eToro is a popular brokerage firm that offers easy deposit and withdrawal. There are many payment methods, some of them support instant transactions within minutes.

Being able to easily access your money is a crucial matter in forex trading. It's not just about funding your account, you should also be allowed to cash out any time you wish. While it sounds simple, the way brokers provide payment methods and process the transactions differ significantly.

eToro is one of the most popular brokerage firms with over 30 million registered users worldwide. Established in 2007, the company is widely known as a reliable platform to trade, copy trades, share trading ideas, and gain profits from financial markets. When it comes to deposit and withdrawal, eToro offers a wide range of payment methods.

| 💳Payment Method | ⏳Processing Time | 💲Currencies | 📈Max. Deposit |

| Bank Transfer | 4-7 days | USD, GBP, EUR | Unlimited |

| Online Banking - Trustly (EU region) | Instant | EUR, GBP, SEK, DKK, NOK, PLN, CZK | $40,000 |

| Credit/Debit Cards | Instant | USD, GBP, EUR, AUD | $40,000 |

| eToro Money | Instant | GBP | $250k or unlimited for black card holders |

| PayPal | Instant | USD, GBP, EUR, AUD | $10,000 |

| Skrill | Instant | USD, GBP, EUR | $10,000 |

| Neteller | Instant | USD, GBP, EUR | $10,000 |

Keep in mind that the above list may differ in each country and some payment methods may not be available. Please refer to the broker's official website to see all the supported methods in your area.

Without further ado, let's find out how to make deposits and withdrawals in eToro.

eToro Deposit Tutorial

To make a deposit, you must first register and create an eToro live account. There are several eToro account types that you can choose based on your needs and preferences. Find out more about it here.

- Personal (Retail) Account: eToro's default account type, suitable for all types of traders. With this account, you can trade all available assets, copy other traders, and invest in Smart Portfolios.

- Professional Account: Suitable for expert traders due to the high leverage and advanced trading tools.

- Corporate Account: Intended for companies and businesses.

- Swap-free Account: Allows traders to hold positions overnight without swap fees, suitable for Muslim traders who follow the Sharia law.

Verification is not mandatory to make deposits. However, unverified clients can only deposit up to $2250. To verify your profile, please reach out to customer service and upload the required documents.

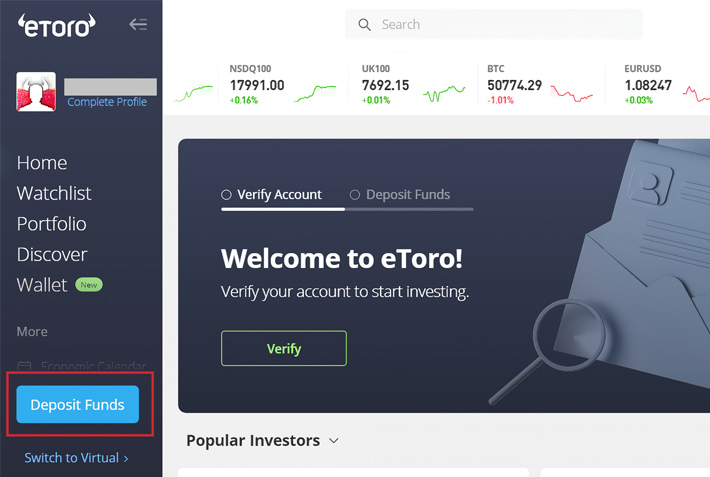

Follow these steps to make a deposit:

- Open eToro's official website and login to your account.

- Click on the "Deposit Funds" button on the bottom left side of the screen to access the deposit page.

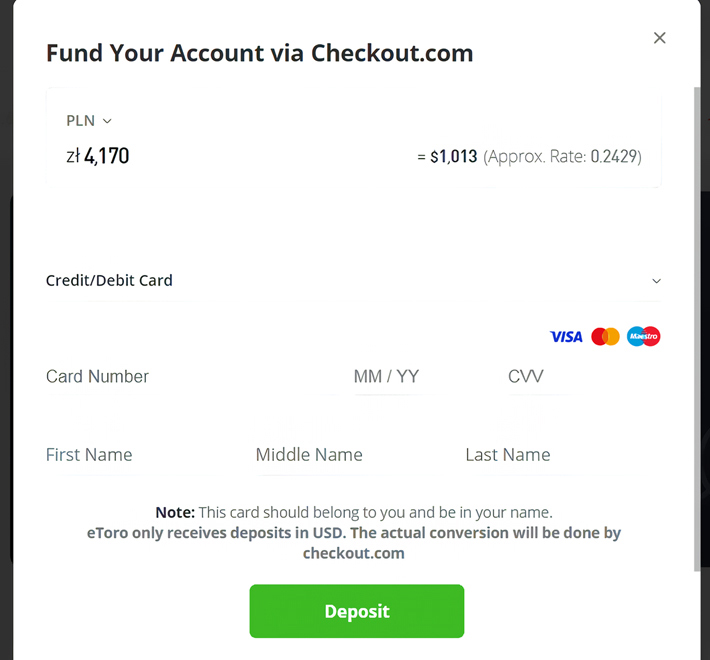

- Enter the deposit amount and specify the currency. Different currencies come with different conditions, so make sure to choose carefully.

- Then, choose your preferred deposit method and fill in your account credentials.

- Click "Deposit" to complete the transaction.

- The funds will be credited to your account.

eToro established in early 2007, with a mission to make trading accessible to anyone, anywhere, and reduce dependency on traditional financial institutions. The company has head offices in the United Kingdom, Cyprus, USA, and Australia.

eToro (Europe) Ltd operates as a Financial Services Company authorized and regulated by the Cyprus Securities Exchange Commission (CySEC) under license no. #109/10. Meanwhile, eToro (UK) Ltd is authorized and regulated by the Financial Conduct Authority (FCA) under the license FRN 583263.

As for eToro AUS Capital Pty Ltd, the legal standing is acknowledged by the Australian Securities and Investments Commission (ASIC) to provide financial services under Australian Financial Services License 491139.

A broker that belongs to the 4-digit type, eToro offers both short-term options for day traders and long-term options for investors, such as their innovative Smart Portfolios, a fully managed thematic portfolio.

Since 2007, eToro has been at the forefront of the Fintech revolution. The most recent was launched in 2017, which is Smart Portfolios powered by Machine learning Al. Beyond developing Smart Portfolios, the company integrated Microsoft's machine learning technology into Momentum DD.

The new Smart Portfolios investment strategy uses artificial intelligence to find the steadiest traders who are most likely to generate a double-digit return and bundle traders into one fully-managed portfolio. eToro has hundreds of financial assets for trading across several categories including stocks, commodities, crypto assets, currencies, indices, and ETFs. Each asset class has characteristics and can be traded using a variety of investment strategies.

Some positions on eToro involve ownership of underlying assets, such as non-leveraged positions on stocks and cryptos. Employing CFDs will enable a variety of options, such as leveraged trades, short (sell) positions, fractional ownership, and more. For example, traders can invest as little as USD100 in gold, even if a single unit of gold cost USD1,000. Some of eToro's most popular CFD commodities include gold, oil, natural gas, silver, and platinum.

Currencies are traded on eToro only as CFDs. Also, CFDs enable Sell (short) positions and leveraged trade, even for assets that don't offer the option in traditional trading. Some of the popular currencies include EUR/USD, GBP/USD, AUD/USD, USD/JPY, and USD/CAD.

Furthermore, An Exchange-Traded Fund (ETF) is a financial instrument comprising several assets grouped to serve as one tradable fund. After opening an account in eToro, traders can invest as little as USD250 in an ETF that costs USD500. Some of the popular ETFs on eToro include SPY, VXXB, TLT, and HMMJ.

However, eToro also offers additional functions using CFD trading. All leveraged ETF positions in the UK are under FCA regulations. Meanwhile, all CFD positions executed by eToro Australia are under ASIC regulations.

The company has other advantages. In all financial assets that can be traded, eToro does not charge any deposit or trading frees other than spreads.

eToro charges a USD25 fee for withdrawals and the minimum withdrawal amount is USD50. Long (Buy), non-leveraged crypto, stock, and ETF positions are not executed as CFDs and do not incur any fees. eToro does charge overnight or weekend fees for CFDs positions, such as leveraged positions and short (sell) orders.

Fee updates always apply to open positions. Fees are subject to change at any given time and could change daily, without prior notice, depending on market conditions.

As a beginner, trader can use CopyTrading eToro. Different from the features of other brokers, traders can copy the strategies of professional traders without fee or profit-sharing. Therefore, 100% profit is fully owned by traders. For example, while trader A who is copied by trader B, produces a profit of 10% this month, then trader B also gets a profit of 10%.

The company is the world's leading social trading network. Since eToro operates in complete transparency, each trader has valuable information on their eToro profiles, so other traders that are interested to copy their trades can have assistance in creating their best portfolios.

Another feature that is unique to eToro is the personalized, social News Feed. Just like on any social media, traders can post their updates on feed, comment on other's posts, and gradually create a feed that is tailor-fitted to trader's trading and investing interests. On eToro social trading platform, traders will also get notifications when a trader writes a new post and many other important updates.

Making a Withdrawal from eToro

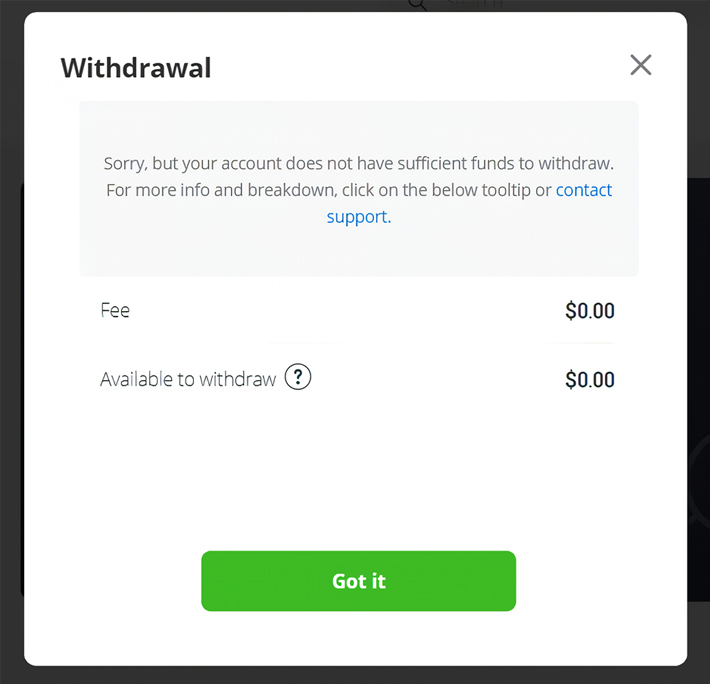

To withdraw from your trading account, you need to fulfill several conditions:

- Your account must be fully verified, indicated by a green tick on your profile.

- You must have enough withdrawable funds in your account balance.

- The minimum withdrawal amount is $30 regardless of your payment method.

eToro withdrawal is subject to processing fees. You will see how much you owe after you enter the withdrawal amount. At this point, you can halt the process and cancel the request if the fee is not to your liking. Moreover, you may also be charged with conversion fees if you withdraw using a currency other than USD.

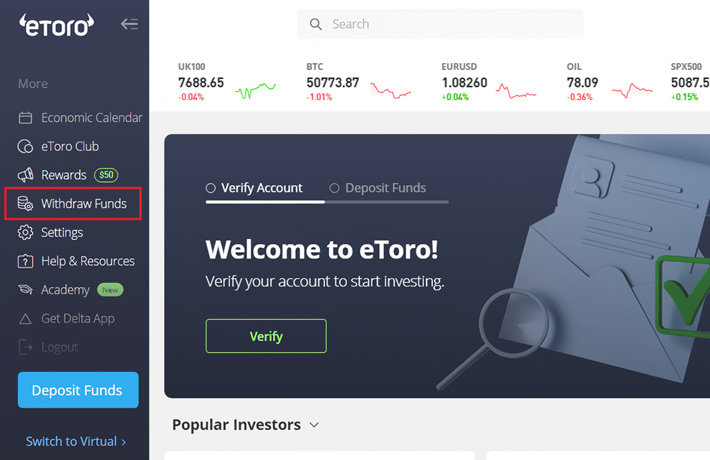

Here are the complete steps to make a withdrawal from eToro accounts:

- Login to your eToro Client Portal.

- Hover your mouse to the side menu and scroll down until you find the "Withdraw Funds" button.

- You'll see the total and withdrawal amount along with the applicable fees in a pop-up window.

- Enter the withdrawal amount and the currency to proceed to the next step.

- Check if the default withdrawal method is correct. If not, click "Other Payment Options".

- Once you're done, click "Submit".

- You will be notified via email once your withdrawal request has been completed or you can check the status in the transaction history section on your Client Portal.

Final Words

We can conclude that making a deposit and withdrawal in eToro is extremely easy. You only need to open your Client Portal and follow the simple steps either from your PC or mobile phone. eToro offers a wide range of payment methods, so make sure to choose the one that you're most comfortable with. If you have any trouble, you can visit the FAQ page or contact customer service.

eToro stands out as an exceptional option for individuals seeking cost-effective stock, CFD, forex, and crypto trading through its impressive mobile app. With an active user community, eToro provides social features dedicated to supporting the needs of traders and investors across the globe.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance