eToro's TipRanks brings a set of market insights to complement your analysis when trading stocks. Among its features are insider transactions and hedge fund activity.

As a top copy trading platform, eToro is continually working to improve its services to help traders and investors make better decisions. One of these improvements is the Research tab by TipRanks.

With this feature, the eToro broker shows essential information about recommendations from leading professional analysts to retail investors. Retail investors and traders can use these tools to enhance their trading skills.

✔️ Pros

- User-friendly and intuitive interface

- Allows you to copy the trades of successful traders on the platform

- A wide range of assets for trading, including stocks, ETFs, cryptocurrencies, and commodities

- Connect with other traders and share ideas through the platform's social features.

- No account management fees

❌ Cons

- Smaller selection of stocks and ETFs compared to other brokers.

- Trading fees, particularly for CFDs, can be higher than some competitors.

- Basic research tools compared to more advanced platforms.

- Customer service options may be limited.

- Past performance of copied traders is not a guarantee of future success

eToro established in early 2007, with a mission to make trading accessible to anyone, anywhere, and reduce dependency on traditional financial institutions. The company has head offices in the United Kingdom, Cyprus, USA, and Australia.

eToro (Europe) Ltd operates as a Financial Services Company authorized and regulated by the Cyprus Securities Exchange Commission (CySEC) under license no. #109/10. Meanwhile, eToro (UK) Ltd is authorized and regulated by the Financial Conduct Authority (FCA) under the license FRN 583263.

As for eToro AUS Capital Pty Ltd, the legal standing is acknowledged by the Australian Securities and Investments Commission (ASIC) to provide financial services under Australian Financial Services License 491139.

A broker that belongs to the 4-digit type, eToro offers both short-term options for day traders and long-term options for investors, such as their innovative Smart Portfolios, a fully managed thematic portfolio.

Since 2007, eToro has been at the forefront of the Fintech revolution. The most recent was launched in 2017, which is Smart Portfolios powered by Machine learning Al. Beyond developing Smart Portfolios, the company integrated Microsoft's machine learning technology into Momentum DD.

The new Smart Portfolios investment strategy uses artificial intelligence to find the steadiest traders who are most likely to generate a double-digit return and bundle traders into one fully-managed portfolio. eToro has hundreds of financial assets for trading across several categories including stocks, commodities, crypto assets, currencies, indices, and ETFs. Each asset class has characteristics and can be traded using a variety of investment strategies.

Some positions on eToro involve ownership of underlying assets, such as non-leveraged positions on stocks and cryptos. Employing CFDs will enable a variety of options, such as leveraged trades, short (sell) positions, fractional ownership, and more. For example, traders can invest as little as USD100 in gold, even if a single unit of gold cost USD1,000. Some of eToro's most popular CFD commodities include gold, oil, natural gas, silver, and platinum.

Currencies are traded on eToro only as CFDs. Also, CFDs enable Sell (short) positions and leveraged trade, even for assets that don't offer the option in traditional trading. Some of the popular currencies include EUR/USD, GBP/USD, AUD/USD, USD/JPY, and USD/CAD.

Furthermore, An Exchange-Traded Fund (ETF) is a financial instrument comprising several assets grouped to serve as one tradable fund. After opening an account in eToro, traders can invest as little as USD250 in an ETF that costs USD500. Some of the popular ETFs on eToro include SPY, VXXB, TLT, and HMMJ.

However, eToro also offers additional functions using CFD trading. All leveraged ETF positions in the UK are under FCA regulations. Meanwhile, all CFD positions executed by eToro Australia are under ASIC regulations.

The company has other advantages. In all financial assets that can be traded, eToro does not charge any deposit or trading frees other than spreads.

eToro charges a USD25 fee for withdrawals and the minimum withdrawal amount is USD50. Long (Buy), non-leveraged crypto, stock, and ETF positions are not executed as CFDs and do not incur any fees. eToro does charge overnight or weekend fees for CFDs positions, such as leveraged positions and short (sell) orders.

Fee updates always apply to open positions. Fees are subject to change at any given time and could change daily, without prior notice, depending on market conditions.

As a beginner, trader can use CopyTrading eToro. Different from the features of other brokers, traders can copy the strategies of professional traders without fee or profit-sharing. Therefore, 100% profit is fully owned by traders. For example, while trader A who is copied by trader B, produces a profit of 10% this month, then trader B also gets a profit of 10%.

The company is the world's leading social trading network. Since eToro operates in complete transparency, each trader has valuable information on their eToro profiles, so other traders that are interested to copy their trades can have assistance in creating their best portfolios.

Another feature that is unique to eToro is the personalized, social News Feed. Just like on any social media, traders can post their updates on feed, comment on other's posts, and gradually create a feed that is tailor-fitted to trader's trading and investing interests. On eToro social trading platform, traders will also get notifications when a trader writes a new post and many other important updates.

What Is TipRanks?

TipRanks is a company that offers thorough research services through the eToro broker's Research Tab. This tab provides crucial extra information about US stocks, including summaries of analyst recommendations, target prices, hedge fund activity, and insider transactions.

eToro TipRanks's information aims to help clients make informed investment decisions based on data. They collect financial data from prominent market influencers and track the public filings of top investors worldwide.

Some big names they monitor include renowned hedge funds like Warren Buffett's Berkshire Hathaway and Carl Icahn's investment fund.

TipRanks has also developed a few Partner CopyFunds for eToro, like EWachenheim-CF, which is based on Greenhaven Associates' public filings, and CarlIcahn-CF, which is derived from Carl Icahn Enterprises' filings.

The Research tab service is exclusively available to clients who have made deposits.

How to Access eToro's TipRanks

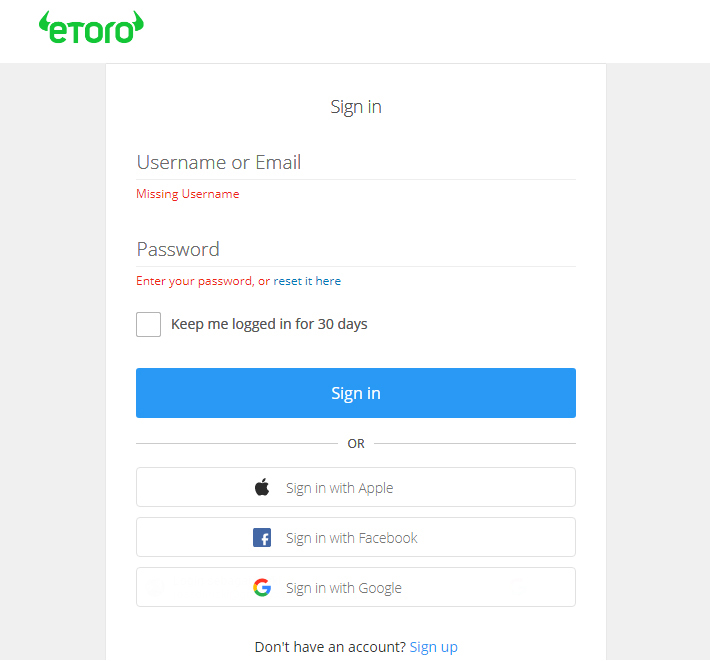

To find TipRanks on the eToro platform, follow these steps:

1. Log in to your eToro account using your username/email and password.

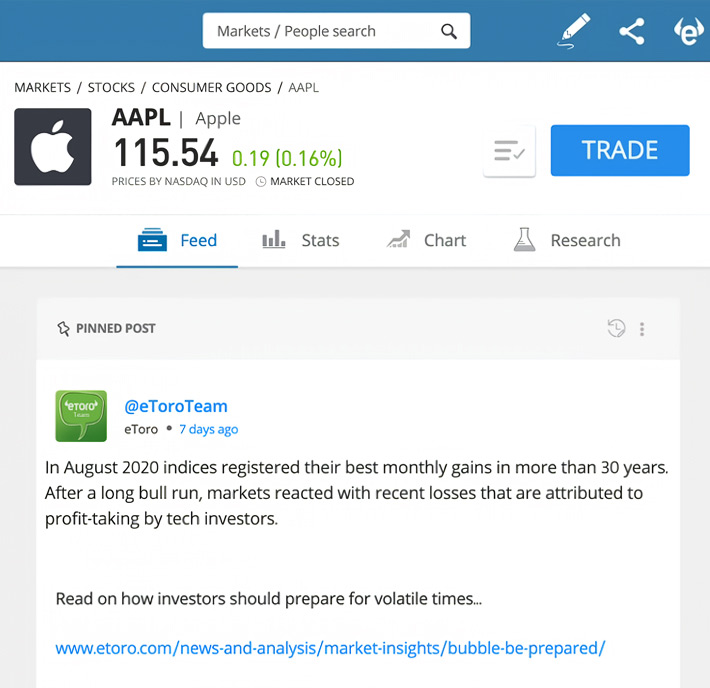

2. Search for the US stock you want by typing its name in the "markets/people search" box at the top. For instance, if you're looking for Apple stock (AAPL), type it in. You'll then see the relevant page.

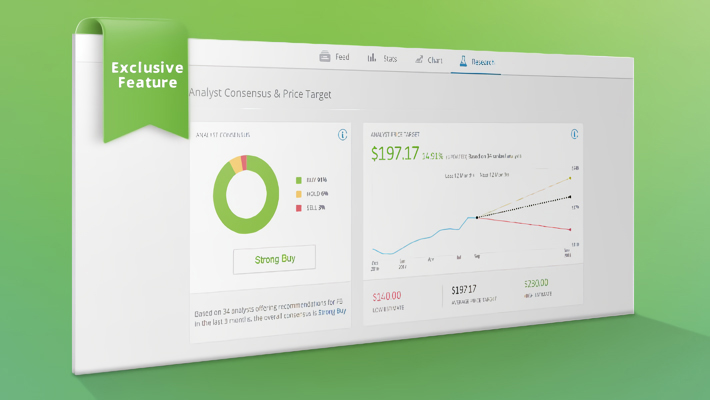

3. Click "Research" in the top menu to view a display like this.

How eToro's TipRanks Helps Traders in Market Research

TipRanks is an invaluable tool for traders looking to conduct thorough market analysis. This eToro research tool gathers recommendations from respected analysts worldwide, including those from top banks and financial institutions

These recommendations aren't just opinions but are supported by comprehensive research and analysis.

A standout feature of eToro's TipRanks is its detailed insights into price targets. This tool includes forecasts from analysts about how specific stocks may perform. Accessing this data helps traders gain a clearer picture of market trends, allowing them to adjust their strategies accordingly.

Furthermore, eToro's TipRanks goes beyond analyst recommendations by providing information on hedge fund activities. Traders can observe major institutional investors' buying and selling patterns, gaining valuable insights into market sentiment and trends. eToro's TipRanks enables etoro traders to align their trading decisions with the actions of influential market players.

Additionally, eToro's TipRanks offers visibility into insider transactions. By monitoring trades made by company insiders, such as executives and board members, traders can assess the confidence levels of those familiar with the company's operations.

This data is particularly insightful, as insider transactions often reflect insider sentiment and expectations for the company's future performance.

In general, here are the features of eToro's TipRanks and their usages:

| Analyst Consensus & Price Targets | Aggregates recommendations from professional analysts worldwide, whether analysts recommend buying, selling, or holding a particular stock. Price Targets offer estimated price ranges for a stock based on analysts' assessments and predictions. |

| Analyst Ratings | Provides a breakdown of individual analyst ratings for a specific stock, such as "Buy," "Hold," or "Sell." Understanding these ratings helps you gauge market sentiment and potential stock performance. |

| Hedgefund Activity | Tracks actions taken by hedge funds related to a stock, including information on hedge fund buying or selling activity. Monitoring hedge fund moves can provide valuable insights into market trends. |

| Insider Transactions | Reveal actions taken by company insiders (such as executives, directors, or major shareholders), including buying or selling company stock. Analyzing insider transactions can help you assess a stock's health and potential. |

Using eToro's TipRanks to Trade: A Case Study

Let me illustrate how eToro's TipRanks is used on the platform.

Firstly, you must determine the stock you're analyzing. If you choose Apple stock (AAPL), click on Apple stock and navigate to the Research tab on the right-hand menu.

In the research tab, at the top, you'll find "Analyst Consensus & Price Target."

Analyst Consensus & Price Target

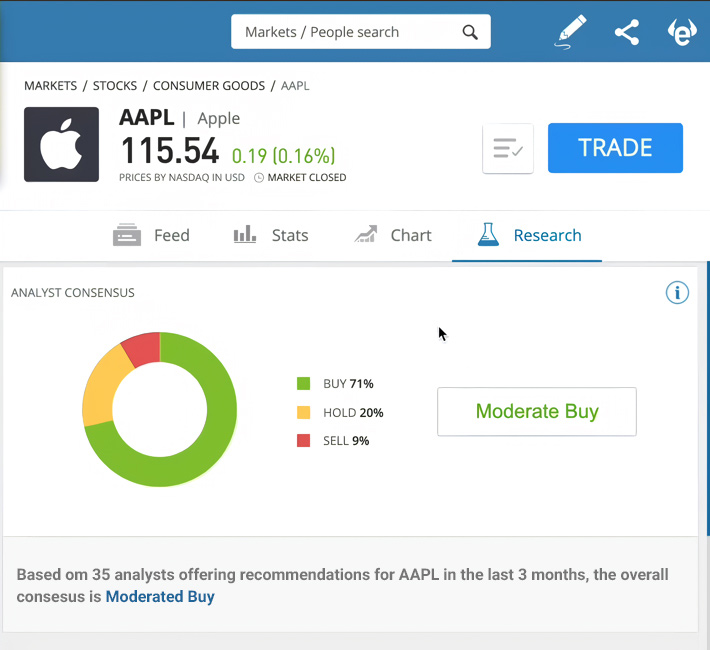

Over the past three months, a consensus of 35 analysts indicates a "moderate buy," with 71% recommending "buy," 20% suggesting "hold," and 9% advising "sell."

This data serves as a general indicator of whether others anticipate Apple stock prices to rise or fall. However, it's just one part of our analysis.

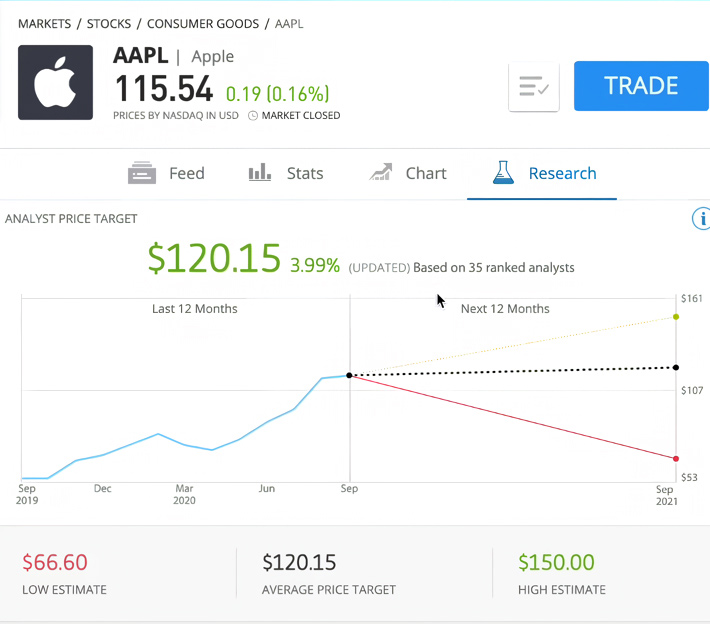

Scroll down to view price targets from analysts in eToro platform. In this case, most analysts predict Apple stock to reach $120.15.

Additionally, you'll see the highest estimate at $150 and the lowest at $66.60. Further down, you'll find analyst ratings.

Analyst Ratings

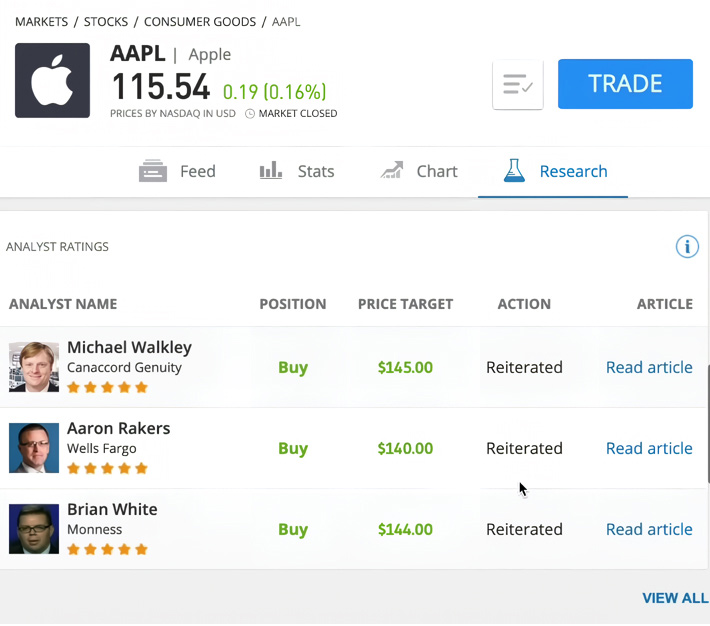

In this table, further support to invest in AAPL appears in ratings from 3 analysts at banks or financial institutions, along with their recommendations and articles. eToro's TipRanks have assigned each analyst a star rating to ascertain their credibility.

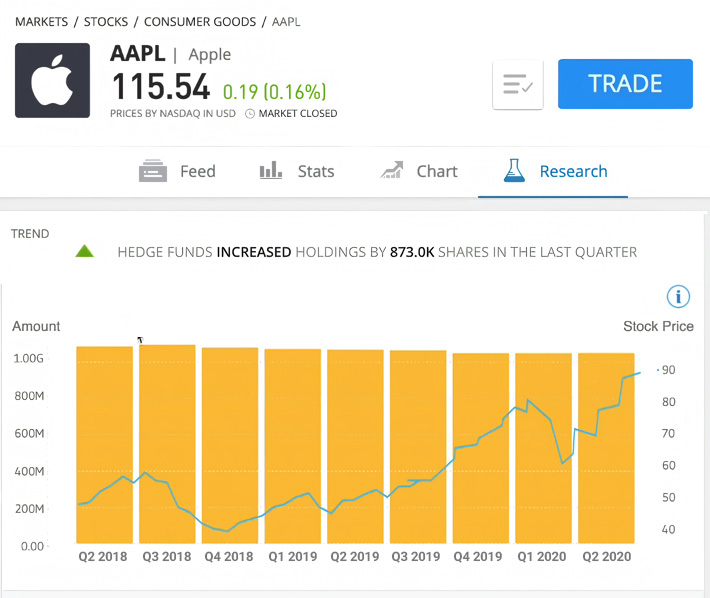

Hedgefund Activity

Continuing to scroll down on eToro's TipRanks, you'll come across hedge fund activity. The eToro platform shows prominent hedge fund companies like Berkshire Hathaway and Goldman Sachs purchase Apple stock.

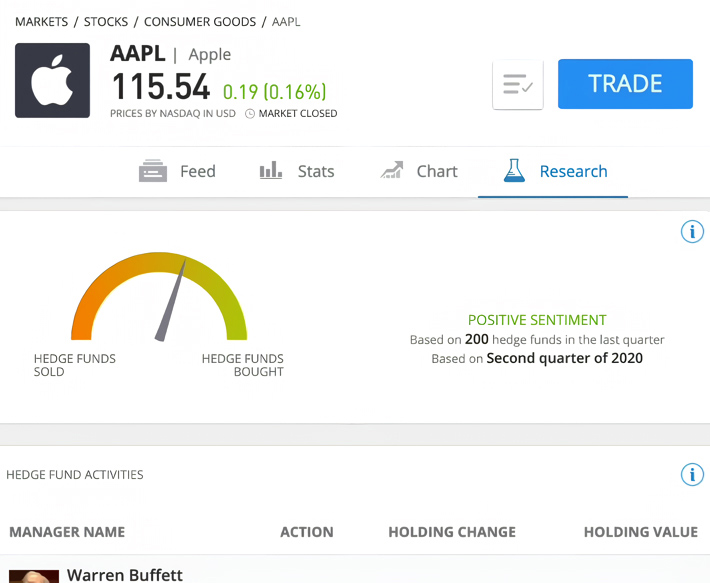

It's evident from the display above that hedge funds have been buying Apple shares since the second quarter of 2018. Further down, you'll find hedge fund sentiment, indicating that Apple stock received positive sentiment from 200 hedge funds in the second quarter of 2020.

If you wish to see which hedge funds are active, continue scrolling down.

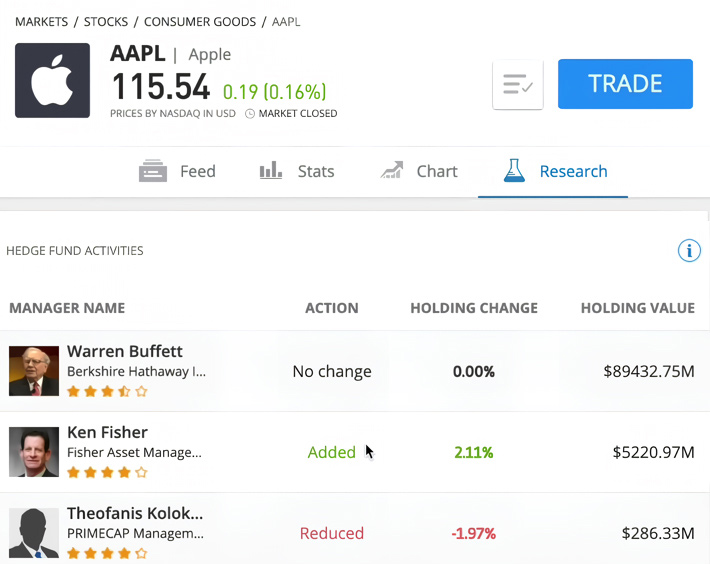

eToro's TipRanks shows that Warren Buffett has stayed the same in the second quarter, holding Apple stock worth around $89 billion. You'll also notice Ken Fisher from Fisher Asset Management increased his Apple stock ownership by 2%. Meanwhile, Theofanis from PRIMECAP Management decreased his Apple stock ownership by 2%.

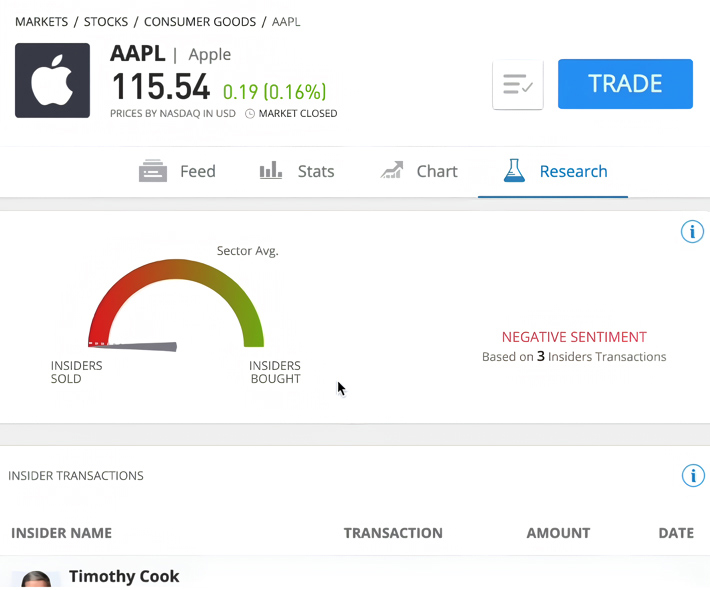

Insider Transaction

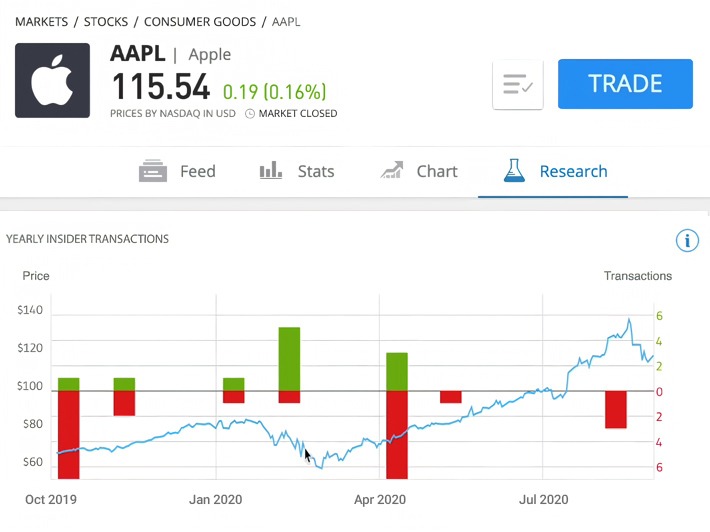

eToro's TipRanks are also able to display insider transactions, which are stock transactions conducted by Apple employees.

eToro's TipRanks shows that in March 2020, many Apple employees bought shares because they felt the stock price was too low. This information offers additional insight into potential stock price movements.

But scrolling down, you'll also find negative insider sentiment.

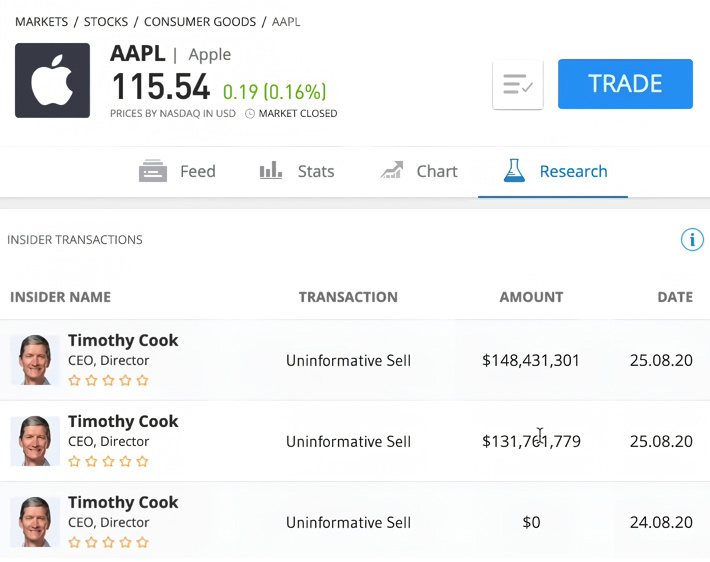

To see which insiders are conducting transactions, continue scrolling down.

In the display above, you'll see Timothy Cook, the CEO and Director of Apple, sold shares twice on August 25, 2020, totaling $148.43 million and $131.76 million.

💡So, What's the Conclusion? |

| From the above data from eToro's TipRanks, it's clear that Apple stock is attractive for purchase. This is supported by leading analysts targeting a price as high as $150 per share and hedge fund activity increasing Apple stock holdings in recent months. The negative insider sentiment is less relevant because the reasons for Tim Cook selling his shares still need to be defined. |

Pros and Cons of Using eToro's TipRanks in Analysis

Here are some advantages and disadvantages to consider when using eToro's TipRanks for analyzing US stocks:

Advantages | Disadvantages |

| ✔️Comprehensive Data: eToro's TipRanks collects information from various sources such as analysts, bloggers, and market research firms, giving a fuller picture of market sentiment towards specific stocks. ✔️Analyst Ratings: eToro's TipRanks ranks analysts based on accuracy and predictive performance, helping investors assess their confidence in particular analyst recommendations. ✔️Prediction Feature: eToro's TipRanks allows investors to view future stock price forecasts based on historical analysis and current market trends. | ❌Dependency on Historical Data: eToro's TipRanks, like many other stock analysis tools, heavily relies on historical data. While it can offer insights into future performance, it may only sometimes be accurate. It might overlook unexpected market events or trends. ❌Complexity: eToro's TipRanks may appear complex and challenging for beginner investors. Learning to utilize all its features and data effectively takes time and effort. |

FAQs on eToro's TipRanks

What is TipRanks?TipRanks is a comprehensive research tool designed for investment traders, helping them make more informed decisions backed by data. It condenses news, stock market research ratings, and analysts' forecasts into actionable insights. |

How many people use TipsRanks?Regarding its user base, TipRanks boasts an impressive reach, with over 4 million monthly users currently utilizing its services. Moreover, its influence extends beyond individual traders, as numerous financial institutions, including eToro, Nasdaq, E*TRADE, TD Ameritrade, and Bank Santander. This widespread adoption underscores the platform's credibility and utility within the financial industry. |

Can we trust eToro's TipRanks?Traders often grapple with trust when utilizing third-party tools for market analysis. However, TipRanks has garnered significant acclaim and trust from its user base. With a "Great" rating on Trustpilot, TipRanks earns an impressive score of 4.7 out of 5 from 1,416 reviews. This positive feedback underscores the platform's reliability and effectiveness in aiding traders in decision-making. Many traders, including eToro's traders, favor TipRanks over penny stock promoters, recognizing its commitment to providing transparent and data-driven insights rather than engaging in potentially predatory practices. |

Apart from access to TipRanks, what are the benefits of trading with eToro?

|

Are there other eToro's tools that work alongside TipRanks?Yes, there are. Two tools that support TipRanks on eToro are:

|

Explore eToro's Tools and Platforms Now

eToro stands out as an exceptional option for individuals seeking cost-effective stock, CFD, forex, and crypto trading through its impressive mobile app. With an active user community, eToro provides social features dedicated to supporting the needs of traders and investors across the globe.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance