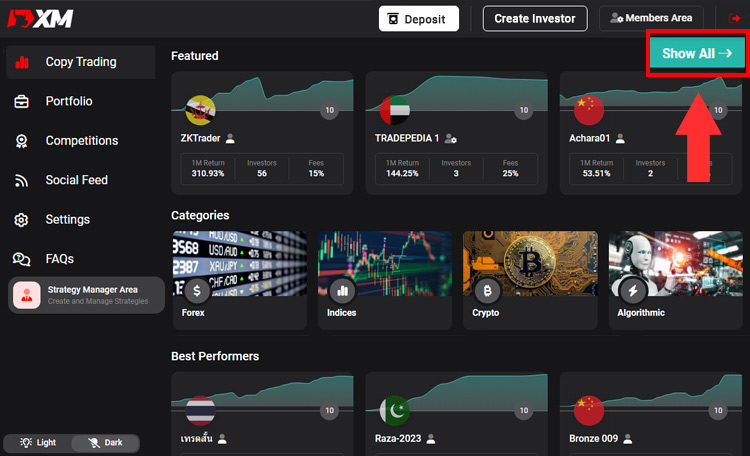

- After that, you'll be directed to the dedicated copy trading page like this. What you see on the screen now is a list of available strategy providers to copy. To start creating an investor account, click the "Create Investor" button.

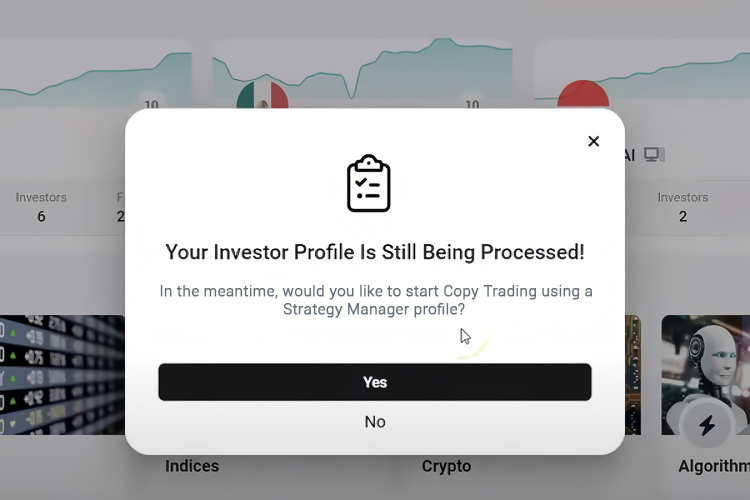

- Wait for a moment until your account is processed. In this pop-up, you can click "No."

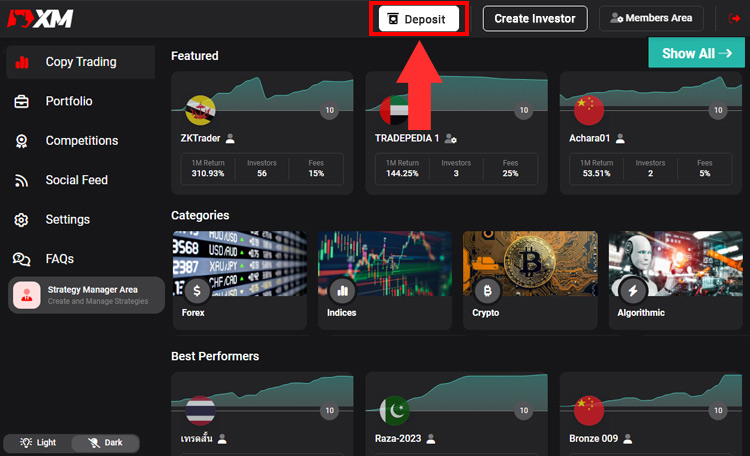

After your account is set up, you can start to fund your account. To do this, you can simply click the "Deposit" button located on the main page of XM copy trading.

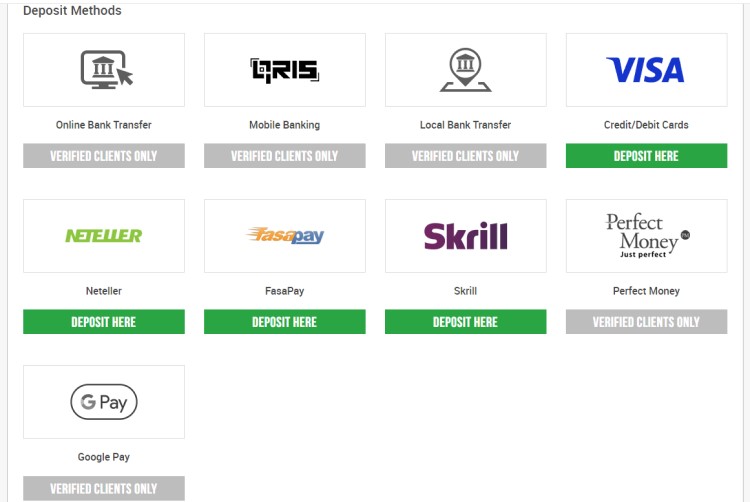

Choose one of the 9 deposit methods provided by XM, namely: Online bank transfer, Mobile banking, Local bank transfer, Credit/debit cards, Neteller, FasaPay, Skrill, Perfect Money, Google Pay.

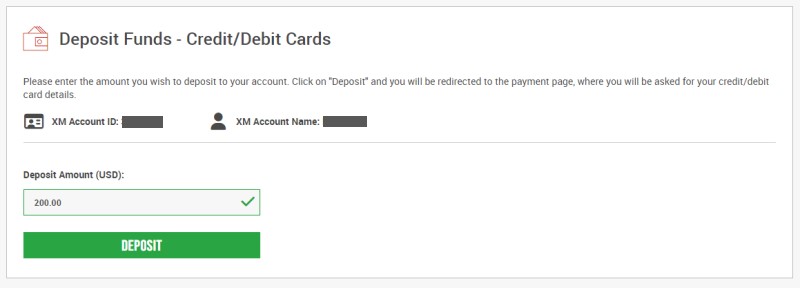

It's important to note that these nine methods are applicable in all countries. So, traders with XM worldwide have the same options. The only difference is local bank transfers, which naturally adjust to the national banks of each country.In this example, we will use the credit card option. Enter the deposit amount in the provided field.

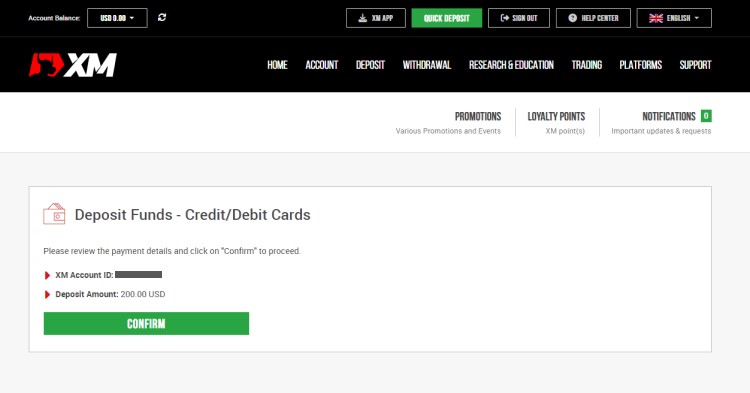

Review the deposit amount and the trading account you intend to fund. If it's correct, click "Confirm."

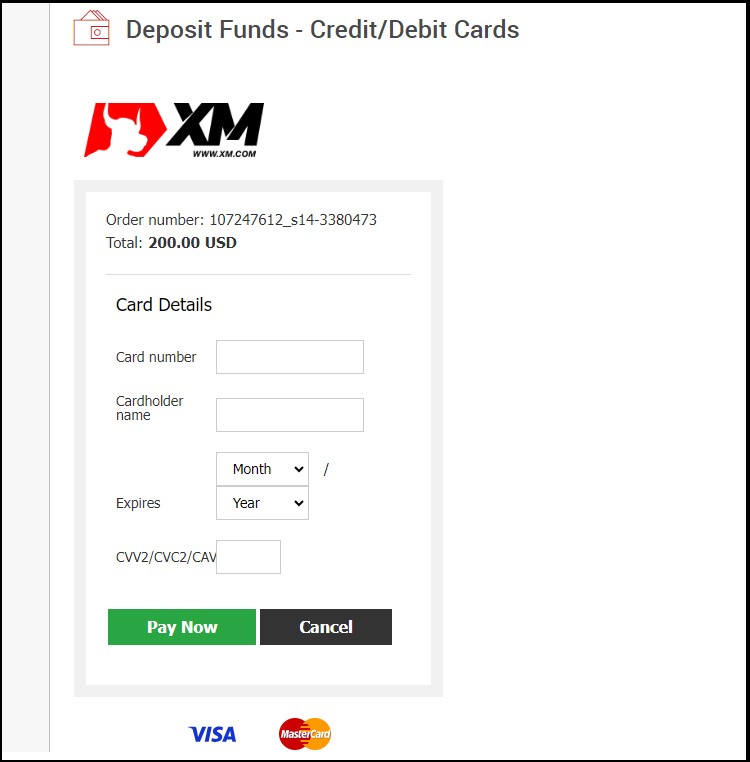

Enter your card details, and once done, click the "Pay Now" button.

All done. You can now wait for a moment until the funds are credited. You can check your investor account to confirm. Once that's done, you can start to find the most reliable strategy provider who consistently generates profits.

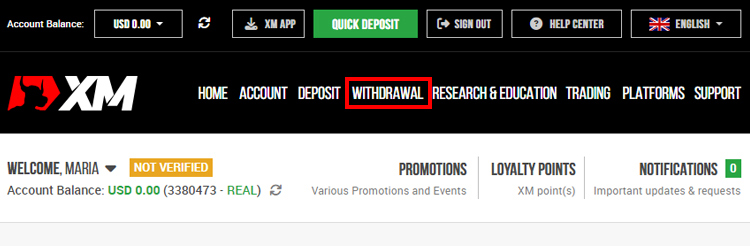

One of the advantages of copy trading is that you can profit by simply following the provider's strategy. If, at some point, you want to withdraw your funds, you can do so by accessing the "Withdrawal" menu in the Member Area.

Just follow the provided steps, and you can enjoy your money.

See Also:

How Is Profit Calculated for Investors?

As previously explained, by being an investor in XM copy trading, you can earn the same profit as the strategy provider you're copying, regardless of the amount.

So, if the provider you're following makes a profit of $500 from their trading, you automatically receive $500 as well. If they profit $10, your profit is also that amount.

However, there are certain commission fees that you need to pay to the provider. The commission fees in XM copy trading are entirely determined by the strategy provider. They are free to set commissions ranging from 0-50% of the investor's profit.

You can view these commission fees on each provider's profile. When they make a profit, regardless of the amount, you have to pay the commission, which will be deducted from your profit. For a clearer picture, consider the illustration below.

Let's say you invest $1,000, and you follow a strategy provider with a 10% commission. One day, they successfully made a profit of $100. With a 10% commission, here's what you get:

- Initial investment = $1,000

- Profit generated from copy trading = $100

- Commission fee = 10% commission amount = 10% x $100 = $10

- Your profit amount = $100 - $10 = $90

- Your total investment = $1,000 + $90 = $1,090

Using this calculation, you can evaluate the strategy provider you intend to follow. The lower their commission fee, the more advantageous it is for you.

However, consider how much profit they can generate. If their profits are minimal, it makes sense. It doesn't make sense if they set a high commission, say around 25-50%, for minimal profits. But if their profits are substantial and they have a high win rate, it's acceptable.

For instance, in the example above, if the provider set a 25% commission instead of 10%, you would still receive $75.

See Also:

Finding Reliable Strategy Providers in XM Copy Trading: An Example

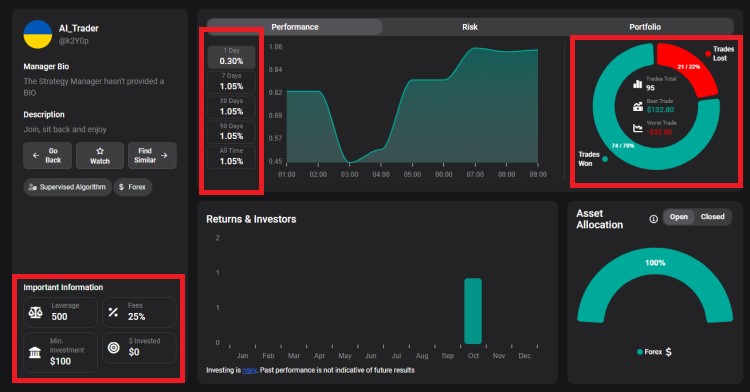

Because you have to copy someone's strategy to make a profit, you need to find the best strategy providers. One crucial thing you should do is look for a provider whose profile doesn't have the number 10.

This sign indicates a very high risk of following that person's strategy. They might be using risky tactics, such as not using stop loss and take profit orders. If you see the number 10 in their profile, it's highly recommended not to follow them.

It's better to choose a strategy provider with a low to medium risk rating, typically in the range of 0-7. An 8 is still okay, as long as you also consider their win rate.

To view the complete information of a strategy provider, you can click directly on their profile located in the copy trading menu and then click the "Show All" button.

Now, below is an example of a strategy provider with a low-risk level, only 1. After checking their profile, AI_Trader has won 74 out of a total of 95 trades conducted. His best win was $132.80, and his worst loss was $32.80.

How about his strategy? It appears that he uses a supervised algorithm, which is a combination of Expert Advisors and manual methods. So far, it looks good. However, why does he have no investors? It seems that his invested amount is still $0.

Regarding his commission fee, AI_Trader sets it at 25%, which isn't high, but it's not considered low either, as some providers charge only 10-15%.

You should also consider the minimum investment. This is the equity amount you need to have to follow his strategy. It seems that he has set it at $100. When compared to his monthly return, it appears quite low.

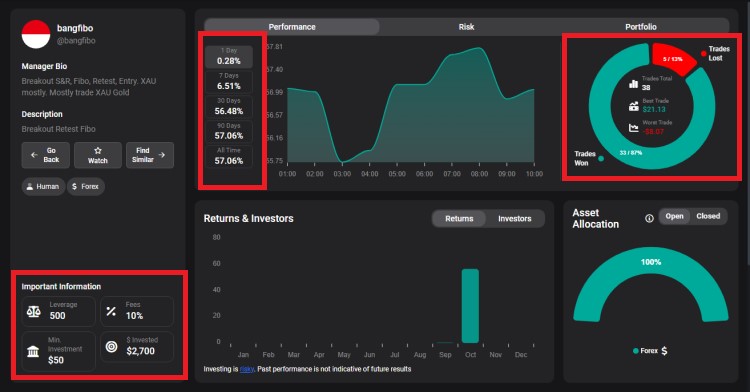

Now, let's take a look at another strategy provider with a risk level of 5, which is considered medium, namely Bangfibo from Indonesia. Here, you can see that Bangfibo has won 33 out of a total of 38 trades.

His best win generated $21.13, while the worst loss was $8.07. The minimum investment is half of AI_Trader's, and the commission fee is much lower. Combined with his relatively high monthly return, it seems that Bangfibo is a better choice for duplicating his strategy.

Features for Investors

One of the main goals of copy trading is to achieve more profits by following the strategies of more experienced traders. To help you with that, XM offers features that can assist you in reaching this goal.

Show All Button

This is a feature that can help you see all the lists of available strategy providers in the XM service. This button is located on the right side of the screen in the Copy Trading menu.

Filter Button

This button is located on the right side of the screen after you click the "Show All" button. Its icon is shaped like a funnel. This button is used to filter strategy providers based on:

- Trading frequency: low, medium, high.

- Risk score: you can slide it from 0 to 10.

- Fees: this is to filter the amount of fees set, which you can slide from $0 to a maximum of $50.

- Group: this includes categories like Most Popular, Featured, Best Performers, and Watchlist.

- The Featured list is decided by XM at its sole discretion

- The Best Performers list is sorted in descending order

- The Most Popular list is sorted by number of investors, in descending order

- A Watchlist is a list of providers whose profiles you've viewed and marked as "Watch."

- Strategy type: consisting of human, algo, and supervised algo.

- Categories: these are the assets traded by the provider. You can also choose to follow a provider who trades forex, indices, crypto, algorithms, or commodities.

You can apply multiple filters at once. For example, if you want to find a strategy provider in the "best performer" category with a trading fee of 15% and a trading risk of 5. Once you've finished setting these filters, click "Save." If you want to remove them, click "Reset."

Search Button

This button is located next to the Filter button. Its function is to search for a strategy provider based on their name. Maybe, if you want to follow a strategy provider whose name you already know, you can directly search for them using this feature.

Deposit Button

This feature serves to simplify the process for you if you want to make a deposit without needing to navigate to the home page or Member Area. This feature will also be very helpful if you suddenly need additional funds.

Portfolio

This feature serves as a record of all the trades you've ever copied. It includes the name of the strategy provider, the positions opened, the traded assets, transaction times, and notes on wins and losses.

Competition

If you didn't already know, XM hosts ongoing copy trading competitions until a specified future date. If you click on the "Competition" button on the left side of the screen, you can see what competitions are currently in progress, what's coming up, and what has already ended.

These competitions can either use real accounts or demo accounts. If you want to test how good your trading skills are, you can participate in competitions using a demo account. This is more suitable for you if you're an investor.

What are the Rules of XM Copy Trading for Investors?

In regard to XM copy trading for investors, there are a few things you need to pay closer attention to. It can be said that these are some of the terms and conditions you must follow. Some of them are as follows:

- You are limited to having only one investor account, but you can follow an unlimited number of strategies as long as you have the required equity available.

- To begin copying a strategy, a minimum of $50 deposit is necessary. However, each strategy may have its own minimum investor amount, which is determined by the provider and might exceed $50.

- The progress bar on the copy trading platform clearly displays margin calls at 50% and stop-outs at 20%.

- Stock CFDs are currently not accessible on investor accounts, although there may be plans to introduce them in the future. Consequently, any positions in stock CFDs opened by strategy providers will not be reflected in your investor account.

- If you hold an Islamic trading account, your investor account will automatically be treated as an Islamic account as well.

- A demo account is not available for investor copy trading accounts.

How to Look for a Strategy Provider as Investor?

So, what should and shouldn't you do when looking for a strategy provider to copy? To make it easier for you, here are the do's and don'ts:

| Do's | Don't's |

|

|

Bottom Line

Up to this point, it can be concluded that being an investor in XM copy trading is an easy way to generate profits by relying solely on the strategies of the provider.

This allows beginners to have the opportunity to profit as much as experienced traders without the need to create their own strategies. However, you must set aside a portion of your profits to pay commissions to the strategy provider.

You also need to be extra cautious in choosing a provider because their wins and losses become yours as well. As long as you understand how it works and minimize all its risks, copy trading is something very appealing to try.

XM is a well-regulated forex brokerage that offers a wide range of trading instruments, including forex, CFDs, stocks, indices, commodities, and cryptocurrencies. XM also offers a variety of educational resources, including webinars, tutorials, and e-books. These resources can help traders learn about the forex market and how to trade.

Earn Infinite Loyalty Rewards

Earn Infinite Loyalty Rewards Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients