EUR/USD started to rebound after US Dollar weakened following the release of NFP data. An opportunity to open a long position will appear when the price tests the demand zone.

Hi fellow traders! EUR/USD closed higher on Friday, January 6th. Euro started rising after the US NFP data failed to support the greenback. Even though the NFP figure was above expectations, the market considered that the achievement was still in a downward trend. As a result, Euro crawled up and formed a bullish lane.

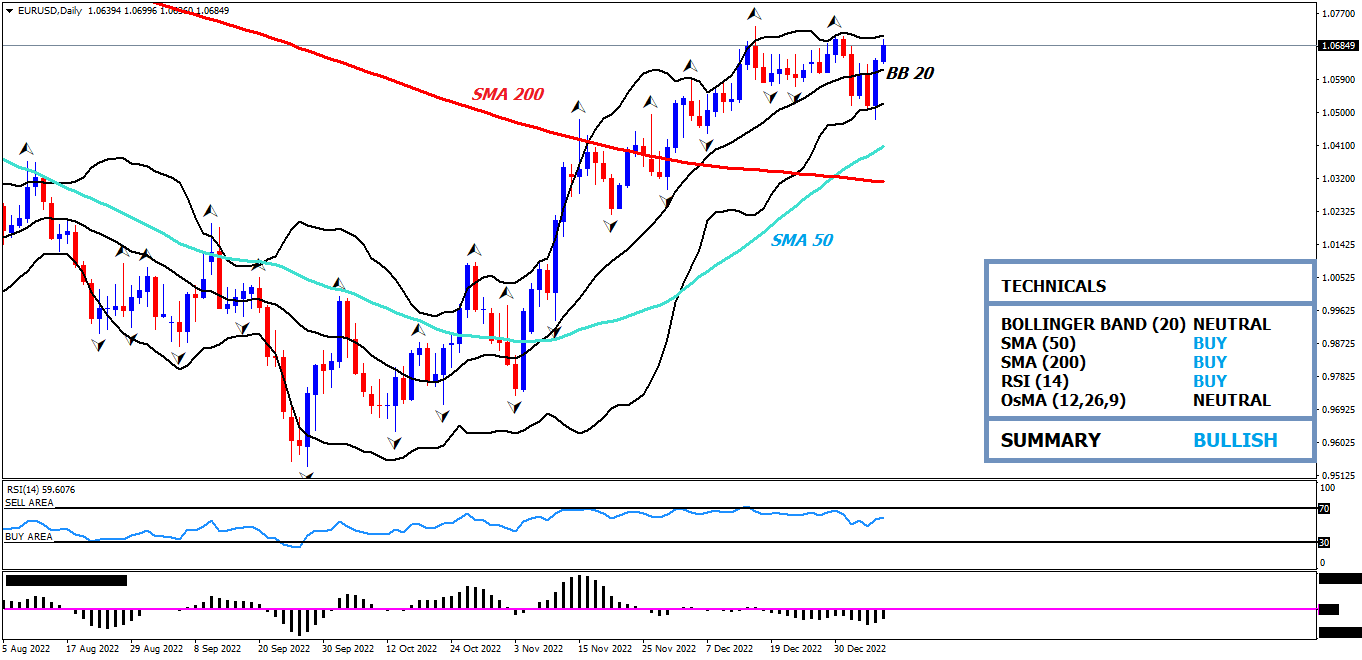

Analysis and Recommendation

Let's take a look at the following EUR/USD H1 chart below:

Based on the H1 chart above, it has been pointed out that EUR/USD rally formed after the US NFP data was released. Euro rose and almost touched the supply zone 1.0746 – 1.0706. EUR/USD is in a correction at the time of the analysis, but this could be an indication of a further rally.

Be aware if this correction phase continues since EUR/USD has the risk of depleting the demand zone around 1.0645 – 1.0613. If the demand zone is successfully cleared, Euro will continue to wear out while looking for a lower demand zone as the next correction target.

- Therefore, set a long position at 1.0645 when the price manages to enter the demand zone and a bullish signal confirms it. Stop loss may be positioned at 1.0613, while the profit target on 1.0746.

- Alternatively, set a short position at 1.0613 when a significant breakout signal confirms it. Stop loss may be positioned at 1.0645, while the profit target on 1.0518.

Keep in mind to always use risk and money management before trading! In addition, to make use of trailing stops, don't forget to exit the market as soon as you find a reversal signal!

EUR/USD key levels:

- Resistance: 1.0746, 1.0706

- Support: 1.0645, 1.0613, 1.0518, 1.0472

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance