Explore why investing in Netflix stock is a smart choice and start your investment with eToro, the leading social trading platform. Read more to find out.

Netflix is one of the world's most popular and successful streaming platforms. It offers millions of subscribers a wide range of movies, TV shows, documentaries, and original content.

But is Netflix (NFLX) a good investment opportunity? What is the potential of Netflix as a stock?

In this article, we will explore why you should invest in Netflix and how you can invest in it with eToro, a leading social trading platform.

Contents

Reasons to Invest in Netflix

Netflix started in 1997 as a DVD rental service by Reed Hastings and Marc Randolph. After a decade, in 2007, Netflix shifted to online streaming, which became its main way of delivering content.

As the internet got faster and people began watching shows and movies on various devices, Netflix gained more users and started partnering with content creators to expand its library. In 2013, they launched their first original series, House of Cards, which was a big hit. Since then, Netflix has created many popular shows like Stranger Things, The Crown, The Witcher, and The Queen's Gambit.

Netflix also went global, offering shows and movies in different languages and expanding to 190 countries by 2016. In 2020, they had over 200 million paid subscribers worldwide, making them the biggest streaming service. Despite challenges from the COVID-19 pandemic, Netflix performed well financially, with over $25 billion in revenue and $2.7 billion in net income.

Investing in Netflix can be a wise choice for several reasons:

Subscription Surge and Original Content Dominance

As a streaming platform company, Netflix's performance has been consistently growing. In Q3 2023 alone, the company gained over 8 million subscribers.

Netflix has invested heavily in producing and acquiring original content, which gives it a competitive edge over other streaming platforms that rely more on licensed content. Netflix's original content also helps it attract and retain customers and generate positive word-of-mouth and brand recognition.

Netflix's subscription numbers and original content are expected to continue to increase in the future, as the company expands its reach and diversifies its genres and formats.

Global Audience Expansion Potential

Netflix has a huge potential to grow its audience in international markets, especially in emerging economies where internet penetration and disposable income are rising. As of Q3 2023, Netflix boasted over 97 million international subscribers.

Netflix has been adapting its strategy to cater to the preferences and needs of different regions and cultures, offering localized content, pricing, and payment options. Netflix has also partnered with local producers and distributors to increase its presence and visibility in various countries.

Netflix's international audience currently accounts for about 60% of its total subscribers, and this percentage is likely to grow further as Netflix taps into new and underserved markets.

Consistent Price Growth

Netflix's stock price has steadily grown in the past few years, reflecting its strong performance and growth prospects. It has increased by over 300% in the past seven years, outperforming the S&P 500 index by a wide margin.

Netflix's stock price has also been resilient to market fluctuations and external shocks, such as the COVID-19 pandemic, which boosted its demand and usage. The price is currently trading at around $500 per share, and some analysts predict that it could reach $600 or even $700 in the next year or two.

What Drives Netflix's Stock Price?

NFLX is influenced by both measurable factors like subscribers and revenue, and intangible elements tied to content creation.

For the assessable aspects, the company discloses its quarterly revenue and subscription figures that consistently display growth. Investors interested in NFLX should closely follow these reports and related forecasts. On the other hand, content-related news can also drive the stock price significantly.

Netflix's content partnerships, including major collaborations with giants like Disney (covering brands like Marvel and Star Wars), also impact its stock. With a constantly expanding array of on-demand content, Netflix has become synonymous with binge-watching and streaming.

Who Should Have Netflix in Their Portfolio?

Netflix is an attractive investment for those who:

- Embrace cord-cutting: NFLX is ideal for investors aligning with the trend of shifting from traditional TV to digital platforms. Netflix, being a leader in multi-device accessibility, caters to this transition seamlessly.

- Seek growth stocks: Investors pursuing high potential returns and value growth should include Netflix in their portfolios. The stock offers elevated returns, albeit with increased risks and volatility. This aligns well with investors possessing a long-term outlook, high-risk tolerance, and growth expectations.

- Are tech enthusiasts: With a substantial market cap nearing $60 billion, an expanding user base, and robust year-over-year growth, Netflix is an appealing option for those looking for long-term investments in the tech sector.

- Are film and TV enthusiasts: Despite piracy concerns, Netflix, with its affordable pricing and robust content production, is favored by entertainment lovers. Beyond a streaming service, it has evolved into one of the world's premier production houses with numerous prestigious awards.

- Are day traders: Particularly around Netflix's earnings reports and major content-related announcements, the stock may present short-term opportunities, making it attractive for day traders.

Should You Invest in Netflix Inc.?

Investing in Netflix presents an appealing opportunity because it is a highly successful and influential player in the global entertainment industry. Despite initial impressions of reaching its peak, the company maintains momentum through consistent revenue generation, user base expansion, and continuous content production.

To maintain its dominance in the platform competition with Disney+ and others, Netflix has been implementing several strategies. Apart from improved user experience and recommendation strategy, Netflix announced a new pricing strategy that significantly cut subscription prices in over 100 countries.

As for the content, Netflix has several upcoming projects that could potentially support the performance of its stocks. Here are some highlights:

- New Fantasy Series: Netflix has several new fantasy series in development for release in 2024, 2025, and beyond such as Avatar (The Last air bender), Dead Boy Detectives, Devil May Cry, Monsters, The Rats, Arcane, and Sharaman.

- New Anime: There are several new anime coming to Netflix, such as One Piece, Maroboshi, The Seven Deadly Sins, Masters of the Universe, and Delicious in Dungeon.

- New K-Dramas: There are many K-dramas to look forward to on Netflix in 2024, such as Parasyte: The Grey, Hierarchy, Sweet Home, Hellbound (season 2), A Killer Paradox, the 8 Show, and Chicken Nugget.

- Illumination and DreamWorks Movies: More movies are coming alongside other new theatrical releases from the two Universal animation studios. They include Despicable Me 4, Kung Fu Panda 4, Orion and the Dark, Migration, Ruby Gillman (Teenage Kraken), Trolls Band Together, and The Wild Robot.

Boasting a robust competitive advantage, a devoted customer following, and significant growth potential, Netflix remains an attractive prospect for long-term investors. Some analysts predict that the Netflix stock price could reach $600 or even $700 in the next year or two. You can use this opportunity to invest in Netflix now.

Investing in Netflix with eToro

If you decide to invest in Netflix, one of the best ways to do so is with eToro. eToro broker is a leading social trading platform that has been operating for more than a decade. The platform has more than 20 million registered users.

eToro allows you to buy and sell stocks, as well as other financial instruments, such as cryptocurrencies, commodities, indices, and ETFs. Investing with eToro offers several advantages and features for investors, such as:

- Low Fees: eToro charges zero commissions and low spreads on stock trading, which means that you can save money and increase your returns. The average spread for trading Netflix in eToro is $2. eToro also offers competitive fees on other services such as deposits, withdrawals, conversions, and copy trading.

- Regulated and Secure: eToro is regulated and authorized by several reputable and respected authorities, such as the SEC (US), FCA, CySEC, and ASIC, which means that it complies with the highest standards of security, transparency, and customer protection. eToro also uses advanced encryption and verification methods, which ensure that your personal and financial information is safe and secure.

- User-Friendly Platform: eToro has a user-friendly and intuitive platform, which is easy to use and navigate, even for beginners. The mobile app allows you to access and manage your portfolio anytime and anywhere, as well as to receive notifications and alerts on market events. There are also supporting tools like ProCharts and TipRanks.

- Social Trading: eToro enables you to interact and learn from other traders and investors, who share their opinions, insights, and strategies on various markets and instruments. Netflix is one of the most favorite/popular stocks to invest in eToro social trading.

- High leverage: You can use leverage up to 1:5 in trading Netflix stock in eToro.

There are two ways of investing in Netflix with eToro:

1. Investing in Netflix Independently

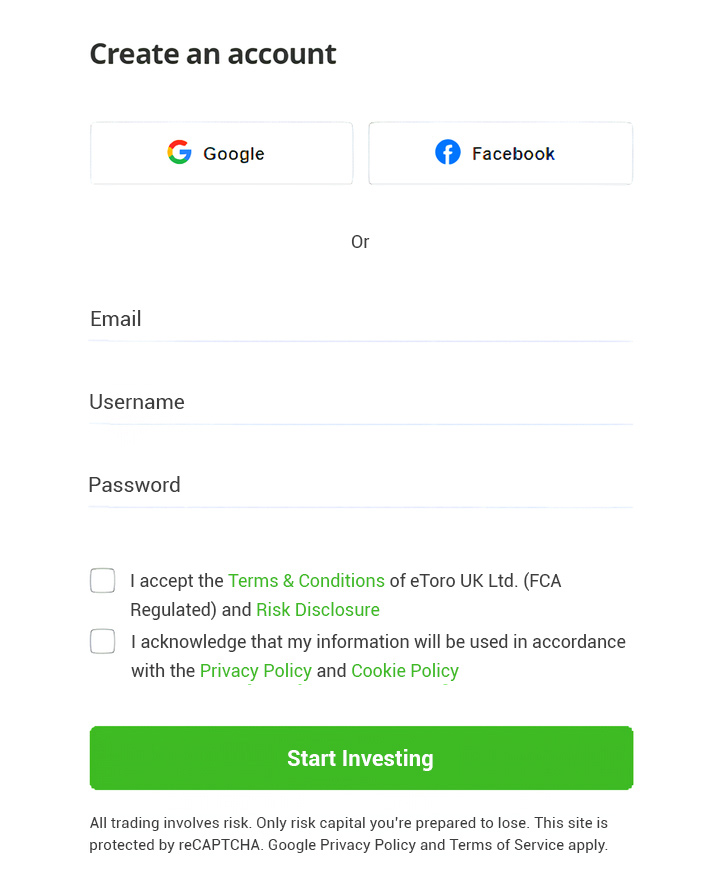

- Sign Up: Create a free account on eToro by providing some basic information, such as your name, email, and password. You will also need to verify your identity and address by uploading some documents, such as your ID and a utility bill.

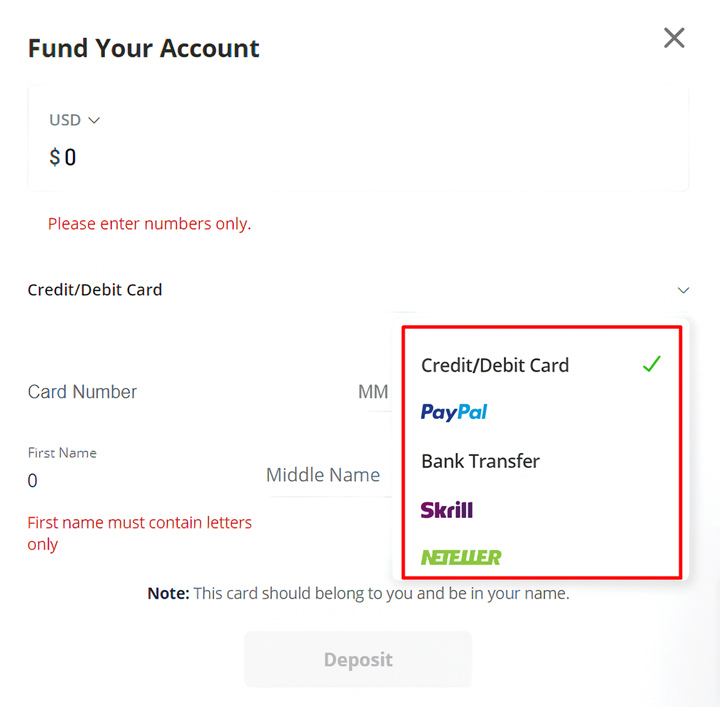

- Deposit Funds: Fund your account with your preferred payment method, such as credit card, debit card, PayPal, Skrill, Neteller, or bank transfer. The minimum deposit amount is $200, but you can start trading with as little as $50.

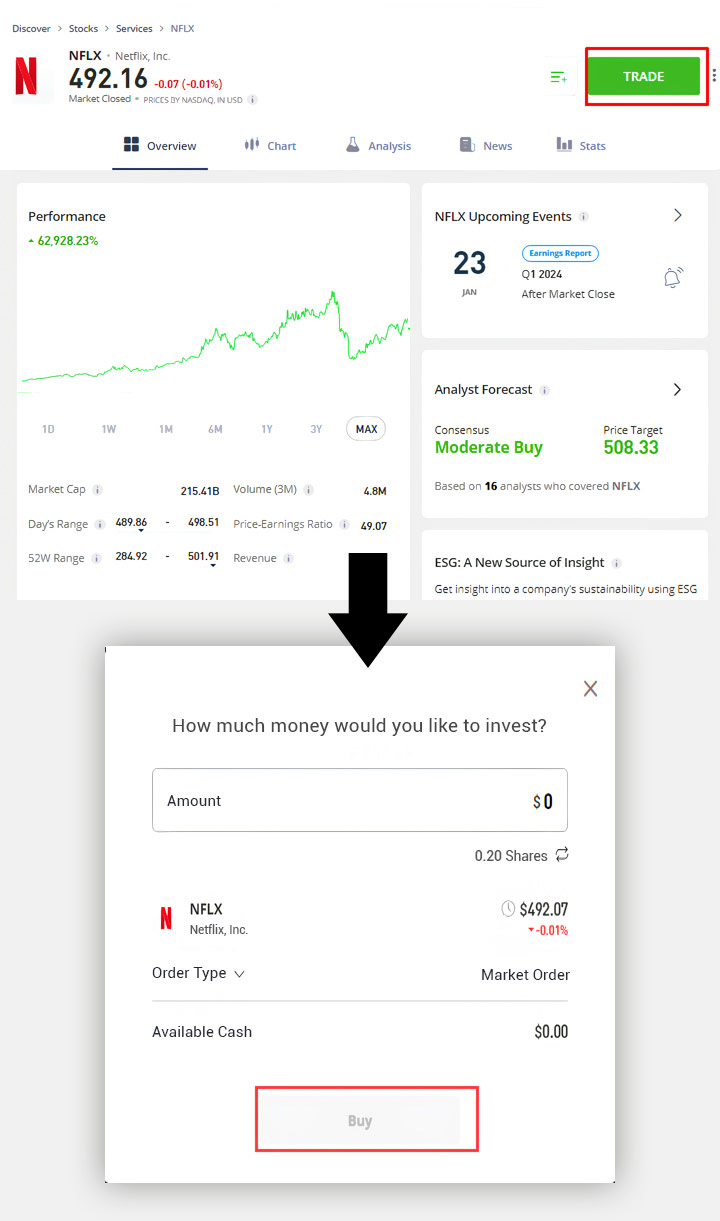

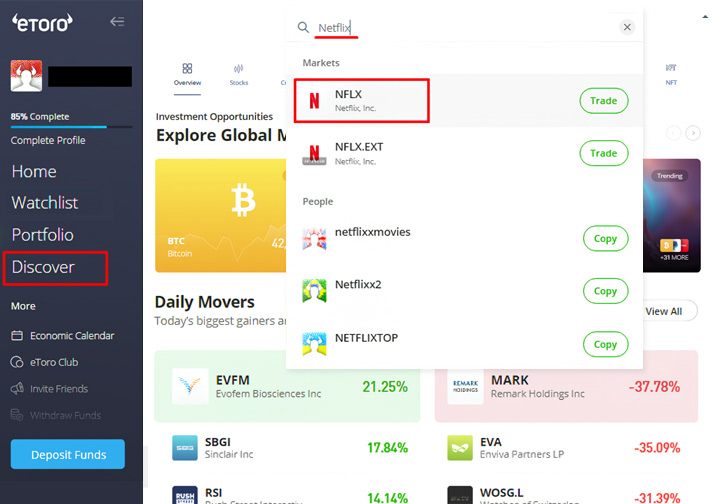

- Buy Netflix Stock: Search for Netflix (NFLX) on the eToro platform, and click on the "Trade" button. You will see a pop-up window where you can enter the amount of money or the number of shares you want to buy. Here, you can also set the order type such as market order (instant sell/buy) or limit order. Once you are ready, click on the "Buy" button to complete the transaction.

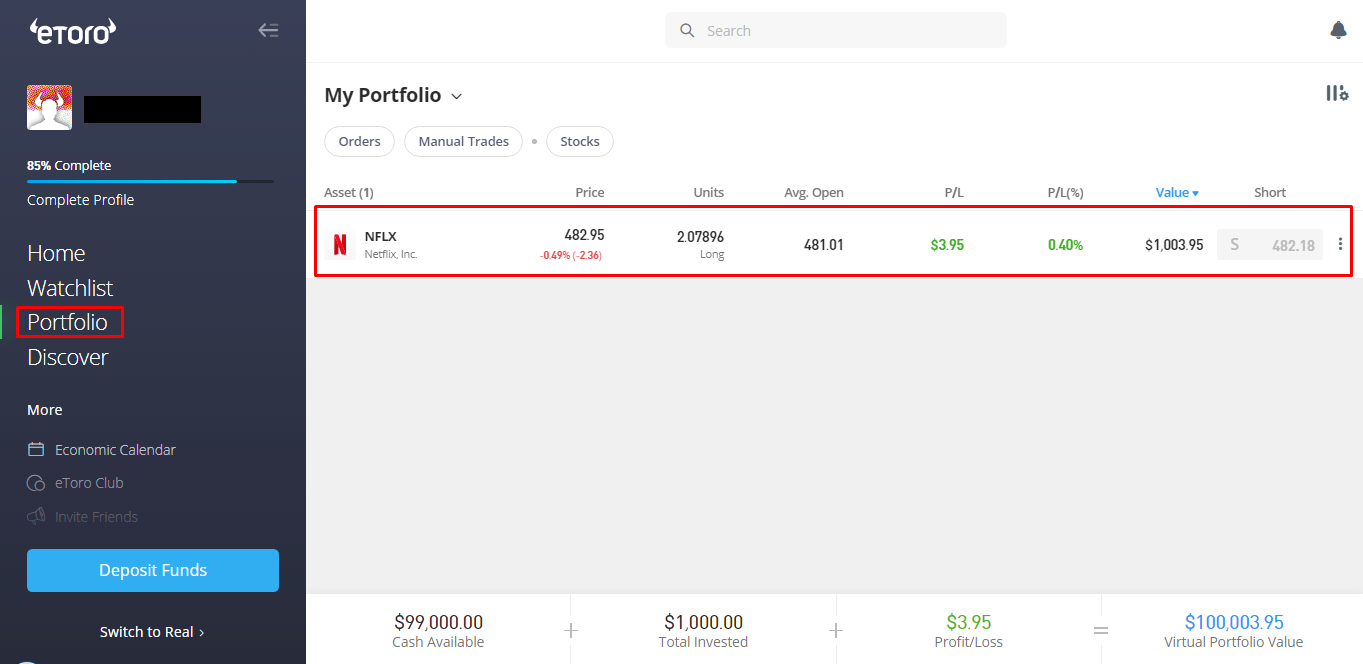

- Monitor your investment performance: After buying Netflix stock on eToro, you can monitor your investment performance on eToro. Click on "Portfolio" in the left pane, then your portfolio will show up.

Information:

- Asset: This represents the financial instrument you have invested in. It could be a stock, cryptocurrency, commodity, etc.

- Price: This is the current market price of the asset.

- Units: This refers to the quantity of the asset you own.

- Avg Open: This is the average price at which you purchased the asset. If you bought the same asset multiple times at different prices, this would be the average of those prices.

- P/L: This shows the profit or loss you've made on this asset.

- P/L (%): This is the percentage change in the value of your investment.

- Value: This is the current total value of your investment in the asset.

You need to monitor the units, P/L, avg open, and value for several reasons:

- The number of units of an asset you hold is crucial as it directly impacts the total value of the investment. More units mean more exposure to the asset's price movements, which could lead to higher profits or losses.

- Monitoring P/L helps you understand how your investments are performing. If the P/L is positive, the investment is making a profit. If it's negative, the investment is at a loss. This information can help you decide whether to hold, sell, or buy more of an asset.

- The average open price provides a benchmark against which current performance can be measured. If the current price is higher than the average open price, the investment is profitable. Conversely, if the current price is lower, the investment is at a loss.

- You need to monitor this to understand the size of their investment in their overall portfolio. It can also indicate the level of risk where a high value in a single asset might represent a high concentration, and therefore higher risk.

To initiate modifications, simply click on the three parallel dots situated on the right side of each asset within the portfolio.

eToro established in early 2007, with a mission to make trading accessible to anyone, anywhere, and reduce dependency on traditional financial institutions. The company has head offices in the United Kingdom, Cyprus, USA, and Australia.

eToro (Europe) Ltd operates as a Financial Services Company authorized and regulated by the Cyprus Securities Exchange Commission (CySEC) under license no. #109/10. Meanwhile, eToro (UK) Ltd is authorized and regulated by the Financial Conduct Authority (FCA) under the license FRN 583263.

As for eToro AUS Capital Pty Ltd, the legal standing is acknowledged by the Australian Securities and Investments Commission (ASIC) to provide financial services under Australian Financial Services License 491139.

A broker that belongs to the 4-digit type, eToro offers both short-term options for day traders and long-term options for investors, such as their innovative Smart Portfolios, a fully managed thematic portfolio.

Since 2007, eToro has been at the forefront of the Fintech revolution. The most recent was launched in 2017, which is Smart Portfolios powered by Machine learning Al. Beyond developing Smart Portfolios, the company integrated Microsoft's machine learning technology into Momentum DD.

The new Smart Portfolios investment strategy uses artificial intelligence to find the steadiest traders who are most likely to generate a double-digit return and bundle traders into one fully-managed portfolio. eToro has hundreds of financial assets for trading across several categories including stocks, commodities, crypto assets, currencies, indices, and ETFs. Each asset class has characteristics and can be traded using a variety of investment strategies.

Some positions on eToro involve ownership of underlying assets, such as non-leveraged positions on stocks and cryptos. Employing CFDs will enable a variety of options, such as leveraged trades, short (sell) positions, fractional ownership, and more. For example, traders can invest as little as USD100 in gold, even if a single unit of gold cost USD1,000. Some of eToro's most popular CFD commodities include gold, oil, natural gas, silver, and platinum.

Currencies are traded on eToro only as CFDs. Also, CFDs enable Sell (short) positions and leveraged trade, even for assets that don't offer the option in traditional trading. Some of the popular currencies include EUR/USD, GBP/USD, AUD/USD, USD/JPY, and USD/CAD.

Furthermore, An Exchange-Traded Fund (ETF) is a financial instrument comprising several assets grouped to serve as one tradable fund. After opening an account in eToro, traders can invest as little as USD250 in an ETF that costs USD500. Some of the popular ETFs on eToro include SPY, VXXB, TLT, and HMMJ.

However, eToro also offers additional functions using CFD trading. All leveraged ETF positions in the UK are under FCA regulations. Meanwhile, all CFD positions executed by eToro Australia are under ASIC regulations.

The company has other advantages. In all financial assets that can be traded, eToro does not charge any deposit or trading frees other than spreads.

eToro charges a USD25 fee for withdrawals and the minimum withdrawal amount is USD50. Long (Buy), non-leveraged crypto, stock, and ETF positions are not executed as CFDs and do not incur any fees. eToro does charge overnight or weekend fees for CFDs positions, such as leveraged positions and short (sell) orders.

Fee updates always apply to open positions. Fees are subject to change at any given time and could change daily, without prior notice, depending on market conditions.

As a beginner, trader can use CopyTrading eToro. Different from the features of other brokers, traders can copy the strategies of professional traders without fee or profit-sharing. Therefore, 100% profit is fully owned by traders. For example, while trader A who is copied by trader B, produces a profit of 10% this month, then trader B also gets a profit of 10%.

The company is the world's leading social trading network. Since eToro operates in complete transparency, each trader has valuable information on their eToro profiles, so other traders that are interested to copy their trades can have assistance in creating their best portfolios.

Another feature that is unique to eToro is the personalized, social News Feed. Just like on any social media, traders can post their updates on feed, comment on other's posts, and gradually create a feed that is tailor-fitted to trader's trading and investing interests. On eToro social trading platform, traders will also get notifications when a trader writes a new post and many other important updates.

2. Following Other Netflix Investors

Investing in Netflix stocks through eToro's social trading involves the following steps:

- Login: Login to your eToro account, or if you haven't signed up yet, register as per the provided instructions.

- Deposit: Initiate a deposit to serve as your initial investment capital (refer to the provided screenshot).

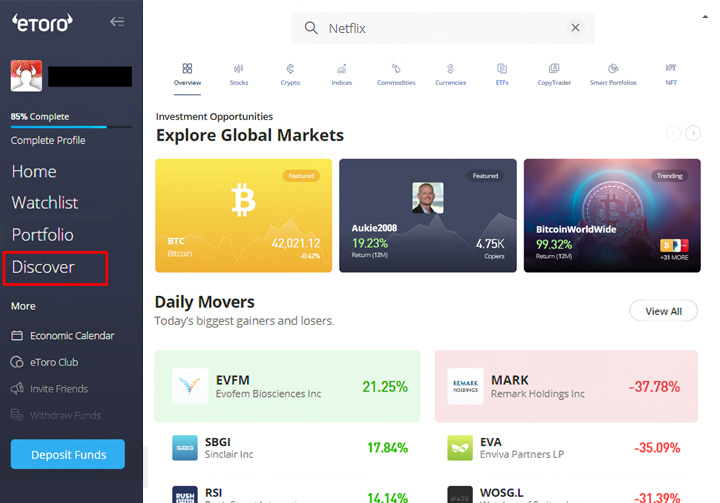

- Choose Discover: Navigate to the "Discover" section located on the left side of the screen.

- Search Netflix: Upon accessing the Discover page, enter "NETFLIX" in the search bar.

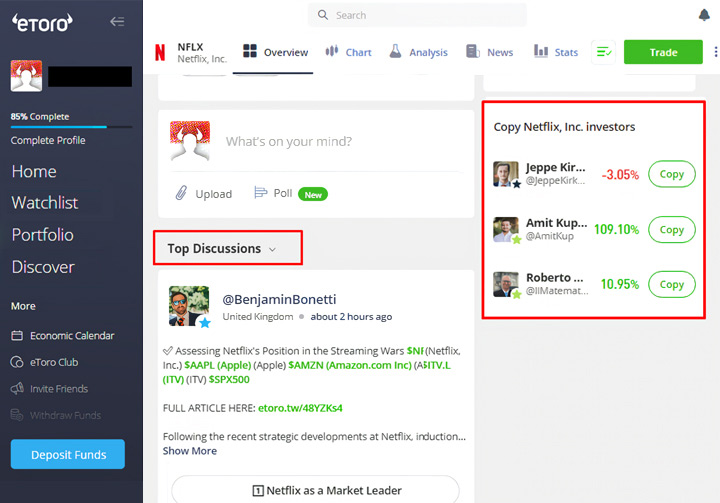

- Scroll Down: When the Netflix stock page appears, scroll down to locate the "Copy Netflix, Inc. Investors" section, where you'll find three recommended Netflix investors available for direct copying. Additionally, you can explore opinions and comments from others about Netflix in the "Top Discussion" area.

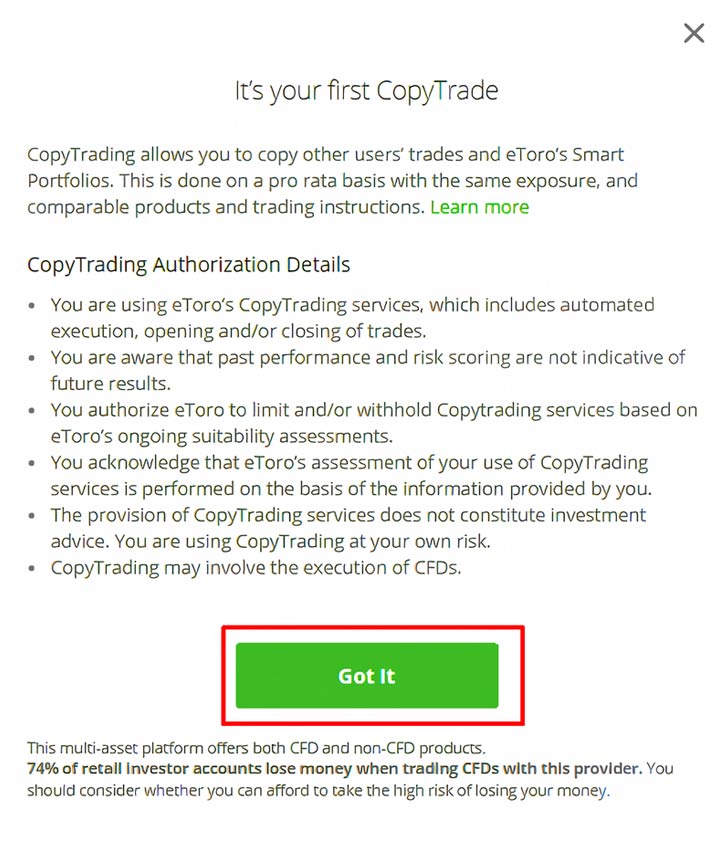

- As an example, let's copy Roberto Anzellotti (@IlMatematico) by clicking the "Copy" button next to his name. You'll see a notification pop-up about copy trading. Simply click "Got It" to proceed.

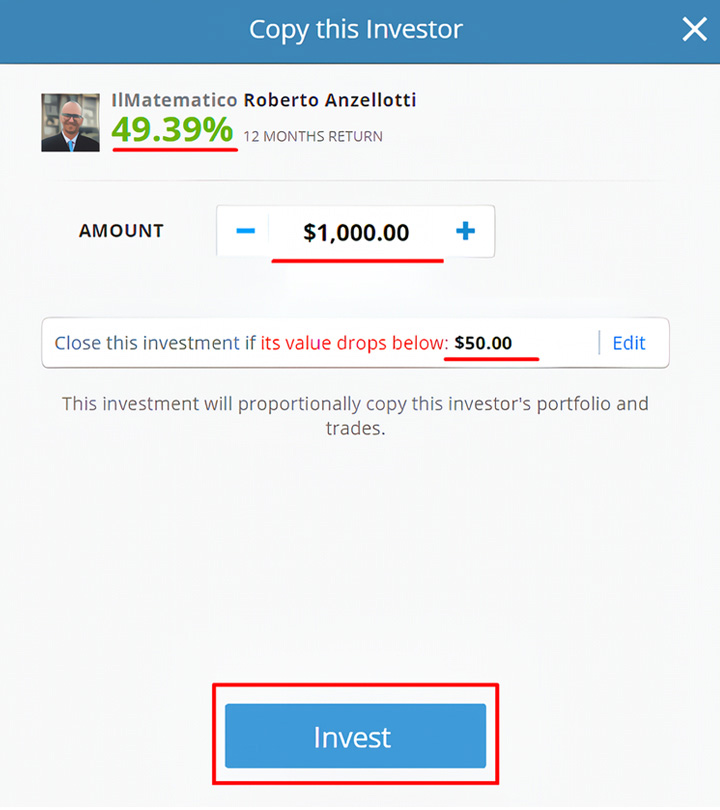

- Next, a page will appear for copying this investor. It shows the percentage of return this investor achieved in the last 12 months. Enter the amount to copy (at least $200) and decide the value at which the investment will be closed if it incurs a loss. In my case, I entered $1,000 to copy and set the investment to close if it drops below $50. Once done, click "Invest."

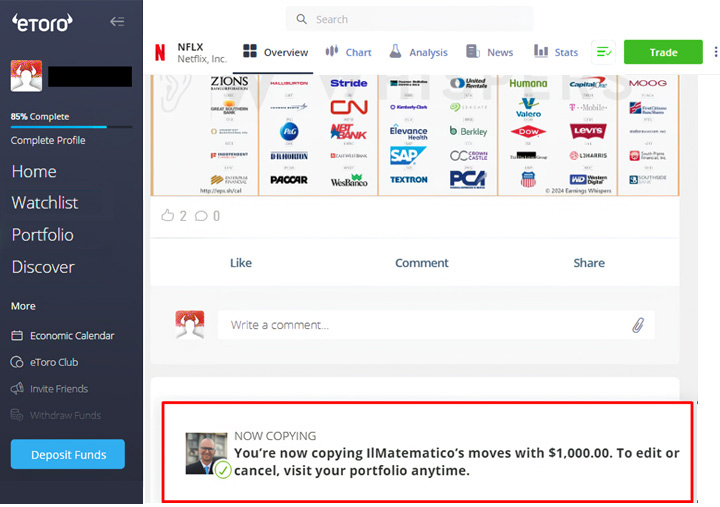

- After clicking invest, a pop-up notification at the bottom panel will confirm that you've copied the investor along with the amount.

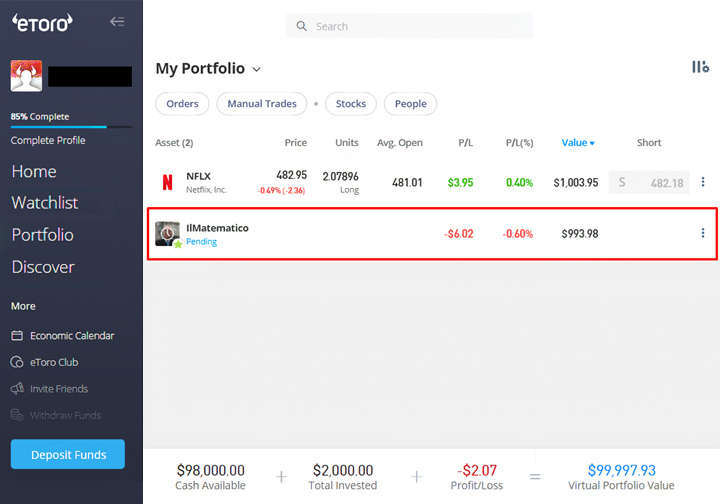

- To check if your copy trade is active, go to the portfolio on the left panel. There, you can see that you've successfully copied that investor.

eToro stands out as an exceptional option for individuals seeking cost-effective stock, CFD, forex, and crypto trading through its impressive mobile app. With an active user community, eToro provides social features dedicated to supporting the needs of traders and investors across the globe.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance