The big speculators are racking up their short positions and cutting their long ones. The RBA could drop their rates again to 0.25% at some point in the next 2 months. Under these conditions, I expect the AUD/USD to drop to 0.6829.

Alpari: Technical Analysis

Short-term Trading Idea FX AUD/USD - Bear Speculation: Following Correction, Await Further Fall in Rate

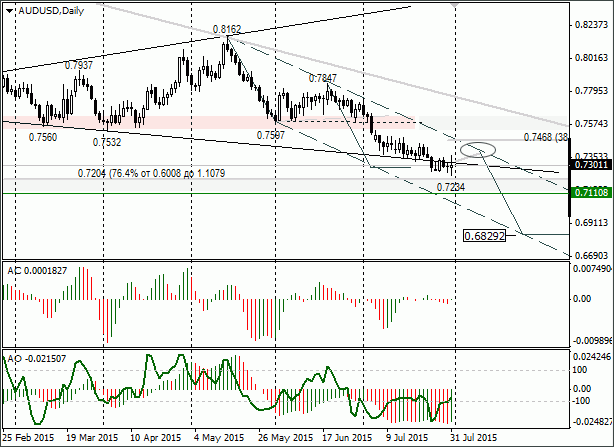

Trading opportunities on currency pair: the price of iron ore is still low. The stock market situation in China is still uncertain. The big speculators are racking up their short positions and cutting their long ones. The RBA could drop their rates again to 0.25% at some point in the next 2 months. Under these conditions, I expect the AUD/USD to drop to 0.6829. The lengthways downward impulse should be like other ones with a maximum of 0.8162 and 0.7847 (see graph below).

Today I have again done an idea on an Aussie dollar pair since, during my holiday, price levels on its pairs were reached.

The last idea I did on the AUD/USD was on 6th July, 2015. Back then I expected a fall of the Aussie to the 0.7380 lower limit of an expanding formation and then for it to head to 0.7280 due to the reaction in the price of iron ore and weak stats from Australia and China.

At first the AUD/USD rate dropped to 0.7371. Then after an eleven-day consolidation, the Australian dropped to 0.7234. The two targets were reached, so what now can we expect from the Aussie dollar?

The rate of the Aussie is still under tremendous pressure due to the low price of iron ore and Chinese stock market uncertainty. Ore last week was slightly up due to a recovery in the price of steel. It’s expected that the steel manufacturers will start to use their port ore reserves.

In my opinion, the recovery of prices will be unsustainable. According to Bloomberg: according to assessments made by the world’s largest shipbroker, Clarksons Platou Securities Inc., iron ore could drop to 35 dollars a ton in the second half of the year due to a growth in port ore reserves. Goldman Sachs Group Inc. agrees with this, believing that iron ore will fall in price over the next four quarters.

Last week the iron ore reserves in Chinese ports stood at 82.5 million tons. According to an assessment made by Australia & New Zealand Banking Group Ltd., these reserves could increase to 95 million tons in September.

Saturday saw China publishing their business activity index. The July PMI in the manufacturing industry fell by 0.2% to 50.0. At the same time, the index grew from 53.8 to 53.9 in the service sector. China is Australia’s main trading partner, so any negative news from China has a real effect on the Australian currency.

In just a week the SHANGHAI COMPOSITE index fell by 10% to 3663.73. Over the last 3 months this fall is by 17.5%. The Chinese government is continuing in its attempts to stabilize the stock market. There are too many factors which point to a further reduction in the Australian dollar.

On Friday the AUD/USD lifted to 0.7366 after US inflation data came out. This says something about the significant reduction in the growth rate of Q2 labor force costs. The buyers didn’t manage to hold on to their positions at their weekly maximums. By the US trading session close, the AUD/USD had returned to 0.7301.

The Australian dollar is moving within a downward channel since May and the recent consolidation looks like a gasp for air before it heads down once more. Taking into account that traders are reacting to US stats, there are risks of an upward correction. Afterwards I expect a break through the 0.7204-0.71 zone.

Furthermore, according to a weekly commission report on commodities future trading (CFTC – Commodity Futures Trading Commission) from 31st July, with growing public interest the big traders are continuing to increase short positions and reduce long ones on the Australian dollar.

Long positions have been cut by 4,819 contracts to 46,572 and short ones have increased by 4,062 to 96,318 contracts. The number of pure short positions is at 49,746 contracts. Smaller speculators are buying and selling the Aussie dollar (more of the latter than the former). My target for the end of August is 0.6829.

Vladislav Antonov, Alpari

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance