eToro social trading is the pioneer of copy trading system that allows traders to learn directly from other experienced traders with high transparency and other advantages that you should know.

Difficulties of trading have driven away many forex traders within their first years. Such difficulties arise from the lack of knowledge of current affairs that might affect the price movement, the ability to create a sound trading plan, and the inability to properly analyze what is currently happening in the market.

Therefore, we have financial experts, fund managers, or simply experienced traders with a better understanding of how the market works to show the ropes to the new traders. However, their services are not known to be cheap.

That is where eToro comes in. They offer a social trading platform that you can use to expand your knowledge about trading by learning from the experts or sharing your experience with fellow traders.

See Also:

Enter eToro Social Trading Platform, A Place to Learn and Be Learned

eToro, formerly known as RetailFX, has grown to be more than just a forex broker ever since its inception in 2007. They have more than 11 million users around the globe and offices in many countries like the US, Australia, the UK, and China. By 2018, the company is valued at $800 million.

Just two years after the company started helping newcomers to trade, they launched WebTrader with an array of tools for all skill levels. They also launched OpenBook, the very first social trading platform in the world featuring CopyTrader, the one feature that distinguishes them from any other social media.

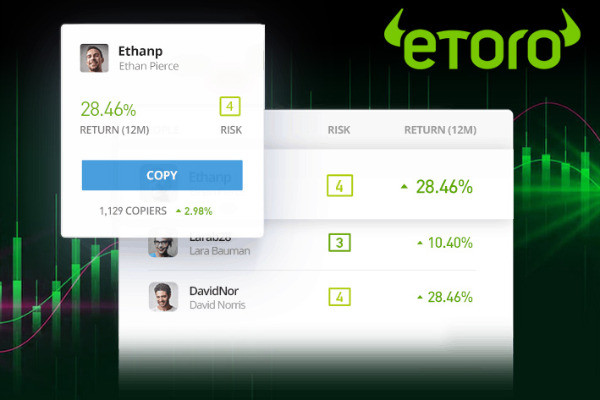

The CopyTrader feature allows any trader to take note and mirror what an experienced trader does in his work. In other words, this feature can lessen the learning curve by allowing new traders to learn from the collective knowledge that is available in eToro's social trading platform.

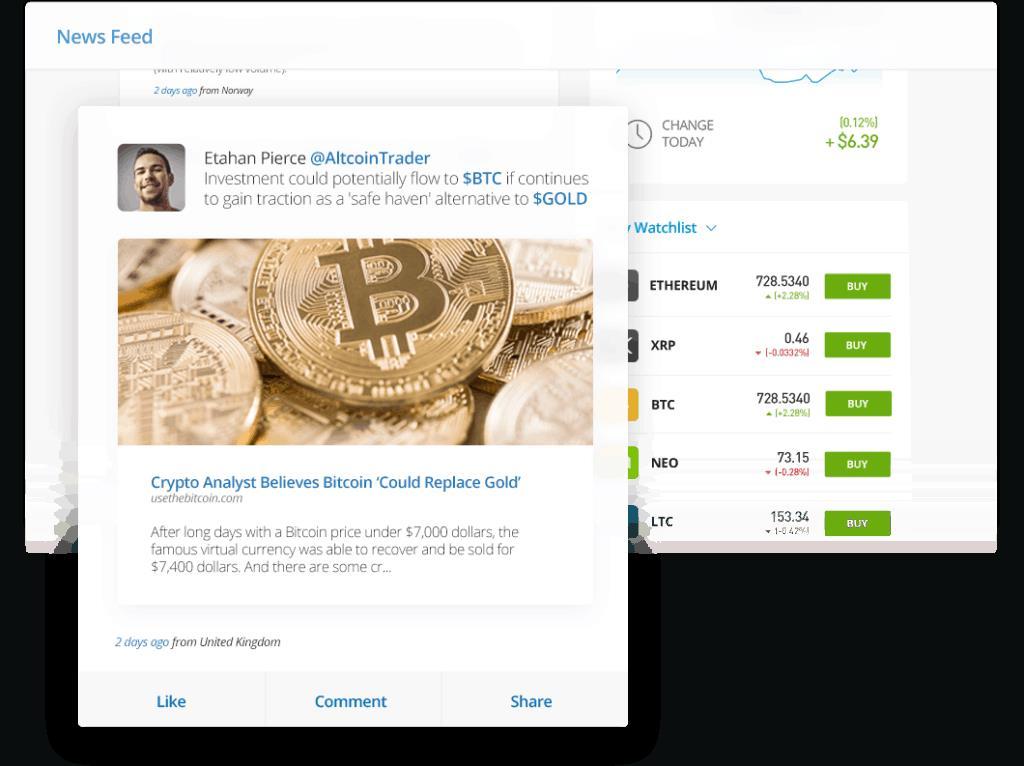

A social media platform often made in order to share one's thoughts with the world. eToro broker social trading platform is made with the same goal but more focused on trading. Users of said social media platform can copy the strategy of other users, share their thoughts, or let other users know of important news and analysis regarding that news.

There are two kinds of people that use this social trading platform: the one that shares their knowledge or experience (traders) and the one that absorbs them (investors). The benefit for the latter is pretty clear; they can build up their skills in trading. While the one that shares can also benefit by having their names be noticed by people who might want to hire their services.

Both investors and traders are connected on the same social platform to make the whole forex trading less exclusive. It is in eToro's mission to make a statement that anyone should have a chance at earning a piece of $5 trillion that circulates around every single day in the forex market. After all, they provide the ability to trade forex as low as 1 pip.

As of 2020, the eToro social trading platform is used by over 12 million people from at least 100 countries to share with fellow traders and learn a thing or two from some of the more experienced traders.

eToro established in early 2007, with a mission to make trading accessible to anyone, anywhere, and reduce dependency on traditional financial institutions. The company has head offices in the United Kingdom, Cyprus, USA, and Australia.

eToro (Europe) Ltd operates as a Financial Services Company authorized and regulated by the Cyprus Securities Exchange Commission (CySEC) under license no. #109/10. Meanwhile, eToro (UK) Ltd is authorized and regulated by the Financial Conduct Authority (FCA) under the license FRN 583263.

As for eToro AUS Capital Pty Ltd, the legal standing is acknowledged by the Australian Securities and Investments Commission (ASIC) to provide financial services under Australian Financial Services License 491139.

A broker that belongs to the 4-digit type, eToro offers both short-term options for day traders and long-term options for investors, such as their innovative Smart Portfolios, a fully managed thematic portfolio.

Since 2007, eToro has been at the forefront of the Fintech revolution. The most recent was launched in 2017, which is Smart Portfolios powered by Machine learning Al. Beyond developing Smart Portfolios, the company integrated Microsoft's machine learning technology into Momentum DD.

The new Smart Portfolios investment strategy uses artificial intelligence to find the steadiest traders who are most likely to generate a double-digit return and bundle traders into one fully-managed portfolio. eToro has hundreds of financial assets for trading across several categories including stocks, commodities, crypto assets, currencies, indices, and ETFs. Each asset class has characteristics and can be traded using a variety of investment strategies.

Some positions on eToro involve ownership of underlying assets, such as non-leveraged positions on stocks and cryptos. Employing CFDs will enable a variety of options, such as leveraged trades, short (sell) positions, fractional ownership, and more. For example, traders can invest as little as USD100 in gold, even if a single unit of gold cost USD1,000. Some of eToro's most popular CFD commodities include gold, oil, natural gas, silver, and platinum.

Currencies are traded on eToro only as CFDs. Also, CFDs enable Sell (short) positions and leveraged trade, even for assets that don't offer the option in traditional trading. Some of the popular currencies include EUR/USD, GBP/USD, AUD/USD, USD/JPY, and USD/CAD.

Furthermore, An Exchange-Traded Fund (ETF) is a financial instrument comprising several assets grouped to serve as one tradable fund. After opening an account in eToro, traders can invest as little as USD250 in an ETF that costs USD500. Some of the popular ETFs on eToro include SPY, VXXB, TLT, and HMMJ.

However, eToro also offers additional functions using CFD trading. All leveraged ETF positions in the UK are under FCA regulations. Meanwhile, all CFD positions executed by eToro Australia are under ASIC regulations.

The company has other advantages. In all financial assets that can be traded, eToro does not charge any deposit or trading frees other than spreads.

eToro charges a USD25 fee for withdrawals and the minimum withdrawal amount is USD50. Long (Buy), non-leveraged crypto, stock, and ETF positions are not executed as CFDs and do not incur any fees. eToro does charge overnight or weekend fees for CFDs positions, such as leveraged positions and short (sell) orders.

Fee updates always apply to open positions. Fees are subject to change at any given time and could change daily, without prior notice, depending on market conditions.

As a beginner, trader can use CopyTrading eToro. Different from the features of other brokers, traders can copy the strategies of professional traders without fee or profit-sharing. Therefore, 100% profit is fully owned by traders. For example, while trader A who is copied by trader B, produces a profit of 10% this month, then trader B also gets a profit of 10%.

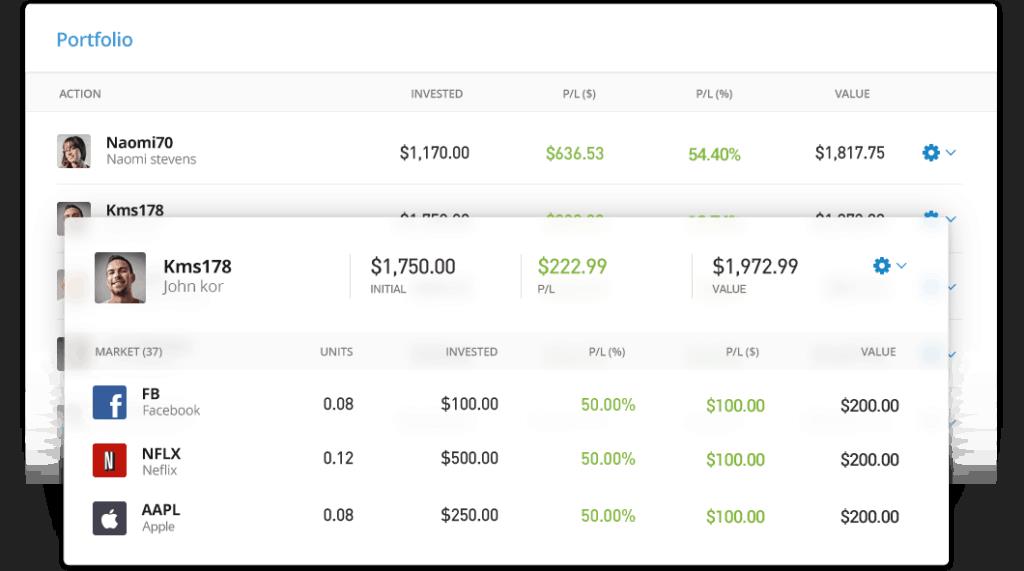

The company is the world's leading social trading network. Since eToro operates in complete transparency, each trader has valuable information on their eToro profiles, so other traders that are interested to copy their trades can have assistance in creating their best portfolios.

Another feature that is unique to eToro is the personalized, social News Feed. Just like on any social media, traders can post their updates on feed, comment on other's posts, and gradually create a feed that is tailor-fitted to trader's trading and investing interests. On eToro social trading platform, traders will also get notifications when a trader writes a new post and many other important updates.

What's Special about eToro Social Trading?

These are the 6 things you need to know about eToro social trading:

1. A Simple Yet Effective Main Goal

CopyTrader allows beginners to imitate what and how an experienced trader is doing in order to conduct profitable trades in real-time. The simple objective can help traders with incredible needs to learn straight from the professionals. They can trade effectively and not waste their resources (both money and time) trying to learn how forex trading works.

2. No Payment Required

Back then, a good financial manager may require some sort of payment for their service. That is not the case in CopyTrader, as new traders may copy a strategy that they see fit for free. Any commission is only required should they decide to invest in some traders that they deem worthy to follow. But if they use eToro social platform trading only as a source of information from many traders, they technically don't have to pay anything. Also, the stock copy trading platform is basically a 0% commission service.

3. High Transparency

You can make a well-executed decision thanks to high levels of transparency. The choice of which trader to copy is in your hands. As a matter of fact, eToro has made a special platform to list the traders and their portfolios containing any important information for investors to take into account.

4. Risk Score

Do you have what it takes to follow a high-risk strategy? Or you want to make yourself comfortable in trading with a low-risk strategy? The choice is yours since CopyTrader includes a risk score so you can choose which strategy to copy. For your consideration, always remember that high profit is always followed by risk, while low-risk strategy bears the consequence of gaining low profit.

5. Full Control

If you think the strategy that you have chosen does not work very well with you, then you can stop it or pause it for a moment. You can add or remove funds whenever you want as well.

6. Easy to Use

All you need to do is pick the trader that you wish to copy such as the one in eToro broker and choose the amount you want to invest. All in real-time in a single click.

eToro stands out as an exceptional option for individuals seeking cost-effective stock, CFD, forex, and crypto trading through its impressive mobile app. With an active user community, eToro provides social features dedicated to supporting the needs of traders and investors across the globe.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance

15 Comments

Martinez

Apr 2 2023

Hey there, as a beginner, I think the concept of social trading is a great idea. It can be time-consuming to practice trading strategies in a demo account and we might not always get the results we want. But with copy trading on social trading platforms, we can follow and copy the trades of experienced traders, which can help us make profits faster.

However, I'm a bit confused about the difference between social trading and copy trading. They seem pretty similar to me. What are the advantages of social trading over copy trading?

Taylor

Apr 2 2023

As the article has said, social trading platforms, like eToro, allow you to follow and interact with other traders from around the world. You can see what they're trading, how they're performing, and even ask them questions directly. This can be a great way to learn from more experienced traders and get a better understanding of the markets.

Copy trading takes social trading one step further by allowing you to automatically replicate the trades of other traders. So, if you find a trader who you think is really skilled and consistent, you can choose to copy their trades and potentially make the same profits they do. (read at here for the information : Pros and Cons of Copy Trading')

Now, to answer your question about the advantages of social trading versus copy trading. The main advantage of social trading is that you have more control over your own trades. You can interact with other traders, get advice, and make your own decisions based on the information you gather. Copy trading, on the other hand, is more passive.

Rendy

Apr 2 2023

There is another advantage of using social trading. It can be a great tool for education, especially for beginner traders who are just starting out. By participating in social trading platforms, traders can observe the trading behaviors of more experienced traders, ask questions, and learn from their strategies and techniques. Social trading can also offer a more interactive and engaging learning experience compared to other forms of education, such as reading books or attending seminars. Through social trading, traders can gain a deeper understanding of the markets, as well as develop their own trading skills and strategies. Additionally, social trading can help traders build a network of other traders, which can be beneficial for sharing information and insights in the future.

And I have experienced about the OpenBook and it is really like social media but with trading theme. OVerall, it is good place to sharing and accepting knowledge.

Yerry

Apr 2 2023

I need to question about the fees that occured in the CopyTrader in the eToro. I mea, you have said about the charge that may occur if you trade deeply with the provider. But it is free if you use it as the source of the information.

What kind of information that I can get? Is it just the information like trading signal so we dedided our own to trade or not? Or we still can do the copy trade with free without no commission at all? Need some answer here

Gibbs

Apr 2 2023

So, to answer your question, if you're just using the CopyTrader feature on eToro to gain insights and information from other traders, then there are no fees involved. You can simply browse through the profiles of other traders, check out their performance history, and even communicate with them directly to learn more about their trading strategies.

However, if you decide to copy the trades of another trader, then there may be some fees involved, depending on the provider you choose to copy. Each provider sets their own fees, which can vary based on factors such as the size of the trade, the asset being traded, and the level of risk involved.

But don't worry, mate! The fees are clearly displayed on the CopyTrader interface, so you can see exactly what you'll be charged before you decide to copy any trades

Gareth

May 3 2023

Including a risk score in copy trading is a smart move. Traders have varying levels of risk tolerance, and having a risk score can help traders avoid copying strategies that are too risky for their personal preferences. This can be beneficial for both the provider and the copier, as negative reviews resulting from high-risk trades can damage a provider's reputation and ultimately harm both parties.

On a related note, I was wondering if it's possible to become a copy trading provider on eToro, and if so, what benefits there might be for doing so?

Peter

May 4 2023

it's definitely possible to become a copy trading provider on eToro. In fact, many traders have found success by sharing their trading strategies and allowing others to copy their trades.

As a copy trading provider, you could potentially earn additional income by receiving a percentage of the profits generated by those who choose to copy your trades. Additionally, you may also gain exposure and recognition within the eToro community, which could lead to more followers and potential profit opportunities in the future.

However, it's important to note that becoming a copy trading provider does come with certain responsibilities. You'll need to consistently make good trading decisions and manage risk effectively in order to attract and retain copiers. You'll also need to be transparent about your trading strategy and communicate with your copiers regularly.

Josh

May 3 2023

Hey there! If you are interesting to become provider in eToro, you can simply follow these steps :

Verified eToro account: You'll need to have a verified eToro account in order to be eligible to become a provider. This involves providing some basic personal information and completing a KYC (Know Your Customer) process.

Minimum account equity: You'll need to have a minimum of $1,000 in your eToro trading account in order to be able to offer copy trading.

Consistent trading history: In order to be a successful copy trading provider, you'll need to have a consistent and successful trading history. This means demonstrating that you have a solid track record of profitable trades and effective risk management.

Transparent trading strategy: It's important to be transparent about your trading strategy and communicate regularly with your copiers. This means explaining your trading decisions and providing regular updates on your trading activity.

Compliance with eToro's guidelines: You'll need to comply with eToro's guidelines and policies, including its risk management policies, in order to offer copy trading on the platform.

If you meet these requirements and are approved to become a copy trading provider on eToro, you'll be able to start sharing your trading strategies and potentially earn additional income from your successful trades.

Renka

May 4 2023

It said that If you think the strategy that you have chosen does not work very well with you, then you can stop it or pause it for a moment. You can add or remove funds whenever you want as well. So, it means the control of the copy trade is not 100% at trader hand but in provider hand, right?

I mean, we just can quit the trading whenever we like but we cannot control the whole such as leverage, risk management and the other that involved in trading in eToro social trading right? Just want to ask about that anyway!

Taylor

May 4 2023

To address your question, as a copier in eToro's social trading platform, you do have some control over your copy trading account, but the provider is ultimately responsible for the specific trading strategy, which includes the amount of leverage used and the risk management approach taken. Essentially, you are following the provider's expertise and approach to trading. If you have any concerns or questions about the trading strategy or the level of risk involved, you can communicate with the provider directly through the platform. This feature sets eToro's social trading apart from other copy trading providers, as it allows for direct communication between copiers and providers. It's important to fully understand the potential risks and rewards before committing to any trade, and by communicating with the provider, you can make informed decisions about your investments.

Chou

Jul 31 2023

Hey there! For traders exploring the CopyTrader feature on eToro, the decision of whether to open a live account immediately or start with a demo account can be pivotal. Considering that CopyTrader offers new traders the opportunity to learn from experienced traders and reduce the learning curve by leveraging the collective knowledge on the social trading platform, what factors should one consider when deciding between opening a live account or starting with a demo account? How does each option affect the trader's learning process and overall trading experience on eToro's social trading platform? Thank you!

Sienta

Aug 2 2023

No, it is not necessary to open a live account before trying out copy trading on eToro. The platform offers the option of starting with a demo account, which allows new traders to practice copy trading using virtual funds in a risk-free environment. This enables them to gain valuable experience, understand the mechanics of copy trading, and learn from the strategies of experienced traders without putting real money at risk.

Using a demo account first can be a great way for beginners to familiarize themselves with the CopyTrader feature, explore different traders to copy, and get a feel for the platform's capabilities. It provides an opportunity to build confidence, test various trading styles, and determine which approach aligns best with their trading goals and risk tolerance.

Once traders feel comfortable and more confident in their abilities, they can then choose to transition to a live account. Opening a live account allows traders to engage in real trading with actual funds and experience the potential profits and losses associated with copy trading.

Read more: Understanding eToro Copy Trading Platform

Gordon

Jul 31 2023

So, I'm a beginner in trading, and I've got this decent chunk of money to play around with. I'm checking out eToro's CopyTrader, where I can just follow other traders' moves without doing all the complicated analysis stuff. Sounds pretty cool, right?

But here's the deal, I've heard that trading can be like a rollercoaster: high risk, high return, or low risk, low return. So, if I wanna go for higher profits, I gotta be okay with taking on more risk. On the flip side, if I want a safer ride, I might have to settle for lower profits.

With all this dough to play with, I'm kinda stuck between choosing high risk or low risk. I mean, who doesn't want bigger bucks, but I don't wanna go broke either, you know?

As a fellow trader, I'm hoping to get some advice from you. What do you think? Should I go for the thrill and risk it all, or play it safe and take it slow? Your tips and insights would be super helpful as I start this trading journey.

brian

Aug 1 2023

Hey there, buddy!

As a fellow trader, I completely understand where you're coming from. It's natural to desire larger profits, but at the same time, nobody wants to watch their hard-earned cash disappear. So, let's break it down.

If you're just starting out and still getting the hang of things, I'd suggest leaning towards a low-risk strategy. That way, you can get a feel for the whole trading concept without putting too much on the line. It's like dipping your toes in the water before diving headfirst, you know what I mean?

Once you gain more experience and confidence, you can gradually increase the risk if you feel comfortable doing so. Remember, trading is a learning process, and it's perfectly fine to take it one step at a time.

Also, keep in mind that it's not all about profits. Managing risk is just as crucial. Set some stop-loss levels and be disciplined about adhering to them. This way, you'll protect your capital and avoid any major setbacks.

Kyllian

Aug 2 2023

I think you can do both! However, when considering the second option of going for high risk, it's like embracing the excitement and adrenaline rush of a rollercoaster ride in the trading world. This path offers the potential for higher profits, which can be quite enticing for someone with a good amount of money to invest.

Nevertheless, it's essential to remember that higher risk also entails a greater chance of facing significant losses. It's akin to stepping into the wild side where you need to be well-prepared and have a solid risk management plan in place.

The key here is to approach high-risk trading with caution and only when you feel more experienced and confident in your trading skills. As you gain knowledge and become familiar with the ups and downs of the market, you can explore the thrill of high risk, but always keep an eye on safety measures to protect your hard-earned cash.

Read more: 10 Ways to Find the Best eToro Trader